Visa Data Scientist Interview Guide (2025): Questions, Process & Salary Insights

Introduction

Preparing for a Visa data scientist interview means showing that you can apply advanced analytics and machine learning to solve problems at global scale. In this guide, we’ll cover what the role entails, Visa’s culture, and why this opportunity is both challenging and rewarding.

Role Overview & Culture

Visa data scientists spend their days building models for fraud detection, credit risk scoring, customer segmentation, and personalization. The work blends statistical rigor with business impact. You might run experiments on cardholder behavior one week and design scalable ML pipelines the next. Teams are structured in agile pods that encourage rapid experimentation, cross-functional collaboration, and end-to-end ownership of solutions. What makes the culture distinct is Visa’s balance: the scale and resources of a global fintech leader paired with the agility of smaller teams empowered to test, learn, and ship.

Why This Role at Visa?

Visa data scientists are uniquely positioned to influence decisions that touch millions of daily transactions. Compensation is competitive. Glassdoor reports U.S. data scientist salaries at Visa typically range from $158K to $218K, with senior roles exceeding that. Beyond pay, the career trajectory is strong: many data scientists grow into senior technical roles or pivot into product analytics and strategy. With access to one of the richest financial datasets in the world and the ability to test models that directly affect fraud losses, approval rates, and customer trust, this role offers both technical depth and global business impact.

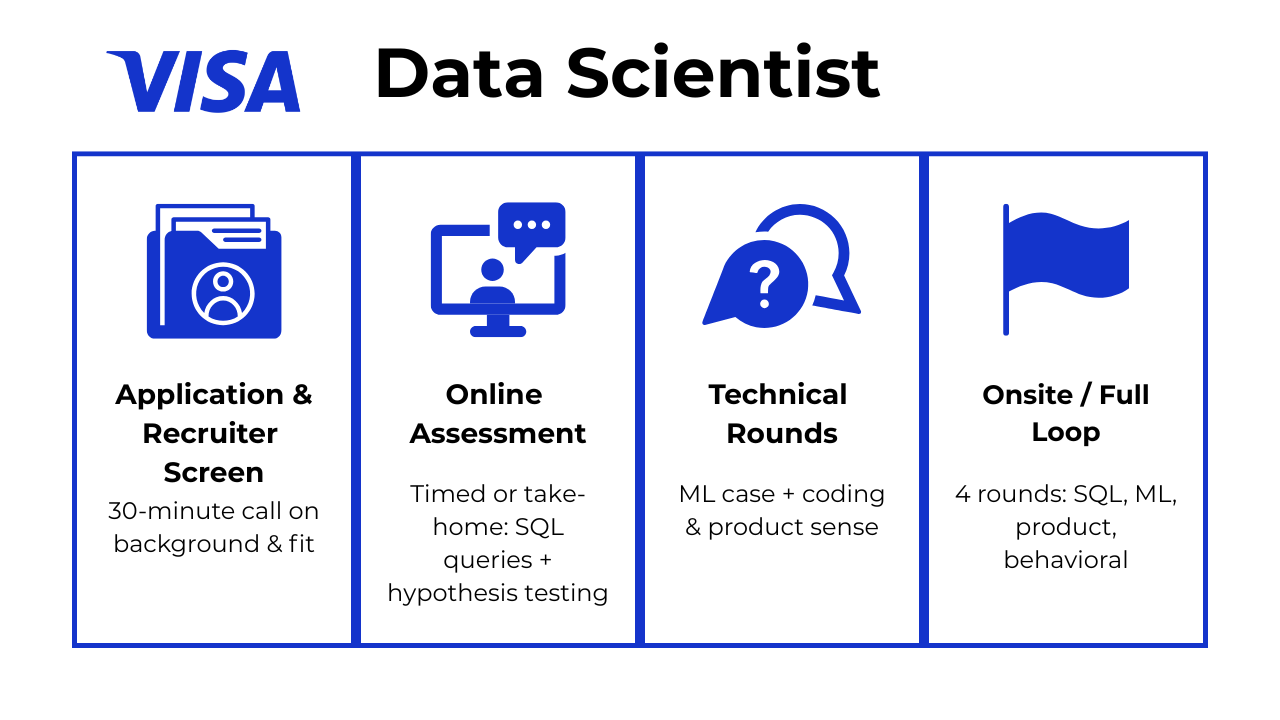

What Is the Interview Process Like for a Data Scientist Role at Visa?

The Visa Data Scientist interview is designed to evaluate not just your technical ability, but your business intuition, stakeholder alignment, and ability to drive measurable impact with data. Whether you’re applying for a product-focused team or a core modeling role, the structure is rigorous and fast-paced.

Application & Recruiter Screen

A 30-minute intro call covering your background, Visa’s data science org, and role alignment. This ensures you’re matched to the right team and that your project experience aligns with Visa’s priorities in payments, fraud, or personalization.

Tip: Prepare a crisp narrative of 2–3 data projects, highlighting dataset size, methods, and measurable business outcomes.

Online Assessment (SQL + Stats)

A take-home or timed test featuring SQL joins, window functions, probability, and hypothesis testing tied to real product data. Visa aims to for analytical rigor and the ability to manipulate large transaction datasets.

Tip: Practice advanced SQL (CTEs, window functions, conditional aggregations) and review A/B testing concepts like p-values, power, and false discovery rates.

Technical Rounds

Typically two rounds:

ML Case Round: Focuses on how you frame problems, engineer features, choose models, and reason about trade-offs. Visa wants to see if you can connect modeling to Visa’s business KPIs like fraud loss reduction or approval rate lift.

Tip: Use a structured approach: Problem → Data → Features → Model → Metrics → Risks.

Coding + Product Sense Round: Solve a Python-based problem, then interpret experiment results or model outputs. Visa values scientists who can both code efficiently and communicate the “so what” of their analysis.

Tip: Practice live coding in Python while explaining your reasoning in plain language.

Onsite/Full Loop

The virtual or in-person onsite includes four rounds:

SQL/Data Manipulation: You’ll query realistic datasets, such as transactions, merchants, or user spend history, and extract KPIs, retention curves, or anomalies. Visa aims to test whether you can write efficient queries and reason about messy data issues like NULLs, deduplication, and skew.

Tip: Think aloud about trade-offs and performance implications, not just query correctness.

Machine Learning Deep Dive goes beyond definitions, pushing you to walk through end-to-end modeling. You may be asked to design a fraud detection pipeline: how you’d clean data, choose features, compare models, monitor drift, and handle imbalanced classes. Expect follow-up questions on why you selected a metric like AUC vs. precision-recall, or how you’d retrain in production.

Tip: Be ready to compare metrics (AUC vs. PR-AUC) and justify retraining strategies under real-world constraints.

Product/Business Judgment interview is case-style, where Visa looks for structured thinking. You might get asked to improve cross-border payments or optimize merchant incentives. Interviewers expect you to frame the problem, size the opportunity, propose solutions, and highlight risks. Clarity and business grounding matter as much as creativity.

Tip: Use a consulting-style framework (Problem → Options → Impact → Risks) and tie answers to Visa’s scale.

Behavioral Fit & Communication round focuses on STAR-style stories. You’ll be expected to describe times when you influenced stakeholders with data, resolved conflicts, or made tough trade-offs. Visa looks for candidates who can explain technical ideas simply to non-technical partners while showing alignment with their collaborative, mission-driven culture.

Tip: Prepare 3–4 STAR stories highlighting measurable impact, cross-team work, and tough trade-offs.

Hiring Committee + Offer

Your performance is reviewed by a hiring committee (HC), and decisions are often finalized within 24 hours. The committee looks for consistent performance across coding, design, and behavioral rounds, weighing both technical depth and communication skills.

Behind the Scenes

Visa aims to deliver structured feedback within 24 hours, with a hiring committee (HC) reviewing interviewer notes and voting on whether to move forward. The process is designed to balance speed with rigor, ensuring multiple perspectives shape the final decision.

Differences by Level

For senior roles, expect additional focus on data strategy, cross-functional leadership, and mentoring impact. You may be asked how you’ve scaled analytics processes, influenced roadmaps, or built data-driven cultures.

Next, we’ll dive into the kinds of data scientist Visa interview questions you can expect by topic and round.

What Questions Are Asked in a Visa Data Scientist Interview?

The Visa data scientist interview questions test your skills in SQL analytics, A/B testing methodology, and production-grade modeling. You’ll face technical challenges across product metrics, fraud detection systems, and statistical inference—all tailored to Visa’s data-driven decision-making culture.

Coding/Technical Questions

The Visa data scientist interview questions often begin with SQL and A/B testing challenges that assess your analytical depth and statistical rigor in real business scenarios.

1 . Write a SQL query to calculate the average number of card swipes per user per day

This is a classic use case for window functions—frequently asked in Visa Data Scientist interview questions. Use PARTITION BY and DATE_TRUNC() to group daily swipes and compute rolling averages. Pay attention to user-session granularity and time zone effects. This reflects real-world analysis of user spending behavior at Visa.

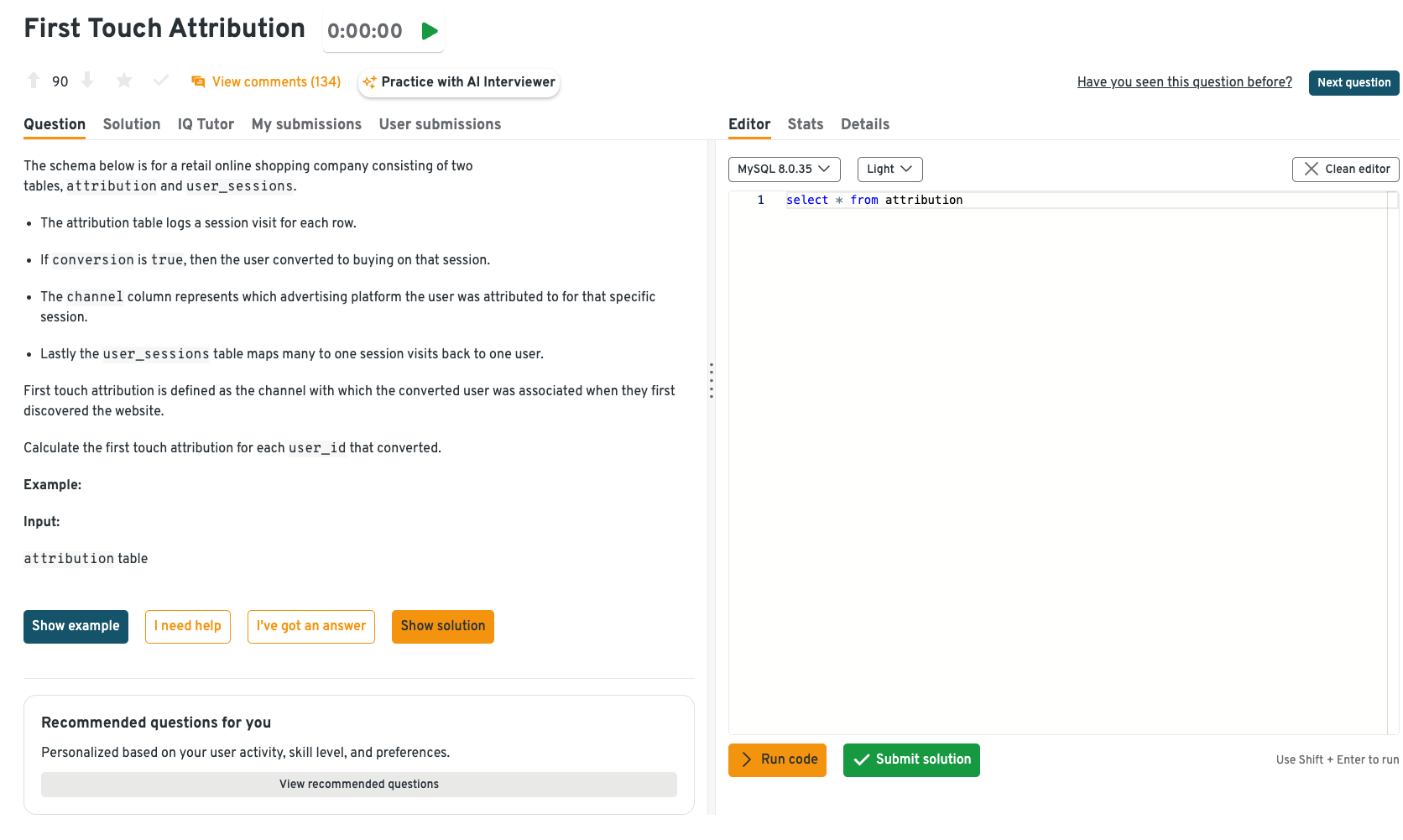

2 . Calculate the first touch attribution channel for each converted user

Use window functions or subqueries to find the earliest interaction per user. Join across conversion logs and marketing touchpoints. This question tests data wrangling and marketing analytics skills. Attribution is a key challenge in Visa’s multi-channel customer journey.

On the Interview Query dashboard, this problem appears in an interactive workspace where you can write and test queries, review hints, compare community solutions, and track your progress over time. Practicing it on the dashboard offers tangible benefits: it simulates the interview setting, strengthens your fluency with advanced SQL techniques, and helps you understand attribution in a business context while learning to explain trade-offs, which is exactly the kind of thinking Visa expects from its data science candidates.

3 . Write a query to count users who made additional purchases after initial signup

Use JOIN, GROUP BY, and filtering logic to segment by event type and date. This is useful for retention or revenue analysis. It demonstrates your ability to slice event data into conversion funnels. Visa teams often run these queries to evaluate onboarding effectiveness.

4 . Determine the lift and p-value in an A/B test of two marketing strategies

Break down treatment vs. control, then compute average metrics, variance, and t-statistic. Consider stratified sampling if the groups differ in size. This tests your statistical rigor and intuition. Lift-based testing is common in Visa’s campaign optimization workflows.

5 . Evaluate whether your A/B test suffered from sample size bias

Identify pitfalls from early stopping or unequal group allocation. Discuss power analysis and minimum detectable effect. Expect to critique test setup as well as results. Visa expects its data scientists to go beyond execution to interpretability and trustworthiness.

6 . Design a model to predict whether a transaction is fraudulent

Choose relevant features (e.g., velocity, merchant history), and describe your feature pipeline. Include class imbalance techniques, and discuss thresholds for false positives. Extend into real-time scoring infrastructure. This problem is core to Visa’s trust and risk modeling platforms.

7 . Compare MLE vs. MAP estimation and their assumptions

MLE relies purely on the likelihood, while MAP incorporates priors from Bayesian inference. Discuss which to use when you have domain knowledge or sparse data. Provide examples like fraud probability modeling. This question reveals statistical depth, important for Visa’s regulatory-facing analyses.

ML System Design & Product Strategy Questions

These questions test your ability to design scalable, data-driven solutions like forecasting models and fraud detection pipelines—core to Visa’s real-time infrastructure.

1 . Design a model to forecast Visa’s interchange-fee revenue

Segment users and merchants by geography, card type, and transaction category. Use time-series models or gradient boosting with external features like seasonality and policy changes. Discuss how you’d handle lagging regulatory effects and unexpected shocks. Revenue forecasting is a critical function tied to Visa’s global strategy and pricing.

2 . Design a real-time anomaly detection pipeline for transactions

Use a streaming ingestion tool like Kafka or Flink, followed by a scoring layer with autoencoders or clustering models. Define a feedback mechanism for false positives and human review. Address how you’d store labeled anomalies and retrain regularly. This question reflects Visa’s need for robust fraud and risk infrastructure.

3 . Design a recommendation system for merchant discovery

Use a hybrid of content-based and collaborative filtering models trained on transaction data. Build an API layer for low-latency serving and A/B test recommendation quality. Personalization at Visa must scale globally, which makes candidate generation and re-ranking architecture a key challenge.

4 . Design a model for predicting credit default risk

Start with credit history, income, spending behavior, and account delinquency as inputs. Use logistic regression or tree-based models, depending on explainability needs. Include a discussion of fairness constraints and compliance. Visa’s lending partners rely on predictive models like this for underwriting.

5 . Build a fraud-detection classifier based on merchant approval patterns

Focus on building merchant profiles using location, approval rate, transaction volume, and complaints. Use anomaly detection or supervised models with imbalanced labels. Think through model deployment in real-time vs. batch fraud alerting. Visa’s risk team uses models like this for compliance and trust evaluation.

Behavioral Questions

Visa looks for data scientists who not only analyze well but also influence decisions, collaborate across teams, and communicate insights clearly, especially under uncertainty. These behavioral questions test your ability to turn analysis into action.

1 . Tell me about a time you influenced the product roadmap with data

Use the STAR method to describe the insight, how you communicated it, and the resulting decision shift. Emphasize how you structured the analysis to match business priorities. This is one of the most critical visa data scientist interview questions, showcasing product intuition.

Example: While analyzing cross-border payment trends, I found a drop in approval rates tied to specific regions. I presented the findings with projected revenue impact, which led product to prioritize feature rollouts in those markets. The shift improved regional approval rates by 6% within a quarter.

2 . Describe a situation where you worked with a skeptical stakeholder

Focus on how you translated data into business language. Show persistence in validating assumptions and building trust over time. Visa’s cross-functional orgs often include non-technical audiences, so stakeholder empathy is essential.

Example: A PM doubted our churn model’s predictions, so I validated assumptions with A/B testing and translated results into customer lifetime value terms. Over time, this built trust, and the model was adopted as a core retention KPI.

3 . Tell me about a time your analysis revealed an unexpected insight

Set up the initial hypothesis and how you noticed the anomaly. Explain how you explored it further and what action it led to. Visa looks for analysts who dig beyond the surface.

Example: While reviewing merchant data, I spotted a spending spike in off-peak hours. Digging deeper, we discovered fraud rings exploiting weak checks, and the insight triggered new monitoring rules that cut fraud losses by 15%.

4 . Have you ever had to make a decision with incomplete data?

Describe how you bounded the problem, tested assumptions, and prioritized speed over certainty. Mention how you communicated limitations clearly. Visa values pragmatism and business judgment under ambiguity.

Example: In a loyalty program test, early data was sparse, but we used directional metrics and confidence intervals to guide launch. I clearly communicated limitations, and the decision saved three weeks of delay without hurting outcomes.

5 . How do you prioritize requests from multiple teams or stakeholders?

Talk about frameworks (e.g., impact vs. effort), your communication style, and how you protect time for high-leverage work. This shows maturity in a matrixed, high-demand setting like Visa.

Example: I use an impact vs. effort framework and align priorities in a weekly sync. At Visa, this helped ensure fraud-detection projects with higher financial risk took precedence over lower-impact requests.

6 . Tell me about a time when you disagreed with your performance rating

Focus on professionalism and growth. You should frame your disagreement as constructive feedback-seeking, and avoid sounding defensive. Show how you clarified expectations, backed your perspective with evidence, and used the experience to improve. At Visa, interviewers want to see resilience, maturity, and a bias toward learning rather than conflict.

Example: During a mid-year review, I was rated “meets expectations,” though I had delivered an A/B testing framework that improved approval rate tracking. I respectfully asked for clarity on the evaluation criteria and shared the measurable impact of my work. While the rating wasn’t changed, my manager later gave me more visibility in leadership meetings, and I used the feedback to focus on cross-team communication, which ultimately strengthened my impact on future projects.

How to Prepare for a Data Scientist Role at Visa

Success in the Visa Data Scientist interview starts with understanding how payments data flows through Visa’s global ecosystem, and where analytics or ML can create measurable impact. Beyond technical skills, candidates are expected to demonstrate product intuition, regulatory awareness, and the ability to communicate insights that influence billion-dollar decisions. In this guide, we’ll cover technical prep, case studies, behavioral strategies, and company-specific focus areas to help you stand out.

Study Visa’s Payments Data Architecture

Review how Visa authorizes, clears, and settles transactions, and where data science drives value, like fraud scoring, customer segmentation, merchant insights. Being able to tie a modeling approach back to transaction flow or approval rates will set your answers apart in system design and case rounds.

Practice SQL + Statistics OA

Expect complex joins, window functions, and hypothesis tests rooted in transaction or merchant datasets. Use Interview Query dashboard to practice. Focus not just on query correctness, but also on trade-offs: how you’d handle NULLs, duplicates, or skew at Visa’s scale.

Mock ML Case Studies

Visa interviews lean heavily on applied ML judgment, not academic definitions. Practice structuring open-ended problems: fraud detection, credit scoring, or loyalty optimization. Walk through framing, feature engineering, evaluation metrics, and trade-offs between accuracy, interpretability, and latency. Running a session through Interview Query’s mock interviews is a great way to pressure-test your approach.

STAR Stories for Leadership Principles

Visa looks for scientists who can influence decisions, own outcomes, and thrive in matrixed teams. Prepare 3–4 STAR stories about model failures, cross-team collaboration, or delivering under tight deadlines.

Research Data Scientist Jobs in USA with Visa Sponsorship Trends

If you’re an international candidate, follow visa sponsorship trends in major hubs (SF, Austin, NYC). Visa hires globally but competition is intense, so highlight both technical expertise and adaptability in cross-cultural teams.

FAQs

What Is the Average Salary for a Visa Data Scientist?

Average Base Salary

Average Total Compensation

The Visa data scientist salary in the U.S. varies widely depending on level, experience, and location. According to Glassdoor and levels.fyi:

- The total salary range for data scientists at Visa is $158K - $218K per year, consisting of 82% base pay, 7.5% bonus and 10.5% stock.

- Associate data scientists at Visa (L3): Total compensation averages around $157K, comprising approximately $136K base, $7.9K stock and $12.9K bonus.

- Mid-level (L4): Total compensation is around $158K, with a breakdown of $140K base, $6.7K stock, and $10.8K bonus.

- Senior-level (L5): Total compensation averages about $179K, including $169K base, $ 3K stock, and $7.1K bonus.

- San Francisco: According to Glassdoor, Total salary range for data scientist in San Francisco is about $174K-$244K per year.

- Atlanta: Glassdoor reports for Visa data scientists in Atlanta, the salary ranges from $140K to $190K per year.

Does Visa sponsor international data scientists?

Yes, Visa actively supports international hiring for qualified candidates. If you’re pursuing a Data Scientist Visa, the company commonly sponsors H-1B visas for full-time roles and also supports TN visa data scientist applicants from Canada and Mexico under the USMCA agreement. Visa’s global presence—including offices in Canada, Singapore, the UK, and India—offers additional flexibility for international placements or intra-company transfers.

For those searching data scientist jobs in USA with visa sponsorship, Visa remains a top-tier employer with a strong track record of onboarding international talent. That said, competition is high, so early application and interview prep are critical.

Can I work at Visa on a short-term contract?

Yes. Visa regularly hires contractors for specialized roles, including temporary employment data scientist positions. These contract roles typically last 6 to 12 months and often focus on specific initiatives like fraud analytics, experimentation tooling, or model validation. While not guaranteed, strong performance during a contract stint can lead to conversion into a full-time role, especially on fast-growing teams or during hiring surges.

Is it easy to pass data scientist interviews at Visa?

Not typically. Visa’s data scientist interviews test advanced SQL, statistics, ML case studies, and product judgment. Success depends on both technical mastery and your ability to link data to Visa’s business priorities like fraud loss reduction or approval rate improvements.

What does a Visa data scientist do?

Visa data scientists work on projects such as fraud detection, risk scoring, personalization, and transaction analysis. Day-to-day tasks include designing experiments, building ML models, analyzing massive datasets, and partnering with product and engineering teams to drive measurable business outcomes.

Is it hard to become a data scientist?

Yes, it’s competitive because the role requires a mix of coding, math, business sense, and communication skills. The path is more achievable if you build expertise in SQL, Python, machine learning fundamentals, and statistical reasoning, which are core areas companies like Visa test heavily.

What are the required data scientist skills to crack a data science interview?

You’ll need strong SQL and Python skills, solid grounding in probability and statistics, and the ability to design and evaluate machine learning models. At Visa specifically, you should also show business acumen, such as framing problems in terms of KPIs like fraud losses, approval rates, or customer engagement.

How to become a top 1% data scientist?

The best data scientists combine technical depth with business storytelling. To stand out, go beyond coding by mastering system design for ML, developing intuition for experiment design, and sharpening communication skills to influence decisions. At Visa’s scale, the top performers are those who can translate models into global impact.

Conclusion

The Visa data scientist interview demands a well-rounded blend of technical depth, business acumen, and communication clarity. The best way to prepare isn’t just reading guides, it’s practicing real SQL, ML, and case questions under interview conditions.

Start with our Visa Interview Questions & Process to practice realistic problems and benchmark your answers.

Then, explore the Visa Software Engineer and Visa Data Engineer guides if you are considering lateral moves or hybrid data roles.

Want to test your readiness under pressure? Book a 1-on-1 mock interview and get tailored feedback from professionals on both technical and behavioral performance.