American Express Software Engineer Interview Guide (2026): Process, Coding Questions & Prep

Introduction

Preparing for an American Express software engineer interview means entering a technology environment where reliability, security, and scale are non-negotiable. As American Express continues to modernize its global payments and fraud prevention platforms, software engineers are expected to build systems that handle real-time transactions with precision, resilience, and long-term maintainability. The interview process reflects this bar, focusing on how you think through production-grade problems rather than how quickly you can solve abstract puzzles.

At American Express, interviewers evaluate your ability to write clean, defensible code, reason about distributed systems, and communicate trade-offs clearly in high-stakes scenarios. This guide outlines each stage of the American Express software engineer interview, highlights the most common software engineering specific questions, and shares proven strategies to help you stand out and prepare effectively with Interview Query.

American Express Software Engineer Interview Process

The American Express software engineer interview process evaluates how well you build reliable systems, reason through complex backend problems, and communicate technical decisions in a regulated, high-impact environment. The process typically spans three to five weeks and includes multiple stages focused on coding fundamentals, object-oriented design, system reliability, and behavioral alignment with company values. Throughout the loop, interviewers assess not just correctness, but how you think about failure modes, data integrity, and long-term maintainability in real-money systems at American Express.

Application and Resume Screen

During the initial resume review, recruiters look for strong foundations in software engineering fundamentals, especially experience with Java or similar backend languages, APIs, and production systems. Resumes that stand out clearly demonstrate ownership of services, contributions to system reliability, and experience working with distributed or high-traffic applications. Exposure to financial systems, payments, or security-sensitive domains is helpful but not required if your impact is well articulated.

Tip: Highlight situations where your code handled scale, failure, or strict correctness requirements. This signals engineering maturity and shows interviewers you are ready to work on systems where mistakes are costly.

Initial Recruiter Conversation

The recruiter call is a short, non-technical discussion focused on your background, motivation for American Express, and role alignment. Recruiters validate your core experience, level expectations, and interest in teams that work on payments, fraud platforms, or internal developer systems. You may also discuss location preferences, interview timeline, and compensation range.

Tip: Clearly connect your past engineering work to why building secure, reliable systems matters to you. This demonstrates purpose-driven motivation, which Amex values strongly in long-term hires.

Online Coding Assessment

Many American Express software engineering roles include an online coding assessment, often hosted on platforms like Codility. These problems typically test data structures, algorithms, and edge-case handling under time constraints. Questions emphasize correctness, clarity, and basic efficiency rather than obscure tricks.

Tip: Prioritize readable, well-structured solutions and explain your logic through comments if possible. This shows disciplined thinking and reduces ambiguity for reviewers assessing your code quality.

Technical Interviews (Virtual Or Onsite)

The technical interview stage is the core of the American Express software engineer interview process. It usually includes two to three interviews, each lasting 45 to 60 minutes, and focuses on real-world engineering skills rather than theoretical puzzles.

Coding and problem-solving round: You will solve algorithmic problems involving arrays, strings, hash maps, or basic data structures. Interviewers assess how you break down problems, handle edge cases, and reason about time and space complexity. Clear communication is as important as the final solution.

Tip: Talk through your approach before coding and call out edge cases explicitly. This demonstrates structured thinking and reduces the risk of logical gaps, a key skill for production engineering.

Object-oriented design or backend systems round: This round evaluates how you design classes, services, or APIs that are maintainable and extensible. You may be asked to model systems related to transactions, users, or notifications and explain design trade-offs.

Tip: Focus on clean abstractions and responsibility boundaries. This shows you can build systems that other engineers can safely extend and operate over time.

System design round (for experienced candidates): Senior candidates may face a system design interview focused on scalability, availability, and data consistency. Scenarios often resemble real Amex problems such as transaction processing or fraud detection pipelines.

Tip: Design for failure first, then scale. Explicitly discussing retries, monitoring, and fallback behavior signals strong production judgment, which is critical at American Express.

Behavioral and Values Interview

The behavioral interview assesses how you collaborate, handle pressure, and take ownership. Questions are aligned with American Express values and often explore past incidents involving outages, conflicting priorities, or cross-team communication.

Tip: Emphasize accountability and learning from mistakes. Interviewers look for engineers who improve systems after failure, not those who avoid responsibility.

Hiring Committee and Offer

After interviews conclude, feedback is reviewed collectively to evaluate your technical strength, communication clarity, and overall readiness for the role and level. If approved, a hiring committee finalizes leveling and compensation before extending an offer. Team matching may also occur at this stage based on your strengths and interests.

Tip: If you have preferences for backend, platform, or fraud-related teams, share them early. Clear signals help ensure you are matched to work where you can create the most impact quickly.

Want to build up your Amex interview skills? Practicing real hands-on problems on the Interview Query Dashboard and start getting interview ready today.

American Express Software Engineer Interview Questions

The American Express software engineer interview focuses on how well you design reliable systems, write clean and defensible code, and reason through real-world engineering problems in a financial domain. Questions span coding fundamentals, backend and object-oriented design, system design for scale and reliability, and behavioral scenarios aligned with company values. Interviewers are assessing not just whether you reach a correct answer, but how you communicate trade-offs, handle edge cases, and think about failure in systems that move real money at American Express.

Coding And Data Structures Interview Questions

This portion of the interview evaluates your fundamentals in algorithms and data structures using practical, production-oriented problems. Questions commonly involve arrays, strings, hash maps, and basic data structures, with an emphasis on correctness, clarity, and edge-case handling rather than clever tricks.

Given a list of integers, identify all the duplicate values in the list.

At American Express, this question reflects real scenarios like detecting duplicate transactions, repeated events, or data quality issues in pipelines. A strong approach involves using a hash set or hash map to track seen values while iterating once through the list, ensuring linear time complexity. You should also explain how your approach behaves with large inputs and whether order matters in the output.

Tip: Call out how you would handle very large lists or streaming inputs. This shows scalability awareness, which is critical for Amex systems that process high transaction volumes.

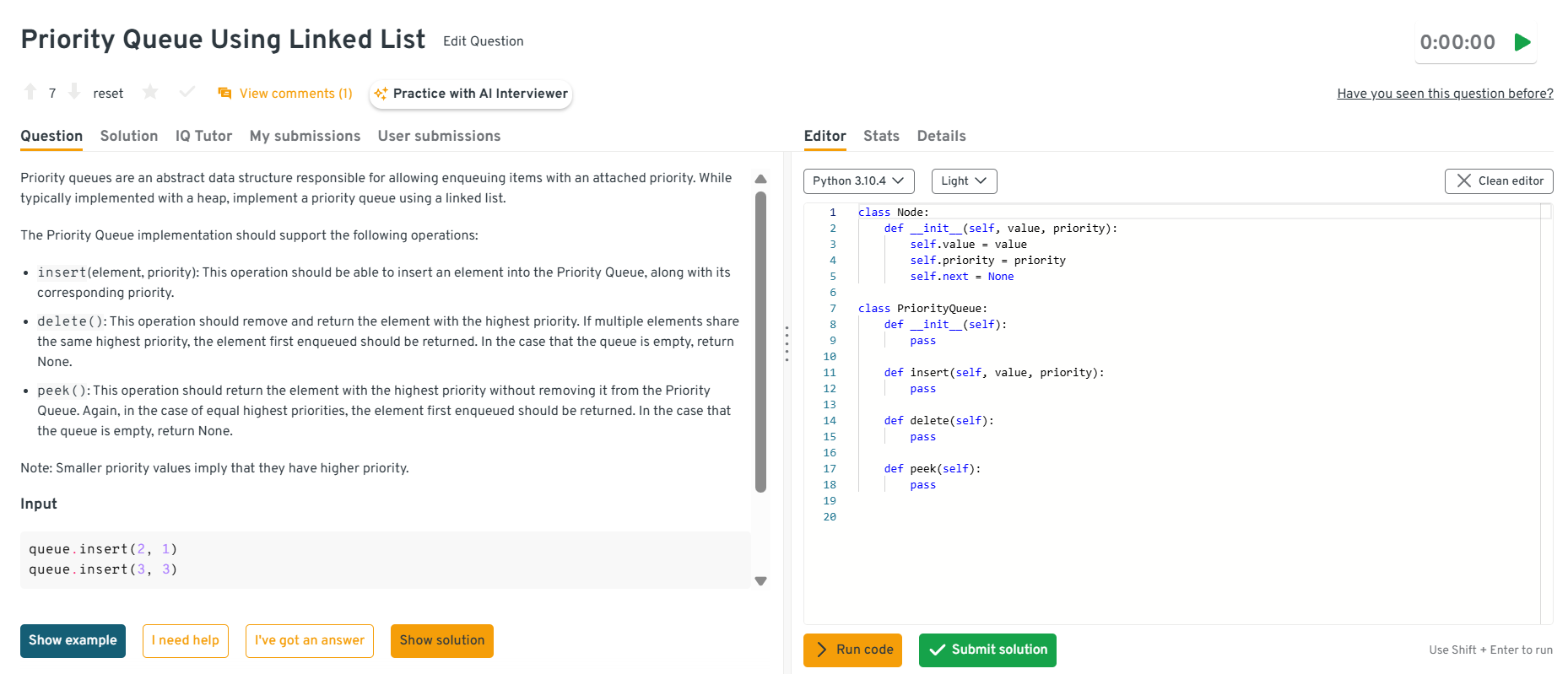

-

This question tests how well you reason about data structures beyond their standard library implementations. At American Express, engineers often need to balance correctness and simplicity when building internal tools. A solid answer explains maintaining the list sorted by priority during insertion, handling ties by appending after existing nodes with the same priority, and keeping delete and peek operations efficient.

Tip: Explain why you chose a linked list over a heap in this scenario. This demonstrates trade-off analysis, a skill Amex values when evaluating design decisions.

Head to the Interview Query dashboard to practice American Express–specific software engineering interview questions in one place. You can work through coding and data structures, object-oriented design, system design, and behavioral questions with built-in code execution and AI-guided feedback, making it easier to prepare for the exact mix of technical rigor, production judgment, and ownership mindset that American Express interviews expect.

-

American Express asks this to evaluate your ability to apply graph algorithms to cost-based decision problems, similar to routing, scoring, or optimization systems. A strong response explains modeling the grid as a graph and using Dijkstra’s algorithm with a priority queue to account for varying costs. You should also discuss handling boundaries, visited states, and performance implications.

Tip: Mention how you would optimize for large grids or early termination. This shows you can adapt algorithms for production constraints, not just academic correctness.

-

This question evaluates pointer manipulation and attention to detail, both essential for backend work at American Express. A good answer walks through locating the k-th node, reversing pointers from that point onward, and reconnecting the reversed portion to the unchanged prefix. Clear explanation matters as much as the final code.

Tip: Talk through pointer updates step by step before coding. This signals precision and reduces the risk of subtle bugs in production systems.

Given an array of integers, find all pairs that sum to a target value.

This problem tests your understanding of hashing, iteration, and edge-case handling. A strong solution uses a hash set or map to track seen values and avoids returning duplicate pairs, even when negative numbers or repeated values are present. At American Express, this mirrors real matching or reconciliation logic in backend services.

Tip: Explain how you would adapt the solution for streaming data or large datasets. This demonstrates systems thinking beyond the immediate problem and aligns well with Amex’s scale-focused engineering mindset.

Watch Next: Python Interview: Reverse a List from Index K | Coding Tips by MAANG Engineer

In this mock coding session, Ravi, a MAANG Software Engineer, walks through how to reverse a list from a specific index K, which is a common coding interview challenge. In this video, you’ll receive a thorough analysis, strategic approach, and Python code implementation, all explained step-by-step. Whether you’re working on Python projects, or exploring Python applications, this tutorial will sharpen your problem-solving skills and boost your confidence.

Object-Oriented Design And Backend Interview Questions

This section evaluates how you design backend systems that are safe, maintainable, and resilient under real-world constraints. At American Express, these questions are used to assess your ability to model financial workflows, reason about data consistency, and make sound design decisions that hold up under scale, concurrency, and strict security requirements.

How would you design a transaction processing service?

At American Express, this question reflects core payment flows where correctness and idempotency are non-negotiable. A strong answer walks through modeling entities like accounts, transactions, and ledgers, clearly separating responsibilities between validation, execution, and persistence layers. You should explain how you guarantee idempotency using transaction identifiers, handle partial failures safely, and ensure retries do not create duplicate charges.

Tip: Explicitly describe how your service behaves during retries or downstream failures. This demonstrates production judgment and shows you can be trusted with real-money transaction systems.

-

This question tests how you approach performance bottlenecks in analytical systems, which matter at Amex for reporting, reconciliation, and regulatory audits. A strong answer explains how you would analyze query patterns, identify expensive joins or scans, and decide between pre-aggregations, materialized views, or partitioned rollups based on access frequency and freshness requirements.

Tip: Explain how you balance query speed with data accuracy and freshness. This shows systems thinking and an understanding of trade-offs Amex engineers make regularly.

-

American Express asks this to evaluate your understanding of scaling data safely. A good response clearly differentiates logical partitioning within a single system from physical sharding across nodes, then ties the choice to consistency, operational complexity, and failure isolation. You should explain scenarios where sharding introduces operational risk and when it becomes necessary.

Tip: Call out operational overhead like rebalancing and cross-shard queries. This signals maturity and awareness of long-term system ownership.

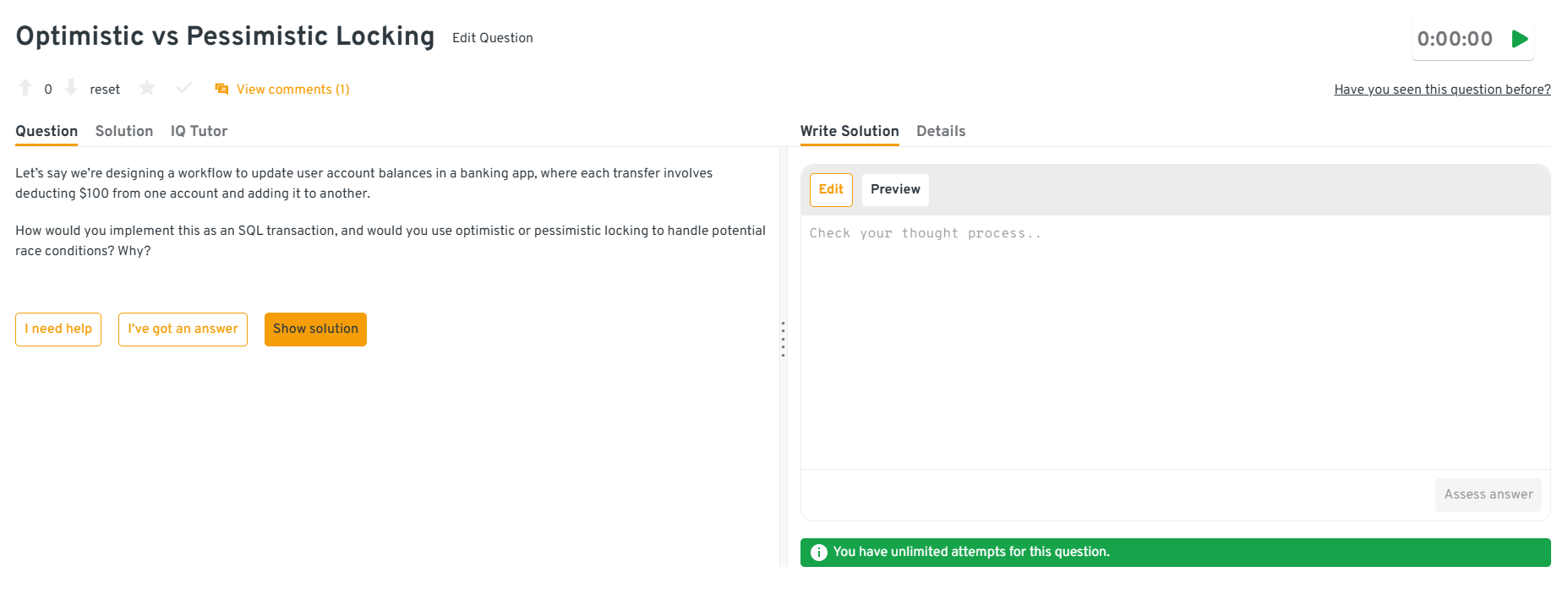

-

This question mirrors real concurrency challenges in financial systems. A strong answer explains wrapping the debit and credit operations in a single transaction, enforcing invariants, and choosing a locking strategy based on contention levels. You should articulate why pessimistic locking may be safer under high contention, while optimistic locking can improve throughput when conflicts are rare.

Tip: Tie your locking choice to business risk, not just performance. This demonstrates risk-aware decision-making, which is critical at American Express.

Head to the Interview Query dashboard to practice American Express–specific software engineering interview questions in one place. You can work through coding and data structures, object-oriented design, system design, and behavioral questions with built-in code execution and AI-guided feedback, making it easier to prepare for the exact mix of technical rigor, production judgment, and ownership mindset that American Express interviews expect.

How do you manage configuration and secrets in a backend service?

This question evaluates security discipline and operational hygiene. A strong answer explains separating configuration from code, using secure secret stores, rotating credentials, and limiting access based on service identity. At American Express, improper secret handling is a serious risk, so clarity and rigor matter more than tooling specifics.

Tip: Emphasize least-privilege access and auditability. This shows security-first thinking and signals that you understand the responsibility that comes with handling sensitive systems.

Struggling with take-home assignments? Get structured practice with Interview Query’s Take-Home Test Prep and learn how to ace real case studies.

System Design Interview Questions

This section tests whether you can design services that stay correct under scale, handle failures gracefully, and remain observable in production. At American Express, system design questions often mirror real financial constraints like real-time fraud decisions, strict audit requirements, and data pipelines that must be resilient even when parts of the system degrade.

-

American Express asks this because fraud systems live or die by the metrics you choose and how quickly you can act on them. A strong answer starts with clear goals such as reducing fraud loss while protecting approval rates, then defines metrics like fraud rate, false positive rate, time-to-detect, and model latency. You should explain real-time data ingestion, feature computation, decisioning thresholds, and how you monitor drift and incident spikes without blocking legitimate customers.

Tip: Always pair security metrics with customer impact metrics like approval rate and friction. That balance signals product judgment and shows you can protect the platform without breaking the card member experience.

How would you build a highly available transaction ledger?

This question reflects the need for a source of truth that never loses money movement and can always be audited. A strong approach explains data modeling for immutable ledger entries, write paths that guarantee durability, and replication strategies that meet availability targets without sacrificing correctness. You should cover consistency choices, idempotency keys, reconciliation workflows, and how you would expose queries safely for downstream systems like reporting and disputes.

Tip: Describe how you would reconcile records after partial failures using idempotency keys and immutable events. This shows reliability, ownership, and the ability to design systems that remain correct under real incident conditions.

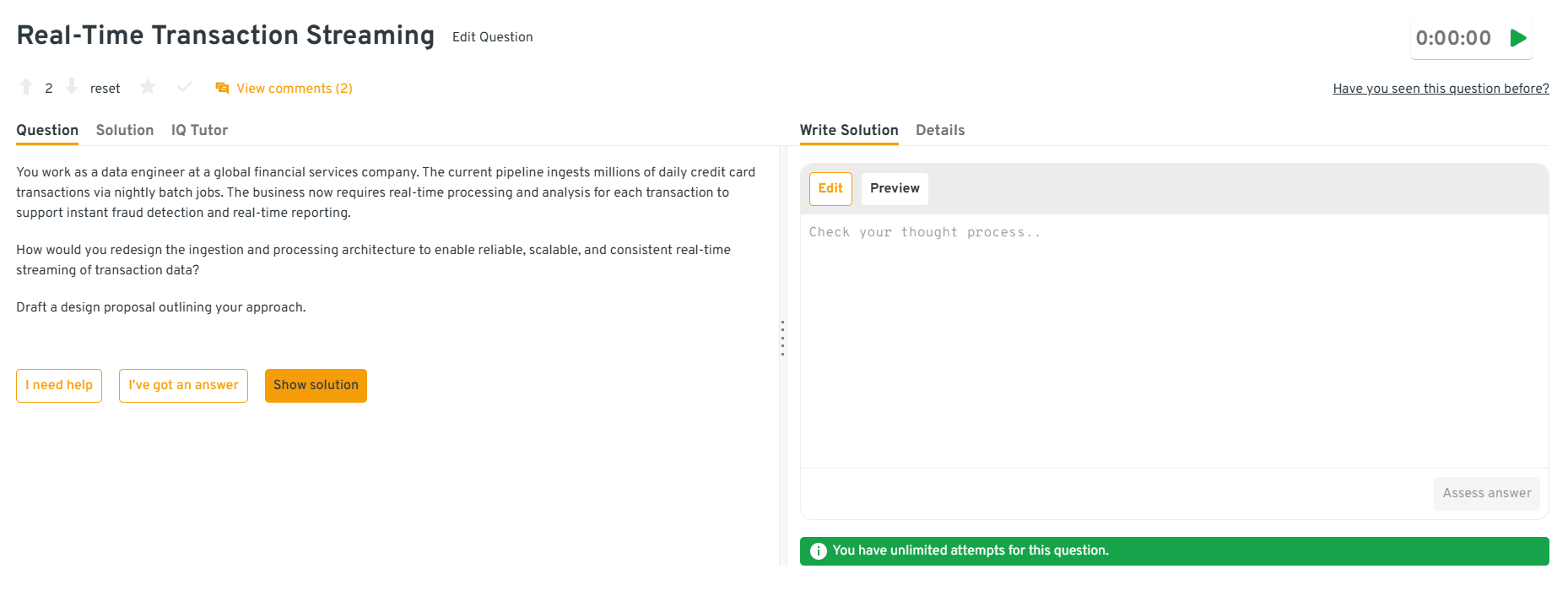

-

American Express asks this because moving from batch to streaming changes failure modes, latency expectations, and data guarantees. A strong answer outlines an event-driven architecture with durable ingestion, a stream processor for enrichment and scoring, and downstream sinks for fraud decisions and reporting. You should discuss ordering, deduplication, backpressure, replay strategy, and how you would keep reporting consistent even when events arrive late or out of order.

Tip: Explain your strategy for deduplication and replay, not just the happy path. That signals you understand real-world streaming failures and can build pipelines that are safe to operate at scale.

Head to the Interview Query dashboard to practice American Express–specific software engineering interview questions in one place. You can work through coding and data structures, object-oriented design, system design, and behavioral questions with built-in code execution and AI-guided feedback, making it easier to prepare for the exact mix of technical rigor, production judgment, and ownership mindset that American Express interviews expect.

-

This question tests your ability to design a dependable data pipeline with clean schema modeling and strong data quality controls. A solid answer explains ingestion, normalization, and incremental loads, then covers how you handle late-arriving updates, refunds, chargebacks, and idempotent upserts. At American Express, the key is showing you can build pipelines that analysts can trust, with clear lineage, validation, and monitoring.

Tip: Call out the specific integrity checks you would add, like reconciliation totals and duplicate detection. This demonstrates data reliability thinking, which is essential when dashboards influence financial decisions.

How would you monitor and alert on system health for a critical service?

American Express asks this because building the service is only half the job, operating it safely is the other half. A strong answer defines service-level indicators like latency, error rate, throughput, saturation, and dependency health, then ties alerts to symptoms that matter to users such as payment failures or timeouts. You should also explain alert tuning, runbooks, and how you avoid noisy pages that cause teams to miss real incidents.

Tip: Tie alerts to user impact first, then add technical diagnostics second. This shows operational maturity and proves you can keep critical services reliable without drowning the team in noise.

Behavioral Interview Questions

Behavioral interviews at American Express evaluate how you take ownership, communicate under pressure, and make sound decisions in high-stakes environments. Interviewers look for clear STAR-structured stories that show accountability, collaboration, and learning, especially in situations involving incidents, disagreements, or long-term system ownership at American Express.

Tell me about a time you handled a production incident.

This question assesses how you operate during outages, including diagnosis, communication, and follow-through. Interviewers want to see calm execution and ownership, not heroics.

Sample answer: During a peak traffic window, a service I owned began timing out, impacting about 8 percent of payment requests. I immediately rolled back the last deployment, coordinated with downstream teams, and set up a temporary throttle to stabilize traffic. After recovery, I led a root-cause analysis that identified an unbounded retry loop. We added circuit breakers and alerting, which reduced similar incidents to zero over the next quarter.

Tip: Emphasize what you changed after the incident. This shows accountability and reliability, two traits Amex values deeply in production owners.

What are your three biggest strengths and weaknesses you have identified in yourself?

Interviewers use this to evaluate self-awareness and growth mindset. They want concrete examples, not generic traits.

Sample answer: One strength is system ownership. I have led services handling over 2 million daily requests and improved uptime from 99.5 to 99.95 percent through better monitoring. Another is clear documentation, which reduced onboarding time by 30 percent on my team. A weakness has been over-indexing on perfection early. I addressed this by shipping smaller iterations and gathering feedback sooner, which cut delivery timelines by nearly half.

Tip: Tie strengths and weaknesses to measurable outcomes. This demonstrates maturity and honest self-assessment, not rehearsed answers.

Head to the Interview Query dashboard to practice American Express–specific software engineering interview questions in one place. You can work through coding and data structures, object-oriented design, system design, and behavioral questions with built-in code execution and AI-guided feedback, making it easier to prepare for the exact mix of technical rigor, production judgment, and ownership mindset that American Express interviews expect.

Why do you want to join American Express as a software engineer?

This question tests motivation and alignment with Amex’s mission. Interviewers want to see intent beyond brand recognition.

Sample answer: I want to join American Express because the engineering challenges align with what I enjoy most: building systems where correctness and trust matter. In my current role, I worked on financial workflows processing millions of events daily, and I value environments where reliability and security come first. Amex’s focus on long-term system ownership and customer trust makes it a place where my experience can have real impact.

Tip: Connect your past work to Amex’s reliability-first culture. This shows intentionality and long-term commitment.

Describe a time you disagreed with a technical decision.

This question evaluates conflict resolution and collaboration. Interviewers look for data-driven influence, not authority-based wins.

Sample answer: I disagreed with a proposal to shard a database early to solve latency issues. I gathered metrics showing the bottleneck was query design, not scale, and prototyped an indexing change that reduced latency by 45 percent. After reviewing the data together, the team aligned on deferring sharding and avoided unnecessary operational complexity.

Tip: Show how you used data to persuade, not escalate. This demonstrates mature collaboration and sound technical judgment.

Tell me about a system you owned end to end.

This question assesses ownership beyond initial delivery. Interviewers want to hear about maintenance, monitoring, and iteration.

Sample answer: I owned a transaction reconciliation service from design through production. It processed over 500,000 records daily and initially had frequent manual interventions. I added automated checks, dashboards, and alerts, reducing manual effort by 70 percent and improving detection time from hours to minutes. I continued to support the service through audits and scaling events.

Tip: Highlight long-term stewardship, not just launch success. This signals readiness for owning critical systems at American Express.

Looking for hands-on problem-solving? Test your skills with real-world challenges from top companies. Ideal for sharpening your thinking before interviews and showcasing your problem solving ability.

What Does an American Express Software Engineer Do?

An American Express software engineer builds and maintains the systems that power secure payments, credit services, fraud detection, and digital customer experiences at global scale. The role sits at the intersection of distributed systems, backend services, and platform reliability, supporting real-time financial transactions for millions of card members and merchants. At American Express, engineers are expected to write production-grade code, design fault-tolerant services, and make thoughtful trade-offs that balance performance, security, and regulatory requirements.

How American Express Software Engineers Turn Work Into Impact

| What They Work On | Core Skills Used | Tools And Methods | Why It Matters At American Express |

|---|---|---|---|

| Transaction processing systems | Data structures, concurrency, error handling | Java services, APIs, distributed workflows | Ensures payments are processed accurately and reliably |

| Fraud detection platforms | Backend design, data reasoning, scalability | Event-driven systems, real-time pipelines | Protects card members and reduces financial risk |

| Cloud-native services | System design, resilience, observability | Microservices, cloud infrastructure, monitoring | Supports global traffic with high availability |

| Internal developer platforms | Clean architecture, maintainability | Shared libraries, CI/CD pipelines | Improves developer velocity and code consistency |

| Compliance and security tooling | Secure coding, access control, auditing | Authentication services, encryption standards | Meets strict financial and regulatory requirements |

Tip: American Express engineers are evaluated on how safely their code behaves under pressure. In interviews, explain how you design for failure, validate assumptions, and protect data integrity. This signals strong production judgment and ownership, which are critical skills for engineers working on real-money systems.

How to Prepare for an American Express Software Engineer Interview

Preparing for an American Express software engineer interview requires a different mindset than standard technology company interviews. You are preparing to work on systems where correctness, reliability, and security directly affect customer trust and financial outcomes. Success depends on demonstrating strong engineering fundamentals, production judgment, and the ability to reason clearly about failure in complex backend systems at American Express.

Below is a focused preparation framework to help you prepare effectively without repeating what you have already covered.

Practice coding with production constraints in mind: Go beyond solving problems correctly and focus on writing readable, defensive code. Practice explaining how your solution handles invalid inputs, unexpected states, and scaling limits, since Amex interviewers pay close attention to edge-case thinking.

Tip: Always state assumptions and failure cases before coding. This signals production awareness and shows you can be trusted with systems that handle real money.

Build intuition for backend reliability and failure handling: Review concepts like idempotency, retries, timeouts, and graceful degradation. Many Amex systems must remain correct even during partial outages, network failures, or downstream latency.

Tip: Be ready to explain what happens when a dependency fails mid-request. This demonstrates operational thinking and reliability ownership.

Strengthen object-oriented and service design fundamentals: Focus on designing clean APIs, clear class responsibilities, and extensible service boundaries. Interviewers care more about maintainability than clever abstractions.

Tip: Explain why you rejected certain designs. This shows judgment and restraint, which matter more than overengineering.

Prepare system design with a correctness-first mindset: When practicing system design, prioritize data consistency, auditability, and monitoring before optimization. American Express values systems that are safe and observable over those that are merely fast.

Tip: Start every design by identifying what must never break. This signals risk awareness and senior-level thinking even at mid-level roles.

Refine how you tell engineering stories: Review your past projects and frame them around decisions, trade-offs, and lessons learned. Be explicit about how you handled incidents, technical debt, or design mistakes.

Tip: Emphasize what you improved after something went wrong. This demonstrates accountability and continuous improvement, which Amex interviewers value highly.

Simulate realistic interview conditions: Practice full interview loops that include a coding round, a design discussion, and a behavioral conversation back to back. Use structured Interview Query mock interviews to pressure-test both your reasoning and communication.

Tip: After each mock, note where your explanations drifted or became vague. Tightening those moments often leads to the biggest improvement in interview performance.

If you want to practice Amex style SWE problems, explore the Interview Query question bank with coding tests, system design walk throughs, and role specific exercises that mirror real interview expectations.

Salary and Compensation for American Express Software Engineers

American Express software engineers earn competitive compensation designed to reward engineers who build secure, highly reliable systems that support global payments, credit services, and fraud prevention. Compensation typically includes a strong base salary, annual performance bonus, and equity grants, with total pay varying based on level, location, technical scope, and team. Most candidates interviewing for software engineering roles fall into mid-level or senior bands, especially if they have experience with backend services, distributed systems, or high-availability platforms.

Read more: Software Engineer Salary

Tip: Confirm your target level with your recruiter early in the process. At American Express, leveling directly determines compensation range and the scope of technical ownership expected in the role.

American Express Software Engineer Compensation Overview (2026)

| Level | Role Title | Total Compensation (USD) | Base Salary | Bonus | Equity (RSUs) | Signing / Relocation |

|---|---|---|---|---|---|---|

| SE I | Software Engineer I | $120K – $155K | $100K–$120K | Performance based | Standard RSUs | Occasional |

| SE II | Software Engineer II | $145K – $195K | $115K–$145K | Performance based | RSUs included | Case-by-case |

| Senior SE | Senior Software Engineer | $170K – $235K | $135K–$165K | Above target possible | Larger RSU grants | More common |

| Staff | Staff Software Engineer | $210K – $300K+ | $155K–$195K | High performer bonuses | High RSUs + refreshers | Frequently offered |

Note: These estimates are aggregated from data on Levels.fyi, Glassdoor, TeamBlind, public job postings, and Interview Query’s internal salary database.

Tip: Compare ranges across at least two sources and ask for location-specific bands early, as American Express compensation varies across New York, Phoenix, Atlanta, and remote roles.

Average Base Salary

Average Total Compensation

Negotiation Tips that Work for American Express

Negotiating compensation at American Express is most effective when discussions are grounded in level clarity, market benchmarks, and demonstrated engineering impact.

- Confirm your level early: The difference between Software Engineer II and Senior Software Engineer can shift total compensation by tens of thousands. Always align on level before negotiating numbers.

- Use verified benchmarks and communicate professionally: Anchor expectations using sources like Levels.fyi, Glassdoor, and Interview Query salary data. Frame your value through measurable impact such as system reliability improvements, latency reduction, or service ownership.

- Account for geographic differences: Pay varies meaningfully across New York, Phoenix, Atlanta, and remote roles. Ask explicitly for location-adjusted ranges to evaluate offers accurately.

Tip: Ask your recruiter for a complete compensation breakdown including base salary, bonus target, equity grant size, vesting schedule, and any signing incentives. This demonstrates financial awareness and helps you negotiate from a well-informed position.

FAQs

What qualities help candidates stand out in an American Express software engineer interview?

Candidates stand out by showing strong production judgment, not just coding ability. Interviewers look for engineers who think about failure modes, data correctness, and long-term maintainability. Clear communication around trade-offs is especially valued at American Express.

How much emphasis is placed on code quality versus speed?

Code quality is prioritized over speed. Interviewers prefer a correct, readable solution with clear reasoning rather than a rushed or overly optimized one. Explaining assumptions and edge cases is often more important than finishing early.

Are system design questions asked for mid-level roles?

Yes, lightweight system design discussions can appear even at mid-level roles. These usually focus on service boundaries, reliability, and data flow rather than large-scale architecture. Senior roles go deeper into scalability and fault tolerance.

How should I approach explaining my thought process during coding rounds?

Interviewers expect you to talk through your approach before and while coding. This helps them understand how you break down problems and adjust when new constraints arise. Silent coding is generally viewed as a missed opportunity to show reasoning.

What type of behavioral examples resonate most with Amex interviewers?

Examples involving ownership, incident response, or improving system reliability resonate strongly. Stories where you took responsibility during failures and drove fixes forward are especially impactful. Focus on lessons learned, not just outcomes.

Is there flexibility in choosing the interview language or tools?

You can usually choose the programming language you are most comfortable with, as long as it is suitable for backend work. Interviewers focus on logic and structure rather than language-specific syntax. Clarify expectations with your recruiter ahead of time.

How are interviewers calibrated across different rounds?

Each interviewer focuses on a specific competency such as coding, design, or collaboration. Feedback is reviewed collectively to balance strengths and gaps across rounds. A single weaker round does not automatically disqualify a strong overall candidate.

What happens if I do well technically but struggle in behavioral rounds?

Behavioral performance carries meaningful weight in hiring decisions. American Express looks for engineers who can collaborate, communicate, and take accountability in high-stakes environments. Strong technical skills alone are usually not enough without solid behavioral signals.

Become an American Express Software Engineer with Interview Query

Preparing for the American Express software engineer interview means developing strong engineering fundamentals, clear system design judgment, and the ability to operate confidently in a security-first, high-reliability environment. By understanding American Express’s interview structure, practicing real-world coding and backend design scenarios, and refining how you communicate trade-offs, you can approach each stage with clarity and confidence.

For targeted preparation, explore the full Interview Query question bank, practice with the AI Interviewer, or work directly with an experienced mentor through Interview Query’s Coaching Program to sharpen your approach. With structured practice and the right feedback, you will be well equipped to stand out in the American Express software engineering hiring process.