Optiver Research Scientist Interview Guide: Process, Questions & Preparation Tips (2026)

Introduction

Investment in research automation, decision science, and faster signal discovery is rapidly increasing, poised to reach $325 billion by 2030 as markets become more competitive and data-rich. For candidates preparing for an Optiver research scientist interview, this shift matters. With an estimated acceptance rate of only 10%, Optiver is highly selective. It doesn’t hire researchers to publish models in isolation, but prioritizes scientists who can reason under uncertainty and translate research insights into decisions that operate in live, real-time markets.

At Optiver, research scientists leverage their knowledge of probability, statistics, machine learning, and market intuition to solve complex financial and trading problems. Your work is evaluated not only on theoretical correctness, but on whether it improves trading outcomes under tight latency and risk constraints. That applied focus is what differentiates this role from broader quantitative research positions across finance.

In this guide, you will learn what the Optiver research scientist role actually involves, how the interview process is structured, and how skills are tested at each stage through common interview questions. You will also find preparation strategies and compensation insights to help you plan your next steps.

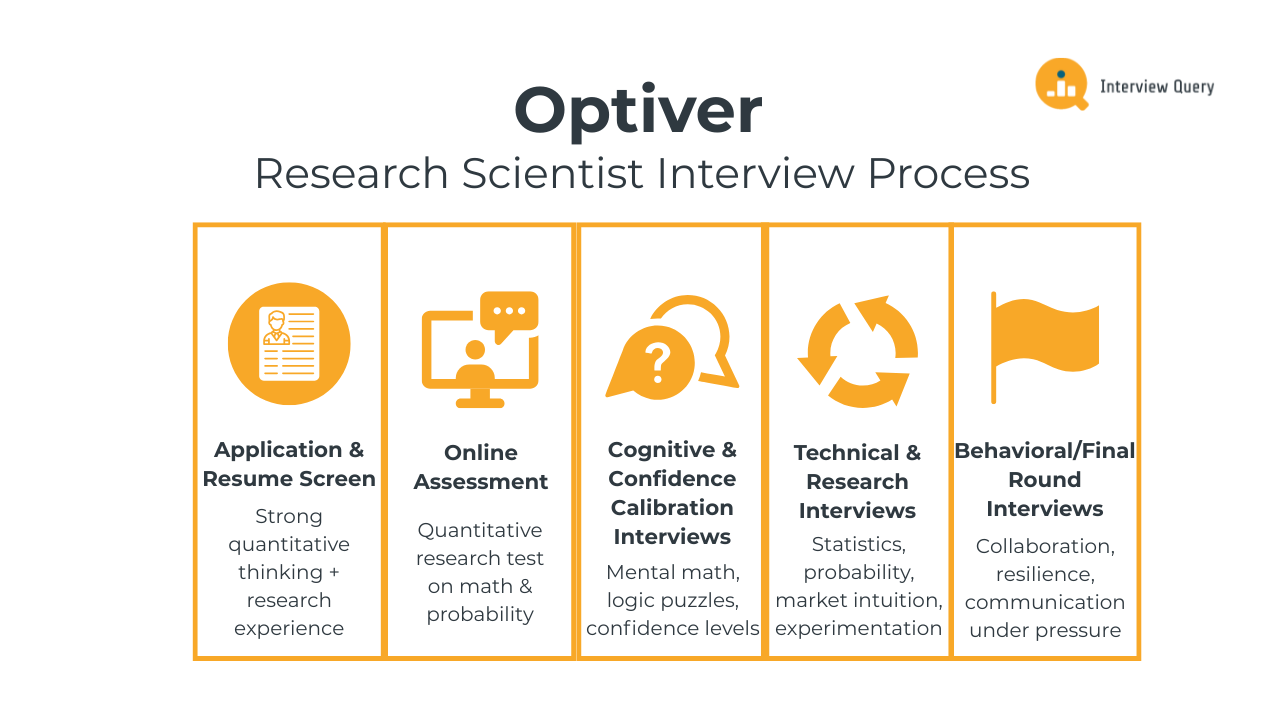

Optiver Research Scientist Interview Process

Optiver’s research scientist interview process is deliberately designed to surface how you reason under uncertainty, going beyond whether you’ve memorized formulas or mastered a particular tech stack. Every stage stresses probabilistic intuition, mathematical clarity, and judgment under incomplete information. The firm cares far more about how you update beliefs, test assumptions, and communicate uncertainty than about polished code or domain buzzwords.

While the exact order can vary by location or team, the core stages outlined below remain consistent and reflect Optiver’s emphasis on cognition and applied research over rote coding.

Application and resume screen

Your application is reviewed by recruiters in close collaboration with researchers. This screen focuses on signals of strong quantitative thinking, including coursework or experience in mathematics, statistics, physics, engineering, or related research-heavy fields. Optiver is largely tool-agnostic at this stage. A PhD thesis, a well-designed experiment, or a project where you derived insight from noisy data carries more weight than listing every language or library you’ve used.

Trading experience is a plus, not a prerequisite. Many successful candidates come from academic research or industry roles where they tackled ambiguous problems and validated assumptions through data.

Tip: When highlighting research problems you’ve worked on, show where your conclusions changed after you challenged your own assumptions, as Optiver cares more about the iteration than the outcome.

Online assessment and quantitative research test

Candidates who pass the resume screen are typically invited to complete an online assessment or quantitative research test. This stage often includes math-heavy and probability-driven questions designed to evaluate reasoning speed, accuracy, and clarity of thought. Some versions are administered through platforms like HackerRank, but the emphasis is not on advanced programming syntax.

Coding, when present, is usually minimal and secondary to logical structure and correctness. Interviewers care far more about how you approach a problem, break it into components, and justify your conclusions under time pressure.

Tip: Interviewers notice disciplined thinking even when time runs out, so use Interview Query’s AI Interviewer to get feedback when practicing question categories like SQL. If you’re stuck, write down what must be true and be prepared to explain your reasoning.

Cognitive and confidence calibration interviews

One of the most distinctive parts of the Optiver interview process is the cognitive interview, which often includes mental math, logic puzzles, and confidence calibration exercises. These sessions test how you process information quickly and how accurately you assess your own certainty.

Interviewers closely watch how accurately you assess your own certainty. Being wrong isn’t a problem; being confidently wrong or hedging everything is. The strongest candidates adjust their confidence as new information arrives.

Tip: State your confidence level clearly instead of overcommitting. For example, saying “I’m about 70% confident” shows you understand uncertainty, which is integral to the job.

Technical and research interviews

Technical and research interviews focus on applied probability, statistics, market intuition, and experimental thinking. You may be asked to analyze a stylized market problem, reason through a probabilistic model, or explain how you’d stress-test a strategy across regimes.

The structure is intentionally open-ended. Interviewers want to see how you explore ideas, discard weak assumptions, and recover when an approach fails. Silence while thinking is fine; hand-waving or insubstantial language is not.

Tip: Interviewers appreciate when you walk them through dead ends and failed approaches. As you practice technical and market-based questions on Interview Query’s question bank, don’t just focus on the final answers; good research is about knowing why something doesn’t work.

Behavioral and final round interviews

The final stage typically includes behavioral interviews that assess collaboration, resilience, and communication under pressure. Expect questions about working through disagreement, learning from mistakes, and adapting your thinking when data contradicts your initial view.

Alignment with Optiver values and comfort in high-feedback environments are key themes. Strong answers emphasize reflection and evidence-driven decision-making since the company values people who can revise opinions quickly without ego.

Tip: Share concrete examples where data forced you to abandon a strong prior, as that’s exactly the muscle they’re testing.

Want to practice these conversations with experienced interviewers? Interview Query’s mock interviews help you rehearse real Optiver-style scenarios and get targeted feedback before the final round.

Most Asked Optiver Research Scientist Interview Questions

Throughout the Optiver research scientist interview loop, questions are deliberately open-ended and time-bound, pushing candidates to set assumptions quickly, make defensible estimates, and articulate trade-offs clearly. This structure reflects the reality of the role: research scientists at Optiver make decisions that affect live trading systems, where perfect information is never available and speed matters.

Rather than separating “technical” and “behavioral” skills, Optiver blends them. Probability questions test intuition despite noisy environments, while cognitive questions test clarity under pressure. Research questions test whether you can stress-test ideas before trusting them, and behavioral questions round out the process by probing how you respond when evidence challenges your initial view.

Below, we break down the most common categories of Optiver research scientist questions and how interviewers evaluate your responses.

Read more: Quant Interview Questions

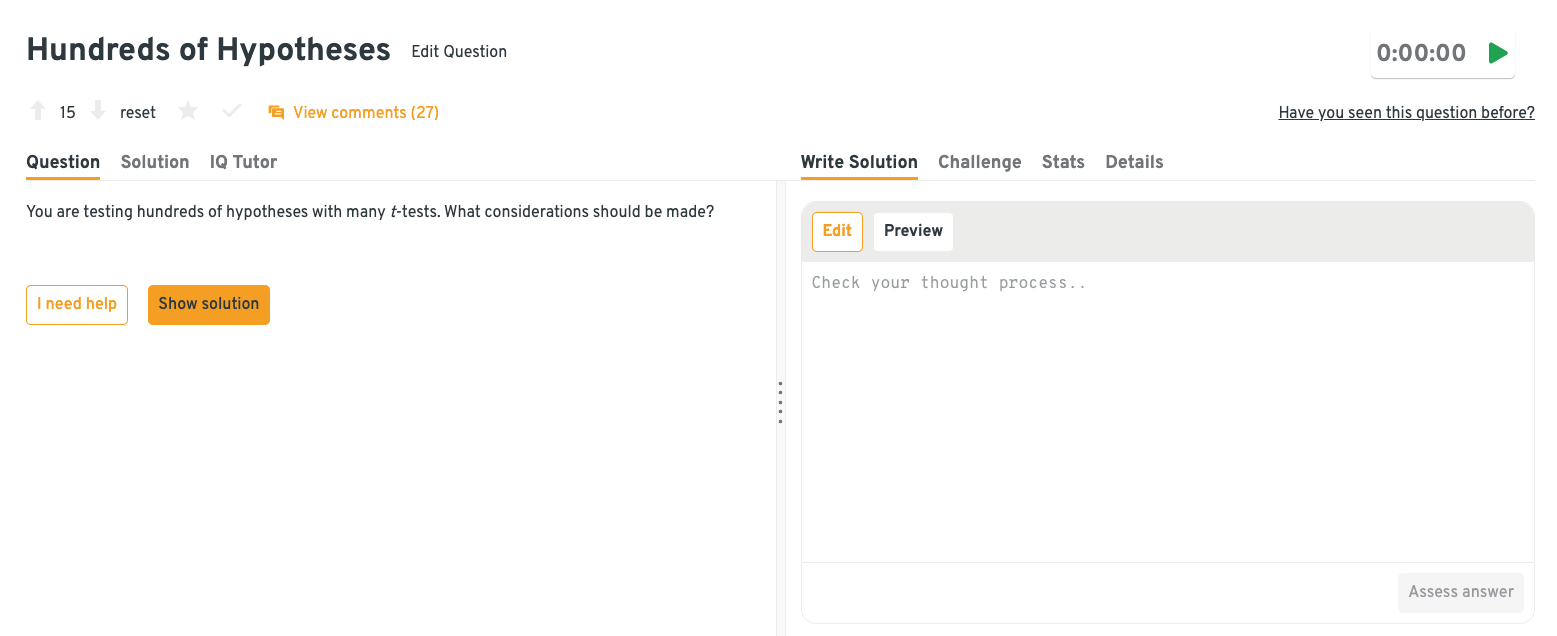

Probability and statistics interview questions

Probability and statistics form the backbone of most Optiver research scientist questions. Interviewers are less interested in closed-form solutions and more focused on how you structure uncertain problems, choose reasonable approximations, and reason about distributions under limited information. Many Optiver interview questions in this category resemble simplified versions of real trading decisions, where signals are noisy and sample sizes are constrained.

-

This question evaluates your understanding of multiple testing, false discoveries, and statistical rigor under scale. When many hypotheses are tested simultaneously, some signals will appear significant purely by chance, so you need to adjust thresholds using techniques like Bonferroni correction or false discovery rate control. In practice, you’d also validate results with out-of-sample testing or simulation to confirm the signal survives beyond noise.

Tip: When discussing this, explicitly mention how you’d prioritize which signals deserve deeper follow-up. Optiver interviewers like hearing how you’d allocate limited research time, not just how you’d control p-values.

To go deeper, the Interview Query dashboard lets you practice more statistics and probability questions like this one and instantly check your reasoning. You can use features like the IQ Tutor for AI-powered guidance to refine your approach and build confidence before the interview.

How would you estimate the expected value of a noisy trading signal?

This probes your ability to reason about estimation under uncertainty and noisy data. A common approach is to average observations while accounting for variance, often using techniques like shrinkage or Bayesian updating to avoid overreacting to limited samples. The key is balancing responsiveness with stability as new data arrives.

Tip: A strong answer goes beyond the estimator. Briefly explain how your estimate would evolve as new data arrives, since real Optiver research is continuous rather than one-shot analysis.

-

This question tests model evaluation judgment and awareness of statistical pitfalls. R-squared measures in-sample fit, not predictive power, and can look impressive even when a model fails out of sample or captures spurious correlations. A stronger evaluation combines cross-validation, error metrics, and robustness checks across market regimes.

Tip: Tie your evaluation back to decisions: interviewers perk up when you explain how a “good” metric can still lose money in production if it fails under changing market conditions.

-

Here, interviewers assess both statistical fundamentals and communication clarity. An unbiased estimator has an average value equal to the true parameter, even though individual estimates may vary. A simple explanation is that while any single guess might be off, the method doesn’t systematically overshoot or undershoot over time.

Tip: Practice explaining this without equations. Optiver values researchers who can translate statistical ideas clearly to traders during fast market discussions.

How do you think about variance when evaluating short-term trading performance?

This question measures your ability to separate signal from noise in volatile environments. Short-term results can be dominated by randomness, so variance must be considered alongside returns to avoid drawing premature conclusions. Researchers often contextualize performance using confidence intervals, longer horizons, or simulated baselines to understand what outcomes are statistically meaningful.

Tip: Try framing variance as information rather than just noise; describing how volatility can reveal regime changes or model breakdowns signals a more mature research mindset.

Ready to practice like an Optiver researcher? Sharpen this style of probabilistic reasoning under realistic constraint through the Interview Query question bank. You’ll find Optiver-style probability, statistics, and market intuition questions with guided solutions that train you to think the way interviewers expect.

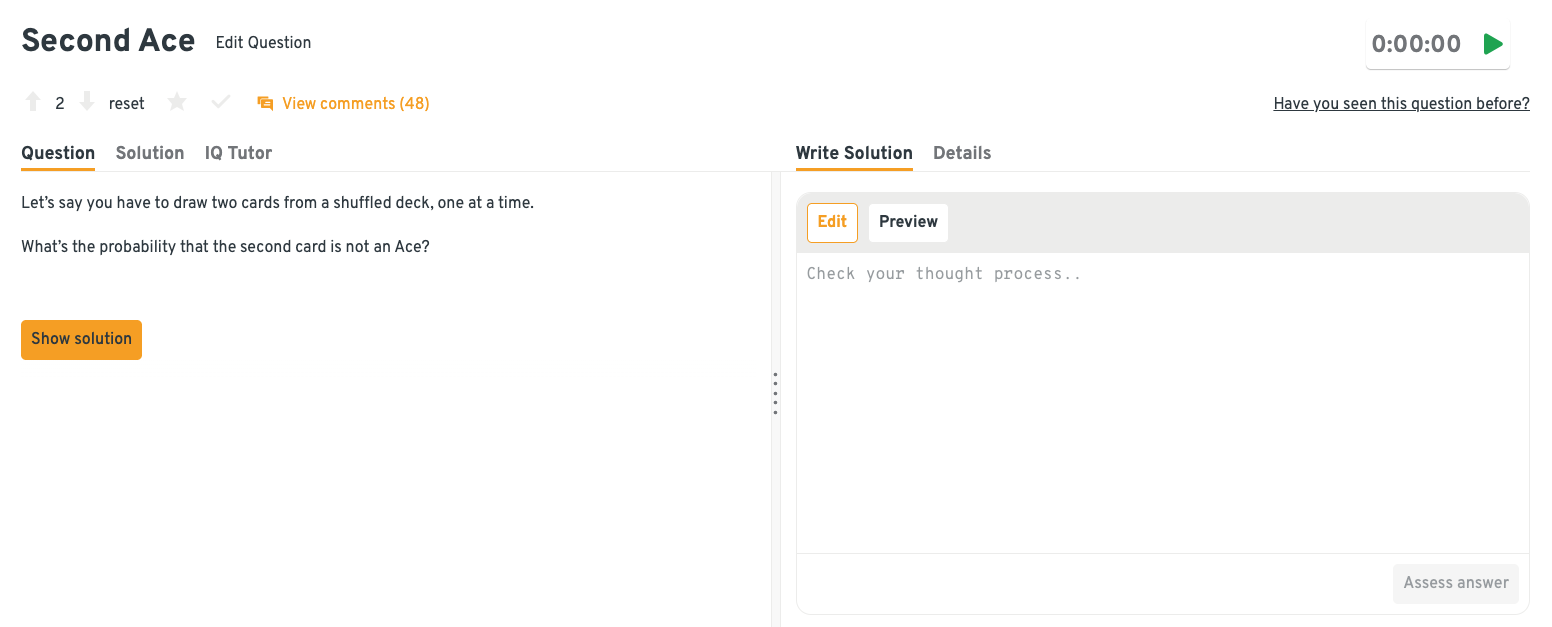

Cognitive and logic-based interview questions

Cognitive interview questions are a distinctive part of the Optiver interview process. These questions often involve mental math, logic puzzles, or rapid estimation tasks designed to test clarity of thought under pressure. Optiver interviewers care less about raw speed and more about whether you stay organized, correct mistakes, and communicate your reasoning as you go.

How would you estimate the number of trades occurring in a market per day?

This question tests estimation, decomposition, and comfort with back-of-the-envelope reasoning. A strong approach breaks the market into components, such as number of active instruments, average trades per instrument, and trading hours, then multiplies rough but defensible assumptions.

Tip: Anchor your estimate to a concrete market you’d actually trade (for example, a single liquid equity or futures product) before scaling up, thus showing that you can ground abstract estimates in real market structure.

-

Here, the focus is on logical enumeration and probabilistic reasoning under symmetry. Each trader independently chooses one of two directions, creating a small, countable set of outcomes. By listing the cases where all traders move in the same direction and comparing them to the total possibilities, you can compute the probability cleanly.

Tip: Before calculating, pause and describe the symmetry you see; calling out invariances early is something strong Optiver candidates do instinctively.

-

This question checks whether you understand conditional probability and independence intuitively. While the outcome of the first draw affects the deck composition, symmetry ensures that the probability a specific position contains an Ace is unchanged. Recognizing that shortcut avoids unnecessary casework.

Tip: If you spot a shortcut, explain why it works. Interviewers care that you understand the structure of the problem, not just that you memorized a trick.

Practice more logic-based problems like this on the Interview Query dashboard, where you can compare your solutions with detailed explanations and see insights from other users. Leveraging these features helps you spot patterns, shortcuts, and common pitfalls to strengthen your reasoning skills.

-

This problem tests comfort with relative motion and recognizing when a complicated process simplifies. Rather than tracking every back-and-forth movement, it helps to focus on total time elapsed until the trader reaches the boundary. Multiplying that time by the signal’s speed yields the total distance directly.

Tip: When a problem looks messy, explicitly ask yourself what variable actually matters most; simplifying the frame is often the real signal Optiver is testing for.

How do you handle realizing halfway through that your approach is flawed?

This question evaluates adaptability, composure, and intellectual honesty under pressure. A strong response acknowledges the mistake quickly, explains what triggered the reassessment, and pivots to a better approach without defensiveness. Interviewers value candidates who can course-correct efficiently rather than stubbornly defend a weak path.

Tip: Practice saying “I think this path is wrong—here’s a better one” calmly and early. At Optiver, the fastest way to lose trust is pretending a weak idea is still viable.

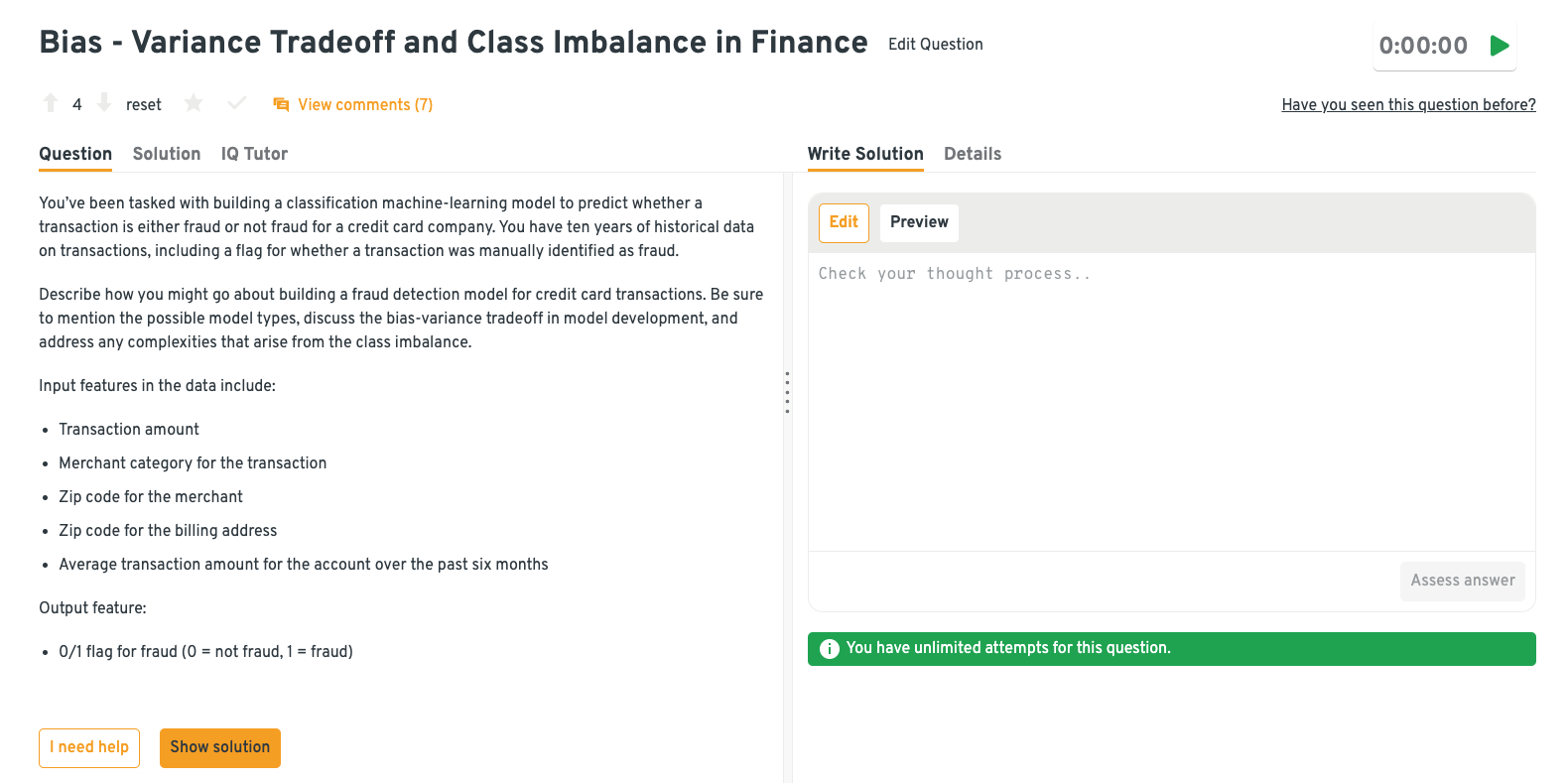

Research and modeling interview questions

Research and modeling questions reflect the core of the Optiver research scientist role. These questions explore how you design experiments, test robustness, and reason about market dynamics. Unlike academic interviews, Optiver research scientist questions prioritize applicability and stress-testing over theoretical elegance.

How do you think about model simplicity versus complexity?

This probes your judgment around bias–variance tradeoffs and your ability to prioritize robustness over elegance. A good answer emphasizes starting with the simplest model that captures the core signal, then only adding complexity if it delivers stable out-of-sample gains. You’d also mention interpretability, maintenance costs, and how noisy market data often punishes overfitting.

Tip: Reference how latency, monitoring, and fast iteration matter in Optiver-style environments. Calling out when a simpler model lets traders and researchers debug behavior in real time shows that you understand how research meets production here.

How would you decide whether a weak signal is still worth trading?

This question tests statistical reasoning and economic intuition rather than raw modeling skill. The key is to evaluate the signal’s consistency, capacity, and risk-adjusted returns after costs, not just its standalone Sharpe. Even a weak predictor can be valuable if it’s uncorrelated with existing signals and improves the portfolio when combined.

Tip: Mention how you’d test marginal contribution to PnL when layered into an existing signal stack. At Optiver, candidates who naturally think in terms of ensembles and incremental edge sound much closer to how research actually works.

How would you test whether a strategy is robust across market regimes?

Here, the focus is on validation discipline and understanding non-stationarity in markets. A strong approach involves slicing performance by regimes such as volatility, trend, or liquidity conditions and checking for stability rather than peak performance. You might also discuss stress tests, rolling retrains, and drawdown behavior during regime transitions.

Tip: Go one step further and talk about failure modes, i.e., what specifically breaks first when the regime shifts, and how you’d detect that early. Interviewers are impressed when you discuss diagnostics you’d monitor live, not just retrospective analysis.

-

This evaluates your ability to design models under asymmetric risk and skewed data distributions. You’d typically favor simpler or regularized models, use cost-sensitive losses, and optimize metrics tied to economic impact rather than accuracy. Careful cross-validation, resampling, and threshold calibration help ensure the model generalizes without missing critical rare events.

Tip: Mention how you’d sanity-check the model with traders or domain experts to validate whether flagged events make sense economically. Showing you can bridge statistical outputs with trading intuition is valued at Optiver.

Explore more research and modeling questions like this on the Interview Query dashboard, Features like the IQ Tutor and user comments help you test your approaches and refine your solutions, ultimately strengthening both your technical reasoning and your ability to explain choices like a real Optiver researcher.

-

This question focuses on statistical rigor, causal thinking, and understanding of performance attribution. Highlight how you’d separate skill from noise using long-horizon metrics, bootstrapping, and shrinkage toward the mean. Adjusting for risk, market conditions, and opportunity sets is essential to avoid rewarding variance instead of true edge.

Tip: Discuss how you’d prevent gaming once such a system exists, including feedback loops and behavioral changes. Demonstrating awareness of second-order effects tells interviewers you think like someone building tools for real trading desks, not just running offline analysis.

Want to think through these modeling questions the way Optiver expects? The Modeling & Machine Learning Interview learning path on Interview Query is built for exactly this kind of problem: balancing bias–variance tradeoffs, handling noisy market data, and stress-testing models under real-world constraints. This path helps you turn solid modeling intuition into interview-ready answers.

Behavioral interview questions

Behavioral questions at Optiver are tightly linked to research thinking. Rather than generic culture fit, Optiver behavioral interview questions examine how you update beliefs, handle uncertainty, and collaborate under pressure. Interviewers expect concise, evidence-driven stories rather than polished narratives.

Tell me about a time you were confident and wrong.

Optiver asks this to assess intellectual humility and how quickly you course-correct when markets invalidate your assumptions. Candidates can quantify impact by referencing performance deltas, error rates, or how fast they detected and fixed the mistake.

Sample answer: “I once pushed a short-term signal I believed was robust, but live results underperformed backtests by ~15% Sharpe within the first week. After reviewing execution logs, I realized latency effects were distorting fills during volatile periods. I rolled back the change within two days and replaced it with a simpler variant that recovered half the lost performance. That experience taught me to stress-test assumptions closer to production conditions.”

Describe a time you struggled to align with traders or stakeholders on a research direction.

This evaluates collaboration and whether you can translate research goals into trading-relevant outcomes. Strong answers quantify alignment through adoption, usage, or downstream PnL impact.

Sample answer: “I proposed a volatility-driven feature that traders felt was too indirect to act on. I reframed the work around specific scenarios where it reduced adverse selection and showed a 3–4 bps improvement in simulated fills. After a short pilot, the traders incorporated it into one strategy, which increased daily PnL consistency. The key was anchoring the discussion in outcomes they cared about.”

Describe a time you changed your approach after seeing new data.

Optiver uses this to test adaptability and respect for evidence over ego. Candidates should highlight before-and-after metrics to show the decision was data-driven.

Sample answer: “I initially favored a nonlinear model, but new out-of-sample results showed performance degrading by ~20% during regime shifts. I switched to a more constrained linear approach and focused on feature stability instead. The revised model had lower peak returns but improved drawdowns by 30% and behaved more predictably. That tradeoff proved better for production use.”

How would you explain a complex trading model or research insight to non-technical stakeholders?

This question checks whether you can bridge research and decision-making without hiding behind jargon. Impact can be framed by how well stakeholders act on the explanation or adopt the model.

Sample answer: “I’d start with the decision the model improves, not the math behind it. For example, I’d explain how the model flags moments when spreads are likely to widen, helping avoid bad trades, rather than describing the full feature set. I’d then show a simple before-and-after chart where execution costs dropped by ~10%. If needed, I’d offer deeper details only after the intuition lands.”

How do you handle feedback that contradicts your analysis?

This probes maturity, openness, and how you integrate dissent into better research outcomes. Quantifying how feedback improved results helps demonstrate real impact.

Sample answer: “When a trader questioned my conclusions about a signal’s robustness, I revisited the analysis with their concerns in mind. That led me to uncover a data leak that inflated backtest results by about 25%. After fixing it, the signal was weaker but still additive, and we deployed it with tighter risk limits. Treating feedback as a diagnostic tool consistently improves my work.”

Mastering Optiver interviews means being sharp across probability and statistics, logic, modeling judgment, and behavioral clarity under pressure. The full Interview Query question bank for research scientists brings all of these together in one place, helping you train with realistic questions and build the instincts Optiver interviewers look for.

How to Prepare for an Optiver Research Scientist Interview

The Optiver research scientist interview requires a different approach than traditional quant interview prep. Optiver is testing how you reason in fast, noisy environments, where data is imperfect, assumptions change quickly, and decisions must still be defensible. In other words, strong candidates don’t just “know the math”; they demonstrate disciplined thinking, intellectual honesty, and comfort operating under uncertainty.

Below are the preparation strategies that consistently separate average candidates from standout ones.

Start with mental math and estimation drills. Practice mental arithmetic daily (percent changes, ratios, expected values, back-of-the-envelope calculations), but pair speed with structure. When estimating, explicitly define variables, make assumptions out loud, and sanity-check your result. Optiver interviewers often interrupt mid-solution, so being directionally correct and explaining your approach clearly matters more than exact answers.

Tip: Time yourself on short drills and force a verbal explanation even when practicing alone. Interview Query’s question bank offers Optiver-style timed questions, making this much easier to simulate than generic brainteasers.

Refresh core probability and statistics concepts. Focus on concepts that show up repeatedly in trading research: expected value, variance and covariance, distributions, tail risk, conditional probability, and Bayesian updating. Practice explaining these ideas verbally, since Optiver interview questions often require you to talk through assumptions and trade-offs in real time rather than write equations. Remember to dapt your logic when interviewers ask how conclusions change when conditions shift.

Tip: Pick one concept per day and practice answering “What breaks if this assumption is wrong?” to show research maturity and align with how Optiver evaluates model robustness. Use personalized feedback from Interview Query’s expert coaches to tighten your reasoning.

Practice calibrated confidence. Optiver evaluates how accurately you assess your own uncertainty. Get used to expressing confidence ranges (“I’m about 70% confident because…”) and updating beliefs when new information is introduced. Avoid bluffing. Saying “I’m not sure, but here’s how I’d investigate further” is often stronger than forcing an answer.

Tip: After every practice question, write down what information would most change your answer. This habit trains you to think in terms of marginal value of information, which comes up constantly in Optiver research discussions.

Train yourself to think aloud like a researcher. Optiver interviews reward transparency of thought. Practice narrating your reasoning as you solve problems: what you’re optimizing for, what shortcuts you’re taking, and what could break your approach. Treat each question like a mini research discussion rather than a test. Clear communication under pressure is a core skill for research scientists working closely with traders and engineers.

Tip: Record yourself solving problems and listen back specifically for clarity gaps or hand-wavy transitions. Interview Query’s structured mock interviews are especially useful here because they replicate real interview environments.

Understand Optiver’s edge. Be familiar with how Optiver operates as a leading options market maker. Review core ideas in market microstructure, volatility modeling, and how signals behave at short time horizons. Think about questions like: How would you test whether a signal survives transaction costs? How does latency or discrete pricing affect your assumptions?

Tip: Prepare one concrete example of a signal that looks good on paper but fails in live trading, and make sure to explain why. Stay updated on Optiver’s news and announcements and analyze how market frictions can change research conclusions.

If you want focused practice with Optiver-style questions, Interview Query’s real-world challenges are designed to sharpen the exact skills that’ll be tested during interviews: reasoning speed, uncertainty calibration, and research communication.

Role Overview and Culture at Optiver

The Optiver research scientist role sits at the core of the firm’s systematic trading strategy. Research scientists focus on signal discovery, market microstructure modeling, and decision optimization across futures and options markets. Rather than producing academic papers, Optiver research is highly applied. The goal is to improve real trading outcomes in low-latency environments where small edges matter and feedback is immediate.

Day to day, research scientists are embedded in the trading workflow, working on problems where feedback is fast and mistakes are visible. Typical responsibilities include:

- Developing and evaluating predictive signals using market data and microstructure features

- Modeling short-horizon price dynamics, volatility, and order flow behavior

- Testing hypotheses under realistic trading constraints, including latency, transaction costs, and discrete pricing

- Collaborating with traders to translate research insights into actionable strategies

- Partnering with engineers to ensure models are robust, efficient, and production-ready

- Iterating quickly based on live performance and post-trade analysis

Watch Next: What Does a Research Scientist Actually Do?

In this video, data science expert and Interview Query co-founder Jay Feng gives a concise perspective on what a research scientist does in practice, especially how the role operates within a data-driven or applied science context. The video highlights that research scientists are practical problem solvers, tasked with turning data and theory into actionable solutions that matter to the business rather than just academic outputs.

Compared with traditional quantitative researcher roles at banks or hedge funds, the scope is narrower but deeper, with faster iteration cycles and clearer accountability for results. Culturally, Optiver is known for its flat structure and intellectually demanding environment. Ideas are challenged openly, regardless of seniority, and strong arguments matter more than titles. Because research directly informs trading decisions, clarity of communication is just as important as technical strength.

Ultimately, Optiver looks for researchers who make sound decisions with incomplete information. Complex models have their place, but disciplined reasoning, good calibration, and adaptability are what drive long-term success.

To explore how this role compares across teams and the rest of the organization, see Interview Query’s full Optiver company interview guide, which breaks down expectations, interview formats, and preparation strategies in more detail.

Average Optiver Research Scientist Salary

Optiver research scientists are compensated at the top end of the market, reflecting the firm’s focus on research that directly impacts live trading performance. Pay is structured to reward both immediate contribution and long-term value creation, with a strong mix of base salary, performance bonuses, and equity-linked compensation.

According to aggregated data from sources like Glassdoor and Levels.fyi, total compensation varies by seniority, location, and scope of responsibility. Early on, pay is anchored by a competitive base and cash bonus. As researchers gain tenure and influence trading outcomes more directly, equity and bonus components become a much larger share of overall compensation, especially after vesting begins.

Compensation by level

| Level | Total / Year | Base / Year | Stock / Year | Bonus / Year |

|---|---|---|---|---|

| Research Scientist | ~$200K | ~$150K | ~$20K | ~$30K |

| Senior Research Scientist | ~$280K | ~$190K | ~$40K | ~$50K |

| Lead / Principal | ~$350K+ | ~$220K | ~$60K | ~$70K+ |

For many researchers, total compensation steps up meaningfully after the first year, particularly once equity begins to vest and bonus payouts reflect sustained trading impact.

Regional salary comparison

| Region | Salary range | Notes |

|---|---|---|

| United States | $220K–$350K+ | Highest total compensation, driven by performance bonuses |

| Europe (Amsterdam, London) | $180K–$280K | Strong base salaries with slightly lower bonus upside |

| Asia-Pacific | $170K–$260K | Competitive packages aligned with local markets |

Overall, the data highlights a clear theme: Optiver rewards research scientists who move the needle on trading results, with compensation that scales alongside responsibility and real-world impact.

To better benchmark offers and understand how compensation evolves across levels, Interview Query’s salary insights break down pay structures based on factors like seniority, education, and location.

FAQs

Is the Optiver research scientist interview hard?

Yes, the Optiver research scientist interview is considered challenging, but the difficulty comes from how candidates are evaluated rather than obscure technical content. Questions are intentionally time-constrained and open-ended, which makes the process feel demanding even for candidates with strong academic or industry backgrounds. The difficulty is real, but it is also consistent and learnable with the right preparation strategy.

Is the Optiver online assessment automatic?

Parts of the Optiver online assessment are automatically graded, particularly structured math or probability questions. However, progression is not fully automated. Recruiters and researchers review results in context, including how consistently you perform and whether your outcomes align with Optiver’s expectations for reasoning accuracy and speed.

How should I practice for the Optiver online assessment?

The best Optiver online assessment practice focuses on mental math, probability reasoning, and estimation under time pressure. Rather than grinding large coding problem sets, prioritize short, timed exercises that force you to explain assumptions and approximate efficiently. Practicing how you think out loud is just as important as getting answers right.

Is LeetCode useful for Optiver interviews?

LeetCode has limited relevance for Optiver research scientist roles. While basic programming skills may be tested, Optiver interview questions emphasize mathematical reasoning and applied research thinking far more than algorithmic coding patterns. LeetCode can help with general problem discipline, but it should not be the core of your preparation.

Become an Optiver Research Scientist with Interview Query

The Optiver research scientist interview process is rigorous by design. Across online assessments, cognitive interviews, technical research discussions, and behavioral rounds, candidates are evaluated on reasoning depth, calibrated confidence, and the ability to make sound decisions under uncertainty. Success depends less on memorization and more on structured thinking, adaptability, and clear communication.

Preparing effectively means practicing how you approach problems, not just what you know. Interview Query’s question bank can sharpen probability and statistics intuition, while mock interviews help simulate real Optiver-style pressure. Supplement these with personalized coaching to accelerate improvement by cultivating self-assurance and identifying gaps early.

This type of holistic preparation helps you build the skills Optiver expects from top research scientists.