American Express Data Engineer Interview Guide: Process, Questions & Salary

Introduction

What happens when a data pipeline fails at a company processing trillions of dollars in transactions each year?

At American Express, that question is not academic. Data engineers power the infrastructure behind payments, rewards, risk, and digital servicing, where reliability, scalability, and correctness are non-negotiable. From ingesting massive transaction streams to enabling analytics and machine learning on enterprise platforms like LUMI, American Express data engineers sit at the backbone of decision-making.

That reality shapes the American Express data engineer interview. This is not a role focused on writing isolated ETL scripts or solving toy problems. Interviewers are evaluating whether you can design resilient data pipelines, reason about performance and failures, and collaborate with product, analytics, and platform teams in a regulated environment. In this guide, we break down the interview process, what each stage is designed to test, and how candidates should prepare for data engineering roles where scale, reliability, and judgment matter as much as code.

American Express Data Engineer Interview Process

The American Express data engineer interview process typically spans three to four rounds, depending on team and seniority. The process blends hands-on technical evaluation with system design, project deep dives, and behavioral assessment, with a strong emphasis on real-world data engineering constraints rather than purely academic problems.

Interview Process Overview

| Stage | What happens | What AmEx is really testing |

|---|---|---|

| Recruiter / HR screen | Background, role fit, expectations | Alignment with data engineering scope and enterprise environment |

| Technical round(s) | SQL, Python or PySpark, big data concepts | Core data engineering fundamentals and reasoning under scale |

| Project deep dive | Resume-based architecture discussion | Ownership, system thinking, and troubleshooting ability |

| Managerial / behavioral round (or GD) | Scenario-based discussion | Judgment, communication, and delivery under pressure |

Recruiter Or HR Screen

This is usually a short call focused on role alignment, experience level, and expectations around location, team, and responsibilities. Recruiters often confirm your experience with large datasets, cloud platforms, and collaborative delivery.

Tip: Be clear about the scale of systems you’ve worked on. Interviewers respond well to concrete examples (data volume, latency requirements, failure impact).

Technical Rounds (SQL, Python/PySpark, Big Data)

Technical interviews are the core of the American Express Data Engineer process. These rounds usually combine hands-on coding questions with conceptual discussions around data pipelines and performance.

What typically comes up:

- SQL queries involving joins, aggregations, and window functions

- Python or PySpark coding focused on transforming large datasets

- Big data concepts such as partitioning, data skew, fault tolerance, and optimization

- Cloud or platform discussions, especially around GCP services or Spark-based workflows

Interviewers are not looking for clever tricks. They want to see whether you can write correct, readable code and explain how it behaves at scale.

Tip: Practice explaining trade-offs out loud. Using Interview Query’s mock interviews is especially helpful for pressure-testing how you communicate optimization choices and failure handling.

Project Deep Dive

This round focuses on your past data engineering work. Interviewers typically ask you to walk through a pipeline or platform you built: from ingestion to transformation, storage, monitoring, and recovery.

They often probe:

- Why certain design decisions were made

- How failures were detected and handled

- What you would change if the system scaled 10×

Tip: Structure answers end to end. Treat this as a system design walkthrough, not a list of tools. Practicing real-world scenarios through Interview Query’s challenges helps build this narrative muscle.

Managerial, Behavioral, Or Group Discussion Round

The final stage varies by team and region. Some candidates face a managerial or behavioral interview, while others may participate in a group discussion. These rounds assess how you operate in ambiguity, collaborate across teams, and respond to incidents or delivery pressure.

Tip: Prepare examples where you handled pipeline failures, data quality issues, or tight delivery timelines. Interviewers value calm, structured responses over dramatic problem-solving stories.

American Express Data Engineer Interview Questions

American Express data engineer interview questions are designed to test whether you can build reliable, scalable, and well-governed data systems in a high-volume, regulated environment. Interviewers evaluate how you reason about correctness, performance, failure modes, and trade-offs—not just whether you can write SQL or Spark code—especially in the context of American Express.

SQL And Data Modeling Questions

SQL questions focus on correctness, edge cases, and how queries behave on large, evolving datasets. Interviewers expect clean logic, explicit assumptions, and awareness of downstream impact.

How would you compute rolling metrics, such as a 7-day moving average, on a large fact table?

This evaluates your understanding of window functions and their performance implications at scale. Follow-ups often probe partitioning strategy and validation techniques.

Tip: Talk through partitioning, ordering, and how you would sanity-check results on a smaller sample.

How would you identify duplicate records and retain only the most recent entry per business key?

This tests data quality reasoning and deterministic deduplication strategies. Interviewers want to see how you define “latest” and enforce consistency across reruns.

Tip: Clarify how ties are handled and how duplicates are prevented downstream.

How would you calculate user retention or repeat activity using transaction data?

This assesses cohort definition, temporal joins, and avoidance of double counting. Interviewers care more about your definition of retention than the final number.

Tip: Clearly define the cohort event and explain how you validate retention counts.

How would you determine whether a sudden drop in a key metric is caused by data issues or real behavior change?

This mirrors real American Express scenarios involving upstream pipeline or schema changes. Interviewers expect a structured diagnostic approach before drawing conclusions.

Tip: Start with freshness, completeness, and upstream checks before business hypotheses.

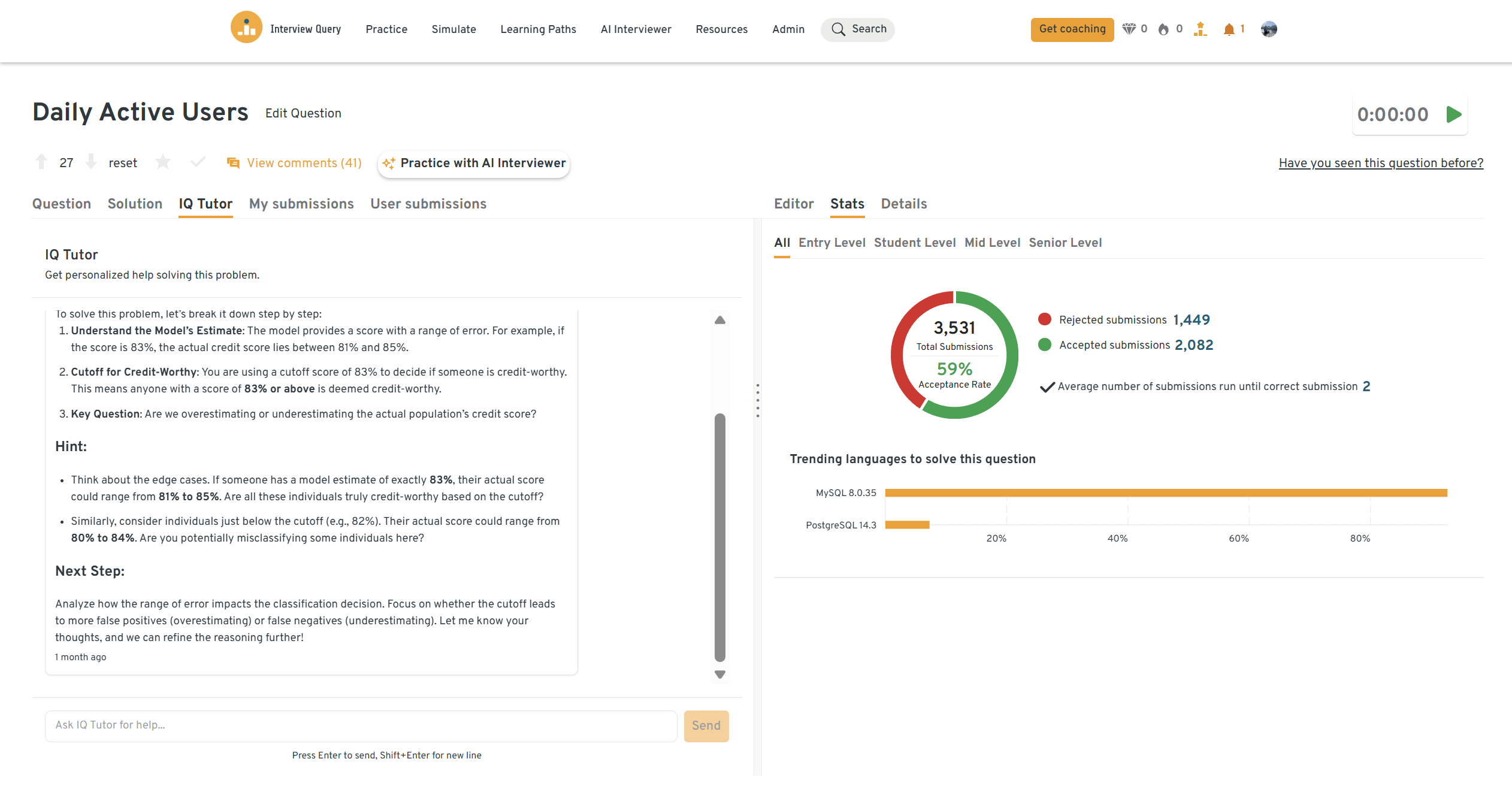

How would you calculate daily active users (DAU) and weekly active users (WAU) from an events table?

This question tests aggregation logic, date handling, and metric definition clarity. Interviewers care whether your logic matches the business meaning of “active,” not just whether the query executes.

Tip: Explain how you handle time zones, late-arriving events, and partial days.

You can practice this exact problem on the Interview Query dashboard, shown below. The platform lets you write and test SQL queries, view accepted solutions, and compare your performance with thousands of other learners. Features like AI coaching, submission stats, and language breakdowns help you identify areas to improve and prepare more effectively for data interviews at scale.

System Design And Architecture Questions

These questions evaluate whether you can design enterprise-grade data systems that scale, remain secure, and fail safely.

How would you add a column to a billion-row table without affecting users?

This tests whether you understand online schema changes and safe rollout strategies. Strong answers emphasize phased deployment and validation rather than risky one-step changes.

Tip: Describe adding nullable columns, dual writes, batched backfills, and post-deployment verification.

Describe how you would design a secure, scalable data pipeline on GCP.

This evaluates end-to-end thinking across ingestion, transformation, storage, and serving. Security and governance should be first-class design constraints.

Tip: Anchor your design around IAM, encryption, and auditability before scaling.

How would you design a pipeline to ingest and process near-real-time transaction data?

This assesses streaming fundamentals, latency trade-offs, and correctness under failure. Interviewers care about idempotency and ordering guarantees.

Tip: Clarify latency SLAs and define a single source of truth early.

How do you manage access control and data governance across multiple teams?

This reflects American Express’s regulated environment and emphasis on trust. Interviewers want governance that enables delivery rather than blocking it.

Tip: Discuss centralized identity, cataloging, lineage, and policy-driven access.

How would you design a system that supports both analytics and machine learning workloads?

This tests whether you can balance competing access patterns and performance needs. Strong answers separate raw ingestion from curated consumption layers.

Tip: Explain how you prevent analytical changes from breaking ML pipelines.

Pipelines, Lakehouse, And Spark Questions

These questions test hands-on depth in PySpark, orchestration, and modern data lake design.

Design a data pipeline for hourly user analytics.

This evaluates incremental processing, orchestration, and data freshness guarantees. Interviewers want to see explicit handling of late data and backfills.

Tip: Include watermarking or reconciliation strategies.

How would you build an ETL pipeline to ingest payment data from an external API?

This tests ingestion reliability, schema evolution, and idempotency. Payment data magnifies the cost of duplication or loss.

Tip: Call out retry logic, idempotency keys, and replay handling.

Explain the Bronze, Silver, and Gold layers in a modern data lakehouse.

This evaluates conceptual clarity and operational understanding. Interviewers want to hear how layering supports trust and reprocessing.

Tip: Tie each layer to quality guarantees and SLAs.

How do you optimize a slow PySpark job processing large datasets?

This tests whether you understand distributed execution rather than treating Spark as a black box.

Tip: Mention partitioning, skew, shuffle reduction, and Spark UI usage.

How do you design pipelines to handle schema changes safely?

This mirrors real-world enterprise data evolution. Interviewers look for proactive controls rather than reactive fixes.

Tip: Discuss schema validation, versioning, and backward compatibility.

Behavioral And Collaboration Questions

Behavioral questions in the American Express Data Engineer interview focus on how you operate in high-stakes, enterprise data environments. Interviewers assess judgment, communication, and whether you can protect data reliability while collaborating across product, risk, and platform teams.

Tell me about a time you handled a data pipeline failure in production.

This question evaluates your incident response maturity and ability to balance speed with correctness. Interviewers look for structured diagnosis, clear communication, and concrete prevention steps rather than heroics or blame-shifting.

Tip: Emphasize containment, stakeholder communication, and what you changed to prevent recurrence.

Sample answer:

In a previous role, a critical batch pipeline failed due to an upstream schema change. I first confirmed data completeness and scoped the impact, then implemented a temporary schema guard to restore downstream reporting. After resolution, I added contract checks and alerts so similar changes would be caught before production, which reduced repeat incidents.

Describe a time you had to push back on unrealistic delivery expectations.

This tests whether you can protect system integrity while maintaining stakeholder trust. American Express values engineers who surface risk early and propose viable alternatives instead of simply saying no.

Tip: Frame pushback around business risk and data correctness, not personal preference.

Sample answer:

A stakeholder requested a late change that would have bypassed validation steps. I explained the risks clearly, including potential downstream reporting errors, and proposed a phased alternative that delivered partial value safely. This approach preserved timelines while keeping data quality intact.

Tell me about a project where you worked closely with multiple teams.

This question assesses cross-functional collaboration and alignment in a matrixed organization. Interviewers want to see how you prevent misalignment across engineering, analytics, and product stakeholders.

Tip: Highlight shared artifacts such as schemas, contracts, or runbooks that enabled collaboration.

Sample answer:

I worked with product, analytics, and platform teams to standardize schema definitions and metric logic for a shared dataset. By documenting contracts and review processes, we reduced downstream confusion and improved consistency across reports.

How do you prioritize work when multiple pipelines fail at the same time?

This evaluates triage judgment under pressure. Interviewers want a repeatable framework rather than ad hoc decision-making.

Tip: Show how you balance business impact, dependency chains, and recovery time.

Sample answer:

I prioritize based on business criticality and dependency impact, restoring pipelines that unblock others first. I also communicate status and expected timelines clearly so stakeholders understand trade-offs while fixes are underway.

Why are you interested in a Data Engineer role at American Express?

This question evaluates motivation and role fit. Interviewers look for alignment with the company’s emphasis on trust, scale, and reliability rather than generic interest in data engineering.

Tip: Tie your motivation to building resilient systems in regulated, high-impact environments.

Sample answer:

I’m motivated by building data systems where correctness and reliability truly matter. At American Express, data engineering directly supports payments, risk, and customer trust, which makes the work both challenging and meaningful.

If you want deeper practice, you can explore the full set of 100+ data engineer interview questions with answers. This walkthrough by Interview Query founder Jay Feng covers 10+ essential data engineering interview questions—spanning SQL, distributed systems, pipeline design, and data modeling.

How To Prepare For An American Express Data Engineer Interview

Preparing for an American Express data engineer interview goes beyond reviewing SQL syntax or Spark APIs. Interviewers are evaluating whether you can build and operate reliable data systems in a regulated, high-volume environment where correctness, security, and recoverability matter as much as performance.

Prepare For End-To-End Data Delivery, Not Isolated Tasks

American Express data engineers are expected to reason across the full lifecycle of data: ingestion, transformation, storage, serving, and monitoring. Interview questions frequently move from “how would you write this” to “what breaks next” and “how do you know it’s safe.”

When practicing, always push yourself to explain:

- where data comes from,

- how it changes,

- who consumes it,

- and what happens when something goes wrong.

This systems mindset matters more than naming the “right” tool.

Practice SQL With Edge Cases And Validation In Mind

SQL questions are rarely trick-heavy, but they are detail-sensitive. Interviewers care about time windows, late data, duplicate handling, and metric definitions that hold up under scrutiny.

When practicing SQL, get into the habit of explaining:

- how you would validate results,

- what assumptions you’re making,

- and how the query behaves on large datasets.

Live practice through Interview Query’s mock interviews is especially useful for pressure-testing this reasoning style.

Strengthen PySpark And Big Data Fundamentals

For teams working on platforms like LUMI or cloud-based lakehouses, PySpark is a core skill. Interviewers expect you to understand distributed execution concepts such as partitioning, shuffles, skew, and fault tolerance.

You should be comfortable explaining how you diagnose slow jobs and what you change first when performance degrades. Practicing with Interview Query’s real-world challenges helps reinforce this practical, diagnostic approach.

Be Ready To Defend Design Decisions

System design questions are often discussion-heavy and follow-up driven. Interviewers want to see whether you can defend architectural choices under constraints like cost, governance, and delivery timelines.

When preparing, practice structuring answers around:

- requirements and constraints,

- proposed architecture,

- failure modes and mitigation,

- validation and monitoring.

Clear structure often matters more than architectural sophistication.

Prepare Behavioral Stories Around Reliability And Judgment

Behavioral interviews at American Express focus on incident handling, communication, and delivery under pressure. Prepare STAR-style examples where you:

- handled pipeline failures,

- pushed back on risky requests,

- aligned multiple teams around shared data contracts.

Strong answers emphasize calm decision-making and prevention, not heroics.

Role Overview: American Express Data Engineer

An American Express data engineer builds and maintains the data infrastructure that powers payments, rewards, risk, and digital servicing. The role sits at the intersection of platform engineering, analytics enablement, and enterprise governance, with a strong emphasis on reliability and scale.

On a day-to-day basis, data engineers design and operate pipelines that ingest high-volume transaction data, transform it into trusted datasets, and make it available for analytics, reporting, and machine learning. Much of the work involves collaborating with product owners, analysts, and platform teams to translate business needs into durable data systems.

Core Responsibilities

- Data pipeline engineering: Build and operate batch and near-real-time pipelines for ingestion, transformation, and delivery.

- Data modeling and architecture: Design schemas and models that balance flexibility with correctness and performance.

- Platform collaboration: Work with core platforms such as LUMI and cloud services to support enterprise workloads.

- Data quality and governance: Implement validation, monitoring, access controls, and lineage to ensure trust.

- Performance and reliability: Optimize jobs, handle failures, and design for recovery at scale.

- Cross-functional delivery: Partner with product, analytics, risk, and compliance teams to support business decisions.

Culture And What Makes The Role Distinct

At American Express, data engineering operates in a high-trust, risk-aware environment. Engineers are expected to think carefully about the downstream impact of every change, especially when working with financial and customer data.

What differentiates strong data engineers at American Express:

- A production-first mindset focused on correctness and recoverability

- Comfort explaining trade-offs to non-engineering stakeholders

- Discipline around validation, monitoring, and documentation

- Willingness to take ownership of systems beyond initial delivery

Because data systems directly support customer trust and regulatory obligations, American Express values engineers who combine technical depth with sound judgment and clear communication.

Average American Express Data Engineer Salary

American Express data engineer compensation in the United States follows the company’s band-based structure, with total pay made up primarily of base salary plus annual bonus, and limited equity at most levels. While titles may vary across teams, Data Engineers typically map to the same engineering bands used for software engineers.

Based on reported data from Levels.fyi, U.S. compensation for Data Engineers at American Express spans a wide range depending on band and scope.

| Band (Approx. Level) | Role Scope (Typical) | Estimated Total Compensation (Annual) |

|---|---|---|

| Band 30 | Entry / Early-career Data Engineer | ~$140K – $150K |

| Band 35 | Mid-level / Senior Data Engineer | ~$160K – $185K |

| Band 40 | Staff / Lead Data Engineer | ~$200K – $230K |

| Band 45+ | Principal and above (rare for DE) | Can exceed ~$250K+ |

The median total compensation for a U.S.-based Data Engineer at American Express is reported at ~$147K per year, with higher bands driven by broader system ownership and architectural responsibility.

Average Base Salary

Average Total Compensation

What Drives Higher Offers

Several factors strongly influence where an offer lands within these ranges:

- Band and leveling: Staff-level (Band 40) engineers see a significant jump due to system-wide ownership expectations.

- Role focus: Platform and infrastructure-heavy data engineering roles typically sit higher than reporting-focused roles.

- Location: These figures reflect U.S.-based roles; compensation is lower in other regions.

- Interview performance: Strong system design and failure-handling discussions can meaningfully affect leveling decisions.

When evaluating an offer, it’s more useful to confirm the band and scope than to compare job titles alone. For senior candidates, performance in architecture and system design interviews often determines whether an offer lands at the top or bottom of a band.

FAQs

How hard is the American Express Data Engineer interview?

The American Express data engineer interview is considered moderately to highly challenging, especially for mid-level and senior candidates. The difficulty comes less from trick questions and more from the expectation that candidates can reason through real production scenarios involving scale, failures, and governance. Many candidates find the system design and project deep-dive rounds the most demanding due to follow-up depth.

What technical skills does American Express prioritize for Data Engineers?

American Express prioritizes strong SQL, Python or PySpark, and data pipeline design skills, along with a solid understanding of distributed systems. Beyond tools, interviewers care deeply about data correctness, validation, and failure handling. Candidates who demonstrate a production-first mindset tend to perform best.

Are American Express Data Engineer interviews more coding-heavy or design-heavy?

They are intentionally balanced, but lean more toward design and operational judgment as seniority increases. Early rounds may focus on SQL or Spark coding, while later rounds emphasize architecture, scalability, and recovery strategies. Senior candidates should expect heavier system design and project discussion.

Do I need fintech or payments experience to pass?

No prior fintech experience is required. However, interviewers expect you to reason carefully about data reliability, security, and trust, even if the domain is new. Candidates who can logically break down unfamiliar financial workflows perform just as well as those with direct industry experience.

What differentiates strong Data Engineer candidates at American Express?

Strong candidates consistently show structured thinking, calm incident response, and ownership. They explain trade-offs clearly, validate assumptions, and communicate effectively with non-engineering stakeholders. American Express values engineers who build systems that are safe to operate at scale, not just impressive on paper.

Building Reliable Data Systems At American Express

The American Express data engineer interview is designed to identify engineers who can move beyond writing pipelines and help build durable, trustworthy data infrastructure. Successful candidates show they can design scalable systems, handle failures gracefully, and make sound decisions under real enterprise constraints.

To prepare effectively, focus on end-to-end thinking rather than isolated practice. Work through realistic SQL and Spark problems, rehearse system design discussions that emphasize failure modes and governance, and pressure-test your explanations through live mock interviews. Combined, these steps closely mirror how American Express evaluates Data Engineers and help you walk into the interview confident, structured, and production-ready.