Uber Product Manager Interview Guide: Process, Questions & Preparation Tips (2026)

Introduction

Careers in product management are expected to grow by 10% through 2030, with roles spanning technology platforms like Uber. As Uber’s product focus spans sustained profitability across Uber Eats, Ads, and its ride-sharing services, preparing for an Uber product manager interview entails understanding these real-time marketplaces at a global scale. Product managers are expected to balance incentives across riders, drivers, and merchants, ultimately owning problems where pricing, supply, demand, and user experience are constantly entwined and shifting.

This is what make the Uber PM interview process uniquely challenging. Beyond product intuition, candidates are tested on their ability to reason through multi-sided tradeoffs, define the right metrics before proposing solutions, and make sound decisions grounded in marketplace dynamics and under real-world constraints.

This guide is designed to go deeper than most resources you will find online. It provides a clear, practical breakdown of Uber’s interview stages, including the often-misunderstood Group Round evaluation that many candidates struggle to prepare for. Throughout the guide, you will see common Uber interview questions and concrete examples of the metrics Uber product managers are expected to reason with, from supply utilization to order quality and earnings stability.

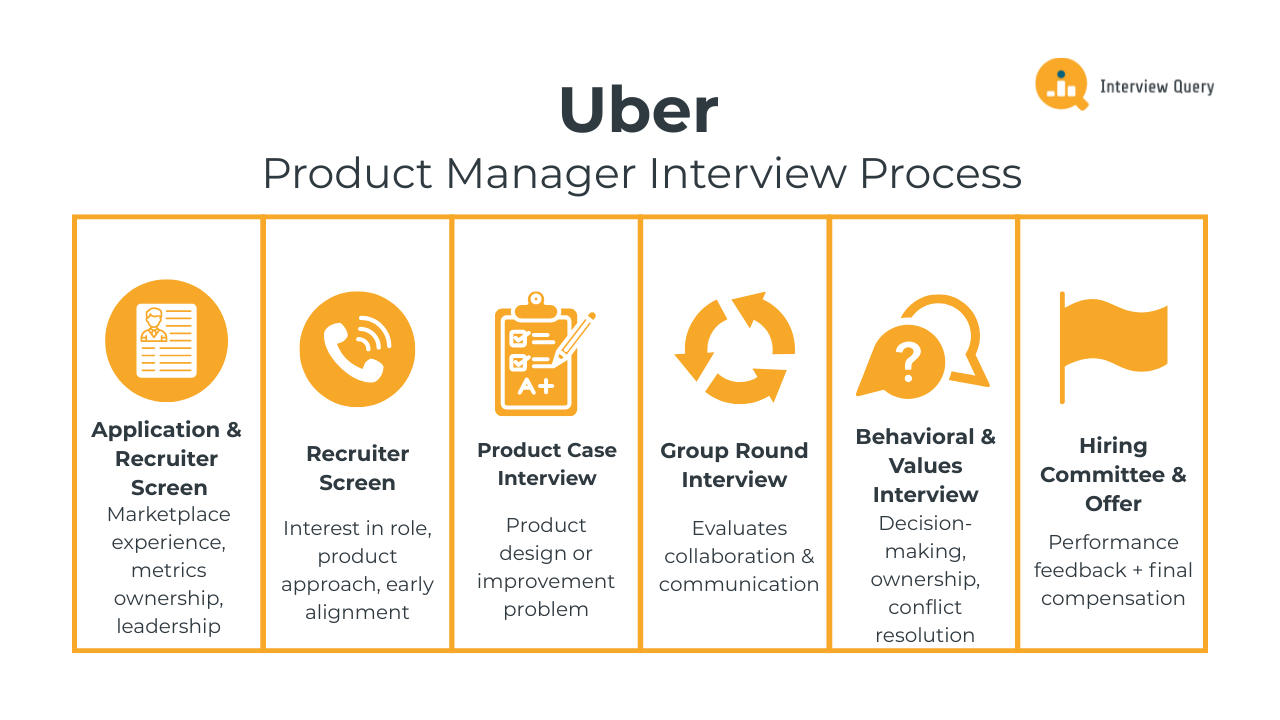

Uber Product Manager Interview Process

The Uber product manager interview process is structured to evaluate how well you can think through complex marketplace problems, communicate tradeoffs, and lead cross-functional decision-making. While the exact sequence can vary slightly by team (Rides, Uber Eats, New Verticals, Platform) and level, most candidates move through a consistent set of stages that assess product sense, analytical rigor, and cultural alignment.

What differentiates strong performers is not just “good answers,” but how clearly they frame problems, tie decisions to metrics, and anticipate second-order effects across Uber’s ecosystem.

Below is a stage-by-stage breakdown of what Uber is evaluating to help you prepare with intention.

Application and resume screen

The process begins with a resume and application review led by Uber recruiters and hiring managers. At this stage, Uber is looking for signals that you can operate effectively in marketplace or logistics-driven environments.

Recruiters typically screen for:

- Experience working on marketplace, logistics, payments, or growth-related products

- Clear ownership of business or product metrics rather than surface-level feature delivery

- Evidence of cross-functional leadership with engineering, design, data, and operations

Resumes that focus heavily on outputs, such as features shipped, without tying them to measurable outcomes tend to underperform. Uber values candidates who can show how their decisions moved key metrics and influenced multiple stakeholders.

Tip: Frame each role around a problem, the constraint you faced, the decision you made, and the metric impact. Marketplace metrics (supply utilization, fulfillment rate, take rate, lifetime value to customer acquisition cost ratio) carry far more weight than generic engagement stats.

Recruiter screen

If your resume passes the initial screen, you will be invited to a recruiter conversation. This is a non-technical call, but it plays a meaningful role in shaping the rest of your interview loop.

The recruiter screen focuses on:

- Why you want to work at Uber, and why now (beyond “scale” or “impact”)

- How you approach product decisions and tradeoffs in ambiguous environments

- Early team alignment across Rides, Uber Eats, or other product areas

Recruiters also use this call to confirm level alignment, location preferences, and compensation expectations. Strong candidates clearly articulate why Uber’s marketplace challenges fit their background and career goals.

Tip: Tie your experience directly to Uber’s operating model, e.g., local marketplaces, real-time constraints, regulatory pressure, or multi-sided incentives. Show that you understand what makes Uber hard, not just exciting.

Product case interview

The product case interview is the core evaluation in the Uber product manager interview process. This round is designed to test how you structure ambiguous problems and reason through tradeoffs under constraints.

You can expect:

- An open-ended product design or product improvement problem

- Heavy emphasis on defining success metrics before proposing solutions

- Follow-up questions that probe prioritization, edge cases, and tradeoffs

Unlike some companies, Uber interviewers expect you to ground your thinking in the realities of a multi-sided marketplace. Solutions that optimize for one user group without acknowledging downstream effects on others are typically viewed as incomplete.

Uber interviewers look explicitly for:

- Clear success metrics articulated early in your answer

- Discussion of rider, driver, and merchant incentives

- Awareness of cost, operational complexity, and scalability

Tip: Anchor your answer in one or two north-star metrics, and call out second-order effects proactively to signal senior product judgment. Interview Query’s real-world product challenges emphasize metric-first thinking and marketplace tradeoffs, which mirrors how Uber scores these interviews.

Group Round (GR) interview

The Group Round is one of the most distinctive and misunderstood parts of the Uber interview process, particularly for Uber Eats roles. In this round, you will work through a product problem alongside other candidates or interviewers in a group setting.

The Group Round evaluates:

- Collaboration and communication, not just idea quality

- Your ability to influence without dominating the conversation

- How clearly and concisely you frame problems and metrics

Common mistakes include trying to outshine others, contributing vague ideas without grounding them in metrics, or disengaging when your idea is not selected. Uber values candidates who can build on others’ points and move the discussion forward productively.

Tip: Group-style mock interviews and collaborative case practice are critical for this round and are built into Interview Query’s advanced prep offerings. Make sure to build on others’ points instead of competing.

Behavioral and values interview

Behavioral interviews at Uber are closely tied to the company’s core values. Interviewers assess how you demonstrate ownership, adaptability, customer obsession, and accountability through real past experiences.

You will be asked to share concrete examples of:

- Making decisions with incomplete information

- Handling conflict or disagreement with cross-functional partners

- Taking responsibility for outcomes, including failures

Answers are expected to be specific, structured, and reflective, with a clear emphasis on impact and learning.

Tip: Treat behavioral questions as decision audits and not just storytelling exercises. By clearly separating what you influenced from what you learned, you help differentiate Uber from companies that prioritize inspirational leadership stories and emphasize its high-accountability culture.

Hiring committee and offer

After interviews conclude, feedback from each interviewer is reviewed collectively to calibrate performance across competencies and levels. Uber uses this step to ensure consistent hiring standards across teams and to determine appropriate leveling.

If approved, the hiring team works with recruiting to finalize role scope, level, and compensation before extending an offer. This calibration step helps ensure that offers align with both candidate performance and long-term expectations within Uber’s product organization.

Overall, Uber’s PM interview process rewards candidates who think in systems, communicate with clarity, and ground every decision in measurable impact. Jump into Interview Query’s learning paths to familiarize yourself with marketplace tradeoffs, metric-driven reasoning, and real collaboration—helping you become aligned with how Uber actually hires PMs.

What Questions Are Asked in an Uber Product Manager Interview?

Across product design, metrics, and behavioral rounds, the Uber product manager interview is designed to evaluate your ability to structure ambiguous problems, reason with data, and make principled tradeoffs in a real-time, multi-sided marketplace. Strong candidates consistently anchor their answers in metrics, constraints, and incentives rather than jumping straight to feature ideas.

Below is a breakdown of the most common question types you will encounter, along with examples that reflect how Uber actually evaluates PM candidates.

Read more: Waymo Product Manager Interview Guide

Product design and strategy interview questions

Uber uses product design and strategy questions to assess how you operate under ambiguity. These questions are intentionally open-ended and reflect real product problems Uber PMs face, from balancing supply and demand to improving reliability across cities with very different constraints. Interviewers look for a clear problem definition, thoughtful metric selection, and solutions that account for riders, drivers, and merchants.

Design a new driver incentive for peak demand periods.

This question evaluates how well you understand supply elasticity and incentive design in a marketplace. Interviewers expect you to define peak demand clearly, outline success metrics such as fulfillment rate or rider wait time, and discuss different incentive levers. You should compare short-term bonuses, dynamic pricing signals, and longer-term loyalty mechanisms, while explaining tradeoffs like cost to the platform and driver behavior over time.

Tip: Anchor your thinking in behavior change, not payouts. Interviewers want to hear how the incentive alters when, where, and how long drivers stay online, along with how you’d detect gaming or fatigue before it shows up in weekly metrics.

Watch Next: Uber Data Scientist Interview Question: Decoding Ride-Share Incentive Schemes

For a deeper walkthrough of this type of marketplace incentive problem, watch this breakdown with senior data scientist and Interview Query coach Hanif Mahboobi, and Interview Query co-founder Jay Feng.

Together, they unpack how to frame peak demand definitions and choose the right levers for driver behavior and cost tradeoffs. Learn step-by-step reasoning and expert tips on metrics, tradeoffs, and structuring your answer.

How would you improve Uber Eats delivery times in dense cities?

This question tests your ability to diagnose operational bottlenecks before proposing solutions. A strong answer starts by defining what “delivery time” means, such as order acceptance time, food preparation time, courier pickup latency, and last-mile delivery duration. From there, you should identify which segments or geographies are underperforming and why, for example merchant prep variability or courier congestion during peak hours. Solutions should be prioritized based on impact, feasibility, and cost, not brainstormed randomly.

Tip: Call out how solutions differ between Manhattan at lunch vs. SF on a rainy Friday night, and explicitly state what you’d not fix first. Uber PMs earn credibility by showing they can narrow the blast radius before scaling anything globally.

How would you decide whether Uber should expand Eats into a new suburban market?

Here, Uber tests strategic thinking and risk assessment. A strong response frames the decision around demand density, merchant availability, courier supply, and unit economics. You should discuss pilot metrics, leading indicators of success, and how you would de-risk expansion through phased rollouts or merchant partnerships.

Tip: Focus on go or no-go criteria and decision thresholds. Describe the minimum data you’d need to walk away after a pilot, and explain how you’d protect core markets from distraction while still learning fast from the experiment.

How would you redesign Uber’s rider cancellation experience?

This question probes customer experience thinking within operational constraints. Interviewers look for clarity on why cancellations occur, how they impact drivers and marketplace efficiency, and which metrics matter most. Your solution should weigh transparency, fairness, and operational cost, while acknowledging unintended consequences.

Tip: Strong Uber PMs articulate how small changes in language, timing, or penalties influence long-term rider expectations. Always consider downstream effects on drivers when optimizing rider-facing flows.

How would you prioritize product improvements for Uber Eats merchants?

This question tests your ability to work across stakeholders. Strong candidates segment merchants by size or maturity, identify pain points like prep time predictability or menu management, and tie proposed improvements back to platform-level metrics such as order accuracy and delivery time.

Tip: Show you can say no to merchants thoughtfully. Explain how you’d avoid building one-off features for vocal partners, and instead invest in primitives that scale across thousands of restaurants while still making top merchants feel heard.

Metrics and analytics interview questions

Metrics and analytics questions are central to the Uber product manager interview. Uber PMs are expected to be deeply metrics-fluent and comfortable reasoning about tradeoffs using data. Interviewers care less about perfect metric lists and more about whether you can select the right metrics for the problem and explain how you would act on them.

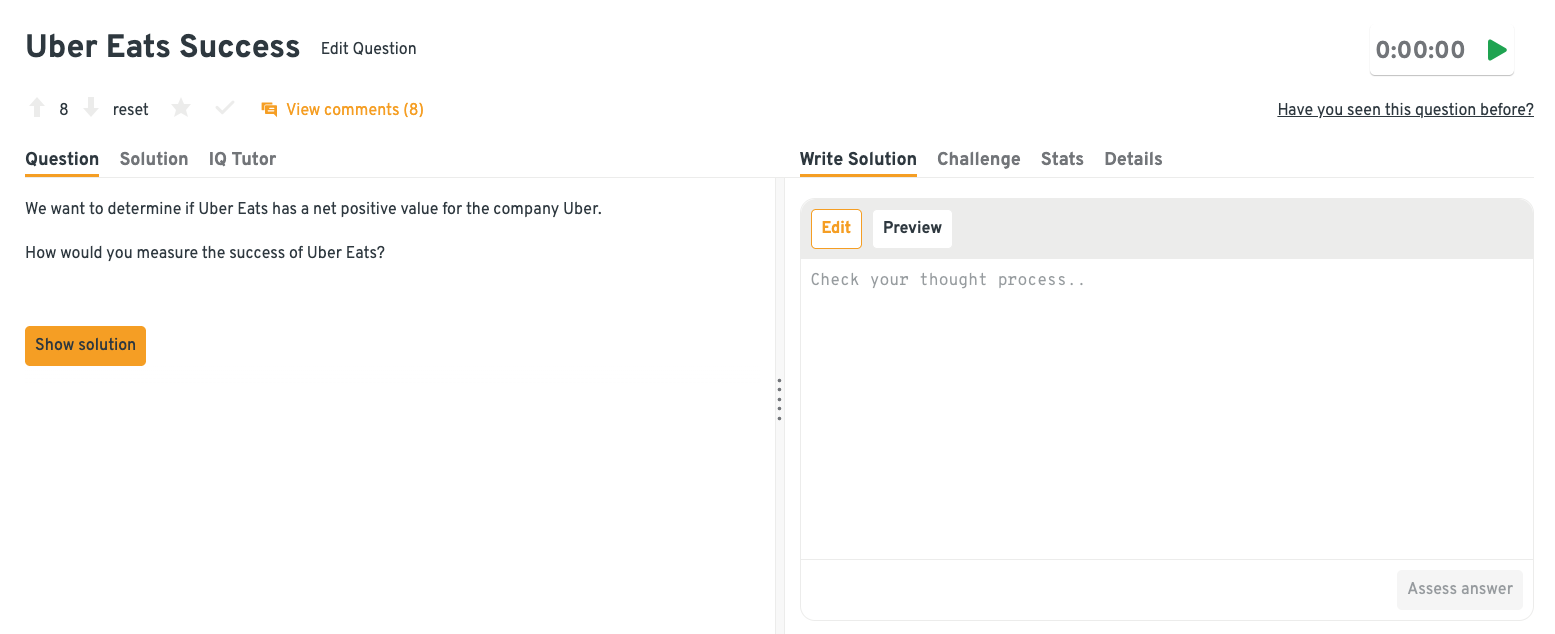

-

This question evaluates your ability to connect customer experience to measurable outcomes and prioritize metrics that actually drive behavior. A strong approach starts by mapping the end-to-end Eats journey and identifying friction points (e.g., search, checkout, delivery), then selecting metrics that correlate most strongly with retention and reorder rates. From there, you’d validate impact using cohort analysis or experiments to ensure improvements reflect real customer value rather than surface-level gains.

Tip: Explicitly call out which metrics are decision metrics versus diagnostic metrics. At Uber, PMs are expected to know which numbers trigger action and which ones simply explain why something moved.

-

This question tests marketplace thinking and financial judgment across multiple stakeholders. Frame success in terms of unit economics and ecosystem health by analyzing contribution margin, customer lifetime value, courier supply sustainability, and cross-sell benefits to the core Uber platform. You’d also account for indirect value—such as user acquisition spillover and shared infrastructure—while stress-testing whether growth remains profitable at scale.

Tip: Strong candidates show they can zoom out to Uber-level strategy, not just Eats-level performance. When preparing, practice explaining how a product decision would be defended in a leadership review where tradeoffs across orgs actually matter.

Practice this and other similar marketplace metrics questions by heading to the Interview Query dashboard. As you solve problems, refine your thinking using the IQ Tutor, which gives AI-powered guidance, follow-up prompts, and instant feedback so you can pressure-test your answers the way interviewers do.

How would you detect if Uber Eats delivery times are improving for the wrong reasons?

To spot misleading metrics and reason about unintended consequences, decompose delivery time improvements and check for offsetting negative signals, such as increased order cancellations, lower courier utilization, or tighter delivery radius constraints. Segmenting by geography, courier availability, and order mix helps confirm whether gains come from real operational improvements rather than demand suppression or selection bias.

Tip: Interviewers love when candidates proactively protect against “metric gaming.” Train yourself to ask, “What would leadership be nervous about if this metric suddenly improved?” since that instinct mirrors how experienced Uber PMs think.

-

This question measures your analytical rigor and comfort with retention modeling in a marketplace context. Start by building a survival or cohort-based model using early driver behavior (e.g., trip frequency, earnings consistency) to predict churn over time. You’d then estimate lifetime value by combining expected active duration with contribution margin, adjusting for incentives, regional differences, and seasonality.

Tip: At Uber, driver metrics are rarely evaluated in isolation. In prep, get comfortable discussing how incentives, earnings predictability, and policy changes can quietly break otherwise clean-looking models.

-

This prompt tests your ability to reason about real-time systems and balance marketplace efficiency with user experience. A solid approach combines leading indicators like request volume, ETA inflation, and unfulfilled requests with supply-side metrics such as active drivers and acceptance rates. Surge thresholds should be informed by historical elasticity analysis to ensure pricing corrects imbalance without materially harming conversion or long-term trust.

Tip: Practice narrating how you’d monitor metrics during a live incident. Interviewers respond well when you speak like someone who has actually been on-call for a marketplace issue, not just analyzing it after the fact.

Want to sharpen your product analysis even more? If you’re serious about cracking Uber’s metrics interviews, Interview Query’s Product Metrics Learning Path gives you hands-on drills, real marketplace case questions, and structured frameworks that mirror how Uber PMs actually reason with data.

Behavioral interview questions

Behavioral interviews at Uber focus on ownership, judgment, and decision-making under uncertainty. Interviewers expect specific, structured stories that demonstrate accountability and learning. Vague or overly polished answers tend to underperform compared to honest, reflective responses.

-

Uber PMs must align engineers, ops, and business teams around the same decision. Interviewers look for candidates who can quantify impact using metrics like conversion rate, estimated time of arrival (ETA), cancellation rate, net promoter score (NPS), or gross market value (GMV), while also clearly explaining how the insight changes those numbers.

Sample answer: “In a previous role, I explained a conversion drop by mapping it to the user journey instead of raw SQL output. I showed that a 300ms checkout latency increase correlated with a 4% drop in completed orders. Framing it around lost orders and revenue helped non-technical partners align quickly. The fix recovered roughly $1.2M in monthly GMV.”

Tell me about a time you made a product decision with incomplete data.

Many Uber decisions happen before data is fully mature. Candidates should show how they used proxy metrics, such as early retention, fulfillment rate, ETA inflation, or support contact rate, and how they defined success thresholds before shipping.

Sample answer: “We launched a peak-hour feature with limited historical data, so I relied on early fulfillment rate and average ETA as leading indicators. I set a clear rollback threshold if cancellations rose above 2%. After launch, fulfillment improved by 6% while cancellations stayed flat. That gave us confidence to expand the feature to more cities.”

-

Uber PMs are expected to influence leadership using data, not just report it. Strong answers quantify impact using metrics like unfulfilled requests, driver utilization, rider wait time, or contribution margin, and show how insights drove a concrete decision.

Sample answer: “I presented data showing surge caps reduced price spikes but increased unfulfilled requests by 8% in dense cities. I tied this directly to longer rider ETAs and lower driver utilization. Based on that analysis, leadership approved a city-level experiment instead of a global change. The test improved trip completion by 5% with no NPS decline.”

Build fluency with behavioral and leadership-style prompts like this, not just technical cases, by practicing inside the Interview Query dashboard. Use IQ Tutor to get tailored coaching on your responses, or learn from peer insights in the comments section, where candidates break down what strong answers actually sound like in real interviews.

Tell me about a time you owned a product failure.

Uber values accountability in high-velocity environments where mistakes happen. Interviewers want to hear how you identified the issue using indicators like cancellations, support tickets, retention, or error rates, and how you prevented repeat mistakes.

Sample answer: “I shipped a notification change that increased open rates but also raised cancellations by 3%. I flagged the issue using real-time cancellation and support metrics and rolled the feature back within 48 hours. After identifying unclear messaging as the cause, we relaunched with an A/B test. The new version improved engagement by 7% without hurting cancellations.”

Describe a time you had to make a tradeoff that impacted users negatively.

Uber PMs often balance efficiency, cost, and experience. Candidates should quantify impact using metrics like retention, churn, contribution margin, promo ROI, or fulfillment, then explain how they monitored second-order effects.

Sample answer: “We reduced promo eligibility for about 15% of users after seeing low repeat rates and negative ROI. I tracked churn, reorder rate, and contribution margin post-change. Retention stayed flat while margin improved by 2 points. We paired the change with clear messaging to support teams to manage user sentiment.”

Ready to go deeper? If you want to practice beyond Uber-specific examples, Interview Query’s full PM question bank gives you hundreds of real product, metrics, and behavioral questions from top tech companies. These curated questions are perfect for building intuition, stress-testing your frameworks, and getting interview-ready with confidence.

How to Prepare for an Uber Product Manager Interview

Preparing for an Uber product manager interview requires a deliberate shift away from generic product interview prep. Uber doesn’t reward polished frameworks on autopilot. Rather, it looks for PMs who can reason through complex, real-world marketplace dynamics where every decision creates ripple effects. The strongest candidates consistently demonstrate preparation pillars: marketplace frameworks, metrics-first thinking, city-level intuition, and structured communication.

Master marketplace frameworks tailored to multi-sided platforms: Every Uber problem involves tradeoffs across riders, drivers, merchants, and the platform itself. Practice framing problems by clearly identifying the primary user, secondary users, and the incentives that connect them. Interviewers expect you to articulate how improving one side of the marketplace can create downstream effects elsewhere, both positive and negative.

Tip: When evaluating options, explicitly name the tradeoffs you’re making and explain why you’re comfortable accepting the downsides.

Develop city-level intuition, not just global thinking: Uber operates as a global platform, but many decisions are local. When practicing, ask yourself how your approach would differ between a dense urban core, a suburban market, or an emerging city. Calling out when something should not **be scaled globally is a subtle signal that you understand how Uber actually operates.

Tip: Read Uber product blog posts and city launch stories, then use Interview Query’s product-focused questions to practice tailoring one solution across two very different city contexts.

Build metrics-first thinking into every answer: Uber interviewers expect you to define success before proposing solutions. Select a small set of core metrics, explain why they matter, and show how you would use them to guide decisions. Focus on metrics such as fulfillment rate, wait time, utilization, and defect rate rather than vanity indicators. Strong candidates explain how they would diagnose issues, run experiments, and adjust based on early signals.

Tip: Practice metrics-heavy prompts from Interview Query’s question bank and pause after each answer to ask yourself which metric would actually trigger a decision in a weekly Uber business review.

Prioritize structured communication: Use a consistent structure when answering questions: clarify the goal, define success metrics, outline constraints, then propose and prioritize solutions. Avoid feature-first thinking; clear structure signals strong product judgment and makes it easier for interviewers to follow your thinking.

Tip: Record yourself answering Interview Query case challenges out loud, then replay them to check whether your structure is obvious to someone hearing it for the first time. This mirrors how Uber interviewers experience your response.

Reading frameworks and practicing solo can only take you so far. The fastest way to level up for Uber interviews is through Interview Query’s mock interviews, which simulate real pressure, where you’re forced to structure quickly, defend metrics, and adjust on the fly.

Role Overview and Culture at Uber

Instead of owning narrow feature areas, Uber product managers are responsible for navigating interconnected systems where rider experience, driver earnings, and platform economics constantly push against one another. Every decision has second-order effects, and understanding those tradeoffs is core to the role.

At a practical level, Uber PMs spend much of their time shaping how supply and demand meet in real time. Whether it’s pricing logic, incentives, or reliability improvements, the work is deeply operational and heavily data-driven.

Day-to-day responsibilities typically include:

- Designing and tuning pricing, incentives, and marketplace mechanisms

- Improving supply–demand matching and marketplace efficiency

- Optimizing reliability metrics such as ETA accuracy, trip completion, and order fulfillment

- Partnering with operations teams to address city- or merchant-specific issues

- Using metrics like driver utilization, order defect rate, cancellation rate, and refunds to guide decisions

- Running experiments and iterating quickly based on real-time signals

There’s also a meaningful distinction between Rides and Uber Eats PM roles. Rides teams focus on real-time mobility problems like surge pricing, supply elasticity, and city-level availability. Eats teams operate closer to logistics and operations, with emphasis on merchant quality, prep-time predictability, courier efficiency, and last-mile reliability. Uber treats Eats as a distinct product track, with its own challenges, metrics, and growth paths.

Culturally, Uber has evolved. The company now prioritizes profitability, efficiency, and operational discipline over unchecked growth. In terms of internal mobility, PMs can move across Rides, Eats, Freight, and Ads, building broad marketplace intuition while deepening expertise over time. That cross-pollination is encouraged and often accelerates career growth.

For a deeper look at what it’s like to work at Uber, check out Interview Query’s Uber company interview guide, which has a closer breakdown of teams, interview expectations, leveling, and how PMs differ from other roles across the organization.

Average Uber Product Manager Salary

Uber product managers are paid at the top end of the market, and for good reason. PMs at Uber are expected to operate complex, real-time marketplaces at massive scale, whether that’s balancing rider supply and demand, optimizing delivery logistics, or growing ads revenue across global regions. As a result, compensation is both competitive and heavily tied to scope, impact, and long-term ownership.

Based on aggregated data from Levels.fyi, total compensation varies by level, team, and geography, but equity plays an increasingly important role as you move up the ladder. Early-career PMs see most of their pay come from base salary and annual bonus, while senior and group PMs have a much larger portion of compensation tied to stock, aligning incentives with Uber’s long-term performance.

Compensation by Level

| Level | Total / Year | Base / Year | Stock / Year | Bonus / Year |

|---|---|---|---|---|

| Product Manager I | ~$165K | ~$130K | ~$20K | ~$15K |

| Product Manager II | ~$200K | ~$150K | ~$30K | ~$20K |

| Senior Product Manager | ~$255K | ~$175K | ~$55K | ~$25K |

| Group Product Manager | ~$320K | ~$195K | ~$90K | ~$35K |

One notable inflection point comes after the first year, when equity vesting accelerates. From year two onward, total compensation can jump meaningfully, especially for senior PMs who own high-impact surfaces or multi-team initiatives.

Average Base Salary

Average Total Compensation

Regional Salary Comparison

| Region | Salary Range | Notes |

|---|---|---|

| San Francisco Bay Area | $220K–$320K | Highest total compensation and equity grants |

| Seattle | $200K–$290K | Strong tech market, slightly lower equity than SF |

| New York City | $195K–$285K | Comparable base pay, modestly lower stock |

| Other U.S. hubs | $170K–$250K | Varies by team, org, and problem space |

Geography still matters. Core tech hubs like San Francisco and Seattle tend to offer the highest upside, particularly in equity, while newer or smaller offices may trade some compensation for flexibility or scope. Overall, Uber compensation reflects a strong emphasis on ownership and long-term impact, especially at senior levels.

If you’re evaluating an offer or planning your next move, dive deeper with Interview Query’s salary guides to compare levels, locations, and equity structures so you know exactly where you stand.

FAQs

Is the Uber Eats PM interview different?

Yes. Uber Eats product manager interviews are treated as a distinct track. While core evaluation criteria are similar, Eats interviews focus more heavily on logistics, merchant experience, preparation time, and order quality. Candidates should expect deeper questions around fulfillment metrics and operational constraints compared to Rides roles.

How hard is the Group Round?

The Group Round is one of the most challenging stages for many candidates because it evaluates collaboration and influence, not just idea quality. Success depends on framing ideas clearly, building on others’ input, and grounding suggestions in metrics. Candidates who dominate or disengage tend to struggle, while those who guide discussion perform best.

Does Uber test technical skills for PMs?

Uber does not test coding skills for product managers. However, PMs are expected to be analytically strong. Interviewers frequently probe metrics reasoning, experimentation design, and data interpretation. Comfort with numbers and causal thinking is essential.

How long does the Uber PM interview process take?

From initial application to offer, the process typically takes four to six weeks. Timelines vary based on scheduling availability, team matching, and hiring committee calibration.

What metrics should I study most for Uber PM interviews?

Focus on marketplace metrics such as fulfillment rate, wait time, utilization, cancellation rate, earnings consistency, and defect rate. Understanding how these metrics interact is critical.

How should I prepare differently for senior roles?

Senior candidates are expected to demonstrate stronger judgment, prioritization, and stakeholder management. Interviewers probe long-term strategy, tradeoffs, and organizational influence more deeply.

Start Your Uber Product Manager Journey with Interview Query

Overall, Uber product manager interviews reward candidates who think clearly, reason with metrics, and communicate tradeoffs effectively in complex marketplaces. From product design cases to analytics-heavy discussions and behavioral evaluations, success comes from structured preparation and realistic practice.

Interview Query helps you prepare at every stage of the Uber PM interview process. Use the product manager question bank to practice real-world product design, metrics, and behavioral questions. Schedule mock interviews to simulate interview pressure and receive actionable feedback. Lastly, work through challenges that mirror business scenarios and marketplace problems.

With the right preparation system and realistic practice, you’ll walk into your Uber PM interviews prepared, confident, and ready to stand out.