American Express Business Intelligence Interview Guide: Process, Questions & Salary

Introduction

An American Express business intelligence interview is designed to test whether you can turn complex, messy data into decisions that matter. This is not a purely technical analytics role. American Express looks for BI professionals who can write reliable SQL, build trustworthy dashboards, and clearly explain what the numbers mean to business leaders across revenue, customer experience, and operations.

Because BI teams sit close to decision-makers, interviewers care less about exotic algorithms and more about data correctness, metric definition, and judgment. Strong candidates show they can translate vague business questions into structured analyses, validate results, and communicate insights without oversimplifying or overstating confidence.

At American Express, BI work supports high-stakes domains such as payments, loyalty, servicing, and risk. As a result, interviews emphasize practical SQL, real analysis scenarios, and behavioral signals around ownership, clarity, and stakeholder management.

American Express Business Intelligence Interview Process

The American Express business intelligence interview process typically spans three to four rounds, depending on team and seniority. The process blends SQL and analytics evaluation with case-style problem solving and behavioral assessment, with a strong emphasis on data correctness, metric definition, and stakeholder communication.

Interview Process Overview

| Interview stage | What happens | What AmEx is really testing |

|---|---|---|

| Recruiter phone screen | Background, role fit, and process overview | Communication clarity and baseline fit |

| Technical / hiring manager round(s) | SQL, analytics scenarios, resume deep dive | Practical SQL skill, analytical judgment, and data validation |

| Case study or assessment | Business or data problem (sometimes GD) | Structured problem-solving and insight communication |

| Final manager / director round | Technical depth + behavioral discussion | Ownership, judgment, and cultural fit |

Recruiter Phone Screen

This initial call focuses on your background, BI experience, and alignment with the role. Recruiters assess whether you understand what a BI role at American Express entails and whether your experience aligns with stakeholder-facing analytics work.

Tip: Be ready to explain the types of dashboards and analyses you’ve built, who used them, and what decisions they supported.

Technical Or Hiring Manager Round(s)

These rounds form the core of the American Express BI interview. Interviewers typically review your resume and projects, then move into hands-on SQL and data analysis questions.

Common focus areas include:

- SQL joins, aggregations, and window functions

- Translating business questions into queries

- Validating metrics and identifying edge cases

- Interpreting results and explaining implications

Interviewers care less about clever syntax and more about correct logic and defensible conclusions.

Tip: Talk through your assumptions and explain how you would validate outputs before presenting them.

Case Study Or Assessment

Some teams include a case study, take-home task, or group discussion. These exercises evaluate how you reason through ambiguous business problems and communicate insights clearly.

Candidates are expected to structure their approach, define success metrics, and explain trade-offs rather than jump straight to answers.

Tip: Lead with the question you are trying to answer before discussing analysis.

Final Manager Or Director Round

The final round focuses on depth, judgment, and long-term fit. Interviewers may revisit technical concepts at a higher level and assess how you influence stakeholders with data.

Behavioral questions often follow the STAR method and focus on ownership, prioritization, and handling pressure.

Tip: Prepare examples where your BI work directly influenced decisions or resolved ambiguity.

American Express Business Intelligence Interview Questions

American Express business intelligence interview questions focus on whether you can translate business questions into reliable metrics, scalable reporting, and decision-ready insights. Interviewers care about SQL correctness, metric definition, dashboard judgment, and how you reason through ambiguity in high-stakes domains like payments, servicing, and customer experience.

Questions typically fall into three categories: SQL and data transformation, dashboarding and visualization, and analytics or case-style problem solving.

SQL And Data Transformation Questions

These questions assess whether you can work confidently with enterprise datasets, structure queries correctly, and support reporting logic that leadership teams rely on.

How would you calculate month-over-month changes for a key business metric?

This question evaluates your ability to compute period-over-period KPIs commonly used in executive dashboards. Interviewers look for correct aggregation, window function usage, and handling of incomplete or missing periods.

Tip: Explain how you validate partial months and avoid misleading comparisons.

How would you identify customers who made repeat purchases after their first transaction?

This tests customer behavior analysis and cohort logic, which is highly relevant for AmEx use cases like repeat spend, loyalty engagement, and card usage. Strong answers clearly define the “first” event and avoid double counting.

Tip: State your grain explicitly before writing any SQL.

How would you return the last transaction for each day from a transactions table?

This mirrors operational BI reporting where daily snapshots are used to track performance or reconcile volumes. Interviewers care about correct window ordering and date handling.

Tip: Call out how you handle timestamps and business-day cutoffs.

How would you calculate a rolling average over time for a performance metric?

Rolling metrics are frequently used to smooth volatility in spend, transactions, or service volume. Interviewers want to see correct window framing and awareness of performance on large tables.

Tip: Explain why the chosen window length matches the business question.

-

This question tests data quality awareness and remediation skills. BI professionals at AmEx are expected to detect and correct upstream data issues before they reach dashboards.

Tip: Emphasize auditability and how you reliably identify the “current” record.

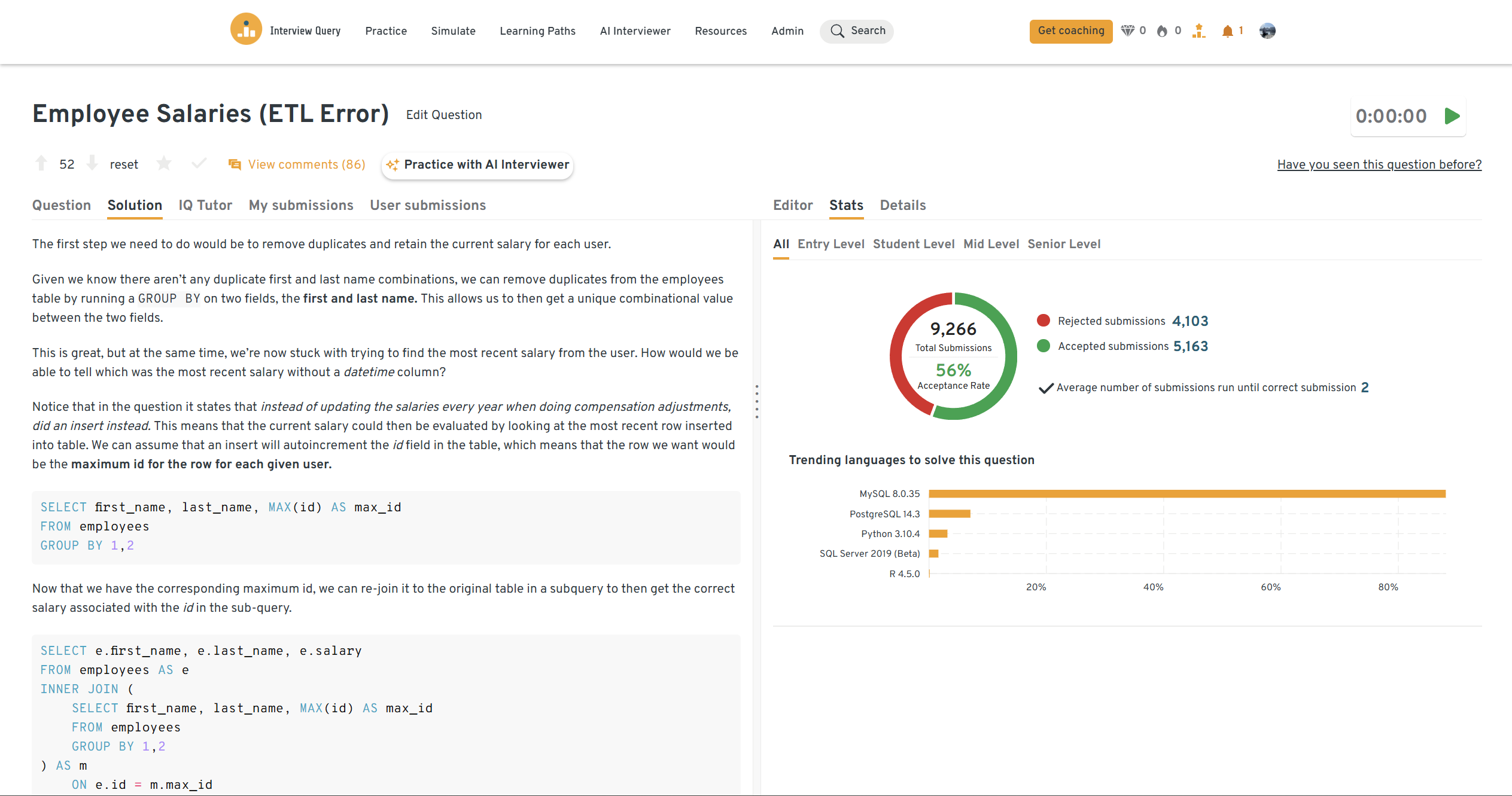

You can practice this exact problem on the Interview Query dashboard, shown below. The platform lets you write and test SQL queries, view accepted solutions, and compare your performance with thousands of other learners. Features like AI coaching, submission stats, and language breakdowns help you identify areas to improve and prepare more effectively for data interviews at scale.

Dashboarding And Visualization Questions

These questions evaluate how well you design dashboards that support decisions, not just display metrics.

Walk through how you would design a KPI dashboard for senior leadership.

Interviewers want to see whether you start from decisions and business priorities rather than available data. Strong answers focus on hierarchy, narrative flow, and signal-to-noise ratio.

Tip: Begin by stating the decisions the dashboard should enable.

Explain how you would diagnose and optimize a slow-performing Power BI or Tableau dashboard.

This tests both BI tool understanding and analytical reasoning. Interviewers care whether you investigate data models, query performance, and calculations before adjusting visuals.

Tip: Always start with backend query efficiency before front-end tuning.

How would you choose the right metrics and visuals for a dashboard used by different business units?

This evaluates stakeholder segmentation and whether you avoid one-size-fits-all dashboards. AmEx values role-based views and tailored insights.

Tip: Prioritize comparisons, trends, and exceptions over static totals.

-

This tests analytical skepticism and validation discipline. Interviewers want to see that you confirm visual insights with supporting queries.

Tip: Pair every visual insight with at least one validation check.

How do you decide which metrics to remove when a dashboard becomes cluttered?

This assesses judgment and prioritization. Strong BI candidates can explain why fewer metrics often lead to better decisions.

Tip: Anchor metric inclusion to a specific action or decision.

Analytics And Case-Style Questions

These scenarios assess structured problem-solving, ambiguity handling, and how BI work connects to enterprise outcomes.

How would you add and backfill a new column in a very large table without disrupting reporting?

This evaluates coordination with data engineering and awareness of performance risk. Interviewers expect phased approaches rather than brute-force updates.

Tip: Mention staged rollout and validation before exposing the column.

Identify the root cause of a sudden spike in service volume or operational workload.

This tests diagnostic thinking common in AmEx servicing and operations analytics. Strong answers segment by time, channel, and upstream events.

Tip: Separate demand-driven causes from system or data issues.

How would you investigate a noticeable decline in an average transaction or usage metric?

This evaluates whether you can distinguish real behavior change from reporting artifacts. Interviewers care about hypothesis sequencing and validation.

Tip: Always check data pipelines and definitions first.

How would you prioritize which insights to surface when stakeholders ask for “everything”?

This tests stakeholder management and judgment. BI professionals at AmEx are expected to push back constructively.

Tip: Tie insights directly to decisions, not curiosity.

How would you evaluate whether a new dashboard is actually being used and delivering value?

This assesses outcome orientation and measurement mindset. Strong answers include usage tracking and feedback loops.

Tip: Define success metrics before launch, not after.

Behavioral And Stakeholder Collaboration Questions

These questions assess how you operate in ambiguity, manage stakeholders, and protect data integrity while still driving business outcomes. American Express places particular emphasis on judgment, communication, and accountability in BI roles, given the visibility of dashboards and insights.

Tell me about a time you had to push back on a stakeholder request using data.

This evaluates whether you can challenge requests constructively while preserving trust. BI professionals at American Express are expected to protect metric integrity and decision quality, especially when insights inform leadership or regulatory-sensitive decisions.

Tip: Frame pushback around risk, accuracy, or decision impact rather than personal opinion.

Sample answer:

A stakeholder requested a week-over-week comparison without accounting for known reporting delays in one channel. I validated the data and showed that the apparent decline was driven by late-arriving records rather than real behavior. I proposed an adjusted view with a reporting lag and clear annotations, which the stakeholder accepted. This prevented a misleading conclusion while maintaining confidence in the dashboard.

Describe a time when you discovered a data issue after a report or dashboard was already shared.

This tests accountability and how you handle mistakes in high-visibility environments. At AmEx, BI teams are expected to act quickly and transparently when data trust is at risk.

Tip: Emphasize speed of response and prevention, not blame.

Sample answer:

After distributing a dashboard, I noticed an upstream schema change had inflated one metric. I immediately notified stakeholders, explained the issue in plain language, and temporarily removed the metric. After fixing the logic, I added validation checks and documented the change. The proactive communication helped maintain trust despite the error.

Tell me about a time you had to explain a complex analysis to a non-technical audience.

This assesses your ability to translate technical work into business-relevant insights. American Express BI roles require frequent communication with product, operations, and leadership teams who care more about implications than methods.

Tip: Lead with the conclusion and business impact before explaining the analysis.

Sample answer:

I analyzed drivers of declining engagement across customer segments using multiple joins and cohort logic. Instead of walking through SQL details, I summarized three key drivers and their impact using simple visuals. I kept technical details in backup slides, which allowed the discussion to focus on actions rather than mechanics.

Describe a situation where priorities changed suddenly and you had to adapt your analysis.

This evaluates flexibility and judgment under pressure. BI professionals at AmEx often respond to urgent business questions without losing control of longer-term deliverables.

Tip: Show how you re-prioritized based on impact and urgency, not just speed.

Sample answer:

Midway through a reporting sprint, leadership requested an urgent analysis related to a customer experience issue. I quickly assessed which tasks could be paused, aligned with my manager on trade-offs, and reused existing data models to accelerate delivery. The analysis informed an immediate decision without derailing the broader roadmap.

Tell me about a time your analysis directly influenced a business decision.

This tests outcome orientation and whether your work drives action. American Express values BI professionals who connect insights to clear recommendations.

Tip: Lead with the decision made, then explain how your analysis supported it.

Sample answer:

I identified a consistent drop-off in a customer journey step and traced it to a recent process change. I presented a clear recommendation supported by data, which led to a rollback of the change. The fix improved completion rates within weeks, reinforcing the value of data-led decisions.

Want to practice more? In this mock interview session, Jay Feng interviews a data scientist and business intelligence engineer at Amazon, who walks through how to solve a commonly asked BI case study on identifying duplicate products. We break down an open-ended business problem, explore how to structure clarifying questions, and design a scalable analytical approach that can help you build confidence and elevate your BI interview performance.

How To Prepare For An American Express Business Intelligence Interview

Preparing for an American Express business intelligence interview is less about memorizing syntax and more about demonstrating decision-ready analytics. Interviewers want to see that you can move from messy data to clear insights that influence product, risk, or operational outcomes.

Master SQL For Business Logic, Not Just Correctness

SQL interviews at American Express emphasize logic, definitions, and edge cases, especially around customer behavior, transactions, and time-based metrics. You are expected to reason clearly about joins, window functions, aggregation grain, and metric definitions.

Tip: When practicing SQL, always explain what business question the query answers and how you would validate results against raw data.

Practice Translating Analysis Into Decisions

BI roles at American Express sit close to leadership and stakeholder decision-making. Interviewers frequently probe how you frame insights, prioritize findings, and avoid misleading conclusions.

Tip: Practice leading with conclusions first, then supporting them with data. Avoid walking interviewers through queries line by line unless asked.

Prepare End-To-End Project Walkthroughs

Expect deep dives into past projects covering problem definition, data sourcing, modeling choices, dashboard design, and stakeholder communication. Interviewers care more about why decisions were made than the tools used.

Tip: Structure project answers as problem → constraints → approach → outcome → what you would improve.

Strengthen Dashboard And Visualization Judgment

For BI roles, dashboards are treated as decision products, not reporting artifacts. You should be ready to explain why certain metrics exist, how visuals guide attention, and how you prevent misuse.

Tip: Be prepared to justify what you excluded from a dashboard, not just what you included.

Prepare Behavioral Stories Around Ownership And Integrity

Behavioral interviews focus heavily on data trust, accountability, and stakeholder management. American Express values BI professionals who protect metric integrity and communicate issues early.

Tip: Prepare STAR stories involving data issues, pushback, prioritization conflicts, and moments where your analysis changed a decision.

Role Overview: American Express Business Intelligence

An American Express business intelligence professional sits at the intersection of data, decision-making, and stakeholder communication. The role focuses on transforming large, complex datasets into clear, trusted insights that guide business strategy across areas such as customer experience, revenue optimization, risk, and operations.

Day to day, BI professionals design and maintain dashboards, write complex SQL queries, analyze trends, and partner closely with product managers, operations leaders, and executives. Success in the role depends as much on judgment and communication as on technical skill.

Core Responsibilities

- Data analysis and insight generation: Analyze large datasets to identify trends, risks, and opportunities.

- SQL development: Write and optimize queries using joins, aggregations, and window functions to support reporting and analysis.

- Dashboarding and visualization: Build Power BI or Tableau dashboards that communicate insights clearly and accurately.

- Stakeholder collaboration: Translate business questions into analytical approaches and present findings to non-technical audiences.

- Data quality and integrity: Validate metrics, investigate anomalies, and ensure consistency across reports.

- Ad-hoc analysis: Support urgent business questions with structured, defensible analysis.

What Makes Business Intelligence At American Express Different

Business Intelligence at American Express operates in a high-stakes, highly visible environment. Metrics often inform leadership decisions, customer-facing changes, and regulatory-sensitive processes. As a result, BI professionals are expected to prioritize accuracy, transparency, and clarity over speed alone.

What interviewers look for:

- Strong SQL and analytical fundamentals

- Clear reasoning under ambiguity

- Ability to translate data into decisions

- Comfort pushing back on unclear or risky requests

- Accountability for data quality and outcomes

Candidates who demonstrate structured thinking, strong communication, and a genuine respect for data integrity tend to stand out in American Express BI interviews.

FAQs

How hard is the American Express Business Intelligence interview?

The American Express business intelligence interview is considered moderately to highly challenging, depending on level. While the SQL and analytics questions are not trick-heavy, interviewers expect clean logic, correct definitions, and strong validation thinking. Many candidates find the difficulty comes from explaining why an insight matters, not just producing a query or dashboard.

How hard is the American Express Business Intelligence interview?

The American Express business intelligence interview is considered moderately to highly challenging, depending on level. While the SQL and analytics questions are not trick-heavy, interviewers expect clean logic, correct definitions, and strong validation thinking. Many candidates find the difficulty comes from explaining why an insight matters, not just producing a query or dashboard.

Turning Data Into Decisions At American Express

The American Express business intelligence interview is designed to test whether you can move beyond reporting and deliver decision-ready insights in a high-visibility environment. Strong candidates show clean SQL fundamentals, sound analytical judgment, and the ability to communicate clearly with stakeholders who rely on BI outputs to guide strategy, operations, and customer experience.

To prepare effectively, focus on realistic SQL problems, BI-style case questions, and end-to-end project walkthroughs that emphasize why decisions were made, not just how dashboards were built. Practicing with Interview Query’s curated business intelligence interview questions helps reinforce metric logic, validation thinking, and stakeholder-driven analysis. Pressure-testing your explanations through mock interviews is especially valuable for refining clarity, confidence, and decision framing under follow-up questions.

If your goal is to succeed in an American Express BI interview, prepare the way the role operates in reality: structured reasoning, strong SQL, thoughtful visualization choices, and the discipline to protect data integrity while driving outcomes.