Citi Business Analyst Interview Questions & Hiring Process Guide (2026)

Introduction

As organizations increasingly become data-reliant, the business analyst job market continues to soar. The U.S. Department of Labor projects an 11% growth for business analysts in the next decade, with their influence spanning finance companies like Citi. At Citi, business analysts are essential to supporting its continued digital transformation, risk modernization, and large-scale operational systems.

The Citi business analyst interview thus centers on structured problem-solving and cross-functional collaboration to help expand the company’s global service delivery. Candidates are expected to show how they work with data, map complex processes, and influence decisions across compliance, payments, onboarding, and servicing teams.

To help you stand out and meet those expectations, this guide outlines each stage of the Citi business analyst interview, highlights common questions, and shares proven strategies to prepare effectively with Interview Query.

Citi Business Analyst Interview Process

Citi’s business analyst hiring process is structured, multi-stage, and built to evaluate how well you operate within a highly regulated, data-driven, global environment. While each team may tweak the sequence, most roles follow a consistent path: application review, recruiter screening, online assessment (for select groups), technical and business analysis interviews, a case study mirroring Citi’s internal workflows, and a final stakeholder-focused round.

Across stages, Citi emphasizes candidates who can navigate ambiguous business problems, articulate requirements cleanly, and balance risk, customer outcomes, and operational feasibility. Most processes move within 2–5 weeks, with senior roles or cross-regional hiring taking slightly longer.

Application & resume screen

The initial screen evaluates how well your background aligns with Citi’s operating model and domain needs. Teams look for experience in areas like regulatory reporting, payments operations, AML/KYC, credit processes, customer onboarding, or issue management. Skills like SQL fluency, workflow documentation, and cross-functional project ownership also signal readiness.

Because Citi relies heavily on documentation rigor and auditability, clear, metric-driven achievements, such as reduced turnaround time, lowered defect rates, improved reconciliation accuracy, stronger controls, carry significant weight.

Tip: Write bullet points that link your actions directly to measurable risk reduction or operational uplift (e.g., “cut KYC backlog by 18% through redesigned intake flow”).

Initial recruiter conversation

The recruiter call focuses on your communication style, familiarity with financial operations, and ability to summarize complex work clearly. Expect targeted questions on how you handle requirements gathering, multi-team coordination, RCA (root cause analysis), control gaps, and any prior exposure to regulatory timelines.

Recruiters listen for structured thinking when asking questions related to your past roles, why you want to join Citi, and what motivates your move into global banking. They also preview the interview sequence, validate compensation expectations, and ensure your motivations for joining Citi align with the business unit’s mandate.

Tip: Prepare a concise walkthrough of a project where you navigated competing priorities, such as balancing customer experience improvements with compliance or audit requirements.

Online assessment

Some teams, especially in operations analytics, regulatory reporting, or data-heavy groups, use an online assessment. These commonly blend logical reasoning, numerical pattern recognition, and judgment-based scenarios that test how you prioritize under operational pressure.

Certain groups add a short SQL or data accuracy section. Rather than advanced joins, the emphasis is on quickly spotting outliers, mismatches, or inconsistencies, all of which reflect the day-to-day reality of analyzing operational data feeds at Citi.

Tip: Practice scanning small datasets quickly instead of solely focusing on technical depth. SQL challenges on Interview Query can enhance your speed and accuracy under time pressure.

Technical/business analysis interview

This stage dives into how you think, not just what you know. Interviewers present scenarios involving failed payments, AML escalations, credit decision flows, customer disputes, onboarding delays, reconciliation breaks, or process gaps. You may also be asked to interpret tables, write basic SQL, validate data logic, or walk through how you’d document a complex workflow.

Citi values analysts who avoid superficial answers and instead show step-by-step reasoning: how you isolate problems, confirm assumptions, gather missing inputs, and evaluate downstream impacts on operations or compliance.

Tip: Demonstrate how you break down unclear or conflicting stakeholder requests, as Citi teams often face competing regulatory, customer, and operational constraints.

Case study or exercise

The case study simulates challenges common in Citi’s global banking workflows. Exercises may involve mapping an end-to-end process, drafting requirements for a new control, analyzing trends behind a spike in failed transactions, or deciding how to fix a fragmented onboarding flow.

You’re assessed on clarity, structure, and whether your recommendations consider customer impact, regulatory obligations, system limitations, and change-management practicalities.

Tip: Explain the tradeoffs behind your decisions, e.g., how tightening a control may slow processing but reduce regulatory exposure. Anchoring your decisions in risk governance and operational resilience also sets you apart.

Final round interview/Superday

The final stage emphasizes stakeholder management, communication maturity, global coordination, and ownership. These conversations typically involve a mix of hiring managers, senior analysts, and cross-functional partners.

Expect deep dives into how you escalate issues, manage delivery timelines, resolve conflicting priorities, and collaborate with technology, risk, and regional operations teams. For senior roles, expect scenario prompts that test leadership in ambiguous, time-sensitive situations, such as handling data quality incidents or cross-border go-live issues.

Tip: Highlight examples where you influenced without authority or coordinated teams across time zones. Such experiences resonate strongly in Citi’s global model.

Strengthen your preparation with a full Citi business analyst mock interview on Interview Query, including real case studies and guided feedback to help you perform confidently across every stage.

Most Asked Citi Business Analyst Interview Questions

Citi’s business analyst interviews are designed to reveal how you think, not just what you know. Expect questions that test analytical depth, SQL fluency, and your ability to interpret data from large, regulated financial systems.

Understanding the context of real-world problems is key, and this video provides a concise overview of how companies like Citi evaluate problem-solving and business judgment in interviews.

Watch: Business Analyst Interview Questions ANSWERED

In this video, Interview Query co-founder and data scientist Jay Feng highlights the importance of structuring answers clearly, linking your analysis to tangible business impact, and demonstrating both ownership and sound judgment in high-stakes scenarios.

This is especially important as many questions mirror real patterns the bank sees daily, from failed transaction trends to digital transformation requirements.

Let’s take a look at the core question categories and representative examples for each of them:

SQL Interview Questions at Citi

SQL is central to Citi’s analytics work, helping analysts uncover patterns across transactions, risk indicators, and customer behavior. Many Citi data analyst interview questions also appear in BA interviews because both roles rely heavily on structured data analysis. Expect questions that test how well you handle joins, aggregations, and data validation in large, regulated financial systems.

Identify the final transaction of each business day from a Citi banking ledger.

This question checks comfort with window functions, date manipulation, and filtering. A common approach is to partition transactions by date, rank them by timestamp in descending order, and select only those with rank = 1. Ordering the output by datetime provides a clean chronological view of daily end-of-day activity.

Tip: Emphasize how your query choices support daily reconciliation workflows, since Citi teams frequently rely on precise end-of-day transaction extracts for operational reporting.

-

It evaluates skills in time-based aggregation and grouping by calendar periods. You typically extract the month from the transaction date, group by it, and compute distinct users, count of transactions, and total amounts. Ensuring that the filter restricts the data to the desired year keeps the report consistent.

Tip: Highlight your ability to turn raw monthly aggregates into trends or insights to show that you can translate SQL output into business-facing narratives.

-

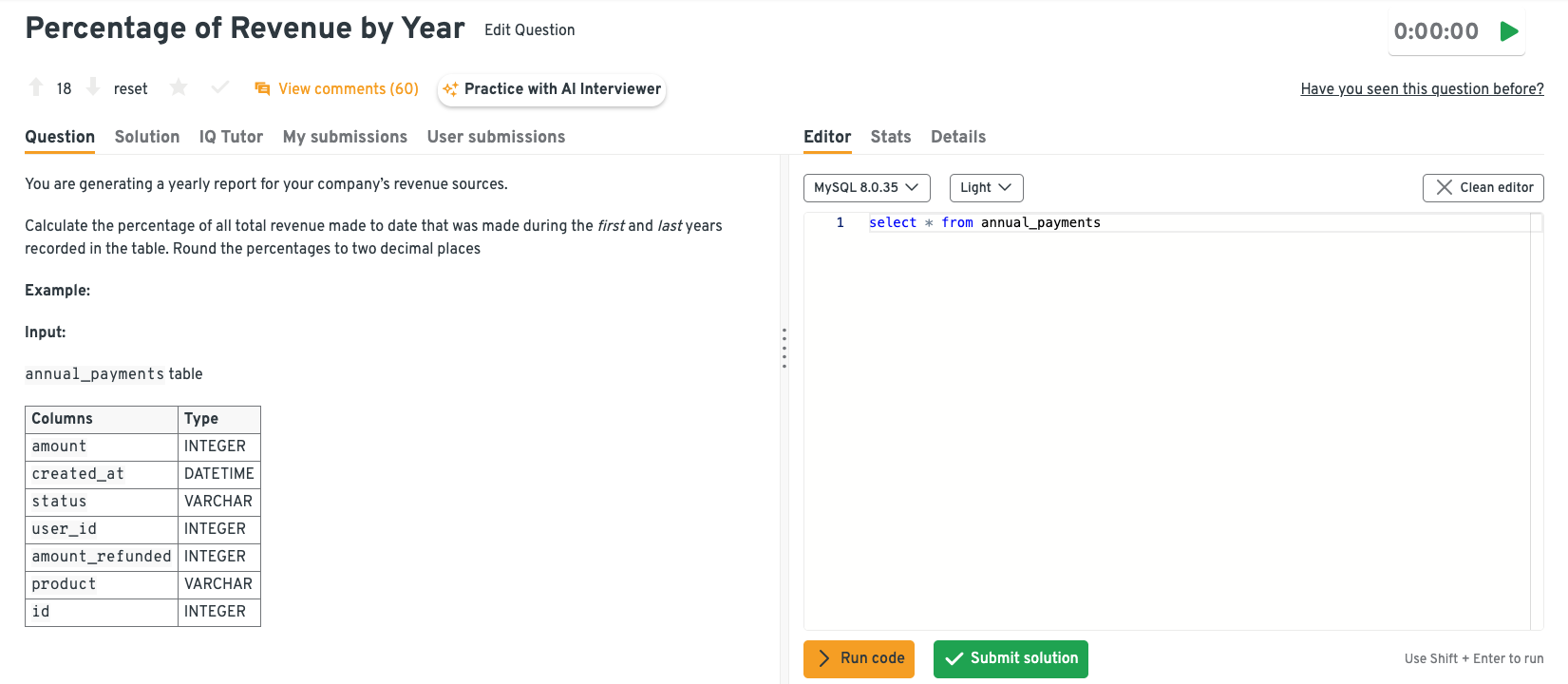

Mastery of aggregate functions and ratio calculations is the focus here. Start by calculating total revenue across all years, then isolate revenue for the minimum and maximum years using grouping and conditional aggregation. Dividing each year’s revenue by the overall total and rounding gives the final percentages.

Tip: Mention how year-over-year comparisons feed into financial planning and forecasting discussions, demonstrating that you understand how these metrics drive Citi’s strategic analysis.

Practice this question and other types of SQL problems interactively in Interview Query’s dashboard, where you can write queries in a built-in editor and get AI-powered hints and guidance from the IQ Tutor to refine your approach.

Detect customers with potential anomalous transaction spikes by comparing each transaction to their 7-day rolling average.

This tests window functions, moving averages, and anomaly detection logic. The solution usually partitions by customer, orders by transaction date, and applies a 7-day rolling

AVGorSUMwindow. A spike is detected by comparing a transaction’s value against the rolling metric using a threshold ratio or difference.Tip: Tie your anomaly-detection logic to fraud monitoring or risk-flags, as Citi values analysts who can bridge technical SQL work with real-world risk management needs.

Identify Citi clients with cross-product engagement by querying customers who hold both checking and credit accounts and summarizing their total balances.

The challenge centers on joins, conditional filtering, and grouped summaries. One method is to join or self-join the accounts table, filter for customers with both product types, and then aggregate balances at the customer level. Presenting the results in a consolidated customer summary highlights multi-product engagement.

Tip: Point out how cross-product visibility helps strengthen customer segmentation and wallet-share analyses.

Looking for more practice? Explore a wider range of SQL problems in Interview Query’s question bank to sharpen your skills and benchmark against real analyst interview patterns. It’s a great way to build confidence before tackling more advanced Citi-style scenarios.

Business Analysis Interview Questions

Citi’s business analysis questions dig into how you break down workflows, gather requirements, and identify gaps in processes tied to payments, onboarding, and risk controls. Expect prompts about mapping onboarding journeys, defining gaps in payments processes, documenting risk controls, and structuring requirements for compliance-heavy features. Interviewers look for structured thinkers who can translate ambiguity into clear, actionable documentation.

-

A strong approach starts with segmenting the decline by product, channel, customer type, and geography to isolate where the drop is concentrated. From there, reviewing recent policy changes, system releases, and customer-experience issues helps narrow down the drivers and guide corrective actions.

Tip: When segmenting the data, consider Citi-specific product features like co-branded cards or promotional APR offers, as these often create distinct behavioral patterns that may explain unusual declines.

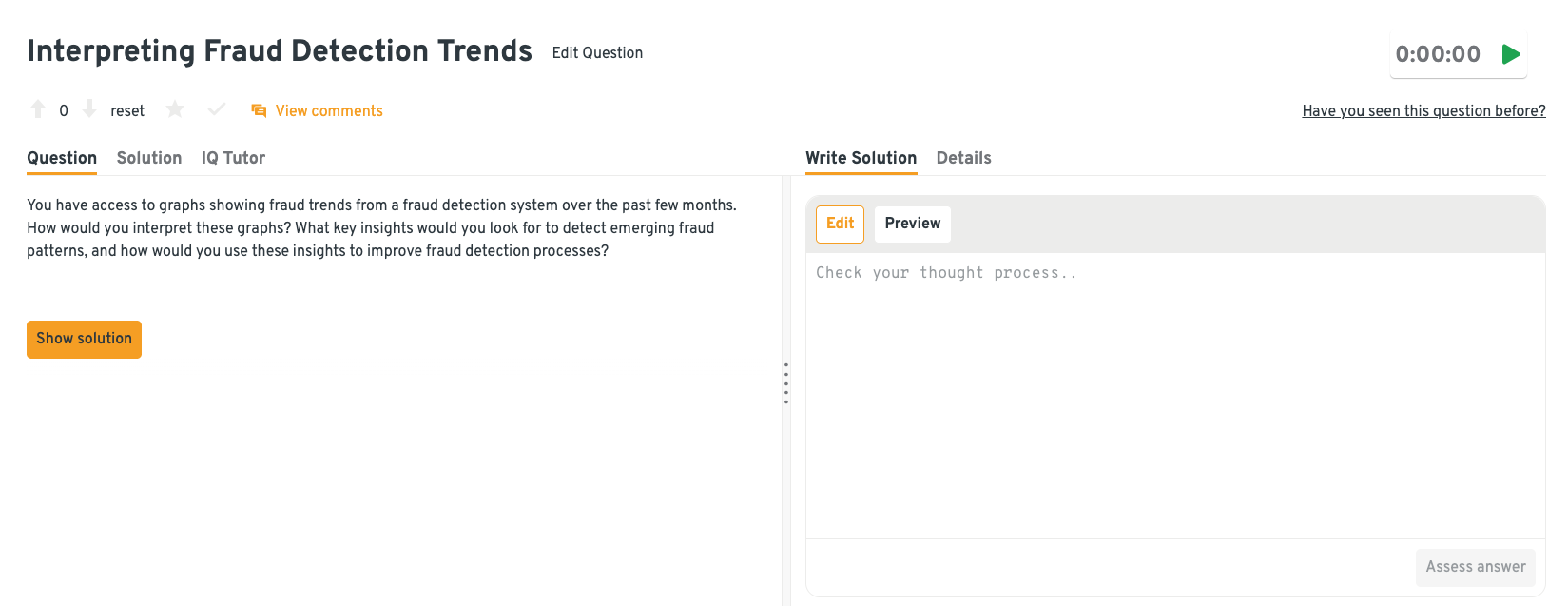

-

Candidates should look for unusual spikes, shifts in attack vectors, seasonality, or sudden changes in decline/approval patterns. Translating these observations into actionable updates, such as new rules, enhanced monitoring windows, or model recalibrations, demonstrates strong business-risk intuition.

Tip: Pay special attention to Citi’s high-volume geographies or corporate card lines, since fraud patterns often differ between retail and commercial segments.

Take this further on the Interview Query dashboard, where you can explore similar business analysis scenarios, receive step-by-step guidance from the IQ Tutor, and see how other users approached the same problem.

-

This tests an understanding of system design, data flows, and stakeholder reporting requirements. A solid approach defines the key metrics, then outlines a lightweight schema and a streaming or micro-batch pipeline capable of feeding data to the dashboard with low latency. Ensuring data quality checks and alert triggers are baked into the workflow shows awareness of operational realities.

Tip: Incorporate Citi’s reporting hierarchy (global, regional, branch) into your dashboard design, so stakeholders at each level can drill down without needing separate datasets.

Map the end-to-end Citi payments lifecycle and identify key failure points that require business or system controls.

The question assesses process-mapping skills and familiarity with banking operational flows. Start by laying out each stage (authorization, clearing, settlement, posting) and then highlight where errors, delays, or breakages commonly arise. Calling out specific controls such as reconciliation checks, exception queues, and automated alerts demonstrates a practical understanding of risk mitigation.

Tip: Include Citi-specific channels such as CitiDirect, mobile apps, and cross-border ACH flows when mapping, as failure points often vary by channel.

Perform a gap analysis for a proposed Citi regulatory reporting enhancement and outline the requirements needed to achieve compliance.

You are tested on your ability to read requirements, compare current capabilities, and formalize the steps needed to close gaps. Begin by identifying the new regulatory changes, then document how existing data, processes, and systems fall short. From there, define functional requirements, data sourcing needs, and validation procedures to ensure the updated report consistently meets regulatory expectations.

Tip: Factor in Citi’s existing legacy systems and upstream data feeds. Understanding where historical limitations exist will help you propose realistic, implementable compliance requirements.

Case-Based and Scenario Based Interview Questions

From fraud spikes to payment failures, scenario prompts mirror real Citi challenges and show how you prioritize and structure solutions. Interviewers want to see practical reasoning grounded in compliance, customer impact, cross-functional awareness, and operational feasibility.

-

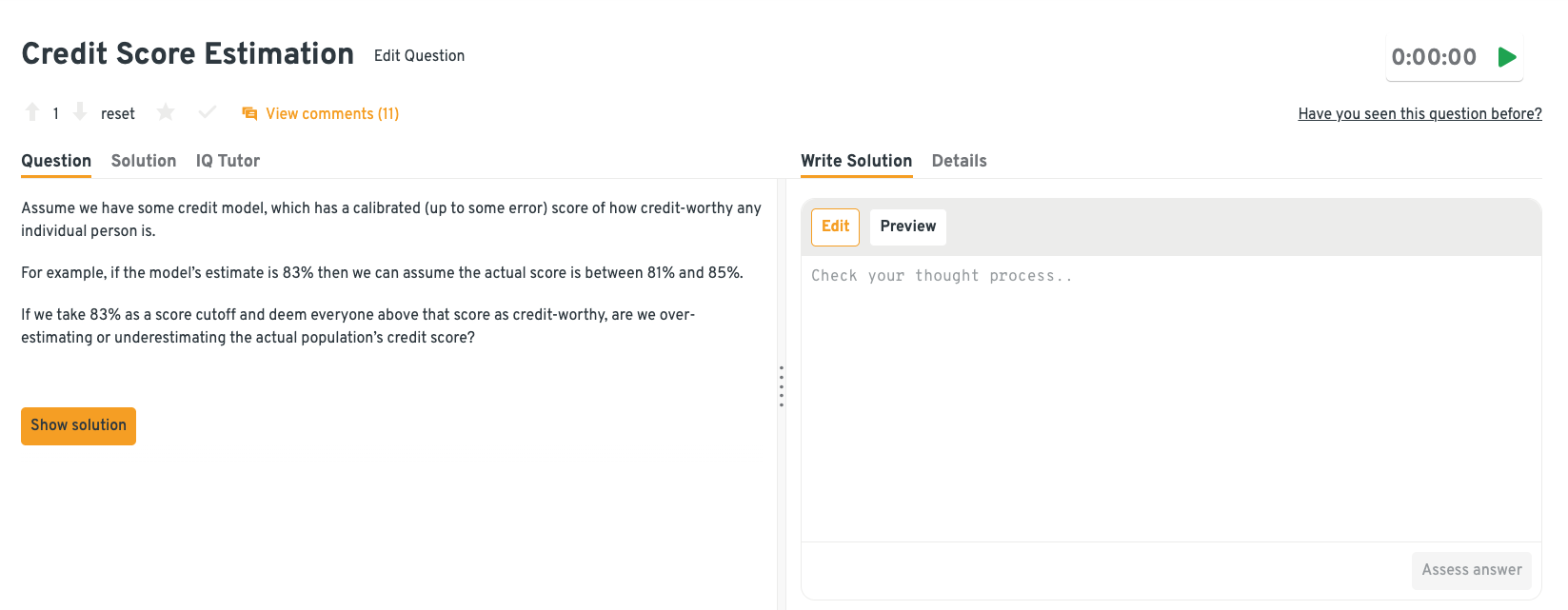

Compare the model’s estimated cutoff to the true score range and evaluate how many customers may fall above or below the threshold once error bands are applied. The key is determining whether more individuals are being incorrectly included or excluded based on the uncertainty around the predicted score.

Tip: Reference Citi’s practice of using conservative buffers in credit decisions and emphasize how you’d validate model assumptions with historical performance or challenger models.

Explore more business-analyst case scenarios like this one on the Interview Query dashboard. When attempting Citi-style problems, you can check your solutions instantly, get AI guidance from the IQ Tutor, and review insights and strategies shared by other users to compare approaches.

-

The question gauges prioritization, segmentation, and data-driven targeting. Outline how you would score merchants using variables like transaction volume, customer overlap with Citi cardholders, industry fit, and likelihood of adoption. From there, rank and filter the list, adding operational checks to ensure outreach resources focus on the highest-impact leads.

Tip: Mention how you’d align outreach criteria with segments that historically drive higher swipe volume or deepen customer engagement.

Infer a Citi customer’s home location from purchase activity to support a fraud-detection system.

Examine transaction clusters over time, weighting recurring locations such as grocery stores or weekday evening purchases more heavily than travel or atypical spend. Use frequency, recency, and geographic consistency to infer a probable home base that can be compared against future transactions for fraud detection.

Tip: Mention that Citi often blends rule-based approaches with machine-learning signals, so highlight how you’d design a simple, explainable starting heuristic before integrating model-driven enhancements.

How would you diagnose the root cause of rising customer payment delays for Citi’s retail card portfolio and propose actions to reduce them?

Start by segmenting delinquency trends across credit tiers, product types, customer demographics, and recent policy or economic shifts. Investigate operational issues like statement timing, payment channel failures, or call-center backlogs, then align each root cause with targeted fixes and KPIs to track improvements.

Tip: Demonstrate familiarity with Citi’s customer-experience mindset by noting how you’d incorporate voice-of-customer insights or operational pain-point reviews when diagnosing payment-delay causes.

How would you prioritize a backlog of Citi customer accounts requiring AML/KYC remediation given limited operations capacity and varying levels of regulatory risk?

You are evaluated on your risk-based decision-making and workflow optimization. Build a triage framework that scores accounts by regulatory exposure, transaction volume, customer type, and severity of missing documentation. Higher-risk accounts should move to the front of the queue, while lower-risk cases can be batched or automated, ensuring compliance deadlines are met without overwhelming operations.

Tip: Describe how you’d communicate prioritization logic clearly to compliance partners and ensure audit-ready documentation throughout remediation, thus signaling awareness of regulatory scrutiny.

Looking to sharpen your case-based problem-solving even further? Try Interview Query’s real-world analytics and product challenges to practice scenarios similar to what Citi business analysts face every day.

Behavioral Interview Questions

Citi’s behavioral questions reveal reveal how you collaborate, manage uncertainty, and maintain judgment in high-stakes, compliance-driven environments. Interviewers look for ownership, judgment, and your ability to drive progress when requirements, timelines, or regional expectations shift. Strong answers tie your actions to business impact, e.g. reduced risk, faster cycle times, cleaner processes, or improved cross-team alignment.

-

Citi places strong value on analysts who can translate data into crisp, decision-ready recommendations for leadership. Interviewers want to see that you can distill complexity, frame trade-offs, and guide stakeholders toward a confident next step.

Sample Answer: I once consolidated three months of operational data into a simple decision tree showing the impact of each option on cycle time and cost. Instead of walking through every metric, I highlighted the two variables that actually drove risk and recommended the path that optimized both. As a result, the leadership team aligned within minutes and approved the proposed path, reducing decision lag and accelerating implementation by a full sprint.

-

Citi’s work often requires balancing competing priorities across product, operations, tech, and regional teams. Your interviewer wants to understand how you rebuild clarity, uncover root causes, and re-establish momentum when voices diverge.

Sample Answer: On a data-remediation project, operations wanted speed while compliance insisted on additional checks. I brought both groups into a short working session to map where the friction came from and proposed a tiered workflow that satisfied the highest-risk cases first. Both teams agreed to the new approach, which cut overall turnaround time by 20% while maintaining full compliance coverage.

Describe a time you drove progress on a project despite shifting requirements or unclear direction.

You are expected to make progress even when ambiguity is high, whether due to evolving regulations, new data constraints, or changing regional expectations. Interviewers look for ownership, structured thinking, and steady forward movement.

Sample Answer: During a reporting revamp, requirements changed twice based on new legal guidance. I created a flexible template that isolated the variable components and locked down the stable sections. That framework allowed the team to adjust quickly without restarting work, keeping the delivery on track.

Share an example of when you identified a process or control gap and took ownership to reduce risk.

Risk awareness is central to Citi’s culture, so interviewers want to hear how you spot issues early and proactively strengthen controls. They’re assessing your attention to detail, judgment, and willingness to step in before a gap escalates.

Sample Answer: While reviewing account exceptions, I noticed inconsistent documentation patterns coming from one region. I flagged the issue, traced it back to a missing step in their workflow, and drafted a simple checklist that standardized the process. Within a month, exception rates dropped noticeably and compliance sign-off accelerated.

Tell me about a situation where you had to coordinate across multiple teams or regions to meet a tight deadline.

Citi’s global footprint means analysts regularly navigate complex handoffs and time zones. Interviewers want to see that you can keep teams aligned, remove blockers, and maintain momentum without overcomplicating communication.

Sample Answer: For a cross-region analytics rollout, I set up a streamlined schedule where each team delivered inputs before the next handoff window. I kept a shared tracker updated daily and flagged delays early so we could redistribute tasks. The coordination helped us finish ahead of schedule with no rework required.

Overall, practicing with a variety of SQL problems, case scenarios, and behavioral prompts helps you build confidence and structure your answers around business impact.

For more targeted practice, explore Interview Query’s Citi-specific question bank to deepen your readiness and ground your approach on real interview patterns. Tackling these questions consistently can sharpen your problem-solving and communication skills for every stage of the interview.

What Does a Citi Business Analyst Do?

A Citi business analyst helps the bank improve processes, reduce risk, and deliver scalable solutions across its global consumer and institutional businesses. The role blends requirements gathering, process analysis, and cross-functional coordination.

Key responsibilities include:

- Gathering and documenting requirements

- Translate complex financial workflows into clear functional specs.

- Partner with product, engineering, compliance, and operations teams to align on business needs.

- Mapping and improving processes

- Chart end-to-end flows across onboarding, servicing, credit decisioning, and transactions.

- Identify inefficiencies, analyze root causes, and recommend improvements that boost resilience and reduce risk.

- Analyzing data to drive decisions

- Evaluate KPIs related to fraud, payments, customer behavior, and system performance.

- Use SQL, dashboards, and multiple data sources to identify trends and support evidence-based decisions.

- Translating regulatory requirements

- Interpret AML, KYC, and other compliance expectations and convert them into business requirements.

- Document risk controls and support audit-ready change management.

These responsibilities directly shape how Citi structures its interviews. Citi looks for candidates who communicate clearly, think analytically, collaborate well with stakeholders, and understand core banking and compliance workflows.

Learn more through our full set of business analyst interview questions on Interview Query.

How to Prepare for the Citi Business Analyst Interview

As you prepare for the Citi business analyst interview, you must demonstrate that you can navigate complex data, understand core banking processes, and communicate clearly across global teams. The guide below breaks down the most important skills and knowledge areas Citi expects, along with practical steps to strengthen each one. Use it to focus your prep and show up ready to think like a Citi analyst from day one.

Practice SQL skills

Citi BAs are expected to pull and analyze large transactional datasets, so SQL proficiency directly impacts your ability to investigate issues and generate insights.

Learn how to join and aggregate datasets so you can analyze multi-table banking data like transactions, customers, and accounts.

Use subqueries and window functions to rank activity, calculate rolling metrics, and identify anomalies in operational data.

Work with transactional datasets involving failed payments, fraud flags, and segmented customer profiles to mimic real Citi analytics tasks.

Resources: Interview Query’s SQL Question Bank

Review banking and risk fundamentals

Citi heavily tests domain fluency because analysts need to understand compliance, risk, and product flows to diagnose operational problems effectively.

Understand payment rails and settlement flows so you can reason about transaction delays, declines, and reconciliation issues.

Know KYC/AML workflows to speak to identity verification, monitoring obligations, and risk-based decisioning.

Study the customer lifecycle from onboarding to servicing, transactions, and exception handling.

Resources: ACAMS & KYC overviews; Citi product documentation (public)

Sharpen business analysis fundamentals

Citi expects BAs to translate business problems into structured requirements and process improvements, making BA fundamentals essential for both interviews and the job itself.

Practice writing clear requirements documents that capture business needs, user flows, and acceptance criteria.

Conduct gap analyses to compare current vs. target processes and identify what needs to change.

Review basic change-management principles to explain how you’d support system or process rollouts.

Resources: BA handbooks; IIBA learning materials

Use structured frameworks to solve cases

Citi case interviews evaluate how logically you break down ambiguous operational or product problems, so a structured thinking toolkit is crucial.

Apply a Problem → Root Cause → Data → Constraints → Recommendation flow for ambiguous operational and technical issues.

Use Current State → Pain Points → Requirements → Target State → Risks to frame system and workflow redesign scenarios.

Resources: Interview Query’s Case Study Challenge

Prepare behavioral stories with STAR

Citi relies on cross-functional coordination and regulatory precision, so strong behavioral examples must show your maturity in collaboration and execution.

Develop examples of stakeholder conflict or misalignment and how you resolved them through analysis and communication.

Show global collaboration experience by highlighting how you worked across time zones, teams, or regulatory contexts.

Demonstrate adaptability to regulatory changes or ambiguity with stories about navigating unclear requirements or shifting priorities.

Resources: Interview Query’s Behavioral Question Bank

Need tailored support? Maximize your Citi business analyst interview performance by exploring Interview Query’s Coaching Services. Work one-on-one with experts to receive personalized guidance, constructive feedback, and insider tips on SQL, business analysis, case studies, and behavioral interviews.

Average Citi Business Analyst Salary

Citi business analysts receive competitive compensation that varies by level, location, and assigned function. According to Levels.fyi data, the total compensation reflects base salary, potential bonuses, and in some cases stock or restricted stock units (RSUs).

Compensation by level (United States)

| Level | Total / Year | Base / Year | Bonus / Year |

|---|---|---|---|

| C10 (Analyst) | ~ $85K | ~ $83K | ~ $2K |

| C11 | ~ $85K | ~ $79K | ~ $5K Levels.fyi |

| C12 (AVP) | ~ $109K | ~ $109K | ~ $900 |

Note: RSUs at Citi vest over a four-year schedule (25 % per year) for roles or levels where stock grants are provided.

Meanwhile, alternate data sources, such as Glassdoor, show a total pay range of roughly $92K–$128K/yr for many BA roles at Citi in the U.S.

Average Base Salary

Average Total Compensation

Regional salary comparison

| Region | Typical Total / Year (BA role) | Notes |

|---|---|---|

| New York, United States (general U.S.) | $85K–$186 K depending on level | Variation driven by seniority, responsibilities, bonus, location cost-of-living |

| Tampa–St. Pete, Florida, United States | Median ~ $123K (all levels) | Lower cost-of-living vs major metros — less stock/bonus at some levels |

| India (e.g. major centers) | ₹2.03 M–₹5.04 M per year depending on level | Local compensation benchmarks; because of currency and cost-of-living differences, direct comparisons with USD are approximate |

Negotiation Strategies for Citi Business Analyst Candidates

- Negotiate for total-comp, not just base: Because Citi offers bonuses and RSUs at certain levels, frame negotiations around the entire compensation package. A slightly lower base but better bonus/RSU could still yield competitive total pay.

- Leverage local cost-of-living and skill premium (if relocating): If you are applying from a lower-cost region (e.g. outside major U.S. cities), highlight the cost-of-living differential and any specialized skills (analytics, domain knowledge, language, banking regulations) that add value.

- Clarify vesting schedule and bonus eligibility: Before accepting, confirm when RSUs vest, how bonus is calculated, and whether bonus/stock is guaranteed or discretionary.

Learn how to benchmark your offer and prepare for every stage with Interview Query’s salary insights.

FAQs on Citi Business Analyst Interviews

Why choose the business analyst role at Citi?

The Citi business analyst path because offers exposure to large-scale financial systems, global operations, and high-impact regulatory and digital transformation initiatives. Business analysts gain experience across compliance, payments, onboarding, credit, and risk management, building skills that translate across the broader financial industry. Citi’s collaborative culture and emphasis on structured problem-solving also make it an ideal environment for analysts who want to develop both technical and stakeholder-facing capabilities.

How difficult is the Citi business analyst interview?

The interview is moderately challenging for candidates who have strong requirements gathering experience, baseline SQL skills, and familiarity with banking workflows. However, it becomes more difficult for those who have limited exposure to risk, payments, onboarding, or regulatory projects. It’s important to note that Citi places significant emphasis on communication clarity, structured thinking, and the ability to break down ambiguous processes.

What technical skills does Citi expect?

Citi evaluates SQL fundamentals, data interpretation, and comfort working with dashboards or large transactional datasets. Candidates should be able to explain joins, aggregations, and filtering logic, along with how they approach metrics analysis or root cause investigation. Experience with workflow documentation, process mapping, and structured requirements writing is often as important as SQL.

What does “business review” or “Citi job application status: business review” mean?

This status indicates that a recruiter or hiring manager is assessing your resume against the specific needs of the team. It signals that your application has passed the initial screening and is under further review for domain experience, operational background, or alignment with the role’s requirements.

Does Citi ask domain-specific questions?

Yes. Citibank interview questions and answers frequently involve scenarios related to payments, Know Your Customer processes, fraud controls, credit workflows, or operational risk. These questions assess whether you understand how financial systems function, how issues propagate across upstream and downstream teams, and how to recommend solutions grounded in compliance and customer impact.

How long does the Citi hiring process take?

The timeline varies by team but often ranges from two to five weeks. Roles in heavily regulated groups or high-volume hiring functions may require more steps, including assessments or additional stakeholder interviews. Delays often occur during the scheduling of the Citi final round interview, particularly when teams span multiple regions.

How do BA roles differ across Consumer, Institutional Clients Group, and Operations?

Consumer-focused analysts work on credit cards, payments, onboarding flows, and servicing systems. Institutional Clients Group analysts concentrate on corporate banking, Treasury and Trade Solutions, and global markets processes. Operations roles emphasize process controls, reconciliation, regulatory programs, and large-scale workflow optimization. All three paths require strong communication skills and the ability to collaborate with distributed teams, but each emphasizes unique systems and regulatory contexts.

Become a Citi Business Analyst with Interview Query

Citi’s structured interview process rewards candidates who master business analysis fundamentals, banking domain knowledge, SQL, and clear cross-functional communication.

With a strong understanding of Citi’s workflows and a well-organized preparation plan, you can present yourself confidently at every interview stage. To continue your preparation, explore Interview Query’s resources, starting with the comprehensive Citi company guide for better alignment, the question bank for balanced prep, and mock interviews to boost your confidence through simulated scenarios.