Visa Machine Learning Engineer Interview Guide (2025)

Introduction

Preparing for a Visa machine learning engineer interview means solving problems at a scale few companies can match. With more than 200 billion transactions processed annually, Visa applies machine learning to everything from fraud detection to real-time scoring, demanding engineers who can design pipelines, optimize production models, and deploy solutions across its fast-moving “Network of Innovation.”

In this guide, we’ll list most asked machine learning engineer interview questions, interview process, and the skills Visa prioritizes in candidates. Whether you’re navigating SQL and coding challenges, system design, or applied ML case studies, you’ll find actionable insights and sample questions with best ways to asnswer them that will help you prepare with confidence.

By the end, you’ll know exactly what Visa looks for in a machine learning engineer and how can you stand out in one of the most competitive roles in fintech.

Role Overview & Culture

Day-to-day, Visa machine learning engineers build scalable fraud-detection pipelines, tune real-time scoring systems, and integrate model outputs into production environments. You’ll work closely with product and engineering teams while leveraging Visa’s internal MLOps platforms for rapid iteration. The culture emphasizes speed, ownership, and data-driven experimentation, giving engineers the freedom to innovate while operating at a global scale.

Segment users based on behavior and generate candidate offers using collaborative filtering or embeddings. Use a two-stage ranker: an offline model for training, a real-time re-ranker for live session features. Ensure the system handles cold starts and integrates feedback loops for personalization. This design challenge mirrors Visa’s offer of personalization engines deployed across global markets.

Why This Role at Visa?

Visa operates the world’s largest payment network, which means every Visa machine learning engineer is solving problems at global scale. Compensation is competitive, with Machine Learning Engineers typically earning between $165K and $220K in total compensation.

Beyond pay, the role offers strong career growth, with many analysts and engineers moving into product analytics, data science, or leadership roles within two to three years thanks to Visa’s internal mobility programs. Most importantly, the work has real impact: the insights you generate directly shape fraud detection, personalization, and global payment strategies that influence billions of dollars in transactions daily.

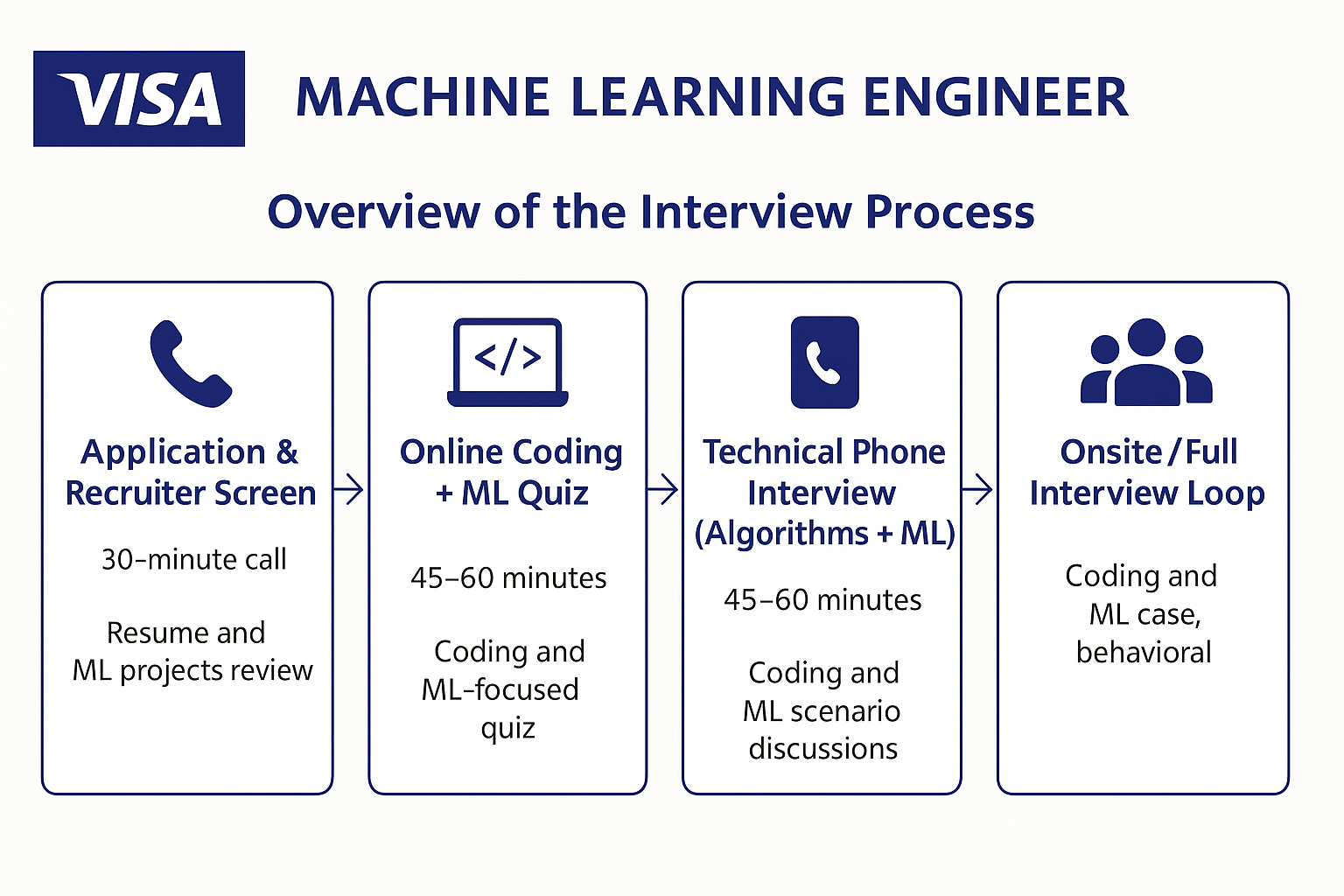

What Is the Interview Process Like for a Machine Learning Engineer Role at Visa?

The Visa machine learning engineer interview process is built to test both your core software engineering skills and your ability to apply machine learning at scale. From model design to production-readiness, each stage evaluates your technical depth, business awareness, and ability to collaborate cross-functionally.

Application & Recruiter Screen

A 30-minute call to review your resume, past ML projects, and alignment with Visa’s technical tracks. Visa uses this round to filter for strong technical alignment early and ensure your project experience matches the scale and domains they hire for.

Tip: Be ready with a 2–3 minute walkthrough of your most impactful ML project, including data size, modeling choices, and business impact.

Online Coding + ML Quiz

Includes standard algorithms and data structures challenges, alongside an ML-focused quiz, often covering model evaluation, supervised/unsupervised learning, and real-world deployment trade-offs. This round ensures you have the fundamentals needed to work with Visa’s massive datasets and can translate theory into practical trade-off decisions.

Tip: Review core algorithm patterns on Interview Query question bank and refresh ML basics like bias-variance tradeoff, overfitting, and evaluation metrics.

Technical Phone Interview (Algorithms + ML)

A 45–60 minute session combining hands-on coding with ML scenario discussions. You might be asked to design a basic recommender system, optimize fraud detection recall, or explain regularization trade-offs. Visa looks for engineers who can code efficiently while connecting solutions back to real-world business use cases like fraud detection or personalization.

Tip: Practice explaining the “why” behind each coding choice: not just the code, but also the scalability and ML reasoning that supports it.

Onsite/Full Interview Loop

Typically includes four rounds:

Coding Round: Expect medium to hard problems in Python or Java, with a focus on algorithmic efficiency and data structures. Questions often test your ability to handle large datasets (e.g., optimizing joins, hash maps, or sliding windows). Interviewers will also probe how you reason about time and space complexity. Visa wants to confirm you can code at scale with clean, efficient solutions, which is essential when dealing with high transaction volumes.

Tip: Focus on time and space trade-offs in your practice problems: verbalize complexity analysis during the interview to show structured thinking.

System Design (ML Focused): This round goes beyond generic system design into ML-serving challenges. You might be asked to design a real-time fraud detection system or an architecture for personalizing card offers. Interviewers expect you to discuss data ingestion, feature stores, model training vs. inference, scalability, and monitoring. Tradeoff discussions (e.g., latency vs. accuracy) are key. Visa emphasizes ML systems that are not only accurate but also production-ready and reliable across billions of daily transactions.

Tip: Study modern ML system architectures: practice drawing end-to-end pipelines and be ready to defend choices around inference speed, monitoring, and cost.

ML Case Study: You’ll walk through a business problem end-to-end, such as predicting transaction anomalies or optimizing a loyalty program. Expect to frame the problem, define success metrics (precision/recall, AUC, business KPIs), outline your modeling approach (baseline vs. advanced models), and consider bias, drift, or data quality issues. Visa uses this round to test your ability to connect ML modeling directly to business outcomes like fraud prevention, customer retention, or risk management.

Tip: Practice case questions by structuring answers: problem framing → success metric → baseline → advanced models → risks. Always tie back to a business KPI.

Behavioral Round: In this stage, Visa looks beyond technical skills to understand how you lead, collaborate, and drive outcomes in complex environments. You’ll be asked to share examples, where you navigated ambiguity, influenced cross-functional teams, or turned model insights into business action. The goal is to see whether you can translate technical expertise into decisions that reduce risk, improve customer trust, or create measurable business value. This round helps Visa identify engineers who not only build models but also shape outcomes across a global organization.

Tip: Prepare 3–4 STAR stories in advance: highlight challenges, your specific actions, and measurable impact, ideally with numbers.

Hiring Committee & Offer

Once the onsite loop wraps up, all interviewer feedback is compiled and reviewed by Visa’s hiring committee. This group usually includes the hiring manager, the recruiter or HR partner, and a mix of technical and behavioral interviewers who participated in the loop. In some cases, a cross-functional stakeholder may also weigh in to assess broader business alignment. The committee looks for consistent performance across coding, design, and behavioral rounds, weighing both technical depth and communication skills.

Behind the Scenes

The process follows a strict 24-hour turnaround for feedback, ensuring momentum is not lost.

Differences by Level

For senior candidates, the interview process goes beyond standard coding and ML case discussions to include a deeper architecture round that tests your ability to design distributed ML systems at Visa’s scale. Rather than sketching a basic pipeline, you may be asked to outline how transaction data is ingested from millions of daily events, how features are stored and served across global regions, and how models are retrained to prevent drift.

Common scenarios include designing a real-time fraud detection system that balances latency and accuracy, proposing monitoring strategies for drift or fairness, and debating trade-offs such as batch versus streaming ingestion or deep learning versus gradient boosting in production. This round is meant to assess whether you can architect resilient, compliant, and business-aligned ML systems that deliver consistent value.

Tip: To prepare, senior candidates should review modern ML infrastructure practices such as feature stores, registries, and streaming frameworks, while practicing how to explain design choices in terms of both technical trade-offs and measurable business outcomes like fraud loss reduction or improved customer trust.

Next, let’s explore the kinds of questions you’ll face at each stage.

What Questions Are Asked in a Visa Machine Learning Engineer Interview?

The Visa machine learning engineer interview is designed to mirror the real challenges engineers tackle at Visa: operating at extreme scale, making trade-offs under tight latency constraints, and connecting technical solutions directly to business impact. Rather than testing theory in isolation, the process emphasizes applied judgment, like how you structure problems, reason about data quality, and design resilient systems that influence billions of transactions worldwide. Candidates should expect an evaluation that goes beyond algorithms to measure how effectively they can align machine learning with Visa’s global mission of secure, seamless payments.

Coding/Technical ML Interview Questions

In the Visa machine learning engineer interview, you’ll face hands-on questions that simulate real-world ML engineering challenges, from streaming data pipelines to GPU inference optimization. These questions test your ability to write clean, scalable code while solving problems rooted in Visa’s core infrastructure.

1 . Implement a real-time data ingestion pipeline that filters invalid records and enriches events for modeling

This problem simulates what you might see in a Visa machine learning engineer interview. Design a Python or Spark pipeline that reads streaming transaction events, discards invalid inputs, and appends derived features for downstream models. Optimize for throughput and error handling. You’ll be tested on pipeline logic, edge case handling, and parallelism awareness.

2 . Optimize GPU batch inference to reduce latency and cost

Given a model deployed on GPU infrastructure, your task is to dynamically batch inputs to maximize GPU utilization without breaching SLA latency. Consider trade-offs in queue time, model throughput, and inference parallelism. This question tests your ability to balance hardware and model serving constraints, which is key in Visa’s high-volume systems. Expect extensions like tuning Triton or TensorRT.

3 . Design real-time feature computation from a stream of payment transactions

Extract time-windowed aggregates (e.g., last N purchases, merchant diversity) and prepare features in a low-latency context. Use Redis, Kafka Streams, or Flink to maintain state. Discuss how you’d ensure consistency and durability. This simulates the feature engineering work for fraud detection and personalization pipelines.

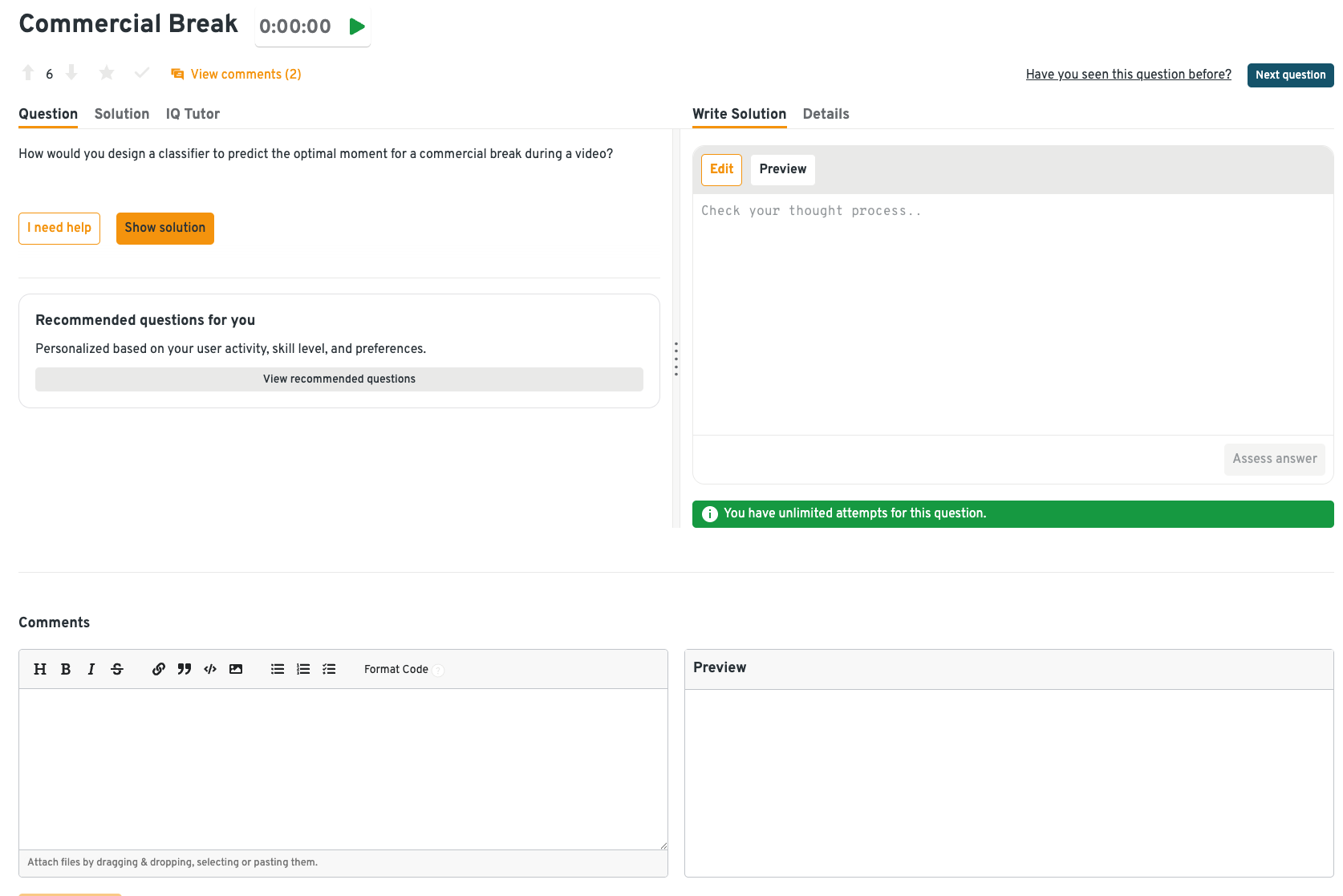

4 . Design a classifier to predict the optimal moment for a commercial break

Start with labeled viewer retention data and engineer features based on engagement metrics. Choose a classification algorithm, then discuss real-time vs. batch inference. Extend into model observability and feedback loops. This question emphasizes trade-offs in temporal modeling under time-sensitive constraints.

You can also access this exact question on the Interview Query (IQ) dashboard, where it comes with a structured workspace for solving, hints to guide your approach, and community-submitted solutions. The dashboard allows you to track progress, revisit past attempts, and benchmark your answers against others, helping you not just practice but improve iteratively.

As shown in the screenshot above, the dashboard organizes each question with a clear problem statement, input/output expectations, and space for your solution code. The discussion threads and solution tabs help you see multiple perspectives, making it easier to refine your reasoning and learn how other candidates approach similar ML interview challenges.

5 . Describe the process of building a restaurant recommendation system

Build a user-item matrix or embed users and restaurants using content-based signals. Address cold start and explore online learning for dynamic re-ranking. Serve recommendations via RESTful APIs and optimize response times. Visa often personalizes offers and benefits, which maps to similar infrastructure.

6 . Design a recommendation algorithm for Netflix-style type-ahead search

Use prefix trees for fast autocomplete, combined with ranking logic from historical search and click logs. Discuss latency trade-offs and hybrid offline/online training pipelines. Add language normalization or typo tolerance if time allows. Real-time user experience is critical for any customer-facing Visa product.

System/ML Design Interview Questions

This section assesses your ability to architect end-to-end ML systems, with an emphasis on scalability, latency, and model lifecycle. Expect design questions around fraud detection, personalization engines, and real-time ML serving, all central to Visa’s production use cases.

7 . Design a scalable fraud-detection service processing 50K transactions per second

Begin by outlining a streaming architecture using Kafka or Google Pub/Sub to capture transactions. Route events through a model-scoring service (e.g., TensorFlow Serving) that uses real-time features like location deviation or spending anomaly. Include Redis or Feature Store for low-latency lookups and a fallback rules engine. This problem is foundational to Visa’s risk management systems and emphasizes throughput, accuracy, and system resilience.

8 . Architect a personalized card-offer ranking system

Segment users based on behavior and generate candidate offers using collaborative filtering or embeddings. Use a two-stage ranker:offline model for training, real-time re-ranker for live session features. Ensure the system handles cold starts and integrates feedback loops for personalization. This design challenge mirrors Visa’s offer of personalization engines deployed across global markets.

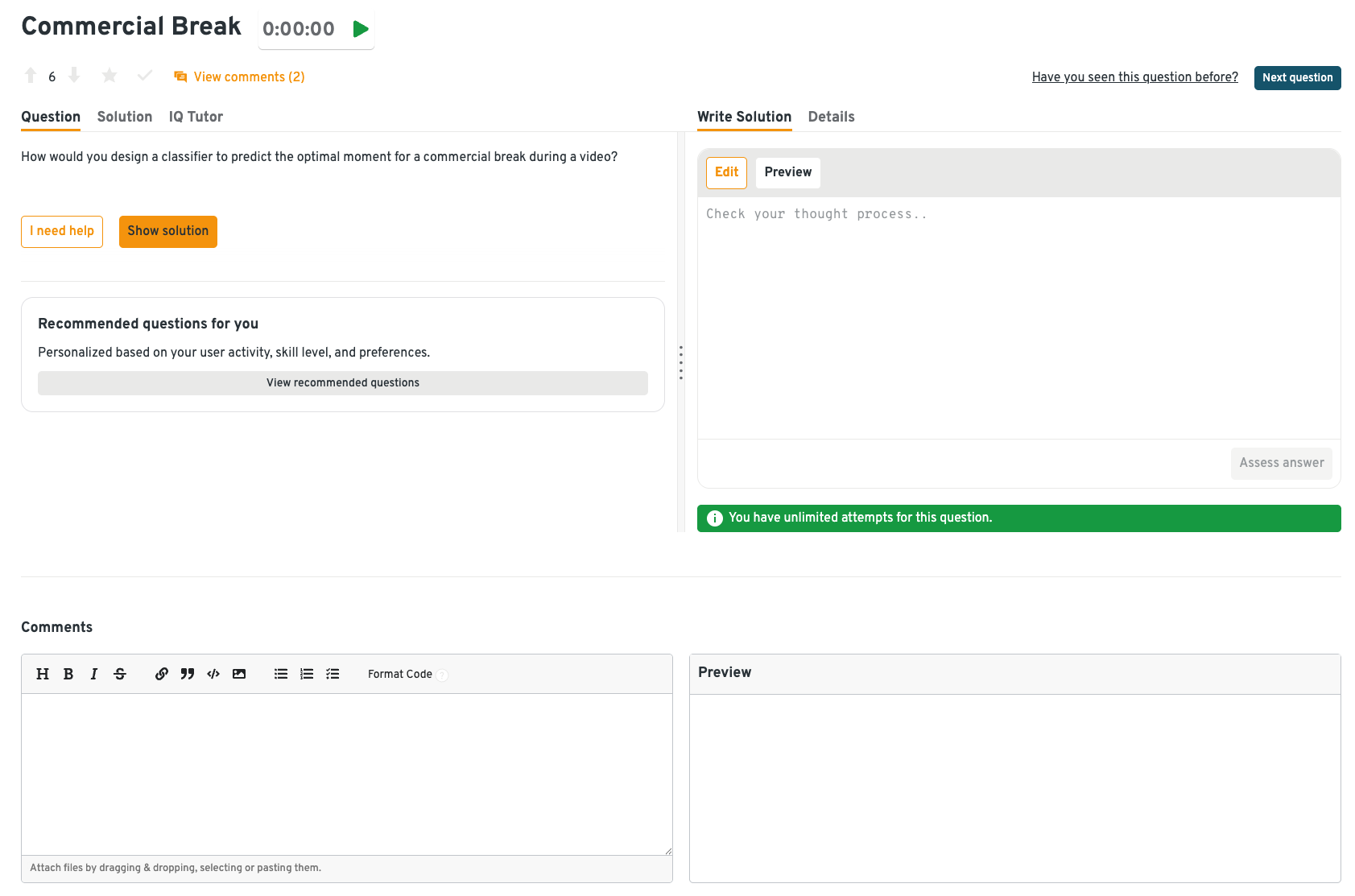

9 . Design a classifier to predict the optimal moment for a commercial break

Structure the problem using temporal features such as viewer retention drop-off, program segment tags, and ad inventory. Train using historical viewer engagement, then serve decisions in real time using lightweight models. Discuss feedback loops, A/B testing, and performance tracking. This simulates designing ML systems for content personalization or fraud alert timing.

As shown in the screenshot, the IQ dashboard presents the problem statement, input and output expectations, and tabs for Hints and Solutions alongside your editor. Open the linked IQ question above to access the live prompt, explore alternative solutions, and track your progress as you refine your approach.

10 . Describe the process of building a restaurant recommendation system

Begin with collaborative filtering or embedding-based models trained offline, then use re-ranking for session-specific signals. Deploy recommendations via a latency-sensitive API and experiment with diversity boosting. Discuss A/B testing and long-term engagement tracking. This parallels Visa’s merchant or offer recommender pipelines.

11 . Design a recommendation algorithm for Netflix-style type-ahead search

Use prefix indexing for efficient autocomplete, paired with ML-based ranking driven by past interactions. Cache frequent prefixes, normalize user input, and handle typos with fuzzy matching. Explore model training for personalized sorting and online evaluation. This is highly applicable to Visa’s search UX for rewards, merchants, or support tools. While the content differs, the UX problems are similar: both need sub-100ms intent prediction as the user types, relevance re-ranking from behavioral signals, and guardrails for safe suggestions. Visa swaps “titles and genres” for “merchants, rewards, and help topics,” but the core loop (prefix match → personalized rank → instant feedback) remains the same. The main delta is compliance and risk: Visa’s system must respect PCI/PII constraints and incorporate fraud/risk signals into ranking and logging.

- Design a scalable fraud-detection service processing 50 K TPS.

- Architecture for personalised card-offer ranking (include offline vs. online training).

Behavioral/Culture Fit Questions

Visa values machine learning engineers who can navigate ambiguity, communicate across teams, and take ownership when models face real-world complexity. These behavioral questions are just as important as the technical ones because they reveal how you handle model failures, make trade-offs, and collaborate under pressure. At Visa’s scale, technical skills alone aren’t enough. Success depends on resilience, clear communication, and the ability to translate machine learning into measurable business impact.

12 . Tell me about a time your model failed in production

Highlight the root cause (data drift, labeling error, system bug), how you diagnosed it, and your mitigation plan. Share what monitoring tools you implemented after. Visa values engineers who are resilient and accountable in high-stakes ML environments.

Example: When a fraud-detection model suddenly spiked in false positives, I traced the issue to feature drift in location data. I quickly implemented validation checks and built monitoring alerts, which cut false positives by 30% and prevented future outages.

13 . How do you balance research vs. delivery timelines?

Explain how you scope MVP models that meet business needs without over-optimizing. Discuss trade-offs between experimentation depth and shipping fast. Mention alignment with PMs or business owners. This question tests pragmatism, which is a core skill at Visa because engineers operate at a global scale, where delays can stall multi-million-dollar initiatives, and overly complex solutions can jeopardize reliability, compliance, or customer trust.

Example: On a tight six-week project, I scoped an MVP model that met baseline recall while planning improvements in later phases. This approach allowed us to launch on time, reduce fraud losses by 12%, and still upgrade the model post-launch.

14 . Describe a situation where you had to challenge assumptions about model accuracy

Share how you pushed back with data or experimentation results. Walk through how you influenced a team to reframe success criteria. Visa teams expect machine learning engineers to lead with evidence while remaining collaborative.

Example: A stakeholder wanted 95% precision, but I demonstrated with data that a higher recall would save more in fraud losses. By reframing success metrics around dollar impact, I won buy-in and helped reduce chargeback costs by $3M annually.

15 . Tell me about a cross-functional collaboration that impacted model outcomes

Highlight how you worked with data engineering, analytics, or product to refine requirements. Share how the model improved due to shared domain context. Visa’s orgs are matrixed, so cross-team impact matters.

Example: While building a loyalty recommendation model, I worked with data engineering to source merchant metadata and with product to define engagement metrics. This collaboration improved model lift by 15% and boosted redemption rates by 10%.

16 . How do you ensure your model is fair and doesn’t introduce bias?

Talk about techniques like stratified sampling, feature auditing, and fairness metrics (e.g., equal opportunity). Share how you communicate risks transparently. Visa operates globally; therefore, fairness isn’t optional.

Example: On a credit offer model, I noticed demographic imbalances in the data. I applied stratified sampling, audited features, and tested fairness metrics, which ensured compliance and improved stakeholder trust in the system’s transparency.

- “Tell me about a time your model failed in production.”

- “How do you balance research vs. delivery timelines?”

How to Prepare for a Machine Learning Engineer Role at Visa

Preparing for the Visa machine learning engineer interview means going beyond textbook prep. You’ll need to show you can apply algorithms and ML design principles to Visa’s massive payments ecosystem. At this scale, small changes to fraud thresholds or approval logic can shift millions of transactions, which is why Visa tests both your technical depth and your ability to reason about business impact.

Review Visa’s Payments Data Flow

Study how transactions are authorized, cleared, and settled across Visa’s network. This isn’t just background knowledge. Understanding where ML fits (fraud scoring, credit risk, personalization) helps you anchor design answers in Visa’s ecosystem. Be ready to explain how a model you propose would plug into this flow and what KPIs it would influence, such as approval rates, fraud losses, or transaction speed.

Practice ML-Focused Coding Questions

Go beyond generic algorithm practice: focus on problems that simulate Visa-scale workloads. On Interview Query Dashboard, target string matching, prefix trees, sliding windows, and dynamic programming which are patterns often tested in payments and search scenarios. In PySpark, get hands-on with large dataset manipulation: rolling spend features, merchant joins, deduplication, and skew handling. Always tie your practice back to Visa-relevant contexts like reducing false declines in fraud detection or analyzing DAU/WAU for tokenized cards.

Mock ML System Design Whiteboards

When whiteboarding, follow a clear framework: Goal → Metrics → Architecture → Trade-offs. For example, if asked to design a fraud detection system, start with the business goal (minimize fraud without hurting approvals), define metrics (precision, recall, latency), then walk through the architecture (data ingestion, feature store, model service, rules engine, monitoring). Call out trade-offs like latency vs. accuracy and interpretability vs. complexity. Don’t forget compliance and fail-safes. At Visa, resilience and regulatory alignment are as critical as accuracy.

STAR Stories Around Model Failures

Prepare 3–4 concise stories where your model underperformed or failed in production. Focus on diagnosing the problem (drift, bad labels, system bug), the actions you took (alerts, retraining, feature audits), and the results (improved stability, prevented future outages). Keep answers 2–3 sentences long and quantify the outcome. Visa values engineers who not only fix issues but also demonstrate ownership and measurable impact at scale.

Benchmark on Visa’s Leadership Principles

Review Visa’s principles around ownership, collaboration, and innovation velocity. In interviews, connect your past work to these themes: e.g., how you led a project under ambiguity, influenced non-technical stakeholders, or drove an ML initiative that created business value. Think of this as the behavioral “system design”: you’re showing how your decision-making framework fits Visa’s culture, not just your coding ability.

FAQs

How much do machine learning engineers make at Visa?

Visa’s machine learning engineer roles command competitive pay, with compensation rising sharply with level.

Total compensation: The range for Visa machine learning engineer is from $164-$216K per year, with a median pay of $187K, consisting of 82.4% of base pay, 7.2% of bonus, and 10.4% of stock.

Levels: Visa machine learning engineer with 1-3 years of experience earn $145K-$204K per year, while senior position earn $168K-$237K per year.

Does Visa Sponsor International ML Engineers?

Yes, Visa is known to sponsor international candidates for machine learning roles. They support H-1B visas and TN visas (for eligible Canadian and Mexican citizens), and often provide relocation assistance for candidates moving within or outside the U.S. Sponsorship and support packages may vary by team, so confirm details with your recruiter early in the process.

How Many Rounds Are There in Total?

There are five main stages in the Visa MLE interview process:

- Recruiter Screen

- Online Coding + ML Quiz

- Technical Phone Interview

- Onsite Interview Loop (typically 4 rounds)

- Hiring Committee Review

The onsite loop usually spans 3 to 4 hours, covering coding, system design, a machine learning case study, and behavioral fit.

Do machine learning engineers have coding interviews?

Yes. At Visa, ML engineers face coding interviews that test algorithms, data structures, and applied problem-solving. These sessions often mix standard coding tasks with ML-specific scenarios, like feature engineering or optimizing inference speed.

Is machine learning hard?

It can be challenging because it requires strong math, coding, and systems knowledge, but the difficulty depends on your foundation. At Visa, the focus is on applying ML to real-world payments data, which makes preparation more structured and practical.

What code is used for machine learning?

Most machine learning engineers use Python with libraries like TensorFlow, PyTorch, scikit-learn, and Pandas. At Visa, you’ll also see PySpark for distributed data processing and tools like Kafka or Redis for production integration.

Is Visa a good company to work for?

Yes—Visa is widely regarded as a strong employer, offering global impact, competitive compensation, and exposure to one of the largest financial datasets in the world. Engineers benefit from clear career growth, rotational opportunities, and a culture that values innovation and ownership.

Conclusion

Cracking the Visa machine learning engineer interview requires structured preparation across coding, ML system design, and behavioral depth. The best way to prepare is not only reading guides, but also practicing real questions under timed conditions and refining your answers with feedback.

Ready to start? Explore our Visa machine learning engineer questions to practice real ML design and coding challenges.

For broader prep, explore our Visa Data Scientist and Visa Data Engineer guides.

Need more practice or insider tips? Book a 1-on-1 mock ML interview to test your readiness under pressure. You’ll get personalized coaching from professionals to pinpoint your gaps before the real interview.