Citi Data Analyst Interview Guide: Process, SQL Questions, Tips & Preparation

Introduction

Data-driven decision-making sits at the center of Citi’s global operations, from consumer banking and anti–money laundering to credit risk, operations, and markets. As the financial industry becomes more regulated and more dependent on accurate reporting, data analysts have become one of the most steadily growing roles in banking. In fact, the U.S. Bureau of Labor Statistics projects continued expansion in analytics roles through 2032, driven by demand for operational transparency, automation, and compliance accuracy.

For candidates preparing for Citi data analyst interview questions, this guide will walk you through the full interview process, the skills Citi evaluates, and how to prepare effectively. Because Citi handles trillions of dollars in transactions and operates across more than 90 countries, analysts must demonstrate strong SQL fundamentals, sound data judgment, and an ability to work with risk, operations, and compliance teams. This guide gives you a structured roadmap so you enter each interview round prepared and confident, with examples of real Citi data analyst interview questions and structured ways to answer them.

What does a Citi data analyst do?

Citi data analysts extract, transform, and interpret large datasets to support regulatory reporting, operations, risk management, and business decision-making. Unlike general analytics roles, Citi analysts balance technical execution with rigorous data quality, process controls, and documentation standards. Analysts work across global teams and often support functions that directly impact customer protection, regulatory compliance, and financial performance.

Key responsibilities include:

- Extracting, cleaning, and transforming data using SQL, SAS, and Python

- Developing analytical models, reports, and dashboards that support business decisions

- Investigating and remediating data quality issues across operational systems

- Partnering with global teams to align data definitions, processes, and controls

- Performing trend and root-cause analysis to identify issues or opportunities

- Communicating insights clearly to internal stakeholders across operations, risk, and technology

- Ensuring compliance with Citi policies, regulatory standards, and risk frameworks

Citi analysts operate at the intersection of business and technology, ensuring that decisions are supported by clean, reliable, and well-governed data.

Why this role at Citi?

A Citi data analyst role is an excellent fit for candidates who want to work at scale, influence high-impact decisions, and grow within one of the world’s largest financial institutions. Citi’s global footprint means analysts work with diverse datasets, multilingual teams, and cross-border operations—giving them a unique foundation in complex data environments.

Candidates choose this role because:

- You work on meaningful problems. Analysts contribute to credit workflows, anti–money laundering efforts, operational efficiency, customer analytics, and regulatory reporting.

- You gain strong technical foundations. Citi emphasizes SQL, SAS, Python, and controlled analytical processes, building rigor and structure early in your career.

- You operate in a compliance-first environment. Analysts learn how data quality, documentation, and traceability tie directly to financial risk and regulatory expectations.

- You collaborate across global teams. Many roles involve working with counterparts in APAC, EMEA, and NAM, strengthening your communication and project coordination skills.

- You build a transferable analytics career path. Skills gained here apply to future roles in data engineering, risk analytics, model validation, operations, and product analytics.

For candidates seeking a role that blends analytics, process discipline, and real-world business impact, Citi offers one of the most structured and globally relevant paths.

Citi Data Analyst Interview Process

This section breaks down the full Citi data analyst interview process, from online assessment to final round.

Citi’s interview process evaluates your analytical foundations, SQL fluency, data judgment, and ability to work in a highly regulated financial environment. Because analysts frequently support risk, compliance, operations, and reporting teams, interviewers look for candidates who think clearly, document their assumptions, and communicate well across global groups. Many candidates prepare with the data analyst interview learning path and strengthen SQL fundamentals using the SQL interview learning path, which mirror the structure and complexity of Citi’s technical screens.

Below is the full interview flow.

Interview stages

| Stage | What it focuses on |

|---|---|

| Initial screening / online assessment | Resume alignment, basic reasoning, SQL or logic checks |

| Technical Interviews (1–2 rounds) | SQL, Python, analytics scenarios, data quality, project walkthroughs |

| Behavioral / HR interview | Collaboration, communication, stakeholder management |

| Final round | Senior stakeholder alignment, deeper technical or domain discussion |

Initial screening / online assessment

This stage confirms whether your background fits the team’s expectations. For some roles, Citi includes an online assessment with logic, pattern recognition, or light technical questions.

Some teams include a structured Citi data analyst online assessment, which may mix logical reasoning with basic SQL-style problems.

What interviewers evaluate:

- SQL or logic fundamentals

- Ability to explain past projects clearly

- Fit with analytics, operations, or risk-oriented workflows

- Your interest in Citi and understanding of the role

Tip: Prepare a 60–90 second overview of your most relevant project. Focus on impact, not tool lists.

If you want to practice logical and SQL-style questions similar to Citi’s online screens, try the data analyst interview questions library.

Technical interviews (1–2 rounds)

Citi’s technical rounds combine SQL, Python, and scenario-based analytics questions. Interviewers often ask you to walk through how you clean data, investigate inconsistencies, or design an analysis for business partners. Reviewing patterns in the SQL scenario-based questions can help here.

Here is the structure in a clearer table:

| Category | What to expect |

|---|---|

| SQL (core focus) | Joins, window functions, aggregations, data cleaning, duplicate handling, writing queries live |

| Python | Filtering, grouping, manipulating DataFrames, basic modeling logic |

| Analytics scenarios | Trend analysis, root cause analysis, KPI definition, risk/operational cases |

| Project deep dives | End-to-end explanation of your role, data sourcing, challenges, and decision impact |

| Data quality reasoning | How to detect inconsistencies, validate numbers, reconcile mismatched reports |

Example topics Citi frequently tests:

- Handling missing values or duplicate trade/transaction records

- Investigating sudden metric changes

- Designing a reporting query for monthly performance

- Explaining model evaluation metrics (AUC, recall, confusion matrix)

- Analyzing a financial or operational dataset

Many candidates practice related questions through the data science interview questions section, which overlaps heavily with Citi’s analytics expectations.

Tip: Always narrate your assumptions (“I’m assuming this is one row per transaction…”) before writing your SQL.

Behavioral / HR interview

This round assesses communication style, teamwork, and how you handle ambiguity. Interviewers also look for how clearly you collaborate with cross-border teams and how you manage stakeholder expectations.

What to highlight:

- Clear STAR-formatted answers

- Ownership, proactiveness, and analytical rigor

- How you balance speed with accuracy in a regulated environment

- Evidence of strong communication with global teams

If you want practice prompts, check the behavioral interview questions library for data-focused scenarios.

Final interview

The final stage may be with a senior manager, lead analyst, or cross-functional partner. Expect a blend of higher-level technical questions and broader discussions of risk, compliance, and how you structure your work.

They may ask about:

- How you prioritize analytical requests

- How you validate data before delivering a report

- Your understanding of Citi’s businesses (e.g., retail banking, credit, AML, operations)

- How you communicate blockers or escalate issues

This stage ultimately evaluates judgment, maturity, and whether you can operate in an environment where accuracy and documentation matter.

Tip: Bring one polished project story. Keep it to problem → data → approach → insights → impact.

Citi Data Analyst Interview Questions

Citi’s data analyst interviews focus on SQL depth, data quality reasoning, and your ability to structure ambiguous business problems. You can expect hands-on SQL, scenario-based analytics questions, and stakeholder-oriented behavioral prompts. If you want to practice with similar patterns, explore the SQL interview learning path or the broader data analyst interview questions library.

SQL and data manipulation interview questions

Citi’s interviews lean heavily on SQL depth. Many candidates prepare specifically for Citi data analyst SQL questions, which often include joins, window functions, deduplication, and time-based reporting logic.

-

Filter the dataset to the 2020 time window, extract the month field, and compute three aggregates: number of distinct users, total transactions, and sum of order amount. Interviewers evaluate whether you correctly group by month and avoid duplicated counting. This question tests your ability to build recurring operational dashboards.

Tip: Always clarify whether “users” refers to distinct active users or total customers with any activity that month.

-

Join employees with departments, filter out smaller groups, and calculate the percentage of employees exceeding the threshold. Then rank the resulting percentages using a window function. Interviewers check denominator correctness and grouping discipline.

Tip: State how you would handle departments with exactly ten employees versus more.

How would you write a query to identify duplicated customer accounts in a client master table?

Use grouping or window functions on key attributes such as name, date of birth, or client reference. Once duplicates are identified, choose the canonical record through rules like earliest creation date or highest-quality source. Citi uses similar logic for KYC, AML, and onboarding.

Tip: Explain how you would track duplicate rates over time with automated alerts.

How would you calculate year-over-year growth in transaction count for each banking product?

Aggregate transactions by product and year, join each year to its prior year, and compute either absolute or percentage change. This tests your ability to compare performance across time while handling missing values for new products.

Tip: Confirm whether growth should be shown for all products or only those with multiple years of history.

How would you identify accounts whose daily balance dropped more than 40 percent relative to the prior day?

Use LAG to retrieve the previous balance, compute the percent change, and filter on large declines. Citi analysts use similar logic when investigating unusual client behavior or operational anomalies.

Tip: Point out how you would handle weekends, holidays, and missing days.

-

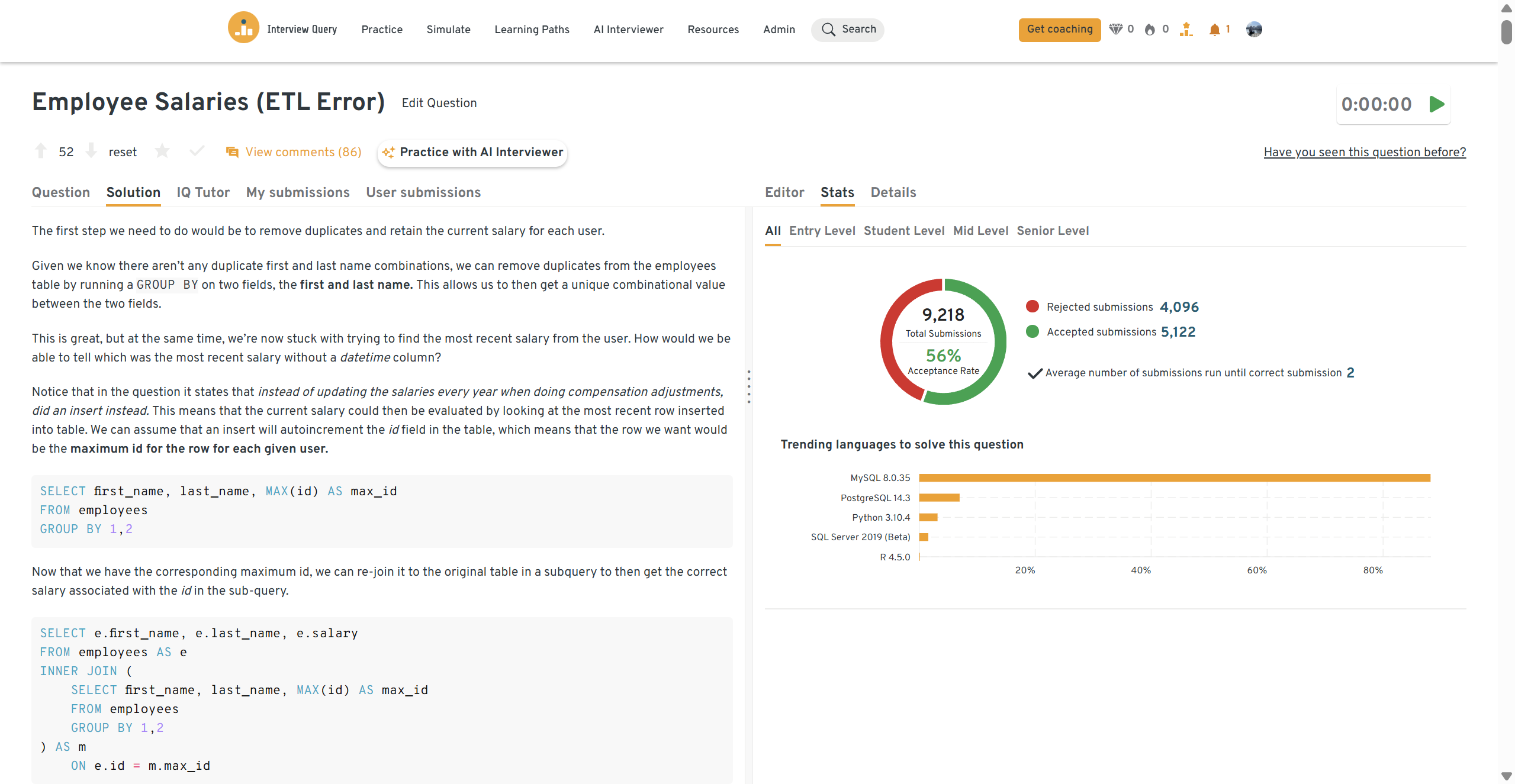

Identify the most recent row per employee by using MAX(id) or ROW_NUMBER ordered by ingestion timestamp. This tests your ability to resolve upstream data quality issues—one of the most common tasks at Citi. Interviewers want to see awareness of how bad data impacts compliance and reporting.

Tip: Mention implementing data validation rules to prevent the issue from recurring.

You can practice this exact problem on the Interview Query dashboard, shown below. The platform lets you write and test SQL queries, view accepted solutions, and compare your performance with thousands of other learners. Features like AI coaching, submission stats, and language breakdowns help you identify areas to improve and prepare more effectively for data interviews at scale.

Applied case and problem-solving interview questions

Citi evaluates whether analysts can structure ambiguous business problems, tie data insights to operational or risk outcomes, and propose measurable steps forward. These scenarios test your ability to reason clearly without being handed a perfect dataset.

How would you verify whether customers are being routed to the wrong branch or service channel?

Break the problem down into expected routing logic versus observed routing outcomes. Analyze mismatches by geography, customer type, time of day, and transaction type. Map deviations to system rules and identify whether the issue is technical, process-based, or user-driven.

Tip: Tie your final recommendation to reduced friction, improved accuracy, or better customer experience.

How would you evaluate a loan model and compare it to a new alternative model?

Based on the Loan Model question. Determine the model type (classification) and compare models using AUC, precision, recall, and calibration. Then incorporate loan-specific metrics such as missed good borrowers, default curves, and payment cycle stability.

Tip: Always mention the need for fairness, transparency, and regulatory alignment.

How would you diagnose a sudden drop in credit card approvals?

Start by examining the approval funnel: application, verification, scoring, and decisioning. Check for rule changes, system outages, data quality drops, or credit policy updates. Segment declines by geography, channel, or credit tier to isolate where the issue is happening.

Tip: Separate “real business changes” from “data or system errors.”

-

Start with aggregations, confidence intervals, and score distributions. Consider rater consistency, segment preferences, and variance. Propose ranking logic supported by statistical justification.

Tip: Explain how you would identify outliers or biased response patterns.

How would you determine whether map-based ATM or branch locations are inaccurate?

Compare expected coordinates against device-captured coordinates, define a distance threshold, and compute the rate of errors. Identify whether inaccuracies cluster by region, device type, or time.

Tip: Quantify business impact, not just detection.

How would you assess the effectiveness of a new operations workflow designed to reduce manual reviews?

Establish a baseline, track completion times, error rates, and manual intervention frequency. Use pre-post analysis and, where possible, control groups.

Tip: Emphasize measurable improvements and stakeholder adoption.

Behavioral and communication interview questions

Citi’s behavioral interviews evaluate whether you can act as a trusted partner, think globally, communicate clearly across functions, and take ownership—all core values highlighted on Citi’s About Us page. Strong answers balance technical clarity with risk awareness, cross-team collaboration, and measurable business impact. Use concise STAR structure, connect your actions to outcomes, and highlight how you uphold integrity and deliver with pride.

Describe a data project you worked on. What challenges did you face?

Interviewers want to see how you handle ambiguity, navigate stakeholder misalignment, and take ownership when data or requirements are unclear. They also assess whether you demonstrate integrity by validating assumptions and protecting data quality.

Tip: Include both a technical challenge and a stakeholder challenge.

Sample Answer: I worked on standardizing regional customer reporting where different markets used different definitions. The biggest challenge was misaligned logic across upstream systems. I met with each regional team, proposed a unified definition, and built automated validation checks. This reduced reconciliation time and improved report consistency across all markets.

Talk about a time you had difficulty communicating insights to a non-technical stakeholder. How did you adapt?

Citi values succeeding together, which means tailoring communication so all partners—operations, risk, finance—can make informed decisions. Interviewers want to know if you can translate complex analysis into simple, actionable guidance.

Tip: Show empathy and your ability to translate data into decisions.

Sample Answer: I supported an operations director who wasn’t comfortable interpreting SQL outputs. I switched from dense tables to simplified visuals and added clear narrative comments. After the redesign, he began using the dashboard independently, and escalations dropped because he could quickly identify process issues.

What are effective ways to make data more accessible to non-technical people?

Analysts at Citi often liaise with global teams, so clarity, structure, and intuitive design are essential for helping stakeholders make decisions confidently. This also ties to Citi’s values of being a trusted partner and delivering with pride.

Tip: Connect accessibility to business value, not just design.

Sample Answer: I start by identifying the core decisions the stakeholder needs to make, then highlight three to five metrics that directly support that decision. I simplify visualizations, add a short glossary, and include a one-slide “how to interpret this” guide. Adoption rates increase because the dashboard feels intuitive, not overwhelming.

Give an example of when you influenced a business decision using data.

Citi looks for analysts who can use data to drive meaningful actions, not just produce reports. Interviewers assess whether you combine critical thinking, customer impact, and ownership.

Tip: Choose an example with a clear before/after impact.

Sample Answer: I investigated a sudden drop in digital logins and discovered that a recent UI update added unnecessary friction. I presented the findings to product, recommended removing the added step, and they reverted the change. Login volume rebounded, customer complaints decreased, and the team now runs pre-launch analytics reviews.

Tell me about a time you found and resolved a data quality issue.

Data quality is critical in a regulated environment like Citi, where errors can impact risk reporting and compliance. Interviewers evaluate whether you take ownership and think about long-term prevention, not just one-off fixes.

Tip: Always show both remediation and prevention.

Sample Answer: During a monthly reporting cycle, I noticed inconsistencies in transaction counts between systems. After validating raw tables, I found that an ETL job had partially failed for one region. I coordinated a backfill with engineering and added automated checks to flag anomalies before the next cycle, strengthening our data governance process.

This breakdown by Interview Query founder Jay Feng covers the five most common data analyst interview questions and how to answer them with clarity, structure, and insight. It’s an efficient way to tighten your fundamentals before tackling Citi–style analytics interviews.

How to Prepare for a Citi Data Analyst Interview

Preparing for a Citi data analyst interview requires strong SQL fundamentals, comfort with data cleaning, and the ability to translate ambiguous business problems into structured analytical steps. Citi expects analysts to think clearly under regulation-heavy environments, communicate insights to both technical and non-technical teams, and demonstrate strong operational discipline. Many candidates practice with data analyst interview questions, refine technical reasoning through SQL interview questions, and rehearse structured behavioral stories using mock interviews.

To help you get ready, here are five strategies tailored specifically for Citi’s expectations.

Strengthen your SQL fundamentals with regulatory-grade accuracy

Citi relies heavily on SQL for reporting, reconciliations, and operational dashboards across compliance, risk, and product teams. Interviewers expect precise grouping logic, clean join conditions, correct handling of duplicates, and thoughtful edge cases around missing or inconsistent data. When practicing queries, prioritize clarity over cleverness and always show how you validate results. This mirrors Citi’s real workflow, where small mistakes can affect reporting accuracy in a highly regulated environment.

Tip: Before writing any SQL, restate the grain (“one row per…”) and confirm business definitions, just like you would with internal stakeholders.

Be ready to explain your analytics projects with structure and business impact

Citi looks for analysts who can connect technical work to operational or customer outcomes. Structure your project walkthroughs around the problem, the data sources, what you built, and the measurable results (time saved, improved data quality, faster reporting). Describe specific challenges such as inconsistent data, manual processes, or ambiguous requirements, and explain how you resolved them. This signals ownership, clarity of communication, and high-quality decision making.

Tip: Prepare two short project stories: one technical (e.g., ETL, SQL cleanup) and one stakeholder-focused (e.g., dashboard adoption or operational improvement).

Practice translating ambiguous business questions into analytical steps

Many Citi interviews include scenario questions such as diagnosing anomalies, evaluating model changes, or identifying operational bottlenecks. Interviewers want to see whether you can structure an unclear problem into assumptions, metrics, data sources, and a step-by-step plan. Show how you break down the problem, what data you would request, and how you would verify the output before sharing results. This reflects Citi’s culture of disciplined, risk-aware analysis.

Tip: Use a consistent structure: clarify the objective → outline the data you need → propose the analytical steps → define success metrics.

Demonstrate strong communication skills for global, cross-functional teams

Citi analysts support teams across multiple regions and time zones. You must explain insights clearly to colleagues in operations, risk, compliance, or product — many of whom are not technical. Practice simplifying metrics, avoiding over-technical language, and creating summaries that highlight what decisions stakeholders should make. Interviewers evaluate how well you handle “translation” moments where technical detail must become business action.

Tip: Rehearse one example of explaining a complex insight in simple terms, and one example of influencing a decision through data.

Show readiness to work in a controlled, risk-sensitive environment

Even at the analyst level, Citi expects awareness of risk, compliance, and data integrity. Demonstrate that you double-check assumptions, validate data quality, and think about downstream impacts of errors. Mention any experience with audits, reconciliations, lineage documentation, or data governance—or show how you work carefully with sensitive data. This tells interviewers you fit well in financial services, where accuracy and traceability matter.

Tip: When answering technical questions, briefly note how you would validate the data or confirm correctness before delivering findings.

For additional practice, you can supplement your preparation with case-style prompts, behavioral drills, and SQL pattern recognition through Interview Query’s question libraries, take-home challenges, and mock interviews.

Citi Data Analyst Salary

Data analyst compensation at Citi varies by level, location, and business line, but most roles fall within a consistent range across the United States. According to Levels.fyi, Citi Data Analysts earn between $108K to $132K per year, depending on seniority (C10–C13). Compensation is primarily base salary, with bonus making up a smaller portion and stock generally not included.

Average Annual Compensation by Level (United States)

| Level | Total Compensation (yr) | Base Salary (yr) | Bonus (yr) |

|---|---|---|---|

| C10 (Analyst) | $108K | $94.8K | ~$8.3K |

| C11 | — | — | — |

| C12 (Senior Analyst) | $108K | $108K | ~$2.6K |

| C13 (AVP) | $132K | $132K | $0 |

How Citi’s compensation compares

Citi tends to offer:

- Higher base stability vs tech companies

- Lower bonus variability vs investment banking roles

- More predictable pay bands due to structured leveling (C10–C16)

- Minimal stock compensation, unlike tech-heavy analytics roles

Average Base Salary

Average Total Compensation

This structure appeals to candidates who prefer role stability, clear progression, and predictable compensation in a regulated financial environment.

FAQs

How competitive is the Citi Data Analyst interview?

Citi’s process is structured and selective because analysts support regulated functions like risk, AML, operations, and finance. You are typically evaluated on SQL fluency, Python fundamentals, data quality reasoning, and ability to communicate clearly with global teams. Many candidates prepare using the SQL interview learning path and submit practice problems through take-home exercises to build pattern recognition.

Do I need Python for a Citi Data Analyst role?

Python is not mandatory for every team, but familiarity with pandas, data cleaning, and simple modeling helps you stand out. SQL remains the primary tool across Citi’s analyst teams. You can strengthen both languages using the data analyst interview questions library.

What type of SQL questions does Citi ask?

Expect multi-step business questions like filtering monthly reports, validating data quality issues, identifying duplicates, or computing time-based metrics. The focus is on correctness and transparency. Reviewing scenario-style problems in the SQL practice dashboard is very effective.

How should I prepare for the behavioral interview at Citi?

Behavioral questions evaluate communication clarity, global collaboration, ownership, and alignment with Citi’s values of integrity, client excellence, and responsible decision-making. Use structured STAR responses and rehearse with live mock interviews or the behavioral question bank.

Is financial services experience required?

Not always. Citi values analysts who learn quickly and apply structured reasoning. You should understand basic financial concepts, but deep domain expertise is not required. Reviewing fundamentals through the analytics learning path helps close any gaps.

What projects should I highlight in the interview?

Any project involving cleaning messy data, clarifying business definitions, automating reports, or improving data quality is strong. Be ready to walk through the data, your logic, your technical choices, and the business impact. Practicing a ninety-second walkthrough with the AI interview coach can help refine your story.

Advance Your Citi Data Analyst Interview Prep With Confidence

Succeeding in the Citi Data Analyst process means combining technical clarity with strong communication and a disciplined approach to data quality. You can accelerate your preparation by pairing hands-on SQL practice with targeted behavioral coaching and real scenario walkthroughs. Explore more resources through Interview Query, including the SQL learning path, take-home challenges, and live mock interviews to build a preparation plan that reflects Citi’s expectations and helps you interview with confidence.