PayPal Data Analyst Interview Guide: How to Ace the Process in 2026

Introduction

Preparing for a PayPal data analyst interview means stepping into one of the most complex and high impact analytics environments in fintech. With hundreds of millions of transactions flowing through PayPal’s platform every day, analysts are responsible for turning vast amounts of operational and behavioral data into insights that improve payment reliability, strengthen trust, and shape product decisions. Because analysts sit at the intersection of product, risk, engineering, and compliance, PayPal looks for candidates who can balance analytical rigor with business context and communicate clearly in a fast moving environment.

In this guide, you will learn how the PayPal data analyst interview works, what types of questions you can expect, and the preparation strategies that consistently help candidates succeed. Whether you are just beginning your prep or fine tuning your final interview approach, this guide will help you develop the SQL fluency, product reasoning, and structured communication skills needed to stand out in one of fintech’s most competitive analytics roles.

What Does a PayPal Data Analyst Do

A PayPal data analyst transforms large scale transaction, risk, and customer behavior data into actionable insights that improve payment reliability, strengthen trust, and support seamless experiences for both consumers and merchants. Analysts work closely with product, engineering, finance, and risk teams to uncover friction in the payments flow, diagnose anomalies, design metrics, and evaluate the performance of new features or operational processes.

Core responsibilities include:

- Writing efficient SQL to analyze large scale transactional, payments, and risk datasets

- Building dashboards and monitoring systems for authorization rate, fraud rate, dispute trends, and merchant performance

- Investigating anomalies across issuers, devices, geographies, or funding sources to identify root causes

- Supporting A B tests for checkout flows, product changes, and risk rule adjustments

- Designing metrics and event based datasets that help teams track product health and operational performance

- Partnering with PMs, engineers, and risk analysts to scope ambiguous problems and define data driven solutions

- Communicating insights clearly through presentations, deep dive analyses, and narrative summaries

- Ensuring data accuracy by validating upstream pipelines and reconciling inconsistent or incomplete logs

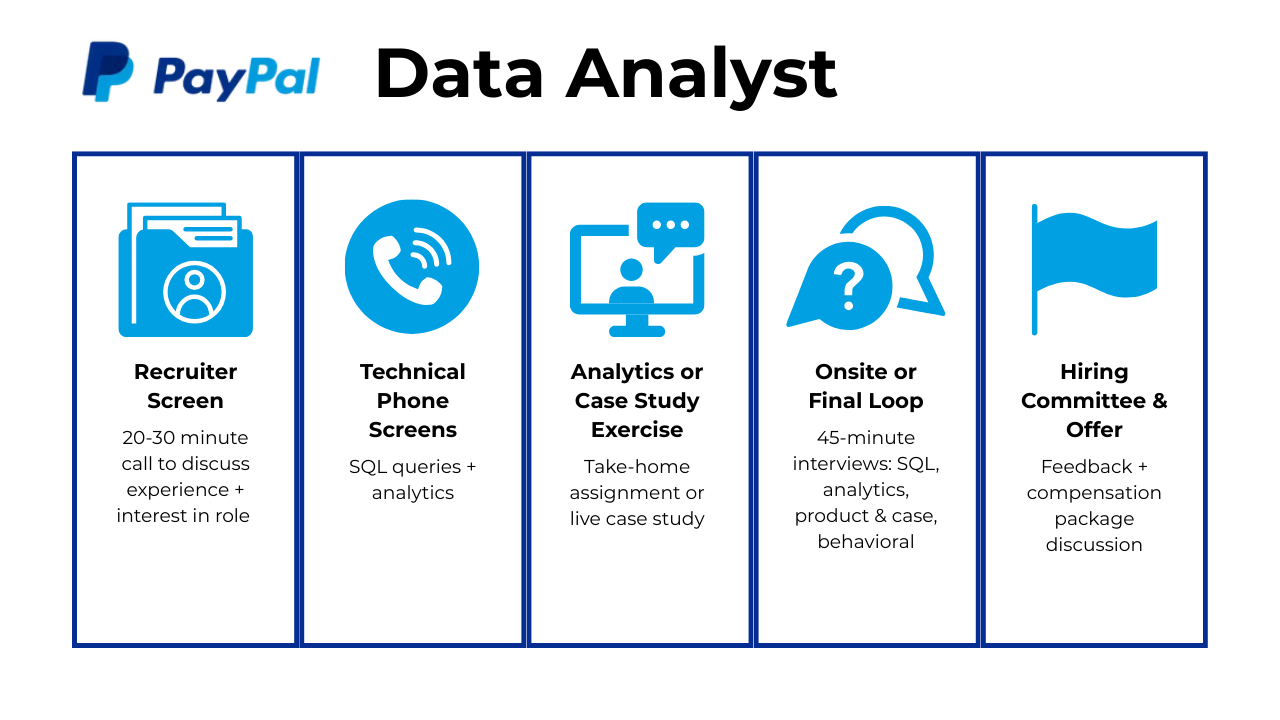

PayPal Data Analyst Interview Process

The PayPal data analyst interview process is designed to evaluate how you think, how you communicate, and how well you can translate complex datasets into actionable recommendations. It is a structured and practical loop that mirrors the real work analysts do across payments, fraud, risk, merchant analytics, and product teams. You can expect multiple rounds that test SQL proficiency, analytical reasoning, product intuition, and your ability to collaborate with cross functional partners.

Recruiter Screen

After you submit your application, your background is reviewed for domain fit and relevant technical experience. If selected, you will have a 20 to 30 minute call with a recruiter to discuss your experience with SQL, dashboards, experimentation, and any fintech or payments exposure. This conversation also covers your interest in PayPal, compensation expectations, and alignment with specific analytics teams like Risk, Enterprise Systems, or Product Analytics.

Tip: Keep your background overview structured and emphasize measurable impact in past roles to make a strong early impression.

Technical SQL And Analytics Screen

This round evaluates your ability to work with real world data. Over 45 to 60 minutes, you will write SQL queries from scratch, analyze sample tables, and interpret funnel metrics or behavioral trends. Interviewers look for clear logic, structured problem solving, and strong communication. Expect questions involving joins, window functions, time based patterns, anomaly detection, and scenario interpretation tied to PayPal checkout or risk workflows.

Tip: Practice solving SQL questions without autocomplete and verbalize each step so your reasoning is easy to follow.

Analytics Or Case Study Exercise

Depending on the team, you may receive a short take home assignment or live case study. You might analyze a checkout funnel, investigate a spike in dispute rates, build a segmentation using merchant behavior, or propose metrics for a new feature. The focus is on how you structure problems, validate data, communicate insights, and support recommendations.

Tip: Use a simple framework such as problem, approach, insights, and recommendations to keep your analysis clear and compelling.

Onsite Or Final Loop

The final stage is the most comprehensive. You will participate in three to five interviews that evaluate technical depth, collaboration skills, and product sense. Each interview is about 45 minutes and typically includes:

SQL and data analysis round

You will solve complex SQL problems involving window functions, multi table joins, and event based metrics. Interviewers assess how you handle ambiguity and check assumptions.

Tip: Explain early how you would validate the dataset or identify anomalies to show practical data intuition.

Experimentation and analytics reasoning round

This assesses your ability to design or evaluate A/B tests, interpret experiment results, and define appropriate metrics for PayPal products. You may analyze payment success changes or risk model adjustments.

Tip: Anchor your answers in business outcomes by discussing what decisions stakeholders could make from the results.

Product and case analysis round

Expect scenario based questions tied to PayPal flows such as payment failures, merchant onboarding friction, or fraud spikes. You will define success metrics, propose investigative steps, and recommend actions.

Tip: Use a clear structure such as problem, metric definition, data needed, and decision to keep your thinking organized.

Behavioral and cross functional collaboration round

This round explores how you work with diverse teams, handle ambiguity, and demonstrate PayPal’s values of inclusion, innovation, collaboration, and wellness.

Tip: Prepare STAR examples that highlight ownership, communication, and how you navigate disagreements or unclear situations.

Some candidates may also have a specialization round focused on risk analytics, enterprise systems, or regulatory reporting depending on the role’s domain.

Hiring Committee And Offer

Once all interviews are complete, feedback is consolidated and evaluated by hiring leaders. They assess technical ability, communication clarity, and overall team alignment. If successful, you will move into the offer stage, where compensation, equity, benefits, and hybrid work details are finalized. PayPal is known for competitive pay, strong wellness benefits, and opportunities for internal mobility.

Tip: Come prepared with market data and clear priorities so you can confidently negotiate your offer.

Want to build up your PayPal interview skills? Practicing real hands-on problems on the Interview Query Dashboard and start getting interview ready today.

PayPal Data Analyst Interview Questions & Answers

PayPal data analyst interviews focus on how well you can work with real transactional data, measure performance across complex payment flows, reason through ambiguous product problems, and communicate insights clearly. Interviewers evaluate your SQL fluency, analytical depth, experiment design knowledge, payments domain understanding, and ability to collaborate across risk, engineering, product, and operations teams. Below are the key categories of questions you can expect, each tailored to real data challenges PayPal analysts handle.

SQL And Data Manipulation Questions

SQL is one of the most important skills for PayPal analysts because the company processes millions of daily transactions across multiple funding sources, merchants, and geographies. These questions test your ability to query large datasets, build meaningful metrics, and identify patterns or anomalies that influence payment success and risk outcomes.

-

This question checks whether you can combine filtering with conditional aggregation, which is important in PayPal analytics because you often compute multiple KPIs from the same transaction table. A strong answer would reference using

COUNT(*)for total transactions,COUNT(DISTINCT user_id)for unique users, a conditionalSUM(CASE WHEN amount > X THEN 1 END)for high value payments, and grouping withORDER BYor window functions to identify the top revenue product. This kind of multi metric summary is typical in dashboards used to evaluate payment performance or merchant health at PayPal.Tip: Explain how you validate your filters before aggregating because transaction tables can include reversals or retries.

Write a query to find projects where actual spend exceeds budget

This question looks at your ability to join two related datasets and highlight mismatches, which mirrors PayPal’s need to reconcile financial, operational, and risk data. You would join both tables by project ID, compute aggregated actual spend, and then filter for projects where spend exceeds budget. Mentioning grouping logic and handling partial month expenses shows an understanding of how analysts monitor operational cost drivers inside PayPal’s Enterprise Systems and finance teams.

Tip: Clarify whether the comparison should use lifetime budget, monthly allocation, or quarterly targets because finance reporting often uses different aggregation windows.

Compute month-over-month growth in revenue

This question focuses on your ability to apply window functions to payment data, something PayPal analysts do often when evaluating revenue shifts, funding source behavior, or merchant trends. You would group transactions by month, sum revenue, and use

LAG()to reference the previous month’s total, then compute percentage or absolute growth. This kind of time series comparison is useful when analysts investigate seasonal patterns or changes in authorization performance.Tip: Mention checking for partial months because incomplete data can distort growth calculations.

Write a SQL query to calculate the authorization rate by country for the last 7 days.

This question evaluates whether you can create a core payments metric from raw logs. You would filter to the last 7 days, group by country, and calculate successful authorizations divided by total attempts, taking care to filter appropriately on the event type or status. At PayPal, analysts regularly compute authorization metrics to diagnose regional declines or examine how routing and issuer behavior vary by market.

Tip: Ask which transaction status codes map to a “successful authorization” because PayPal uses multiple internal states.

Write a query to find users who attempted more than three failed payments in a single day.

This question looks at your ability to combine grouping, date logic, and conditional filtering. You would group attempts by user and transaction date, count the failures, and select rows where the failure count exceeds three. PayPal analysts use this kind of approach to detect abnormal retry behavior, potential fraud activity, or issues with specific funding instruments.

Tip: Clarify the definition of a failure, since certain soft declines may behave differently from hard declines in PayPal’s systems.

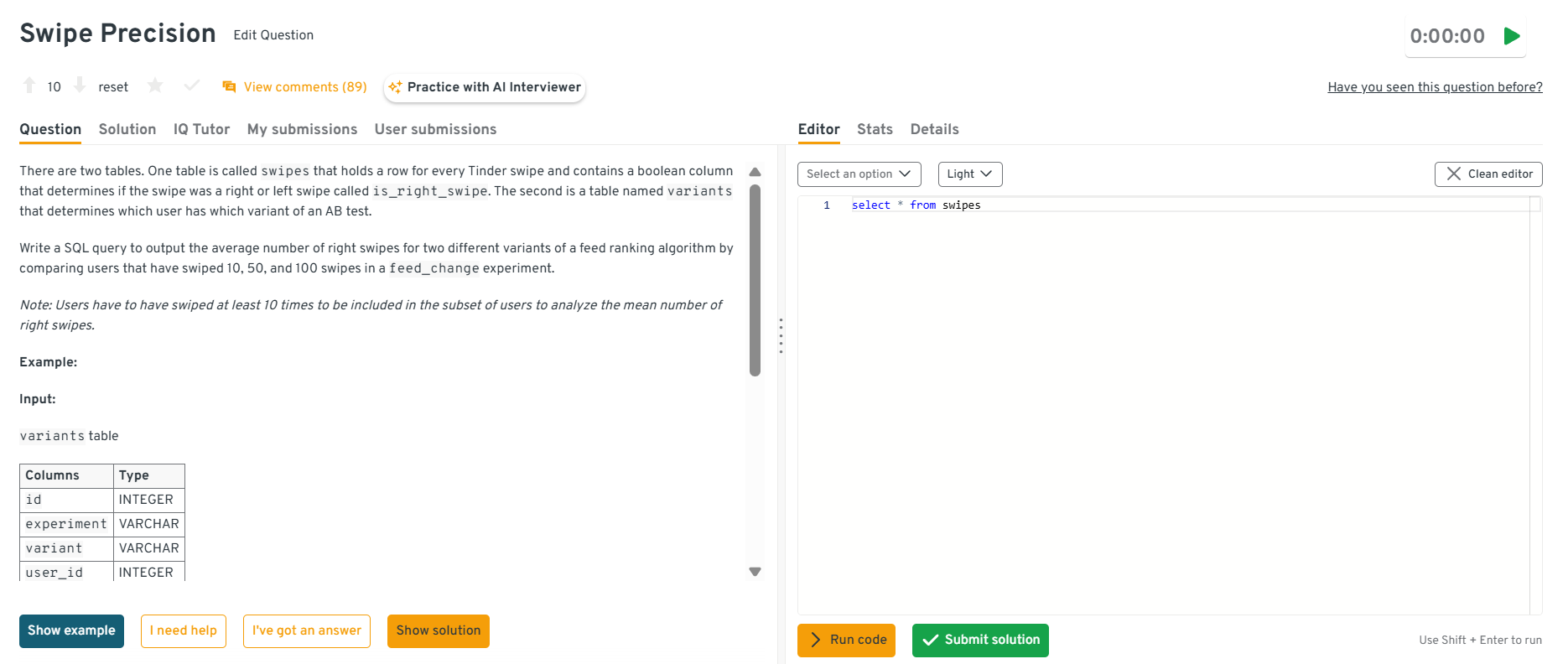

-

Even though the example is framed in a different product context, the underlying analytical skill applies to PayPal experiments. You would filter users by minimum swipe counts, group by experiment variant, and compute average activity, possibly using a subquery or window function to enforce baseline thresholds. This mirrors how PayPal analysts evaluate user behavior in A B tests where only sufficiently active users should be included to avoid bias in metrics like engagement or checkout completion.

Tip: Mention excluding extremely low activity users to prevent skew in behavioral experiment metrics.

Head to the Interview Query dashboard to practice the full set of PayPal’s interview questions. With built-in code testing, performance analytics, and AI-guided tips, it’s one of the best ways to sharpen your skills for PayPal’s data interviews.

-

This question evaluates your ability to aggregate usage and revenue metrics across time, something PayPal analysts do frequently when producing monthly business reviews. You would filter to the 2020 date range, group by month, count distinct users, count total transactions, and sum payment volume. The ability to produce clean monthly summaries is essential for analyzing seasonality, identifying long term declines, or monitoring the impact of product changes.

Tip: Explicitly state how you define a monthly active user, because PayPal teams may track MAU based on logins, wallet activity, or completed payments.

Analytics And Metrics Questions

These questions assess your ability to interpret payment, merchant, and risk metrics that drive the business. PayPal analysts regularly investigate dips in authorization rate, spikes in disputes, or checkout friction, so you are expected to break down metrics clearly and identify potential root causes.

-

This question evaluates your ability to extract stable behavioral signals from noisy transactional data, something PayPal fraud and risk teams rely on heavily. A strong answer would mention clustering transactions by timestamp and geography, identifying recurring patterns such as nighttime or weekend purchases near a consistent location, and weighting transactions differently depending on merchant type or travel behavior. You might also discuss excluding outlier events like international spikes or digital purchases that do not reflect physical presence. These kinds of derived features help PayPal assess whether a transaction aligns with a user’s typical geographic footprint.

Tip: Emphasize how you would incorporate recency and frequency so fraud scoring adapts to users who relocate or travel.

What metrics would you define to measure merchant onboarding quality?

This tests your ability to design metrics relevant to operational and compliance workflows. You might include onboarding completion rate, document failure rate, time to first transaction, and post activation success rate. PayPal values clear connections between metrics and merchant experience.

Tip: Mention the need to track friction caused by compliance checks.

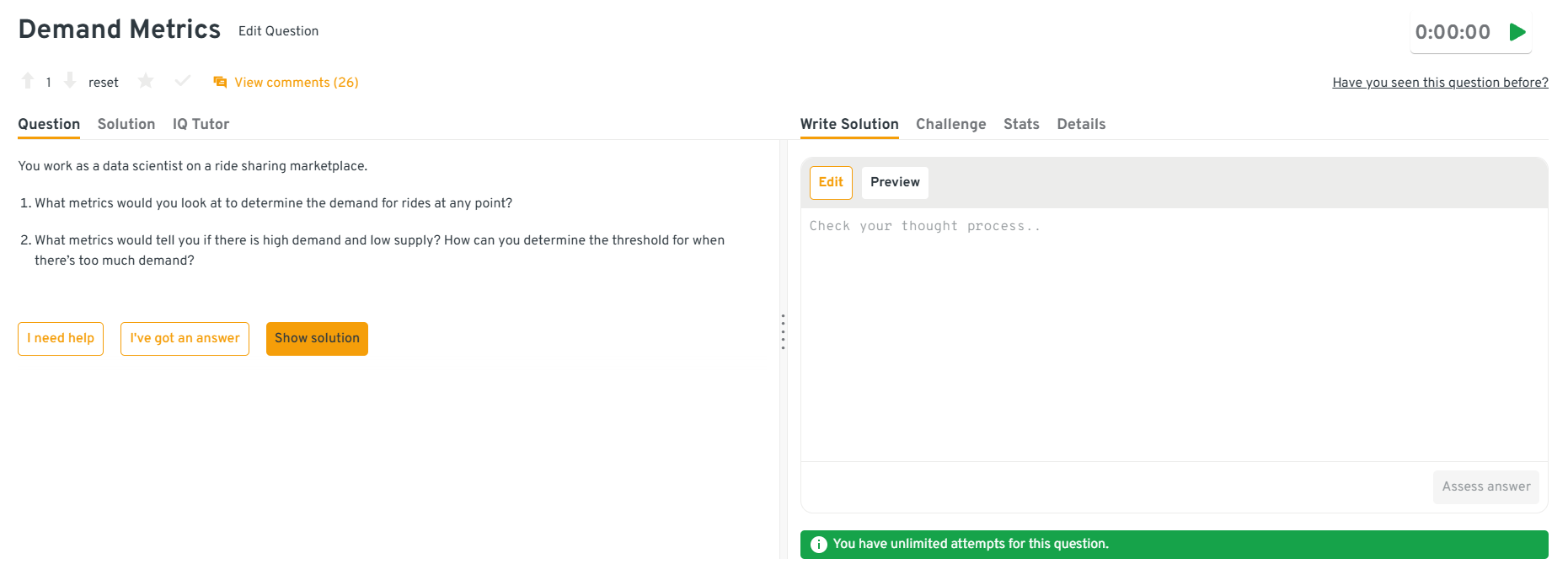

-

This kind of analytical thinking applies directly to PayPal’s merchant and payment systems. You would define core demand and supply metrics such as payment requests per minute, merchant availability, funding source success rates, and platform latency. The goal is to detect when volumes exceed system or merchant capacity, leading to failures in authorization or increased checkout abandonment. PayPal analysts often build these kinds of stress indicators to anticipate outages, fraud spikes, or merchant bottlenecks.

Tip: Highlight the importance of setting dynamic thresholds that adjust based on historical peaks and seasonality.

Head to the Interview Query dashboard to practice the full set of PayPal’s interview questions. With built-in code testing, performance analytics, and AI-guided tips, it’s one of the best ways to sharpen your skills for PayPal’s data interviews.

How would you determine whether a decline in authorization rate is seasonal or abnormal?

This question tests your understanding of historical comparison. You would compare current trends with previous periods, examine year over year patterns, and segment by geography or funding source. You should mention analyzing merchant mix shifts.

Tip: Explain that normalization by volume and mix is essential to avoid misleading comparisons.

What do you think are the most important metrics for WhatsApp?

This question looks at how well you can generalize product metric design across domains. You might mention DAU, retention, message delivery success, session frequency, and user engagement depth, then explain how similar principles apply to PayPal features such as checkout completion, wallet engagement, peer-to-peer activity, and post payment satisfaction. PayPal expects analysts to reason about core value, reliability, and repeat usage regardless of product type.

Tip: Connect every metric back to user or merchant value, since PayPal prioritizes trust and reliability above vanity metrics.

Looking for hands-on problem-solving? Test your skills with real-world challenges from top companies. Ideal for sharpening your thinking before interviews and showcasing your problem solving ability.

Experimentation And A/B Testing Questions

PayPal runs experiments to improve checkout flows, optimize fraud models, and enhance merchant onboarding, so analysts must understand experiment design, statistical evaluation, and high risk decision making. These questions test how you balance performance improvements with financial and compliance risk.

How would you evaluate an experiment that increases payment success but slightly raises dispute rates?

This question tests your ability to weigh trade offs. You would compare lift in success to added risk exposure, examine segment level patterns, and model financial impact. PayPal values analysts who consider downstream effects on trust and compliance.

Tip: Emphasize that revenue benefits must be balanced with fraud and customer satisfaction risks.

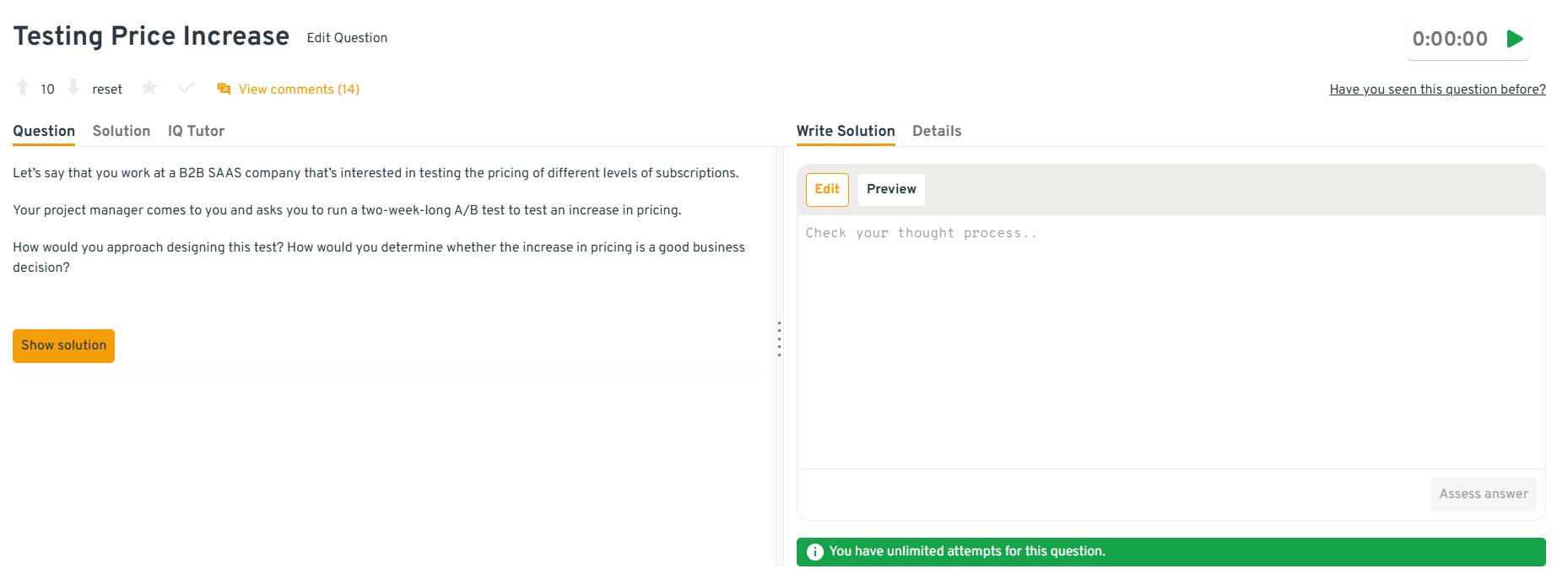

-

This directly applies to PayPal subscription and merchant pricing experiments. You would randomly split eligible merchants into control and treatment groups, apply the new pricing to treatment, and track metrics such as churn rate, net revenue retention, upgrade activity, and downstream transaction volume. It is also important to evaluate whether higher prices change merchant behavior, especially for small or high risk accounts, and to model the long term lifetime value impact before recommending rollout. PayPal expects analysts to balance revenue upside with merchant satisfaction and platform health.

Tip: Highlight how you would perform sensitivity analysis across merchant segments to ensure the price increase does not disproportionately harm small businesses.

Head to the Interview Query dashboard to practice the full set of PayPal’s interview questions. With built-in code testing, performance analytics, and AI-guided tips, it’s one of the best ways to sharpen your skills for PayPal’s data interviews.

-

This question examines your ability to evaluate performance across competing acquisition channels, which parallels PayPal’s work in optimizing merchant growth and wallet engagement campaigns. You would define clear success metrics such as cost per activation, downstream transaction value, or lifetime value, then assign portions of the budget to each channel in a controlled split. The test should run long enough to stabilize channel effects and capture post acquisition behavior, since PayPal often tracks whether new users or merchants actually complete transactions or stay active. Once results stabilize, you would compare ROI across channels and recommend reallocations based on incremental impact.

Tip: Mention including holdout groups to understand the true incremental lift of each marketing channel rather than measuring raw conversions alone.

How would you analyze an experiment where sample sizes are extremely large?

This question evaluates your understanding of practical significance. With massive datasets, tiny differences may be statistically significant but not meaningful, so focus on effect size and long term value. PayPal wants analysts who look beyond p values.

Tip: Emphasize interpretation of absolute impact rather than statistical noise.

How would you design an experiment to test a new fraud scoring threshold?

This question tests safe experimentation. Explain defining treatment and holdout groups, using risk tier segmentation, and monitoring fraud, false positives, and customer experience. Emphasize cautious rollout.

Tip: Highlight starting with small traffic slices to limit financial exposure.

Watch Next: Top 5 Insider Interview Questions Data Analysts Must Master Before Any Interview!

In this video, Jay Feng, an experienced data scientist and cofounder of Interview Query, dives into five of the most frequently asked data-analyst interview questions, from handling over-connected users who post less to simulating truncated distributions. You’ll see how to break down each prompt, choose the right methods, implement clear solutions, and tie your answer back to business context for maximum impact.

Product And Business Case Questions

These questions evaluate your ability to think like a product analyst who understands customer behavior, merchant needs, and the mechanics of digital payments. PayPal expects clear frameworks for diagnosing issues and making data informed recommendations.

How would you investigate a rise in failed payments during peak hours?

This question tests structured issue diagnosis. To answer this, start by segmenting failures by processor, issuing bank, device type, geography, and funding source to identify where the spike is concentrated. Then examine system metrics such as latency, API error rates, and throughput constraints to see whether load is affecting performance. Next, compare decline codes, recent product launches, and risk rule changes that may have introduced friction. Finish by assessing financial and user impact to prioritize fixes.

Tip: Begin with system and processor health checks because infrastructure bottlenecks often surface first during peak load.

How would you define success for a new PayPal checkout feature?

This tests KPI design tied to product value. Think about how PayPal evaluates whether a new feature improves the payment experience. You would define primary metrics such as checkout conversion, authorization rate, time to completion, and step level drop off. Then include secondary measures like user satisfaction, payment retries, and dispute rates to capture downstream impact. Finally, monitor stability post launch to ensure the feature scales well under real traffic.

Tip: Tie each metric to a clear customer or merchant outcome so success criteria feel meaningful and actionable.

If cross border payments see a rise in declines, how would you investigate?

This question evaluates domain awareness. Start by segmenting declines by corridor, currency pair, issuing bank, funding source, and payment type to pinpoint where the issue is concentrated. Then review regulatory changes, FX routing shifts, processor outages, or updated risk rules that may have introduced friction. Analyzing decline codes over time helps determine whether the problem stems from issuer behavior or PayPal’s internal filters.

Tip: Break decline patterns down by region first because cross border issues are often highly localized.

How would you measure whether Uber Eats provides a net positive impact on Uber’s overall business?

To answer this, think about how PayPal assesses the ecosystem effects of new services such as enhanced wallet features, rewards programs, or merchant tools. You would start by defining both direct and indirect value drivers, including boosts in transaction volume, retention improvements, cross sell activity, and engagement lift. Next, compare these gains to added operational cost, fraud risk, and potential cannibalization of existing products. A complete analysis also examines changes in merchant satisfaction, checkout success, and long term revenue contribution to ensure the feature strengthens the broader PayPal network.

Tip: Include downstream metrics such as cross border usage, repeat payment activity, or merchant lifetime value since ecosystem features often create delayed but meaningful impact.

Head to the Interview Query dashboard to practice the full set of PayPal’s interview questions. With built-in code testing, performance analytics, and AI-guided tips, it’s one of the best ways to sharpen your skills for PayPal’s data interviews.

How would you prioritize which merchants to contact when disputes spike?

This tests resource allocation thinking. First identify merchants with the largest absolute increases in disputes, weighted by their transaction volume and revenue contribution. Then segment disputes by reason codes, geography, and recent product or policy changes to understand root causes. Prioritize outreach to merchants whose spikes pose the greatest financial, regulatory, or customer experience impact. Creating tiers helps focus efforts on high value or high risk accounts.

Tip: Combine dispute rate trends with merchant revenue importance to build a balanced and defensible prioritization framework.

Behavior And Team Collaboration Questions

PayPal places strong emphasis on communication, ownership, and cross functional teamwork. Behavioral questions evaluate how you collaborate with engineering, risk, product, and operations teams while handling ambiguity and high stakes decisions.

What makes you a good fit for our company?

This question evaluates how deeply you understand PayPal’s mission and whether your experience aligns with the challenges of a global payments ecosystem. Strong candidates connect their analytical background to PayPal’s focus on trust, security, risk mitigation, and seamless customer experiences while demonstrating genuine motivation for the role.

Example: “I am drawn to PayPal because of its mission to build trust and enable secure digital payments worldwide. In my previous role, I built anomaly detection models that reduced manual review times and improved risk team efficiency by 18 percent. I enjoy working with large scale behavioral and transactional datasets, and I believe my mix of analytics, product thinking, and collaboration aligns closely with PayPal’s culture of innovation and customer focus.”

Tip: Show familiarity with PayPal’s values and highlight experience related to payments, fraud, compliance, experimentation, or high scale analytics.

Tell me about a time you had to explain complex data to a non technical audience.

This question assesses your ability to translate technical analysis into business language, which is critical at PayPal where stakeholders range from product to operations to compliance teams. Interviewers want to see clarity, empathy, and an understanding of how to distill complexity into actionable insights.

Example: “In my last role, our operations team struggled to understand why certain payment methods were driving higher refund rates. I created a simple visualization that showed refund patterns by funding source and walked the team through the key drivers in plain language. By framing the insights around customer experience rather than technical details, we aligned on a set of fixes that reduced refund volume by 12 percent in one quarter.”

Tip: Emphasize your ability to simplify without losing analytical accuracy.

-

This question evaluates your ability to navigate misalignment, especially common at PayPal where analysts work across product, engineering, risk, and sales. Interviewers want to see maturity, active listening, and a collaborative approach to resolving communication gaps.

Example: “I once worked with a product manager who felt my analysis contradicted their intuition about a checkout change. Instead of debating, I scheduled a working session to review my assumptions, data sources, and methodology. By walking through the data together, we discovered a sampling bias in the initial dataset. After correcting it, we aligned on the insights and shipped a revised experiment that ultimately improved conversion by 4 percent.”

Tip: Show that you value partnership over being right and that you handle disagreements constructively.

Head to the Interview Query dashboard to practice the full set of PayPal’s interview questions. With built-in code testing, performance analytics, and AI-guided tips, it’s one of the best ways to sharpen your skills for PayPal’s data interviews.

How do you manage competing priorities in a fast paced environment?

This question focuses on prioritization and clarity, which matter deeply at PayPal where analysts may support multiple teams simultaneously. Strong answers highlight your ability to evaluate impact, communicate proactively, and balance short term urgencies with long term goals.

Example: “When I supported both the risk and payments teams, I often had conflicting deadlines. I created a simple prioritization rubric based on impact, urgency, and dependency. I would share this with stakeholders at the start of each week, flag any upcoming bottlenecks early, and update timelines transparently. This helped set expectations and ensured the most important insights were delivered on time without sacrificing quality.”

Tip: Mention proactive communication because PayPal values analysts who prevent surprises.

Describe a time you took ownership of a problem without being asked.

This question tests initiative, which is especially important at PayPal where analysts are expected to identify issues in data quality, risk patterns, or merchant performance before they escalate. Interviewers want candidates who act independently and drive meaningful improvements.

Example: “I noticed recurring inconsistencies in our transaction logs that were causing delays in reporting payment success rates. Instead of waiting for an engineering request, I investigated the issue, identified the root cause in an upstream ingestion job, and documented the findings with examples. After partnering with engineering to fix the pipeline, our dashboard latency improved from 24 hours to under 2 hours, which helped leadership make faster operational decisions.”

Tip: Focus on the measurable impact of your ownership, not just the action itself.

Need 1:1 guidance on your interview strategy? Explore Interview Query’s Coaching Program that pairs you with mentors to refine your prep and build confidence.

How To Prepare For A PayPal Data Analyst Interview

Preparing for the PayPal data analyst interview goes beyond practicing SQL queries or reviewing analytics theory. The strongest candidates understand how PayPal operates as a global payments platform, how its risk and compliance constraints shape decision making, and how data tells the story behind user behavior, merchant performance, and transaction flows. Think of your preparation as developing three core abilities: analyze like a detective, think like a product partner, and communicate like a storyteller who can translate complexity into clarity.

Read more: How to Prepare for a Data Analyst Interview

Below are the key areas to focus on to show up confident, structured, and ready for PayPal’s unique interview style.

Study PayPal’s end to end payments flow: Understanding how a transaction moves through authentication, funding checks, issuer networks, fraud scoring, and settlement helps you answer product and metrics questions with more precision.

Tip: Draw the full flow on paper and note where data gets logged, where failures occur, and which teams own each step.

Develop intuition for noisy, real world financial data: PayPal’s datasets include retries, reversals, soft declines, partial approvals, and time based dependencies. You’ll be evaluated on how well you interpret these signals, not just clean tables.

Tip: Practice deduplicating events, correcting timestamps, and reconstructing multi step user flows on open datasets.

Learn how to reason about risk and compliance tradeoffs: Payments decisions often require balancing revenue, conversion, trust, and regulatory constraints. Showing that you understand this instantly makes your answers stronger.

Tip: When practicing cases, always ask: How does this impact fraud, compliance, or user trust?

Practice turning ambiguous signals into investigative plans: PayPal analysts often start with loose signals like “declines spiked in one region.” Interviewers want to see how you break that into segments, hypotheses, and a clear investigative plan.

Tip: Use a structured flow: signal → segmentation → comparisons → anomalies → hypotheses → data needed → next steps.

Strengthen your ability to work backwards from business problems: Interviewers evaluate whether you can translate goals such as reducing disputes or improving merchant health into measurable analytics work.

Tip: Reframe business goals as data questions such as: “What would I need to measure to confirm the problem?”

Show fluency with monitoring and alerting concepts: PayPal analysts maintain dashboards for payment success, dispute trends, fraud spikes, and merchant performance. Knowing what should be monitored and why gives you an advantage.

Tip: Prepare to discuss how you would design alerts, thresholds, or dashboards for a key metric like authorization rate.

Build domain specific vocabulary and mental models: Using correct terminology (issuer, acquirer, soft decline, AVS, 3DS, wallet engagement, funding instrument, cross border routing) signals domain fluency.

Tip: Create a glossary of payments, fraud, and merchant operations concepts and incorporate them into practice answers.

Rehearse concise, narrative style communication: Analysts must summarize analyses into crisp, decision ready insights. Practicing this will help in both behavioral and case interviews.

Tip: Practice giving 30 second summaries of why a metric changed, your top hypothesis, or what data you’d pull first.

Simulate end to end practice with multi round mock interviews: Mock interviews help you identify blind spots early. Simulate full loops that include SQL, product sense, and behavioral questions so you build confidence and stamina. Use Interview Query’s AI Interviewer or mock interview sessions to practice in real world conditions and get targeted feedback from experienced analysts.

Tip: Track patterns in your mock results. If the same weakness appears more than twice, adjust your prep plan and practice intentionally.

If you focus on these areas consistently, you will walk into your PayPal interviews with stronger technical foundations, sharper product intuition, and the communication skills needed to stand out.

Struggling with take-home assignments? Get structured practice with Interview Query’s Take-Home Test Prep and learn how to ace real case studies.

PayPal Data Analyst Salary And Compensation

PayPal’s compensation structure is designed to stay competitive within the fintech and payments industry. Data analysts benefit from strong base salaries, performance bonuses, equity grants, and comprehensive wellness and insurance benefits. Total compensation varies by level, team (Product Analytics, Risk Analytics, Enterprise Systems), and location, with higher ranges in hubs like San Jose, New York, and Austin. Analysts working on risk, compliance, or enterprise systems often receive slightly higher offers due to the specialized nature of their work and the regulatory sensitivity of PayPal’s data environment.

For context across the industry, see Interview Query’s salary resources:

Read more: Data Analyst Salary: What to Expect and How to Maximize Earnings

Tip: Clarify which PayPal analytics track you’re interviewing for. Compensation varies meaningfully between Enterprise Systems, Risk Analytics, and Product Analytics roles.

Average PayPal Data Analyst Compensation (2025)

| Level | Typical Role Title | Total Compensation Range (USD) | Breakdown |

|---|---|---|---|

| Entry-Level / Analyst I | Data Analyst I | $85K – $120K | Base $70K–$95K + Bonus + Equity |

| Mid-Level / Analyst II | Data Analyst II | $110K – $145K | Base $90K–$115K + Target Bonus + Equity |

| Senior Analyst | Senior Data Analyst | $140K – $180K | Base $110K–$140K + Higher Bonus + RSUs |

| Enterprise Systems Analyst | Analyst / Staff Analyst | $137,500 – $236,500 | Base $120K–$180K + Bonus + Equity (per PayPal job posting) |

| Specialized Risk or Compliance Analysts | Senior / Staff Analyst | $150K – $210K | Base $120K–$150K + Equity + Annual Bonus |

*Note: These bands reflect aggregated data from Levels.fyi, Glassdoor, PayPal’s public job listings, and verified candidate submissions. Compensation is typically higher in California and New York markets and slightly lower in remote or lower cost regions.*

Tip: When reviewing an offer, ask for clarity on bonus targets, equity refresh cycles, and the vesting schedule. These components can significantly increase long term earnings.

Average Base Salary

Average Total Compensation

How PayPal Structures Compensation

PayPal’s total compensation package includes four major components. Understanding how each works helps you evaluate your offer clearly and compare it to other fintech companies.

| Component | What It Means | Notes |

|---|---|---|

| Base salary | Fixed annual pay aligned to market benchmarks | Typically the least flexible part of the offer during negotiation |

| Annual performance bonus | Bonus tied to company performance and individual impact | Commonly ranges from 10% to 20% for data analysts |

| Equity (RSUs) | Restricted Stock Units that vest over four years | Higher levels and teams like Risk or Enterprise Systems often receive larger grants |

| Signing bonus or relocation assistance | One time payment for new hires or candidates moving locations | More common for senior roles or hard to fill positions |

Tip: Do not focus only on the base salary. PayPal’s bonuses and RSUs can add substantial long term financial value.

Negotiation Tips For PayPal Candidates

Negotiation at PayPal is collaborative and data driven. Recruiters expect candidates to understand market compensation and articulate what matters most to them.

| Negotiation Tip | Why It Matters |

|---|---|

| Ask about level early | Your level determines pay bands, responsibilities, and promotion timelines. Even a one level shift can significantly change total compensation. |

| Use multiple data sources | Referencing data from Levels.fyi, Glassdoor, and Interview Query salaries helps you make specific, well supported requests. |

| Leverage competing offers appropriately | PayPal recruiters expect candidates to be in multiple processes. Present competing offers factually and professionally to align expectations. |

| Highlight scope and impact | PayPal values measurable outcomes, especially in fraud, payments, and financial system analytics. Leading with impact strengthens your negotiation stance. |

| Clarify location and hybrid expectations | Pay varies by region. Understanding location based adjustments helps avoid surprises and ensures accurate compensation discussions. |

Tip: Always negotiate calmly, with clear numbers and rationale. A data backed approach mirrors PayPal’s analytical culture and strengthens your case.

Evaluating Your PayPal Offer

Before accepting an offer, assess your full compensation package beyond the first year. Consider vesting schedules, bonus targets, expected equity refreshers, and opportunities for long term growth. Analytics at PayPal often leads to roles in product management, risk strategy, or senior analytics positions, which can increase your earning potential over time.

Tip: Request a year by year breakdown of base, bonus, and RSU vesting. This helps you compare offers accurately and understand long term value.

FAQs

What analytics teams exist for data analysts at PayPal?

PayPal employs data analysts across several core teams including Product Analytics, Risk and Fraud Analytics, Enterprise Systems, Compliance Analytics, and Merchant Analytics. Each team works with different datasets and solves unique challenges such as optimizing checkout, detecting fraud patterns, or supporting regulatory reporting. The interview process varies slightly by team depending on domain complexity and technical expectations.

How important is payments or fintech experience for this role?

Payments experience is helpful but not required. PayPal primarily looks for strong analytical skills, clear communication, and the ability to break down complex problems using data. Candidates with backgrounds in e-commerce, operations, risk, or financial analytics often adapt quickly because they understand similar workflows and data structures.

What SQL level does PayPal expect from data analyst candidates?

Most PayPal teams expect intermediate to advanced SQL proficiency. You should be comfortable with joins, CTEs, aggregations, window functions, and time-based analysis without relying on autocomplete. Interviewers also evaluate how clearly you explain your reasoning and validate assumptions.

How long is the PayPal interview process?

The full process typically takes two to four weeks depending on scheduling and whether a case study or take-home assignment is included. Some candidates progress faster if team needs are urgent. Coordination across multiple interviewers can occasionally extend timelines.

Do analysts rotate between teams at PayPal?

PayPal does not have a formal rotation program, but internal mobility is common. Analysts often transition between product, risk, merchant, and enterprise systems teams as they grow or shift interests. Strong internal performance and proactive communication make these transitions smoother.

How technical are the case studies in PayPal’s interview process?

Case studies focus on practical analytics tasks such as funnel analysis, anomaly detection, segmentation, or risk investigations. You may work with sample datasets or walk through logic verbally. The level of technical depth varies by team but aligns closely with real work.

What tools do PayPal data analysts use?

Analysts rely on SQL, Python, R, Tableau, Excel, and internal ETL and experimentation platforms. Some teams also work with Spark or Hive for large-scale data processing. Tooling depends on the domain, with risk and fraud teams using more specialized systems.

Does PayPal support remote or hybrid work?

PayPal uses a balanced hybrid model where most employees work three days in the office and two days remotely. Certain roles, especially those involving sensitive financial or regulatory data, may require more in-person collaboration. Remote eligibility depends on team and location.

How competitive is the PayPal data analyst hiring process?

The process is competitive due to PayPal’s global scale and the complexity of its payments and risk systems. Candidates who demonstrate structured thinking, strong SQL skills, and clear communication tend to stand out. Domain familiarity in payments or fraud analytics can provide an advantage.

Can you negotiate a data analyst offer at PayPal?

Yes, PayPal expects candidates to negotiate professionally based on market data and prior experience. Components like signing bonuses, equity, and relocation support often have more flexibility than base salary. Clear, data-backed conversations help ensure alignment.

Does PayPal hire international candidates or sponsor visas?

PayPal does hire international candidates and provides visa sponsorship for many roles depending on business needs. Sponsorship availability can vary based on location, position level, and team requirements. Candidates should confirm eligibility with their recruiter early in the process.

What are common pitfalls candidates face in the interview?

Common pitfalls include writing overly complex SQL, failing to validate assumptions, and giving unstructured answers to case or product questions. PayPal values clarity and practical reasoning, so rambling or overfitting solutions can weaken your performance. Practicing frameworks and explaining logic step by step helps avoid these issues.

Conclusion

Preparing for the PayPal data analyst interview means strengthening your technical foundation, sharpening your product intuition, and learning to communicate insights clearly across teams. As you move through each stage of the process, stay focused on clarity, analytical rigor, and practical problem solving. For targeted practice, explore the full Interview Query Question Bank, try the AI Interviewer, or work with a mentor through Interview Query’s Coaching Program to refine your approach and build confidence for the PayPal interview.