American Express Machine Learning Engineer Interview Guide (2026): Process, Questions & Prep

Introduction

Preparing for an American Express machine learning engineer interview means stepping into a role where models power real-time financial decisions at massive scale. At American Express, machine learning is central to fraud detection, credit risk, and personalization, with a strong emphasis on reliability, explainability, and customer trust. As transaction volume and regulatory expectations continue to rise, engineers are expected to build systems that balance performance with responsibility.

This ML engineer interview process at American Express is built to assess how you think as much as what you know. You will be evaluated on your ability to design end-to-end machine learning solutions, reason through tradeoffs, and communicate decisions clearly to both technical and non-technical partners. This guide walks through each stage of the American Express machine learning engineer interview, the most common American Express machine learning engineer interview questions, and practical preparation strategies grounded in real AmEx use cases to help you stand out and prepare effectively with Interview Query.

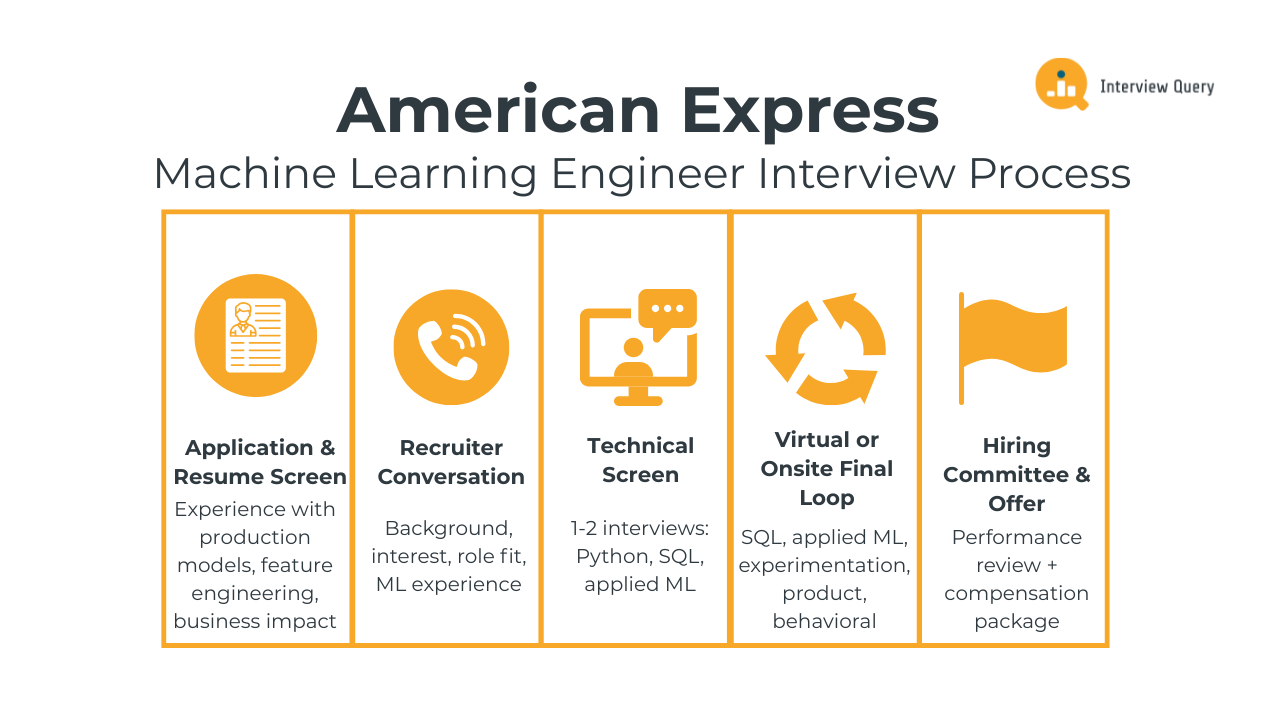

American Express Machine Learning Engineer Interview Process

The American Express machine learning engineer interview process is designed to evaluate how well you build reliable machine learning systems in high stakes, real world environments. Interviewers focus on your ability to work with large scale transactional data, reason through fraud and credit risk tradeoffs, and communicate clearly with cross functional partners. The process typically includes multiple stages covering applied machine learning, Python and SQL, analytical reasoning, and behavioral alignment with company values. Most candidates complete the full loop within three to six weeks, depending on role level and team needs. Below is a detailed breakdown of each stage and what interviewers at American Express consistently look for.

Application and Resume Screen

During the initial application review, recruiters look for evidence that you have worked on applied machine learning problems at scale. Strong resumes highlight experience with production models, feature engineering on large datasets, and measurable business impact. Experience in domains such as fraud detection, credit risk, personalization, or decision systems is especially relevant. Recruiters also scan for strong Python and SQL usage, collaboration with product or risk teams, and ownership of models beyond experimentation.

Tip: Clearly tie your work to outcomes like fraud loss reduction, approval rate improvement, or stability gains. This signals to interviewers that you understand how machine learning drives business decisions at American Express.

Initial Recruiter Conversation

The recruiter conversation is a short, non technical call focused on understanding your background, motivations, and role fit. You can expect questions about your experience with machine learning systems, the types of problems you enjoy working on, and why American Express is of interest to you. Recruiters also cover logistics such as team alignment, location preferences, interview timeline, and compensation expectations. While technical depth is not tested here, clarity and intent matter.

Tip: Connect your past projects to trust, risk management, or customer impact. This shows strong alignment with the problems AmEx machine learning teams solve every day.

Technical Screen

The technical screen usually consists of one or two interviews focused on Python, SQL, and applied machine learning fundamentals. You may be asked to analyze transactional data, write queries involving joins and window functions, reason about model performance metrics, or walk through an end to end modeling pipeline from a previous role. Interviewers often use realistic scenarios such as investigating a spike in fraud or designing features for a credit risk model to assess both problem solving and communication.

Tip: Talk through your assumptions before coding or modeling. This demonstrates structured thinking and reduces errors, a critical skill when building models that influence financial decisions.

Virtual Onsite or Final Loop

The final loop is the most comprehensive stage of the American Express machine learning engineer interview process. It typically includes four to five interviews, each lasting around 45 to 60 minutes. These rounds assess how you approach real business problems, collaborate across teams, and apply machine learning responsibly in production environments.

SQL and data analysis round: You will work with large transactional datasets and write queries to uncover patterns or risks. Common tasks include identifying abnormal spending behavior, comparing approval or fraud rates across segments, and calculating rolling metrics. Interviewers evaluate how cleanly you write queries, how you handle edge cases, and how you interpret results in a business context.

Tip: Always explain what the output means for the business. This shows analytical maturity and your ability to turn raw data into actionable insights.

Applied machine learning round: This round focuses on designing and evaluating machine learning solutions. You may be asked to build a fraud detection or risk scoring pipeline, choose features, discuss model selection, or explain how you would monitor performance and drift. Interviewers care deeply about tradeoffs such as precision versus recall, explainability, and stability over time.

Tip: Emphasize how you balance model performance with interpretability and risk controls. At AmEx, this judgment is just as important as technical accuracy.

Experimentation and case study round: You will be given an open ended problem, such as analyzing a decline in approval rates or evaluating the impact of a new model threshold. This round tests how you structure ambiguous problems, define success metrics, and reason through potential causes and solutions. There is rarely a single correct answer.

Tip: Start by clearly defining the objective and constraints. This shows strong problem framing skills, which are essential for effective machine learning work at scale.

Product and business context round: This interview examines how well you connect machine learning work to broader business goals. You may discuss how model decisions affect customer experience, merchant trust, or regulatory compliance. Collaboration with product managers, engineers, and risk partners is often a key theme.

Tip: Tie technical recommendations to measurable outcomes like customer trust, loss reduction, or approval stability. This signals strong product awareness.

Behavioral and collaboration round: The behavioral round focuses on how you work with others and handle challenges. Expect questions about ownership, handling failure, giving and receiving feedback, and navigating disagreements. Interviewers want to understand how you operate in a cross functional, high accountability environment.

Tip: Share examples where you owned a problem end to end and adapted based on feedback. This demonstrates resilience and accountability, traits highly valued at American Express.

Hiring Committee and Offer

After the final loop, interviewers submit detailed written feedback. A hiring committee reviews your performance across all rounds, weighing technical strength, decision making, communication, and cultural alignment. If approved, the team determines your level and prepares a compensation package aligned with your experience and scope. Team matching may also occur at this stage based on your strengths and interests.

Tip: Be transparent about the types of problems and teams you are most excited about. Clear preferences help hiring managers place you where you can have the greatest impact.

Want realistic ML interview practice without scheduling or pressure? Try Interview Query’s AI Interviewer to simulate Amex style coding, modeling, and system design questions and get instant, targeted feedback.

American Express Machine Learning Engineer Interview Questions

The American Express machine learning engineer interview includes a focused mix of SQL and analytics, applied machine learning, system design, experimentation, and behavioral questions. These questions are designed to evaluate how you work with large scale transactional data, reason through fraud and credit risk tradeoffs, and build models that perform reliably in regulated, high impact environments. Interviewers care as much about how you structure problems and explain decisions as they do about technical correctness. Across all question types, American Express looks for engineers who demonstrate judgment, ownership, and strong communication under ambiguity.

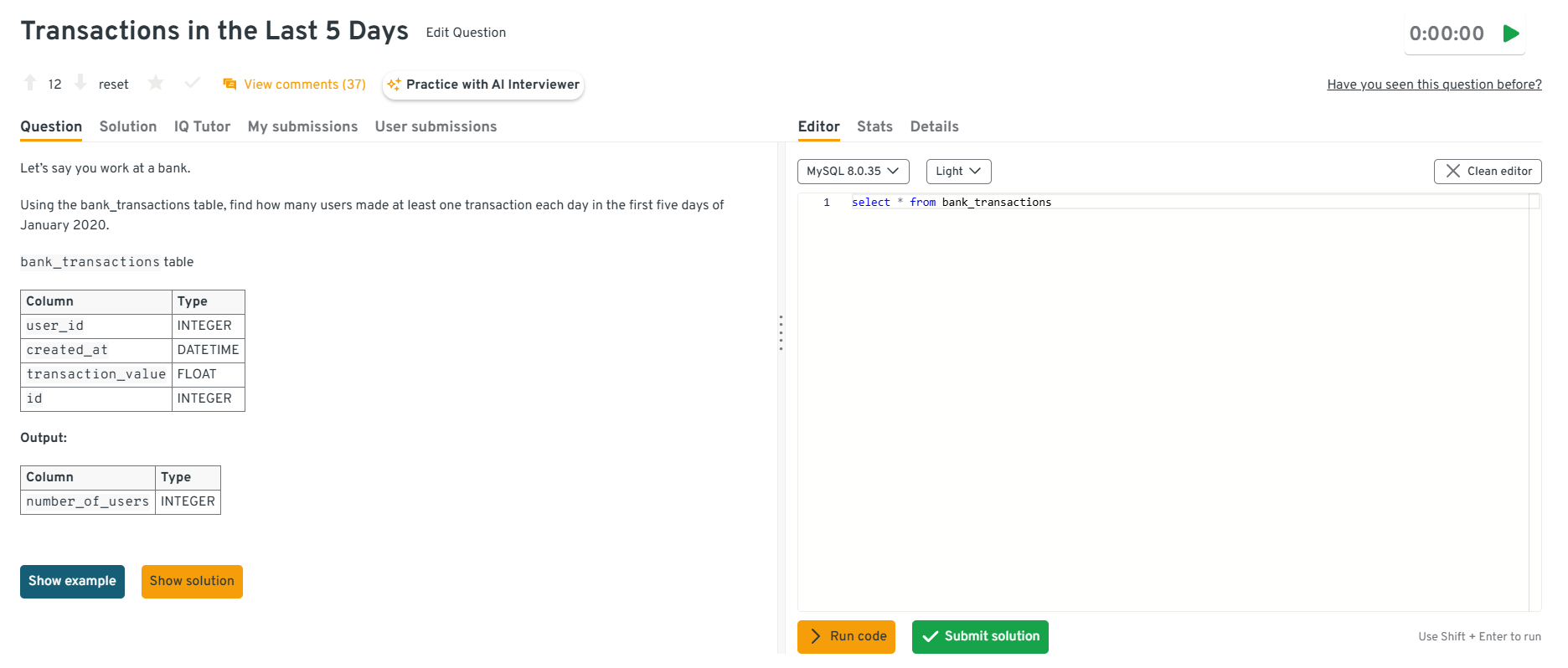

SQL and Analytics Interview Questions

SQL is a core skill for machine learning engineers at American Express because most modeling work begins with understanding transactional behavior at a granular level. These questions assess whether you can reason through noisy financial data, identify meaningful patterns, and translate raw signals into inputs that improve fraud and risk models used in real time decisioning.

-

This question tests your ability to move beyond visualization into decision making. At American Express, fraud trend graphs often show changes by merchant type, geography, or transaction channel. A strong answer explains how you would look for sustained shifts rather than short spikes, compare trends across segments, and validate whether patterns reflect real risk or external factors like seasonality. You would then describe how those insights inform feature updates, threshold changes, or model retraining priorities rather than immediate reactive changes.

Tip: Talk through how you would confirm a trend is actionable before changing a model. This demonstrates judgment and risk awareness, which are critical for AmEx fraud systems.

-

This question evaluates your understanding of grouping, filtering, and completeness logic. The solution involves filtering transactions to the date range, grouping by user and date, and ensuring each user appears on all five distinct days using a count check. At American Express, this type of query mirrors behavioral analysis used to define consistent activity patterns that later feed engagement or risk features.

Tip: Mention handling multiple transactions per day correctly. This shows attention to edge cases, which directly impacts feature accuracy in production models.

Head to the Interview Query dashboard to practice American Express–specific data science interview questions in one place. You can work through SQL and transactional analytics problems, applied machine learning scenarios, system design cases, and behavioral questions with built-in code execution and AI-guided feedback, making it easier to prepare for the exact balance of technical depth and business judgment AmEx interviews demand.

How would you detect duplicate or near duplicate transactions within a short time window?

This question tests your ability to identify suspicious or erroneous behavior using SQL. You would typically partition transactions by user and merchant, order them by timestamp, and compare adjacent rows using window functions or self joins to flag transactions with similar amounts occurring within a defined time threshold. This mirrors real AmEx use cases where duplicate charges may signal merchant errors or fraud scripts.

Tip: Explain how you would tune time and amount thresholds using historical data. This shows practical experience and avoids over flagging legitimate customer behavior.

-

This question evaluates your ability to create stable metrics from volatile financial data. The correct approach aggregates deposits at the daily level and then applies a rolling window using window functions to smooth short term fluctuations. At American Express, rolling averages are commonly used to monitor system health and reduce noise before metrics are fed into models or alerts.

Tip: Call out why smoothing matters for downstream models. This demonstrates that you think about how analytics directly affect machine learning stability.

How would you validate data quality before training a risk model?

This question tests analytical discipline and ownership. A strong answer walks through checks for missing values, duplicated records, delayed or out of order events, inconsistent joins, and label leakage across time. At American Express, poor data quality can lead to biased or unstable risk decisions, so this step is considered non negotiable before any model training begins.

Tip: Tie each validation step to a potential business risk. This shows you understand how data issues translate into real customer and financial impact.

Want to build up your machine learning interview skills? Practice real hands-on problems on the Interview Query Dashboard and start getting interview ready today.

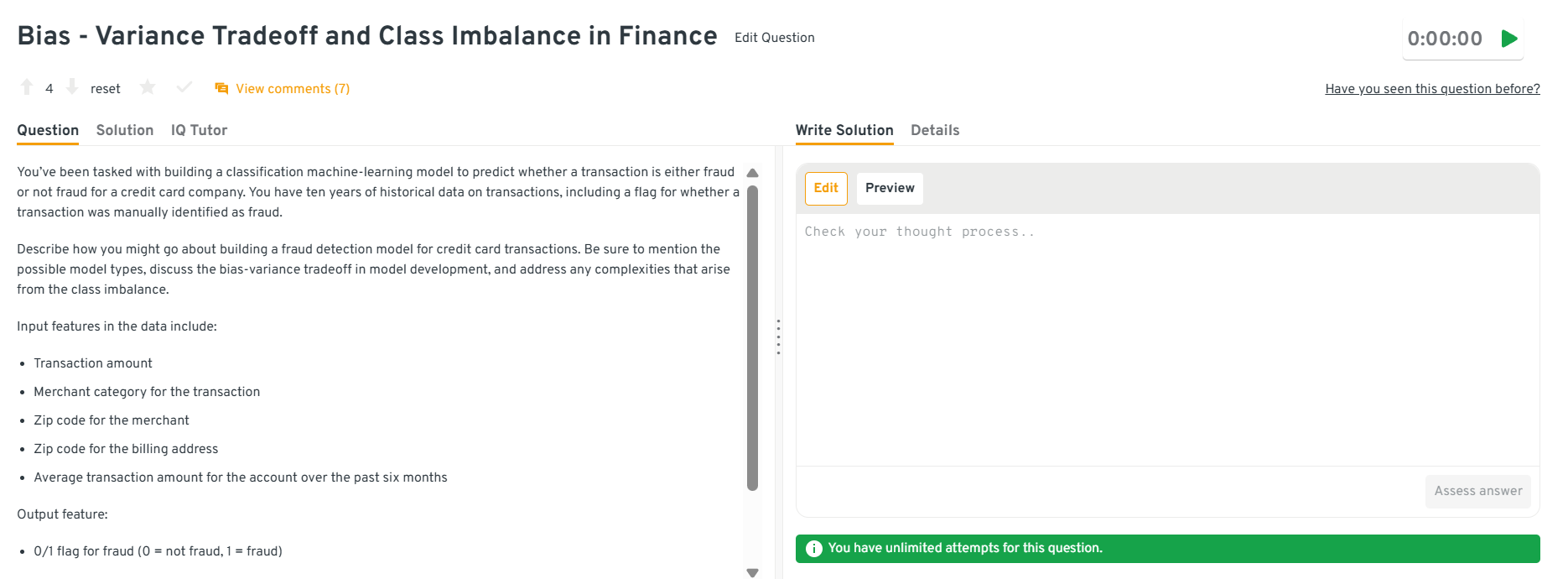

Machine Learning and Modeling Interview Questions

These questions evaluate how you design, evaluate, and operate machine learning models that directly influence financial decisions. At American Express, models must perform consistently under real world constraints like class imbalance, regulatory scrutiny, and customer trust. Interviewers are looking for engineers who can own the full lifecycle of a model, make principled tradeoffs, and explain decisions clearly to both technical and non technical partners.

How would you build a fraud detection model with highly imbalanced data?

This question tests your understanding of class imbalance and evaluation. A strong answer discusses sampling strategies, appropriate metrics like precision recall curves, and threshold tuning based on business cost.

Tip: Always connect metric choice to financial impact. This shows you think like an owner, not just a modeler.

How do you choose between logistic regression and gradient boosted trees for a risk model?

This question evaluates model selection judgment. You should explain tradeoffs around interpretability, non linearity, stability, and regulatory constraints.

Tip: Highlight scenarios where simpler models are preferred. This demonstrates maturity and alignment with AmEx risk standards.

-

This question tests end to end thinking across modeling, systems, and user experience. A strong answer explains how you would score transactions in real time, define a risk band for step up authentication, and design feedback loops from customer responses back into the model. At American Express, this flow balances fraud reduction with minimizing customer disruption, so discussing latency, fallback logic, and learning from confirmation data is critical.

Tip: Highlight how you would prevent over triggering SMS prompts. This shows you understand customer trust and long term experience, not just short term fraud gains.

How would you evaluate a model when false positives are more costly than false negatives?

This question examines cost sensitive decision making. You should explain how you would move beyond symmetric metrics and focus on cost weighted loss, precision at key thresholds, and segment level analysis. At American Express, false positives often mean declined legitimate transactions, so a strong answer shows how business context drives threshold selection and ongoing tuning rather than relying on a single global metric.

Tip: Discuss how you would revisit thresholds as behavior shifts. This signals strong operational awareness and long term ownership.

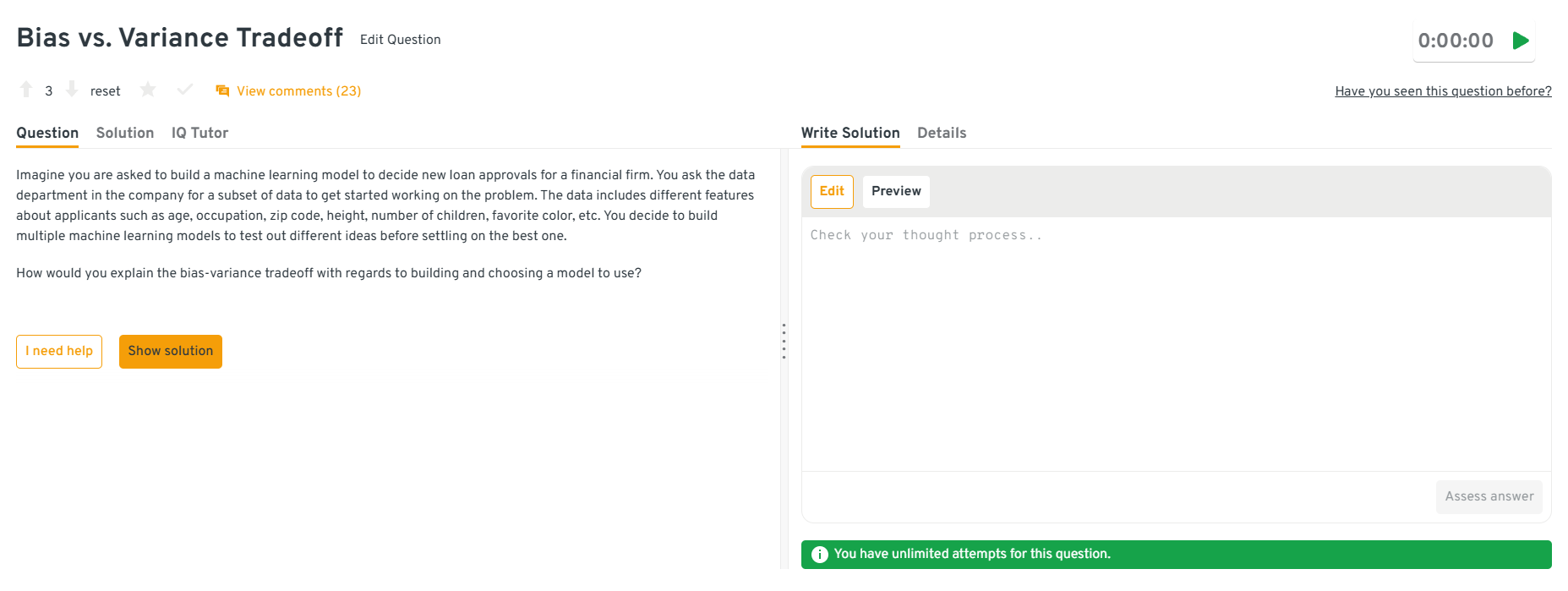

-

This question tests whether you can reason about generalization in a high stakes setting. A good answer explains bias as underfitting important patterns and variance as overfitting noise, then ties those concepts to loan approval outcomes like inconsistent decisions or unfair rejections. At American Express, you should also mention how cross validation, regularization, and monitoring help manage this tradeoff over time.

Tip: Frame bias and variance in terms of decision consistency and fairness. This shows you can translate theory into real business and customer impact.

Head to the Interview Query dashboard to practice American Express–specific data science interview questions in one place. You can work through SQL and transactional analytics problems, applied machine learning scenarios, system design cases, and behavioral questions with built-in code execution and AI-guided feedback, making it easier to prepare for the exact balance of technical depth and business judgment AmEx interviews demand.

Want to master the entire ML pipeline? Explore our ML Engineering 50 learning path to practice a curated set of machine learning questions designed to strengthen your modeling, coding, and system design skills.

System Design and ML Infrastructure Interview Questions

These questions evaluate how well you translate machine learning models into production ready systems that operate reliably at scale. At American Express, system design is inseparable from machine learning because models must deliver low latency decisions, remain stable under traffic spikes, and fail safely when upstream systems degrade. Interviewers want to see end to end ownership, strong engineering judgment, and awareness of real time financial constraints.

Design a real time fraud scoring system for card transactions.

This question tests whether you can think beyond the model and design a full decisioning system. A strong answer walks through real time ingestion of transaction data, feature computation using cached and streaming features, low latency model serving, and decision thresholds that trigger approvals, declines, or step up authentication. At American Express, you should also discuss fallback logic when features or services fail, since uninterrupted authorization is critical for customer trust.

Tip: Always describe how the system behaves when something breaks. Calling out graceful degradation shows production readiness and reliability, which are core AmEx expectations.

-

This question evaluates your ability to balance modeling rigor with system constraints. A strong answer explains how you would handle imbalance through sampling or weighting, manage bias variance through regularization and validation, and deploy the model with monitoring that detects drift over time. At American Express, you should emphasize stability and consistency across customer segments, not just offline performance gains.

Tip: Tie bias variance decisions to downstream customer impact. This shows you understand how modeling choices affect approval consistency and trust.

Head to the Interview Query dashboard to practice American Express–specific data science interview questions in one place. You can work through SQL and transactional analytics problems, applied machine learning scenarios, system design cases, and behavioral questions with built-in code execution and AI-guided feedback, making it easier to prepare for the exact balance of technical depth and business judgment AmEx interviews demand.

How would you design a feature pipeline used by multiple models?

This question tests engineering discipline and scalability. A good answer covers centralized feature computation, versioning, freshness guarantees, and reuse across training and inference. At American Express, shared feature pipelines reduce inconsistencies between teams and prevent subtle bugs that can cause model drift or performance drops in production.

Tip: Emphasize strict alignment between training and inference features. This signals strong engineering fundamentals and reduces production risk.

-

This question evaluates model evaluation in live systems. A strong answer explains how you would analyze historical decisions, align predictions with outcomes over time, and compare models using metrics that respect temporal ordering. At American Express, this protects against data leakage and ensures new models truly outperform existing systems under real conditions.

Tip: Call out why time based validation matters more than random splits. This shows deep understanding of financial modeling pitfalls.

-

This question tests your ability to scale from data understanding to deployment. A strong answer starts with exploratory analysis, feature construction, and baseline modeling, then moves into evaluation, threshold tuning, and deployment considerations. At American Express, interviewers want to hear how you would iterate safely and avoid rushing a model into production without sufficient validation.

Tip: Explain how you would stage the rollout and monitor early signals. This demonstrates cautious, high ownership thinking expected from AmEx machine learning engineers.

Watch Next: How to Ace a Machine Learning Mock Interview - Design a recommendation engine

In this mock interview session, Ved, a PhD student and ML research scientist intern at LinkedIn, walks through a realistic applied machine learning prompt that closely mirrors how American Express interviews evaluate candidates. He demonstrates how to break a vague problem into well defined features, choose modeling approaches that balance performance and explainability, select metrics aligned with business risk, and present conclusions clearly for stakeholders. This walkthrough gives you a practical, interview-ready framework you can directly apply when preparing for American Express machine learning engineer interviews, where structure, judgment, and clarity matter as much as technical depth.

Behavioral and Product Thinking Interview Questions

Behavioral questions assess how you collaborate, communicate, and make decisions in ambiguous environments. American Express values engineers who can own problems end to end and work effectively across functions. Strong candidates show they can navigate ambiguity, influence stakeholders, and learn quickly when things do not go as planned.

Why do you want to join American Express as a machine learning engineer?

This question tests motivation and alignment with American Express’s mission around trust and responsible decisioning. Interviewers want to see that your interest goes beyond brand recognition and connects to the real problems AmEx solves with machine learning at scale.

Sample answer: In my previous role, I worked on risk models that evaluated millions of transactions daily, and I saw how small threshold changes could meaningfully impact customer experience. At American Express, I’m excited by the opportunity to work on models where explainability and long-term trust matter as much as performance. I’ve consistently enjoyed roles where machine learning directly supports customer protection and fair decisioning, which aligns closely with AmEx’s focus on reliability and responsibility.

Tip: Reference specific AmEx problem spaces like fraud prevention or credit risk. This shows intentional preparation and genuine alignment with the role.

Tell me about a time your model caused an unexpected negative outcome.

This question evaluates accountability, learning, and resilience. American Express interviewers want to understand how you respond when models behave unexpectedly and how you reduce future risk.

Sample answer: I deployed a model update that improved recall by 6 percent but unintentionally increased false positives for a small customer segment, leading to higher decline rates. After identifying the issue through monitoring, I rolled back the change, analyzed segment-level performance, and introduced guardrail thresholds before re-releasing the model. As a result, we recovered the lost approval rate and still achieved a net fraud reduction of 3 percent.

Tip: Emphasize detection and correction speed. At AmEx, owning mistakes and mitigating impact quickly is a strong signal of production readiness.

How do you push back on a stakeholder who wants a risky model change?

This question tests judgment and influence without authority. Interviewers want to see how you balance collaboration with protecting customers and the business.

Sample answer: A product partner once asked to lower a fraud threshold to improve approval rates before a peak period. I simulated the change using historical data and showed it would increase fraud losses by roughly 12 percent in a high-risk segment. We aligned on a smaller, staged adjustment with close monitoring, which preserved approval gains while keeping losses within tolerance.

Tip: Show that you lead with data, not opinion. This demonstrates calm, credible decision making under pressure.

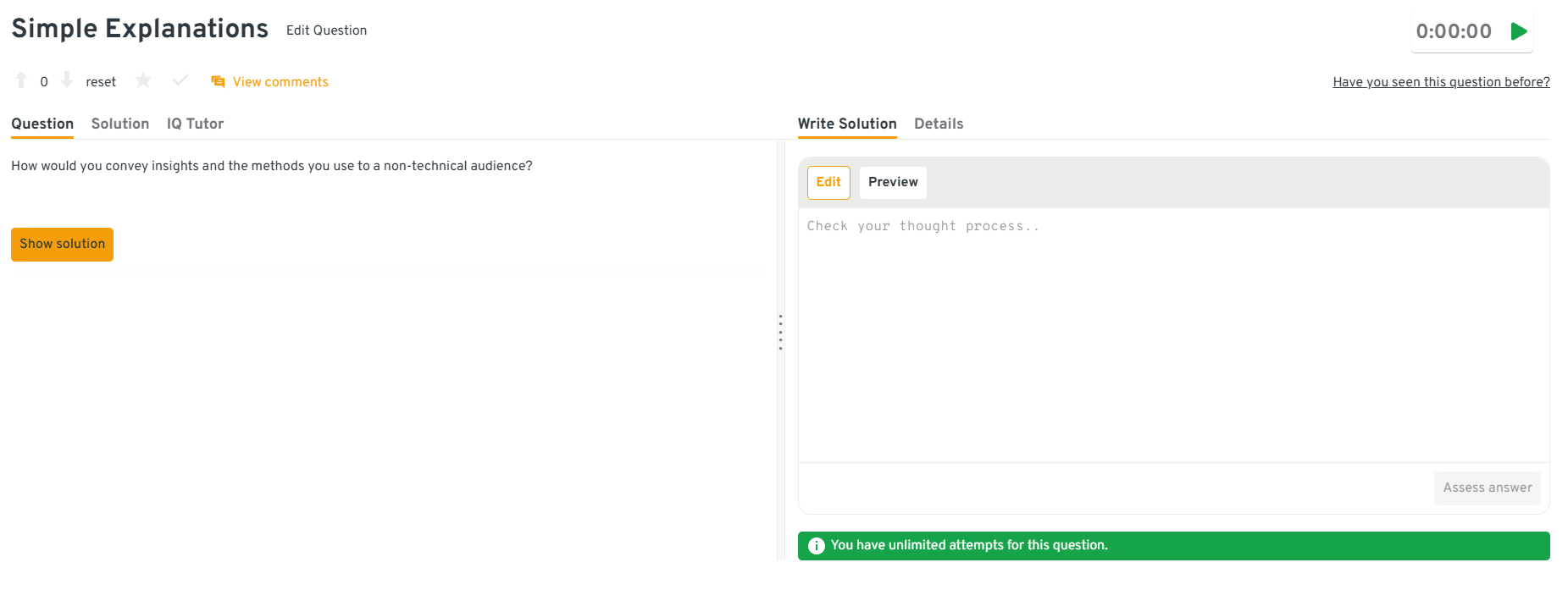

Describe a time you had to explain a complex model to a non technical audience.

This question evaluates communication clarity and empathy. At American Express, machine learning engineers regularly explain models to risk, product, and compliance partners.

Sample answer: I once explained a gradient boosted model to a risk committee by focusing on decision drivers rather than algorithms. I walked through the top features, how they influenced outcomes, and used real transaction examples. This helped the group approve the model, which later reduced fraud losses by 8 percent without increasing customer complaints.

Tip: Focus on outcomes and intuition over mechanics. This shows you can build trust with non technical stakeholders.

Head to the Interview Query dashboard to practice American Express–specific data science interview questions in one place. You can work through SQL and transactional analytics problems, applied machine learning scenarios, system design cases, and behavioral questions with built-in code execution and AI-guided feedback, making it easier to prepare for the exact balance of technical depth and business judgment AmEx interviews demand.

How do you prioritize model improvements when resources are limited?

This question tests strategic thinking and business alignment. Interviewers want to see how you decide what not to do.

Sample answer: When bandwidth was limited, I ranked potential improvements by expected impact on loss reduction and customer friction. We prioritized monitoring and threshold tuning over new feature development, which stabilized performance and reduced false positives by 4 percent before investing in larger model changes.

Tip: Tie prioritization to measurable impact. At AmEx, disciplined focus is valued more than chasing marginal gains.

Looking for hands-on problem-solving? Test your skills with real-world challenges from top companies. Ideal for sharpening your thinking before interviews and showcasing your problem solving ability.

What Does an American Express Machine Learning Engineer Do?

An American Express machine learning engineer builds and maintains models that power fraud prevention, credit risk assessment, and personalized customer experiences across millions of daily transactions. The role sits at the intersection of large-scale transactional data, real-time inference, and regulated decision-making, where accuracy alone is not enough. Engineers are expected to design systems that are explainable, resilient, and tightly aligned with business risk. At American Express, machine learning engineers work closely with product, risk, and data science teams to take models from concept to production and continuously monitor their performance in live environments.

How American Express Machine Learning Engineers turn Work into Impact

| What They Work On | Core Skills Used | Tools And Methods | Why It Matters At American Express |

|---|---|---|---|

| Fraud detection and prevention | Classification, imbalance handling, feature engineering | Gradient boosting, anomaly detection, real-time scoring | Protects customers and reduces financial losses at transaction time |

| Credit risk modeling | Statistical modeling, model evaluation, explainability | Logistic regression, scorecards, monitoring frameworks | Enables fair and accurate lending decisions under regulatory scrutiny |

| Personalization and offers | Predictive modeling, segmentation, experimentation | Supervised learning, A/B testing, feature pipelines | Drives customer engagement without increasing risk exposure |

| Model monitoring and governance | Drift detection, bias analysis, performance tracking | Dashboards, alerts, retraining workflows | Ensures models remain reliable as customer behavior evolves |

| ML systems in production | System design, scalability, reliability | Python, SQL, distributed data processing | Supports low-latency decisions across high transaction volumes |

Tip: In interviews, clearly explain how you translate model outputs into business decisions. At AmEx, strong machine learning engineers stand out by showing judgment around thresholds, monitoring, and risk tradeoffs, not just model accuracy.

How to Prepare for an American Express Machine Learning Engineer Interview

Preparing for the American Express machine learning engineer interview requires a different mindset than roles focused purely on experimentation or research. At American Express, machine learning directly influences financial outcomes, customer trust, and regulatory compliance. Strong candidates demonstrate not only technical depth but also sound judgment, risk awareness, and the ability to operate reliably in production. Below is a focused preparation framework to help you build those signals intentionally.

Build intuition for risk driven decision making: American Express models rarely optimize for accuracy alone. Spend time understanding cost sensitive learning, threshold tuning, and how false positives versus false negatives affect customers and the business differently. Practice explaining how you would set and adjust thresholds under changing risk conditions.

Tip: In interviews, explicitly connect model decisions to loss prevention and customer experience. This shows business judgment, a core signal AmEx looks for in senior machine learning engineers.

Practice end to end ML ownership, not isolated modeling: Review full pipelines from raw data to deployment, including feature validation, monitoring, retraining, and rollback strategies. Be ready to explain what can break in production and how you would detect issues early.

Tip: Call out failure modes before interviewers ask. Proactively identifying risks demonstrates maturity and ownership, which strongly differentiates candidates.

Strengthen SQL driven analysis on transactional data: Many interview questions begin with data exploration before modeling. Practice writing clean SQL for time based analysis, rolling metrics, and anomaly detection. Focus equally on interpreting results and explaining what actions you would take next.

Tip: Narrate what the numbers imply for real customers or merchants. This highlights analytical clarity and decision making, not just query fluency.

Prepare clear stories around past machine learning projects: Select two or three projects and rehearse them using a consistent structure: problem context, constraints, modeling choices, tradeoffs, results, and follow up iterations. Emphasize decisions you made under uncertainty.

Tip: Discuss what you chose not to do and why. At AmEx, restraint and prioritization signal strong engineering judgment.

Refine communication for cross functional audiences: Machine learning engineers regularly explain models to risk, product, and compliance partners. Practice simplifying complex ideas without losing correctness, especially around model behavior and limitations.

Tip: If you can explain your model to a non technical stakeholder clearly, interviewers trust you to operate effectively in production environments.

Simulate realistic interview pacing: Practice a full mock interview loop that includes SQL analysis, an applied machine learning discussion, a system design walkthrough, and a behavioral round in one sitting. This helps build stamina and clarity under pressure.

Tip: After each mock session, identify one explanation that felt unclear and rewrite it. Improving clarity is often the fastest way to raise interview performance.

Struggling with take-home assignments? Get structured practice with Interview Query’s Take-Home Test Prep and learn how to ace real case studies.

American Express Machine Learning Engineer Salary

American Express machine learning engineers earn competitive compensation across levels, reflecting the high impact and responsibility of building decisioning systems that operate in regulated, real time financial environments. Total compensation typically includes a strong base salary, annual performance bonus, and meaningful equity through restricted stock units. Compensation varies based on scope, level, location, and the type of machine learning work you support, such as fraud, credit risk, or personalization. For most candidates, especially those with prior production experience, equity becomes a meaningful component of total compensation by the second year.

Read more: Machine Learning Engineer Salary

Tip: Confirm your target level with your recruiter early. At American Express, leveling has a significant impact on both compensation range and expectations around ownership and decision making.

American Express Machine Learning Engineer Compensation Overview (2026)

| Level | Role Title | Total / Year | Base / Year | Stock / Year | Bonus / Year |

|---|---|---|---|---|---|

| MLE I | Machine Learning Engineer I | ~$135K – $175K | ~$115K – $135K | ~$10K – $20K | ~$5K – $10K |

| MLE II | Machine Learning Engineer II | ~$165K – $215K | ~$130K – $155K | ~$20K – $35K | ~$10K – $15K |

| Senior MLE | Senior Machine Learning Engineer | ~$200K – $260K | ~$150K – $175K | ~$35K – $55K | ~$15K – $20K |

| Staff / Principal | Staff or Principal ML Engineer | ~$240K – $330K+ | ~$165K – $200K | ~$55K – $90K | ~$20K – $30K |

Compensation increases meaningfully after stock vesting begins in year two, especially at senior and staff levels where refreshers are more common.

Note: These estimates are aggregated from data on Levels.fyi, Glassdoor, Teamblind, public job listings, and Interview Query’s internal compensation data.

Average Base Salary

Average Total Compensation

Negotiation Tips That Work For American Express

Negotiating at American Express is most effective when discussions are grounded in level clarity and market benchmarks rather than aggressive positioning.

- Confirm your level before discussing numbers: A shift from Machine Learning Engineer II to Senior Machine Learning Engineer can materially change base, bonus, and equity expectations.

- Anchor discussions with verified data: Reference sources like Levels.fyi, Glassdoor, and Interview Query salary insights to support your expectations.

- Factor in long term value: Stock refreshers, stability, and scope expansion matter at American Express, especially for engineers working on core risk platforms.

Tip: Ask for a complete breakdown of base, bonus target, equity vesting schedule, and refreshers. Understanding the full package helps you evaluate offers accurately and negotiate with confidence.

FAQs

How long does the American Express machine learning engineer interview process take?

Most candidates complete the process within three to six weeks. Timelines vary based on team matching, seniority, and interviewer availability. Recruiters usually share clear next steps after each stage to keep expectations aligned.

Does American Express use online assessments or coding tests?

Some teams include a short online assessment for Python or SQL, particularly for early career roles. Many mid level and senior candidates move directly into live technical screens focused on applied problem solving rather than timed tests.

How important is fraud or financial services experience at American Express?

Prior experience in fraud, credit risk, or financial data is helpful but not required. Strong machine learning fundamentals and clear decision making matter more. Candidates with adjacent experience typically ramp up quickly if they show good risk awareness.

What is the difficulty level of SQL questions at American Express?

SQL questions are moderately challenging and highly practical. Expect joins, window functions, rolling metrics, and time based analysis on transactional data. Interviewers care more about correctness and interpretation than clever query tricks.

Are machine learning interviews more theoretical or applied?

Interviews are strongly applied. You will be asked to design, evaluate, and monitor models in production scenarios. The focus is on tradeoffs, reliability, and real world constraints rather than academic proofs.

Do machine learning engineers need system design skills at American Express?

Yes, especially at senior levels. Interviewers expect you to reason about data flow, latency, monitoring, and failure handling for real time decision systems. Clear end to end thinking is a key signal.

How are behavioral interviews evaluated at American Express?

Behavioral rounds focus on ownership, communication, and judgment. Interviewers look for examples of handling ambiguity, pushing back responsibly, and learning from failures in cross functional environments.

What is the best way to stand out in the American Express interview?

Candidates stand out by explaining decisions clearly and tying technical choices to business and customer impact. Showing awareness of risk, monitoring, and long term stability consistently differentiates strong machine learning engineers.

Become An American Express Machine Learning Engineer With Interview Query

Preparing for the American Express machine learning engineer interview means building strong applied machine learning depth, clear system design thinking, and the ability to make sound decisions in high impact financial environments. By understanding American Express interview structure, practicing real world SQL and transactional analysis through scenario-based SQL problems, and refining how you explain modeling and risk tradeoffs, you can approach each stage with confidence.

For targeted preparation, explore the full Interview Query question bank, practice live with the AI Interviewer, or work one on one with experienced mentors through Interview Query’s Coaching Program. With structured practice and focused feedback, you will be well equipped to stand out in the American Express machine learning engineer hiring process.