Goldman Sachs Data Analyst Interview Guide: Process, Questions, and Tips

Introduction

Data analysts at Goldman Sachs sit at the intersection of data, strategy, and decision making. In a firm that processes millions of financial transactions and operational signals every day, analysts help uncover the trends that shape trading behavior, operational risk, and strategic planning. With demand for data driven roles growing more than 20 percent year over year across financial services, Goldman Sachs continues to expand its analytics teams to support faster, more informed decision making.

This guide walks through everything you can expect from the Goldman Sachs data analyst interview—from responsibilities and team culture to the interview process structure and preparation tips. Each section is designed to help you build clarity, confidence, and the analytical fluency Goldman looks for in successful analyst candidates.

What a Goldman Sachs data analyst does

Goldman Sachs data analysts play a core role in transforming raw data into insights that guide decisions across trading, operations, risk, and internal strategy. The role blends technical problem solving with communication and cross functional collaboration, making analysts a key bridge between data engineering teams and business stakeholders.

- Analyze large datasets to identify trends, anomalies, and opportunities that inform business decisions.

- Build dashboards, reports, and visualizations in tools like Tableau or Power BI for internal stakeholders.

- Write SQL queries and use Python or similar languages to clean, manipulate, and interpret data.

- Collaborate with data engineers, auditors, and business teams to locate reliable data sources and improve collection processes.

- Create automated tools or scripts that streamline auditing, reporting, or internal workflow tasks.

- Ensure that data is managed correctly and integrated into Goldman Sachs’ internal platforms.

Why this role at Goldman Sachs

Goldman Sachs values analysts who combine technical depth with strong communication and business awareness. The firm’s apprenticeship model gives analysts early exposure to complex datasets and high impact projects, encouraging rapid learning and collaboration with senior stakeholders. Analysts who thrive in fast moving environments and enjoy solving ambiguous problems will find opportunities to grow and make meaningful contributions.

To build strong fundamentals early, explore Interview Query’s curated collection of data analyst interview questions and role-specific analytics learning paths.

Goldman Sachs Data Analyst Interview Process

The Goldman Sachs data analyst interview is designed to test how you think with data, not just whether you know specific tools. Across stages, you are evaluated on SQL fluency, analytical reasoning, communication, and how well you fit into a collaborative, high pressure environment. As you move through the process, expect questions that mix hands on querying, case style interpretation, and stakeholder oriented communication, so it helps to prepare with structured resources like the data science and analytics learning paths and targeted SQL interview prep.

| Stage | What it covers | Format |

|---|---|---|

| Recruiter screen | Background, role alignment, basic analytics fit | Phone |

| Video Interview (HireVue) | Behavioral and scenario-based questions | Video |

| Technical screen | SQL, data cleaning, basic analytics | Virtual live coding or shared screen |

| Case interview | Data interpretation, metrics, business recommendations | Virtual |

| On-site loop | SQL, analytics, visualization, stakeholder communication, behavioral | Multi-round virtual or in person |

| Hiring committee review | Aggregate feedback and final decision | Internal panel |

Overall, the Goldman Sachs analyst interview process blends technical depth with structured communication, emphasizing problem-solving across business and data contexts.

Recruiter screen

The process usually starts with a recruiter conversation that confirms your background, experience with SQL and analytics, and interest in Goldman Sachs. They clarify the role expectations, walk through the next stages, and may probe a few light examples of data projects you have worked on. This is also where they assess your communication style and general fit for the data analyst track.

Tip: Prepare one or two concise project stories that clearly show business impact, not just tools used.

Goldman Sachs Video Interview (HireVue)

Many candidates complete a Goldman Sachs video interview (HireVue) before the technical screen. You’ll answer timed behavioral and scenario-based questions on camera, with no live interviewer. Expect prompts like describing a past project, explaining a challenging stakeholder situation, or walking through a metrics-driven decision.

Tip: Keep answers concise (60–90 seconds), use STAR, and look directly at the camera to simulate stakeholder communication.

Technical screen

- Live SQL or shared screen exercise focused on joins, filtering, aggregation, and basic window functions.

- Short scenario questions about cleaning messy data or reconciling conflicting data sources.

- Light Python or spreadsheet questions in some teams, especially if the role supports automation or tooling.

- Clarifying follow ups to test how you reason about query correctness and performance.

Tip: Think aloud as you write queries so the interviewer can see how you debug and refine your logic. Strengthen the SQL concepts tested in this round with the structured SQL interview learning path.

Case interview

| Focus area | What they are looking for |

|---|---|

| Metric definition | How you define and sanity check KPIs in a realistic business scenario |

| Trend analysis | Ability to interpret charts, tables, or dashboard outputs and spot meaningful patterns |

| Hypothesis framing | How you form hypotheses, identify drivers, and propose ways to validate them |

| Recommendation | Whether you can turn analysis into clear, practical suggestions for stakeholders |

In the case round, you might be given a dataset, a metric trend, or a dashboard and asked to walk through what you see, what concerns you, and what you would investigate next. The goal is to understand how you move from raw data to structured narrative and actionable recommendations.

Tip: Always connect your observations back to the business question instead of listing numbers without context. For more case-style problems like these, practice with Interview Query’s set of analytics case interview questions.

On-site loop

The on-site loop (often conducted virtually) usually includes multiple rounds that dive deeper into your SQL skills, analytics reasoning, visualization approach, and behavioral fit.

SQL and data manipulation round

You will write queries that combine joins, aggregates, and possibly window functions against realistic schemas. The interviewer may ask you to optimize or extend your queries to test your flexibility.

Tip: Confirm assumptions about the schema before diving into complex logic to avoid rework.

Analytics and metrics deep dive

This round focuses on how you define metrics, diagnose anomalies, and think about experiment or analysis design. You may be asked to break down a business problem into measurable components.

Tip: Start by restating the problem in your own words, then outline your approach before going into detail.

Visualization and stakeholder communication

Here you discuss how you would present insights to non technical stakeholders, possibly walking through how you would design a dashboard or explain a trend. The interviewer is looking for clarity, structure, and empathy for the audience.

Tip: Emphasize how you tailor your message and level of detail based on who is in the room. If you want to sharpen how you present insights visually, explore Interview Query’s visualization and dashboard-style questions.

Behavioral and culture fit

This round explores how you handle ambiguity, tight deadlines, and cross functional collaboration. Expect questions about past projects, conflicts, and how you responded to unexpected issues in data or reporting.

Tip: Use a simple STAR structure so each answer clearly shows situation, action, and outcome. For real-time practice with behavioral delivery, try Interview Query’s mock behavioral interviews.

Hiring committee review

After the interviews, a hiring committee reviews feedback from every interviewer and considers your overall trajectory across technical, analytical, and behavioral dimensions. They look for consistency in how you approached problems, communicated tradeoffs, and demonstrated ownership, rather than focusing on one perfect or imperfect moment. The committee also considers how well your strengths match the specific team’s needs and whether you are likely to thrive in Goldman Sachs’ apprenticeship oriented culture.

Once the committee reaches a decision, the recruiter will share the outcome and, if you receive an offer, may walk through level, team fit, and compensation details. Even if the decision is a no, strong candidates are often encouraged to reapply later or considered for other analytics roles if the fit is better elsewhere.

Tip: Treat every round as equally important because the committee evaluates the full trajectory of your performance, not isolated moments.

Goldman Sachs Data Analyst Interview Questions

In the Goldman Sachs analyst interview process, candidates face a mix of SQL challenges, scenario-based analytics problems, and behavioral prompts. These are the most commonly asked Goldman Sachs data analyst interview questions, based on real reports and patterns across teams.

Each category reveals a different dimension of how you solve problems, communicate insights, and work with cross functional partners. The mix of SQL challenges, business context cases, and stakeholder scenarios reflects the day to day work analysts face in fast moving environments. Strengthening your preparation through structured resources such as the data analytics learning paths or practicing realistic scenarios in mock interviews will help you answer these questions with clarity and confidence.

The following sections break down each category in detail, providing question prompts, explanations, and the specific competencies Goldman looks for in strong candidates.

Analytical, SQL and technical interview questions

Goldman Sachs data analyst interviews lean heavily on SQL, analytical reasoning, and your ability to work with imperfect real world datasets. Expect to write queries, interpret trends, and propose schema structures in a fast paced setting. Strengthening your fundamentals through the SQL learning path and hands-on challenges in the Interview Query question bank will help you move confidently through this round.

-

This question tests your ability to identify incorrect ETL behavior and retrieve the latest valid record using ordering, IDs, or timestamps.

Tip: Always confirm how “current” should be defined before writing the query.

-

You must correctly interpret sequential role changes and use SQL to determine role transitions without intermediate titles.

Tip: Clarify what counts as “immediate” to avoid including users with extra steps in between.

-

This evaluates ranking logic, grouping, sorting, and producing readable aggregated outputs.

Tip: Use ROW_NUMBER or DENSE_RANK to control how ties are handled.

-

This question assesses how well you work with dates, time series grouping, and multi-metric aggregations.

Tip: Extract month fields explicitly to avoid relying on implicit date formats.

How would you write a query that returns the distribution of conversations created per user per day?

This tests your ability to calculate distributions and think about insights the dataset might reveal.

Tip: Mention how you might visualize the distribution to reveal usage patterns.

-

The question combines SQL reporting with performance interpretation, similar to pacing analysis in marketing analytics.

Tip: Focus on explaining both the calculation and how you interpret the trending behavior.

How would you write a query to return all wines that meet specific numeric filtering criteria?

This evaluates precision with filtering conditions and your ability to translate requirements into SQL constraints.

Tip: Repeat the criteria back to the interviewer to ensure clarity before coding.

-

This question checks your ability to manipulate dataframes using boolean logic in Python or a similar tool.

Tip: Break your conditions into separate boolean statements to keep the logic readable.

-

This tests your understanding of relationships, keys, and how transactional data should be structured.

Tip: Explain why each field belongs in each table to demonstrate schema intuition.

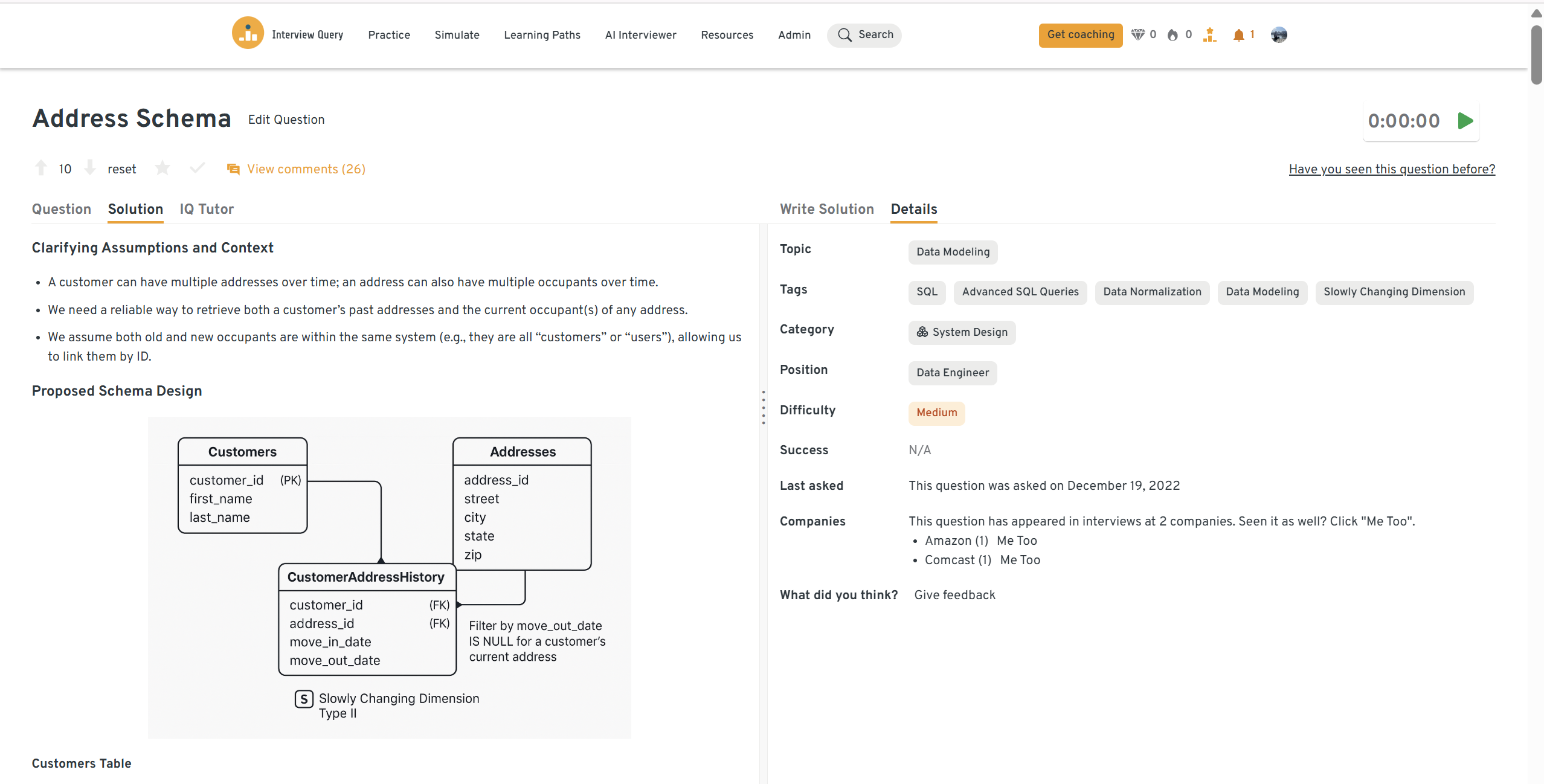

How would you structure a database to track a customer’s address history and changes over time?

This question assesses your ability to model slowly changing dimensions and preserve historical accuracy.

Tip: Ground your reasoning in auditability since financial institutions rely heavily on it.

You can practice this exact problem on the Interview Query dashboard, shown below. The platform lets you write and test SQL queries, view accepted solutions, and compare your performance with thousands of other learners. Features like AI coaching, submission stats, and language breakdowns help you identify areas to improve and prepare more effectively for data interviews at scale.

Product and strategy interview questions

This part of the interview assesses how you think about business problems, interpret data in context, and translate insights into actions. Goldman Sachs looks for analysts who can balance quantitative rigor with clear reasoning, especially when working with cross functional partners like auditors, traders, and risk teams. Practicing structured problem solving using resources such as the analytics learning paths and real world case studies helps build the intuition you need for these questions.

These are example Goldman Sachs scenario-based interview questions, designed to test how you think with messy or ambiguous data.

How would you evaluate the impact of a data quality issue in a daily PnL report?

Interviewers want to see if you can assess business risk, identify affected stakeholders, and outline a short term and long term mitigation plan. Emphasize traceability, reconciliation checks, and quantifying the downstream impact.

Tip: Always clarify which decisions rely on the dataset so you can prioritize fixes.

How would you design metrics to measure the performance of an operations team?

This tests your ability to define KPIs, understand process bottlenecks, and balance leading and lagging indicators. Think accuracy, timeliness, throughput, and exceptions handling.

Tip: Start by defining the team’s core objective before proposing any metric.

How would you prioritize data requests when multiple stakeholders need conflicting analyses?

Goldman values analysts who can manage competing priorities pragmatically. Show how you assess business impact, urgency, dependencies, and potential risks.

Tip: Mention the importance of documenting assumptions to keep everyone aligned.

If a trading desk wants to automate a manual reporting workflow, what questions would you ask before starting?

This evaluates discovery skills: data sources, pain points, frequency, accuracy thresholds, and failure modes. It also shows whether you can design a scalable, maintainable solution.

Tip: Always ask how they currently validate correctness to avoid hidden assumptions.

How would you determine whether a drop in a key metric (for example, transaction volume) is real or caused by a data pipeline issue?

The goal is to display structured hypothesis testing. Consider comparing multiple data sources, checking upstream dependencies, and validating processing logs.

Tip: Split your investigation into “business causes” and “data causes” to stay organized.

What framework would you use to evaluate the success of a new internal analytics dashboard?

This question tests your ability to define adoption metrics, interpret usage patterns, and gather feedback from diverse users.

Tip: Focus on measuring behavior change, not just page views.

How would you justify building an automated audit tool to a leadership team unsure of the ROI?

This assesses how well you quantify operational savings, error reduction, and scalability. Discuss time saved, risk mitigation, and improved consistency.

Tip: Translate technical benefits into dollars, hours saved, or reduced risk.

If asked to redesign a reporting workflow that is slow and error prone, where would you begin?

Interviewers want to see systematic thinking: map the current process, identify failure points, analyze dependencies, and evaluate automation potential.

Tip: Ask for concrete examples of errors to ground your recommendations in real data.

Behavioral interview questions

Goldman Sachs places significant weight on collaboration, communication, and how you operate under pressure. Behavioral interviews are designed to uncover how you handle ambiguity, work with stakeholders, resolve data issues, and learn from difficult situations. Clear, structured storytelling matters just as much as the content of the story itself. Practicing with the Interview Query coaching program or running through live mock interviews can help you refine delivery and tighten your narratives.

Describe a data project you worked on. What were some of the challenges you faced?

Interviewers want to evaluate your problem solving process, how you work through roadblocks, and your approach to incomplete or unreliable datasets.

Sample answer: In a recent analytics project, I discovered inconsistencies across multiple data sources while preparing a quarterly performance report. I validated each source, identified where the mismatches originated, and built a reconciliation script that automated future checks. The process improved accuracy and reduced manual review time for the team.

Tip: Focus on one concrete challenge so your story stays structured.

What are some effective ways to make data more accessible to non technical stakeholders?

This question assesses how well you tailor insights to different audiences and build trust with non technical teams.

Sample answer: I prioritize simplifying visuals, limiting unnecessary metrics, and grounding explanations in stakeholder language. I also host short walkthroughs to ensure teams understand the nuances behind the numbers. This approach consistently improves adoption of dashboards and reporting tools.

Tip: Emphasize how you adjust communication for the audience.

What would your current manager say about you and what constructive feedback might they give?

Goldman looks for self awareness and the ability to reflect on your improvement areas.

Sample answer: My manager would say I take ownership of complex tasks and communicate clearly across teams. One area I’m working on is balancing speed with documentation, so I’ve started building lightweight templates that help me move quickly while keeping everything traceable.

Tip: Pair each weakness with a clear action you’ve already taken.

Talk about a time when you had trouble communicating with stakeholders. How did you overcome it?

This question tests emotional intelligence, cross functional collaboration, and your ability to clarify misalignment.

Sample answer: In a previous project, a stakeholder misunderstood a dataset’s definition and expected a metric we couldn’t calculate. I scheduled a brief alignment call, walked through the data lineage, and shared examples. Once aligned, we redesigned the report with mutually agreed definitions.

Tip: Show that you take initiative to resolve miscommunication early.

Why do you want to work with us?

The interviewer wants to understand your motivation and how your goals align with the firm’s culture and work.

Sample answer: I’m motivated by Goldman’s apprenticeship culture and the opportunity to work on large, high impact datasets that drive critical financial decisions. I enjoy solving ambiguous data problems and collaborating across teams, and I see Goldman as a place where I can grow by contributing to real world analytics challenges.

Tip: Make your answer specific to Goldman Sachs rather than generic across companies. To refine your behavioral storytelling, check out Interview Query’s 1-on-1 coaching program.

This breakdown by Interview Query founder Jay Feng covers the five most common data analyst interview questions and how to answer them with clarity, structure, and insight. It’s an efficient way to tighten your fundamentals before tackling Goldman Sachs–style analytics interviews.

How to Prepare Goldman Sachs Data Analyst Interview

Preparing for the Goldman Sachs data analyst interview requires a structured approach that sharpens your SQL fundamentals, analytical reasoning, and communication skills. The process blends technical execution with business context, so your preparation should balance hands on practice with frameworks that help you interpret data and present insights clearly. You can move faster by following curated resources like Interview Query’s learning paths, SQL modules, and realistic mock interviews.

Strengthen your SQL fundamentals

SQL is the single most important technical skill in the GS data analyst process. Focus on joins, aggregates, filtering logic, window functions, and handling messy or incomplete data. Reinforce these topics with the SQL interview learning path and scenario based practice questions.

Tip: Practice writing queries out loud to build clarity for the live coding rounds.

Develop clean analytical reasoning for case interviews

Case questions test how you interpret trends, frame hypotheses, define metrics, and make recommendations. Build a habit of explaining what a pattern means and why it matters, rather than just describing visuals.

Tip: Always link every observation back to the business question to show structured thinking.

Practice communicating insights visually

Visualization rounds focus on how well you present data to non technical stakeholders. Revisit dashboards you’ve built or study strong examples to understand how layout and narrative shape decision making.

Tip: Use simple explanations that highlight the “so what” behind each insight.

Get comfortable with real world data cleaning and validation

Many questions involve ambiguous, incomplete, or inconsistent data. Practice identifying anomalies, handling missing values, and validating assumptions.

Tip: When answering, call out both the issue and how you would detect it with data.

Refine your behavioral stories using a clear structure

Goldman Sachs weighs collaboration, ownership, and communication heavily. Prepare stories around cross functional work, tight deadlines, unexpected data issues, and stakeholder alignment. Practicing through mock interviews or coaching can help you sharpen delivery.

Tip: Focus on what you did in each story, not just what the team accomplished.

Simulate the full interview experience

Combine SQL drills, case walkthroughs, and behavioral rehearsals in one session so the flow feels familiar. Tools like Interview Query challenges and live mock sessions help you practice the same mental transitions you’ll make on interview day.

Tip: After each simulation, write down one improvement to apply in the next session. For realistic end-to-end practice, combine Interview Query’s mock interviews with hands-on analytics challenges.

Build light domain intuition around finance workflows

You do not need deep finance expertise, but knowing how data flows through trading, risk, or operational teams helps you answer product and strategy questions more confidently.

Tip: Learn a few short examples of how delayed or inaccurate data can impact decisions to make your answers more grounded.

FAQs

What skills does Goldman Sachs look for in data analyst candidates?

Goldman Sachs looks for strong SQL fundamentals, the ability to clean and analyze data, and clear communication skills. Experience with Python, dashboards, and working with large datasets is also important, along with the ability to translate complex findings into business insights.

How technical is the data analyst interview at Goldman Sachs?

The interview is moderately technical and heavily SQL focused. You can expect live querying, data cleaning scenarios, and metrics reasoning. Some teams may also include light Python or case based interpretation, especially for roles that support automation or reporting workflows.

Do I need finance experience to become a Goldman Sachs data analyst?

Finance experience is helpful but not required. Many successful candidates come from tech, consulting, research, or other analytical backgrounds. You mainly need strong data skills and the ability to grasp how data impacts decisions within risk, operations, or product teams.

What types of SQL questions are commonly asked?

Interviewers often test joins, aggregations, window functions, and data validation logic. Practicing scenario based questions and analytics problems through resources like SQL interview prep or challenge questions can help you understand the format you’ll face.

How can I prepare for the case interview?

Focus on interpreting trends, defining metrics, forming hypotheses, and explaining business impact. Reviewing analytics case walk throughs and practicing structured reasoning through mock interviews can significantly strengthen your delivery.

Is there a take home assignment for Goldman Sachs data analyst roles?

Some teams include a take home data cleaning or analysis task, though it is not required for every role. If included, it usually involves writing SQL queries, identifying issues in a dataset, and summarizing your findings clearly.

How important are behavioral interviews in the Goldman Sachs process?

Behavioral rounds matter a lot because the firm evaluates collaboration, ownership, communication, and cultural fit. Prepare stories that show how you work with stakeholders, handle pressure, and solve unexpected data issues.

What data tools does Goldman Sachs expect analysts to know?

SQL is essential, and Python is increasingly common. Experience with Tableau, Power BI, or other visualization platforms is useful. Knowledge of RDBMS systems and general data wrangling practices is also valuable for most teams.

How long does the interview process take?

Most candidates complete the process in two to four weeks, depending on scheduling. Roles with more cross functional evaluation or additional rounds may take slightly longer.

What is the biggest mistake candidates make in the GS data analyst interview?

Many candidates jump straight into writing SQL or interpreting charts without clarifying assumptions or restating the problem. Interviewers look for structured thinking, so slowing down and framing your approach goes a long way.

Start Your Goldman Sachs Data Analyst Journey With a Real Prep Strategy

Cracking a Goldman Sachs interview isn’t about memorizing answers. It’s about learning to think the way their teams think: structured, analytical, and laser focused on clarity. The right preparation builds that mindset, helping you move from scattered practice to deliberate, targeted growth. When your SQL is crisp, your reasoning is clear, and your communication is grounded in business impact, every interview round becomes an opportunity to stand out.

If you want to accelerate that process, explore Interview Query’s deeper prep tools. Build a strong foundation through analytics focused learning paths, pressure test your skills with real world challenges, or level up your delivery through expert led mock interviews. With a structured system behind you, you can walk into your Goldman Sachs interviews prepared to perform at your highest level.