Goldman Sachs Business Analyst Interview Questions, Process & Salary

Introduction

Business analyst roles have become some of the fastest growing jobs in business and finance, with management analyst positions projected to grow about 9 to 11 percent from 2024 to 2034, much faster than the average for all occupations. Banks and fintech firms drive a large share of that demand as they digitize products, automate back offices, and navigate heavier regulation. In that environment, Goldman Sachs business analysts help untangle complex financial workflows, align teams on requirements, and keep new systems compliant and resilient.

Because the stakes are high, the Goldman Sachs business analyst interview is intentionally rigorous. Candidates typically move from online numerical and situational judgment tests to a HireVue video screen, then into a Superday with two to five back-to-back interviews that each run 30 to 60 minutes. Across those stages you are tested on problem solving, stakeholder communication, understanding of markets, and your ability to translate messy business problems into structured solutions.

If you are preparing for the Goldman Sachs business analyst interview, this guide will walk you through what the role involves, how the interview process works, and the most common Goldman Sachs business analyst interview questions you should practice. You can pair it with the data analytics learning path, SQL interview learning path, and mock interviews to build a structured prep plan before Superday.

What does a Goldman Sachs business analyst do?

Business analysts at Goldman Sachs sit between business teams and technology, making sure that trading desks, operations, risk, and finance all work from the same playbook. They analyze how money, data, and approvals flow through systems and then reshape those workflows so they are faster, safer, and easier to maintain.

Core responsibilities include:

- Analyzing and improving processes: Reviewing end to end workflows, system handoffs, and exception paths to find bottlenecks and control gaps.

- Recommending solutions: Proposing better tools, automation, and process changes that reduce risk and manual work.

- Defining requirements: Translating business needs into clear functional and technical requirements for engineering and operations teams.

- Facilitating communication: Acting as a liaison between front office, middle office, technology, and control functions so everyone aligns on scope and timelines.

- Ensuring compliance: Embedding regulatory and internal policy requirements into new workflows, especially around controls, reporting, and audit trails.

- Supporting system upgrades: Coordinating testing, rollout, and training when platforms are upgraded or replaced.

Many candidates build these skills through roles in consulting, operations, or analytics and then sharpen their technical toolkit with resources like SQL interview questions or the business analyst interview questions collection before applying.

Why this role at Goldman Sachs?

The Goldman Sachs business analyst role is a strong fit if you want to work where financial products, technology, and regulation intersect. You help design how trades are booked, how risk is monitored, and how internal teams move from legacy processes to modern, automated platforms. Your work shows up directly in lower operational risk, cleaner data, and smoother client experiences.

Reasons candidates choose this role:

- Exposure to complex financial systems: You work on projects that touch trading, risk, payments, and regulatory reporting across global markets.

- Structured early career path: Many business analyst roles sit within formal analyst programs that include training, mentorship, and clear promotion routes into product, project management, or leadership.

- High-impact problem solving: You are responsible for fixing real bottlenecks in revenue-generating and control-critical processes, not just building reports.

- Collaboration across functions: Daily interaction with engineers, quants, traders, operations, and compliance teams builds a broad network inside the firm.

- Transferable skills: Requirements gathering, process redesign, and stakeholder management translate well into roles like product manager, strategy associate, or senior operations leader.

If you are still comparing options, you can also look at the broader Goldman Sachs interview guide or related roles like the Goldman Sachs data analyst interview to see how the business analyst track fits into the firm’s wider hiring landscape.

Goldman Sachs Business Analyst Interview Process

Goldman Sachs uses a multi-stage business analyst interview process designed to measure analytical strength, communication clarity, and your ability to operate in a fast-paced, risk-sensitive environment. The process typically starts with online assessments, moves into a HireVue video round, and culminates in a Superday, which is a series of back-to-back interviews with colleagues, managers, and senior leaders. Each stage evaluates a different part of the job: how you solve problems, how you interpret financial workflows, how you handle pressure, and how well you align with the firm’s culture.

Many candidates prepare for these steps using the business analyst interview questions collection or sharpen fundamentals through the data analytics learning path. If you want a broader view of how Goldman Sachs hires across roles, you can also browse our company interview guides.

Interview Stages Overview

| Stage | What it focuses on |

|---|---|

| Online assessments | Numerical reasoning, situational judgment, problem-solving speed |

| HireVue video interview | Behavioral fit, communication clarity, motivation, scenario judgment |

| Superday interviews | Technical reasoning, workflow logic, business cases, market awareness, firm fit |

Online assessments

Goldman Sachs begins the process with online numerical reasoning and situational judgment tests. These assessments filter for candidates who can process information quickly, make sound decisions with limited context, and handle the pace of real-time financial workflows.

What the assessments measure

| Skill Area | What it looks like |

|---|---|

| Numerical reasoning | Interpreting charts, spotting trends, analyzing ratios, and making quick calculations |

| Logical reasoning | Pattern recognition, evaluating statements, identifying correct sequences or rules |

| Situational judgment (SJT) | Choosing the most effective action in professional scenarios based on Goldman’s values |

| Time management | Completing multiple short questions under strict time limits |

| Risk-aware decision making | Selecting answers that balance efficiency, accuracy, and control awareness |

Common question types

- Reading data tables and calculating differences or percentages

- Identifying the best response to workplace dilemmas

- Ranking actions from most to least effective

- Evaluating business scenarios with incomplete information

- Recognizing inconsistencies or errors in short data snippets

How to prepare

- Practice with timed numerical tests to improve speed and accuracy.

- Learn to eliminate obviously incorrect options to save time.

- Review common SJT frameworks such as prioritizing stakeholder clarity, communication, and risk mitigation.

- Build confidence with structured drills found in analytics-focused learning paths like the data analytics learning path.

Tip: Focus on staying structured under pressure. Goldman evaluates how calmly and logically you work with time constraints, not just your math skills.

HireVue video interview

Candidates who pass the online assessments move to a HireVue interview. This stage evaluates communication, motivation, and situational judgment. It is recorded rather than live, and most questions require a short preparation window followed by a one or two minute response.

What the HireVue evaluates

| Category | What they look for |

|---|---|

| Communication clarity | Ability to speak concisely, logically, and with a beginning-to-end structure |

| Behavioral reasoning | How you think through past experiences using structure such as STAR |

| Situational judgment | How you respond to workplace conflicts, deadlines, or shifting requirements |

| Cultural alignment | Interest in the firm, teamwork approach, professionalism |

| Motivation | Why Goldman Sachs, why finance, and why this business analyst role |

Common question themes

- “Tell me about a time you solved a complex problem.”

- “Describe a situation where you had to balance multiple priorities.”

- “Why do you want to work at Goldman Sachs?”

- “How do you handle ambiguity or unclear requirements?”

- “Walk me through your resume.”

What strong answers show

- Clear thinking under time limits

- Ownership and accountability in past experiences

- Ability to translate messy situations into structured actions

- Understanding of how analysts support workflow improvements and cross-team alignment

How to prepare

- Record yourself answering 5 to 10 behavioral prompts to practice pacing and tone.

- Use STAR or a similar structure to keep answers tight.

- Have one or two finance-related motivations ready that sound personal, not generic.

- Review your resume line by line so you can narrate experiences smoothly.

- Build confidence with scenario-style practice using the business analyst interview questions.

Tip: Treat every answer like a mini case. Start with a headline (“The issue was…”) so the interviewer understands your direction immediately.

Superday interviews

Candidates selected from HireVue advance to Superday. This stage includes two to five interviews, each lasting 30 to 60 minutes, usually with a mix of managers, team members, and in some cases senior leaders. Interviews may be virtual or in person. Expect a blend of behavioral questions, technical reasoning, workflow thinking, and market awareness.

| Category | What they evaluate |

|---|---|

| Problem structuring | How you break down ambiguous problems and communicate a clear approach |

| Workflow reasoning | Ability to map current processes, identify gaps, and propose improvements |

| Technical and analytical thinking | Comfort with data checks, requirements gathering, and process validation |

| Market and firm understanding | Awareness of financial products, recent events, and why you want Goldman Sachs |

| Collaboration and stakeholder alignment | How you work with cross-functional teams and manage conflicting inputs |

| Professional presence | Clarity, confidence, and composure during fast-paced back-to-back interviews |

| Case or scenario questions | How you handle small prompts on workflow issues or system changes |

Tip: Start all answers with a short outline. For example: “I would approach this in three steps.” This helps interviewers see your structure immediately.

Goldman Sachs Business Analyst Interview Questions and Answers

Goldman Sachs business analyst interviews test how well you structure problems, validate data, understand financial workflows, and communicate clearly with cross-functional teams. You can expect a blend of technical reasoning, workflow analysis, data interpretation, process redesign, and behavioral scenarios modeled after real operations and system-upgrade projects at Goldman.

Many candidates practice using the business analyst interview questions collection and refine their analytical judgment through the data analytics learning path, since Goldman interviews often mix logic, requirements engineering, and light analytical reasoning.

Below are examples of common question patterns you may encounter during HireVue and Superday.

Technical and analytical interview questions

Goldman Sachs business analysts often work with trade, client, and operational data to support process changes and system implementations. Interviewers want to see whether you can translate ambiguous business definitions into precise logic, spot data quality issues, and build datasets that control teams, operations, and engineering can rely on. You can target these skills directly through business analyst SQL interview questions and then go deeper with the SQL interview learning path.

Calculate first touch attribution for each client who converted.

In a Goldman context, this type of question maps to understanding which initial interaction led a client to open an account or execute a trade. A strong answer joins client interaction logs to conversion events, filters to clients who converted, and then uses

ROW_NUMBER()orMIN(timestamp)to identify the earliest relevant touch per client. You should clarify what counts as a “session” or event, which timestamp you use, and how you handle overlapping or missing records. Interviewers want to see that you can define attribution rules that sales, marketing, and management can trust, similar to how analysts support decisions around outreach channels or coverage models.Tip: Always state the grain of your final table, such as “one row per converting client,” so your logic stays consistent from start to finish.

Write a query to get the number of customers that were upsold.

Here you need both technical skills and clear business thinking, because “upsold” is not defined for you. In a bank, you might define an upsell as a client moving to a higher-fee product, increasing assets under management, or adding an additional account type. You would then group by client, compare earlier and later states, and count those who meet your upsell criteria. Interviewers assess whether your definition makes sense in a financial context and whether you explain how you would handle multiple changes over time. The reasoning directly links to real work such as measuring cross-sell, pricing changes, or relationship deepening.

Tip: Say your upsell definition out loud before writing SQL so the interviewer sees that your logic aligns with how the business tracks revenue and AUM growth.

Write a query to get the current salary for each employee after an ETL error duplicated records.

This question checks how you deal with data quality issues that can affect headcount reporting, budgeting, or regulatory disclosures. You typically identify the correct “current” row per employee by ordering records using an effective date or update timestamp and then assigning

ROW_NUMBER()in a window partitioned by employee. After that, you keep only the row with rank one as the official record. Interviewers look for whether you mention reconciling results to control totals and following up with data engineering to fix the root cause. Goldman expects analysts to preserve data integrity and not just patch issues at the report layer.Tip: When you see duplicate records, describe both your immediate fix and at least one long term control you would recommend, such as validation in the ETL pipeline.

How would you join noisy operations logs to an account-level table to create a clean lifecycle dataset?

This generated question mirrors how business analysts support trade lifecycle or client onboarding analysis. A strong answer starts by clarifying the keys that link logs to accounts, such as account ID, trade ID, or legal entity code. You then describe how you would handle malformed IDs, missing values, or internal system noise, and which filters you would apply to exclude test data or system pings. You should also define the grain of the final dataset, for example “one row per account per business day,” and mention at least one control check such as reconciling event counts to a known total. Interviewers want to see that you understand how to move from raw logs to a dataset that control, risk, and operations teams can actually use.

Tip: Always pair your join logic with at least one data quality check so your answer shows both engineering awareness and control thinking.

-

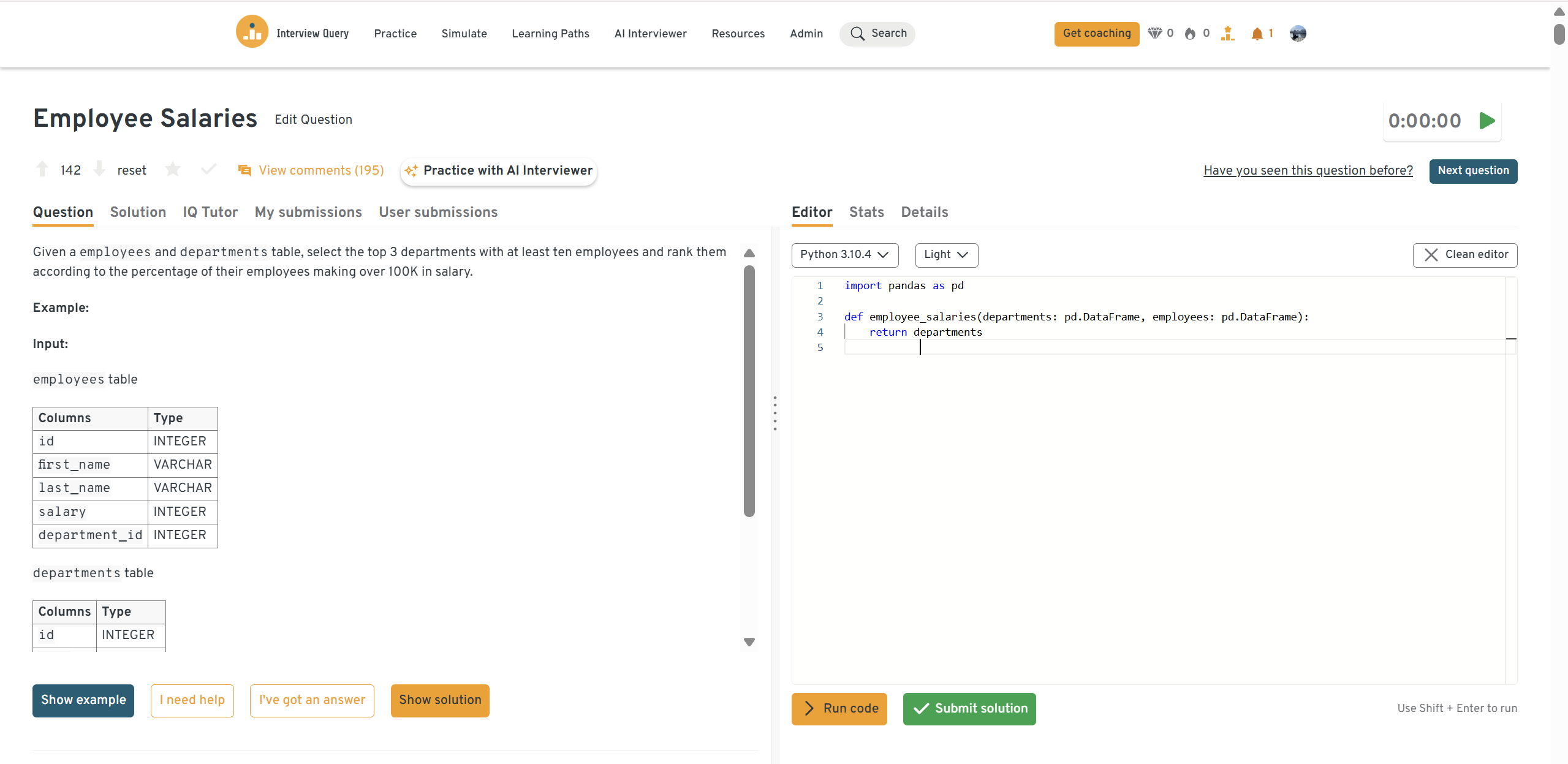

This question evaluates whether you can aggregate HR or compensation data into a ratio that leadership can interpret. You need to group by department, calculate the percentage of employees above the compensation threshold, and filter out departments with fewer than ten employees to avoid misleading ratios. Ranking with a function such as

DENSE_RANK()lets you identify the top three departments even when percentages tie. Interviewers notice if you use common table expressions to keep the query readable and if you mention validating results against headcount totals. At Goldman, similar logic might support diversity reporting, budgeting, or benchmarking across divisions.Tip: When computing ratios, explicitly state how you treat null salaries, interns, or employees on leave so stakeholders know exactly who is included in the analysis.

You can practice this exact problem on the Interview Query dashboard, shown below. The platform lets you write and test SQL queries, view accepted solutions, and compare your performance with thousands of other learners. Features like AI coaching, submission stats, and language breakdowns help you identify areas to improve and prepare more effectively for data interviews at scale.

Business case and process improvement interview questions

Business analysts at Goldman Sachs often drive workflow redesigns, reduce operational risk, and coordinate system or regulatory changes. Interviewers want to see whether you can structure ambiguous problems, communicate clearly, and recommend solutions that balance control, efficiency, and feasibility. You can practice similar end to end thinking through mock interviews and scenario-based challenges.

A post-trade operations team is seeing a spike in settlement breaks for a specific product. How would you investigate and resolve it?

This tests your ability to structure an operational issue. You should begin by validating the spike, then segment breaks by counterparty, region, product subtype, and time window. Map the trade lifecycle to pinpoint where breaks cluster and review recent system or static data changes. Close by proposing targeted fixes such as data checks, booking templates, or workflow adjustments, plus a monitoring plan to ensure the issue does not recur.

Tip: Keep your structure simple: validate → segment → diagnose → propose fixes.

A new regulation requires additional fields in trade reporting. How would you design and roll out the required process changes?

Start by interpreting the regulation into specific business and data requirements. Identify which systems, teams, and workflows are impacted, then perform a gap analysis to see what information is missing. Outline how you would source the new data, partner with technology for implementation, and define acceptance criteria. End with controls such as updated documentation, training, and ongoing monitoring for compliance.

Tip: Break your answer into requirements, implementation, and controls.

If a credit model estimates someone’s creditworthiness at 83 percent with a small error range, and you use 83 percent as the approval cutoff, are you more likely to overestimate or underestimate the number of creditworthy applicants?

This question tests how you think about uncertainty and model error in a business context. A strong answer explains that applying a hard cutoff at the estimated score biases decisions because individuals slightly below 83 percent may actually qualify once model error is considered. This can lead to underestimating the true creditworthy population. You should briefly mention real world implications such as rejecting borderline but qualified applicants or misallocating credit limits.

Tip: Always clarify whether model error introduces upward or downward bias before giving your final conclusion.

You are asked to streamline a manual reconciliation process between two internal systems. How would you approach the improvement?

Begin by mapping the current process and identifying the most error prone or time consuming steps. Propose quick wins such as standardizing input files, adding validations, or creating a simple matching script. Then outline longer term enhancements that could be automated once value is proven. Prioritize risk reduction and measurable improvements like fewer breaks or faster resolution times.

Tip: Use a phased mindset: stabilize first, then simplify, then automate.

A front office desk wants to launch a new product on an existing platform. What analysis would you run to assess feasibility?

Start by understanding the product’s lifecycle requirements and comparing them to current system capabilities. Review booking workflows, pricing, risk calculations, settlement, collateral, and reporting needs. Identify gaps and estimate the level of effort with technology, operations, and compliance. Evaluate control impacts and propose interim workarounds if needed before presenting a go or no-go recommendation.

Tip: Address both functional fit and operational risk so your answer feels balanced.

Multiple teams are requesting conflicting process changes. How would you prioritize and sequence the work?

Describe how you would gather context from each stakeholder and clarify underlying objectives. Propose prioritization criteria such as impact, urgency, regulatory risk, effort, and dependencies. Use a simple framework like impact versus effort to sequence work transparently. Communicate tradeoffs clearly and maintain a shared backlog to manage expectations.

Tip: Ground your answer in a transparent decision framework rather than personal judgment.

Behavioral and motivational interview questions

Behavioral interviews at Goldman Sachs assess how you work with cross functional teams, handle pressure, communicate clearly, and align with the firm’s culture of ownership and accountability. Interviewers want structured, concise stories that show how you navigate ambiguity, influence others, and deliver results in fast moving environments. You can practice these skills using STAR style scenarios in mock interviews, which mirror Superday conversations closely.

Tell me about a data project you worked on. What challenges did you face?

This question tests resilience and problem solving. A strong answer highlights a specific project, the constraints you faced, and how you communicated risks early to keep stakeholders aligned. Close with a measurable improvement you delivered.

Tip: Mention both a technical hurdle and a collaboration hurdle.

Sample Answer: I worked on a workflow accuracy audit where several required data fields were missing for one region. I quantified the impact, shared a concise risk summary with the PM, and partnered with engineering to recover part of the dataset. To maintain progress, I designed a temporary proxy metric that allowed stakeholders to continue decision making. The final insights informed a process update that reduced error rates in the next cycle.

What are some effective ways to make data more accessible to non technical people?

Interviewers want to see whether you simplify information for decision clarity. Strong answers focus on identifying stakeholder needs first, then designing dashboards or summaries that remove unnecessary complexity. Mention limiting KPIs, adding definitions, or providing short walkthroughs.

Tip: Connect accessibility to better decisions, not just cleaner visuals.

Sample Answer: I begin by understanding which decisions the team needs to make. I reduce dashboards to a few core KPIs, add inline definitions, and use simple visuals that highlight direction rather than unnecessary detail. I also provide a short recorded walkthrough to help new users. This makes the data easier to interpret and increases adoption across non technical teams.

What would your manager say about your strengths and weaknesses?

This evaluates self awareness and your ability to reflect honestly. Choose strengths that match the role and select a weakness you are actively improving. Keep the example concrete and grounded.

Tip: Avoid weaknesses tied to core analyst responsibilities.

Sample Answer: My manager would highlight structured problem solving and communication as strengths because I make complex findings easy for stakeholders to act on. A weakness I am improving is spending too much time exploring edge cases. I now use time boxing and share early drafts sooner, which keeps projects moving faster.

Talk about a time you had trouble communicating with stakeholders. How did you overcome it?

This tests adaptability and interpersonal awareness. Describe the misalignment, how you identified the communication gap, and what changes you made in your delivery. Emphasize how your adjustment improved collaboration.

Tip: Highlight the moment you realized you needed to adapt.

Sample Answer: I partnered with a stakeholder who preferred headline summaries while I initially shared detailed analyses. After noticing repeated delays in approvals, I switched to a one page format with recommendations upfront and optional deep dives. This improved alignment immediately and accelerated the decision timeline.

Why do you want to work with us?

Goldman wants a motivation rooted in its culture and business model. Strong answers connect your interest to financial systems, global workflows, or the scale of operational change you can influence.

Tip: Make your answer specific to Goldman Sachs.

Sample Answer: I want to join Goldman Sachs because the firm operates at the center of global financial systems and emphasizes ownership, partnership, and high accountability. I am interested in improving large scale workflows that support trading, risk, and client operations. I also value Goldman’s focus on excellence and continuous improvement, which aligns with how I like to approach analytical and cross functional work.

Describe a time you had to work under intense time pressure. How did you manage competing priorities?

This tests prioritization and decision making in fast paced environments. A strong answer shows how you triaged tasks, communicated expectations early, and protected quality despite constraints.

Tip: Focus on how you structured your decisions.

Sample Answer: During a regulatory reporting deadline, multiple teams escalated last minute requests. I created a quick impact versus urgency matrix, communicated what could realistically be delivered, and escalated risks to leadership. I completed the highest impact items first and documented the rest for the next cycle. This kept the submission accurate and on time.

Tell me about a time you had to align multiple teams with conflicting views. What was your approach?

This evaluates stakeholder management and influence. Strong answers highlight how you gathered context, identified shared objectives, and facilitated alignment using data or structured frameworks.

Tip: Mention the specific tool or tactic you used.

Sample Answer: I worked on a project where operations and engineering disagreed on root causes of delays. I held a short working session to map the workflow and quantify each pain point. Once both groups saw the same data, it became easier to agree on priorities. We aligned on a phased solution that reduced rework by focusing on the highest friction step first.

If you prefer a quick video breakdown first, watch this video by Jay Feng, co-founder of Interview Query and former data scientist at Nextdoor and Monster. It’s a fast way to understand what hiring managers look for before you dive into deeper practice.

How To Prepare for a Goldman Sachs Business Analyst Interview

Preparing for a Goldman Sachs business analyst interview requires more than strong analytical skills. Goldman expects candidates to think in systems, understand financial workflows, and demonstrate the firm’s core values of Partnership, Client Service, Integrity, and Excellence. Every stage of the interview is designed to evaluate whether you can bring structure to ambiguity, collaborate across high-stakes environments, and uphold rigorous control and compliance standards.

To build the right foundation, many candidates practice with the business analyst interview questions, refine technical reasoning through the business analyst SQL interview questions, and rehearse structured delivery in mock interviews.

Demonstrate structured reasoning that reflects Goldman’s culture of excellence

Excellence at Goldman means operating with precision. Interviewers expect you to break down complex operational or regulatory problems into logical, auditable steps. Whether investigating settlement breaks or defining reporting requirements, clarity of structure matters more than jumping to solutions.

Tip: Open with a roadmap (“I’d approach this in three steps…”) to show disciplined, high-quality thinking.

Show understanding of financial systems, trade lifecycles, and control frameworks

Business analysts at Goldman work closely with operations, middle office, risk, and engineering. You will be expected to understand how trades flow through booking, clearing, settlement, reconciliation, and reporting, as well as where controls and regulatory checks fit in. This reflects both Integrity and Client Service, because stable processes protect clients and the firm.

Tip: Before interviews, review basics like trade booking, reference data, reconciliations, regulatory filings, and exception management.

Translate business needs into requirements that support client outcomes

Client Service at Goldman means ensuring systems and processes perform reliably. Interviewers want to know you can turn ambiguous requests from desks or operations into concrete requirements that technology teams can build. Strong candidates clarify assumptions, define success metrics, and understand upstream and downstream impacts.

Tip: Practice summarizing requirements in plain language with measurable acceptance criteria.

Strengthen your analytical toolkit so you can validate data with confidence

While not every BA role is SQL heavy, all require comfort validating data and spotting inconsistencies. Goldman expects analysts to challenge assumptions, detect anomalies, and ensure numbers tie out before decisions are made. This ties directly to Integrity.

Tip: Drill fundamentals in the SQL interview learning path and focus on reasoning, not flashy syntax.

Prepare 2–3 end to end stories that demonstrate partnership and ownership

Partnership is one of Goldman’s defining values. Behavioral interviews will probe how you collaborated with other teams, navigated conflicting priorities, and took ownership of outcomes. Choose examples that show cross functional work, disciplined communication, and tangible impact under non-ideal conditions.

Tip: Use a structure such as problem → constraints → actions → measurable result to make your story memorable.

Demonstrate stakeholder alignment in high pressure environments

Analysts often coordinate between front office, operations, technology, compliance, and risk. Interviewers want to see how you handle conflicting views while preserving long term partnerships. Strong candidates show they escalate early, communicate clearly, and make decisions grounded in facts and controls.

Tip: Prepare one example where you aligned multiple groups with different incentives or timelines.

Connect your motivation to Goldman’s mission, values, and global impact

Goldman Sachs expects candidates to articulate why they want this role at this firm. Strong answers reference the firm’s purpose of advancing sustainable economic growth, its emphasis on responsible finance, and the analyst’s role in strengthening systems that underpin client trust.

Tip: Study Goldman’s values—Partnership, Client Service, Integrity, Excellence—and tie each one to how you naturally work.

Average Goldman Sachs Business Analyst Salary

Recent data from Levels.fyi shows that the Goldman Sachs business analyst salary in the United States typically centers around a median total compensation of roughly $110,000–$120,000 per year, depending on team and level. In New York City, one of the most common locations for these roles, recent submissions show higher medians in the low-to-mid $120,000 range. Packages are driven mainly by base salary and annual cash bonuses, with stock playing a smaller role compared to tech companies.

National Compensation Overview (United States)

| Level | Total Compensation (Annual) | Base Salary (Annual) | Bonus (Annual) |

|---|---|---|---|

| Analyst | $108,000 | $108,000 | $2,700 |

| Associate | $108,000 | $98,400 | $9,300 |

| Vice President | $192,000 | $156,000 | $39,600 |

Across most U.S. offices, analysts and associates cluster around $100K–$110K, while vice presidents show a noticeable jump due to larger bonuses tied to business performance.

Average Base Salary

Average Total Compensation

New York City Compensation

New York City, Goldman’s largest hub, consistently reports higher compensation because of market competitiveness and cost of living. While base salary is similar to other regions, bonuses tend to be materially higher for both junior and mid-level talent. The figures below reflect this uplift based on NYC submissions.

| Level | Total Compensation (Annual) | Base Salary (Annual) | Bonus (Annual) |

|---|---|---|---|

| Analyst | $120,000 | $108,000 | $15,600 |

| Vice President | $204,000 | $168,000 | $44,400 |

Candidates interviewing for New York roles should expect ranges at the upper end of Goldman’s BA compensation, especially when team performance influences bonus pools.

How to interpret these salary ranges

Goldman Sachs compensation varies by:

- Team placement (e.g., operations vs. global markets vs. consumer banking)

- Bonus pool performance for the business line

- Market location, with NYC and Salt Lake City showing different pay norms

- Leveling, since titles like Analyst, Associate, and VP cover wide responsibility bands

For most candidates, a realistic expectation is:

- Early-career analyst: $105K–$125K total compensation

- Associate: $110K–$130K depending on team

- Vice president: $180K–$210K with bonus-driven variance

FAQs

How competitive is the Goldman Sachs business analyst interview?

Goldman Sachs interviews are highly competitive due to strong applicant volume and the firm’s emphasis on analytical rigor and cultural alignment. Candidates must show structured thinking, composure under pressure, and familiarity with financial workflows. Practicing realistic scenarios through mock interviews can help you stand out.

What is the typical hiring timeline for this role?

Most candidates progress from online assessments to HireVue and then to Superday within three to six weeks. Timelines may move faster for campus recruiting and slightly slower for lateral candidates depending on team availability.

Do I need technical skills like SQL or modeling for this role?

Not every team requires SQL, but many expect comfort with data validation, requirements documentation, and analytical reasoning. Groups in risk, finance, or regulatory reporting may expect familiarity with SQL logic or systems mapping. You can review fundamentals in the SQL interview learning path.

What kinds of case questions should I expect at Superday?

Superday interviews often include workflow mapping, process improvement prompts, requirements gathering scenarios, and risk or controls questions. Some teams will also test light quantitative reasoning or data quality diagnostics.

How important are Goldman Sachs core values in the interview?

Very important. Interviewers evaluate how you demonstrate partnership, client service, integrity, and excellence in your examples. Expect situational questions about conflict management, building trust, and responsible decision making.

Do business analysts work directly with clients at Goldman Sachs?

This depends on the team. Many BA roles support internal operations, engineering, or risk functions. Others, such as roles in Global Markets or client onboarding, may involve indirect or direct client interactions. Regardless of team, your work often affects client experience.

Is the business analyst role rotational or fixed?

Campus hires may join structured programs that provide training and exposure to multiple groups. Lateral hires usually join a fixed team but still collaborate widely across the firm. Mobility is common after strong performance.

What background do successful candidates usually have?

Strong candidates tend to come from business, finance, engineering, or analytics backgrounds. Experience in operations, consulting, systems analysis, or cross-functional project work is valuable. Clear communication and strong documentation skills are key differentiators.

Is this role hybrid or in office?

Goldman Sachs maintains a structured in-office culture, especially in New York, Dallas, Salt Lake City, and Bengaluru. Some flexibility exists, but candidates should expect regular in-person collaboration.

Is Goldman Sachs a good place to work as a business analyst?

For many candidates, Goldman Sachs is attractive because of its exposure to complex financial systems, high ownership expectations, and well-defined early-career programs. As a business analyst, you work close to the core of trading, risk, and operations workflows, which accelerates learning but also comes with a fast pace and high standards. Whether it is a good fit depends on how much you enjoy structured problem solving, cross-functional coordination, and operating in a high-accountability culture.

What should I focus on when preparing for Superday?

Superday rewards candidates who communicate frameworks clearly, handle ambiguity with confidence, show integrity in decision making, and understand financial systems. Reviewing your resume walkthrough and practicing structured responses will help you perform well.

Start Your Goldman Sachs Business Analyst Prep With Momentum

Preparing for a Goldman Sachs business analyst interview is about showing clarity, discipline, and strong judgment in how you solve problems in a financial systems context. When you can translate complex workflows into structured recommendations, communicate with precision, and connect your decisions to client and control impact, you already signal that you can thrive in Goldman’s fast, high-ownership environment. The strongest candidates practice with intention and build the habits that top financial institutions look for.

Interview Query gives you a focused way to develop those skills. You can sharpen your reasoning through learning paths, build confidence with realistic mock interviews, and challenge yourself with real case-style prompts in challenges. Start preparing today and walk into your Goldman Sachs interview ready to perform at your highest level.