Visa Business Analyst Interview Guide | Process, Questions & Tips

Introduction

If you’re preparing for the Visa business analyst interview, you’re stepping into one of the most data-rich environments in fintech. Visa processes more than 65,000 transactions per second, and analysts are expected to turn that scale into insights that guide multi-billion-dollar decisions. With median compensation for Visa business analysts at around $100K in the U.S. (Glassdoor), this role combines strong earning potential with unmatched exposure to global payments data.

In this guide, we’ll break down the interview process, common technical and behavioral questions, prep strategies, and FAQs. For hands-on practice, you can also visit Interview Query’s question bank. By the end, you’ll have a clear roadmap to position yourself as a standout candidate and approach the interview with confidence.

Role Overview & Culture

The Visa business analyst role sits at the heart of decision-making in one of the most data-rich companies in the world. On any given day, you might be reporting on card-spend trends, running ad-hoc SQL queries to support pricing strategies, or partnering with product teams to test new features. The work is fast-paced and hands-on, reflective of Visa’s data-first, bottom-up culture that values rapid experimentation and measurable outcomes. Analysts are encouraged to explore hypotheses, test ideas quickly, and contribute insights that can shift the trajectory of major products. It’s a role built for those who love data, but also love telling the story behind it.

Why This Role at Visa?

What makes this opportunity even more compelling is the sheer scale of impact, decisions informed by analysts can influence billions in transaction volume. You’ll gain early exposure to Visa’s consulting & analytics organization, building strategic muscles while working across global functions. It’s also a strong entry point into Visa’s compensation structure, which rewards both technical depth and business savvy. For those who want their work to shape the future of digital payments, this is a rare chance to do so. Here’s what to expect from the Visa business analyst interview process.

What Is the Interview Process Like for a Business Analyst Role at Visa?

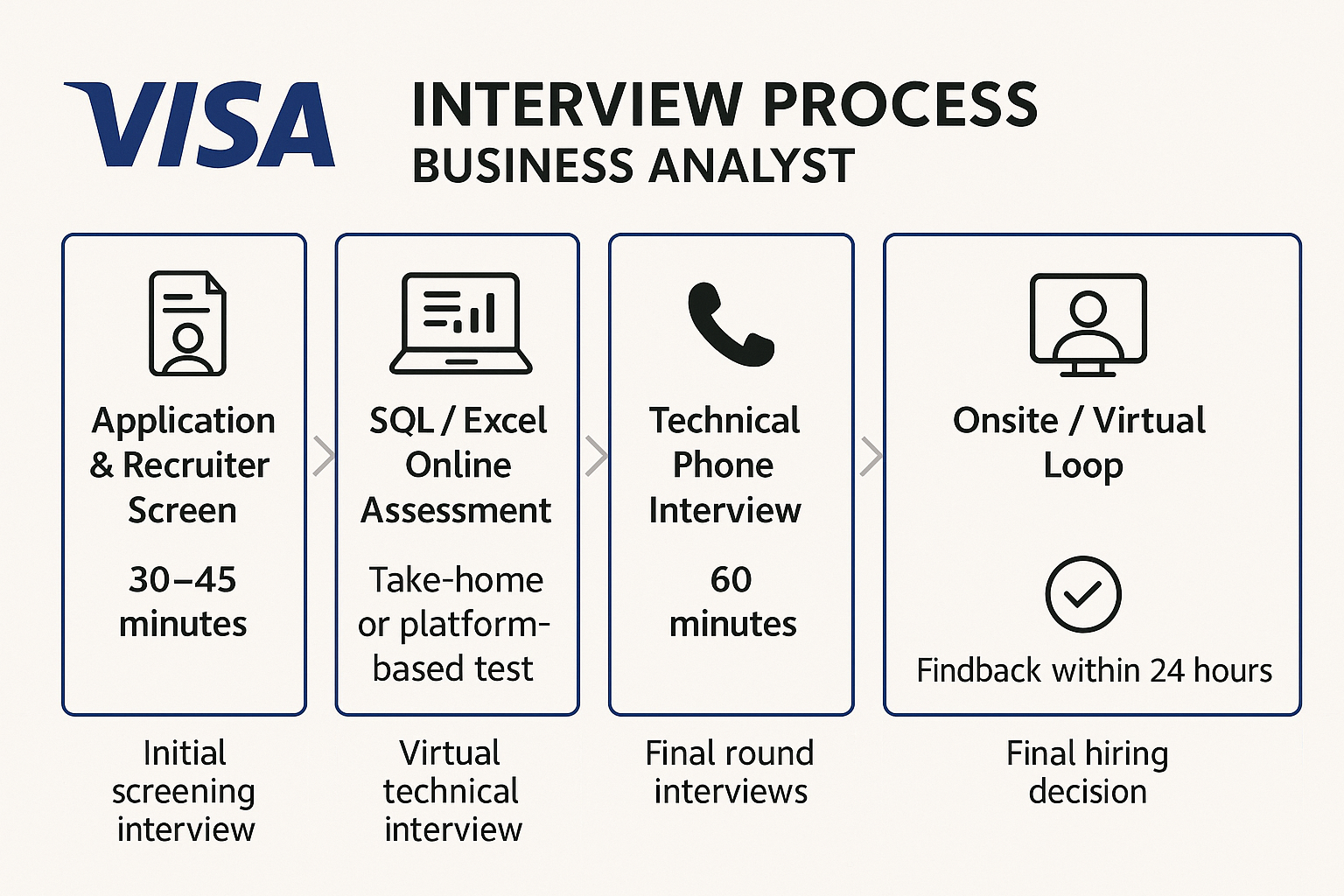

The Visa business analyst interview process is rigorous but efficient, designed to evaluate both technical fluency and strategic thinking. While the core structure remains consistent, senior candidates may encounter an additional strategy-focused round. There’s also notable overlap with the Visa consulting and analytics interview, especially in case-based and data-driven evaluations.

Application & Recruiter Screen

A 30–45 minute conversation covering your background, motivation, and fit. You’ll discuss your resume, previous analysis work, and interest in Visa’s payments ecosystem.

Tip: Be prepared to explain your resume in terms of business impact rather than just technical skills.

SQL/Excel Online Assessment

This is a timed take-home or platform-based test where you’ll query datasets, analyze trends, and draw business conclusions, often using card-spend or transaction volume data. Expect SQL challenges on window functions, joins, and ranking, along with Excel tasks like VLOOKUP, pivot tables, and VBA-based scenario modeling. The test isn’t just about syntax; Visa wants to see if you can turn raw data into insights tied to their payments model.

Tip: Always connect your outputs to Visa’s payments metrics, such as transaction volume or approval rates.

Technical Phone Interview

This 60-minute session blends a business case and SQL challenge. You’ll be expected to walk through metrics, interpret results, and explain tradeoffs clearly. Make sure you’re fluent in key payment metrics, such as approval rates, authorization/settlement flow, transaction volume, spend per card, and fraud rates. Visa interviewers want to see that you can ground your analysis in the levers that drive their business. Practice the most commonly asked SQL questions for a business analyst position to brush up on your SQL skills.

Tip: Practice explaining SQL results in plain English because communication is as important as syntax.

Onsite/Virtual Loop

The onsite (or virtual) loop usually includes four sessions, each led by different interviewers from Visa’s product, analytics, and business teams. You’ll be tested on structured problem-solving, communication, and how well you tie insights to Visa’s business.

Product Sense & Strategy: Expect “how would you improve…” or “trade-off” questions, often tied to Visa Checkout, Visa Direct, or partner-facing tools. Interviewers look for structured thinking, customer empathy, and awareness of Visa’s business model.

Tip: Use a framework such as CIRCLES to ensure your answers stay structured under pressure.

Metrics & Analytics: Focus on SQL, data interpretation, and metric design. You may diagnose issues like a drop in approval rates or propose KPIs for a new payment product.

Tip: Always link your chosen KPIs back to revenue growth, risk reduction, or adoption. You can always practice these questions on Interview Query Dashboard, covering topics for various KPIs.

Stakeholder & Behavioral: Situational questions about influencing without authority, balancing conflicting priorities, or handling launch failures. They want to see collaboration and resilience.

Tip: Prepare STAR stories that highlight conflict resolution and cross-functional wins.

Case Study Presentation: You’ll present a deck and then defend your reasoning. Expect follow-ups, pushback, and scenario tweaks to test how you respond under pressure.

Tip: Keep your slides simple and your story structured, focusing on insights and tradeoffs rather than design polish.

Hiring Committee & Offer

Final feedback is compiled within 24 hours. A VP-level sign-off typically follows, and offers are extended promptly for successful candidates.

Behind the Scenes

Visa moves quickly once interviews wrap. Interviewers submit written feedback within 24 hours, which is then consolidated and reviewed by the hiring panel. Final approval often requires VP-level sign-off, ensuring consistency and alignment across the product org.

Differences by Level

Expect the process to scale with seniority. Associate and mid-level analysts focus heavily on SQL, metrics, and product sense. Senior analyst candidates typically face an additional strategy round, testing their ability to influence roadmap direction, weigh trade-offs across markets, and communicate with executive-level stakeholders.

As you prepare for your interview, consider the types of questions that may arise in each of these stages, particularly those that assess your analytical skills and understanding of the payments landscape.

What Questions Are Asked in a Visa Business Analyst Interview?

Visa’s business analyst interviews test three main areas: technical SQL fluency, case & metrics reasoning, and behavioral influence. Below, I’ve expanded each category with context, how to approach, and Visa-specific angles.

Technical / SQL Questions

As a Visa business analyst, you’ll need to demonstrate SQL proficiency, not just writing queries, but turning data into business insights. Expect problems around joins, aggregations, and window functions. You can practice with Visa SQL interview questions on Interview Query’s dashboard, which provides step-by-step solutions.

1 . Write a query to find two students with the closest SAT scores

Use a self-join or window function to compare scores between students. The goal is to identify the smallest difference between SAT scores in the dataset. Focus on optimizing performance and filtering out duplicate pairs. This question is relevant for business analysts needing to compare customer metrics or performance data efficiently.

Tip: Mention how the same logic applies to comparing customer spend or approval rates at Visa.

2 . Write a query to get the top 3 highest employee salaries

Use the DENSE_RANK() or ROW_NUMBER() window function to sort employee salaries and filter for the top three. Be mindful of how you handle ties and nulls. This pattern is often used in dashboards or compensation benchmarking. Visa may use this logic when segmenting clients or tracking top-performing portfolios.

Tip: Show that you understand ranking logic can be repurposed for client segmentation or portfolio analysis. Review the DENSE_RANK function to avoid common mistakes.

3 . Find employee names who joined before their managers

Join the employee table to itself by matching the manager ID to the employee’s ID. Filter the result set to show employees whose hire date is earlier than their manager’s. This tests understanding of self-joins and filtering logic. It mirrors scenarios where Visa analysts assess hierarchies or relationship-based constraints.

Tip: Explain how this mirrors Visa’s real-world hierarchy checks, such as validating client relationships or compliance timelines.

4 . Write a SQL query to calculate the average number of transactions per user per month

Aggregate transactions by user and month, then calculate the mean of those monthly counts. Use DATE_TRUNC or a similar function to group by month accurately. Consider users with zero transactions in some months. This helps simulate usage reporting or cohort analysis in a Visa B2B product.

Tip: Always highlight how you would handle missing months or zero transactions because completeness matters to Visa’s datasets.

5 . Write a query to return the total number of customers who made exactly two purchases

Use a GROUP BY clause on customer ID and apply a HAVING COUNT(*) = 2 condition. This is common in retention analysis, helping teams understand short-term engagement. Visa might apply this when examining trial behaviors or limited user interactions.

Tip: Frame your answer in terms of retention analysis to show you can connect SQL logic back to business meaning.

Case & Metrics Questions

Market sizing, diagnostics, and experimental reasoning are core to the Visa business analyst interview. You’ll be expected to scope assumptions, test hypotheses, and tie answers to Visa’s transaction model.

6 . Calculate the average lifetime value for a SaaS company’s revenue retention

Use retention cohorts to estimate how long customers stay subscribed and how their value evolves over time. Combine churn rates and ARPU to forecast long-term revenue. A spreadsheet or SQL-based solution can help simulate customer flow. Visa analysts often model recurring revenue, especially in evaluating partnership lifecycles.

Tip: In your answer, show how this approach applies to Visa by linking it to cardholder retention or partner lifetime value.

7 . Evaluate the effectiveness of a 50% rider discount on conversion

Frame the question as an A/B test with key metrics like conversion rate, CAC, and ROI. Consider edge cases like promo misuse or channel-specific responses. Include statistical significance in your interpretation. Visa might test similar incentives for fintech app adoption or merchant engagement.

Tip: Always add a note about measuring long-term retention, not just short-term conversion lifts.

8 . Determine how long it takes for a car traveling at different speeds to meet

Solve with algebra or simulation to understand time/distance interactions. Define inputs clearly and validate edge conditions. This logic is transferable to delivery time calculations or customer flow optimization. Visa business cases may use similar logic in fraud detection velocity analysis.

Tip: Use this as an opportunity to show structured assumptions because Visa cares about clarity as much as accuracy.

9 . Determine metrics to assess app health through celebrity mentions

Define leading indicators such as DAUs, mention virality, and retention rate post-mention. Evaluate attribution by comparing user behavior before and after media events. Consider noise versus signal tradeoffs. Visa may face similar challenges when assessing the impact of co-branded campaigns.

Tip: Show that you would balance leading and lagging indicators to separate hype from sustained growth.

10 . Estimate the cross-border remittance market size in Southeast Asia

Break down by population, remittance usage rate, average transaction size, and frequency. Use external benchmarks from the World Bank or remittance platforms. Sensitivity test different assumptions. This is highly relevant to Visa’s international money transfer business and FX services.

Tip: Mention sensitivity testing because Visa interviewers value candidates who can handle uncertainty in assumptions.

Behavioral Questions

Visa values collaboration, analytical thinking, and the ability to influence without authority. Use the STAR method (Situation, Task, Action, Result) to structure your responses and emphasize impact.

11 . Tell me about a time you had to influence stakeholders without a data science background

Focus on simplifying complex analyses and communicating key takeaways in plain language. Explain how you tailored your message to different audiences and gained alignment on decisions. Include specific tools or visuals (e.g., dashboards) that helped. This reflects a core skill for business analysts at Visa who often act as translators between data and decision-makers.

Tip: Highlight storytelling tools such as visuals or analogies because they help bridge gaps with non-technical teams.

12 . Describe a project where you used data to drive a strategic recommendation

Highlight how you identified the opportunity, gathered the data, and made a persuasive case for change. Emphasize collaboration with cross-functional teams and measurable outcomes. Discuss how you prioritized your analysis. Visa seeks analysts who can drive business value with data insights.

Tip: Include measurable business impact because Visa values quantifiable results over generic wins.

13 . Give an example of how you handled a disagreement with a team member or stakeholder

Showcase your emotional intelligence and ability to resolve conflict constructively. Detail how you listened, reframed the issue, and found a compromise. Mention how it affected team dynamics or project outcomes. This is key in Visa’s collaborative and fast-paced culture.

Tip: Frame conflict resolution as driving alignment on shared goals since Visa operates across global teams with competing priorities.

14 . Tell me about a time when you had to meet a tight deadline with limited data

Describe how you scoped the problem quickly and made assumptions transparent. Focus on your prioritization and decision-making process. Share how you balanced speed with accuracy. Visa analysts often work with incomplete data but must still deliver actionable recommendations.

Tip: Emphasize prioritization and communication so interviewers see that you can deliver under pressure while keeping stakeholders aligned.

15 . Describe a situation where you improved a process or reporting workflow

Talk about a manual or inefficient task you identified and automated or redesigned. Share tools you used (e.g., SQL, Excel, Tableau) and the impact in terms of time savings or accuracy. Mention how you ensured stakeholder adoption. This demonstrates ownership and initiative, which are critical traits Visa looks for in analysts.

Tip: Always close with adoption results because Visa wants proof that process improvements stick with stakeholders.

How to Prepare for a Business Analyst Role at Visa

Preparing for the Visa Business Analyst interview means sharpening both your technical toolkit and your communication game. This role sits at the intersection of data and decision-making, so expect interviewers to test not just your SQL fluency but your ability to frame data as a story. You’ll need to translate insights into business value, communicate clearly with cross-functional stakeholders, and handle ambiguity with structure.

Review Visa’s payments data model

Before your Visa interview, review the payment data model: Visa isn’t a lender; it’s a transaction network earning money through assessment fees (percentage of volume) and processing fees (per transaction). A card swipe flows cardholder → merchant → acquirer → Visa → issuer, and strong answers always tie back to this flow. Anchor on key metrics like total payment volume, transactions per active card, cross-border volume, approval rate, and fraud/chargebacks. When practicing product or metrics questions, frame solutions in terms of growing transaction volume, improving approval rates, or reducing fraud. Remember always linking customer impact to Visa’s revenue model.

Practice SQL and Excel assessments

Visa business analyst candidates often complete an online assessment early in the process, which mixes SQL queries with Excel-based data analysis. The SQL portion usually tests fundamentals like JOINs, GROUP BY aggregations, filtering with CASE WHEN, and sometimes window functions (ROW_NUMBER(), RANK(), LAG()), all framed around business-relevant datasets such as transactions, users, or card approvals. The Excel section typically requires cleaning data, building pivot tables, running quick descriptive statistics, and presenting insights visually.

To prepare, use SQL questions or Excel casebooks to prep for Visa’s online assessment format. The benefit of this prep is twofold: you sharpen technical fluency so syntax doesn’t slow you down, and you learn to connect outputs back to business implications.

Mock slide decks for business cases

When practicing mock slide decks for 15-minute business cases, focus on clarity and structure over design. Cover the problem statement, key assumptions, data analysis, insights, and recommended next steps, keeping each section to one or two slides. A useful framework is Problem → Drivers → Options → Recommendation → Impact, which keeps your story tight. Align your recommendations with Visa’s business model by linking outcomes to transaction growth, approval rates, fraud reduction, or cross-border volume. The goal is to show you can frame problems, analyze tradeoffs, and connect decisions directly to Visa’s revenue levers.

Gather STAR stories on data-driven wins

Prepare STAR stories that highlight how your analysis directly drove business impact. For example, frame situations where you uncovered a data quality issue that prevented a costly error, optimized a metric like approval rate, retention, or transaction volume, or influenced leadership to pivot strategy. Be explicit about the numbers (how much money saved, what % improvement achieved) and always connect the result back to Visa’s priorities: secure, efficient, and growing transaction flows.

Do peer mocks and iterate on clarity

Run mock interviews to pressure-test your explanations. Practice walking through SQL queries step by step, defending your assumptions in case studies, and refining how you frame tradeoffs. Use feedback to tighten your clarity, cut jargon, and anticipate common follow-up questions—just like Visa interviewers will.

Visa values candidates who think deeply and communicate crisply. By following these tips, you will be well-prepared to showcase your qualifications and fit for the Business Analyst role at Visa.

FAQs

What is the average salary for a Visa business analyst?

Average Base Salary

Average Total Compensation

Business analyst salaries at Visa vary significantly by location and level. According to Glassdoor, median total compensation across the U.S. is around $100K per year, typically composed of a $95K base and about $5K in bonus.

Quick breakdown by location:

- U.S. overall: ~$100K median total compensation (Glassdoor)

- San Francisco Bay Area: $107K–$200K+, ~$160K median (Levels.fyi)

- Austin, TX: $81K–$120K, smaller bonuses (Glassdoor)

How many rounds are in the Visa business analyst interview?

The Visa Business Analyst interview includes five core stages:

Application & Recruiter Screen

A 30–45 minute call covering your resume, motivation, and team fit.

SQL/Excel Online Assessment

A 60–90 minute test evaluating your ability to query, analyze, and interpret structured data.

Technical Phone Interview

A 60-minute session combining SQL exercises and a product/business case.

Onsite or Virtual Interview Loop

Includes four rounds: case presentation, stakeholder simulation, behavioral interview, and technical deep dive.

Hiring Committee & Offer

Final feedback is compiled within 24 hours, often followed by VP sign-off and an offer.

Does Visa’s consulting & analytics track use the same process?

Yes, the Visa consulting and analytics interview process closely mirrors that of the business analyst track, with a few small variations. Candidates targeting roles within consulting & analytics (VCA) may face a heavier emphasis on market sizing, competitive strategy, and client-facing case studies, given the external consulting focus. Additionally, senior roles in VCA sometimes include an extra strategy interview or presentation geared toward real-world client engagement. However, the core structure—recruiter screen, assessment, case rounds, and final review—remains consistent across both tracks.

Is a Visa Inc. interview for the business analyst role difficult?

Yes. Visa’s business analyst interview is considered moderately difficult compared to similar fintech and payments companies. The challenge comes from the breadth of skills tested: you’ll likely face SQL and data analysis questions, business case studies involving metrics like transaction volume or approval rates, and behavioral questions about influencing cross-functional teams. Candidates who prepare by practicing SQL queries, brushing up on product metrics, and rehearsing STAR stories often find the process manageable.

Is Visa a prestigious company to work for?

Absolutely! Visa is one of the most prestigious brands in global fintech, processing more than 65,000 transactions per second and operating in over 200 countries. Working at Visa gives analysts exposure to massive datasets, regulatory-driven product launches, and career mobility across analytics, product, and strategy. Its reputation for scale, innovation in digital payments, and competitive compensation makes it a strong credential on any resume.

How long is the Visa hiring process?

The hiring process for a Visa business analyst typically lasts 3–5 weeks. It begins with a recruiter screen, followed by a technical or SQL-focused assessment, then a case or product metrics round. Final stages usually include behavioral interviews and a hiring committee review. For most candidates, decisions are made within a week after completing the onsite or final virtual loop, though senior roles may take longer due to additional stakeholder reviews.

Conclusion

If you’re aiming for the Visa business analyst interview, starting your preparation early and focusing on structured practice will set you apart. Visa looks for analysts who can move seamlessly between SQL, metrics interpretation, and clear business storytelling. The more you rehearse these skills, the more confident you’ll be in each round.

To go deeper, check out our Visa data analyst and Visa data scientist interview guides. These roles share overlapping skill sets in SQL, product metrics, and data-driven decision-making, so cross-prep will sharpen your edge.

Finally, bring it all together with an Interview Query mock interview. You’ll practice with real data professionals who’ve been on both sides of the interview table and get direct feedback on your SQL, case analysis, and communication skills. It’s the closest thing to a Visa business analyst interview, minus the pressure, so you know exactly where you stand before the real thing.