American Express Data Scientist Interview Guide: Process, Questions & Preparation Tips (2026)

Introduction

Data science continues to be one of the fastest-growing roles in technology, with the U.S. Bureau of Labor Statistics projecting roughly 35 percent growth in data science and analytics roles through the early 2030s. That growth is even more concentrated in financial services, where companies like American Express rely on advanced analytics to manage credit risk, detect fraud in real time, and personalize experiences across millions of cardmembers and merchants. As data becomes more central to revenue and risk decisions, the bar for hiring data scientists at American Express has risen sharply.

American Express receives a high volume of applications for data science roles, but only a small fraction progress beyond initial screening due to the company’s emphasis on strong SQL fundamentals, statistical reasoning, and the ability to connect models directly to business outcomes. This guide breaks down the American Express data scientist interview process step by step, explains the most common data science–specific interview questions, and shows you how to prepare for each stage with focus and confidence. Whether you are navigating SQL-heavy screens, modeling case studies, or behavioral interviews, this guide gives you a clear, structured path to stand out and prepare effectively with Interview Query.

American Express Data Scientist Interview Process

The American Express data scientist interview process is designed to evaluate how well you can work with large-scale financial data, reason through risk-sensitive decisions, and translate analytics into business impact. Across each stage, interviewers assess your SQL depth, statistical judgment, applied machine learning skills, and ability to communicate clearly with cross functional partners. The full process typically takes three to six weeks, depending on team availability and role level. While individual teams may vary slightly, the core structure is consistent and reflects how data scientists operate day to day at American Express.

Below is a breakdown of each stage and what interviewers are evaluating throughout the process.

Application and Resume Screen

During the resume review stage, recruiters look for candidates who have worked with complex datasets and can demonstrate clear business impact from their analyses or models. Strong SQL and Python experience is expected, along with exposure to experimentation, statistical modeling, or machine learning. Experience in domains such as credit risk, fraud detection, customer analytics, or financial services is a plus, but not a strict requirement if you can show strong analytical reasoning and decision-making.

Resumes that stand out clearly connect technical work to outcomes such as reduced fraud loss, improved approval rates, increased retention, or better customer segmentation. Vague descriptions of models without impact context tend to fall flat at this stage.

Tip: Highlight one or two projects where your analysis directly influenced a decision. This shows business ownership, a core trait American Express values in data scientists.

Initial Recruiter Conversation

The recruiter conversation is typically a 30 minute discussion focused on your background, motivation for American Express, and general fit for the role. This is not a technical interview, but recruiters will validate your familiarity with data science fundamentals and confirm that your experience aligns with the team’s needs. You may be asked about your previous projects, preferred teams, location flexibility, and compensation expectations.

Recruiters also use this call to assess how clearly you explain your work and whether you understand the type of problems American Express data scientists solve, particularly in risk, customer analytics, and experimentation.

Tip: Prepare a concise narrative that connects your past work to data driven decision-making in high-stakes environments. This signals strong communication skills and business alignment.

Technical Screen

The technical screen usually consists of one or two interviews focused on SQL, Python, statistics, and applied analytics. You may be asked to write SQL queries involving joins, aggregations, and window functions, analyze transactional data patterns, or reason through a modeling approach. Some interviewers also ask conceptual questions around experimentation, bias, or model evaluation.

Scenarios are often grounded in realistic use cases such as detecting unusual spending behavior, evaluating a drop in approval rates, or designing features for a predictive model. Interviewers care as much about how you think as they do about correctness.

Tip: Talk through your approach before writing code. This demonstrates structured problem solving and reduces errors, which is critical when working with financial data.

Take Home Assignment or Case Study

Some American Express teams include a take home assignment or live case study, especially for roles focused on modeling or experimentation. These exercises typically involve analyzing a dataset, identifying key patterns, and proposing a data driven recommendation. You may be asked to build a simple model, evaluate features, or outline how you would improve performance over time.

Evaluation goes beyond accuracy. Interviewers look at your assumptions, clarity of explanation, and ability to weigh trade-offs such as risk versus reward or precision versus recall.

Tip: Clearly state assumptions and limitations in your write-up. This shows judgment and risk awareness, both essential skills for data scientists at American Express.

Final Onsite or Virtual Loop

The final loop is the most comprehensive stage of the American Express data scientist interview process. It typically includes four to five interviews, each lasting 45 to 60 minutes. These rounds test how you apply data science skills to real business problems, communicate with stakeholders, and reason through ambiguity.

SQL and data analysis round: You will work with transaction-style data and be asked to write queries that uncover trends, detect anomalies, or compare performance across segments. Tasks may include calculating rolling metrics, identifying risky behavior patterns, or analyzing customer cohorts. Interviewers assess query structure, edge case handling, and insight generation.

Tip: Explain why each query step exists, not just what it does. This demonstrates analytical clarity and an ability to defend decisions with data.

Applied machine learning round: This round focuses on end-to-end modeling thinking. You may be asked to design a fraud detection or risk scoring model, select features, evaluate performance, or discuss monitoring strategies. Expect discussion around imbalanced data, interpretability, and model drift.

Tip: Emphasize how you balance accuracy with explainability. This signals maturity and awareness of regulatory and business constraints.

Experimentation and case study round: You will likely face an open-ended case involving customer behavior, product changes, or risk trade-offs. Examples include evaluating a new rewards feature or investigating a change in transaction patterns. The goal is to see how you structure ambiguous problems and define success metrics.

Tip: Start by clarifying the decision the business needs to make. This shows strong problem framing, a key skill American Express looks for.

Product and business judgment round: This interview evaluates how well you connect data science work to broader company goals. You may discuss how insights influence customer trust, merchant relationships, or long-term value. Collaboration with product managers and engineers is a common theme.

Tip: Tie recommendations to measurable outcomes like loss reduction or engagement lift. This highlights business impact orientation.

Behavioral and collaboration round: Behavioral interviews focus on teamwork, ownership, and resilience. Expect questions about handling disagreements, receiving feedback, or managing high-pressure projects. Interviewers want to understand how you operate within cross functional teams.

Tip: Reflect on what you learned from each experience, not just what you delivered. This demonstrates growth mindset and self-awareness.

Hiring Committee and Offer

After the final interviews, each interviewer submits independent feedback. A hiring committee reviews your performance across all rounds, focusing on technical strength, communication, and overall fit. If approved, the team determines the appropriate level and compensation package. Candidates may also be matched to specific teams based on feedback and business needs.

Tip: If you have strong interest in certain teams or problem areas, communicate this early. It shows intentionality and helps align you with the right scope.

Looking for hands-on problem-solving? Test your skills with real-world challenges from top companies. Ideal for sharpening your thinking before interviews and showcasing your problem solving ability.

American Express Data Scientist Interview Questions

The American Express data scientist interview includes a mix of SQL, analytics, experimentation, product judgment, and applied machine learning questions. These questions are designed to reflect the real problems data scientists solve at American Express, from detecting fraud patterns in transaction data to designing experiments that balance customer experience with risk control. Interviewers are not only evaluating technical correctness, but also how you reason through ambiguity, communicate trade-offs, and make decisions in a regulated, high-impact environment.

Read more: Top 110 Data Science Interview Questions

SQL and Analytics Interview Questions

SQL is a foundational skill for American Express data scientists. Interviewers use SQL questions to evaluate how well you work with large, messy transaction datasets, identify behavioral patterns, and translate raw data into actionable insights. Expect questions involving joins, window functions, time-based filtering, cohort analysis, and anomaly detection, often framed around cardmember activity, merchant performance, or risk signals.

Write a query to identify cardmembers who had more than three declined transactions in the last 30 days.

This question tests whether you can translate a real risk or customer experience problem into a clean, reliable query. At American Express, repeated declines can signal fraud, system issues, or cardmember frustration. To solve this, you would filter transactions to the last 30 days, select only declined events, group by cardmember, and count declines before applying a threshold. Interviewers also look for awareness of data issues like duplicate decline logs or retry behavior that could inflate counts.

Tip: Explain how you would validate decline reasons before counting them. This shows judgment around data quality and customer impact, which matters when declines can drive churn or unnecessary risk escalation.

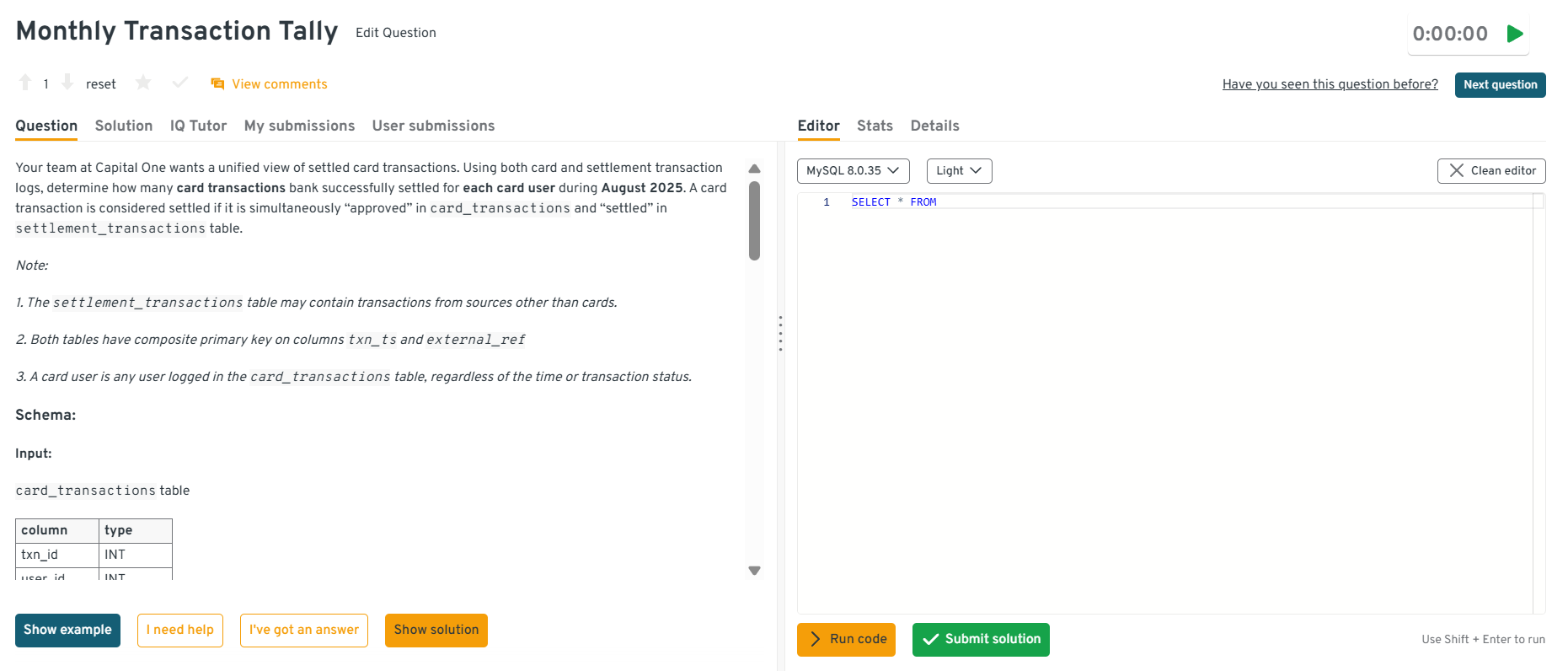

-

This question evaluates your ability to reconcile multiple data sources and reason about transaction lifecycles. At American Express, approval does not always guarantee settlement, so accurate metrics require joining authorization and settlement tables carefully. A strong answer explains joining on transaction identifiers, filtering by date and status in both tables, and grouping by cardmember. Interviewers want to see precision, not shortcuts, because miscounting settled transactions leads to incorrect revenue and risk reporting.

Tip: Call out how you would handle late settlements or reversals. This demonstrates awareness of real-world financial data timing, not just SQL mechanics.

Head to the Interview Query dashboard to practice American Express–specific data science interview questions in one place. You can work through SQL, analytics, case-style, and behavioral questions with built-in code execution and AI-guided feedback, making it easier to prepare for the exact balance of technical depth and business judgment AmEx interviews demand.

-

This question tests cohort analysis and time-window reasoning. You are expected to define a signup cohort, calculate each user’s activity window relative to signup, and aggregate transaction amounts within that window. At American Express, this type of analysis helps assess early customer engagement and long-term value. A strong answer walks through filtering signup dates, joining to transactions, applying a rolling 30-day window, summing volume, and counting qualifying users.

Tip: Explicitly explain how you anchor time windows to signup date. This shows strong analytical framing, which is critical for lifecycle analysis at AmEx.

Write a query to get the cost of all transactions by user ordered by total cost descending.

This question evaluates basic aggregation but in a business-critical context. At American Express, total transaction cost by user can relate to rewards expense, fraud exposure, or servicing cost. The solution involves grouping transactions by user, summing cost fields, and ordering results. Interviewers look for clarity and correct handling of nulls, reversals, or negative adjustments that could distort totals.

Tip: Mention how you would confirm which cost components to include. This signals business awareness and avoids misleading metrics.

Write a query to compute a rolling seven-day approval rate for each merchant.

This question tests window functions and operational metric design. At American Express, rolling approval rates are used to monitor merchant health and detect issues quickly without overreacting to daily noise. A strong answer explains calculating daily approved and attempted transactions, then using a seven-day rolling window to compute the ratio. Interviewers care about why rolling metrics matter, not just how to write them.

Tip: Emphasize how rolling windows reduce false alarms in volatile transaction data. This shows you understand how metrics drive real operational decisions at AmEx.

Watch Next: Meta SQL Data Scientist Interview: Calculate Notification Conversion Rates

In this mock data scientist interview, Vivian, a lead data scientist tackles a real SQL problem from Meta along with Chinmaya as the interviewer, determining which type of notification drives the most conversions. The video walks through analyzing multiple tables, building a logical attribution model, and writing clean, efficient SQL using CTEs and window functions. It’s a great resource for learning how to approach complex, ambiguous SQL interview questions and explain your reasoning clearly under pressure, which are key skills for your next American Express data science interview.

Statistics and Experimentation Interview Questions

Statistics and experimentation questions at American Express test how well you reason under uncertainty and make decisions when mistakes have real financial and customer impact. These questions go beyond formulas and focus on experimental design, probability reasoning, and interpreting results in environments with imbalance, delayed feedback, and strict risk constraints. Interviewers want to see how you connect statistical thinking to responsible decision-making.

How would you design an experiment to test a new credit line increase strategy?

This question tests your ability to design experiments where upside and downside are asymmetric. At American Express, increasing credit lines can drive spend but also increase default risk. A strong answer explains selecting eligible cardmembers carefully, creating a small initial treatment group, and defining success using metrics like incremental spend, delinquency rate, and long-term retention. You should also describe guardrails, phased rollouts, and stopping criteria if risk indicators spike.

Tip: Explain how you would start with low-risk segments first. This shows disciplined experimentation and strong risk judgment, both essential for credit decisions at AmEx.

-

This question evaluates your understanding of conditional probability and base rates. A strong answer walks through applying Bayes’ theorem, explicitly accounting for the fact that fake reviews are rare. At American Express, similar reasoning is used in fraud and risk modeling, where high accuracy does not automatically mean high precision. Interviewers want to see that you do not ignore imbalance when interpreting model outputs.

Tip: Emphasize how base rates can dominate model accuracy. This demonstrates mature statistical intuition and prevents costly misinterpretation of risk signals.

How would you determine if a change in authorization rate is statistically significant?

This question tests your ability to apply hypothesis testing to real operational metrics. At American Express, authorization rates directly affect revenue and customer experience. A strong answer explains defining control and treatment groups, setting hypotheses, estimating variance, and computing confidence intervals or p-values. You should also discuss practical significance and not rely solely on statistical thresholds.

Tip: Mention validating traffic consistency and seasonality before testing. This shows rigor and protects against false conclusions in noisy transaction data.

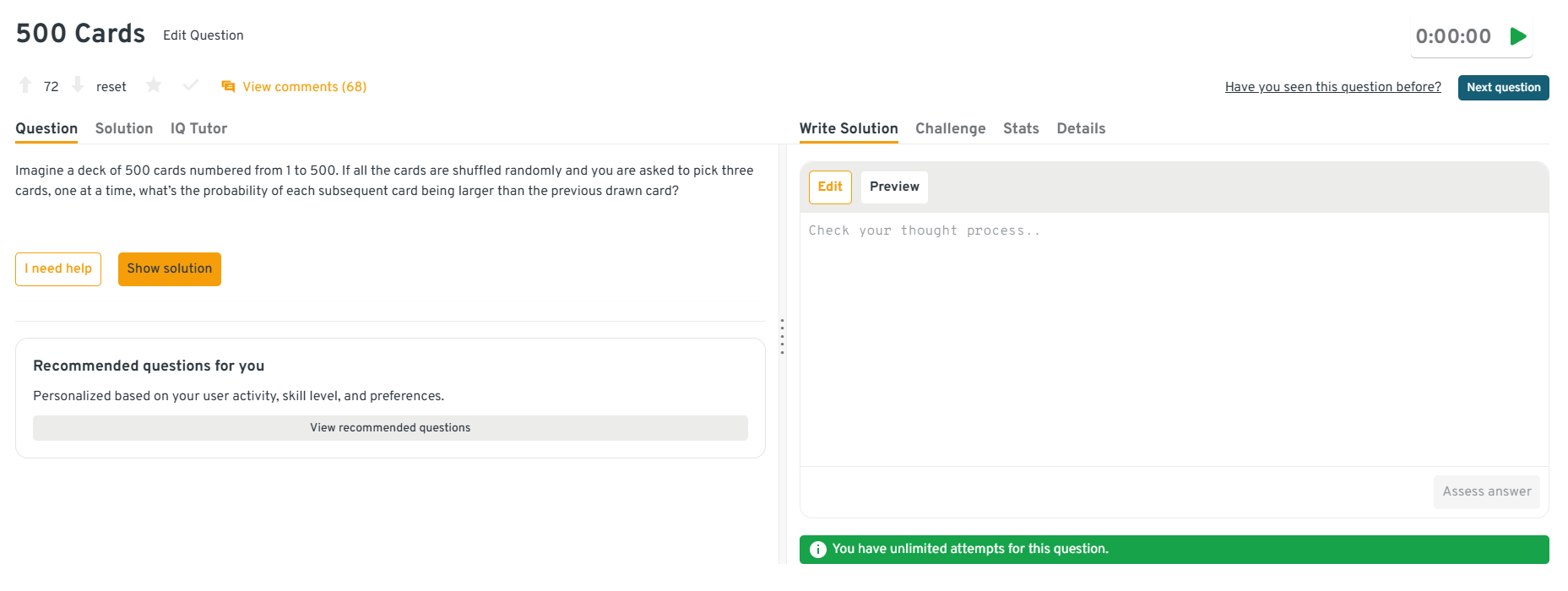

-

This question evaluates combinatorial reasoning and clarity of explanation. A strong answer explains that all orderings of the three drawn cards are equally likely, and only one of the six possible orderings is strictly increasing. At American Express, interviewers use questions like this to assess structured thinking rather than mathematical speed.

Tip: Focus on explaining your reasoning clearly. Communication clarity is critical when presenting risk or probability arguments to non-technical stakeholders.

Head to the Interview Query dashboard to practice American Express–specific data science interview questions in one place. You can work through SQL, analytics, case-style, and behavioral questions with built-in code execution and AI-guided feedback, making it easier to prepare for the exact balance of technical depth and business judgment AmEx interviews demand.

Explain how a probability distribution could not be normal and give an example scenario.

This question tests your understanding of real-world data behavior. At American Express, many metrics such as transaction amounts or fraud losses are skewed or heavy-tailed. A strong answer explains why normality assumptions fail and gives examples like log-normal or exponential distributions. Interviewers want to see awareness of distribution choice in modeling.

Tip: Tie your example to transaction or loss data. This shows applied statistical thinking grounded in AmEx’s business reality.

Struggling with take-home assignments? Get structured practice with Interview Query’s Take-Home Test Prep and learn how to ace real case studies.

Machine Learning and Modeling Interview Questions

Machine learning questions at American Express focus on how you build models that hold up in production, not just on paper. Interviewers evaluate your judgment around interpretability, stability, monitoring, and business risk, especially in regulated decisions like credit and fraud.

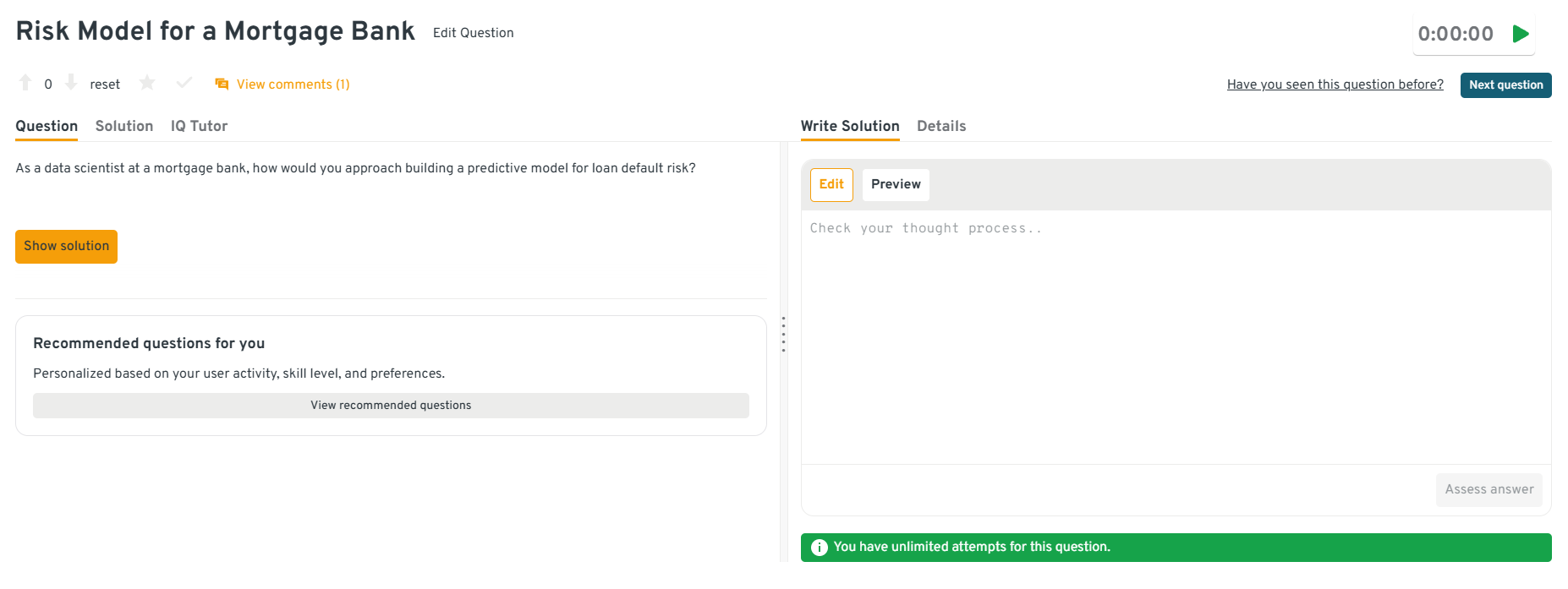

-

This question tests whether you can balance model complexity with reliability in high-stakes decisions. At American Express, overly complex models can overfit historical behavior and fail under changing economic conditions, while overly simple models may miss important risk signals. A strong answer explains bias and variance in plain terms, then ties model choice to stability, explainability, and long-term risk performance rather than raw accuracy.

Tip: Frame the tradeoff around customer fairness and portfolio stability. This shows risk-aware modeling judgment, not just theoretical understanding.

What are the key differences between classification models and regression models?

This question evaluates whether you understand how modeling choices map to business decisions. At American Express, classification models are often used for binary outcomes like fraud or default, while regression models estimate continuous values like spend or loss. A strong answer explains output types, evaluation metrics, and how decision thresholds convert predictions into actions.

Tip: Connect model type to how decisions are actually made. This demonstrates practical thinking beyond textbook definitions.

-

This question tests end-to-end modeling thinking. A strong answer covers feature selection, handling imbalance, model choice, evaluation metrics, and monitoring. At American Express, similar approaches are used in credit risk, where interpretability, stability, and regulatory scrutiny are as important as performance.

Tip: Emphasize how you would validate the model across economic cycles. This signals long-term risk ownership, a key expectation at AmEx.

Head to the Interview Query dashboard to practice American Express–specific data science interview questions in one place. You can work through SQL, analytics, case-style, and behavioral questions with built-in code execution and AI-guided feedback, making it easier to prepare for the exact balance of technical depth and business judgment AmEx interviews demand.

-

This question evaluates system-level thinking and customer experience awareness. A good answer explains real-time scoring, threshold selection, and how customer confirmations feed back into the model. At American Express, these systems must minimize fraud loss without overwhelming customers with false alerts.

Tip: Highlight how you would tune alerts to reduce customer fatigue. This shows empathy and product judgment, not just modeling skill.

-

This question tests whether you understand one of the most common challenges in fraud and risk modeling. A strong answer discusses techniques like stratified sampling, weighting, careful label validation, and metric selection. At American Express, improper handling of imbalance can lead to misleading performance and poor decisions.

Tip: Tie preparation choices to business cost, not model score. This demonstrates impact-driven evaluation, which interviewers value highly.

Need personalized guidance on your interview strategy? Explore Interview Query’s Coaching Program that pairs you with mentors to refine your prep and build confidence.

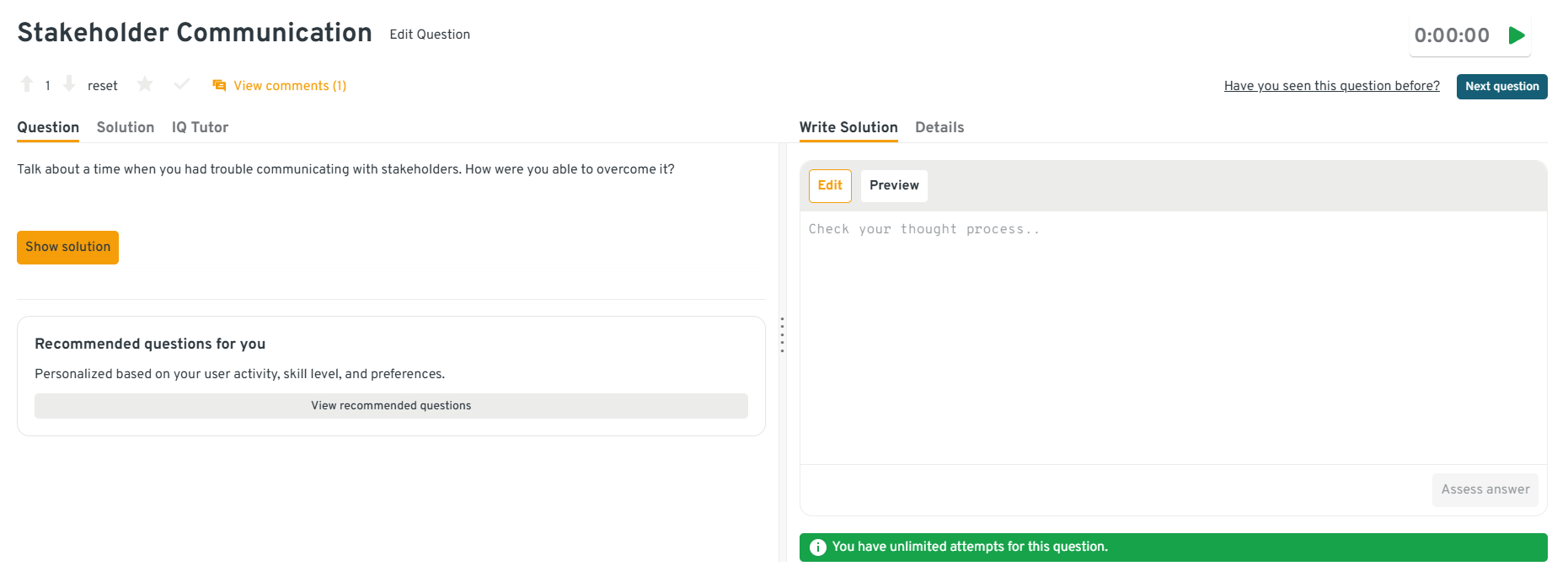

Behavioral and Business Judgment Interview Questions

Behavioral and business judgment questions at American Express focus on how you operate when data is imperfect, timelines are tight, and decisions carry real financial and customer impact. Interviewers evaluate ownership, communication clarity, and your ability to balance data with judgment. Strong answers show how you think, not just what you did, especially in cross-functional, risk-sensitive environments.

How comfortable are you presenting your insights?

This question assesses your ability to communicate analysis in a way that enables decisions. At American Express, data scientists regularly present to product, risk, and business leaders who may not be technical. Interviewers want to see whether you can tailor depth, structure insights logically, and highlight implications rather than raw metrics.

Sample answer: In my previous role, I presented weekly risk insights to senior stakeholders. Initially, I focused too much on methodology. After feedback, I reframed presentations around the decision being made, led with impact metrics like loss reduction, and moved technical details to backup slides. As a result, leadership adopted the recommendations, reducing false declines by 8 percent over two quarters.

Tip: Emphasize how you adjust depth based on the audience. This demonstrates communication judgment, which is critical when influencing decisions at AmEx.

Tell me about a time you influenced a decision using incomplete data.

This question tests risk awareness and decision-making under uncertainty. American Express data scientists often work with delayed or partial signals and still need to recommend a path forward. Interviewers want to see how you assess uncertainty and move responsibly.

Sample answer: I once had to recommend a fraud rule change with only two weeks of data. I quantified uncertainty by comparing trends across similar segments, outlined best and worst case outcomes, and proposed a limited rollout with strict monitoring. The change reduced fraud losses by 5 percent without increasing customer complaints, and we expanded it once more data confirmed the trend.

Tip: Focus on how you framed uncertainty and safeguards. This signals strong ownership and risk judgment.

Why do you want to join American Express as a data scientist?

This question evaluates motivation and alignment with the company’s mission. Interviewers want to hear why the work matters to you, not generic enthusiasm for data science.

Sample answer: I am drawn to American Express because data directly shapes trust, credit decisions, and customer experience. In my current role, I work on risk models, and I enjoy balancing growth with responsibility. AmEx’s focus on explainable, decision-driven analytics aligns with how I want to apply data science at scale.

Tip: Tie your interests to AmEx’s decision-making culture. This shows intentional career alignment.

Describe a situation where your model conflicted with stakeholder intuition.

This question tests persuasion and collaboration. At American Express, data scientists often challenge intuition with evidence while maintaining trust.

Sample answer: A stakeholder believed a segment was high risk based on anecdotal cases, but my model showed stable performance. I walked them through segment-level metrics, explained limitations, and proposed a monitored pilot instead of a full rollback. The pilot confirmed the model’s insight and preserved revenue while maintaining risk controls.

Tip: Show empathy and compromise. This demonstrates influence without arrogance, a key collaboration skill at AmEx.

Head to the Interview Query dashboard to practice American Express–specific data science interview questions in one place. You can work through SQL, analytics, case-style, and behavioral questions with built-in code execution and AI-guided feedback, making it easier to prepare for the exact balance of technical depth and business judgment AmEx interviews demand.

How do you communicate technical risk to non-technical partners?

This question evaluates clarity and leadership potential. Interviewers want to see whether you can translate model risk into business language.

Sample answer: When explaining model risk, I avoid technical terms and focus on outcomes. For example, I describe false positives as unnecessary customer friction and false negatives as potential loss exposure. By framing trade-offs this way, stakeholders can make informed decisions without needing model details.

Tip: Emphasize outcome-based explanations. This shows leadership and the ability to guide decisions across functions.

Want realistic interview practice without scheduling or pressure? Try Interview Query’s AI Interviewer to simulate Amex style data science interviews, and get instant, targeted feedback to refine your thinking and communication before the real interview.

What Does an American Express Data Scientist Do?

An American Express data scientist builds analytical and machine learning solutions that directly influence credit decisions, fraud prevention, customer engagement, and merchant strategy across a global payments network. The role sits at the intersection of large-scale transaction data, risk-sensitive modeling, and real-world business constraints, where decisions must be both accurate and explainable. Data scientists at American Express work closely with product, risk, marketing, and engineering teams to translate raw transaction signals into models and insights that protect customers, drive revenue, and maintain trust across the network.

| What They Work On | Core Skills Used | Tools And Methods | Why It Matters At American Express |

|---|---|---|---|

| Fraud detection and prevention | Classification, imbalance handling, feature engineering | SQL, Python, gradient boosting, monitoring | Protects cardmembers and merchants from real-time financial loss |

| Credit risk and underwriting | Statistical modeling, probability, model validation | Logistic regression, explainability tools, stress testing | Enables responsible lending under strict regulatory standards |

| Customer behavior and retention | Cohort analysis, experimentation, causal reasoning | A/B testing, metrics design, segmentation | Drives long-term cardmember value and engagement |

| Merchant analytics and pricing | Aggregation, trend analysis, forecasting | SQL pipelines, dashboards, time-series models | Helps merchants optimize acceptance and performance |

| Model governance and monitoring | Judgment, communication, risk assessment | Documentation, audits, drift detection | Ensures models remain compliant, stable, and trustworthy |

Tip: At American Express, impact is measured by decision quality, not model complexity. In interviews, explain how your work balances accuracy, interpretability, and risk control, showing the interviewer you understand how data science supports trust and regulatory accountability, not just predictive performance.

How to Prepare for an American Express Data Scientist Interview

Preparing for an American Express data scientist interview requires more than refreshing SQL syntax or reviewing machine learning theory. You are preparing for a role where data directly influences credit decisions, fraud prevention, and customer trust at scale. Success depends on demonstrating strong analytical fundamentals, disciplined judgment, and the ability to communicate clearly in risk-sensitive environments at American Express.

Read more: How to Prepare for Data Science Interviews

Below is a focused preparation framework to help you prioritize what actually matters.

Build strong intuition for financial and transactional data: American Express interviews frequently reference transaction flows, declines, approvals, and customer behavior over time. Practice reasoning about noisy, incomplete data and how metrics behave under real-world constraints such as delays, reversals, or policy changes.

Tip: Be ready to explain how you would sanity check metrics before trusting them. This signals analytical rigor and risk awareness, both critical skills for AmEx data scientists.

Sharpen SQL for decision-focused analysis: SQL questions go beyond syntax. You are expected to extract insights that could drive action, such as identifying risky patterns or monitoring system health. Focus on window functions, time-based aggregations, and edge case handling.

Tip: Practice explaining why a query answers the business question, not just how it runs. This demonstrates decision-oriented thinking.

Strengthen judgment in modeling and evaluation: American Express values models that are stable, interpretable, and aligned with business goals. Review how to evaluate models under class imbalance, choose metrics tied to cost, and monitor drift over time.

Tip: Be prepared to justify why a simpler model may be preferable in regulated settings. This shows maturity and long-term thinking.

Practice structured problem framing for case interviews: Case studies often start ambiguous. Train yourself to clarify the decision, define success metrics, and outline constraints before proposing solutions. This mirrors how real problems are approached internally.

Tip: Explicitly state assumptions and trade-offs as you work. Interviewers see this as a sign of strong ownership and judgment.

Refine how you tell your project stories: Review past projects and prepare to discuss them in terms of impact, trade-offs, and lessons learned. Focus on what changed because of your work, not just what you built.

Tip: Highlight moments where you adjusted direction based on data. This signals adaptability and business alignment.

Simulate realistic interview loops: Practice full interview sessions that include SQL, analytics, modeling discussion, and behavioral questions. Tools like Interview Query’s mock interviews and coaching sessions can help recreate real pacing and pressure.

Tip: After each mock, note where explanations felt unclear. Improving clarity is often the fastest way to stand out in AmEx interviews.

Want to strengthen your end-to-end data science skills? Explore our Data Science 50 learning path to practice a curated set of real-world data science interview questions designed to sharpen your SQL, statistics, experimentation, and machine learning judgment, exactly the skills American Express looks for in data scientists.

American Express Data Scientist Salary

American Express’s compensation framework is designed to reward data scientists who can drive high-impact decisions across credit risk, fraud prevention, and customer analytics. Data scientists typically receive competitive base pay, annual performance bonuses, and meaningful equity through restricted stock units. Your total compensation depends on your level, location, scope of responsibility, and the team you join. Most candidates interviewing for data scientist roles at American Express fall into mid-level or senior bands, especially if they bring strong SQL skills, applied modeling experience, and a track record of influencing business decisions in regulated environments.

Read more: Data Scientist Salary

Tip: Confirm your target level early with your recruiter. At American Express, leveling strongly influences compensation bands and the complexity of problems you will be expected to own.

American Express Data Scientist Compensation Overview (2026)

| Level | Role Title | Total Compensation (USD) | Base Salary | Bonus | Equity (RSUs) | Signing / Relocation |

|---|---|---|---|---|---|---|

| DS1 | Data Scientist I (Entry Level) | $115K – $150K | $95K–$120K | Performance based | Standard RSUs | Limited, role dependent |

| DS2 | Data Scientist II / Mid Level | $140K – $185K | $115K–$145K | Target bonus | RSUs included | Offered case by case |

| Senior DS | Senior Data Scientist | $165K – $220K | $135K–$165K | Above target possible | Larger RSU grants | More common |

| Principal / Lead DS | Principal or Lead Data Scientist | $200K – $275K+ | $150K–$185K | High performer bonuses | Significant RSUs + refreshers | Frequently offered |

Note: These estimates are aggregated from data on Levels.fyi, Glassdoor, Teamblind, public job postings, and Interview Query’s internal salary database.

Tip: Compensation often increases meaningfully after equity vesting begins in year two, so evaluate total compensation over a multi-year horizon rather than year one alone.

Average Base Salary

Average Total Compensation

Negotiation Tips that Work for American Express

Negotiating compensation at American Express is most effective when you combine market benchmarks with a clear articulation of your impact. Recruiters value candidates who approach negotiations professionally and with data.

- Confirm your level early: Leveling from Data Scientist II to Senior Data Scientist can shift compensation by tens of thousands annually. Always clarify level before discussing numbers.

- Use market benchmarks and concrete impact: Anchor expectations using verified sources such as Levels.fyi, Glassdoor, and Interview Query salaries. Frame your value around measurable outcomes like loss reduction, approval lift, or improved decision accuracy.

- Account for geographic differences: Compensation varies across New York, Phoenix, San Francisco, and hybrid or remote roles. Ask for location-specific ranges to evaluate offers accurately.

Tip: Ask your recruiter for a full compensation breakdown, including base salary, bonus target, equity vesting schedule, and any signing incentives. This clarity allows you to negotiate from an informed position and compare offers confidently.

FAQs

How long does the American Express data scientist interview process take?

Most candidates complete the process within three to six weeks, depending on team availability and role level. Timelines can extend if multiple teams are evaluating your profile or if additional interviews are added. Recruiters typically share clear expectations after each stage.

Does American Express use online assessments or coding tests?

Some teams use an initial SQL or analytics assessment, especially for early career roles. Mid-level and senior candidates often move directly to live technical screens. When assessments are used, they focus on practical data reasoning rather than algorithm-heavy problems.

How important is financial services or risk experience for American Express?

Prior experience in payments, credit, or fraud is helpful but not required. Strong analytical thinking, solid SQL skills, and good modeling judgment matter more. Candidates without finance backgrounds succeed by clearly demonstrating how they learn domain context quickly.

What is the difficulty level of American Express SQL questions?

SQL questions are moderately challenging and scenario-driven. Expect multi-table joins, window functions, time-based metrics, and edge case handling. Interviewers care more about clarity and correctness than clever shortcuts.

Are machine learning questions theoretical or applied?

Machine learning questions are applied and business-focused. Interviewers expect you to reason through feature design, evaluation metrics, and trade-offs rather than recite algorithms. Explainability and stability are often more important than marginal accuracy gains.

How are behavioral interviews evaluated at American Express?

Behavioral rounds focus on judgment, communication, and ownership. Interviewers look for how you handle ambiguity, collaborate with partners, and make data-informed decisions under constraints. Clear structure and reflection matter more than perfect outcomes.

Can candidates be matched to different teams during the process?

Yes, team matching often happens during or after the interview loop. If multiple teams see a fit, recruiters may discuss preferences with you. Communicating your interests early helps align you with the right scope.

What helps candidates stand out the most in American Express interviews?

Candidates stand out by connecting technical work to real business decisions. Clear explanations, thoughtful trade-offs, and strong data judgment signal readiness to operate in high-stakes environments at American Express.

Become an American Express Data Scientist with Interview Query

Preparing for the American Express data scientist interview means developing strong analytical fundamentals, disciplined modeling judgment, and the ability to make clear decisions in high-stakes financial environments. By understanding the interview structure at American Express, practicing real-world SQL and experimentation scenarios, and refining how you communicate trade-offs, you can approach each stage with confidence.

For targeted practice, explore the full Interview Query’s question bank, sharpen your reasoning with the AI Interviewer, or work directly with a mentor through Interview Query’s Coaching Program to refine your approach and stand out in American Express’s data science hiring process.