Stripe Data Analyst Interview Guide (2025) – Process, Questions, and Tips

Introduction

Stripe processes hundreds of billions of dollars every year, powering payments for millions of businesses across more than 190 countries. With data flowing at this scale, Stripe is one of the most data-rich companies in fintech, making the data analyst role both highly challenging and rewarding.

If you are preparing for the Stripe data analyst interview, you will need to demonstrate more than SQL fluency. The process tests your ability to connect raw data to real-world product insights, communicate clearly with stakeholders, and align with Stripe’s culture of rigor and ownership.

This guide covers everything you need to know: what the role looks like, how the interview process works, the types of Stripe data analyst interview questions you will face, and proven strategies to help you stand out.

Role overview and culture

Data analysts at Stripe are problem-solvers at the heart of product and strategy. A typical day might include:

- Writing SQL queries to track payment flow health across markets

- Building dashboards that help product managers monitor feature adoption

- Investigating spikes in dispute rates or fraud attempts

- Partnering with engineers to validate metrics before a global rollout

- Presenting insights to strategy and finance teams that shape revenue forecasts

What sets Stripe apart is the combination of scale and culture. Analysts work with a clean, well-structured data warehouse and collaborate with product, engineering, and business leaders on problems that directly influence billions of dollars in transactions. Stripe also emphasizes autonomy and clarity, anchored by its “write everything down” principle, so analysts are trusted to take ownership of analyses end to end.

It is also an energizing place to grow your career. Stripe consistently ranks among the most innovative companies in tech, and employees often highlight the combination of steep technical learning, global impact, and strong mentorship as reasons they thrive here.

Why this role at Stripe?

As a data analyst at Stripe, your insights shape how billions of dollars move around the world. You will work with a clean, reliable data warehouse, close-knit feedback loops with product managers and engineers, and the opportunity to influence metrics that define Stripe’s success—from conversion and latency to dispute rates and payment reliability. The role combines analytical depth with strategic visibility, giving you a direct hand in driving business and product outcomes.

Beyond immediate impact, the Stripe data analyst position offers a well-defined career trajectory. Many analysts advance to senior or lead roles where they manage analytics for entire product lines, mentor peers, and collaborate on cross-functional initiatives like global revenue forecasting or risk optimization. From there, the path can expand into analytics engineering, data science, or strategy leadership positions that shape Stripe’s broader data and product vision.

Stripe’s culture of ownership and transparency supports this progression—performance and initiative are visible, mentorship is encouraged, and contributions are documented through written decision-making. Whether your long-term goal is to specialize in analytics infrastructure, transition toward product analytics leadership, or move into a data-informed strategy function, this role provides a foundation for sustained growth within one of the most data-driven companies in fintech.

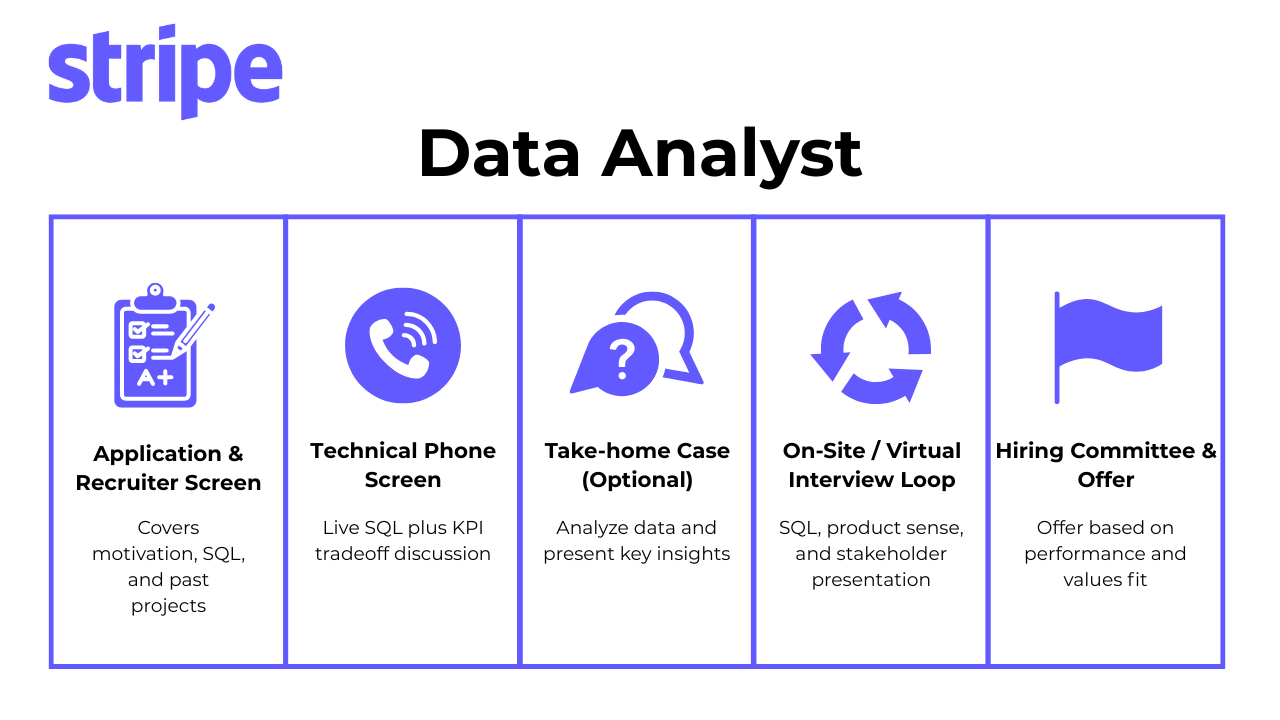

What is the Stripe data analyst interview process?

The Stripe data analyst interview process is built to test both analytical rigor and business judgment. Each round assesses how you translate raw data into actionable insights, communicate clearly under pressure, and demonstrate ownership over your analyses. Below is a walkthrough of every stage—what to expect, how to stand out, and practical tips to help you prepare.

Application and recruiter screen

The process starts with a brief recruiter call focused on your background, motivation, and analytics experience. You’ll discuss how you’ve used SQL and data visualization tools in past roles, what kinds of business questions you’ve solved with data, and why Stripe’s mission resonates with you. Recruiters listen for structured communication, curiosity, and an understanding of how your experience fits within Stripe’s data-driven environment.

Tip: prepare one short story about a project where your analysis drove measurable business impact, like improving a conversion funnel or reducing fraud—and connect that to how you’d create similar value at Stripe.

Technical phone screen

This 45-minute session evaluates how you approach data problems end-to-end. You’ll write SQL queries involving joins, aggregations, or cohort analysis, followed by questions on interpreting your results. The goal isn’t just correctness—it’s showing how you reason through trade-offs, handle ambiguity, and communicate your logic. Strong candidates explain why they chose a particular join or function before running the query and can clearly articulate how their output would drive a real business decision.

Tip: narrate your thinking as you code. Stripe interviewers pay close attention to how you validate assumptions and test for edge cases. Treat the exercise as a collaboration rather than a silent assessment.

Take-home case

Some candidates, especially those applying for senior or specialized roles, receive a 24-hour take-home exercise. You’ll be given a dataset and a business question, then asked to produce a concise 3–5 slide deck summarizing your findings and recommendations.

For example, you might receive a dataset showing a drop in merchant conversion from “account created” to “first transaction.” The task could be to identify potential drivers of the decline, segment results by geography or business type, and recommend experiments to improve activation. A strong submission includes a clear storyline (problem → insight → action), prioritizes the most influential metrics, and communicates results in a way that would help a product manager make a decision.

Tip: simplicity wins. Use one takeaway per slide, quantify every key point, and end with a short “limitations and next steps” section. This signals analytical maturity and self-awareness—two traits Stripe values highly.

Struggling with take-home assignments? Get structured practice with Interview Query’s Take-Home Test Prep to simulate real analytics case challenges. Practice take-home tests →

Onsite or virtual interview loop

The final stage typically consists of three interviews that mirror Stripe’s real working environment: a product-sense discussion, a live SQL session, and a stakeholder presentation. Each round tests your ability to move seamlessly from data to insight to decision.

Product-sense discussion

You’ll be asked to define metrics for a new feature, analyze user behavior, or evaluate a product launch—questions like “How would you measure the success of a new merchant onboarding flow?” This round tests whether you can balance analytical rigor with business intuition, selecting metrics that reflect both user experience and company goals.

Tip: structure your answer around user journey → metric definition → decision impact. Stripe values analysts who can connect technical insight to product context.

Live SQL coding session

This is a real-time data challenge that mimics the work Stripe analysts face daily—debugging issues, building cohorts, or flagging anomalies in massive datasets. Success depends on writing clean, efficient queries while explaining your reasoning. Interviewers often probe how you handle incomplete data, optimize performance, and ensure reproducibility.

Tip: think aloud as you code, and validate your results with quick sanity checks (e.g., row counts or sample outputs). This shows you prioritize accuracy and reliability.

Stakeholder presentation

Finally, you’ll present a data story to a mixed audience of PMs, engineers, and analysts—often based on your take-home exercise or a past project. The goal is to assess your communication clarity, ability to tailor content for non-technical audiences, and skill in linking insights to action.

Tip: keep it simple. Use a three-part structure—Context, Key Insight, Recommendation—and finish with one “Decision Summary” slide that clearly states what you’d do next. Stripe interviewers value brevity, precision, and confidence in delivery.

Hiring committee and offer

After your interviews, each interviewer submits detailed written feedback within 24 hours. A cross-functional hiring committee—composed of senior analysts, data scientists, and a “bar-raiser”, reviews your performance holistically. They assess technical depth, communication clarity, and consistency across rounds rather than looking for perfection in any single area.

If the committee approves, your recruiter will call with a preliminary verbal offer before sending a formal package. Stripe’s compensation typically includes a strong base salary, annual bonus, and meaningful equity refreshers after the first year.

Tip: approach negotiations with professionalism and preparation. Research your target level on Levels.fyi or Glassdoor, understand the balance of cash vs. equity, and emphasize long-term alignment over short-term numbers. Stripe recruiters appreciate candidates who negotiate transparently and can articulate how their experience adds value to the company.

When discussing compensation, frame your ask as part of your commitment to contributing meaningfully—e.g., “I’m excited about the role and its scope; based on my experience leading X analytics projects, I’d love to explore if we can align on total compensation closer to Y.” This signals both confidence and collaboration, helping recruiters advocate for you internally.

What Questions Are Asked in a Stripe Data Analyst Interview?

Every Stripe interview evaluates how well you use data to drive business impact—not just whether you can write a query. Below are the types of questions to expect in each round.

Coding/Technical Questions

Stripe’s SQL interviews go beyond syntax. They test whether you can structure queries for clarity, optimize performance, and interpret results at scale. Expect scenarios like building retention cohorts, debugging anomalous metrics, or writing efficient aggregations across millions of rows.

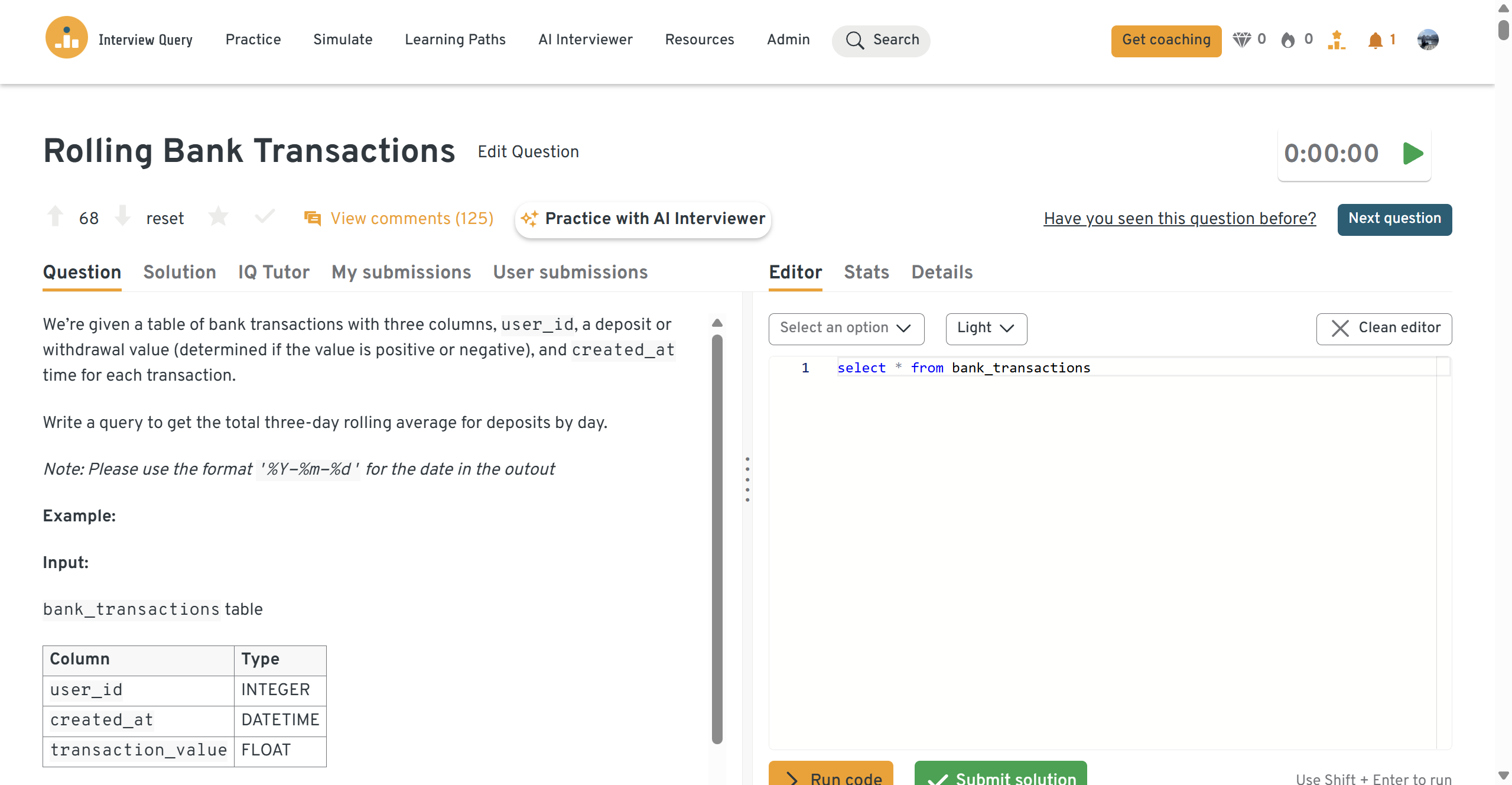

Write a query to compute a three-day rolling average of daily deposits.

You must filter positive

transaction_values, truncate each timestamp to date, and use a window such asAVG(val) OVER (ORDER BY day ROWS 2 PRECEDING). Stripe uses this exercise to be sure you can build time-series features for risk-scoring and understand the effect of window frames on edge dates. Check out Interview Query’s dashboard to see the full solution.

Calculate cohort-based retention for every plan over the first three months.

A solid answer derives

start_monthwithDATE_TRUNC, assigns anum_monthviaDATEDIFF(month, start_date, month), and builds a pivot of retained vs. at-risk users. This mirrors how Stripe Billing tracks plan-level churn and expansion-ARR.Compute annual retention for a B2B SaaS product billed once per year.

Here you group by

customer_id, find consecutive payment years, then flag drop-offs. The task stresses your fluency with date arithmetic and long-period revenue waterfalls—critical for Stripe Revenue Recognition work.Return the last transaction of every calendar day.

Candidates typically use

ROW_NUMBER() OVER (PARTITION BY CAST(created_at AS DATE) ORDER BY created_at DESC) = 1. Stripe favors this because it reveals comfort with partitions and ordering, two pillars of ledger integrity.-

The elegant pattern self-joins each record to its next event and checks

TIMESTAMPDIFF(second)=10. Stripe uses the scenario to mimic fraud-burst detection, asking for clean logic that scales on large log tables. Count unique work days per employee from punch-clock data.

A correct solution aggregates on

DATE(start_ts)or usesCOUNT(DISTINCT DATE(work_ts)). The interviewer listens for edge handling like overnight shifts or null timestamps.Write a function to return the maximum integer in a list, or

Noneif empty.Even though trivial, Stripe slips in this Python warm-up to check that you handle empty inputs, negative numbers, and O(1) memory, reflecting real data clean-room standards.

Prep tip: In Stripe’s SQL interview, strong candidates don’t just produce the correct query. They explain indexing choices, walk through how edge cases (like nulls or overlapping dates) are handled, and connect outputs back to product implications. Treat each query as an opportunity to show both technical depth and business reasoning.

You can practice Stripe-style SQL scenarios in Interview Query’s SQL library, which covers retention analysis, anomaly detection, and fraud-related data patterns. The full Stripe interview guide collection includes even more problems that go beyond this list.

Product/Insight Questions

In product-sense interviews, you’ll be tested on your ability to define metrics, frame ambiguous business questions, and turn data into actionable insight. Stripe wants analysts who can connect numbers to product strategy.

Should Facebook add peer-to-peer payments to Messenger?

To frame your answer, size the TAM of intra-chat payments, weigh fraud-loss risk, and outline KPIs like activation rate, “first send” friction, and cross-sell to Meta Pay. Stripe cares that you balance user value against compliance cost.

Which leading indicators would flag that a new Stripe Dashboard report is not landing with self-serve merchants?

Discuss weekly-active-report-viewers, time-to-insight, click-through to suggestions, and Zendesk tags. Then propose cohort slicing by business size to uncover fit gaps.

Stripe is piloting invoice reminders in WhatsApp. How would you evaluate if the pilot should roll out globally?

Combine open-rate, reminder-to-paid conversion lift, incremental revenue, and opt-out sentiment. Detail an experiment design that isolates regional SMS vs. WhatsApp impact while respecting GDPR consent.

Your dashboard shows a sudden 15 % drop in “Payments Succeeded” for ACH debits. What is your investigation plan?

Lay out a funnel (attempts → submitted → network accepted), check partner bank status, and segment by originator. The goal is to reveal your hypothesis-driven debugging of mission-critical payment rails.

If Stripe launched a micro-lending product for small merchants, what core metrics would prove product-market fit within six months?

Talk about approval-rate, utilization ratio, repeat-borrow rate, NPS, default-loss percentage, and net revenue per funded dollar. Map each to product loops: credit scoring, repayment, retention.

Prep tip: Focus on selecting metrics that balance user value, business risk, and scalability. For example, framing leading indicators (like adoption or drop-off rates) before lagging ones (like revenue impact) shows you understand how Stripe evaluates early product success.

For additional practice, you can work through Interview Query’s data analytics case studies, which simulate real product-sense prompts and help you learn how to structure responses for maximum clarity.

Behavioral & Stakeholder‑Management Questions

Behavioral interviews assess how you work across teams, communicate under pressure, and make decisions when data is incomplete. Stripe expects analysts to be persuasive storytellers as much as technical contributors.

Tell me about a data project you owned. What obstacles did you hit and how did you overcome them?

Interviewers look for evidence of end-to-end ownership, grit, and clarity in retrospection. A strong story outlines the project’s goal, the toughest roadblocks (e.g., missing source data, shifting scope, conflicting stakeholders), and the concrete actions you took to unblock progress—such as proposing a workaround, negotiating new requirements, or automating a manual step. End by quantifying impact and sharing one lesson you now apply to future projects.

Sample answer: I led a project to analyze refund behavior among enterprise merchants to identify early churn signals. Halfway through, I discovered that refund events weren’t consistently logged across APIs, making month-over-month trends unreliable. I collaborated with the engineering team to define a canonical refund schema, backfilled the data using reconciliation rules, and documented the fixes. The improved dataset revealed a 12% refund spike from one product vertical, which led to targeted product changes and a 6% drop in churn over two months. The key takeaway was learning to validate data pipelines early instead of assuming completeness.

Describe a time you made complex analytics accessible to non-technical stakeholders.

Stripe values analysts who translate SQL tables into decisions. Frame your answer around the audience’s needs, the communication medium you chose (lightweight dashboard, narrative memo, workshop), and the techniques—thoughtful data-viz, plain-language KPIs, or real-world analogies—you used to demystify the numbers. Conclude with the downstream action stakeholders took and how you measured their comprehension.

Sample answer: At my last company, the finance team struggled to interpret our weekly LTV dashboards because of inconsistent metric definitions. I rebuilt the reporting in Looker with simplified visuals, standardized terms, and a written glossary linked to every chart. I also ran a short lunch-and-learn explaining how to interpret retention curves. Within a month, 80% of recurring data requests became self-serve, freeing the analytics team for deeper work. It taught me that clarity often matters more than complexity when driving adoption.

What would your current manager say are your greatest strengths and your biggest growth areas?

Show self-awareness and coachability. Pick two strengths that map to Stripe’s cultural values (e.g., “meticulous with data lineage” and “bias for action”) and back each with a short anecdote. For the weakness, choose something real but improvable—perhaps “tendency to dive too deep before socializing early drafts”—and explain the systematic steps you’re taking to close that gap (peer reviews, tighter checkpoints).

Sample answer: My manager would describe me as structured and reliable—I build analyses that others can trust and reuse. For instance, my customer churn dashboard became a company-wide template because it automated validation checks and refreshed daily. One area I’ve been improving is speed. I used to over-polish dashboards before sharing them, which slowed iteration. Now, I circulate draft versions early for feedback, which has made my work faster and more collaborative.

Tell me about a time stakeholder communication broke down. How did you repair the relationship?

Successful answers detail the root cause (misaligned expectations, vocabulary gap), the immediate business risk, and the empathy-first tactics you used: re-framing the objective, implementing a shared doc of definitions, or scheduling regular “demo days.” Finish with measurable improvements (e.g., PRD sign-off time cut in half) and what safeguards you instituted to avoid recurrence.

Sample answer: During a product metrics audit, engineering and analytics disagreed on which events defined ‘active user.’ The misalignment delayed a quarterly report and created confusion in leadership reviews. I proposed a shared ‘source of truth’ document listing every event definition, ownership, and data source, then scheduled recurring syncs to review metric changes. Within a quarter, cross-team escalations dropped to zero, and reports consistently matched across dashboards. The lesson was that shared language is the foundation of good analytics.

Why do you want to work at Stripe, and what unique value would you add?

Stripe screens for genuine mission alignment. Link a personal motivation—democratizing economic access, passion for developer-first tools, or prior fintech exposure—to Stripe’s stated mission and products. Then, highlight a specific skill subscription analytics or experimentation frameworks—that fill a gap on the team. Tie it back to a concrete initiative (e.g., expanding in emerging markets) to show you’ve done your homework.

Sample answer: I’ve always admired Stripe’s mission to grow the GDP of the internet. My background in financial analytics—specifically in tracking transaction integrity and fraud rates—aligns closely with Stripe’s core products like Radar and Billing. I’m particularly drawn to how Stripe builds tools for developers and entrepreneurs, because I believe access to better infrastructure expands economic opportunity. My experience optimizing payment data pipelines for accuracy and speed could directly support that mission by improving how Stripe merchants understand and trust their data.

Prep tip: The strongest answers follow the STAR method (Situation, Task, Action, Result) but go one step further—quantify the impact of your actions and link the outcome back to organizational goals. Stripe favors candidates who can take ownership, communicate with clarity, and influence decisions without overcomplicating.

You can sharpen delivery by running mock behavioral interviews on Interview Query, which provide live feedback on structure, tone, and clarity. More example prompts can also be found in the behavioral interview guide.

How to prepare for a data analyst role at Stripe

Landing a Stripe data analyst offer requires more than writing SQL correctly. The best candidates combine technical precision, product intuition, and clear communication. Preparation should focus on mastering core analytics skills while building the structured, rigorous storytelling that Stripe values.

Master Stripe-Style SQL

Stripe’s SQL interviews reflect the scale and complexity of real payment systems. Expect problems centered on user retention, fraud anomalies, and financial reconciliation. Queries will often require CTEs, nested aggregations, and window functions while demanding readable, efficient logic.

Tip: Don’t just memorize syntax—practice explaining why you structure queries a certain way. Stripe interviewers care about reasoning as much as correctness. Test yourself with Interview Query’s SQL practice library and aim to verbalize your thought process during mock rounds.

Build Story-Driven Decks

Stripe values clarity above complexity. Your analysis should lead to decisions—not just data. In both the take-home and stakeholder rounds, candidates are evaluated on how well they can distill key findings into simple, business-relevant stories.

Tip: Follow a 3–5 slide structure—Problem → Key Insight → Recommendation—and include one quantifiable outcome per slide. Practice with Interview Query case studies to refine your ability to turn metrics into meaningful takeaways.

Practice Live Data Debugs

The live SQL interview is as much about communication as it is about accuracy. You’ll debug queries in real time, handle ambiguous prompts, and explain trade-offs on the spot.

Tip: Simulate pressure with timed practice sessions. Record yourself solving SQL problems aloud to identify filler language or unclear reasoning. Pair this with Interview Query’s mock interviews or the AI interview simulator to mirror Stripe’s fast-paced format.

Align with Stripe’s Values

Stripe deeply values rigor, clarity, and ownership. Interviewers want to see that you can take responsibility for metrics, write down assumptions, and influence outcomes with data.

Tip: Prepare three STAR-format stories (Situation, Task, Action, Result) that demonstrate ownership and accountability, like how you resolved data quality issues, influenced roadmap priorities, or moved a project from analysis to execution.

Leverage Peer and Mentor Feedback

No one sees their blind spots alone. Getting real-time critique helps refine your explanations and improve your confidence in ambiguous situations.

Tip: Join analytics communities on Slack or Reddit, or book a 1:1 with an Interview Query coach. Ask mentors to rate you on clarity and stakeholder empathy, not just technical accuracy.

Master Stripe’s Core Tools and Ecosystem

Stripe’s analysts frequently work across a modern data stack that includes SQL (Snowflake, BigQuery), Python (pandas, NumPy), Mode, and Looker. You’ll also interact with internal systems for experimentation, billing, and product analytics.

Tip: Brush up on:

- Window functions for user metrics and revenue streams

- Data visualization best practices in Mode or Tableau

- Python for quick data exploration, especially cleaning and summarization tasks

- Stripe’s API documentation, to understand how transaction data flows across systems

Familiarity with Stripe’s product ecosystem makes your interview examples more relevant and specific.

Strengthen Quantitative Thinking

Beyond SQL, Stripe expects analysts to reason numerically about product and business performance. Interviewers often ask for back-of-the-envelope calculations or metric sanity checks to see how you balance intuition with math.

Tip: Practice mental estimation exercises: compute expected conversion lifts, project revenue impacts of product changes, or estimate fraud rates based on user cohorts. Structure your answers logically, even if the math is approximate.

Learn to Write Like a Stripe Analyst

Stripe’s written culture is legendary—every proposal, analysis, or experiment is captured in concise, well-structured memos. Writing well is a signal of thinking clearly.

Tip: Summarize your projects as if they were Stripe memos:

- One-line summary (“What are we solving?”)

- Key insights and assumptions

- Visuals or charts only where they clarify a point

- A clear decision or next step

Practicing this style of analytical writing helps you shine in both take-home and stakeholder rounds.

FAQs

What is the average salary of a Stripe data analyst?

As of 2025, the median total compensation for a Data Analyst at Stripe in the United States is US$238,000 per year (around US$19,800 per month). This includes a US$158,000 base salary, US$56,000 in stock, and a US$24,000 annual bonus, based on data from Austin, TX. (Levels.fyi)

Recent submissions indicate that L3 Data Analysts (mid-level individual contributors) typically earn between US$18,000 and US$21,000 per month, depending on location and experience. Compensation is notably higher in San Francisco and Seattle, where Stripe adjusts pay for cost of living and provides more substantial equity grants tied to company performance.

Tip: Stripe’s compensation strategy prioritizes total value over base pay, with a strong emphasis on stock growth potential. Analysts who demonstrate cross-functional impact and analytical depth often see faster equity refreshers and promotions within two to three years.

Average Base Salary

Average Total Compensation

What does a Stripe data analyst do?

You turn raw payment and product data into decisions. Day to day, you write SQL, build dashboards, investigate funnels and anomalies, partner with PMs and engineers on experiments, and present clear recommendations that improve conversion, reliability, and revenue. The role blends analysis, product sense, and crisp communication in a written-first culture.

Are data analyst interviews very hard?

They are rigorous but fair if you prepare with the right focus. Expect SQL under time pressure, product-sense discussions, and a stakeholder presentation that tests clarity and business judgment. Candidates who practice explaining their assumptions, validating edge cases, and tying insights to decisions tend to do well.

What are the required data analyst skills?

Core skills include strong SQL, comfort with data visualization tools, clear written and verbal communication, and product intuition for metrics, cohorts, and experimentation. Extra points for Python or R, plus experience building repeatable analytical artifacts such as dbt models or a metrics layer. Familiarity with Stripe’s products and APIs helps you tailor examples.

Can I crack my Stripe interview with 2 weeks of prep?

Two focused weeks can move the needle, especially if you already use SQL daily. Block time for timed SQL drills, two or three product-sense mocks, and one practice deck that follows Problem → Insight → Recommendation. If you need a deeper refresh, plan three to four weeks to build repetition and feedback loops.

What is the career trajectory of a Stripe data analyst?

Many analysts grow into senior and lead roles that own analytics for a product area and mentor others. From there, paths branch into analytics engineering, data science, or strategy and ops, depending on your strengths in tooling, modeling, or cross-functional leadership. Progress is driven by impact, clear writing, and the ability to influence product decisions.

Take Your Next Step Toward Stripe

Cracking the Stripe data analyst interview comes down to mastering Stripe-style SQL, structuring your insights into actionable narratives, and aligning with the company’s operational rigor. Candidates who excel show not just fluency with metrics and queries, but the ability to move product teams forward.

To get started, explore these Interview Query resources:

- Book a mock SQL or product-sense interview with a Stripe alum.

- Try our AI-powered Stripe simulation to stress-test your live SQL.

- Follow our step-by-step learning path for data analyst interviews.

With the right prep and strategic practice, you’ll be ready to stand out in every round.