PayPal Machine Learning Engineer Interview Guide: Process, Tips & Sample Questions (2026)

Introduction: Preparing for the PayPal Machine Learning Engineer Interview

Machine learning engineers at PayPal power real time decision systems that secure more than four billion transactions each year. With the global ML market projected to expand at a CAGR of more than 35 percent through 2030, fintech companies like PayPal sit at the center of this boom as they accelerate investments in fraud prevention, risk scoring, and real time decision systems. With this growth comes competition. Internal estimates and industry data suggest that fewer than 10 to 15 percent of applicants make it past the initial ML screening, making preparation essential.

PayPal’s machine learning interview is known for its focus on production ready modeling, large scale data processing, and system design under strict latency constraints. Candidates often struggle not because they lack skill, but because the interview blends machine learning strategy, engineering depth, and risk aware thinking. This guide is designed to cut through the noise and give you exactly what you need: a complete breakdown of the interview process, the most common PayPal specific questions, and targeted preparation strategies so you can walk into each round confident, structured, and ready to stand out.

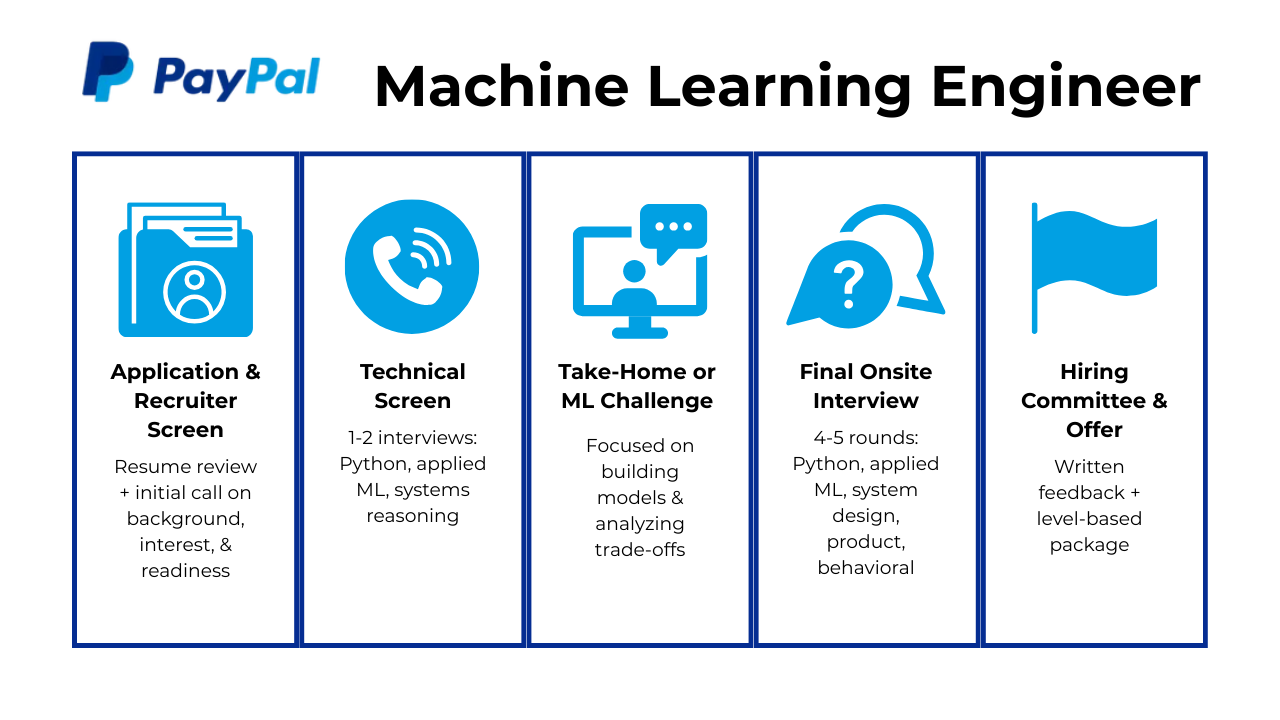

PayPal Machine Learning Engineer Interview Process

The PayPal machine learning engineer interview process evaluates your ability to build high performing models, engineer reliable data pipelines, design scalable ML systems, and collaborate effectively in a risk sensitive environment. The process typically includes several stages that assess Python coding, applied machine learning, ML system design, real time reasoning, and alignment with PayPal’s culture of trust and user safety. Most candidates complete the full process within three to six weeks depending on team schedules and scope. Below is a breakdown of each interview stage and what PayPal teams focus on throughout the evaluation.

Application And Resume Screen

During the resume review, PayPal recruiters look for experience with production machine learning, strong Python development skills, familiarity with distributed data systems, and hands-on ownership of models deployed in real environments. Experience working with imbalanced fraud data, real time inference, or large scale feature engineering is especially relevant given PayPal’s payments ecosystem. Candidates who highlight measurable model improvements, such as latency reductions or precision gains, stand out more effectively.

Tip: Quantify every project when possible using metrics such as model precision lift, fraud loss reduction, or improvements in inference throughput.

Initial Recruiter Conversation

The recruiter call is a short discussion focused on your background, interest in PayPal, and overall readiness for a machine learning engineering role. Recruiters confirm experience with core ML components such as feature engineering, deployment workflows, and real time systems. They may also ask about your familiarity with fraud or risk domains, although direct experience is not required. This stage also covers logistics such as location, timing, and compensation expectations.

Tip: Prepare a concise explanation of your most relevant ML project that demonstrates both technical execution and end to end ownership.

Technical Screen

The technical screen typically includes one or two interviews focused on Python coding, applied machine learning, and reasoning about real time systems. You may be asked to write Python functions that process streaming data, design a training pipeline, calculate key metrics for imbalanced datasets, or walk through how you would handle model drift. Interviewers often present small payment related scenarios to see how you think through challenges like feature sparsity or abrupt behavioral changes.

Tip: Practice solving ML coding tasks in a plain text environment since PayPal screens often use collaborative documents without autocomplete.

Take Home Assignment Or ML Challenge

Some PayPal teams include a take home assessment to evaluate your ability to build models, analyze features, and communicate trade offs clearly. These assignments might involve exploring transactional data, constructing a basic risk scoring model, running experiments, or recommending steps to improve stability and performance. Your write up matters as much as the model since PayPal values clarity, traceability, and defensible reasoning.

Tip: Present your workflow logically with clear assumptions, model limitations, and next steps for improvement if given more time.

Final Onsite Interview

The onsite loop is the most comprehensive stage of the process. It typically includes four to five interviews that simulate real machine learning engineering challenges at PayPal. These interviews emphasize structured problem solving, high quality reasoning, and your ability to operate in complex, ambiguous environments.

Python coding and data engineering round

You will write production style Python focused on data manipulation, feature construction, and efficiency. Expect tasks like computing rolling behavioral patterns, identifying anomalies in user activity, or preparing features for a fraud model.

Tip: Communicate your assumptions before coding and validate edge cases such as missing data or sudden spikes in volume.

Applied machine learning round

This interview assesses model design, evaluation methods, and practical ML considerations. You might be asked to build a classification approach for fraud detection, choose features for a real time risk model, or explain how you would reduce false declines without increasing fraud.

Tip: Discuss metrics clearly and show that you understand how business impact shapes modeling decisions.

ML system design round

You will design an end to end ML system such as a real time scoring service or a retraining pipeline for billions of daily transactions. Interviewers evaluate how you design components for latency, reliability, and scalability.

Tip: Break your design into data flow, model development, serving, monitoring, and fallback layers to show structured thinking.

Product and decision making round

This interview explores how well you connect ML work to PayPal’s overall goals. You might discuss how a model change affects checkout experience, how to evaluate a new merchant verification workflow, or which metrics matter most for cross border payments.

Tip: Always tie technical choices to measurable user safety, merchant impact, or financial outcomes.

Behavioral and collaboration round

Interviewers assess communication style, ownership, and how you work with cross functional teams. Expect questions about handling production issues, partnering with data scientists, or navigating ambiguity in high impact situations.

Tip: Use clear, structured stories that highlight ownership, learning, and collaboration.

Hiring Committee And Offer

After the onsite interviews, PayPal collects written feedback from all interviewers and evaluates your performance across coding, modeling, system design, communication, and cultural alignment. A hiring committee reviews the full packet and determines your final level based on demonstrated experience. If approved, you receive an offer that includes base salary, equity, and bonus components. Team placement is typically discussed near the end of the process and may factor in your interests and strengths.

Tip: Communicate your preferred team domains early since PayPal operates multiple ML groups across risk, identity, credit, payments optimization, and merchant solutions.

Want to build up your PayPal interview skills? Practicing real hands-on problems on the Interview Query Dashboard and start getting interview ready today.

PayPal Machine Learning Engineer Interview Questions

The PayPal machine learning engineer interview includes a mix of Python coding, applied modeling, ML system design, real time inference problems, and product oriented machine learning reasoning. These questions evaluate how well you understand real world challenges like detecting fraud, building low latency scoring pipelines, handling imbalanced datasets, managing drift, and designing models that operate safely across billions of transactions. Beyond technical depth, PayPal interviewers look for engineers who communicate clearly, approach ambiguity with structure, and reason through trade offs that affect financial outcomes and user trust.

Read more: 80+ Python ML Interview Questions

Machine Learning Coding And Data Pipeline Interview Questions

In this part of the interview, PayPal emphasizes your ability to manipulate large datasets efficiently, construct features for fraud and risk models, and write clean Python suited for production workflows. Coding prompts often involve streaming data, rolling computations, anomaly detection, and preprocessing pipelines. The goal is to see whether you can translate machine learning concepts into reliable engineering solutions that scale across millions of daily transactions.

Write Python code to compute rolling behavioral features for users over the past five minutes.

This question assesses your ability to compute time windowed features that mirror real transaction flows. Fraud patterns at PayPal often appear in short, intense bursts, so engineers must efficiently aggregate events, sort timestamps, filter the last five minutes, and compute behavioral metrics like transaction frequency or device switches. A strong solution processes sorted events, uses sliding windows or deque structures, and outputs aggregated features per user.

Tip: Call out how you would scale this computation across partitions since PayPal processes millions of streaming events per second.

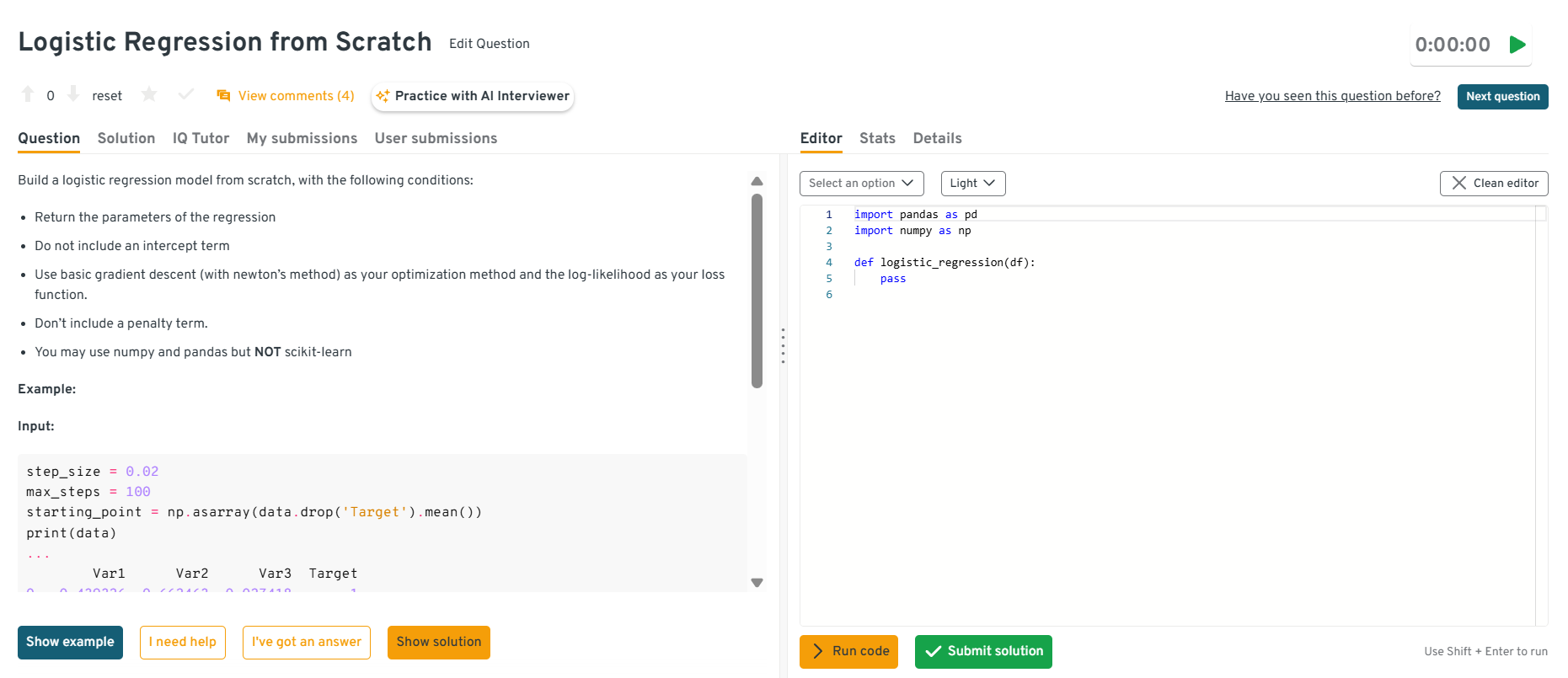

-

Interviewers use this to verify your grasp of core optimization rather than relying on frameworks. For high stakes fraud classification, understanding loss behavior is essential when debugging model instability. The answer defines the sigmoid manually, computes log likelihood across samples, derives gradients, and performs iterative weight updates until convergence or tolerance is met. Mention numerical safeguards like clipping logits and experimenting with learning rates.

Tip: Briefly describe how you would validate correctness by running the implementation on a tiny synthetic dataset before scaling.

Head to the Interview Query dashboard to practice the full set of PayPal’s interview questions. With built-in code testing, performance analytics, and AI-guided tips, it’s one of the best ways to sharpen your skills for PayPal’s data interviews.

Given a stream of transactions, flag users whose activity deviates significantly from their baseline behavior.

This evaluates your ability to build online anomaly detectors, which PayPal relies on for spotting real time fraud changes. A solid approach maintains moving averages or probability estimates per user, updates statistics with each new event, and compares incoming behavior against dynamically computed thresholds. Approaches include EWMA, Z score style deviations, or sketch based summaries to stay memory efficient.

Tip: Explain how you would account for natural surges such as payday cycles or promotional spikes so that alerts only fire on genuine anomalies.

Implement a custom undersampling or oversampling function to rebalance an imbalanced fraud dataset.

Since fraudulent activity makes up a tiny fraction of PayPal’s volume, this question checks whether you understand how to prepare data without distorting evaluation. A concise solution creates balanced batches using random undersampling of majorities, synthetic oversampling, or stratified sampling while ensuring the resampling happens inside each training fold. You should also mention tracking seed control for reproducibility.

Tip: Bring up how preserving temporal ordering is critical so resampling does not shuffle fraud sequences out of their natural timeline.

-

This question probes whether you can prepare features and labels responsibly when positive fraud cases are rare. A strong answer includes cleaning timestamps, engineering strong behavioral and device features, applying stratified splits, using class weights or focal loss, and establishing validation sets that reflect real world class ratios. The goal is to avoid optimistic metrics and maintain realistic performance expectations for PayPal’s risk models.

Tip: Mention that you would evaluate segment based metrics since fraud prevalence varies widely by region, merchant type, and device.

Want realistic ML interview practice without scheduling or pressure? Try Interview Query’s AI Interviewer to simulate PayPal style coding, modeling, and system design questions and get instant, targeted feedback.

Applied Machine Learning And Modeling Interview Questions

These questions evaluate how you design, train, and evaluate ML models in environments where accuracy directly influences financial risk. PayPal relies on classification models, ranking systems, and anomaly detectors to make millisecond decisions. Interviewers expect clear reasoning about metrics, feature selection, model tuning, and how to handle rapidly shifting user behavior.

How would you build a fraud detection model where fraudulent transactions make up less than 0.5 percent of the data?

This question checks whether you can handle extreme class imbalance, a core challenge in payments risk. A strong answer includes stratified sampling, class weighted losses, focal loss, and careful threshold tuning to reflect fraud cost versus customer friction. You should describe creating validation sets that maintain real world ratios, monitoring precision recall trade offs, and tuning thresholds per segment, not globally.

Tip: Emphasize how misclassifying legitimate users triggers false declines, which directly affects PayPal’s revenue and merchant relationships.

How do you detect concept drift in a production fraud model, and what actions would you take when drift is found?

Drift detection matters because attacker behavior evolves quickly, often invalidating risk models. A solid approach compares distributions of key features over time, applies divergence tests like PSI or KL divergence, and monitors changes in prediction consistency. When drift appears, you might retrain the model, adjust thresholds, or introduce new features while validating updates through shadow deployments.

Tip: Call out that PayPal often uses layered detection, such as feature drift, label drift, and business metric drift, to avoid blind spots.

-

This question evaluates how you handle high cardinality features such as merchants, devices, or locations, which are common in PayPal’s datasets. Practical options include feature hashing, target encoding with regularization, entity embeddings, or frequency based grouping. The decision often depends on latency and memory constraints. For real time pipelines, hashing is attractive due to fixed dimensionality, while embedding layers work well for richer deep learning architectures.

Tip: Mention how you prevent leakage when using target encoding by computing statistics only on training folds.

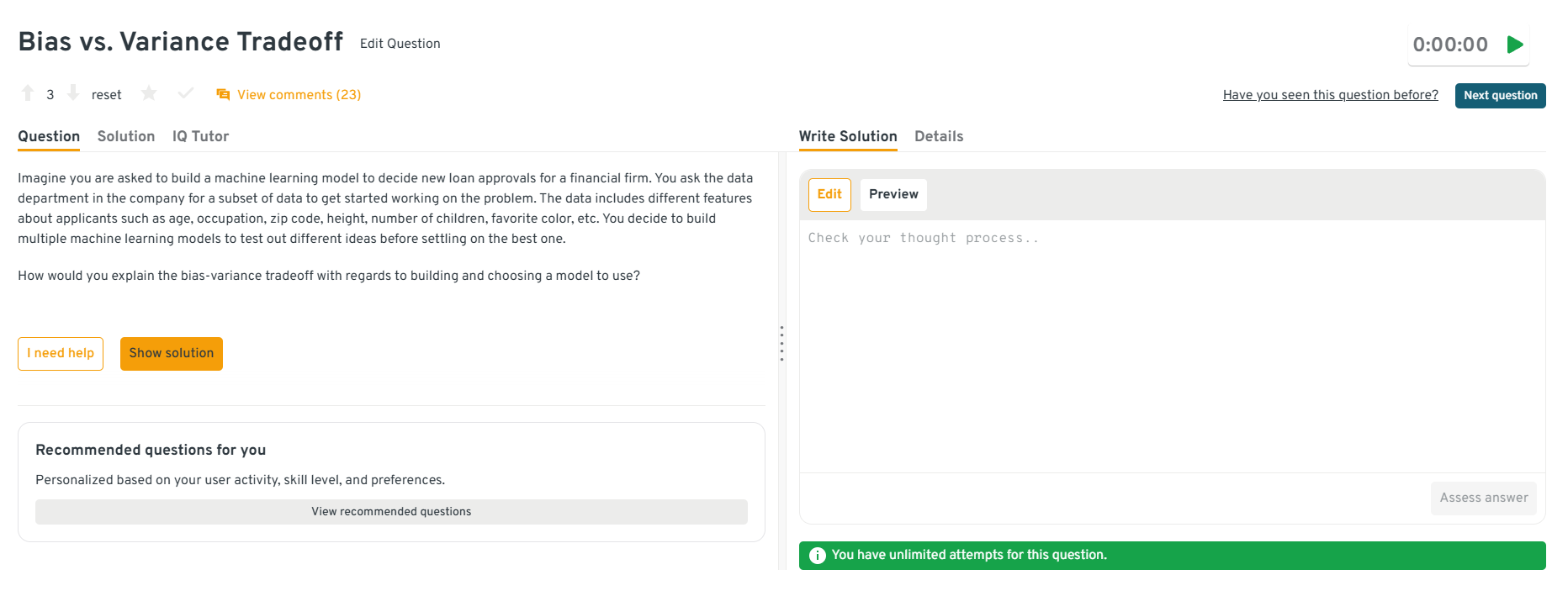

-

Here, interviewers test whether you understand model complexity and its impact on reliability, which is crucial in risk scoring. A good explanation notes that high bias models underfit fraud patterns, while high variance ones overfit noise and destabilize predictions. You would balance the two using cross validation, regularization, and model simplicity appropriate for financial data. PayPal favors models that generalize well across regions, devices, and merchant types.

Tip: Link the tradeoff to model robustness, since unstable models can cause sudden authorization swings in production.

Head to the Interview Query dashboard to practice the full set of PayPal’s interview questions. With built-in code testing, performance analytics, and AI-guided tips, it’s one of the best ways to sharpen your skills for PayPal’s data interviews.

-

This question tests your ability to justify a model choice and think through evaluation lifecycle. You would compare tree simplicity and interpretability against alternatives, validate on historical repayment data, and measure metrics like AUC, precision, and calibration. After deployment, you would monitor stability, segment performance, and drift to ensure the model behaves consistently under new borrower profiles.

Tip: Bring up fairness considerations because PayPal regulators and credit teams often require transparent, auditable model decisions.

Looking for hands-on problem-solving? Test your skills with real-world challenges from top companies. Ideal for sharpening your thinking before interviews and showcasing your problem solving ability.

Machine Learning System Design Interview Questions

PayPal ML system design interviews explore your ability to architect scalable, reliable pipelines for real time decisioning. These problems involve feature stores, latency constraints, monitoring frameworks, retraining workflows, and fail safe mechanisms. Interviewers focus on how you decompose complex systems, reason about trade offs, and ensure resilience.

Design a real time fraud scoring service that returns a decision within 30 milliseconds globally.

This question checks whether you can design low latency systems that support PayPal’s global transaction volume. A strong answer walks through regional routing, fast feature retrieval, precomputed features, and a lightweight model served through optimized inference hardware. You should describe caching hot features, storing models close to users, and validating the outputs across regions. A complete design includes fallback logic and monitoring for latency spikes.

Tip: Mention how you would verify feature parity between offline training datasets and online serving systems to prevent scoring inconsistencies.

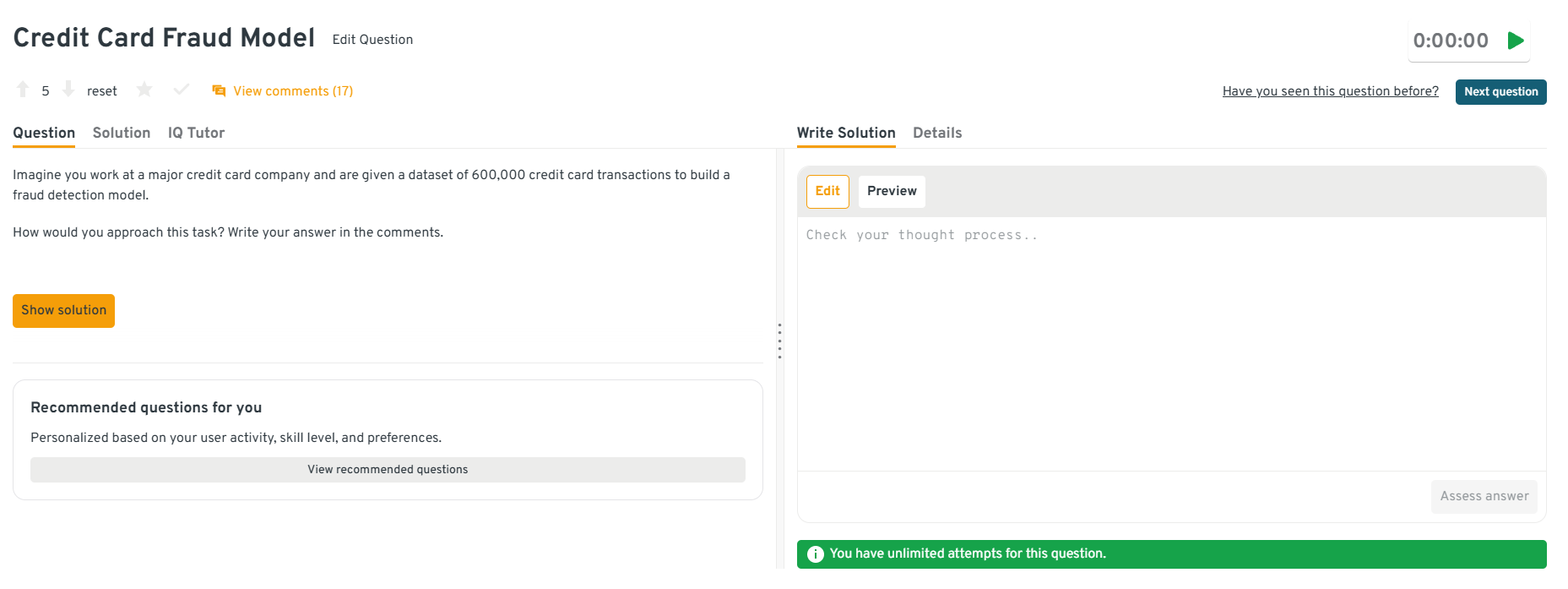

Build a fraud detection model, given a dataset of 600,000 credit card transactions.

Here, interviewers evaluate your ability to design a practical modeling workflow for a moderately sized dataset. You might clean timestamps, create behavioral features, and split data by time to mimic production. Discuss handling imbalance through class weighting and using models like gradient boosted trees that perform well on tabular risk data. You would also validate metrics across segments and test your final model on recent slices to check generalization.

Tip: Explain that you would create separate evaluation windows because transaction patterns evolve quickly in financial environments.

Head to the Interview Query dashboard to practice the full set of PayPal’s interview questions. With built-in code testing, performance analytics, and AI-guided tips, it’s one of the best ways to sharpen your skills for PayPal’s data interviews.

-

This prompt tests how well you solve cold start problems and work with sparse data. You could group similar keywords using embeddings or similarity scores, engineer features that capture competition and historical behavior, and train a supervised model on these clusters. For unseen terms, you would generate predictions based on nearest neighbors or transfer learning. You would refresh bids frequently, apply business rules to control spend, and validate impact through controlled experiments.

Tip: Call out how similarity based features help avoid brittle predictions when historical data is unavailable.

-

This question evaluates your ability to coordinate detection, communication flows, and latency budgets. You can describe ingesting transactions through a streaming system, scoring them using a low latency model, and sending alerts to customers while tracking responses as additional signals. You would tune thresholds to avoid unnecessary alerts and monitor false positives carefully. A feedback loop would feed confirmed cases back into training pipelines.

Tip: Mention that customer responses arrive with delay, so your design should store events until labels can be updated safely.

Explain how you would design a fallback mechanism if the primary model serving endpoint becomes unavailable.

Interviewers want to see if you prioritize reliability in systems that affect financial decisions. A robust answer describes using cached scores for repeat users, simple rule based logic for clear cut scenarios, or a lightweight secondary model hosted on a separate endpoint. You should outline how traffic fails over automatically, how you log these events, and how the system recovers once the main endpoint returns.

Tip: Highlight the importance of monitoring fallback usage since elevated rates often indicate deeper infrastructure issues.

Watch Next: How to Ace a Machine Learning Mock Interview - Design a recommendation engine

In this mock interview session, Ved, a PhD student and ML research scientist intern at LinkedIn, walks through a real-world ML challenge prompt showing how he breaks down the problem into features, modeling strategy, evaluation metrics, and delivery-ready presentation, giving you an interview-ready template you can apply in your own prep.

Product And ML Reasoning Interview Questions

These questions examine how well you apply ML thinking to product and business problems. PayPal looks for engineers who understand the implications of model decisions, trade offs between fraud loss and user friction, and how ML integrates into key flows across checkout, authentication, and merchant operations.

How would you reduce false declines for legitimate customers without increasing fraud losses?

This question tests how you balance user experience with financial risk. A strong answer outlines tuning thresholds per segment, using more personalized features, and improving model calibration so legitimate customers are recognized more accurately. You might also mention layering models so the system can apply secondary checks before declining. This is important at PayPal because false declines hurt merchants and reduce trust while fraud losses remain a real cost.

Tip: Highlight how you would partner with risk teams to validate changes on sensitive segments before rolling out broadly.

What metrics matter most when evaluating improvements to a payment authorization model?

Interviewers want to see if you understand the business impact of model changes. You should discuss approval rate, fraud rate, latency, and customer friction, then explain how each metric influences merchant revenue and user trust. A complete answer also considers stability across markets and device types. PayPal relies on blended metrics because small shifts in authorization performance can affect global transaction success.

Tip: Bring up the value of monitoring segment level effects so improvements do not mask declines in specific regions.

-

This question evaluates your ability to reason about competing business goals. CTR may optimize engagement while conversion rate aligns more directly with revenue. You would choose the metric that best reflects long term value and test both through experiments. For matching, models like gradient boosted trees or deep ranking architectures can work well, especially when incorporating contextual and user features. The key is showing that you align modeling choices with business incentives and data availability.

Tip: Mention that offline metrics should be validated with online tests since user behavior often shifts in real settings.

Head to the Interview Query dashboard to practice the full set of PayPal’s interview questions. With built-in code testing, performance analytics, and AI-guided tips, it’s one of the best ways to sharpen your skills for PayPal’s data interviews.

PayPal is launching a new merchant onboarding tool. How would you determine whether an ML based risk model improves the experience?

This question checks whether you can evaluate ML impact beyond accuracy. You would measure onboarding time, approval quality, fraud outcomes, and the rate of unnecessary manual reviews. Success also depends on clear communication with compliance teams and ensuring the model does not create unintended friction for new merchants. A complete answer includes testing the model on a controlled subset and monitoring stability before expanding.

Tip: Bring up the value of using a phased rollout strategy since onboarding tools can affect regulatory workflows.

Want to master the entire ML pipeline? Explore our ML Engineering 50 learning path to practice a curated set of machine learning questions designed to strengthen your modeling, coding, and system design skills.

Behavioral And Cross Functional Collaboration Interview Questions

These questions assess how well you work with risk teams, product managers, engineers, and operations groups who all play a critical role in PayPal’s ML ecosystem. PayPal wants ML engineers who can collaborate across functions, communicate clearly under pressure, and handle incidents responsibly in systems where even small issues can affect millions of users. Strong answers show ownership, empathy, and the ability to translate complex ML decisions into clear actions.

Describe a time you launched an ML model that caused unexpected user impact. How did you respond?

This question examines your ability to handle incidents in production. A strong answer explains how you quickly diagnosed the issue, validated whether it was caused by data drift or a flawed feature, and coordinated with product and risk teams to mitigate the impact. You should highlight transparent communication and disciplined rollback decisions.

Example: “A real time model began blocking legitimate low risk transactions after a feature skew issue. I halted the rollout, synced with risk teams, replayed logs to isolate the faulty feature, and deployed a corrected version after validation.”

Tip: Emphasize calm, structured response and how you kept stakeholders informed throughout the process.

What makes you a good fit for our company?

Interviewers want to see alignment with PayPal’s mission and the technical challenges you will face. Your answer should connect your ML engineering experience to PayPal’s global scale and trust driven environment.

Example: “I enjoy building ML systems that operate with tight latency and high reliability. My recent work on adversarial detection models and multi region deployments maps closely to PayPal’s fraud and risk challenges, and I am motivated by the chance to improve user trust at global scale.”

Tip: Reference PayPal domains like checkout, identity, or fraud to show genuine understanding of the work.

How would you communicate the risk trade offs of a model update to a non technical stakeholder?

This question tests whether you can simplify complex ML reasoning for partners who influence policy, compliance, and product decisions. You should explain how you translate precision recall changes into real implications like fraud exposure or user friction.

Example: “Instead of discussing metrics, I frame the change in terms of outcomes. For instance, lowering the threshold helps approve more legitimate users but may increase exposure in high risk regions. I walk through examples and show how we monitor early indicators to stay safe.”

Tip: Use concrete scenarios rather than technical terms to keep the discussion grounded.

Head to the Interview Query dashboard to practice the full set of PayPal’s interview questions. With built-in code testing, performance analytics, and AI-guided tips, it’s one of the best ways to sharpen your skills for PayPal’s data interviews.

-

This question looks at how you navigate misalignment in cross functional work. A strong answer explains the communication gap and how you adapted your approach to build shared understanding.

Example: “A product manager misunderstood why a fraud model needed stricter validation delays. I shifted from technical explanations to visualizing how false positives affect merchants. Once we used real examples, we aligned on a safer launch plan and improved our process for future rollouts.”

Tip: Show that you adjust your communication style based on the audience rather than repeating technical detail.

Struggling with take-home assignments? Get structured practice with Interview Query’s Take-Home Test Prep and learn how to ace real case studies.

What Does a PayPal Machine Learning Engineer Do?

Machine learning engineers at PayPal, design and maintain the intelligent systems that protect users, optimize payments, and support new financial products. They work closely with data scientists, risk analysts, and engineering teams to ensure models stay accurate, fast, and aligned with regulatory expectations.

Common responsibilities include:

- Building and optimizing fraud detection and risk scoring models using large scale historical and streaming data, and designing feature pipelines for device behavior, merchant patterns, and user identity signals.

- Developing real time inference services that classify transactions within sub 50 millisecond latency budgets, and implementing monitoring to catch drift, feature quality issues, and performance degradation.

- Partnering with engineering teams to productionize ML models, automate retraining pipelines that process billions of new records daily, and running experiments to test new models, refine thresholds, and minimize false declines without raising fraud loss.

How To Prepare For A PayPal Machine Learning Engineer Interview

Preparing for the PayPal machine learning engineer interview requires a combination of technical strength, product awareness, and the ability to reason through trade offs that influences fraud detection, payment authorization, risk evaluation, and overall platform safety. Because PayPal’s ML teams operate across large, dynamic datasets and strict latency constraints, you need to demonstrate that you can build models that perform reliably in production and communicate clearly.

Read more: How an ML engineer talked to over 50+ companies before landing a job

Below is a step by step guide designed specifically for PayPal’s expectations.

Deepen your understanding of real time ML systems: Study how low latency inference works, including feature retrieval, caching, routing, and latency budgeting. Focus on architectures like online feature stores and model gateways that support millisecond decisioning.

Tip: Time your inference on prototypes to identify and fix bottlenecks.

Build intuition for fraud and risk patterns: Learn how identity attacks, bots, and transaction fraud emerge and adapt. Consider how stale features or sudden behavioral shifts can break models, and analyze how device, region, and merchant signals feed into risk scoring.

Tip: When reviewing fraud examples, ask how an attacker would adapt after being blocked.

Strengthen your experience with large scale feature engineering: Practice designing time based, aggregated, and entity level features. Think through how to keep training and serving features aligned to avoid skew and consistency issues.

Tip: Build a small feature store prototype to practice versioning and online and offline consistency.

Learn how to evaluate ML decisions in financial contexts: Understand how precision and recall changes translate to fraud loss or user friction. Be ready to justify threshold decisions in terms of business safety, not just model metrics.

Tip: Explain thresholds through the lens of user trust and financial exposure.

Master production readiness principles: Prepare to discuss monitoring, alerting, drift detection, shadow testing, and rollback plans. Think about maintaining stability when traffic spikes or data quality shifts.

Tip: Outline an end to end deployment plan that includes validation, rollout, and ongoing maintenance.

Refine your product thinking and communication: Practice translating ML decisions into simple explanations for non technical partners across risk, compliance, product, and engineering. Focus on clarity over jargon.

Tip: Summarize a past ML project in three sentences: problem, solution, and impact.

Run full ML focused mock interviews: Combine ML coding, system design, and scenario based reasoning. After each mock interview, review where your structure or reasoning slipped.

Use Interview Query’s ML Question Bank for PayPal style problems, and the Coaching Program for deeper system design and modeling guidance.

Tip: Track recurring weak points and create an improvement plan for the final prep week.

Need 1:1 guidance on your interview strategy? Explore Interview Query’s Coaching Program that pairs you with mentors to refine your prep and build confidence.

Salary And Compensation For PayPal Machine Learning Engineers

PayPal’s compensation philosophy rewards engineers who can design reliable machine learning systems, improve platform safety, and support the company’s global payments ecosystem. Machine learning engineers typically receive compensation packages that include a competitive base salary, strong performance bonuses, and meaningful equity grants tied to long term company growth. Your total package depends on your level, location, and experience with areas such as fraud modeling, distributed ML infrastructure, and real time decisioning systems.

Read more: Machine Learning Engineer Salary

Tip: Ask your recruiter early about the level you are being considered for since ML engineer leveling determines compensation bands, scope of work, and technical expectations.

Average PayPal Machine Learning Engineer Salary Bands (2025)

| Level | Typical Role Title | Total Compensation Range (USD) | Breakdown |

|---|---|---|---|

| MLE1 | Machine Learning Engineer I (Entry-Level) | $130K – $170K | Base $115K–$140K + Bonus + Equity |

| MLE2 | Machine Learning Engineer II / Mid-Level | $165K – $220K | Base $135K–$165K + Bonus + RSUs |

| Senior MLE | Senior Machine Learning Engineer | $200K – $280K | Base $150K–$185K + Larger Equity + Bonus |

| Staff MLE | Staff or Lead Machine Learning Engineer | $260K – $350K+ | Base $180K–$220K + High RSUs + Bonus |

Note: These estimates reference aggregated 2025 data from industry sources including Levels.fyi, Glassdoor, TeamBlind, and Interview Query’s internal salary database. Actual offers vary based on location (San Jose, Austin, New York, Omaha, Remote), team assignment (Risk, Identity, Credit, Merchant Solutions, Checkout), and interview performance.

Tip: Salary benchmarks for ML engineers shift significantly by city. Always compare your location specific range before negotiating.

Average Base Salary

Average Total Compensation

How PayPal Structures Compensation

PayPal’s compensation packages include four main components. Understanding each one helps you evaluate your offer more accurately and plan your negotiation approach.

| Component | Description |

|---|---|

| Base salary | Fixed annual pay that varies by level and location. Compensation is generally higher in markets like San Jose and New York. |

| Annual performance bonus | Yearly bonus tied to individual impact and company performance. ML engineers who deliver measurable improvements often earn above target payouts. |

| Equity (RSUs) | Restricted Stock Units that vest over multiple years and contribute significant long term value. Senior levels typically receive larger and more frequent grants. |

| Signing bonus and relocation support | One time signing bonuses are common for mid level and senior ML roles. Relocation support may be offered for office based positions. |

Tip: Evaluate the full package instead of focusing only on base pay. RSUs and bonus potential significantly affect total compensation at PayPal.

Negotiation Tips That Work For PayPal

Negotiating effectively at PayPal means demonstrating clear understanding of your value and backing it with data. Recruiters appreciate candidates who present reasonable, well researched expectations.

| Tip | Description |

|---|---|

| Confirm your level early | Moving from MLE1 to MLE2 or MLE2 to Senior can increase your offer by tens of thousands of dollars, so clarify level placement at the start. |

| Use verified salary sources | Compare compensation ranges using trusted resources such as Levels.fyi, Glassdoor, and Interview Query’s salary database to anchor expectations. |

| Share competing offers professionally | PayPal recruiters expect candidates to consider multiple opportunities. Transparent communication helps them assemble a competitive package. |

| Highlight your measurable impact | Emphasize achievements like reducing fraud loss, improving latency, or increasing model precision because PayPal values direct, quantifiable impact. |

| Consider location alignment | PayPal adjusts compensation regionally, so clarifying your location prevents misalignment and ensures your offer reflects local cost and talent market conditions. |

Tip: Request a full compensation breakdown that includes base salary, bonus target, equity value by vesting year, and any signing incentives so you can benchmark the offer against the broader market.

FAQs

How long does the PayPal machine learning engineer interview process take?

Most candidates finish the process in three to six weeks depending on the number of technical rounds, team availability, and whether multiple groups are considering your profile. Some delays happen when PayPal needs extra calibration across risk, identity, or checkout teams. Recruiters typically provide updated timelines after each stage and will notify you if additional interviews are needed.

Does PayPal use HackerRank or online assessments for ML engineers?

Yes, some teams use an online coding and ML assessment, especially for entry level or early career candidates. These assessments usually include Python coding, streaming data manipulation, and lightweight ML reasoning. Many mid level and senior candidates proceed directly to technical phone screens instead. The exact format varies, but the focus is always on practical problem solving rather than theoretical trick questions.

How important is fraud or payments experience for machine learning roles?

It is valuable but not strictly required. PayPal hires ML engineers from a wide range of backgrounds including e commerce, security, finance, and general tech. Experience with detection systems, imbalanced datasets, or real time inference gives you an advantage. If you can reason through risk trade offs, understand user impact, and design models responsibly, you can ramp up quickly in payments and fraud domains.

What coding skills does PayPal expect from ML engineer candidates?

PayPal expects strong Python fundamentals, clean engineering habits, and the ability to work with large datasets. You should be comfortable handling time series data, building feature pipelines, and optimizing code for efficiency. ML engineers are also expected to write production ready functions rather than one off scripts.

How much ML theory appears in the interview?

The interviews focus more on applied modeling and system level reasoning than deep theoretical proofs. You should understand concepts like class imbalance, regularization, model calibration, feature interactions, and drift detection, but the emphasis is on how you apply these ideas to real world problems.

Do ML engineers at PayPal need to know SQL?

SQL may appear occasionally, but it is not the core of the ML engineer interview. Some teams expect familiarity with joins, filtering, or simple aggregations for data exploration. The heavier SQL questions are typically reserved for data scientist and analytics roles. ML engineers spend more time on Python, modeling, and system design.

What ML system design topics should I expect?

You can expect questions about real time inference, feature stores, data consistency, monitoring, drift, and fallback strategies. PayPal cares deeply about reliability because models influence financial decisions. You should be able to describe how to build an end to end ML pipeline from data ingestion to serving and monitoring.

Are behavioral questions important for ML engineers?

Yes. ML engineers collaborate heavily with product managers, data scientists, risk teams, and backend engineers. PayPal interviewers look for clarity, empathy, and structured communication. Behavioral questions often explore how you resolved incidents, handled ambiguity, or delivered impact in complex environments.

How many teams interview ML engineer candidates?

It varies. Some candidates interview for a single team, while others are considered by multiple groups such as Risk, Identity, Checkout, Credit, or Merchant Solutions. When multiple teams are involved, PayPal collects feedback from all groups and matches you to the best fit at the end.

Does PayPal allow remote work for machine learning engineers?

Many ML engineer roles support hybrid or remote options depending on the team. Some groups prefer in office collaboration, especially those working on high volume risk systems. Your recruiter can share which teams offer remote flexibility.

What topics should I focus on if I only have a week to prepare?

Prioritize Python data manipulation, model evaluation for imbalanced classification, drift detection, end to end ML system design, and clear communication. These areas appear in nearly every interview round. Concentrate on structuring your thinking and explaining your reasoning rather than memorizing algorithms.

Conclusion

Preparing for the PayPal machine learning engineer interview means developing strong technical judgment, clear communication, and a deep understanding of how ML shapes global payments. By practicing real world modeling challenges, strengthening your system design instincts, and building comfort with fraud and risk reasoning, you can step into each round with confidence. Simulate the real interview pressure with mock interview sessions to sharpen your skills using realistic scenarios, and get curated, personalized feedback through Interview Query’s coaching sessions. With the right preparation and mindset, you can approach the PayPal interview process ready to make an impact.

Ready build up your PayPal interview skills? Head to Interview Query’s question bank to practice real hands-on questions and start getting interview ready today.