Goldman Sachs Data Scientist Interview Guide: Process, Questions & Salary

Introduction

Goldman Sachs manages over $2 trillion in client assets globally, and data science is central to how the firm drives investment decisions, manages risk, and uncovers opportunities. As a data scientist at Goldman Sachs, your work directly impacts high-stakes financial strategies and trading outcomes, making the role both challenging and highly influential.

This guide will break down the Goldman Sachs data scientist role, outline the Goldman Sachs data science interview process, and provide actionable strategies to help you succeed in one of the most competitive data science interviews in finance.

What does a Goldman Sachs data scientist do?

A Goldman Sachs data scientist turns complex datasets into actionable insights that drive portfolio strategies, trading algorithms, and risk assessments. You’ll collaborate with engineers, traders, and analysts to build predictive models, conduct statistical analyses, and automate key financial processes. Success in this role requires strong programming skills, analytical rigor, and a deep understanding of financial markets—the core of Goldman Sachs data science work.

Core responsibilities include:

- Build predictive models and machine learning pipelines for trading, pricing, and risk management.

- Perform statistical analysis and exploratory data investigation to uncover patterns and anomalies.

- Develop scalable data pipelines to support robust analytics across teams.

- Collaborate with cross-functional teams to turn insights into strategic business actions.

- Communicate technical findings effectively to non-technical stakeholders.

To start preparing, explore the data science interview learning path for a structured approach to SQL, Python, and modeling skills. Once comfortable, test yourself with real-world scenarios in mock interviews or practice case studies with take-home test prep.

Why this role at Goldman Sachs

Goldman Sachs offers data scientists the opportunity to work on projects with immediate, tangible impact on global financial markets. The role combines technical challenge, analytical depth, and exposure to high-stakes decision-making, making it ideal for professionals who thrive in complex, fast-moving environments. If you want to influence multi-billion-dollar portfolios and shape trading strategies with data, this is one of the most coveted data science roles in finance.

Goldman Sachs Data Scientist Interview Process

The Goldman Sachs data scientist interview is one of the most competitive in finance and tech. With thousands of applicants each year, only a small fraction are invited to the rigorous stages of the Goldman Sachs interview process. This process evaluates technical skills, analytical thinking, problem-solving, and communication under pressure. In this guide, you’ll learn how the Goldman Sachs data scientist interview works, what interviewers expect, and how to prepare effectively at each stage using resources like the data science interview learning path and hands-on mock interviews.

Application review

Goldman Sachs screens thousands of applications, looking for candidates who demonstrate a strong combination of technical skills, quantitative aptitude, and business insight. A standout resume highlights measurable impact, coding proficiency, and collaboration on data-driven projects.

What recruiters look for:

- Strong academic background (STEM, quantitative finance, or related fields)

- Demonstrated programming experience (Python, R, SQL, or Java)

- Experience with statistical modeling, machine learning, or data analysis

- Clear, structured communication of results and impact

- Evidence of problem-solving in ambiguous or high-stakes situations

Tip: Tailor your resume to highlight high-impact projects with measurable outcomes. Emphasize cross-functional collaboration where relevant and strengthen your technical toolkit through SQL interview questions for data analysts.

Recruiter phone screen

This 30–45 minute call assesses whether your background fits the Goldman Sachs data scientist role and evaluates your ability to communicate effectively.

What the recruiter evaluates:

- Clarity in explaining past projects and technical impact

- Motivation for joining Goldman Sachs and understanding of financial applications

- Problem-solving approach and logical reasoning

- Basic technical knowledge (data analysis, programming, statistics)

- Communication skills with both technical and non-technical stakeholders

Tip: Prepare concise explanations of your most relevant projects, focusing on methodology, results, and business impact.

Technical phone interview(s)

Candidates who pass the recruiter screen typically face one or two technical phone interviews lasting 45–60 minutes each. These interviews test coding, quantitative problem-solving, and analytical thinking.

Common elements include:

- Solving coding problems in Python, R, SQL, or Java

- Statistical and probabilistic reasoning questions

- Machine learning or data modeling exercises

- Brainstorming on how to approach unstructured or incomplete datasets

- Explaining the rationale behind your solution and trade-offs

Tip: Practice timed coding exercises, and clearly explain your thought process. Use structured resources like the SQL scenario-based interview questions and python/AI interview prep to strengthen your problem-solving skills.

| Problem Type | Description | Skills Evaluated |

|---|---|---|

| SQL query challenges | Aggregate, filter, join, and manipulate data | SQL syntax, logic, efficiency |

| Python/R coding problems | Implement algorithms or data transformations | Programming, debugging, analytical thinking |

| Statistical reasoning | Probability, distributions, hypothesis testing | Quantitative skills, rigor |

| Machine learning modeling | Build predictive models from datasets | ML understanding, feature engineering |

| Data interpretation | Analyze output and recommend actions | Communication, insight generation |

Many candidates specifically ask about Goldman Sachs SQL interview questions . Expect SQL problems that join multiple tables, calculate rolling aggregates, and surface edge cases in messy data. Practicing realistic questions in the SQL interview learning path and SQL scenario-based interview questions will help you handle these confidently.

On-site interview loop

The on-site (or virtual on-site) is the most critical stage and usually consists of 4–6 interviews, each 45–60 minutes long. Goldman Sachs evaluates depth, clarity, and consistency across technical, analytical, and behavioral dimensions.

| Interview Round | Focus Area | Tip |

|---|---|---|

| Technical coding | Algorithms, SQL, data manipulation | Explain assumptions, optimize for clarity, and test your code |

| Quantitative / statistical | Probability, hypothesis testing, experiment design | Show step-by-step reasoning and justify assumptions |

| Machine learning / modeling | Predictive models, feature selection, evaluation metrics | Discuss trade-offs and business implications |

| Case / business problem | Data-driven decision-making for financial scenarios | Connect analysis to financial impact and strategy |

| Behavioral / fit | Leadership, teamwork, conflict resolution | Use STAR format; highlight measurable outcomes |

| System design (optional) | Data pipeline, ETL, or architecture design | Focus on scalability, efficiency, and practical considerations |

Tip: For technical rounds, narrate your reasoning and use examples from practice problems in challenges or take-home exercises. For behavioral rounds, always quantify your impact and demonstrate structured thinking.

Optional take-home assignment

Some teams require a take-home data exercise to evaluate analytical rigor and coding skills in a less time-pressured environment.

Sample formats:

| Assignment Type | What You’re Asked To Do | What Goldman Sachs Evaluates |

|---|---|---|

| Data analysis | Clean, process, and analyze a dataset to answer questions | Data manipulation, statistical reasoning, insight generation |

| Predictive modeling | Build a model to forecast a financial metric | Feature engineering, model choice, evaluation |

| SQL/ETL exercise | Write queries to extract and aggregate data | Accuracy, efficiency, problem-solving |

| Business case with data | Recommend an action based on provided datasets | Analytical reasoning, clarity, business impact |

Tip: Document your methodology clearly, justify decisions, and provide visualizations if helpful. Practicing similar exercises on take-home test prep can make this step much easier.

Behavioral questions

Behavioral interviews evaluate how you collaborate, communicate, and navigate challenges in a high-pressure environment. Goldman Sachs emphasizes teamwork, adaptability, and analytical problem-solving in real-world situations.

Common questions:

- Describe a challenging data project and how you overcame obstacles.

- How have you communicated complex findings to non-technical stakeholders?

- Tell me about a time you had to prioritize conflicting requests.

- Give an example of leading a team or project under tight deadlines.

- Describe a situation where your analysis changed a decision or outcome.

Tip: Use the STAR method (Situation, Task, Action, Result) and quantify your impact. You can practice responses through coaching or mock interviews.

Hiring committee review

After on-site interviews, a committee reviews interviewer feedback, resumes, and candidate packages to ensure consistency and fairness. The committee evaluates:

- Technical depth and analytical skills

- Communication clarity and collaboration

- Problem-solving approach and structured thinking

- Cultural fit and leadership potential

Tip: Even after interviews, stay engaged and be ready to clarify any past discussion points if requested.

Goldman Sachs Data Scientist Interview Questions

The Goldman Sachs data scientist interview evaluates your ability to reason about financial data, design algorithms and models, and communicate analytical insights. Below are core question types you may encounter, along with examples and guidance for preparation.

Product and strategy interview questions

-

This question tests your ability to interpret model outputs without direct access to coefficients. You may need to explore surrogate models, feature importance approximations, or rule-based systems to provide meaningful feedback to users.

Tip: Focus on actionable insights and transparency while acknowledging model limitations.

Suppose your trading team wants to launch a new risk model that predicts market volatility. How would you evaluate whether it adds value beyond existing models?

This assesses your ability to benchmark new models against current standards. You should consider metrics like predictive accuracy, economic value, and robustness under different market conditions.

Tip: Include both quantitative evaluation metrics and potential real-world implications of incorrect predictions.

You notice that a predictive model for loan defaults is performing worse for a specific demographic. How would you investigate and address this issue?

This question tests your understanding of fairness, bias, and model diagnostics. You should identify whether the performance gap is due to data imbalance, feature selection, or systemic issues.

Tip: Discuss corrective actions such as re-sampling, fairness constraints, or retraining models with additional features.

Imagine the firm wants to optimize client recommendations for financial products. How would you measure success and ensure your recommendations increase long-term engagement?

This question evaluates your ability to define success metrics that align with business goals. Consider both short-term conversion metrics and long-term retention or risk-adjusted profitability.

Tip: Propose a mixture of A/B testing, predictive modeling, and feedback loops to validate recommendations.

-

This question evaluates your understanding of statistical calibration and decision thresholds. You must reason about population-level errors that occur when using cutoffs, considering confidence intervals around scores.

Tip: Highlight the trade-off between false positives and false negatives and how it impacts credit decisions.

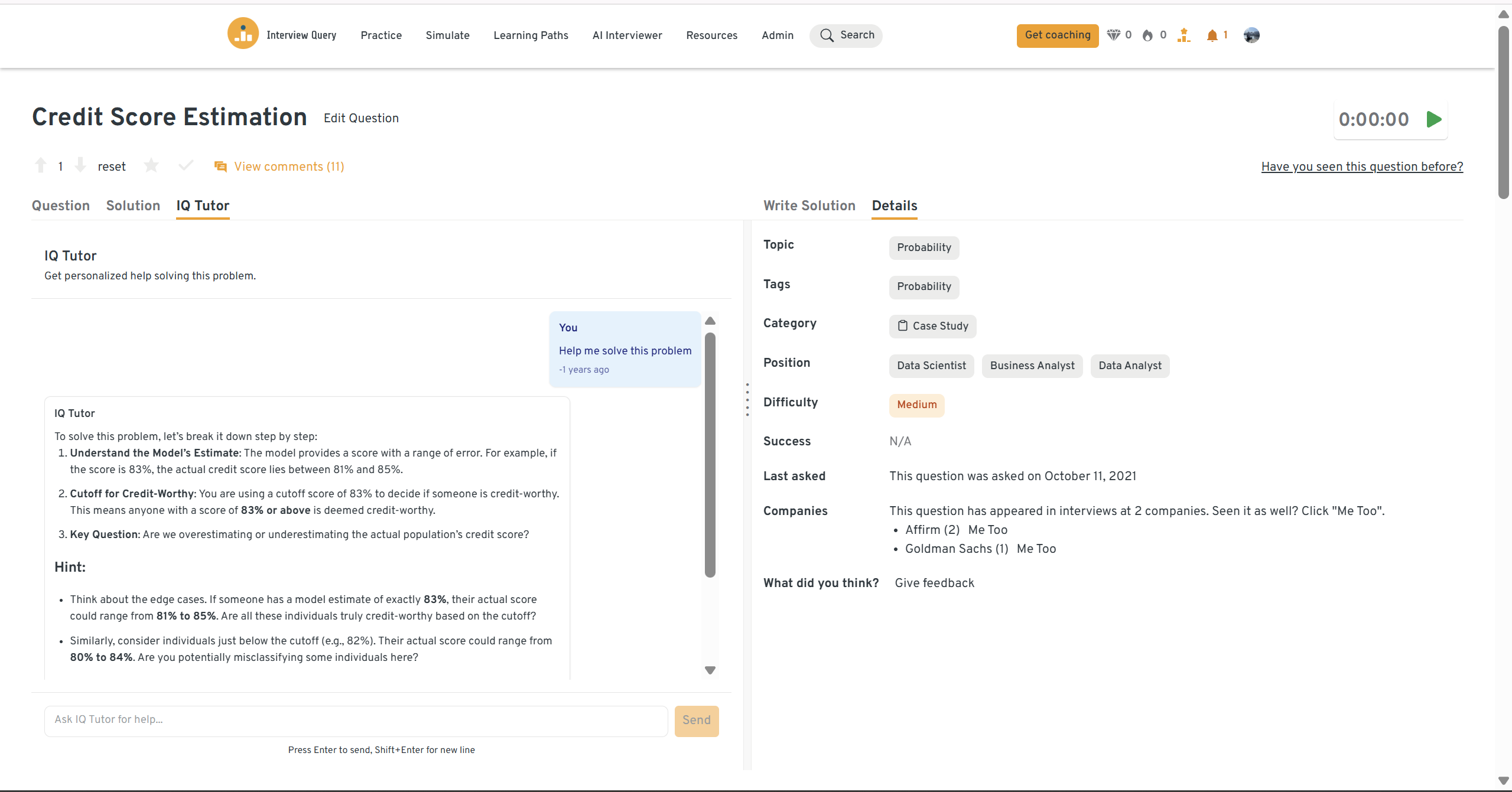

You can practice this exact problem on the Interview Query dashboard, shown below. The platform lets you write and test SQL queries, view accepted solutions, and compare your performance with thousands of other learners. Features like AI coaching, submission stats, and language breakdowns help you identify areas to improve and prepare more effectively for data interviews at scale.

Analytical and technical interview questions

-

This evaluates your ability to handle Markov chains and conditional probability. You need to model the transitions over n days and implement a dynamic or recursive solution.

Tip: Clearly define states and transition probabilities before writing code to avoid logical errors.

-

This tests your problem-solving and algorithm design skills, particularly using stack or two-pointer approaches. You must reason about boundaries and accumulation points efficiently.

Tip: Walk through an example step-by-step to validate your logic before coding.

-

This assesses system design and data engineering skills in addition to modeling. You should address data ingestion, cleaning, transformation, storage, and accessibility for multiple teams.

Tip: Highlight scalability, reliability, and versioning to handle changing API data over time.

You are tasked with predicting daily stock volatility using historical market data. How would you select features, handle missing data, and validate your model?

This tests end-to-end data modeling, including preprocessing, feature engineering, and evaluation. Consider rolling windows, financial indicators, and backtesting approaches.

Tip: Emphasize data leakage prevention and performance metrics that are appropriate for financial predictions.

Given a portfolio of assets, how would you estimate the Value at Risk (VaR) for the next day? What assumptions would you make, and how would you validate them?

This evaluates your knowledge of risk modeling and statistical assumptions. You need to consider historical simulation, parametric methods, or Monte Carlo approaches.

Tip: Always discuss assumptions, confidence intervals, and limitations of your method to demonstrate financial rigor.

Behavioral interview questions

Behavioral interviews at Goldman Sachs assess how you collaborate, handle challenges, communicate with stakeholders, and demonstrate leadership in high-pressure environments. You will need to provide examples from past experiences that showcase problem-solving, resilience, and interpersonal skills.

Describe a data project you worked on. What were some of the challenges you faced?

This question evaluates your ability to take ownership of complex projects and navigate obstacles. Interviewers want to see how you identify problems, manage uncertainty, and drive outcomes despite difficulties.

Sample answer: I worked on a credit risk scoring project where the data from multiple sources was inconsistent. I collaborated with engineering to standardize formats, implemented rigorous validation checks, and reduced error rates by 40% before deploying the model.

Tip: Focus on the challenges you faced, how you approached them, and the measurable results you achieved.

What are some effective ways to make data more accessible to non-technical people?

Goldman Sachs values data scientists who can communicate insights across teams. This question tests your ability to translate complex analytics into actionable insights for non-technical stakeholders.

Sample answer: I created interactive dashboards with simplified visualizations and provided context through brief walkthrough videos. This approach increased stakeholder adoption and reduced repetitive data requests by 30%.

Tip: Emphasize empathy for your audience and the methods you use to ensure clarity without sacrificing accuracy.

-

This assesses self-awareness and your ability to reflect on your performance. Interviewers look for honesty, growth mindset, and your ability to act on feedback.

Sample answer: My manager would say I am highly analytical and proactive in solving data issues. A constructive criticism they gave me was to delegate tasks more effectively, which I have improved by creating structured project plans. My three strengths are problem-solving, collaboration, and attention to detail; my three weaknesses are delegating too slowly, occasionally over-analyzing, and being too detail-oriented.

Tip: Present weaknesses that are real but improvable, and show how you’ve addressed them.

-

This question evaluates interpersonal and communication skills. Interviewers want to see your ability to adapt your communication style and ensure alignment across teams.

Sample answer: During a complex model deployment, stakeholders were confused about the technical details. I simplified the explanation using visual aids, held short alignment sessions, and ensured every team understood the impact. This improved trust and accelerated the deployment timeline.

Tip: Focus on your ability to adjust communication strategies and actively resolve misunderstandings.

-

This assesses motivation, fit, and long-term interest in Goldman Sachs. Your answer should align your skills and experiences with the company’s mission and the role’s responsibilities.

Sample answer: I want to work at Goldman Sachs because I am passionate about applying data science to financial decision-making and risk management. My experience in building predictive models and collaborating across teams aligns with the company’s data-driven approach to solving complex problems.

Tip: Show genuine interest, connect your background to the company’s goals, and highlight specific aspects of the role that excite you.

Tell me about a time you had to prioritize conflicting requests from multiple teams.

This tests judgment, focus, and your ability to manage trade-offs in a fast-paced environment. Interviewers want to see a transparent, repeatable approach to prioritization.

Sample answer: I had competing requests from risk and compliance teams. I created a scoring model based on impact, effort, and regulatory urgency, aligned both teams on the ranking, and delivered the highest-value items first.

Tip: Demonstrate a structured approach to prioritization and clear communication with stakeholders.

Describe a moment where you led a team through a challenging pivot.

This evaluates adaptability and leadership under change. Goldman Sachs wants employees who can guide teams and maintain performance during uncertainty.

Sample answer: A sudden market shift forced our team to refocus a forecasting project. I reframed the goals, reorganized the roadmap, and maintained daily check-ins to ensure alignment. The pivot resulted in actionable insights that mitigated potential portfolio losses.

Tip: Emphasize how you communicated the pivot, maintained morale, and ensured the team delivered results.

You might think that behavioral interview questions are the least important, but they can quietly cost you the entire interview. In this video, Interview Query co-founder Jay Feng breaks down the most common behavioral questions and offers a clean framework for answering them effectively.

How to Prepare for a Goldman Sachs Data Scientist Interview

Preparing for a Goldman Sachs data scientist interview is about more than solving isolated coding challenges. You need to show you can handle real financial data, design models with business impact, and communicate clearly under pressure. Think of it as preparing to analyze like a quantitative researcher, build like an engineer, and explain like a trusted advisor to the trading desk.

Here is what to focus on so you can show up confident and ready:

Sharpen your core technical toolkit

Expect a mix of coding, SQL, statistics, and machine learning questions. Practice writing SQL queries with joins, window functions, and aggregations on realistic datasets, and rehearse Python solutions that manipulate data, implement algorithms, and run quick analyses.

For structured practice, work through the SQL interview learning path and SQL scenario-based interview questions, then layer in modeling practice via the data science interview learning path.

Tip: Time yourself when solving problems. Goldman Sachs cares about clarity and structure under time pressure, not just getting the right answer.

Think like a financial data scientist

A Goldman Sachs data scientist connects models to trading, risk, and portfolio decisions. You might be asked how to evaluate a new risk model, measure the impact of a trading strategy, or diagnose bias in a credit model.

When you see a modeling question, ask:

- What is the business objective?

- What constraints (risk, regulation, capital) matter?

- How will stakeholders use this model in production?

For end-to-end practice on modeling and evaluation, use the modeling and machine learning interview learning path.

Tip: Practice explaining how your metrics (AUC, precision/recall, Sharpe ratio, VaR) tie directly to financial decisions.

Master experimentation and statistical reasoning

You may not run classic A/B tests in every team, but you will reason statistically about noisy markets, sample bias, and uncertainty. Be ready to walk through probability puzzles, hypothesis tests, and backtesting approaches for time-series data.

Use practice problems in challenges to simulate real interview questions that combine probability, statistics, and modeling.

Tip: Always state your assumptions out loud. Interviewers care as much about how you frame uncertainty as they do about the final number.

Refine your communication and stakeholder skills

Much of the job is translating complex analysis into decisions that traders, PMs, and risk managers can act on. Practice summarizing a project in a few clear bullet points: context, method, key findings, and recommended action.

For hands-on practice communicating your thought process, try mock interviews or 1:1 coaching, focusing on explaining your reasoning as you solve technical questions.

Tip: Rehearse explaining one of your projects to a non-technical friend. If they understand the stakes and the outcome, your explanation is in good shape for Goldman Sachs.

Simulate the full interview loop

Don’t just prepare questions in isolation. Run through a full mock loop: a coding round, a statistics / ML round, a product or case-style round, and a behavioral interview in one sitting. This builds stamina and helps you keep your explanations crisp, even when you’re tired.

Combine challenges, take-home test prep, and mock interviews to create realistic practice sessions that mirror the Goldman Sachs data scientist interview.

Tip: After each mock session, write down two things you did well and two things you will change next time. Treat your preparation like an iterative modeling process.

Average Goldman Sachs Data Scientist Salary

Goldman Sachs data scientist salary packages are highly competitive, reflecting both technical expertise and business impact at each level. Salaries vary by level and region, with total annual compensation including base salary, equity or stock grants, and performance bonuses. Understanding these ranges can help you benchmark data scientist salary in Goldman Sachs and support your negotiation strategy.

Across the United States, total annual compensation for Goldman Sachs data scientists ranges from $144K for analysts to $228K for vice presidents, with stock and bonus components increasing at higher levels (Levels.fyi).

| Level | Total (/yr) | Base (/yr) | Stock (/yr) | Bonus (/yr) |

|---|---|---|---|---|

| Analyst | $144K | $120K | $0 | $30K |

| Associate | $144K | $132K | $0 | $9.5K |

| Vice President | $228K | $180K | $700 | $51.6K |

Average Base Salary

Average Total Compensation

Regional Salary Comparison

Compensation varies across regions due to cost of living and local market conditions. The table below summarizes typical total annual pay for data scientists in the New York City and Greater Dallas areas.

| Region | Median Total Compensation (/yr) | Notes |

|---|---|---|

| New York City Area | $156K | Analysts and associates generally earn slightly higher total packages due to NYC cost of living; stock grants are more common |

| Greater Dallas Area | $132K | Compensation leans more on base and bonus; stock grants less common than NYC |

Tip: Use these figures as a benchmark for your expectations. Consider regional differences, seniority, and bonus structures when evaluating offers. For more detailed breakdowns by level and location, see Goldman Sachs salary data on Levels.fyi.

FAQs

What skills does Goldman Sachs look for in data scientists?

Goldman Sachs prioritizes strong Python, R, and SQL skills, statistical modeling, and machine learning experience. Communication and collaboration are also important since data scientists work closely with business teams, engineers, and analysts.

Does Goldman Sachs hire data scientists?

Yes. Goldman Sachs actively hires data scientists across teams like risk, trading, asset management, and data analytics. Roles can range from building predictive models and pricing tools to supporting internal data analytics at Goldman Sachs. Many data scientist Goldman Sachs roles are based in major hubs such as New York, Dallas, Bengaluru, and London. When you apply, tailor your resume and interview stories to the specific team’s mandate (for example, risk vs trading), not just generic “data science” skills.

What kind of SQL questions do Goldman Sachs data scientists get?

Common Goldman Sachs SQL interview questions for data scientists involve joining multiple tables, computing rolling or windowed metrics, filtering large datasets, and catching subtle edge cases in financial data. You may also get scenario-style questions where you design queries to monitor risk or trading performance.

To prepare, work through the SQL interview learning path and SQL scenario-based interview questions, then practice explaining your query logic out loud.

How are Goldman Sachs data scientist interviews different from data analyst interviews?

Goldman Sachs data analyst interview questions focus more on reporting, dashboards, and business analytics, while data scientist interviews go deeper into modeling, statistics, and system design. That said, both roles share a foundation in SQL, data cleaning, and stakeholder communication, so some overlap in questions is normal.

How technical is the Goldman Sachs data scientist interview?

The interview is highly technical and includes coding challenges, SQL exercises, statistical reasoning, and machine learning or data modeling scenarios. Expect both conceptual questions and hands-on problem solving.

Do I need a finance background to apply?

A finance background is not required, but familiarity with market data, trading concepts, and financial metrics helps you connect your analysis to business impact. Curiosity about financial applications is valued.

How many interview rounds are typical?

Candidates usually go through a recruiter screen, one or two technical phone interviews, an onsite or virtual onsite loop, and a final hiring committee review. Onsite rounds typically cover coding, SQL, machine learning, statistical reasoning, and behavioral assessments.

What languages should I use for coding rounds?

Goldman Sachs accepts Python, R, Java, and sometimes Scala. Choose the language you are most comfortable with for algorithmic and data manipulation problems. Python is common for readability and speed.

How can I prepare for the SQL portion of the interview?

Focus on joins, window functions, aggregations, and filtering across multiple tables. Practicing with the SQL interview learning path or SQL scenario-based questions helps reinforce these skills.

Are take-home assignments part of the process?

Some teams require take-home assignments that test SQL analysis, predictive modeling, or data pipeline tasks. Candidates can practice with take-home test prep to become familiar with similar case studies.

How important are behavioral interviews at Goldman Sachs?

Behavioral interviews are significant because Goldman Sachs evaluates collaboration, communication, and problem-solving under pressure. Practicing with mock interviews can help you become more confident in these rounds.

Does Goldman Sachs expect system design knowledge for junior roles?

Yes. Analysts and associates should understand data ingestion pipelines, storage solutions, and validation layers. Designs should be logical, scalable, and well-structured even if not complex.

How long does the interview process usually take?

The process typically takes three to six weeks, depending on scheduling, team availability, and the number of interview rounds. Recruiters usually provide a timeline during the initial phone screen.

Take Control of Your Goldman Sachs Data Scientist Interview Journey

Success in the Goldman Sachs data scientist interview comes from a mix of structured learning, targeted practice, and confidence in both technical and behavioral skills. By understanding the interview process, mastering SQL, Python, machine learning, and statistical reasoning, and practicing real-world scenarios, you can approach each round with clarity and focus.

Take advantage of Interview Query’s data science interview learning path to build a strong foundation, tackle real challenges with curated interview exercises, and refine your approach through mock interviews or take-home test prep. Start your preparation today and step into your Goldman Sachs data scientist interviews equipped to demonstrate both analytical rigor and business impact.