American Express Business Analyst Interview Guide (2026): Process, Questions & Preparation Tips

Introduction

Business analytics continues to be one of the fastest-growing roles across financial services. According to U.S. Bureau of Labor Statistics projections, analytics and business intelligence roles are expected to grow more than 20 percent through 2032, driven by data-heavy industries like payments, lending, and risk management. At companies like American Express, this growth is amplified by the scale and complexity of decision-making. Analysts work with closed-loop transaction data, real-time risk signals, and customer behavior across millions of accounts. As demand has grown, so has competition. Industry recruiting benchmarks suggest that fewer than 15 percent of applicants advance past early interview stages for analytics roles at top-tier financial institutions.

Most candidates do not struggle because they lack SQL or analytics fundamentals. They struggle because the American Express business analyst interview tests how well you apply data to real business trade-offs involving growth, risk, compliance, and customer experience. Interviews blend technical analysis, structured case thinking, and stakeholder communication in ways that feel unfamiliar without targeted preparation. This guide is designed to remove that uncertainty. You will learn how the American Express business analyst interview is structured, the most common business analyst specific question types candidates face, and how to prepare with the same analytical rigor and business context expected from successful analysts inside the company.

American Express Business Analyst Interview Process

The American Express business analyst interview process is designed to assess how effectively you use data to drive decisions in a highly regulated, customer-focused financial environment. Interviews emphasize analytical rigor, structured problem solving, and your ability to translate insights into actions that balance growth, risk, and customer trust. Most candidates complete the process within three to five weeks, depending on role level and team availability. Across each stage, interviewers evaluate how closely your thinking mirrors the way analysts operate day to day at American Express.

Application and Resume Screen

During the initial resume review, recruiters focus on evidence that you have used data to influence real business outcomes. Strong candidates highlight experience with SQL-driven analysis, dashboarding, experimentation, or analytics tied to financial products, risk, or customer behavior. Resumes that clearly show ownership of metrics, decision support, or stakeholder-facing insights tend to advance more consistently than those listing only tools or responsibilities.

Tip: Explicitly connect your analysis to business decisions, such as approval rate improvements or loss reduction. This signals decision ownership and commercial awareness, which are core expectations for analysts at American Express.

Initial Recruiter Conversation

The recruiter conversation is typically a 30 minute discussion covering your background, motivation for American Express, and high-level analytics experience. You may be asked to walk through a recent project, explain how you work with stakeholders, and describe the types of business problems you enjoy solving. This stage also covers logistics such as location, role alignment, and compensation expectations. While non technical, it plays a key role in assessing clarity of thought and communication.

Tip: Frame your experience around solving ambiguous business problems with data. This demonstrates structured thinking and shows that you understand the analyst role beyond pure execution.

Technical and Analytics Screen

The technical screen focuses on core analytics skills. Expect questions involving SQL queries, metric interpretation, and structured reasoning through business scenarios. You may be asked to analyze customer behavior trends, investigate changes in approval or spend metrics, or explain how you would validate a dashboard before sharing it with leadership. Interviewers pay close attention to how you reason through data, not just whether you reach a correct answer.

Tip: Talk through your assumptions before writing queries or giving conclusions. This highlights analytical discipline and reduces misalignment in high-stakes business decisions.

Case Study or Business Problem Round

Many American Express teams include a case-style interview that mirrors real analyst work. These problems often involve evaluating a new product feature, diagnosing a performance decline, or prioritizing competing business initiatives. You will be expected to define success metrics, identify relevant data, and explain trade-offs clearly. There is rarely a single correct answer, which makes structure and prioritization critical.

Tip: Start by clarifying the business objective and constraints. This shows strategic thinking and your ability to align analysis with executive decision-making needs.

Virtual or Onsite Interview Loop

The final interview loop is the most comprehensive stage and usually consists of four to five interviews, each lasting 45 to 60 minutes. These sessions evaluate how you apply analytics in realistic scenarios, communicate with stakeholders, and collaborate across functions.

SQL And Data Analysis Round: You will work through data questions involving joins, aggregations, and trend analysis. Scenarios may include analyzing customer spend patterns, comparing segment performance, or identifying drivers behind metric changes. Interviewers assess clarity, correctness, and how well you connect results to business impact.

Tip: Explain why each metric matters before presenting results. This demonstrates business context awareness, not just query proficiency.

Business Case And Metrics Round: This interview focuses on problem framing and metrics selection. You may be asked how to evaluate a new rewards feature, assess customer engagement changes, or measure risk exposure. The goal is to see how you structure ambiguous problems and choose metrics that guide decisions.

Tip: Prioritize a small set of meaningful metrics and explain trade-offs. This reflects sound judgment, a trait senior analysts at American Express rely on daily.

Stakeholder Communication Round: You will be evaluated on how you present insights to non technical partners. Expect questions about explaining results to leadership, handling pushback, or adjusting recommendations based on feedback. Clear communication and empathy matter heavily here.

Tip: Practice simplifying complex findings into concise narratives. This shows influence and executive readiness, not just analytical strength.

Behavioral And Collaboration Round: This round explores how you work with others, handle ambiguity, and take ownership. Questions often cover conflict resolution, missed deadlines, or learning from failed analyses. Interviewers look for accountability and growth mindset.

Tip: Emphasize what you learned and how it changed your approach. This signals maturity and long-term potential within the organization.

Hiring Committee and Offer

After interviews conclude, each interviewer submits independent written feedback. A hiring committee reviews your performance across analytics, communication, and behavioral dimensions to determine overall fit and level. If approved, the team extends an offer aligned with role scope and experience, and may discuss team matching if multiple groups expressed interest.

Tip: If you have preferences for product, risk, or strategy teams, communicate them clearly. This shows intentional career direction and helps ensure a strong long-term fit.

Want to build your business analyst interview skills for American Express? Practice real, hands-on SQL, analytics, and case-style problems on the Interview Query Dashboard and start preparing the way successful American Express business analysts do.

American Express Business Analyst Interview Questions

The American Express business analyst interview includes a mix of SQL, analytics, business case reasoning, experimentation fundamentals, and behavioral evaluation. These questions are designed to assess how effectively you work with financial data, reason through risk and growth trade-offs, and communicate insights to stakeholders across product, risk, and strategy teams. The goal is not just to test technical correctness, but to understand how you think through ambiguity and turn analysis into decisions at American Express.

Read more: Business Analyst Interview Questions: A Comprehensive Guide

SQL and Analytics Interview Questions

In this portion of the interview, American Express focuses heavily on your ability to analyze large, structured datasets related to transactions, customers, and products. SQL questions often involve segmentation, time-based trends, metric validation, or diagnosing changes in performance. Interviewers look for clean logic, strong assumptions, and business-aware interpretations rather than clever syntax alone.

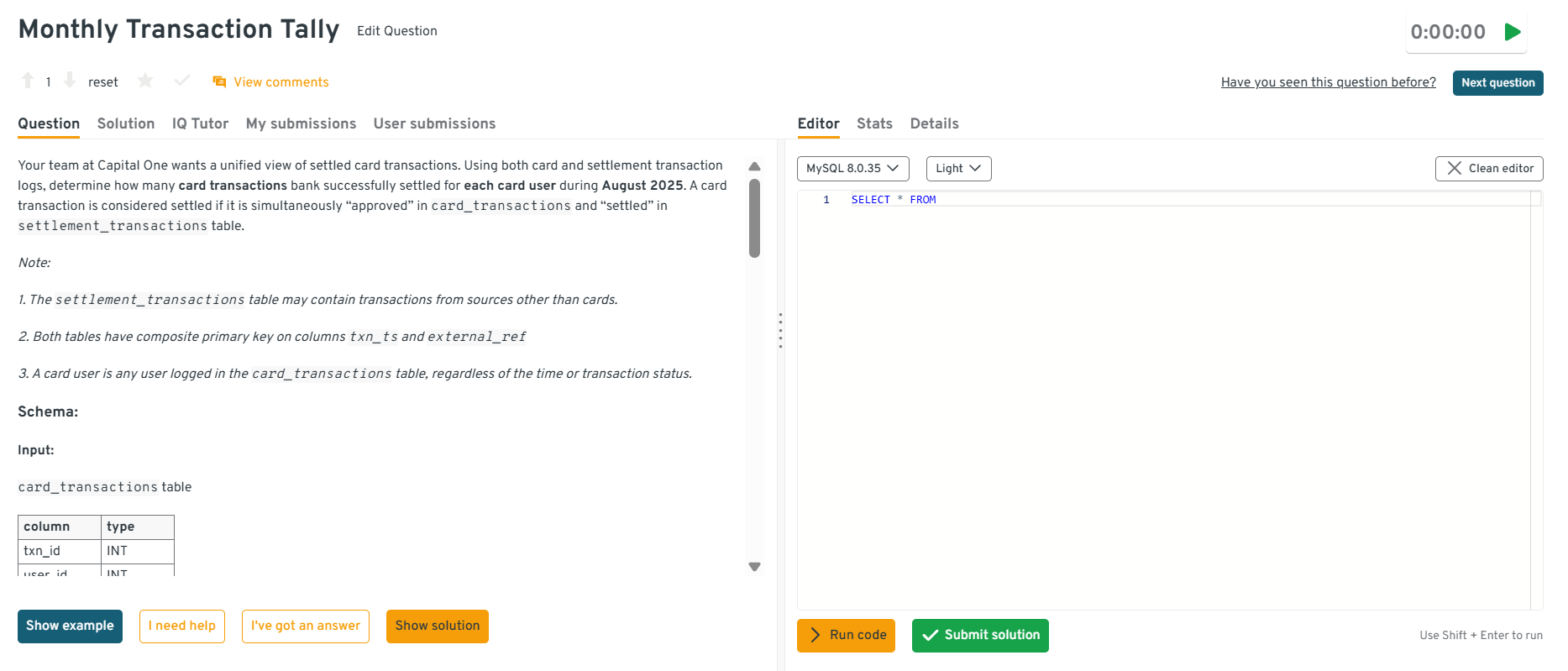

-

This tests whether you can reconcile two critical parts of the payments lifecycle, authorization and settlement, which matters at American Express because “approved” does not always mean “finalized revenue.” To solve it, filter card authorizations to August 2025 and approved status, join to settlement logs on a stable transaction key, keep only rows with successful settlement, then group by card user and count transactions. If multiple settlement rows exist, deduplicate by transaction before counting.

Tip: In your explanation, call out how you prevent double-counting partial captures or retries. That shows data quality instincts and financial reporting reliability, which interviewers value heavily at Amex.

Head to the Interview Query dashboard to practice American Express–style business analyst interview questions in one place. Work through SQL, analytics, business cases, and behavioral questions with built-in code execution and AI-guided feedback, helping you prepare for the data-driven decision-making and stakeholder judgment American Express expects.

Write a query to find merchants with consistently declining authorization rates over the last eight weeks.

This tests your ability to build trend-based monitoring, which is essential at American Express because sustained auth-rate declines often signal integration issues, risk rule changes, or customer experience degradation. Solve it by computing weekly authorization rate per merchant (approved transactions divided by total attempts), then apply a rolling average to smooth noise. Next, measure “consistent decline” by checking week-over-week drops (for example, auth_rate < prior_week_auth_rate for most weeks) or by calculating a negative slope over eight points and filtering merchants with statistically meaningful downward trends.

Tip: Tell the interviewer how you would segment by channel or risk tier before escalating. That shows you can isolate root causes and avoid false alarms, a key judgment skill for merchant analytics at Amex.

How would you identify duplicate transactions that may indicate accidental double charges?

This tests whether you can detect customer-impacting issues with messy, high-volume transaction data, something American Express cares about because duplicates drive disputes, servicing costs, and trust erosion. Solve it by looking for same card user, same merchant, same amount, within a short time window. Practically, you can use a window function with

LAG()over (user, merchant, amount) ordered by timestamp to flag events where the time difference is below a threshold, or use a self-join with a bounded timestamp condition and exclude identical transaction IDs. Then summarize duplicates by user or merchant for investigation.Tip: Mention how you would tune the time window by merchant type, like transit vs retail. This demonstrates customer empathy and domain judgment, which stands out in Amex analyst interviews.

-

This tests retention-style thinking, which is important at American Express because repeat purchase behavior is a direct signal of activation and long-term value. Solve it by first finding each customer’s first purchase date with a

MIN(transaction_date)grouped by customer. Then join back to transactions and filter for purchases withtransaction_date > first_purchase_date. Finally, count distinct customers who have at least one qualifying later purchase, or count how many later purchases per customer depending on the prompt. Be explicit about whether “later date” excludes same-day purchases.Tip: Clarify whether to use transaction date or settled date, and justify it. That shows metric rigor and an understanding of how timing affects business decisions at Amex.

-

This tests whether you can produce an executive-ready performance summary, which is a common American Express analyst task when leaders need a quick view of volume, reach, premium behavior, and product drivers. Solve it by aggregating total transactions with

COUNT(*), unique users withCOUNT(DISTINCT user_id), high-value paid transactions with a conditional count (for example,SUM(CASE WHEN status='paid' AND amount >= X THEN 1 ELSE 0 END)), and highest-revenue product by grouping revenue per product (SUM(amount)), ranking withROW_NUMBER()orRANK(), and selecting the top one.Tip: Explain how you choose the “high-value” threshold and why it aligns to business outcomes. This signals product intuition and stakeholder-ready metric design, which is what Amex looks for in strong analysts.

Watch Next: Business Analyst Interview Questions ANSWERED

In this video, Interview Query co-founder Jay Feng breaks down practical analytics frameworks that help you structure clear, confident interview responses. He walks through common mistakes candidates make, how to decompose ambiguous problems, and how to tie analysis back to real business impact. These techniques map closely to how American Express evaluates business analysts, making the examples especially useful for preparing case, metrics, and reasoning questions to help you practice and walk in confidently for you next business analyst interview.

Business Case and Metrics Interview Questions

These questions test how you structure ambiguous problems and select metrics that guide decisions. American Express uses case-style interviews to evaluate whether you can balance customer experience, risk exposure, and market business growth using data.

How would you evaluate the success of a new rewards benefit introduced for premium cardmembers?

This question tests whether you can define success beyond surface-level engagement and isolate true incremental impact, which is critical at American Express given the high cost of premium rewards. To answer, start by clarifying the objective, such as increasing spend, retention, or card preference. Then outline core metrics like incremental spend per cardmember, redemption rate, retention lift versus a matched control group, and cost per dollar of incremental revenue. You should also discuss time horizons, separating launch effects from sustained behavior change, and controlling for seasonality or external promotions.

Tip: Explicitly explain how you would estimate incrementality, not just raw lift. This shows strategic thinking and an understanding of how Amex protects margin while investing in cardmember value.

A decline in approval rates is reported in one region. How would you investigate it?

This question evaluates structured problem solving under pressure, which is essential for analysts supporting risk and credit decisions at American Express. A strong answer starts by validating the metric and timeframe, then segments the decline by risk tier, merchant category, channel, and customer tenure. From there, you would check for recent policy changes, model updates, data feed issues, or regional merchant outages. The goal is to narrow the problem before hypothesizing causes and proposing fixes.

Tip: Say out loud that you would rule out data quality issues before blaming models or policy. This signals analytical discipline and credibility in high-stakes environments.

-

This question tests your ability to turn noisy behavioral data into a practical signal, something American Express does frequently for fraud and personalization. To answer, explain that you would cluster transaction locations by frequency and recency, giving higher weight to recurring spend near residential categories like grocery or utilities during evenings and weekends. You would then select the most stable location as “home,” while accounting for travelers and remote workers. Validation would involve checking consistency over time and comparing against known addresses where available.

Tip: Mention how you would down-weight travel periods or one-off spikes. This demonstrates risk-aware feature design, which is highly valued in Amex analytics roles.

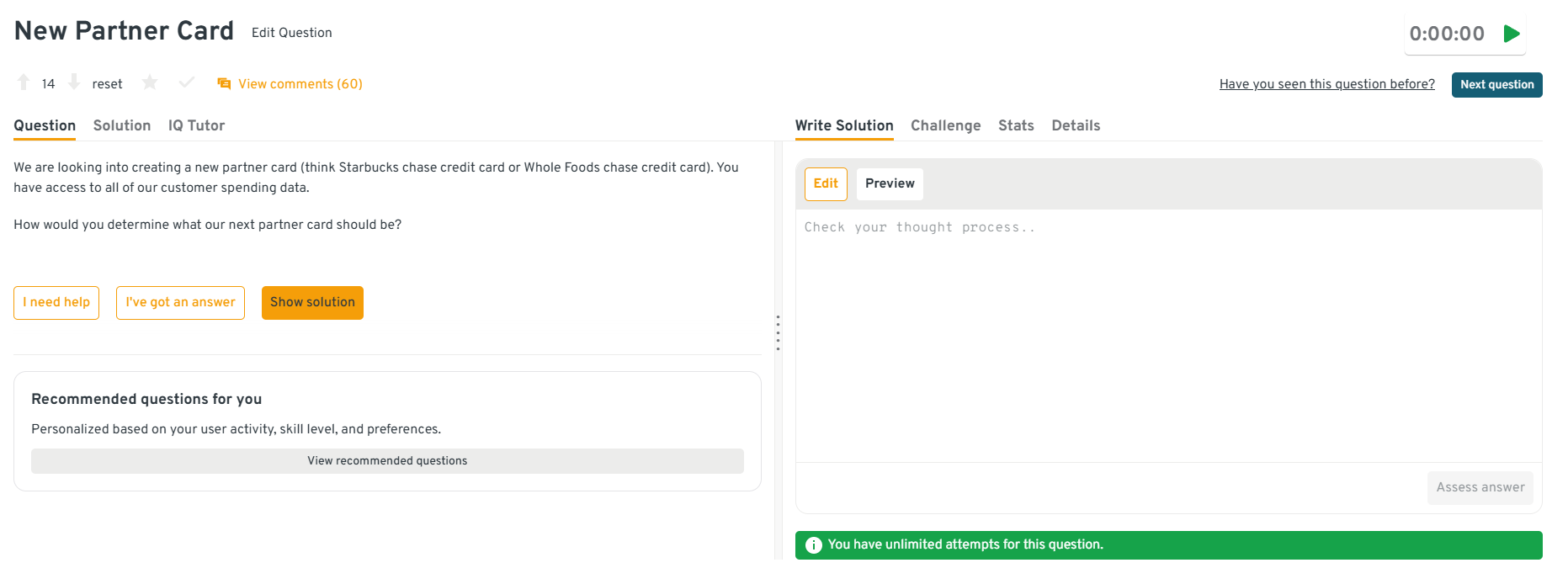

-

This question evaluates your ability to connect analytics to long-term strategy and partnerships. A strong answer explains how you would identify merchants with high overlap among valuable cardmembers, strong share-of-wallet potential, and complementary brand affinity. You would analyze spend concentration, frequency, growth trends, and cross-shopping behavior, then layer in customer demographics and profitability. Finally, you would assess whether the partner attracts incremental customers or simply shifts existing spend.

Tip: Call out how you would avoid partners that cannibalize existing premium cards. This shows strategic judgment and awareness of portfolio-level impact.

Head to the Interview Query dashboard to practice American Express–style business analyst interview questions in one place. Work through SQL, analytics, business cases, and behavioral questions with built-in code execution and AI-guided feedback, helping you prepare for the data-driven decision-making and stakeholder judgment American Express expects.

What metrics would you use to evaluate a change in credit line increase policy?

This question focuses on balancing growth and risk, a core responsibility for American Express analysts. To answer, separate leading indicators like approval rate, utilization change, and incremental spend from lagging indicators such as delinquency, charge-offs, and customer complaints. You should also discuss cohort tracking over time to ensure early gains do not mask longer-term risk. The interviewer wants to see that you think beyond immediate upside.

Tip: Explicitly distinguish leading versus lagging risk metrics. This signals foresight and shows you understand how Amex manages credit decisions responsibly over time.

Want realistic American Express business analyst interview practice without scheduling or pressure? Try Interview Query’s AI Interviewer to simulate SQL, analytics, business case, and stakeholder-style questions and get instant, targeted feedback aligned with how American Express evaluates analysts.

Experimentation and Analytical Reasoning Questions

These questions assess how well you reason about cause and effect, design safe tests, and make decisions when data is incomplete or conflicting. While not always deeply statistical, American Express expects analysts to understand experimentation logic and causal reasoning, especially when evaluating product or policy changes.

How would you design a test to evaluate a new cardmember onboarding flow?

This question tests whether you can design a controlled experiment that measures real impact without exposing the business to unnecessary risk. A strong answer starts by defining the primary objective, such as improving early spend or activation, then selecting success metrics like first-90-day spend, account engagement, and retention. You would randomize eligible new cardmembers into control and treatment, while setting guardrails such as fraud rates, customer service contacts, and payment failures. You should also explain how long the test runs and how you validate results before rollout.

Tip: Explicitly explain how you would monitor fraud and servicing metrics in real time. This shows risk-aware experimentation, a critical skill for analysts at American Express.

-

This question evaluates prioritization and scoring logic, which American Express analysts use frequently for acquisition and partnerships. To answer, explain how you would define “best” based on expected spend, growth trajectory, risk profile, and industry fit. You would then engineer features such as transaction volume, frequency, customer overlap, and growth trends, and rank businesses using a weighted scoring model. Validation would involve back-testing against past partnerships or pilot outreach results.

Tip: Mention how you would pressure-test the model against bias toward already large merchants. This demonstrates strategic fairness and long-term portfolio thinking.

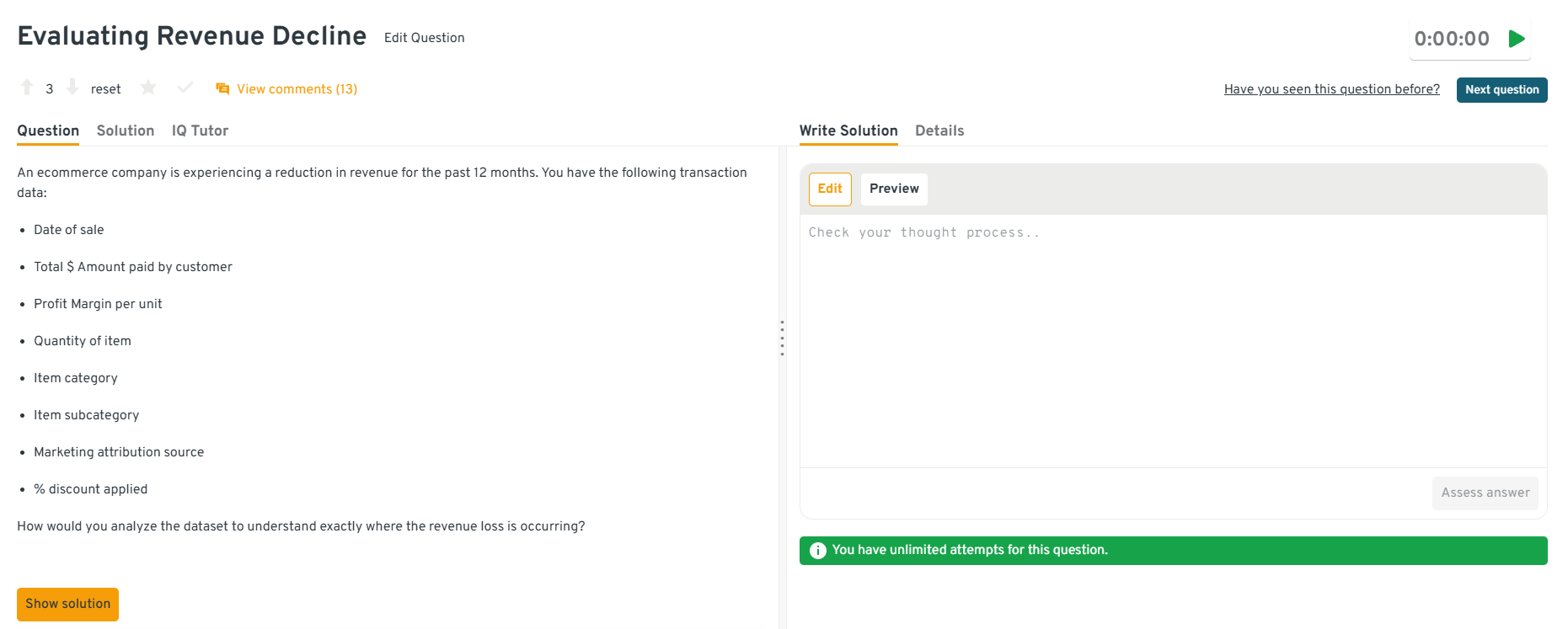

-

This question tests your ability to decompose a complex trend into actionable drivers. A strong answer explains breaking revenue into components such as active cardmembers, transactions per user, and average transaction value, then analyzing changes over time. You would further segment by merchant category, device type, geography, and customer tenure to isolate where declines are concentrated. The goal is to separate demand issues from acceptance, risk, or experience problems.

Tip: Call out how you would rule out data pipeline changes before drawing conclusions. This shows analytical rigor and protects decision-makers from acting on faulty signals.

Head to the Interview Query dashboard to practice American Express–style business analyst interview questions in one place. Work through SQL, analytics, business cases, and behavioral questions with built-in code execution and AI-guided feedback, helping you prepare for the data-driven decision-making and stakeholder judgment American Express expects.

If an experiment shows mixed results across customer segments, how would you decide whether to launch?

This question evaluates judgment under ambiguity, a daily reality at American Express. To answer, explain how you would analyze segment-level effects with confidence intervals, assess business impact by segment size and value, and consider phased rollouts for favorable groups. You should also discuss whether the feature aligns with long-term strategy even if short-term results are uneven.

Tip: Treat segment differences as strategic insight, not statistical noise. This signals mature decision-making and comfort with nuanced outcomes.

-

This question tests whether you can translate financial mechanics into clear analytical logic. A strong answer walks through modeling monthly balances by applying interest to outstanding amounts, subtracting payments, and adding new spend over time. You should explain assumptions clearly, such as compounding frequency and payment timing, and compare total balances after twelve cycles. This reflects real credit reasoning used in lending analytics.

Tip: State your assumptions explicitly and justify them. This shows financial literacy and transparency, both essential for analysts working on credit products at American Express.

Behavioral Interview Questions

Behavioral questions help American Express assess how you think, communicate, and take ownership in situations where data alone is not enough. These interviews focus on judgment, accountability, and collaboration in high-stakes, cross-functional environments where analysts regularly influence senior decisions.

Why do you want to join American Express as a business analyst?

This question evaluates motivation and role alignment. Interviewers want to see whether your interest goes beyond brand recognition and whether you understand how analytics drives decisions at American Express.

Sample answer: In my current role, I use transaction-level data to influence pricing and customer strategy, but I wanted to work in an environment where analytics directly balances growth, risk, and customer trust. American Express stood out because of its closed-loop data and analyst ownership over real financial decisions. In my last project, my analysis helped reduce churn by 6 percent through targeted offers, and I want to apply that same decision-focused approach at larger scale. The opportunity to partner closely with product and risk teams makes this role a natural next step for me.

Tip: Connect your motivation to Amex’s decision-making model, not just its reputation. This shows long-term fit and genuine role understanding.

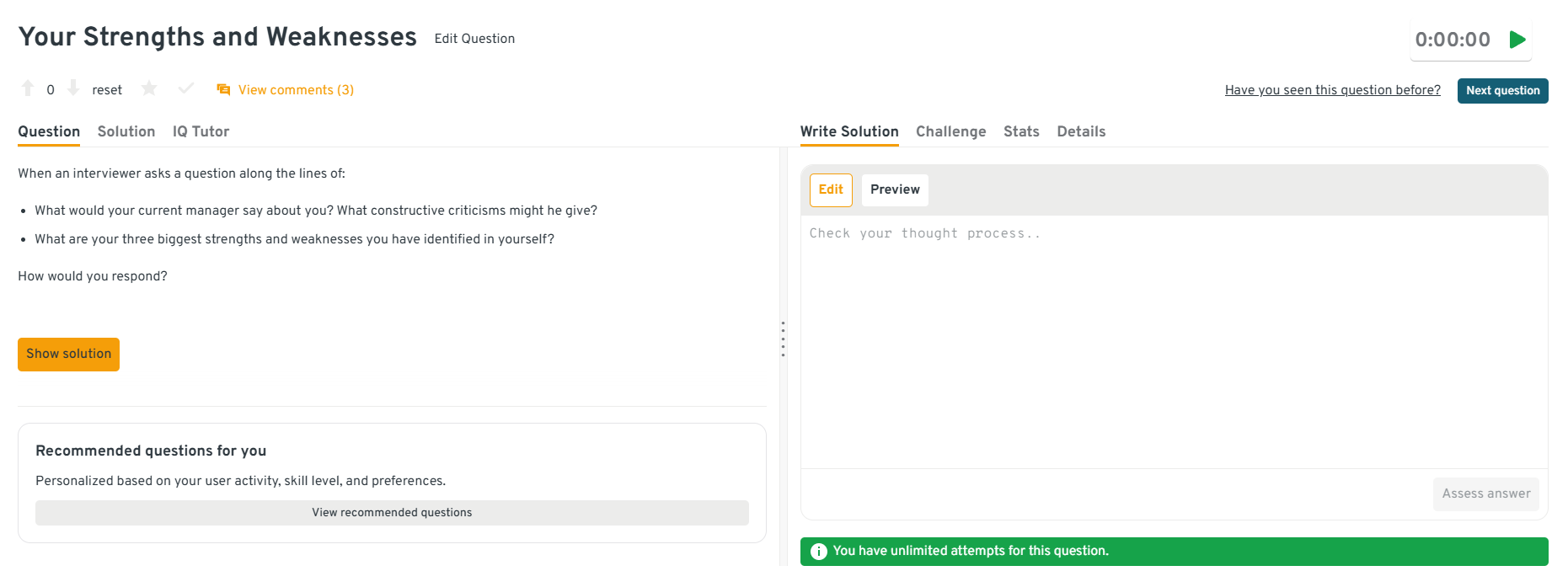

What would your current manager say about you? What constructive criticisms might he give?

This question tests self-awareness and coachability. American Express looks for analysts who can reflect honestly on feedback and improve without defensiveness.

Sample answer: My manager would say I am reliable under pressure and strong at structuring ambiguous problems. On a quarterly pricing analysis, I owned the full workflow and delivered insights that leadership used to adjust thresholds, improving margin by 4 percent. They would also say I sometimes over-validate before sharing early insights. I have worked on this by separating exploratory analysis from final reporting so stakeholders get directional signals sooner without sacrificing accuracy.

Tip: Balance strengths with a real, managed weakness. This demonstrates maturity and continuous improvement, both critical for analyst growth at Amex.

Head to the Interview Query dashboard to practice American Express–style business analyst interview questions in one place. Work through SQL, analytics, business cases, and behavioral questions with built-in code execution and AI-guided feedback, helping you prepare for the data-driven decision-making and stakeholder judgment American Express expects.

Describe a time an analysis you delivered was wrong. What did you do next?

This question assesses accountability and learning. Interviewers want to know how you respond when your work has real consequences.

Sample answer: I once delivered a regional performance analysis that overstated growth due to a duplicated data feed. When a stakeholder flagged inconsistencies, I paused distribution immediately, audited the pipeline, and identified the issue within a day. I corrected the analysis, shared a clear explanation of the error, and added automated checks to prevent recurrence. The revised work delayed a decision by one week but avoided a costly rollout based on incorrect assumptions.

Tip: Emphasize corrective action and process improvement. This shows reliability and ownership, which are essential in Amex’s risk-sensitive environment.

How do you handle disagreement with a senior stakeholder about your findings?

This question evaluates confidence, professionalism, and influence. American Express analysts frequently challenge assumptions while maintaining trust.

Sample answer: In a portfolio review, a senior leader disagreed with my recommendation to slow approvals in one segment. I walked them through the underlying data, highlighted where risk indicators were leading future losses, and asked which assumptions they disagreed with. We aligned on running a controlled pilot instead of a full rollback, which ultimately reduced losses by 3 percent without hurting growth. The key was focusing on shared goals, not being “right.”

Tip: Show how you align on objectives before debating conclusions. This demonstrates executive readiness and collaborative influence.

If you want to practice these question types in realistic scenarios, Interview Query’s mock interviews are built to mirror how American Express evaluates business analysts across analytics, case reasoning, and behavioral rounds.

What Does an American Express Business Analyst Do?

An American Express business analyst sits at the center of data-driven decision-making across payments, lending, fraud, and customer experience. The role focuses on translating complex transaction data into insights that directly influence revenue growth, risk controls, and customer retention. At American Express, business analysts work with closed-loop data that captures both merchant and cardmember behavior, giving them unusually rich visibility into how products perform end to end. Your work typically blends SQL-based analysis, metrics design, experimentation support, and stakeholder storytelling to help leaders make informed trade-offs at scale.

| What They Work On | Core Skills Used | Tools And Methods | Why It Matters At American Express |

|---|---|---|---|

| Customer spend and engagement analysis | SQL analytics, segmentation, trend analysis | Transaction data, cohort analysis, dashboards | Drives card usage, retention, and lifetime value |

| Credit risk and approval strategy | Analytical reasoning, risk trade-off evaluation | Policy metrics, historical performance analysis | Balances growth with default and loss prevention |

| Fraud and risk monitoring | Anomaly detection, metric validation | Alerts, threshold analysis, monitoring dashboards | Protects cardmembers and reduces financial losses |

| Product and rewards performance | Experiment design, KPI definition | A/B testing, controlled rollouts | Ensures new features and rewards deliver measurable value |

| Executive and stakeholder reporting | Data storytelling, prioritization | Executive dashboards, written insights | Enables faster, more confident business decisions |

Tip: Strong American Express business analysts show judgment, not just technical skill. In interviews, explain why you chose specific metrics or segments and how those choices influence risk, growth, or customer trust. This demonstrates business intuition and decision ownership, which is critical for succeeding in analytics roles at Amex.

How to Prepare for an American Express Business Analyst Interview

Preparing for an American Express business analyst interview requires more than refreshing SQL or reviewing common case frameworks. You are preparing for a role that directly influences credit decisions, customer experience, fraud prevention, and enterprise strategy at American Express. Success in this interview depends on how well you connect analysis to real business trade-offs, communicate with stakeholders, and demonstrate judgment in high-stakes financial contexts. Below is a focused preparation plan that reflects how strong analysts at American Express actually operate.

Build fluency with financial and transactional data patterns: American Express interviews frequently reference spend behavior, approval rates, authorization funnels, and risk signals. Practice analyzing time-based trends, cohort behavior, and metric movements that are common in card and payments data. Focus on interpreting what changes mean, not just calculating them.

Tip: Be ready to explain why a metric moved and what decision you would recommend next. This shows business judgment and decision ownership, not just analytical execution.

Practice structuring ambiguous business problems: Case and scenario questions often start with incomplete information. Train yourself to clarify objectives, identify constraints like risk tolerance or regulatory impact, and outline a structured approach before diving into analysis. This mirrors how analysts work with senior stakeholders internally.

Tip: State your assumptions clearly and explain why you chose them. This demonstrates structured thinking and credibility when data is imperfect.

Strengthen stakeholder communication skills: American Express places heavy emphasis on how clearly you explain insights to non technical partners. Practice summarizing analyses in plain language, prioritizing key takeaways, and tailoring depth based on the audience.

Tip: Frame insights as recommendations with trade-offs, not just findings. This signals influence and readiness to operate at a senior analyst level.

Refine your core SQL and validation habits: While SQL is table stakes, interviewers pay attention to how you validate results and handle edge cases. Practice explaining how you check for missing data, duplicates, or unexpected spikes before trusting outputs.

Tip: Call out validation steps proactively. This shows reliability and risk awareness, which are critical traits in financial analytics roles.

Prepare concise, impact-driven project stories: Review your past work and select two to three projects where your analysis directly influenced a decision. Be ready to walk through the problem, your approach, the insight delivered, and the outcome. Avoid long technical detours unless prompted.

Tip: Emphasize what decision changed because of your work. This highlights real business impact, which matters more than tool complexity at American Express.

Simulate realistic interview pacing: Practice back-to-back mock interview sessions that mirror the full interview loop, including a SQL exercise, a business case discussion, and a behavioral conversation. Time yourself and focus on clarity under pressure.

Tip: After each practice session, note where your explanations felt unclear or overly detailed. Tightening those moments is often what separates strong candidates from average ones.

Looking to sharpen your American Express–style problem solving? Practice with real-world analytics challenges that mirror SQL, business cases, and decision-making scenarios business analysts face at American Express.

American Express Business Analyst Salary

American Express business analysts earn competitive compensation that reflects the role’s influence on revenue growth, risk management, and customer experience decisions. The company’s compensation framework is built around base salary, annual performance bonus, and long-term equity incentives, with total pay varying by level, location, and scope of responsibility. Business analysts supporting high-impact teams such as credit risk, enterprise strategy, or product analytics tend to fall into mid-level and senior bands, especially if they own metrics tied directly to financial outcomes at American Express.

Read more: Business Analyst Salary

Tip: Clarify your target level early with the recruiter. At American Express, level alignment affects not just pay, but also expectations around decision ownership and stakeholder influence.

American Express Business Analyst Compensation Overview (2026)

| Level | Role Title | Total Compensation (USD) | Base Salary | Bonus | Equity (RSUs) | Signing / Relocation |

|---|---|---|---|---|---|---|

| BA I | Business Analyst I | $90K – $120K | $80K–$100K | Performance based | Limited or none | Rare |

| BA II | Business Analyst II / Mid Level | $115K – $155K | $95K–$125K | Annual target bonus | RSUs included | Offered case-by-case |

| Senior BA | Senior Business Analyst | $145K – $190K | $115K–$145K | Above target possible | Larger RSU grants | More common |

| Lead / Principal BA | Lead or Principal Business Analyst | $175K – $230K+ | $130K–$165K | High performer bonuses | High RSUs + refreshers | Frequently offered |

Note: These estimates are aggregated from data on Levels.fyi, Glassdoor, public job postings, and Interview Query’s internal salary database.

Tip: Compensation often increases meaningfully after the first equity vesting cycle, so evaluate offers with a multi-year lens rather than focusing only on year-one cash.

Average Base Salary

Average Total Compensation

Negotiation Tips that Work for American Express

Negotiating compensation at American Express is most effective when discussions are data-driven, realistic, and professionally framed. Recruiters expect candidates to understand market benchmarks and to communicate value clearly.

- Confirm your level before negotiating numbers: Leveling from Business Analyst II to Senior Business Analyst can shift compensation by tens of thousands annually. Always align on level before discussing pay.

- Use verified benchmarks and measurable impact: Anchor expectations with trusted sources such as Levels.fyi, Glassdoor, and Interview Query salary data. Frame your value through concrete impact like approval rate improvements, loss reduction, or revenue lift.

- Account for geographic differences: Compensation varies across New York, Phoenix, Sunrise, and international offices. Request location-specific ranges so you can evaluate offers accurately.

Tip: Ask for a full compensation breakdown, including base salary, bonus target, equity vesting schedule, and any signing incentives. This demonstrates financial literacy and helps you negotiate from an informed position.

FAQs

How long does the American Express business analyst interview process take?

Most candidates complete the process within three to five weeks, depending on team availability and role level. Timelines can extend if multiple teams are reviewing your profile or if scheduling onsite interviews takes longer. Recruiters usually share clear expectations after each stage.

Do American Express business analysts need a finance background?

A finance background is helpful but not required. Strong analytical reasoning, SQL proficiency, and experience translating data into business decisions matter more. Candidates from consulting, analytics, or tech backgrounds often perform well if they demonstrate comfort with financial metrics and risk trade-offs.

How technical is the American Express business analyst interview?

The interview is moderately technical but business-focused. You should expect SQL questions, metric interpretation, and structured analytics problems rather than heavy programming. Interviewers care more about how you reason through data and validate insights than advanced coding.

Are case interviews common for American Express business analysts?

Yes, many teams use case-style interviews. These cases reflect real scenarios such as diagnosing performance declines, evaluating new product features, or prioritizing analytics requests. The emphasis is on problem structure, assumptions, and clarity of recommendations.

What tools should I be comfortable with for the interview?

You should be very comfortable with SQL and familiar with dashboards or reporting tools. Experience with spreadsheets, visualization tools, or basic scripting is helpful, but interviews focus on logic and decision-making rather than specific software mastery.

How important is stakeholder communication in the interview?

Stakeholder communication is critical. Interviewers frequently assess how clearly you explain insights to non technical partners and how you handle pushback. Strong candidates frame analysis as actionable recommendations tied to business outcomes.

Does American Express hire business analysts for different teams?

Yes, business analysts support product, risk, marketing, enterprise strategy, and operations teams. The interview structure is similar across groups, but examples and cases may reflect the team’s focus area. Recruiters often discuss team alignment later in the process.

What differentiates strong candidates in American Express interviews?

Strong candidates consistently show judgment, not just analysis. They explain why metrics matter, validate results carefully, and connect insights to decisions that affect customers and risk. This mirrors how successful analysts operate at American Express.

Become an American Express Business Analyst with Interview Query

Preparing for the American Express business analyst interview means developing strong analytical judgment, clear business reasoning, and the ability to translate data into decisions within a highly regulated financial environment. By understanding how American Express evaluates analytics talent, practicing real-world SQL, structuring business cases effectively, and refining how you communicate insights, you can approach every stage of the interview with confidence.

For focused preparation, explore the full Interview Query question bank, practice live scenarios with the AI Interviewer, or work directly with experienced mentors through Interview Query’s Coaching Program to sharpen your approach and position yourself to stand out in the American Express business analyst hiring process.