J.P. Morgan Chase & Co. Data Analyst Interview Questions + Guide in 2025

Introduction

With 14.5% revenue growth and 18% return on equity, JP Morgan Chase is showing resilience in a challenging financial landscape with slower growth projections and persistent inflation, proving once again why it’s among the top financial institutions worldwide.

Data analysts at JP Morgan must identify trends, patterns, and anomalies to make better business strategies and solve organization-wide problems. However, applicants will find fierce competition to secure a data analyst position at JP Morgan. If your approach is to begin or solidify your interview preparation, you’ve come to the right place.

In this article, you’ll find several commonly asked interview questions for the Data Analyst role at JP Morgan, as well as the example answer to help you prepare for the interview. Also, we’ll cover several tips that can set you apart from the competitors during the selection process. So, let’s get started!

In this article, you’ll find several commonly asked interview questions for the Data Analyst role at JP Morgan as well as the example answer to help you prepare for the interview. Also, we’ll cover several tips that can set you apart from the competitors during the selection process. So, let’s get started!

JP Morgan Chase & Co. Data Analyst Interview Experiences

“I applied for a Data Analyst position at JPMorgan Chase. The first step was submitting my resume, followed by a coding assessment and a recorded video interview. If shortlisted, I was then considered by a human recruiter.”

- Bao I.

“I had an online assessment for the JPMorgan Chase role, which included two questions—one easy and one moderately challenging. After completing the assessment, I was invited for a HireVue interview, which was a behavioral round.”

- Wei N.

“I had a long process at JPMorgan Chase, including a technical test and a timed preliminary interview. The pre-loaded questions were random and could be difficult to answer. One question asked about my experience with the stock market.”

- Jun K.

What is the Interview Process Like for a Data Analyst Position at JP Morgan?

As a multinational company, JP Morgan’s interview process for a Data Analyst position varies by location. However, the typical process consists of four to five rounds with different setups and teams.

Application and Resume Review

The first step for any data analyst interview is exploration. Whether you’re an experienced candidate or have just been starting in the industry, you must go through the job search and application process to submit your resume and allow the respective JP Morgan Chase team to review it. If your qualifications meet their criteria, then you’ll go through to the next stage.

As efficient as they are, it typically takes between 2 days to a week for them to reach you, verify basic info, and schedule a telephonic screening round.

Telephonic Screening Round

A member of the JP Morgan hiring team will schedule a 30-40 minute telephonic screening round, where they’ll focus on your basic understanding of data analysis concepts, SQL, and Python/R. Discussion about your resume, past projects, and also your motivation for applying to JP Morgan.

Face-to-Face First Technical Interview

If you pass the screening round, then you’ll face the first technical interview with team members from the Analytics department. In this round, you may be asked hard-skill-related questions where you need to use programming languages such as Python or SQL to conduct data analysis or answer questions about statistics and probability.

Usually, candidates solve problems on a whiteboard or shared document. Questions may also involve hypothesis testing, query optimization, and other technical challenges that require analytical thinking. It takes around an hour to complete.

Expect a return call within 2 days.

Second Technical Interview: Project Analysis and Case Studies

In most cases, where remote hiring is involved, this is the last stage of the JP Morgan data analyst interview process before onboarding, where you will have the interview with the team lead and one of the team members.

This interview round involves a more in-depth approach to the technical details and includes behavioral questions as well. The focus of this multi-round interview step is to learn about your approach, tools used, challenges faced, and the impact of past works. Practical experiences are the main focus of this round.

For senior roles, they might give you a case study where they give you a dataset, and you need to analyze the data and propose data-driven solutions to simulated business scenarios.

On-Site Hiring Manager Round

If your JP Morgan data analyst interview experience involves an on-site hiring manager round, behavioral questions will be asked to assess motivation, career aspirations, and interpersonal skills. This round is critical for determining how well you might integrate into the company culture.

Expect a whole day of interview rounds with multiple managers and partners.

What Questions Are Asked in a JP Morgan Data Analyst Interview?

During an interview for a Data Analyst position at JP Morgan, you will face two kinds of interviews. The first one is behavioral questions that aim to assess your motivation, career goals, and how you would fit into your future team and company culture. The second one is technical questions that aim to assess your hard skills and knowledge regarding concepts commonly applied in data analysis, such as probabilities, statistics, and the use of programming languages like Python and SQL.

In this section, you’ll find typical technical and behavioral questions for a Data Analyst position at JP Morgan.

1. Let’s say you have a categorical variable with thousands of distinct values, how would you encode it?

One of the most important parts of a data analysis project is data preprocessing, in which feature engineering is one of its steps. Your ability to transform a variable into a more powerful and meaningful feature is important, as it will impact the comprehension of your data analysis result. This question assesses your understanding of one of the featured engineering concepts and your practical knowledge in handling real-world data challenges.

How to Answer

First, highlight the reason why we shouldn’t use the famous one-hot encoding approach for this use case, as it could introduce issues such as the curse of dimensionality and computational inefficiency. Then, mention your proposed solution that will be more suited for categorical variables with lots of distinct values.

Example

“Based on my experience in such situations, resorting to one-hot encoding can lead to a high-dimensional and sparse representation, causing computational challenges. Instead, I would propose techniques like target encoding, frequency encoding, or employing embeddings that offer more efficient solutions. As an example, target encoding uses the target variable’s information within each category, providing a meaningful yet computationally feasible representation.”

2. What is the difference between Pearson and Spearman correlation?

This question is designed to assess your knowledge of interpreting data based on their characteristics. This means that you need to interpret the results of continuous and ordinal data differently. JP Morgan wants to ensure that you have the analytical skills necessary for effective decision-making in correlation analysis.

How to Answer

First, start by outlining the description of Spearman and Pearson correlation. Next, mention the key difference between the two methods and in which use case they would preferably be used over the other.

Example

“I’ve used both Pearson and Spearman correlations to interpret my data in my previous role. Pearson correlation is used to measure linear relationships between two continuous variables, assuming a normal distribution. It is ideal for assessing the strength and direction of linear connections. In contrast, Spearman correlation evaluates monotonic relationships and is suitable for ordinal or ranked data.

From my experience, the decision when I should use Pearson or Spearman correlation depends on the nature of the data. If the variables in the data show a linear association and meet normality assumptions, I would go for Pearson correlation. However, when dealing with monotonic relationships or ordinal data, Spearman correlation becomes my preferred choice.”

3. What are the limitations of solely relying on the R-Squared value when assessing the fit of a model to the given data and establishing a relationship between two variables?

Statistics is one of the fundamental hard skills to master if you want to become a Data Analyst at a big company like JP Morgan. This question will assess your understanding of interpreting a predictive model’s result in a concise manner. Specifically, they want to know your ability to think critically about the appropriateness of metrics for assessing a model’s performance and your understanding of the potential shortcomings of such metrics.

How to Answer

Start your answer by explaining the appropriate condition in which we can use R-squared to assess the model performance by emphasizing that R-squared is a measure of explained variance but does not provide insights into the significance of individual predictors. Next, also mention the importance of considering additional metrics, such as Mean Squared Error (MSE) to gain a more comprehensive understanding of the model’s performance.

Example

“R-squared is valuable for understanding the proportion of variance explained, but its limitation lies in not capturing the significance of individual predictors. With R-squared, we don’t know whether the model is biased or not, and also, a high R-squared doesn’t necessarily mean that our model is good. To get a more complete picture, it’s essential to consider additional metrics like Mean Squared Error to ensure the model is making accurate predictions across the entire data range.”

4. What is the formula for liquidity ratio?

When you’re interviewing at a financial service company like JP Morgan, prepare to answer questions related to finance. With this question, the company wants to assess your knowledge and familiarity with technical jargon commonly heard in their industry. Also, as a Data Analyst in a financial service, you’re expected to at least be familiar with common terms normally found in the financial market.

How to Answer

First, mention the liquidity ratio’s definition and then explain its formula. Next, emphasize its relevance in financial analysis, explaining its role in assessing a company’s short-term financial strength.

Example

“Liquidity ratio is a key financial metric used to evaluate a company’s short-term solvency. It is calculated by dividing current assets by current liabilities. Thus, the formula would be

Current Ratio = Current Assets / Current Liabilities.

This ratio is vital for assessing a company’s ability to meet its short-term financial obligations, and a ratio above 1 indicates a potentially healthy liquidity position.”

5. We’re given two tables, a users table with demographic information and the neighborhood they live in and a neighborhoods table. Can you write a query that returns all neighborhoods that have 0 users?

To analyze data efficiently, a good command of SQL is essential for a Data Analyst, especially when you’re going to deal with huge data as commonly found in financial service companies like JP Morgan. This question is designed to evaluate your understanding of SQL to write effective queries for data analysis and to extract information from relational databases.

How to Answer

To answer questions related to SQL, the first thing that you need to do is read the instructions carefully and then look at the available data and data types of each column. Next, think about which key SQL command you can use to solve the problem before writing the complete queries. In this question, our key SQL commands would be LEFT JOIN and WHERE.

Example

“Since we want to fetch the neighborhoods’ name from neighborhoods table, then we can write the SELECT neighborhoods.name FROM neighborhoods command. Then, we need to apply a LEFT JOIN command between the id in the neighborhoods table and users table because we want to include all neighborhoods, even if a neighborhood doesn’t have users. To filter the result to only include rows where there is no matching user, indicating zero users in that neighborhood, we can use a WHERE command. Below is the complete query:

SELECT neighborhoods.name

FROM neighborhoods

LEFT JOIN users ON neighborhoods.id = users.neighborhood_id

WHERE users.id IS NULL;

6. What is the difference between mutable and immutable data?

This question is asked to evaluate your understanding of data structures, as they directly impact the data manipulation process and analysis. As a Data Analyst, you need to comprehend the implications of mutable and immutable data to make informed decisions about data handling and processing efficiently, especially at JP Morgan, where you’ll deal with different types of data.

How to Answer

First, explain the difference between mutable and immutable data types. Then, specify the situation with an example where we need to implement either mutable or immutable data.

Example

“Mutable data means that we’re allowed to modify data after its creation, in which it will alter the existing instance. On the contrary, immutable data, once created, cannot be changed, which means that it will create a new instance for any modification. Which data structure that we should use depends on our use case. As an example, when dealing with historical data that shouldn’t be modified, using immutable structures like Pandas DataFrames in Python ensures data integrity throughout the analysis process.”

7. Can you write a SQL query to select the 2nd highest salary in the engineering department?

This question also tests your knowledge of SQL, as you will use it a lot during your work as a Data Analyst. In this question, you need to use a wide variety of SQL commands to solve the question, and JP Morgan wants to see the way you can deal with everyday challenges when analyzing large sets of data.

How to Answer

As with many SQL questions, start by reading the question and the instructions carefully. Next, take a look at the given tables and the data type of each table. Since we need to fetch the 2nd highest salary in each department, we need to apply the subqueries concept to achieve this. Also, make sure that your query also considers the case where there might be ties for the highest salary.

Example

“To select the 2nd highest salary in the engineering department, we can use a query with appropriate subqueries or window functions. Since we want to fetch the 2nd highest unique salary from a table called employees, then we use a SELECT DISTINCT salary FROM employees command.

Next, apply the necessary filter where we only want to show salary from the engineering department. To achieve this, we can add a WHERE command and apply the subquery concept afterward. Then, we order the salary from highest to lowest with ORDER BY salary DESC command. Since we’re interested in obtaining the second-highest salary, then we can use the OFFSET 1 command. Below is the complete query:

SELECT DISTINCT Salary

FROM employees

WHERE department_id = (

SELECT id

FROM departments

WHERE name = 'Engineering'

)

ORDER BY salary DESC

LIMIT 1 OFFSET 1;

This query assumes that there are at least two distinct salaries in the engineering department. If there’s only one distinct salary, the query will return no results.”

8. How to filter outliers that are to be discarded from the ones that are actually of value?

This question is asked in a Data Analyst interview at JP Morgan to assess your ability to handle outliers in data effectively, as you will encounter them a lot in financial data. They want to ensure that you’re able to identify methods to distinguish which outliers should be kept and which ones can be considered noise.

How to Answer

First, explain the importance of identifying outliers for robust data analysis. Next, mention common statistical approaches used to identify outliers, such as the IQR (Interquartile Range) or z-score. Don’t forget to emphasize the need to understand the context and domain knowledge to discern whether an outlier is meaningful or should be discarded.

Example

”Identifying outliers is crucial in a data analysis project for accurate insights. We can use common statistical approaches to identify outliers like the IQR. However, the decision to discard or retain outliers depends on context. As an example, in financial data analysis, which I know I will encounter a lot at JP Morgan, extreme values may signal potential fraud and should be retained, while in customer satisfaction surveys, extreme ratings may be genuine outliers that can be discarded without losing valuable insights.“

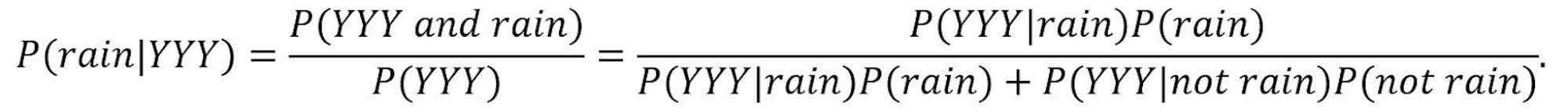

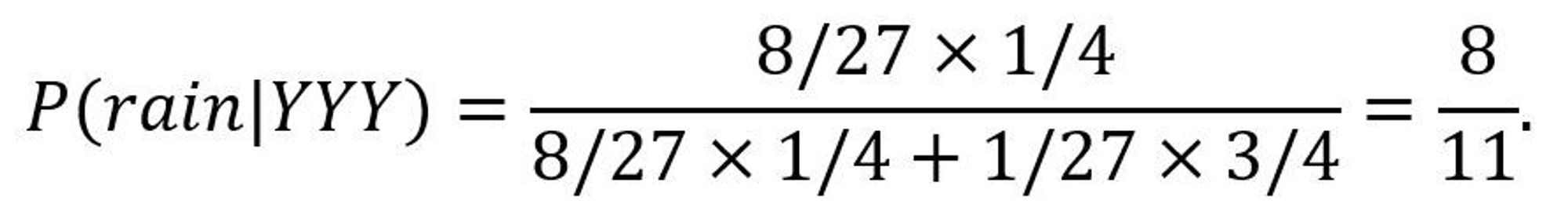

9. What is the likelihood of rain in Seattle if all three randomly called friends, each with a 2⁄3 chance of telling the truth and a 1⁄3 chance of lying, independently confirm that it is raining (Assuming the probability of rain in Seattle is ¼)?

As a Data Analyst, it’s essential for you to master the concept of statistics in order to make informed analyses and decisions from your data. This question, in particular, will assess your knowledge of Bayesian statistics, as you’ll encounter it a lot at JP Morgan for credit risk modeling, financial risk assessment, fraud detection, etc.

How to Answer

To be able to answer this type of question, first, you obviously need to brush up your skills related to Bayesian statistics. To apply Bayes’ theorem, define distinct events: one for “it’s actually raining” and another for “your friends say yes.” Then, compute the probability of “it’s actually raining” given that “your friends say yes.”

Example

To answer this question, we can use Bayes’ theorem. First, we can define independent events as follows:

rain: it’s actually raining

Y: one friend say ‘yes’

From the question, we know that we call 3 random friends and ask each independently if it’s raining. Each of our friends has a 2/3 chance of telling you the truth and a 1/3 chance of lying. This means P(YYY|rain) = (2⁄3)^3 = 8⁄27, and P(YYY|not rain) = (1⁄3)^3 = 1/27.

Plug the probability into Bayes’ theorem equation we get:

10. Why do you need to apply feature scaling to logistic regression?

You’ll encounter the theory behind regression algorithms a lot when dealing with financial data at JP Morgan, so you need to know the necessary preprocessing steps of regression algorithms before we interpret their result. This question is asked to assess your understanding of the preprocessing steps necessary for regression models.

How to Answer

First, explain the importance of feature scaling in logistic regression. Emphasize that logistic regression is sensitive to the scale of input features, and without scaling, some features might disproportionately influence the model.

Example

“Whenever we implement a logistic regression model, it is very important to scale the feature before the training process. This is because a logistic regression algorithm works based on the magnitude of input features. If features are on different scales, it can lead to biased coefficients. By scaling the feature, all features will contribute equally, preventing the dominance of features with larger magnitudes. This is crucial for achieving convergence and optimizing the performance of the logistic regression model.”

11. What’s the difference between Lasso and Ridge Regression?

As a Data Analyst, you don’t have to know in detail about fancy machine learning algorithms. However, regression algorithms like linear regression and logistic regression are a must since you will use them a lot in companies with financial data like JP Morgan during your analysis. To be able to interpret the data correctly, you need to be able to know when to use which regression algorithms.

How to Answer

First, explain the differences between Lasso and Ridge Regression. Highlight that both methods introduce a penalty term to the cost function to prevent overfitting, but they differ in the type of penalty.

Example

“Both Lasso and Ridge Regression introduce penalty terms to prevent overfitting, but they differ in the type of penalty. Ridge adds a penalty based on the squared magnitude of coefficients, while Lasso uses the absolute magnitude.

Another difference is that Lasso has the unique feature of performing feature selection by driving some coefficients to exactly zero, which Ridge does not. These techniques are crucial for handling multicollinearity and improving the generalization of regression models.”

12. Can you explain what descriptive, predictive, and prescriptive analytics are?

As a Data Analyst at JP Morgan, you need to know the fundamentals of different types of analytics. This question evaluates your understanding of them since descriptive, predictive, and prescriptive analytics represent distinct stages in the analytical process.

How to Answer

First, mention the definition for each type of analytics. Next, emphasize the sequential nature of these analytics methods, starting with descriptive, moving to predictive, and then prescriptive. Finally, highlight the value of each type of analytics in extracting insights, making predictions, and guiding decision-making.

Example

“In an analytical process, these three analytics types come in sequentially, starting from descriptive, predictive, and then prescriptive. Descriptive analytics involves summarizing historical data to understand what has happened. Predictive analytics uses statistical algorithms to predict future trends. Finally, prescriptive analytics recommends actions to optimize outcomes based on predictive insights. Each of these analytics types provides different values, with descriptive providing context, predictive offering foresight, and prescriptive guiding actionable decisions.”

13. When evaluating late orders at a food delivery company, is the average or median a better metric, and in the presence of a right-skewed distribution, which metric provides more meaningful insights into the nature of late orders?

One important trait of becoming a great data analyst is knowledge of statistical metrics and the ability to choose appropriate metrics for analyzing data distribution. This question assesses your analytical thinking and capability to make informed decisions based on data characteristics.

How to Answer

Start by explaining the difference between mean and median with respect to their sensitivity to skewed distributions. Then, explain why the median is a better choice when we have a skewed distribution in comparison with the mean.

Example

“Median is the middle value in a data set, separating it into two equal halves, while the mean is the sum of all values divided by the total number. For right-skewed distributions, where there’s a longer tail on the right, the median is generally a better metric than the mean. This is because the median is less sensitive to extreme values, which means that it will provide a more robust measure of central tendency. In the case of late orders in a food delivery company, using the median would offer a more accurate representation of the typical delivery delay, reducing the impact of occasional significantly delayed orders.”

14. Let’s say you have to draw two cards from a shuffled deck, one at a time. What’s the probability that the second card is not an Ace?

This question is asked to assess your understanding of basic probability concepts, which is a skill that we should also possess as data analysts. A general understanding of probability concepts is essential for you to make informed decisions based on data that you analyze.

How to Answer

In order to answer a probability question like this, you need to consider the possible outcomes and favorable outcomes. Since, in this case, it involves a deck of cards, then in total there are 52 possible outcomes, in which four of them are ace. Then, present your logic in a concise manner.

Example

“In a deck of cards, there are 52 possible outcomes, in which four of them are Ace. The probability that the second card is not an Ace can be calculated as the complement of the probability of drawing an Ace on the second draw. Since the first draw doesn’t impact the second, the probability is 48⁄51, or approximately 0.941 or 94.1%.”

15. How would you set up an A/B test to evaluate if changing a button’s color (red to blue) and/or its position (top to bottom) on a webpage increases click-through rates?

At JP Morgan, one of the tasks that you’ll be doing as a Data Analyst is to improve financial products and conduct research on the impact of the improvement on user experience. This is where A/B testing is helpful. This question is asked to assess your understanding of experimental design, particularly in the context of A/B testing, and your knowledge of best practices in experimentation and statistical validity.

How to Answer

When answering the question, emphasize the importance of a well-designed A/B test. We need to start by defining clear and specific hypotheses. Then, outline the key components of the A/B test setup and, finally, highlight the need for monitoring and analyzing the results to draw meaningful conclusions.

Example

“Before we conduct an A/B testing, it’s crucial to define clear hypotheses, specifying the expected impact of changing the button color and position on click-through rates. Also, we need to randomly assign users to different groups to ensure unbiased results. Next, select a suitable metric, such as click-through rate, and carefully monitor the experiment. We need to also determine an appropriate sample size to achieve statistical power and significance. To analyze the result, we can use statistical methods to draw conclusions about the impact of each change on user behavior.”

16. Given a table of bank transactions with user_id, transaction_value (positive for deposits, negative for withdrawals), and created_at timestamp. Write a query to calculate the three-day rolling average of deposits per day.

This SQL question from JP Morgan’s data analyst interview tests your ability to work with financial transactions, aggregate data, and compute rolling averages efficiently. The interviewer wants to see if you can filter relevant data (deposits only), group transactions by day, and apply a three-day rolling average while ensuring correct date formatting. They may also assess your familiarity with window functions and self-joins, as both can be used to solve the problem.

How to Answer

To answer effectively, summarize the problem: calculating a three-day rolling average of deposits while ensuring the correct date format. Explain filtering deposits, aggregating by date, and using window functions for efficiency. If unsupported, mention a self-join alternative but note its performance impact. Present the SQL query and discuss optimizations like indexing created_at and handling missing days. Finally, connect your solution to real-world financial analysis, showing how rolling averages help identify trends and anomalies, demonstrating both technical and business understanding.

17. How do you approach a scenario in which your analysis diverges from the widely accepted viewpoint?

When working as a Data Analyst, especially at a financial service company like JP Morgan, you’ll encounter anomalous cases a lot. This can happen when your findings seem to go against the accepted norm or when your findings reveal something negative. This question evaluates your critical thinking skills, resilience, and capacity to communicate and defend analytical findings effectively. JP Morgan wants to ensure that you can contribute valuable insights even when the findings differ from prevailing viewpoints.

How to Answer

First, you need to respond by mentioning your commitment to objective analysis, open communication, and adapting to new information. You also need to showcase your ability to validate and articulate your findings while remaining receptive to alternative perspectives.

Example

“I am fully aware that as a Data Analyst, encountering scenarios where my analysis diverges from widely accepted viewpoints is not uncommon. In such situations, I prioritize objective analysis and open communication. To implement this, I would thoroughly review my methodology and findings, ensuring they align with the data and are well-supported. During the presentation of my findings, I also invited constructive feedback and alternative perspectives.”

18. Describe a time when you surpassed expectations in a project. What actions did you take, and how did you achieve this outcome

With this question, the interviewer at JP Morgan wants to assess your attitude towards a project. As you already know, a Data Analyst who is passionate and highly motivated to do their job is very desirable. Also, this question will assess how you approach challenges and contribute to the success of projects.

How to Answer

First, start by mentioning the context of a specific project you’ve done in the past. Next, craft a story on how you not only met project expectations but went beyond them. Clearly outline the actions you took and emphasize your analytical and problem-solving skills. Discuss the impact of your contributions on the project’s success, showcasing your ability to deliver meaningful results.

Example

“In my previous role, I did a data analysis project in which the initial goal was to identify cost-saving opportunities. In order to get a comprehensive analysis, I initiated collaboration with the data engineering team to integrate additional data sources. Then, I built advanced statistical models that allowed me to uncover hidden patterns and recommended strategic changes. The result was a 15% reduction in operational costs, surpassing the initial project expectations.”

19. Could you provide an example of a situation where the insights derived from your data analysis had a substantial impact on the performance of the business?

As a Data Analyst at JP Morgan, you’re expected to deliver detailed and impactful analysis most of the time, as you’ll be dealing with high-end clients. Your ability to effectively connect data analysis with tangible business impact is very important.

How to Answer

To answer the question effectively, choose a specific example from your previous experience that highlights the direct influence of your data analysis on business outcomes. Outline the problem, detail your analytical process, and emphasize the measurable impact on key performance indicators.

Example

“In a previous role together with my team, I conducted an in-depth analysis of customer behavior data to improve our marketing strategies. By identifying trends in customer preferences and purchase patterns, we refined our targeted campaigns. As a result, we saw a notable increase in customer engagement, leading to a 15% rise in conversion rates within a quarter.”

20. Can you talk about a time when your colleagues didn’t agree with how you were approaching a task, and how you included them in the conversation and addressed their concerns?

As a Data Analyst in a big company like JP Morgan, it’s expected that you’ll work in cross-functional teams to work on a collaborative project. This question is asked in a Data Analyst interview to assess mainly your interpersonal and communication skills. It aims to understand how well you can handle disagreements or differing opinions within a team setting and foster a positive and constructive work environment.

How to Answer

First, start by mentioning a specific example from your past project where your colleagues disagreed with your approach. Outline the steps you took to involve them in the conversation, listen to their concerns, and work collaboratively to find a resolution. Then, highlight the positive outcome of the project as the result of working together as a team.

Example

“In my previous company, I did a data analysis project where there was a disagreement among the team regarding the selection of the analytical model. Some colleagues favored a traditional approach, while I proposed a more advanced machine learning model for better predictive accuracy. To address this, I organized a team meeting to openly discuss our perspectives and weigh the pros and cons of our approaches. Through collaboration, we reached a consensus to conduct a pilot test, incorporating elements of both approaches. This not only addressed their concerns but also resulted in a more robust and accurate final model.”

21. How do you stay informed about the latest trends in the financial market and their potential implications for our business?

Being a Data Analyst at a big financial service like JP Morgan means that it’s necessary for you to keep informed about the latest trends in the financial market all the time, or at least, to have a big interest in finance and the financial market. The company wants to seek candidates who can proactively contribute valuable perspectives that are also aligned with the organization’s strategic objectives.

How to Answer

First, highlight your desire and approach to staying informed about financial market trends by mentioning tools, resources, or strategies that you’ll use to collect information. Then, mention how you’ll use your knowledge to impact the business decision.

Example

“There are several ways that I always use to make myself stay informed about the latest financial market trends. I would regularly follow reputable financial news platforms, subscribe to industry newsletters, or leverage data analytics tools to analyze market data. For instance, in my previous role, I anticipated a shift in consumer preferences by closely monitoring market trends and analyzing public data using Python. This insight enabled our team to adjust our marketing strategy promptly, resulting in increased customer engagement and improved business performance.”

How to Prepare for a Data Analyst Interview at JP Morgan

Preparing for a Data Analyst interview at JP Morgan involves a combination of technical knowledge, industry awareness, and effective communication skills. Thus, you need to be fully prepared beforehand to make great impressions and increase your chances of getting hired.

In this section, we’ll give you some tips to help you shine ahead of the competition and create great impressions among hiring managers.

Understand the Role and Industry

The first thing you need to do, even before you send your application to JP Morgan, is to familiarize yourself with the specific responsibilities of a Data Analyst by reading the job description carefully and visiting their websites.

Additionally, research the latest developments in the financial industry, including trends in data analytics, regulatory changes, and JP Morgan’s strategic initiatives, such as their focus on digital transformation and AI-driven analytics. Understanding how these trends impact decision-making will demonstrate your industry awareness.

To understand more details about Data Analyst responsibilities and tasks, you can check out Interview Query’s Data Analytics Learning Path as a starting point.

Review Technical Skills

Being a Data Analyst means that you need to possess various hard skills to analyze data efficiently. Common tools used for data analysis include Python, SQL, R, and data visualization tools such as Tableau, Looker, etc. Given the industry’s shift towards advanced analytics and machine learning, brushing up on these skills is vital.

Here on Interview Query, we have tons of interview questions that will help you sharpen your Python and SQL skills. So, make sure that you check us out.

Study Data Manipulation and Master Statistical Concepts

At JP Morgan, you will work with vast amounts of financial data to provide insights into market trends and competitor analysis. Practice data manipulation techniques, such as cleaning, filtering, and transforming data.

You also need to be well-versed in statistical concepts like hypothesis testing, regression analysis, and probability. Thus, make sure that you practice those concepts rigorously before the interview process.

If you would like to brush up on your statistics and hypothesis testing, we have a list of Statistics and A/B Testing Courses that you can follow. If you would like to improve your understanding of regression concepts, we have many of those in our Modeling and ML Learning Path.

Be Ready for Case Studies and Showcase Communication Skills

During one of the technical interviews conducted at JP Morgan, you’ll be presented with case studies in which you’ll be given a sample problem related to the financial industry, and you need to solve it with data analysis. We have a list of courses to guide you through how to answer these case-study questions. If you wish, you can also try to solve take-home challenges, in which you will learn how to conduct data analysis given a particular dataset and prepare your findings with notebooks

Also, when you’re presenting your solution, you need to showcase your ability to explain complex technical concepts to non-technical people.

One of the best ways you can prepare for this kind of scenario is by conducting a mock interview. In a mock interview, you’ll practice articulating your thought process during data analysis and interpretation with fellow data enthusiasts. If you would like to have a mock interview but don’t have a partner yet, you can join our Mock Interviews and AI Interview available on Interview Query.

Those are the tips that we recommend you implement straight away. If you’re seeking more detailed tips for your Data Analyst interview preparation, then you can check out our article dedicated to this.

FAQs

These are some of the frequently asked questions by people interested in working as a Data Analyst at JP Morgan.

How much do Data Analysts at JP Morgan make in a year?

Average Base Salary

Average Total Compensation

Where can I read more about people’s interview experiences for a Data Analyst position at JP Morgan here on Interview Query?

Interview Query does not have a section on interview experience at JP Morgan at the moment. However, you can read about other people’s interview experiences at other companies for Data Analyst and other data-related positions in our Interview Experiences section.

On Slack, you can also interact with other data enthusiasts or people seeking data-related positions in the IQ community.

Does Interview Query have job postings for JP Morgan’s Data Analyst position?

No, Interview Query does not directly list job postings for a specific company and position, including a Data Analyst position at JP Morgan. If you would like to check the most up-to-date available positions, we recommend you go to their official career website.

If you wish, you can also consider finding new opportunities for a Data Analyst position on Interview Query’s Jobs Board. It’s updated with the most recent job postings for data-related positions in the largest companies around the world.

The Bottom Line

This article provides a comprehensive guide to JP Morgan’s Data Analyst interview, covering key questions, the interview process, and salary insights.

For other data-related roles like Data Scientist, Business Analyst, Data Engineer, and Machine Learning Engineer, check out our dedicated interview guides.

Preparing for this role requires covering multiple topics, so we’ve compiled resources on Data Analyst interview questions, behavioral questions, case studies, SQL, Excel, and internship prep.

If you need further assistance, feel free to contact us and explore our site for more interview preparation services.