PayPal Product Analyst Interview Process & Sample Questions (2026 Guide)

Introduction

Like other analytics roles, product analysts continue to see a significant job growth of 11%, with about 108,000 openings projected for the next decade. As PayPal modernizes its platforms for 2026, product analysts are deemed essential to optimizing every offering, from peer-to-peer payments to consumer checkout experiences.

As such, PayPal’s interview for product analysts reinforces every skill crucial to driving its omni-channel strategy. SQL depth and A/B testing expertise are tested in relation to transaction-based metrics and trends, while awareness of risk and compliance principles is evaluated to increase conversions and reduce payment-related losses.

This guide outlines each stage of the PayPal product analyst interview, highlights common questions, and shares proven strategies to help you stand out and prepare effectively with Interview Query.

What Does a PayPal Product Analyst Do?

A PayPal product analyst improves the performance, reliability, and user experience of a global payments ecosystem serving hundreds of millions of consumers and merchants.

Core responsibilities

- Analyze checkout flows to identify friction, latency, and conversion levers.

- Evaluate metrics and trends like payment success rates, fraud patterns, onboarding funnels, and merchant engagement.

- Interpret payments signals, such as authorization outcomes, declines, chargebacks, disputes).

- Translate insights into product recommendations for PMs, engineers, and risk teams.

Technical expectations

- Strong SQL and Python skills, increasingly emphasized in PayPal’s 2026 roles.

- Proficiency with A/B testing frameworks.

- Ability to work with dashboards, experimentation tools, and large-scale event streams.

Example weekly work

- Investigate a drop in checkout conversion.

- Quantify the impact of Smart Buttons placement.

- Assess mobile checkout latency.

- Diagnose merchant-onboarding friction.

- Partner daily with engineering, product, and risk teams to drive measurable improvements.

Comparing PayPal’s expectations with similar roles at Stripe, Shopify, and Visa helps illustrate how leading payments companies approach experimentation and data-driven product decisions.

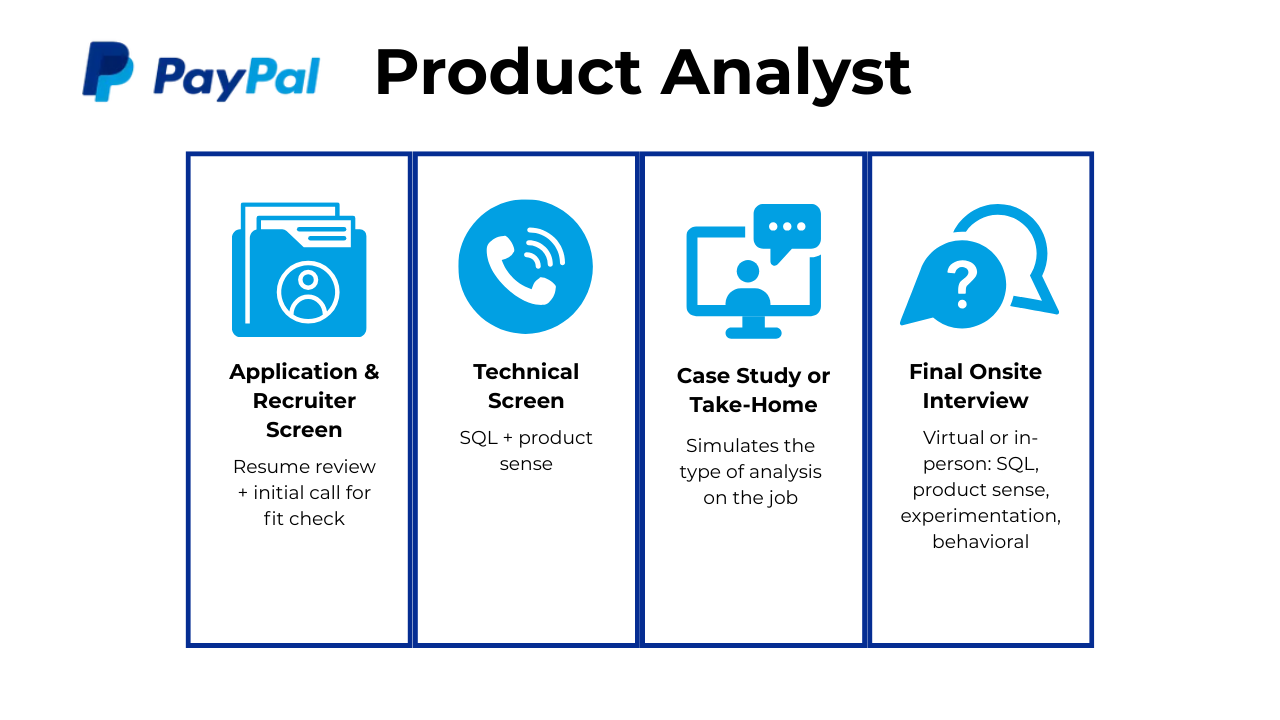

PayPal Product Analyst Interview Process

The PayPal product analyst interview process centers on your ability to understand product analytics, experimentation, SQL, and the fundamentals of how payments work. Most candidates move through the stages in two to five weeks.

Each step tests how you work with data, communicate insights, and collaborate with cross-functional partners. Across the process, interviewers want to see that you can use structured reasoning to show clarity, whether solving technical problems or responding to behavioral prompts.

Application and resume screen

Recruiters begin by scanning for strong analytical foundations and relevant domain experience. Clear SQL experience, hands-on product metrics work, and familiarity with A/B testing are all expected. PayPal also appreciates previous exposure to payments or fintech, especially work involving approval rates, declines, chargebacks, disputes, or onboarding funnels. Your resume should focus on measurable outcomes: improvements to conversion, latency, funnel health, or user engagement.

Tip: Highlight any project where you optimized a decision system, improved a key funnel step, or boosted conversion through data-driven insights. Quantifying the results makes your profile stand out.

Initial recruiter conversation

This first call is a quick fit check. Recruiters validate your background, your comfort with payments or experimentation, and your communication style. They also preview the next steps, the expected timeline, and where the team you’re interviewing with sits, such as consumer payments, merchant experiences, risk products, or another group.

Tip: Draw clear lines between your past work and concepts like transaction flows, merchant behavior, or risk detection. This demonstrates that you understand how product analytics influences both customer experience and financial outcomes.

Technical phone screen

The technical screen blends SQL proficiency with product sense. Expect queries involving joins, window functions, funnel logic, and data hygiene. You may walk through calculations for conversion rates, explore a latency issue, or analyze a shift in authorization success.

Interviewers often introduce short business scenarios, such as diagnosing a checkout dip or proposing ways to improve merchant activation.

This is also where your payments intuition matters. You may be asked about transaction success rates, how fraud controls affect false positives, or the relationship between latency and conversion.

Tip: Show how you balance technical rigor with business reasoning. Interviewers want to see that you can compute the metric, interpret it correctly, and explain why it matters.

Case study or take-home exercise

A strong PayPal take-home assignment always ties insights to financial outcomes. Explain how your proposed changes influence revenue lift, reduce friction cost, or improve long-term retention. This framing mirrors how PayPal teams make decisions.

PayPal’s case study or take-home assignment simulates the type of analysis you’d perform on the job. You might explore a sudden conversion drop, audit an onboarding funnel, assess merchant engagement, or design an experiment for a checkout change.

Strong submissions not only combine exploratory analysis, clear metric definitions, and grounded recommendations, but also tie insights to financial outcomes.

Tip: Describe how your proposed changes could improve revenue, reduce friction costs, or support long-term retention. Try Interview Query’s Take-Home Review for AI-powered feedback that can help you move onto the next round.

Final onsite (Virtual or in-person)

The onsite loop dives deeper into the skills PayPal product analysts rely on daily: SQL fluency, product sense, experimentation design, and strong cross-functional communication.

You’ll mainly work through ambiguous problems tied to checkout flows, merchant experiences, and risk-driven decisions. Behavioral interviews then round out the panel with a focus on ownership, clarity, and decision-quality.

Below is a breakdown of the typical onsite rounds:

| Round Focus | What to Expect (Problems / Prompts) |

|---|---|

| Advanced SQL & Data Interpretation | Complex queries (joins, windows), funnel logic, data-quality checks, pattern interpretation. |

| Product Sense & Metrics Deep Dive | Redesigning checkout steps, defining success metrics, prioritizing improvements, evaluating impact on conversion/transaction health. |

| Experimentation & Causal Reasoning | A/B design, trust/holdout tests, sequential testing, diagnosing variant inconsistencies, proposing experiment setups. |

| Behavioral / Leadership Principles | Ownership and clarity prompts, handling ambiguity, resolving competing priorities, influencing without authority. |

Tip: Use a clear, end-to-end structure in every answer: customer problem → metrics definition → reasoning walkthrough → business impact. This mirrors how PayPal teams evaluate and communicate product decisions.

Ready to sharpen your interview skills before the real thing? Practice the full PayPal-style flow with Interview Query’s Mock Interviews, simulated sessions with peers that let you get feedback, build confidence, and refine your answers under realistic pressure.

What Questions Are Asked in a PayPal Product Analyst Interview?

PayPal product analyst interview questions typically span four areas: SQL, product analytics and experimentation, product sense, and behavioral collaboration. These questions evaluate how well you can query large payments datasets, interpret product metrics, design experiments, reason about customer and merchant needs, and communicate insights clearly.

Watch Next: 7 Types of Product Analyst Interview Questions

This video provides a helpful primer on the types of analytics, product sense, and SQL challenges companies like PayPal commonly ask in analyst interviews. It’s a great warm-up before reviewing the detailed categories and examples below.

In the video, Interview Query co-founder Jay Feng shares that product analyst interviews focus heavily on metrics interpretation, SQL fundamentals, and structured problem-solving—skills that map closely to PayPal’s evaluation process.

Now, let’s look at the core categories and representative question types that appear in PayPal product analyst interviews.

SQL & data manipulation interview questions

SQL is foundational for PayPal product analyst interviews, especially given the company’s transaction-scale datasets. Expect questions involving multi-table joins, window functions, funnel metrics, and debugging issues in authorization or refund logs. You may analyze transaction success rates, identify anomalies in merchant performance, or calculate metrics directly from raw payments tables.

-

This prompt checks comfort with aggregation and grouping logic in SQL. Summing transaction amounts per user and then applying an

ORDER BYon the aggregated value reveals who spends the most. Many candidates also useCOALESCEor filtering logic to handle nulls or irrelevant transaction states.Tip: Consider segmenting users by account type or region while aggregating totals. This can uncover high-value customer patterns relevant to product decisions at PayPal.

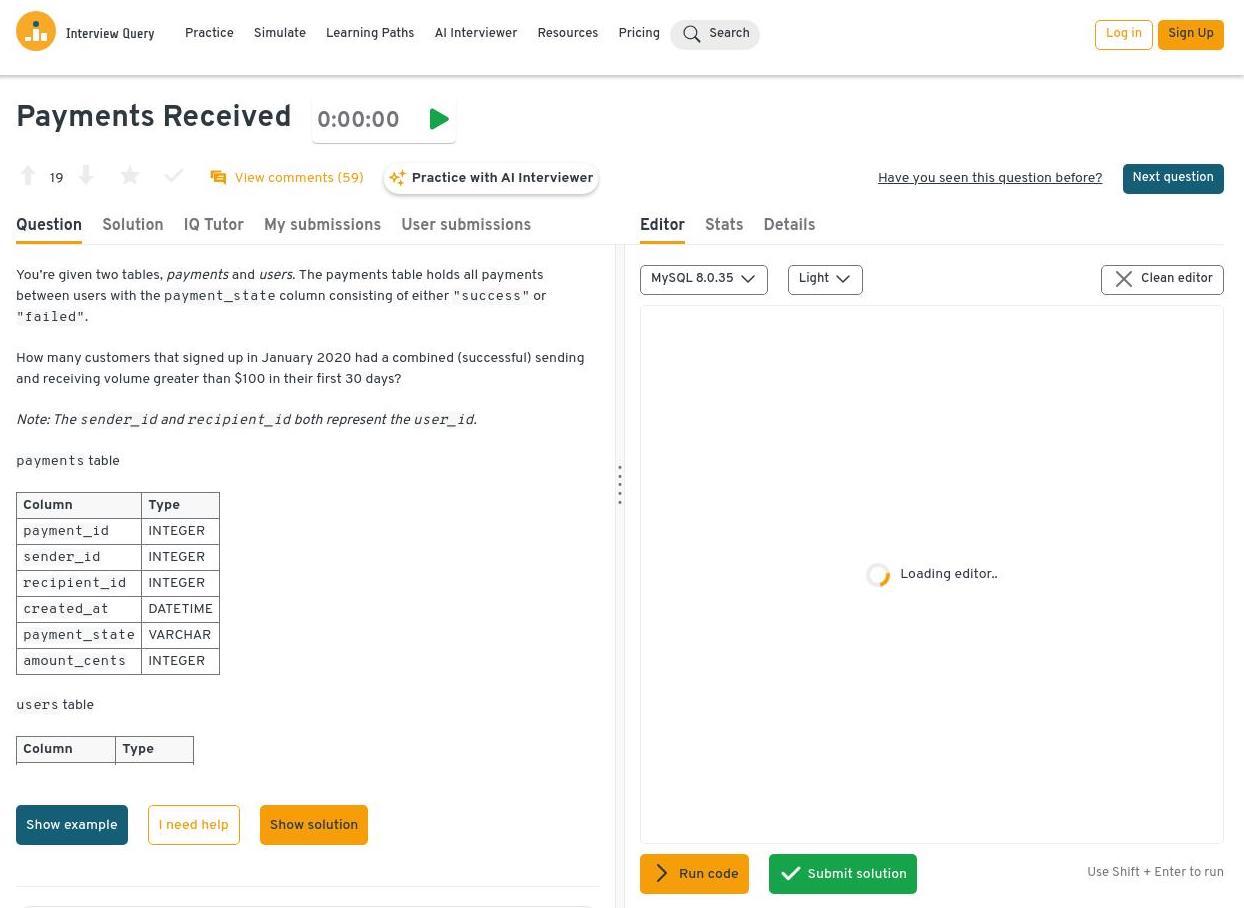

Identify PayPal signups whose first-30-day successful send + receive volume exceeded $100.

Here, the core skill being evaluated is joining tables and applying time-window filters. The solution requires identifying new users from January 2020, linking them to payment activity, filtering to successful transactions, and summing both sent and received amounts. Applying a 30-day constraint via date arithmetic is key to isolating early-lifecycle volume.

Tip: Use cohort-based thinking by comparing first-30-day activity across signup months to identify trends in early engagement and retention, which is highly useful for PayPal growth analysis.

Want to practice problems just like this one? Head to Interview Query’s Dashboard to solve interactive SQL questions, get step-by-step help with IQ Tutor, and run your code directly in the built-in SQL editor.

-

This multi-part query tests a candidate’s ability to combine aggregations, conditional filters, and ranking logic. Each metric can be computed with separate subqueries or CTEs, making the final output cleaner and easier to read. Determining the top-revenue product typically involves grouping by product and ordering by total paid revenue.

Tip: Pay attention to transaction types and product categories. Filtering out refunds or test transactions ensures the revenue analysis reflects real user behavior.

Given a table of refunds, identify merchants with unusually high refund-to-transaction ratios over the past 30 days.

Analysts are expected to show mastery of conditional aggregation and ratio calculations in SQL. By filtering to the latest 30 days, counting both refunds and total transactions per merchant, and computing the ratio, you can highlight outliers. Many solutions then apply a threshold or percentile-based cutoff to flag what qualifies as “unusually high.”

Tip: Comparing merchant ratios against historical benchmarks or platform-wide averages can help flag systemic issues versus isolated cases, a perspective highly relevant for risk management at PayPal.

Query the average payment latency across device types and highlight which segment has the highest delays.

Evaluating mean latency by device type assesses grouping skills and comfort working with performance metrics. Calculating the time difference between payment creation and completion, and then averaging it for each device category, reveals where delays are concentrated. Ordering or ranking those averages helps surface the slowest segment clearly.

Tip: Consider breaking down latency by additional dimensions such as payment method or app version to surface root causes of delays and inform optimization priorities.

To continue brushing up on your coding skills for the product analyst interview, explore Interview Query’s question bank, which has PayPal-specific SQL questions for targeted prep.

Product analytics, metrics & experimentation interview questions

This category focuses on your ability to turn data into insights. Interviewers test how well you interpret changes in conversion, latency, authorization failures, risk false positives, and merchant lifecycle metrics. Experimentation and A/B testing questions are also included in this section because PayPal treats experiment design as part of analytics. You may diagnose unexpected drops in metrics, propose guardrails, or explain how sample imbalance could invalidate results.

-

You calculate LTV using the formula: LTV = Average Revenue per Month × Average Customer Lifetime, where lifetime is derived from churn rate (e.g., 1 / churn). Candidates may also discuss adjusting for monthly retention, discounts, or multi-product scenarios. Tip: Frame LTV calculations in a real PayPal context by considering transaction fees or cross-product usage, as these can materially affect customer value.

-

This question tests ability to map user behavior and identify friction points. The approach involves tracking key event flows, calculating drop-off rates between steps, and highlighting areas with low engagement or high abandonment. Heatmaps, funnel analysis, or cohort comparisons can provide actionable insights.

Tip: Emphasize behaviors unique to financial transactions, such as abandoned payments or incomplete onboarding, to show a product-aware, PayPal-specific perspective.

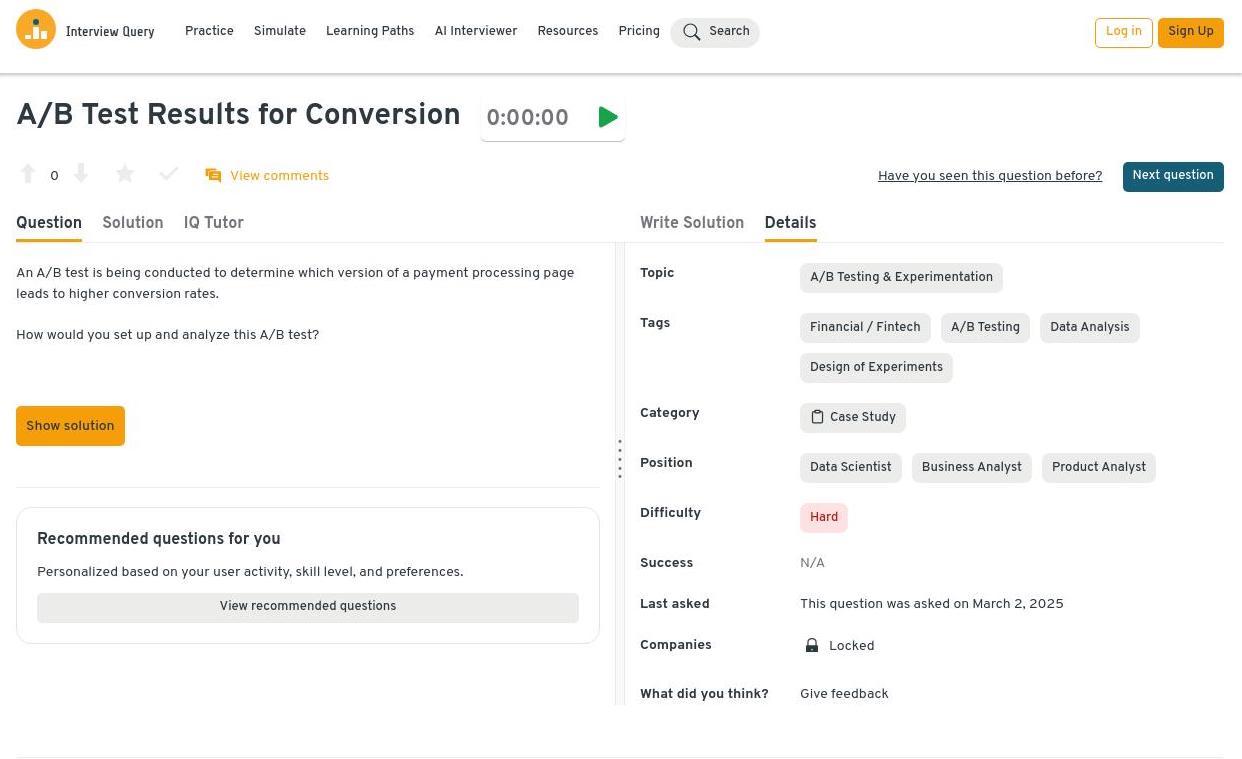

-

You’d randomize users into control and treatment groups, define conversion metrics, calculate statistical significance, and check for segment effects or confounders. Properly accounting for sample size and timing is crucial for reliable conclusions.

Tip: Consider device type, geography, or payment method segmentation when analyzing results, as PayPal conversion can vary widely across these dimensions.

Try more A/B testing questions like this on Interview Query’s Dashboard, where IQ Tutor offers AI-powered hints and explanations. You can browse community comments to see how other candidates approached the same problem.

If PayPal checkout conversion dropped 5% overnight, what metrics would you investigate first and why?

The core skill here is diagnosing short-term anomalies using key product metrics. Start by checking traffic sources, browser/device distribution, payment method failures, error rates, and load times. Comparing trends across segments and identifying correlated drops can quickly pinpoint the underlying issue.

Tip: Pay attention to external factors like regulatory changes, partner API issues, or downtime in critical banking networks, which are often overlooked but can drive sudden drops.

A merchant’s authorization success rate is stable, but revenue has declined. Walk through your diagnostic approach.

Investigate changes in transaction volume, average transaction size, declined payments, seasonality, or shifts in customer mix. Checking related metrics such as refunds, chargebacks, or abandoned carts helps explain revenue drops without apparent authorization issues.

Tip: Drill down by product, region, or channel, since PayPal’s multi-product ecosystem can hide revenue shifts that aren’t reflected in basic authorization metrics.

Need to brush up on your product analytics skills? Check out Interview Query’s structured learning path to understand how to tackle common business problems tied to metrics and experimentation.

Product sense interview questions

Product sense questions differ from analytics questions; instead of diagnosing metrics, you’re asked to understand user problems, propose product changes, and reason through trade-offs. PayPal looks for structured thinking, intuition for payments flows, and the ability to tie product recommendations back to measurable outcomes.

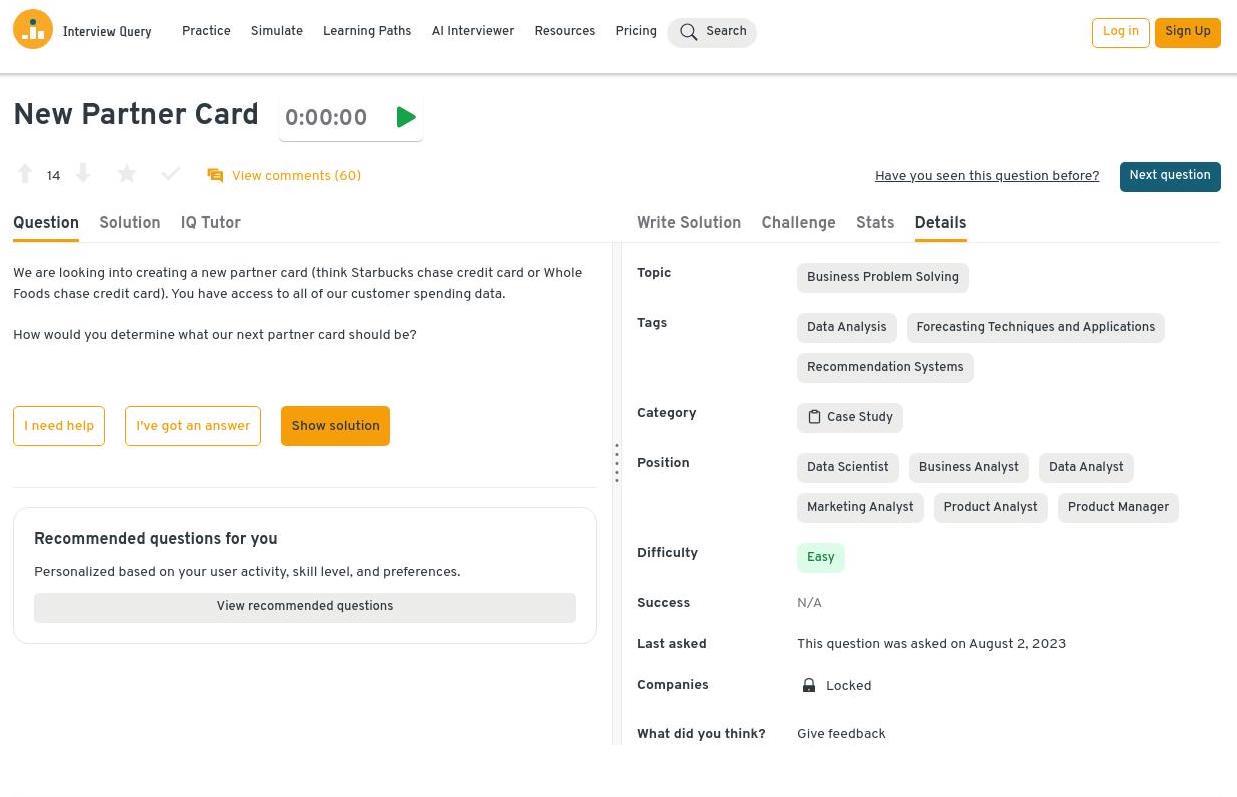

Analyze PayPal customer spending data to recommend the next partner card offering.

Start by segmenting customers based on spend categories, frequency, and merchant types to see where loyalty incentives would resonate most. Then quantify the TAM for each segment and model how a co-branded card could shift spend or increase retention before recommending a targeted card partner with clear upside.

Tip: Focus on categories where PayPal sees high transaction volume or repeat usage, as these are likely to drive higher engagement for a partner card.

Jump into more product analyst practice questions like this on the Interview Query dashboard, where you can practice end-to-end business cases and get AI-powered support as you work through each step.

-

Interviewers use this question to test how well you size impact by weighing acquisition cost, conversion drivers, and the product’s complexity. You’d weigh the personalized guidance and onboarding support of a CS manager against the scalability and low-friction nature of a free trial. Incorporating user segment characteristics, expected revenue impact, and cost of implementation helps frame a data-informed recommendation.

Tip: Highlight scenarios where high-value or complex merchants might benefit from CS support, while simpler transactions or self-service merchants could be served effectively with a free trial.

-

Start by defining “high potential” using measurable thresholds: processing volume, growth trajectory, category profitability, and feature usage gaps. Rank merchants using a weighted scoring model, validate with historical uplift data, and propose a phased outreach plan that lets PayPal test, iterate, and expand to the full segment.

Tip: Incorporate merchant segmentation by verticals that align with PayPal’s strategic priorities, like e-commerce or subscription services, to ensure outreach efforts drive meaningful business impact.

How would you improve the PayPal mobile app onboarding flow for new users? What metrics define success?

This prompt measures your product sense, especially your ability to reason about activation, friction, and early-stage retention. Begin by mapping the current onboarding journey, identifying drop-offs in steps such as identity verification, linking a bank, or first transaction setup. Define success with metrics such as completion rate, time-to-activation, and first-transaction conversion.

Tip: Track cohort-level metrics to see how changes affect different user segments, such as new users from different regions or devices, to ensure improvements generalize.

If merchants complain about friction during Smart Checkout setup, how would you redesign or simplify the experience?

Diagnosing this issue shows how well you balance UX simplification with an understanding of merchant workflows and technical constraints. Isolate where friction occurs and compare merchant expectations against current setup steps. Suggest redesigns like pre-configured templates, auto-detection of platform settings, or interactive setup guides. Iterative design, clearer instructions, pre-filled defaults, and contextual help can reduce friction and improve adoption.

Tip: Measure both setup completion rate and time-to-first-transaction post-setup, as both are critical PayPal-specific indicators of a successful merchant experience.

Behavioral interview questions

During the behavioral round, you’re assessed on how you communicate insights, manage ambiguous problems, and collaborate with PMs, engineers, and risk teams. PayPal values ownership, clarity, and the ability to influence decisions with data, so responses should use the STAR method and emphasize decision-making impact.

-

Interviewers use this to assess how well you communicate analytical findings to product, engineering, design, and business stakeholders who rely on clear insight to ship and optimize payments experiences. Strong candidates show they can distill complex analysis into narratives that influence decisions.

Sample Answer: I once led a review of checkout conversion data that had dozens of competing hypotheses, so I narrowed the story to two core friction points supported by clear visuals. During the meeting, I translated the statistical findings into customer and revenue impact to help product and engineering align on next steps. The clarity of the narrative made it easy for leadership to greenlight an A/B test that ultimately improved conversion.

-

This prompt highlights your ability to navigate ambiguity and ensure alignment across teams with different priorities. Demonstrating empathy, structure, and proactive communication shows you can keep work unblocked.

Sample Answer: I worked with a partner team that kept pushing back on data requirements because they didn’t fully understand the purpose of the analysis. I reframed the conversation by walking them through the business outcome we were targeting and provided a lightweight example of how their data would influence decisions. Once they saw the value, we agreed on a narrower but workable dataset and moved forward smoothly.

Tell me about a time you influenced a product direction using data.

Product analysts at PayPal regularly influence prioritization around checkout, risk, onboarding, and merchant tools, so demonstrating strategic impact is essential.

Sample Answer: At a previous company, I analyzed user drop-off patterns and surfaced a clear correlation between failed verifications and long onboarding times. By quantifying the revenue lost from churn and proposing alternative verification flows, I helped product teams re-sequence features on the roadmap. The update led to a measurable lift in activation rates and validated the data-driven recommendation.

Share a time when you had to make a decision with incomplete data.

PayPal values analysts who can balance rigor with pragmatism, especially when products move quickly and perfect datasets are rare. The ability to choose a direction while acknowledging uncertainty reflects mature decision-making.

Sample Answer: When evaluating a new feature’s adoption potential, I had limited historical data but enough directional signals from similar cohorts. I built a lightweight model using proxy metrics and clearly communicated the key assumptions and risks to stakeholders. That transparency allowed us to proceed with a pilot while instrumenting better tracking for future decisions.

Tell me about a failed experiment or analysis and what you learned from it.

This question helps interviewers understand how you handle setbacks and whether you adopt a learning mindset, which are both central to PayPal’s test-and-iterate culture. Showing ownership and reflection demonstrates resilience and leadership.

Sample Answer: I once designed an experiment that tested a redesign of a pricing page, but the treatment underperformed across every segment. After digging in, I realized we had misjudged users’ sensitivity to complexity and hadn’t validated early prototypes. That experience taught me to invest more in upfront qualitative research and to pilot risky UI changes with a smaller, safer cohort.

Preparing for a PayPal Product Analyst interview requires mastering a mix of technical skills, product intuition, and collaborative problem-solving.

For structured practice across all these domains, Interview Query’s comprehensive question bank is an invaluable resource. It offers real-world examples, detailed solutions, and role-specific insights that can help you build confidence and perform at your best during interviews.

How to Prepare for a PayPal Product Analyst Interview

When preparing for a PayPal product analyst interview, think of the process as building a toolkit: SQL for uncovering insights, experimentation for validating ideas, metrics frameworks for structure, and payments knowledge to anchor your reasoning in real-world behavior. With the right preparation strategy, each part of the interview becomes much more predictable and manageable.

Build a focused SQL prep roadmap

Start by strengthening the fundamentals: joins, window functions, CTEs, aggregations, and time-series logic. PayPal often tests your ability to move quickly from raw tables to interpretable metrics.

A strong prep plan usually includes reviewing:

- Messy data scenarios and practicing “debugging” datasets.

- Funnels from event-level data.

- Questions about conversion rates, drop-off points, and transaction success.

- Real analytics challenges rather than isolated SQL snippets.

Explore Interview Query’s SQL Learning Path to cover common SQL interview questions in a structured manner and monitor your progress along the way.

Use metrics frameworks to structure your thinking

PayPal interviews reward candidates who can organize their reasoning. Before solving a problem, map the key metrics:

- Acquisition → Activation → Conversion → Retention

- Latency → Reliability → Authorization → Revenue impact

- Leading vs. lagging metrics

Using these structures helps you articulate why a metric matters and how it fits into broader product performance.

Strengthen fintech and payments domain knowledge

A product analyst at PayPal interacts with signals that don’t appear in most SaaS environments. Understanding the ecosystem makes your answers sharper and more credible.

Key concepts to review:

- Authorization lifecycle: issuer decisions, soft declines, hard declines, retries.

- Fraud & risk: false positives, chargebacks, dispute flows, rule-based vs. ML controls.

- Payments reliability: latency, processor outages, routing logic, regional behaviors.

Being able to connect a metric change to a domain mechanic sets strong candidates apart.

Practice product intuition

PayPal values analysts who can reason about customer experience as much as statistical accuracy. Build intuition by practicing frameworks such as:

- User journey mapping: where friction appears and why.

- Levers vs. symptoms: separating root causes from surface-level changes.

- Trade-off evaluation: speed vs. safety, convenience vs. risk, revenue vs. reliability.

Communicate insights with clarity and storytelling

Great analysis falls flat without clear communication. During your prep:

- Practice walking through analyses in a narrative arc—setup, insight, implication, action.

- Share decisions and trade-offs slowly and intentionally.

- Use diagrams or mental models when explaining funnels and metrics.

Use PayPal’s public resources to deepen context

Reviewing PayPal’s product pages, merchant center documentation, and developer APIs helps you speak the company’s language. You’ll get a better feel for features like Checkout, Smart Buttons, Pay Later, and merchant onboarding flows.

For structured preparation, Interview Query offers 1:1 coaching tailored specifically for product analytics roles. Coaches with expertise in fintech systems like PayPal can provide personalized feedback to your interview responses, as well as resume enhancement tips to further boost your chances of landing this role.

PayPal Case Studies to Review for the Product Analyst Interview

Product analysts at PayPal regularly work through ambiguous, data-heavy problems. Case studies allow interviewers to see how you structure these problems, form hypotheses, select the right metrics, and translate insights into clear product recommendations. In essence, they mimic the real decision-making environment on PayPal’s product, risk, and merchant teams.

Types of Case Studies

PayPal’s case studies often resemble the challenges analysts tackle in production environments. Common prompts include:

Improve a payment flow

Identify friction, propose hypotheses, and design experiments to improve conversion or reduce latency.

Diagnose a drop in approvals

Analyze issuer behavior, fraud rules, and routing signals to isolate the underlying cause.

Expand a product to a new market

Consider regulatory constraints, payment preferences, and local merchant behavior.

Optimize pricing or fee structures

Model elasticity, assess segment differences, and balance revenue impact against merchant adoption.

Sample Case Study Frameworks

To navigate these scenarios effectively, use a clear, repeatable structure. One reliable framework is:

| Framework Step | Description |

|---|---|

| Problem | Define the objective and the users or merchants affected. |

| Hypotheses | Generate plausible explanations rooted in real payments mechanics. |

| Metrics | Select primary KPIs, supporting metrics, and guardrails. |

| Data Needed | Outline the tables, fields, and signals required for the analysis. |

| Experiment / Action Plan | Design tests, product changes, or rollout strategies. |

| Trade-offs | Consider fraud risk, latency, engineering cost, and customer experience. |

| Recommendation | Propose your final path, supported by reasoning and expected impact. |

Final Tip: Strengthen your interview preparation by practicing with Interview Query’s case study question bank. These cases include PayPal-style scenarios like checkout funnels, approval-rate diagnostics, and fraud-driven experiments, thus offering realistic drills that closely mirror what you’ll see in the interview.

FAQs

Why choose the product analyst role at PayPal?

Choosing a product analyst role at PayPal means contributing directly to the speed, safety, and reliability of global transactions while shaping high-impact areas like approval rates, fraud reduction, and checkout optimization. Because your work influences core customer and merchant experiences, the position also creates strong pathways into product management, risk analytics, strategy, and broader product leadership roles.

How long does the PayPal product analyst interview process take from start to finish?

Most candidates complete the PayPal product analyst interview process within 2–5 weeks, depending on scheduling and team availability. After the recruiter screen, you’ll typically move through a technical phone interview, a take-home or case exercise, and a multi-round onsite. Delays usually occur when interview loops involve cross-functional stakeholders or when multiple teams are considering you at once.

How technical is the PayPal product analyst interview, and what level of SQL should I be prepared for?

Expect intermediate-to-advanced SQL, especially around joins, window functions, funnel queries, and time-series manipulation. PayPal’s analytics teams rely heavily on SQL for experimentation, payments data investigations, and risk monitoring, so you should be comfortable writing full queries under time pressure. You may also be asked to interpret query results or diagnose issues with performance metrics using raw data tables.

Do I need payments or fintech experience to succeed in the PayPal interview?

Fintech domain knowledge is helpful but not strictly required. What matters most is showing you can reason about transaction flows, success rates, authorization failures, dispute patterns, and customer/merchant lifecycle metrics. If you haven’t worked in payments, focus on demonstrating transferable thinking using funnels, risk/quality tradeoffs, and operational metrics.

What types of product metrics does PayPal focus on during interviews?

PayPal often emphasizes metrics tied to checkout performance, payment success rate, latency, risk approval rate, merchant activation, and customer repeat usage. Interviewers want to see whether you understand both the customer experience impact and the downstream financial implications. Being able to quantify how a change affects revenue, loss rates, or operational cost strengthens your answers.

What are the most common mistakes candidates make in the PayPal take-home or case study portion?

Many candidates focus too heavily on surface-level metrics without explaining why those metrics matter in PayPal’s ecosystem. Others fail to tie insights to business value—such as revenue lift, cost avoidance, or merchant conversion improvements. Strong submissions follow a clear structure: define the problem, highlight the right metrics, present clear insights, and recommend actions backed by quantified reasoning.

How should I prepare for product sense questions that involve PayPal Checkout or the mobile app?

Start by mapping the end-to-end customer journey, from initial intent to successful payment or merchant onboarding. Then practice articulating improvements with a structured approach: user pain point → proposed change → metric impact → business outcome. Reviewing recent PayPal product updates, industry checkout trends, and mobile UX patterns will also help anchor your recommendations.

Does PayPal ask a lot of experimentation and A/B testing questions for product analyst roles?

Yes, experimentation is a core pillar for most product analytics teams at PayPal. Expect questions on guardrail metrics, test validity, diagnosing anomalies, and designing experiments for checkout or app flows. You may also be asked to interpret ambiguous experiment results and discuss next steps for iteration.

Is there a difference between interviews for consumer, merchant, and risk analytics teams at PayPal?

Absolutely. Consumer analytics focuses more on user behavior, activation, and retention; merchant analytics leans into onboarding, success rates, and revenue generation; risk analytics emphasizes fraud patterns, model monitoring, and decisioning metrics. The core interview structure stays the same, but domain examples, metrics, and case scenarios shift depending on the team’s focus.

Practice With Interview Query

Sharpen your preparation with Interview Query’s question bank for product analyst SQL drills, case studies, and role-specific analytics challenges. You can also schedule coaching or mock interviews to simulate the full PayPal loop and get personalized feedback. Access community solutions, detailed walkthroughs, and insights from candidates who’ve interviewed across Checkout, Risk, and Merchant teams.

Lastly, explore Interview Query’s full PayPal interview guide for more tailored guidance and alignment with the company’s data-driven, cross-functional, and growth-centric culture. Integrating all these resources into your prep can help you ace the interview with confidence.