Citi Business Intelligence Interview Guide (2026): SQL, Process & Questions

Introduction

Citi’s growing investment in analytics, automation, and data governance has made business intelligence one of the fastest expanding skill areas inside the bank. Across financial services, the demand for analysts with strong SQL, dashboarding, and data storytelling skills continues to rise, with the United States Bureau of Labor Statistics projecting a 35% growth rate for data-focused roles through 2032. This rapid expansion reflects how essential high quality reporting and insight generation have become for risk management, regulatory initiatives, and client analytics at large institutions like Citi.

At the same time, roles in business intelligence remain competitive. Candidates need to demonstrate strong analytical reasoning, comfort with complex datasets, and readiness to contribute within Citi’s highly regulated environment. This guide is curated to help you prepare with clarity and purpose. You will learn how the Citi business intelligence interview works, what business intelligence specific questions are asked, and the strategies top candidates use to stand out. This guide outlines each stage of the Citi business intelligence interview, highlights common questions, and shares proven strategies to help you stand out and prepare effectively with Interview Query.

Citi Business Intelligence Interview Process

The Citi business intelligence interview process evaluates how well you analyze data, build dashboards, write efficient SQL, and communicate insights in a clear and structured way. Because business intelligence teams support risk, finance, operations, and regulatory reporting, Citi places strong emphasis on accuracy, data lineage, and stakeholder communication. The full process typically spans three to five weeks depending on team schedules, and includes multiple rounds assessing SQL proficiency, dashboarding skills, business reasoning, and alignment with Citi’s standards for governance and control. Below is a breakdown of each stage and what Citi teams look for during evaluation.

Application And Resume Screen

During the initial review, Citi recruiters look for strong SQL experience, proficiency in tools such as Tableau or Power BI, and hands on work with large operational or financial datasets. Experience with dashboards, KPI automation, ETL workflows, or data quality processes is especially relevant given Citi’s regulatory and reporting environment. Resumes that highlight measurable improvements to reporting accuracy, workflow efficiency, or business decision making stand out more clearly.

Tip: Quantify your impact by including metrics such as reduced reporting time, improved data accuracy, or the size of datasets and workflows you supported.

Initial Recruiter Conversation

The recruiter call is a short, structured discussion focused on your background and readiness for a business intelligence role at Citi. Recruiters confirm your experience with SQL, dashboard development, reporting workflows, and cross functional communication. They may ask about your familiarity with regulated industries or large enterprise data systems, although prior financial services experience is not strictly required. This stage also covers timing, team fit, and compensation ranges.

Tip: Prepare a concise example of a BI project that demonstrates your ability to clean data, build dashboards, and communicate insights clearly.

Technical Screen

The technical screen usually includes one or two interviews focused on SQL, dashboard thinking, and business reasoning. You may be asked to write SQL queries that join multiple datasets, calculate KPIs, detect anomalies, or generate aggregated views for executive reporting. Interviewers often explore how you validate data, handle inconsistencies, structure metrics, and design dashboards that align with stakeholder needs. Some screens also include conceptual questions about data modeling, KPI frameworks, and reporting logic.

Tip: Practice writing SQL in a plain text environment since many Citi technical screens use collaborative documents without autocomplete.

Case Study Or Take Home Assignment

Some Citi teams require a case study to evaluate how you approach real world analysis, reporting logic, and communication. These tasks may include building a dashboard, writing SQL transformations, identifying root causes of performance changes, or summarizing insights in a format suitable for senior leadership. Practice with Interview Query’s take-home challenges which reflect how top companies assess analytical thinking, to structure your work clearly and communicating impact effectively.

Tip: Present a clear thought process with explicit assumptions, validation steps, and a summary that ties results back to business impact.

Final Onsite Interview

The final onsite includes four to five interviews that mirror real business intelligence challenges at Citi. Each round evaluates your SQL accuracy, dashboard reasoning, analytical structure, and communication in complex, regulated environments.

SQL and data transformation round: You will write SQL to join datasets, compute KPIs, and handle messy data. Interviewers assess how you validate assumptions and ensure reporting accuracy. Practice your SQL fundamentals with our Beginners SQL Challenge, which is a hands-on learning opportunity designed for newcomers to SQL

Tip: Clarify edge cases up front and explain your logic before writing the final query.

Dashboarding and visualization round: You will outline how you design dashboards, choose KPIs, and structure insights for leadership. Teams want clear reasoning tied to decision-making.

Tip: Frame every design choice around user needs and the action the dashboard enables.

Analytics and business case round: You will interpret trends, identify root causes, and recommend next steps for a business scenario. Interviewers look for structured thinking and clarity.

Tip: Focus on a few high impact drivers and tie each insight to a concrete business outcome.

Product and decision support round: You will explain how you support decisions with data, prioritize metrics, and communicate tradeoffs. This round checks strategic judgment and clarity.

Tip: Link recommendations to measurable impact such as efficiency, customer experience, or risk reduction.

Behavioral and collaboration round: You will discuss how you handle data issues, cross functional alignment, and urgent requests. The goal is to assess communication and ownership.

Tip: Use concise STAR stories that emphasize accountability and effective collaboration.

Hiring Committee And Offer

After the onsite, Citi gathers written feedback from each interviewer to evaluate your technical strength, communication clarity, and alignment with team expectations. Hiring managers determine level placement based on demonstrated experience in SQL, reporting, dashboard development, and analytical reasoning. Approved candidates receive an offer that includes base salary, bonus, and potential equity depending on location and level.

Tip: Express your preferred focus areas early since Citi BI teams are spread across risk, finance, operations, and customer analytics.

Ready to strengthen your Citi BI interview approach? Join Interview Query’s Coaching Program to work 1:1 with mentors who help refine your SQL strategy, sharpen your dashboard thinking, and build confidence for every stage of the process.

Citi Business Intelligence Interview Questions

The Citi business intelligence interview includes a mix of SQL analysis, dashboarding scenarios, business case reasoning, and structured behavioral questions. These questions evaluate how well you work with complex operational and financial data, design metrics that support decision making, validate data quality, and communicate insights clearly to risk, finance, and operations stakeholders. Citi interviewers look for precision, structured thinking, and the ability to translate ambiguous business problems into clear, data driven recommendations.

Read more: Business Intelligence Interview Questions

Below are the major question categories and how Citi typically evaluates candidates.

SQL And Data Transformation Interview Questions

In this stage, Citi focuses on your ability to write accurate SQL queries, analyze trends, and structure reporting logic that aligns with strict data governance standards. Queries often involve multiple joins, time based aggregations, anomaly detection, and KPI computations used in executive or regulatory reporting.

-

Citi asks this to gauge whether you can compute period over period KPIs used in executive reporting and regulatory dashboards. The solution uses a window function to compare each month’s revenue to the prior month, applies date truncation, and rounds the percentage change. You would aggregate revenue by month, join it to a lag value, and compute

(current - previous) / previous * 100.Tip: Mention how you validate missing months because incomplete periods can skew Citi’s financial reporting.

-

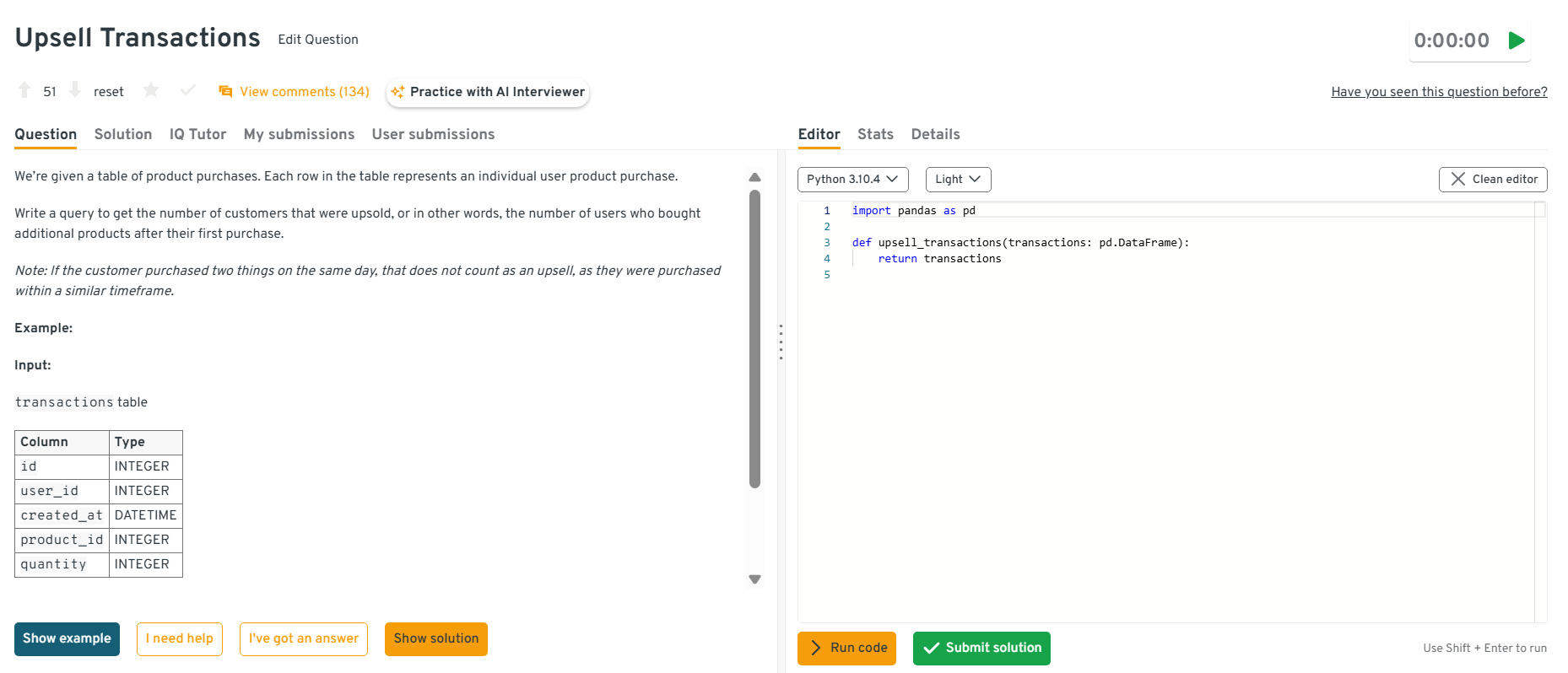

Citi includes this question to check whether candidates can reason about customer journeys and behavioral analytics. You solve it by identifying each customer’s first purchase date, joining it back to all later transactions, and counting customers with at least one subsequent purchase. This typically uses a subquery with

MIN(transaction_date)grouped by customer and a self join filtered on later activity.Tip: Note the importance of grain consistency since Citi datasets often combine multiple transaction systems.

Head to the Interview Query dashboard to practice the full set of business intelligence interview questions. With structured SQL drills, analytics cases, and AI-guided tips, it is one of the most effective ways to sharpen your technical reasoning and decision support skills for Citi BI interviews.

-

This evaluates your ability to extract end-of-day snapshots, which are critical for reconciliation and daily risk monitoring at Citi. You would partition by date using a window function like

ROW_NUMBER()ordered by timestamp descending, then filter for the first row per partition. Finally, sort results chronologically.Tip: Explain how you convert timestamps to the correct business calendar date, especially with late-night postings or time zone differences.

-

The question tests your skill in event frequency analysis and validating activity across consecutive days, something Citi uses for compliance and customer behavior monitoring. You filter transactions to the first five days, group by user and count distinct dates, then return users whose count equals five.

Tip: Call out how you handle days with zero system activity, which can impact controlled reporting environments.

-

Rolling metrics matter to Citi because analysts monitor short-term changes in deposits, liquidity, and operational volume. You aggregate deposits by day, then use a window function with a three day frame such as

ROWS BETWEEN 2 PRECEDING AND CURRENT ROWto compute the rolling average.Tip: Mention performance considerations, since Citi tables can span millions of daily records and require efficient windowing.

-

Citi asks this to see whether you understand data quality remediation, a common responsibility in BI reporting. The solution finds the most recent salary record per employee using

MAX(update_timestamp)or a window function likeROW_NUMBER()ordered by update time, then selects the top row per employee.Tip: Tie your answer to the importance of auditability, since HR and compensation data require strict version control at Citi.

Want to master SQL interview questions? Start with our SQL Question Bank to drill real-world scenario questions used in top interviews.

Dashboarding And Visualization Interview Questions

These questions evaluate how well you design dashboards that support decision making. Citi values clarity, accuracy, and narrative flow, especially for dashboards used in risk or executive reporting.

Walk through how you design a KPI dashboard for senior leadership.

Citi uses this to see whether you build dashboards that help executives make decisions quickly. You begin by identifying the core questions leadership needs answered, select KPIs tied to risk, operational health, or financial performance, and design a clean layout that highlights trends, exceptions, and drill downs. Visual choices must reduce cognitive load and support rapid interpretation.

Tip: Start by defining the decision the dashboard will influence, then design backward from that goal.

Explain how you would optimize a Tableau dashboard that loads slowly.

Performance is critical at Citi because dashboards often sit on large, regulated datasets. To optimize, you would reduce data volume, create extracts, limit quick filters, replace row level calculations with aggregates, and remove unused fields. You would also confirm that backend SQL queries and joins are efficient and aligned to the dashboard’s grain.

Tip: Always profile slow running queries since backend inefficiencies, not visuals, often cause Citi’s dashboard delays.

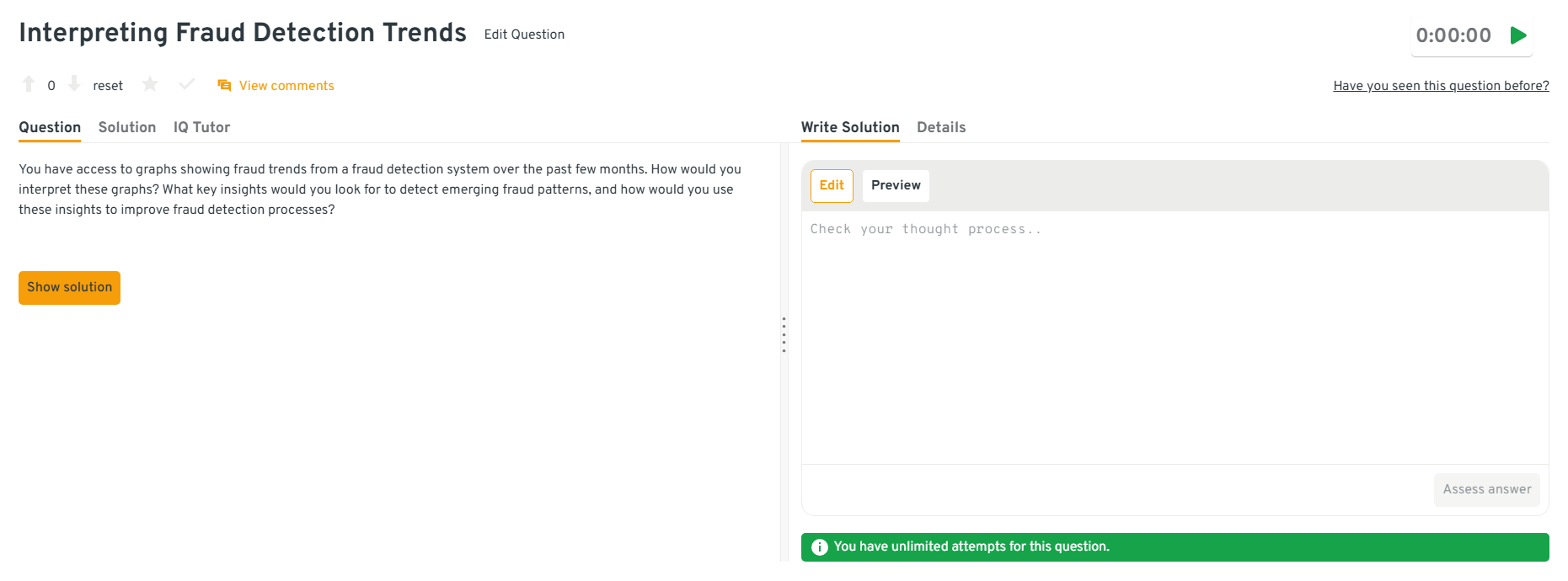

-

Citi expects BI analysts to recognize visual indicators of fraud risk. You would study spikes, shifts in geography or channels, sudden volume surges, and new behavior clusters, then segment the data to isolate the root drivers. These insights inform risk thresholds, monitoring alerts, or policy changes that strengthen fraud controls.

Tip: Pair visual trends with validation queries, as Citi requires evidence backed by multiple data points before adjusting risk logic.

Head to the Interview Query dashboard to practice the full set of business intelligence interview questions. With structured SQL drills, analytics cases, and AI-guided tips, it is one of the most effective ways to sharpen your technical reasoning and decision support skills for Citi BI interviews.

-

This checks whether you design dashboards that adapt to diverse merchant behaviors. You would select KPIs such as sales trends, refund rates, dispute frequency, and customer retention, then pick visuals that highlight patterns across merchant size, product type, or geography. The goal is a dashboard that surfaces performance gaps and operational risks.

Tip: Prioritize segment level comparisons because Citi evaluates merchants differently based on volume and risk exposure.

-

Citi uses this scenario to test your operational reasoning. You would identify the timing and magnitude of congestion, correlate peaks with business processes, and assess impacts on downstream workflows. Recommendations may include rebalancing workloads, adjusting batch schedules, or increasing processing capacity to maintain service stability.

Tip: Tie every recommendation to reduced operational risk, a core focus across Citi’s reporting and infrastructure teams.

Looking for hands-on problem-solving? Test your skills with real-world challenges from top companies. Ideal for sharpening your thinking before interviews and showcasing your problem solving ability.

Analytics And Business Case Interview Questions

These scenarios test your reasoning, business intuition, and ability to interpret ambiguous datasets. Citi wants BI analysts who can identify meaningful patterns, assess operational risks, and structure insights clearly even when data is incomplete. Your responses should illustrate a strong hypothesis-driven approach, awareness of financial and regulatory contexts, and the ability to connect analysis to high-impact decisions across teams.

-

Citi asks this to see how you handle large scale data changes without disrupting reporting pipelines. You would create the column as nullable, backfill in controlled batches during off peak hours, and add indexes only after completion. Using partitioned updates, incremental scripts, or shadow tables ensures the process avoids table locks and latency spikes.

Tip: Always mention coordination with data engineering since Citi enforces strict controls around schema changes.

-

This evaluates your ability to blend analytics with business prioritization. You would build a scoring model using factors like revenue growth, spending patterns, creditworthiness, industry stability, and existing Citi product penetration. After ranking businesses, you validate the list with risk and marketing teams before final selection.

Tip: Reference cross functional alignment, as Citi relies on multiple control groups before launching acquisition campaigns.

Identify the root cause of a sudden spike in customer servicing volume.

Analysts at Citi frequently diagnose operational spikes, so interviewers want structured reasoning. You would segment by channel, product, region, and time of day, compare against historical baselines, and review upstream changes such as system outages, policy adjustments, or marketing campaigns. Each hypothesis is validated with supporting metrics and partner team input.

Tip: Call out how you cross check volume with incident logs or workflow data, common practice in regulated operations.

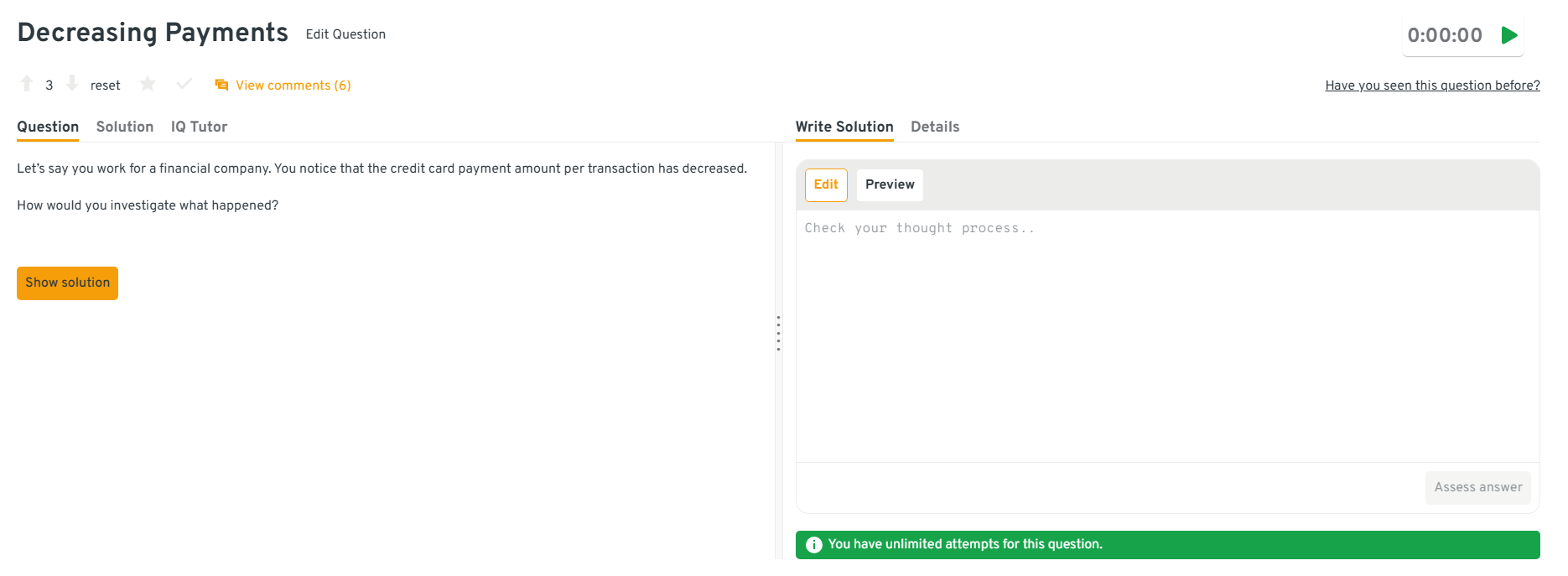

-

Citi asks this to test your ability to uncover financial behavior shifts. You would compare payment distributions over time, segment by card type and customer group, review seasonal impacts, and evaluate external factors like promotions or fee changes. Identifying whether the drop comes from fewer large payments or broad behavioral change guides next steps.

Tip: Always check for data quality issues first, since payment files often have batch timing differences.

Head to the Interview Query dashboard to practice the full set of business intelligence interview questions. With structured SQL drills, analytics cases, and AI-guided tips, it is one of the most effective ways to sharpen your technical reasoning and decision support skills for Citi BI interviews.

-

This question assesses your ability to find partnership opportunities using transaction trends. You analyze spend concentration, loyalty indicators, growth segments, and category overlaps between Citi cardholders and potential merchants. High affinity brands with strong spend velocity and low churn become top candidates.

Tip: Emphasize using multi year trends, since Citi evaluates partnerships on long term stability, not short term spikes.

Watch Next: Amazon Business Intelligence Mock Interview: Duplicate Products

In this mock interview session, Jay interviews a data scientist and business intelligence engineer at Amazon, who walks through how to solve a commonly asked Amazon BI case study on identifying duplicate products. We break down an open-ended business problem, explore how to structure clarifying questions, and design a scalable analytical approach that can help you build confidence and elevate your BI interview performance.

Behavioral Interview Questions

Behavioral questions assess communication, stakeholder alignment, and maturity in ambiguous situations. Citi emphasizes professionalism, ownership, and structured communication in cross-functional settings, so your responses should reflect those values. These questions help interviewers evaluate how you navigate competing priorities, resolve conflicts, and maintain accuracy under pressure.

Tell me about a time you resolved a data quality issue that affected a key report.

This question evaluates how you handle data integrity problems in a high-stakes reporting environment like Citi, where inaccuracies can impact regulatory, risk, or executive reporting. Strong answers show structured diagnosis, cross-functional alignment, and proactive communication.

Example: “In a monthly liquidity report reviewed by senior leadership, I noticed balances were inconsistent with prior trends. I traced the issue to a timestamp mismatch introduced during a recent ETL change. I partnered with data engineering to correct the transformation logic, validated the fix against historical snapshots, and communicated a revised delivery timeline to stakeholders. The corrected report restored confidence and prevented incorrect downstream decisions.”

Tip: Show ownership by explaining how you validated the fix and communicated risk clearly.

What are you looking for in your next job?

Citi asks this to assess whether your goals align with its data-driven culture and emphasis on governance, accuracy, and operational impact. Interviewers want to hear intent and direction, not generic ambition.

Example: “In my current role, I’ve owned reporting for a single product line. I’m looking to expand my scope by supporting broader, enterprise-level metrics where accuracy and governance matter. Citi’s scale and focus on data quality would let me build dashboards that influence risk and operational decisions, which is the direction I want my BI career to grow.”

Tip: Tie your motivation to scope, impact, and learning, not titles or compensation.

-

Citi uses this to gauge how you manage alignment across finance, risk, operations, and technology teams with different priorities and vocabularies.

Example: “During a regulatory reporting project, operations and technology teams disagreed on how to define a key volume metric. I documented each interpretation, identified where assumptions diverged, and facilitated a short alignment session. We agreed on a single definition, documented it in a shared metrics guide, and avoided repeated rework in future cycles.”

Tip: Emphasize how you create shared understanding, not just compromise.

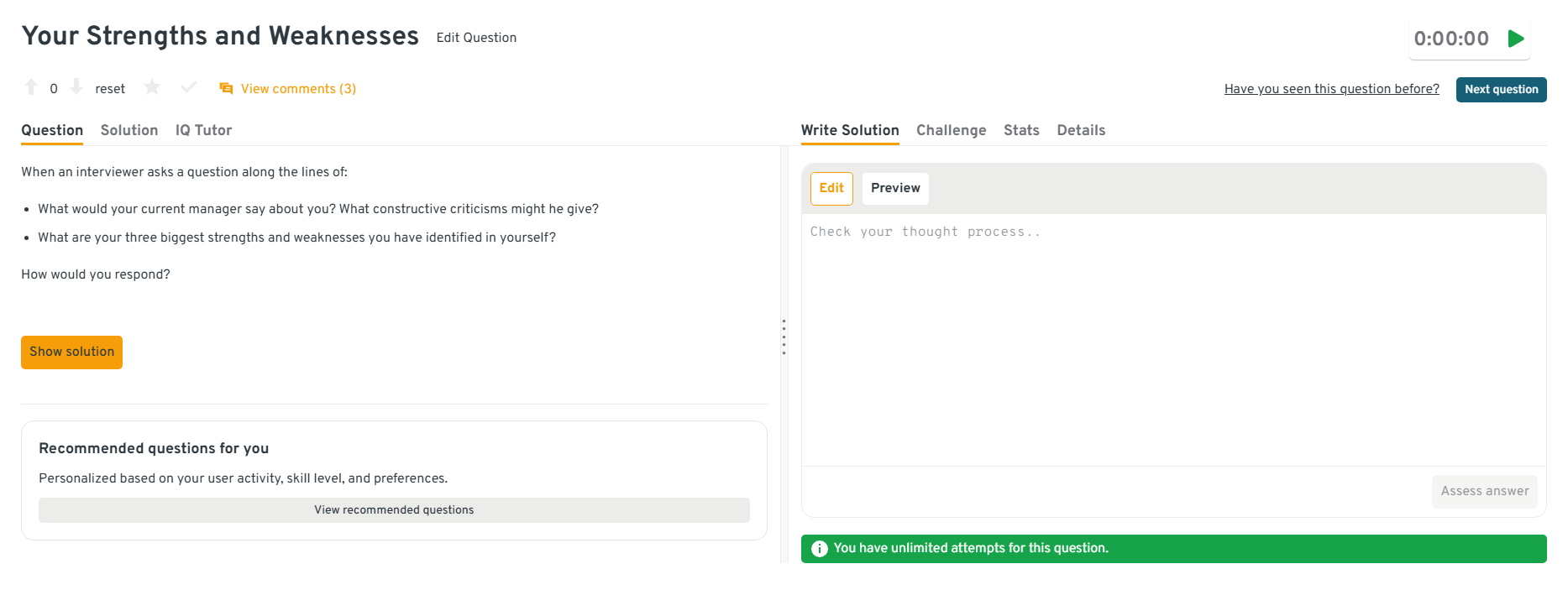

What would your current manager say about you? What constructive criticisms might he give?

This question assesses self-awareness, maturity, and your ability to grow within Citi’s feedback-driven environment. Balance strengths with an authentic, non-alarming development area.

Example: “My manager would say I’m dependable because I consistently deliver executive dashboards on time, even during quarter-end pressure. For example, I led reporting during a system migration without missed deadlines. He’s also advised me to simplify explanations for senior audiences, so I now lead with insights first and keep technical detail in backup slides.”

Tip: Frame weaknesses as actively improving behaviors that won’t impact your core BI responsibilities.

Head to the Interview Query dashboard to practice the full set of business intelligence interview questions. With structured SQL drills, analytics cases, and AI-guided tips, it is one of the most effective ways to sharpen your technical reasoning and decision support skills for Citi BI interviews.

Give an example of working under tight deadlines with incomplete data.

Citi wants to see how you manage ambiguity while maintaining accuracy, especially during regulatory or operational reporting cycles.

Example: “A leadership request required next-day analysis on transaction trends, but one upstream system was delayed. I delivered a preliminary view using validated sources, clearly labeled assumptions, and flagged missing data. Once the final feed arrived, I updated the analysis and confirmed conclusions. This allowed leadership to act quickly without misinterpreting the data.”

Tip: Show calm judgment, clear communication, and respect for data accuracy even under pressure.

Want to strengthen your Citi BI interview skills? Practice real hands-on SQL, analytics, and dashboarding problems on the Interview Query Dashboard and start getting interview-ready today.

What Does a Citi Business Intelligence Analyst Do?

Business intelligence analysts at Citi support the reporting, analytics, and automation that power decisions across risk, finance, operations, and customer engagement. They transform complex data into clear insights, build dashboards leaders rely on, and ensure reporting meets the accuracy standards expected of a global bank operating in a highly regulated environment. Their work directly supports Citi’s modernization efforts, especially as the company expands its investment in data quality, digitization, and real time analytics.

Common responsibilities include:

- Designing and maintaining KPI dashboards in tools like Tableau and Power BI, ensuring each visualization aligns with executive reporting standards and accurately reflects live operational and financial metrics.

- Writing advanced SQL queries to extract, transform, and validate large datasets across multiple systems, with a focus on data lineage, consistency, and audit readiness.

- Supporting regulatory and risk reporting through automated workflows, data quality checks, and structured analysis that helps teams identify anomalies, interpret trends, and mitigate operational risk.

- Partnering with product, finance, operations, and risk teams to translate business requirements into data models, reporting logic, and actionable insights that support strategic planning and continuous improvement.

How to Prepare for a Citi Business Intelligence Interview

Preparing for the Citi business intelligence interview requires a mix of strong SQL skills, clear data storytelling, dashboard design intuition, and the ability to operate within a highly controlled financial environment. Citi relies heavily on accurate reporting and analytical rigor, so candidates must demonstrate precision, structured reasoning, and the ability to translate complex data into actionable insights for risk, finance, and operations teams.

Read more: Google Business Intelligence Interview

Below is a step-by-step preparation guide aligned to Citi’s expectations.

Master financial and operational metric frameworks: Study how banks measure risk exposure, operational efficiency, customer activity, and regulatory KPIs so you can reason through metric design and interpretation.

Tip: Practice explaining the intent behind each KPI and how it influences day to day decisions.

Build dashboards that tell concise stories: Practice structuring dashboards around decisions, not visuals. Prioritize layout, drill downs, and segmentation aligned with leadership needs and financial reporting logic.

Tip: Take an old dashboard you created and rebuild it with fewer visuals and clearer narrative flow.

Develop a habit of rigorous data validation: Financial environments demand traceability. Practice verifying field definitions, comparing sources, and documenting assumptions so your work stands up to scrutiny.

Tip: Build checklists for validating joins, time boundaries, and outlier patterns before presenting results.

Improve your business case reasoning: Work through case prompts that require diagnosing KPI drops, evaluating workflow changes, or recommending new metrics. Focus on structured frameworks rather than ad hoc analysis.

Tip: Summarize each problem using a simple three part structure: driver analysis, insight, and action.

Sharpen communication for cross functional audiences: Practice presenting insights to non technical teammates such as operations or risk managers. Focus on clarity, context, and actionable recommendations.

Tip: Deliver a past analysis in two formats: a 30 second summary and a 3 minute explanation.

Run BI focused mock interviews: Combine SQL drills, dashboard walkthroughs, and case scenarios to simulate Citi’s interview structure. Review your logic, clarity, and assumptions after each session.

Tip: Use Interview Query’s challenges, mock interviews, and coaching program to refine your approach before the final rounds.

Want realistic BI interview practice without scheduling or pressure? Try Interview Query’s AI Interviewer to simulate Citi-style SQL, analytics, and dashboarding questions and get instant, targeted feedback.

Average Citi Business Intelligence Salary

Citi business intelligence analysts earn competitive compensation across levels, supported by robust salary structures typical of large financial institutions. Compensation generally includes a base salary, annual bonus, and stock awards, with equity becoming a more meaningful component at senior levels. Citi’s focus on modernization and data quality initiatives has increased demand for BI talent, resulting in strong compensation bands for analysts and associates.

Citi Business Intelligence Compensation Overview (2025-2026)

| Level | Total Compensation (USD) | Base Salary | Bonus | Stock (RSUs) | Notes |

|---|---|---|---|---|---|

| Analyst / Associate | $90K – $120K | $75K–$100K | Performance based | $3K–$8K | Common entry point for BI roles |

| Assistant Vice President (AVP) | $115K – $145K | $95K–$120K | Performance based | $5K–$12K | Larger bonus potential at this level |

| Vice President (VP) | $140K – $180K | $110K–$140K | Higher bonus targets | $10K–$20K | Compensation varies heavily by business line |

| Senior Vice President (SVP) | $175K – $240K+ | $135K–$170K | High performer bonuses | $20K–$35K+ | Significant increases tied to scope and oversight |

These estimates are based on 2025-2026 salary data from Levels.fyi, Glassdoor, public job postings, and Interview Query’s internal compensation research. Actual ranges may vary by location and team.

Tip: Compensation typically rises significantly after year-two equity vesting begins, especially from AVP level onward.

Negotiation Tips That Work For Citi

Negotiating effectively at Citi requires an understanding of leveling, business lines, and how compensation varies across regulated functions like risk and operations.

- Clarify your target level early: Citi’s titles (Analyst, AVP, VP, SVP) influence both compensation and responsibility. Ensuring accurate leveling before negotiations prevents misaligned expectations.

- Request location specific salary bands: Citi pays noticeably higher ranges for New York and regulatory roles. Ask for geographic adjustments if interviewing for hybrid or in office positions.

- Leverage cross offer benchmarks professionally: Citi responds well when candidates reference market data or competing offers from other banks or fintech companies without pressure tactics.

- Ask for a full compensation breakdown: Request details on bonus targets, equity vesting, and any relocation or sign on incentives so you understand the complete package, not only base salary.

- Emphasize impact and accuracy: Highlighting your contributions to data quality, reporting automation, or decision support strengthens your case because BI work directly affects regulatory and operational outcomes.

Tip: Position yourself as someone who reduces risk and improves reporting accuracy, since these contributions often justify stronger compensation packages at Citi.

FAQs

How long does the Citi business intelligence interview process take?

Most candidates complete the Citi BI interview process within three to five weeks from the initial recruiter screen to final decision. The exact timeline depends on the team, location, and whether a case study or additional stakeholder interviews are included. Recruiters typically provide clear updates after each stage and outline next steps early.

Does Citi require finance or banking experience for BI roles?

Not always. While prior experience in financial services can be helpful, Citi places greater emphasis on SQL proficiency, analytical rigor, and clear communication. Candidates who show strong problem structuring and the ability to quickly learn regulated environments can succeed without a traditional banking background.

How technical is the Citi business intelligence interview?

The interview is moderately technical and centers on SQL, data transformation logic, and dashboard reasoning. You are not expected to write production code, but you should be comfortable handling complex queries, validating data, and explaining analytical decisions clearly. Business context matters as much as query correctness.

What tools should I know for a Citi BI interview?

SQL is essential, and Tableau or Power BI is commonly used across BI teams. Familiarity with Excel is expected, while basic Python knowledge can be useful for data validation or automation. Understanding data governance concepts is especially valuable for teams supporting risk or regulatory reporting.

What types of BI teams does Citi hire for?

Citi hires BI analysts across risk management, finance, operations, customer analytics, and reporting transformation initiatives. Each team focuses on different metrics and data sources, but all value accuracy, structured analysis, and strong stakeholder communication.

Does Citi use take home assignments?

Some teams include a take home assignment as part of the interview process. These typically involve SQL queries, dashboard creation, or a short written summary of insights. The goal is to evaluate analytical thinking, clarity of explanation, and how you structure real-world BI work.

How important is communication in a Citi BI interview?

Communication is critical. BI analysts regularly present insights to non technical stakeholders, including leadership and risk partners. Interviewers assess how clearly you explain metrics, assumptions, and tradeoffs, not just whether your analysis is technically correct.

Do Citi BI roles involve coding beyond SQL?

In most cases, no. SQL is the primary technical requirement for BI roles. Some teams use Python for data checks or workflow automation, but advanced software engineering skills are not expected or heavily tested.

How can I stand out in the Citi BI interview?

Strong candidates demonstrate structured thinking, precise SQL logic, and clear storytelling around dashboards and case scenarios. Emphasizing data validation, decision support, and how your insights drive action helps differentiate you from other applicants.

What is the best way to prepare for the behavioral interview?

Prepare concise STAR stories that show ownership, communication, and collaboration. Focus on examples involving data quality issues, tight deadlines, and cross functional alignment, since these scenarios closely mirror the challenges BI teams face at Citi.

Start Your Citi Business Intelligence Interview Prep Today

Preparing for the Citi business intelligence interview means strengthening your analytical judgment, refining how you communicate insights, and practicing the SQL and dashboarding skills that drive high quality reporting inside a global bank. By working through real world BI scenarios and building confidence in structured problem solving, you can approach each interview stage with clarity and precision. Use realistic practice sessions through mock interview modules to sharpen your reasoning under pressure, and take advantage of personalized guidance through Interview Query’s coaching program to refine your approach even further. With dedicated preparation and the right tools, you can navigate Citi’s process and stand out as a strong BI candidate.

Want to boost your BI interview readiness? Explore Interview Query’s full question bank to practice hands on problems and reach your next interview fully prepared.