Uber Business Analyst Interview Guide: Process, Questions & Preparation Tips (2026)

Introduction

After years of growth-at-all-costs expansion, Uber now operates as a mature, metric-driven platform where pricing, incentives, and supply decisions are constantly tested and adjusted at the city level. Business analyst roles, which are expected to grow faster than the average (10%) due to data demand, thrive in this environment focused on disciplined profitability and marketplace efficiency. At Uber, business analysts don’t just build dashboards but, more importantly, answer ambiguous business questions with structured analysis.

The Uber business analyst interview is designed to assess whether you can define metrics, interpret experiments, and guide trade-offs across riders, drivers, merchants, and city teams. This guide reflects how Uber actually hires business analysts today. You will learn how each interview stage evaluates your ability to turn messy data into clear marketplace recommendations through an overview of the process and common questions. We also highlight proven strategies to tailor your interview preparation to Uber’s operating cadence.

Uber Business Analyst Interview Process

The Uber business analyst interview process is structured to evaluate how well you think and make decisions in marketplace terms, not just how well you write SQL. Across stages, Uber is less interested in raw technical ability and more focused on how you reason through ambiguity and trade-offs, choose the right metrics, and confidently translate analysis into action.

While the exact format can vary by team (Rides, Eats, Freight, Ads, or Central Ops), the signal Uber looks for is remarkably consistent: structured thinking, strong business intuition, and crisp communication.

Application and resume screen

The process begins with a resume review focused on measurable business impact. Uber recruiters prioritize candidates who have worked on growth, pricing, experimentation, or marketplace problems, even outside of ride-sharing or delivery. Resumes that simply list SQL, Python, or Tableau without context tend to be filtered out quickly.

Uber looks for evidence that you understand incentives, supply and demand dynamics, and performance at a granular level such as city, cohort, or time window. Clear metrics, defined outcomes, and concise storytelling matter more than listing technologies.

Tip: If your resume doesn’t clearly answer “what decision changed because of this analysis,” rewrite it. You can benchmark your resume against real Uber-style metrics and expectations through Interview Query’s dedicated Uber company interview guide.

Recruiter screen

The recruiter screen is typically a 30 to 45 minute conversation focused on role alignment and motivation. This is where Uber explicitly distinguishes between business analyst, data analyst, and business operations roles.

You’ll be asked about:

- Your background and analytical experience

- Why Uber’s marketplace excites you

- What kinds of business problems you want to own

This stage also covers team preferences, location, and compensation expectations, but the primary goal is alignment.

Tip: Be explicit about why you are targeting business analyst and not data analyst; speak in terms of decisions, trade-offs, and stakeholders. Ambiguous positioning here can stall your process.

Analytics test (CodeSignal or equivalent)

Most candidates complete a timed analytics assessment, often delivered through CodeSignal or a similar platform. This stage is heavily SQL-focused, but always framed in a business context. You may be asked to calculate retention, utilization, conversion, or supply metrics using simplified marketplace data.

You’re evaluated on:

- Correct logic and joins

- Metric definition choices

- Edge case handling (nulls, partial periods, outliers)

- Your ability to interpret results, not just compute them

Tip: Write queries as if a city operations manager will read your output. Interview Query’s SQL drills mirror the exact structure and pressure of these assessments, helping you practice both speed and business interpretation.

Case study interview

The case interview is the core signal for business analysts at Uber. Cases are intentionally open-ended. You might be asked to diagnose:

- Slowing rider growth in a major city

- Declining driver supply during peak hours

- Rising incentives with flat demand

- Performance gaps across regions or cohorts

Strong candidates clarify assumptions, define success metrics, and explore trade-offs between growth and efficiency. You are expected to reason across riders, drivers, and merchants, and to adjust your approach as new information is introduced.

Tip: Always state who you are optimizing for before proposing metrics or solutions. Doing real-world challenges and business cases on Interview Query can train you to structure ambiguity and not just solve toy problems.

Stakeholder or hiring manager interview

The final stage typically focuses on communication and judgment. Hiring managers assess how you make decisions with incomplete data and how you present insights to non-technical stakeholders.

Expect discussions around:

- Past projects where data informed a tough decision

- How you handled conflicting stakeholder priorities

- How you’d recommend action with incomplete or imperfect data

This is not about showing off technical depth. It’s about whether your insights are clear, credible, and actionable. Uber values analysts who can move teams forward, even when the data isn’t perfect.

Tip: Analysts who bury the takeaway under analysis lose trust quickly, so remember to lead with the recommendation, then support it. Practicing executive-style communication prepares you for the expectations at this level.

Overall, if you can frame problems clearly, choose the right levers, and communicate with conviction, you’ll stand out during Uber business analyst interviews. Interview Query’s mock interviews can help you mirror Uber’s real interview style, allowing you to move beyond generic analytics prep.

What Questions Are Asked in an Uber Business Analyst Interview?

Uber business analyst interview questions are designed to test how you think about marketplaces, not just how well you write queries or recite frameworks. Across SQL, case, and behavioral rounds, interviewers look for clear metric logic, structured problem solving, and the ability to make defensible trade-offs across riders, drivers, and merchants.

Before diving into specific sample questions, it’s helpful to ground your preparation with strategic insights on how Uber approaches data-driven interviews.

Watch Next: Business Analyst Interview Questions ANSWERED

In the video, Jay Feng, Interview Query co-founder, walks through key frameworks and thought processes that strong candidates use to tackle Uber interview prompts effectively, especially around structuring analytical answers and demonstrating business judgment. Use the tips and strategies discussed in the video in answering the questions below, which reflect the patterns Uber uses to evaluate candidates.

SQL and analytics interview questions

Uber uses SQL and analytics questions to assess how you define metrics, join datasets correctly, and aggregate results in ways that reflect real business decisions. Accuracy matters, but clarity of logic and interpretation matters more.

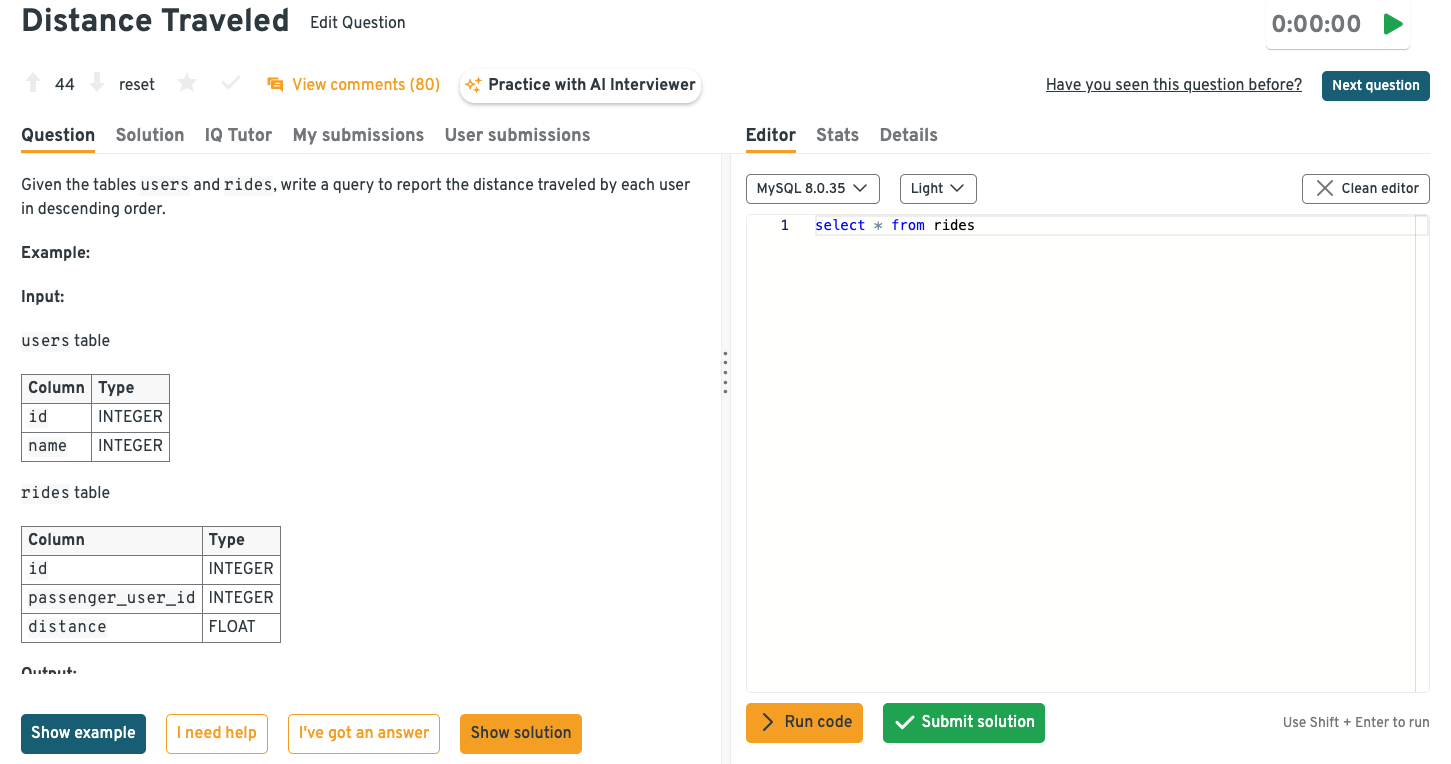

Calculate total trip distance traveled by each Uber user, ranked from highest to lowest.

This question tests SQL fundamentals such as joins, aggregation, and ordering results. The solution involves joining users to rides, summing distance by user, and grouping at the user level. Finally, the results are sorted in descending order of total distance to highlight the most active riders.

Tip: Be ready to explain how you would sanity-check the output with business intuition, such as whether top-distance users align with expectations around power riders, commuters, or long-distance markets.

Practice more SQL and analytics questions like this directly in the Interview Query dashboard, where you can write queries in the built-in editor and instantly check your answers with detailed solutions. It’s a hands-on way to sharpen skills and get real-time feedback on your approach.

Select a driver using weighted random sampling to simulate Uber’s driver-rider matching logic.

Here, the focus is on probabilistic thinking and advanced SQL techniques. A common approach assigns each driver a probability range based on cumulative weights, then uses a random number to select the matching interval. This mirrors how weighted randomness can bias selection toward higher-priority drivers without being deterministic.

Tip: Strong candidates often connect the technical solution back to fairness and efficiency, noting when weighted randomness might need guardrails to avoid starving new or low-weight drivers of trips.

Identify the third purchase made by each Uber user based on transaction time.

This question evaluates window functions and careful handling of ordering rules. The typical method uses

ROW_NUMBER()partitioned by user and ordered by timestamp, with a secondary sort on transaction ID to break ties. Filtering for the third-ranked row per user produces the desired result.Tip: Interviewers look for awareness of edge cases, so it helps to proactively mention how refunds, cancellations, or simultaneous purchases could affect ordering logic in real Uber datasets.

Explain how Uber’s dynamic pricing works and how supply and demand can be estimated analytically.

This prompt tests marketplace intuition and the ability to translate business dynamics into measurable signals. A strong answer describes how prices adjust in response to imbalances between rider demand and driver supply, often using metrics like request volume, acceptance rates, and driver availability. Estimation techniques may include time-series analysis, elasticity modeling, or real-time marketplace indicators.

Tip: Standout answers tie pricing signals to operator decisions, such as when to deploy incentives versus when to allow surge to clear demand, rather than treating pricing as a purely mathematical exercise.

How would you detect data quality issues in trip-level data?

This question assesses analytical rigor and data validation instincts. Effective approaches include checking for missing or duplicated trips, validating ranges for fields like distance or duration, and monitoring sudden shifts in key metrics over time. Comparing aggregates across related tables or against historical baselines can also surface inconsistencies quickly.

Tip: High-impact responses emphasize prioritization. Calling out which data issues would materially affect marketplace decisions versus those that are noisy but low risk for downstream analysis.

Business and case interview questions

Business and case questions assess how you structure ambiguous problems and reason through marketplace trade-offs. Uber interviewers are less interested in perfect answers and more interested in how you frame the problem.

How would you price delivery fees when launching Uber Eats in a new city?

This question evaluates structured thinking, market analysis, and pricing intuition. A strong approach starts by assessing local supply density, courier costs, and competitor pricing to define a viable baseline. From there, fees can be adjusted dynamically based on demand patterns, time of day, and early elasticity signals to balance growth and profitability.

Tip: Reference how pricing decisions would differ between dense urban cores and car-dependent suburbs, as this shows awareness that Uber Eats unit economics vary dramatically within the same city.

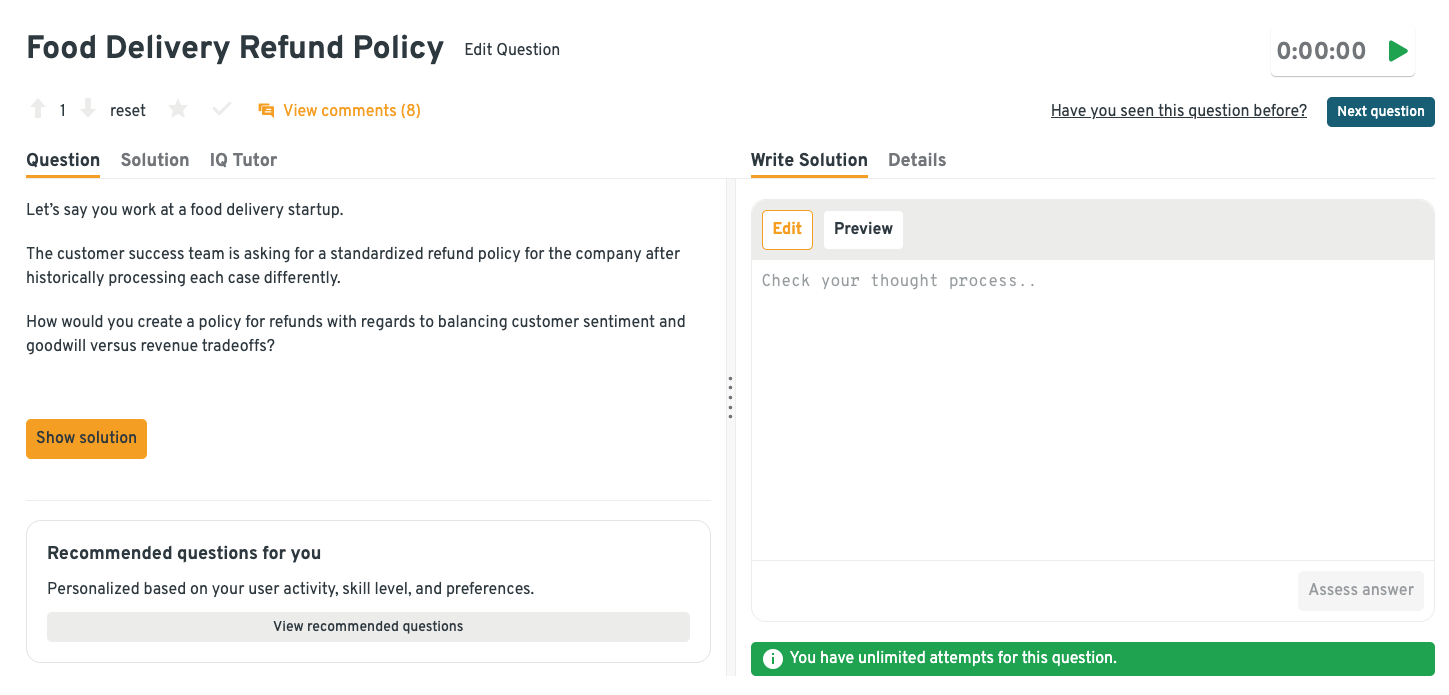

Design a standardized refund policy for Uber Eats that balances customer trust and revenue impact.

This prompt tests business judgment and the ability to manage trade-offs at scale. An effective answer outlines clear refund tiers based on issue severity (missing items, late delivery, incorrect orders) while setting guardrails to prevent abuse. Over time, policy thresholds can be refined using customer lifetime value and repeat incident data.

Tip: It helps to mention how operational simplicity matters at Uber’s scale. Clear rules that frontline support teams can apply consistently are often more valuable than theoretically optimal but complex policies.

Explore more real Uber-style business and case study questions in the Interview Query dashboard, where you can practice end-to-end and validate your thinking. Use features like IQ Tutor for AI-powered guidance to verify your logic and check your answers the way interviewers would.

Which levers would you prioritize to improve the end-to-end customer experience on Uber Eats?

This question focuses on prioritization, customer empathy, and metric-driven decision making. A thoughtful response breaks the experience into key stages, e.g., discovery, ordering, fulfillment, and post-delivery, and identifies friction points within each. Improvements should be tied to measurable outcomes like conversion, on-time delivery, and reorder rates.

Tip: Interviewers respond well when candidates call out one or two “non-obvious” experience levers, such as ETA accuracy or menu availability, rather than defaulting only to faster delivery.

Estimate the lifetime and lifetime value of a new Uber driver using 90 days of ride data.

This question assesses analytical modeling skills and long-term thinking. The approach typically involves cohorting drivers, estimating churn probabilities beyond the observed window, and projecting future activity using survival or retention curves. Lifetime value is then derived by combining expected tenure with contribution margin per trip.

Tip: Standout answers acknowledge uncertainty in early driver behavior and explain how models would be recalibrated as more tenure data becomes available, rather than treating lifetime estimates as static.

How would you measure success for a new rider acquisition campaign?

This question tests KPI selection and an understanding of growth efficiency. A strong answer goes beyond raw sign-ups to include downstream metrics such as first-trip conversion, retention, and cost per incremental active rider. Evaluating performance against a control group helps isolate true lift from organic growth.

Tip: High-impact responses explicitly discuss how acquisition quality varies by channel, noting that the best campaigns are those that produce riders who look similar to strong organic cohorts over time.

Business and case questions are best mastered by practicing scenarios that mimic the complex trade-offs Uber analysts face every day. Strengthen your problem-solving and decision-making skills with hands-on exercises through Interview Query’s real-world challenges.

Behavioral interview questions

Behavioral questions at Uber focus on ownership, conflict, and decision trade-offs. Interviewers want evidence that you can operate effectively under pressure and influence decisions with data.

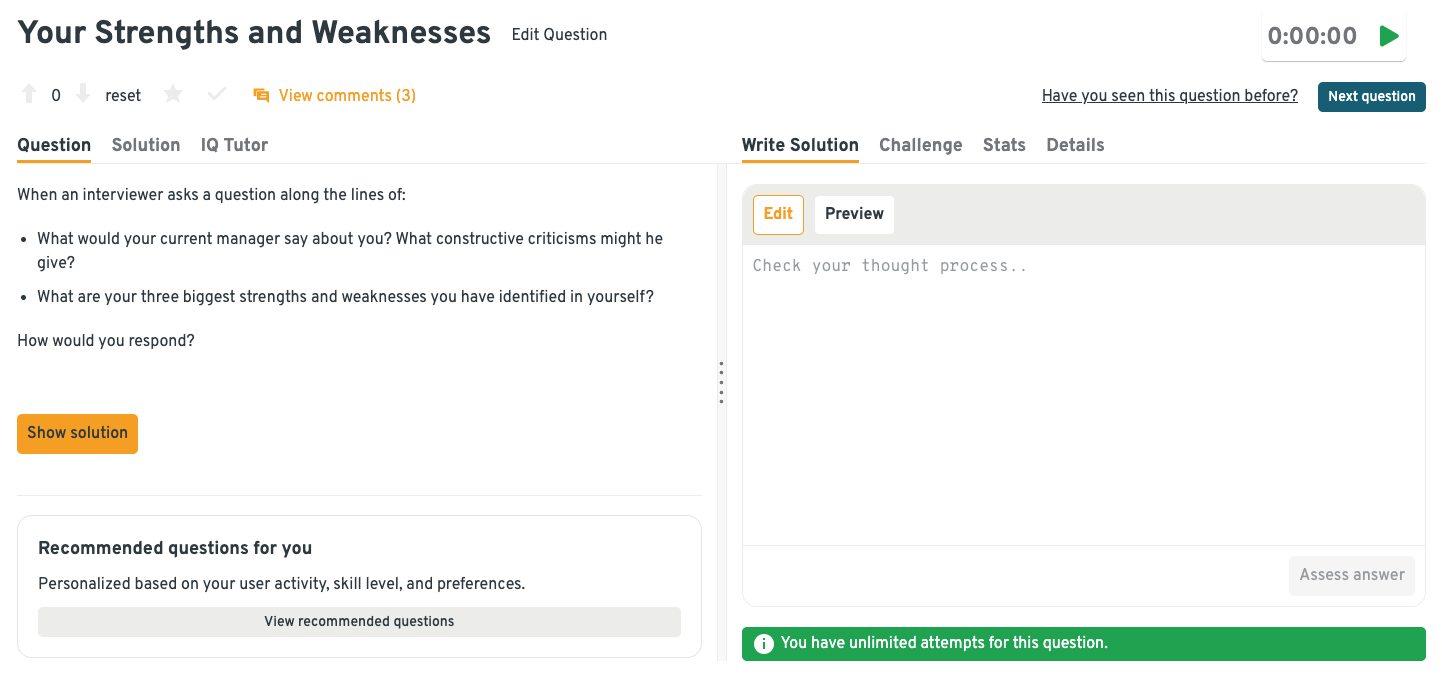

How would your manager describe your strengths and development areas as a business analyst?

Uber asks this to assess self-awareness, coachability, and whether candidates understand how their work creates measurable business impact. Strong answers anchor strengths and growth areas to outcomes such as improved decision speed, cost savings, or stakeholder adoption.

Sample answer: “My manager would describe my strength as translating messy data into clear recommendations that teams act on, such as a pricing analysis that improved weekend trip completion by 6%. They would also note my reliability in partnering with operations and product to unblock decisions quickly. As a development area, they have encouraged me to push more on strategic storytelling, which I’ve been working on by leading quarterly readouts instead of only contributing analyses. That shift has helped reduce follow-up questions and shorten decision timelines.”

Practice more behavioral and business interview questions directly in the Interview Query dashboard. In addition to using the IQ Tutor to refine storytelling, you can compare your responses against other candidates and see how different framing choices land through the user comments section.

-

This question evaluates communication skills in Uber’s matrixed environment, where analysts frequently influence without authority. Quantifying impact through metrics like adoption rates, rollout speed, or reduced rework helps demonstrate effectiveness.

Sample answer: “In one project, operations and product teams disagreed on whether driver incentives were driving real supply growth. Early analyses weren’t landing, so I reframed the discussion around a shared metric: incremental trips per incentive dollar. After aligning on that KPI and running a city-level experiment, we reached consensus and rolled out a revised incentive structure that reduced spend by 12% while maintaining supply. The alignment also sped up future launches since teams trusted the framework.”

Tell me about a time you made a recommendation with incomplete data.

Uber asks this to understand judgment under uncertainty, which is common in fast-moving markets. Candidates stand out by explaining assumptions clearly and tying decisions to risk mitigation or learning velocity.

Sample answer: “During a new market launch, demand data was sparse, but leadership needed a recommendation on initial courier incentives. I used proxy metrics from similar cities and modeled a range of outcomes rather than a single estimate. We launched with a conservative incentive plan and set clear thresholds for adjustment, which allowed us to ramp supply without overspending. Within two weeks, actual performance fell within the projected range.”

Describe a project where your analysis influenced a business decision.

This question looks for evidence that analysis leads to action, not just insight. Referencing concrete decisions, metrics moved, or dollars impacted shows real-world effectiveness.

Sample answer: “I analyzed late delivery complaints and found they were concentrated in a small set of high-volume merchants during peak hours. Based on this, I recommended adjusting prep-time buffers and temporarily pausing promotions for those merchants. After implementation, late deliveries dropped by 18% and customer support tickets declined noticeably. The approach was later reused in other cities.”

Tell me about a time you changed your recommendation after new information.

Uber values intellectual honesty and adaptability, especially when new data challenges initial assumptions. Quantifying how the updated decision improved outcomes reinforces credibility.

Sample answer: ”I initially recommended expanding a rider promotion after seeing strong short-term conversion, but follow-up retention data showed those users churned faster than average. After revisiting the analysis, I shifted the recommendation toward targeting a narrower, higher-intent segment. The revised approach lowered acquisition volume but improved 30-day retention by 9%. Communicating the change clearly helped maintain stakeholder trust despite reversing course.”

Mastering Uber BA interviews requires both strong analytical skills and the ability to communicate insights clearly under real-world constraints. If you’re ready to deepen your practice, explore hundreds of SQL, analytics, case, and behavioral questions in the full Interview Query question bank to sharpen your skills and boost your interview confidence.

How to Prepare for an Uber Business Analyst Interview

When preparing for an Uber business analyst interview, it’s important that you align your skills with how Uber actually makes decisions, instead of resorting to standard analytics prep. Uber evaluates whether you can apply structured analysis to real marketplace problems under time pressure and communicate recommendations clearly to senior stakeholders, including non-technical ones.

Master SQL through the lens of Uber’s marketplace. Focus on retention, utilization, conversion, and supply availability rather than abstract joins or window functions in isolation. Practice writing queries that aggregate by city, time window, or cohort, and get comfortable explaining why a metric matters. After each query, ask yourself: “If this number moved, what decision would change?”

Tip: Uber interviewers look for candidates who could quickly sanity-check their output (“Does this make sense for a large city vs. a small one?”). On Interview Query, you can practice SQL questions where you must explain your logic out loud; this mirrors how Uber analysts actually review work with stakeholders.

Spend time on case practice with ambiguous assumptions. Uber case interviews rarely provide clean problem statements. You are expected to clarify goals, define success metrics, and choose a direction before analyzing data. Practice cases that involve growth versus efficiency trade-offs, pricing changes, or uneven market performance. Train yourself to explicitly state assumptions, define a north-star metric, and explain why you’re prioritizing one side of the marketplace first.

Tip: In real Uber meetings, the strongest analysts don’t rush into analysis and instead pause early to align on the goal. Practice doing this deliberately in mock interviews on Interview Query, where you can get matched with peers and receive feedback.

Practice thinking in “city-level” narratives, not global averages. Uber operates city by city, and many interviews quietly test whether you default to aggregated thinking. Get comfortable breaking metrics down by market size, maturity, or operational constraints, and explaining why the same strategy won’t work everywhere.

Tip: **Interviewers are impressed when candidates proactively ask, “Is this a large, mature city or a newer market?” Practice this habit, as it signals real Uber intuition and pairs perfectly with marketplace-focused case studies and challenges on Interview Query.

Build muscle memory for executive communication. Uber business analysts regularly present to operations leaders, product managers, and executives who do not want technical detail, and instead want to know what to do next. Practice summarizing your analysis into a concise recommendation, supported by two or three key insights and a clear next step. Avoid data dumps; focus on clarity, prioritization, and confidence rather than exhaustive analysis.

Tip: Practice “top-line first” responses where the first sentence includes a decision, a metric, and a time horizon. This mirrors how Uber leaders consume analysis and is a strong signal of senior-level readiness.

Prepare behavioral stories that demonstrate ownership and judgment. Throughout your prep, consistently anchor your thinking in Uber’s reality: real-time supply constraints, local market variation, and incentives that can quickly backfire if misaligned. This is what separates Uber-ready candidates from generic analytics applicants.

Tip: Structure behavioral answers around context → tension → decision → outcome, with extra emphasis on the tension. Interviewers look for candidates who recognize second-order effects and can explain how they monitored risk after the decision was made.

Ultimately, preparing for the Uber business analyst is about training yourself to think and operate the way Uber analysts do every day. If you want targeted feedback on whether your approach actually matches Uber’s expectations, Interview Query’s 1:1 coaching sessions can be a powerful accelerator. Work directly with industry professionals to pressure-test your SQL logic, sharpen your case structure, and refine how you communicate recommendations in real time.

Role Overview and Culture at Uber

The Uber business analyst role is defined by decision ownership and speed. Analysts work at the market level across rides, delivery, or freight, where performance is tracked daily and decisions have immediate operational impact. Rather than focusing on dashboards alone, business analysts frame questions, define metrics, and recommend actions that affect pricing, incentives, and supply demand balance.

A typical Uber business analyst partners closely with city operations teams, product managers, and regional leaders. Day-to-day responsibilities often include:

- Monitoring daily and weekly market-level KPIs such as trip volume, marketplace liquidity, driver supply, and fulfillment rates

- Diagnosing performance changes by analyzing pricing shifts, incentive structures, rider behavior, or operational constraints

- Designing and evaluating experiments (A/B tests) to assess new pricing models, promotions, or product features

- Translating complex analyses into clear recommendations for city managers and regional leadership

- Balancing trade-offs across riders, drivers, couriers, and merchants when proposing changes

Uber’s global scale magnifies the impact of this work. Decisions are often tested city by city, rolled out globally, and measured in real time. This creates fast feedback loops and frequent exposure to senior stakeholders. Despite industry volatility, Uber continues to attract analysts because few roles offer the same combination of responsibility, visibility, and decision velocity early in an analytics career.

For candidates preparing for an Uber business analyst interview, mastering these fundamentals is essential. Interview Query’s Learning Paths provide guided practice across business analytics concepts that regularly show up in Uber interviews, from SQL proficiency to metrics design and experiment analysis.

Average Uber Business Analyst Salary

Uber business analysts are compensated at the high end of the analytics market, largely because the role sits close to revenue, growth, and marketplace balance. Pay reflects not just technical skill, but ownership over city-level decisions, pricing trade-offs, and cross-functional execution.

Read more: Business Analyst Salary

Based on aggregated data from sources like Levels.fyi, total compensation scales meaningfully with scope and seniority, and equity plays a larger role over time than at many peer companies. Rather than flat salary bands, Uber’s compensation tends to reward analysts who influence outcomes across riders, drivers, and merchants, especially those working on high-impact markets or core platform initiatives.

Compensation by level

| Level | Total / Year | Base / Year | Stock / Year | Bonus / Year |

|---|---|---|---|---|

| Business Analyst I | ~$130K | ~$100K | ~$20K | ~$10K |

| Business Analyst II | ~$165K | ~$120K | ~$30K | ~$15K |

| Senior Business Analyst | ~$200K | ~$145K | ~$40K | ~$15K |

| Staff or Lead Analyst | ~$230K+ | ~$160K | ~$55K | ~$15K |

Equity typically becomes more impactful starting in year two, once vesting accelerates. For analysts planning to stay beyond their first year, stock growth can materially change long-term earnings.

Average Base Salary

Average Total Compensation

Regional salary comparison

| Region | Salary range | Notes |

|---|---|---|

| United States (SF Bay Area) | $170K–$230K+ | Highest pay driven by market ownership and cost of living |

| United States (Other major cities) | $150K–$200K | Slightly lower base, comparable equity bands |

| Europe | $110K–$160K | Lower base and equity relative to US roles |

| Asia Pacific | $90K–$140K | Wide variance by country and market maturity |

Across regions, the pattern is consistent. Analysts who take on broader geographic scope, lead cross-functional initiatives, or partner closely with product and operations tend to progress faster into higher equity bands. Over time, this makes Uber particularly attractive for analysts who want compensation growth tied directly to business ownership rather than tenure alone.

If you’re evaluating an offer or planning your next move, Interview Query’s salary guides help you understand where leverage comes from. Our compensation insights break down those trade-offs so you can benchmark intelligently according to industry standards.

FAQs

Is the Uber analytics test harder than SQL interviews elsewhere?

The Uber analytics test is not harder in terms of syntax, but it is more demanding in context. Questions are framed around marketplace metrics like retention, supply, and utilization, and you are expected to interpret results, not just produce correct queries. Candidates who practice business-focused SQL tend to perform better than those who only practice abstract problems.

What is the difference between Uber BizOps and Business Analyst interviews?

Uber BizOps interviews lean more heavily toward strategy, execution, and stakeholder management, with fewer technical analytics questions. Business analyst interviews, by contrast, include a dedicated analytics test and deeper SQL evaluation, alongside cases focused on metric definition and marketplace trade-offs. Clear role targeting is important early in the process.

How long does the Uber interview process take?

From recruiter screen to final decision, the Uber interview process typically takes three to five weeks. Timing depends on team availability, candidate scheduling, and whether additional rounds are needed. Analytics tests and case interviews are usually completed within a two-week window.

Does Uber offer remote roles for business analysts?

Uber has supported hybrid and remote roles in some regions, but most business analyst positions are tied to hubs or regional offices. Location flexibility depends on team needs, time zone alignment, and market coverage. This is usually clarified during the recruiter screen.

Do I need prior ride-sharing or delivery experience to succeed?

No. Uber values marketplace intuition and structured thinking more than direct industry experience. Candidates from e-commerce, fintech, logistics, or growth analytics backgrounds often perform well if they can adapt quickly to Uber’s operating model.

Ace the Uber Business Analyst Interview with Interview Query

Succeeding in the Uber business analyst interview entails practicing marketplace-focused SQL, structured case thinking, and executive-level communication under time pressure. This guide has shown how Uber evaluates candidates across each stage, from analytics tests to stakeholder interviews.

Interview Query helps you prepare with a targeted question bank covering SQL, case, and behavioral questions aligned with Uber-style interviews. Additionally, the Business Analytics 50 study plan provides a curated path to practice the most relevant problem types, while mock interviews simulate the real interview environment and feedback you can expect at Uber.

With the right preparation strategy and realistic practice, you can approach the Uber business analyst interview with confidence and clarity.