CVS Health Business Analyst Interview Questions + Guide in 2025

Introduction

A CVS business analyst at CVS serves as the bridge between raw data and actionable insights, ensuring that pharmacy, retail, and insurance operations run smoothly and efficiently. You’ll work with massive datasets—ranging from prescription fulfillment rates to membership engagement metrics—to uncover trends that directly impact patient outcomes and business performance. In this role, you’ll collaborate with stakeholders across functions, from pharmacists and supply chain managers to marketing and finance teams, translating complex analyses into clear recommendations.

Your work will support initiatives like optimizing inventory levels, improving patient adherence programs, and refining loyalty offerings. Ultimately, you’ll help CVS deliver on its promise of accessible, high-quality care while driving growth and innovation as a business analyst CVS.

Role Overview & Culture

The CVS Business Analyst turns mountains of transactional and operational data into insights that fuel decision-making across the enterprise. Every day, you’ll design and maintain dashboards, build predictive models, and perform ad-hoc analyses to identify opportunities for cost savings and service enhancements.

Collaboration is key: you’ll partner closely with data engineers, IT teams, and business leaders to ensure analytics solutions meet real-world needs. CVS’s culture emphasizes customer-centricity and rapid iteration—you’ll iterate on hypotheses, test solutions through small-scale pilots, and scale successful strategies quickly. In this environment, ownership and clear communication are as important as technical prowess.

Why This Role at CVS?

A CVS business analyst at CVS has the opportunity to influence healthcare outcomes for over 90 million patients and members nationwide. You’ll gain cross-functional exposure, working within pharmacy operations one day and contributing to insurance analytics the next, all while developing skills in SQL, Python, and data visualization tools. CVS offers clear career progression paths—from analytics specialist roles to leadership positions overseeing enterprise-wide initiatives. The role combines meaningful impact with professional growth, making it an ideal platform for analysts who thrive on solving complex problems. If you’re ready to turn data into better patient experiences and drive strategic decisions, this position is made for you.

What Is the Interview Process Like for a Business Analyst Role at CVS?

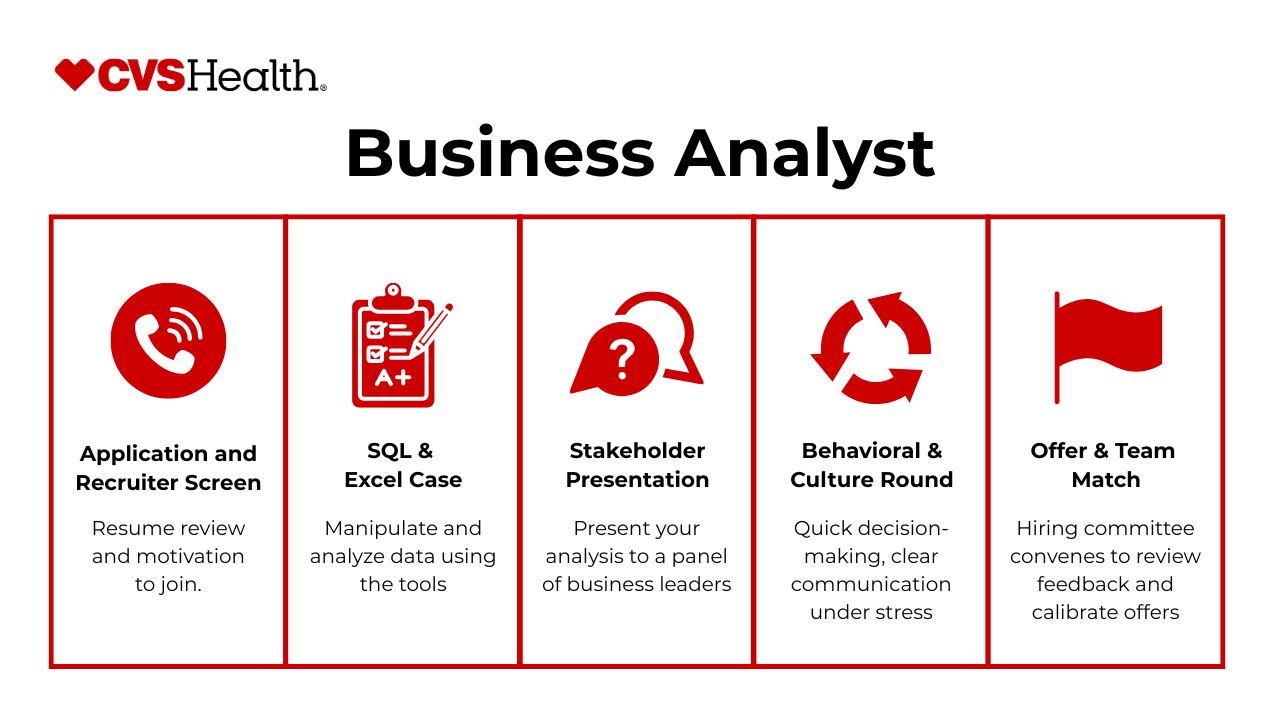

A CVS business analyst interview typically unfolds over several structured stages designed to assess both technical skills and cultural fit. Candidates begin by speaking with a recruiter to confirm résumé alignment and motivation for the role. From there, you’ll complete a hands-on SQL and Excel case study that mirrors real-world pharmacy and retail data challenges. Midway through the process, applicants present their findings to cross-functional stakeholders—demonstrating both analytical rigor and clear communication—before moving on to a deeper behavioral discussion. Finally, successful candidates receive an offer after a comprehensive review.

Recruiter Screen

Your journey starts with a conversation with a CVS talent team member. This initial call focuses on your background, interest in the business analyst CVS position, and logistical details like availability and salary expectations. It’s also an opportunity for you to ask high-level questions about the role and team structure.

SQL & Excel Case

The next step tests your ability to manipulate and analyze data using the tools you’ll use daily. You’ll receive a dataset and be asked to write SQL queries and build Excel models that surface key insights—such as prescription fill-rate trends or loyalty program performance. Interviewers look for accuracy, efficiency, and your approach to validating results.

Stakeholder Presentation

After completing the case study, you’ll present your analysis to a panel of business leaders and subject-matter experts. This stage evaluates your storytelling skills: how well you translate numbers into strategic recommendations and handle probing questions. Strong candidates model professional-grade dashboards and tie findings back to business objectives.

Behavioral Round

In this discussion, CVS interviewers explore how you’ve navigated past challenges and contributed to team success. Expect questions about cross-functional collaboration, handling ambiguity in healthcare data, and examples of driving results under tight deadlines. Your answers should reflect CVS’s values of customer-centricity and rapid iteration.

Offer

The final step involves a hiring committee review of your performance across all stages, followed by a compensation discussion. Upon approval, you’ll receive a formal offer outlining salary, benefits, and next steps for onboarding. Feedback is typically delivered within 24–48 hours of the decision.

Behind the Scenes & Timeline

Once your interviews conclude, expect recruiters to input feedback into CVS’s applicant-tracking system within 24 hours. Weekly hiring committee meetings calibrate candidate evaluations across teams to maintain consistency. Reference checks and final approvals can add a few days, so anticipate a total process length of two to three weeks.

Differences by Level

For associate-level analysts, case studies emphasize core SQL and basic modeling, and presentations focus on problem-solving clarity. Senior business analysts face more complex scenario planning, leading deeper discussions on cross-team influence, and may be asked to propose end-to-end analytics frameworks. Pay bands and scope of work scale accordingly, with senior roles owning larger portfolios and mentoring peers.

Now, let’s dive into the CVS business analyst interview questions.

What Questions Are Asked in a CVS Business Analyst Interview?

In a CVS business analyst interview, you’ll face three main question categories that reflect the day-to-day challenges of turning health-care data into strategic insights. You’ll first tackle case-style scenarios that mirror initiatives like opening clinics or improving prescription adherence. Then, your technical chops are tested through SQL and Excel exercises before you discuss behavioral and stakeholder management situations that gauge your collaboration and influence skills.

Case / Business Questions

Candidates are presented with open-ended business problems—think sizing a potential new clinic, evaluating membership churn drivers, or recommending pricing strategies. These prompts assess your ability to structure analyses using frameworks (e.g., MECE), make grounded assumptions, and synthesize findings into clear, actionable recommendations for leadership.

-

Interviewers want to hear the difference between absolute demand (requests per minute, search pings, surge-multiplier) and balance metrics such as pickup-ETA, driver-acceptance rate, or the ratio of open requests to available drivers. Explaining how you would back-test thresholds—say, “surge > 1.5 for three consecutive five-minute windows”—shows that you can turn noisy telemetry into an actionable alert system that operations teams trust.

-

This question checks that you know both the steady-state formula LTV ≈ ARPU ÷ churn ($1 000) and the cohort-based Net-Present-Value approach ($350) and can spot the inconsistency (3.5 months implies 28 % churn). Interviewers look for explicit margin adjustments, discount-rate discussion, and clarity about which definition should drive financial forecasting.

-

A blanket blast risks throttling by ISPs, unsubscribes, and brand fatigue—costs that can exceed any one-off revenue pop. Good answers propose segmentation (propensity scores, recent engagement) and an A/B hold-out to estimate incremental lift versus churn. This demonstrates you weigh long-run CLV and sender-reputation effects instead of chasing short-term bookings.

-

The aim is to see how you mine transaction graphs: cluster merchants, compute wallet-share gaps, look for high-frequency but under-penetrated merchants among existing customers, and project incremental interchange. Detailing lift-tests (geo pilots, synthetic cohorts) shows you know how to turn descriptive analytics into a revenue model executives can bank on.

-

Strong responses triangulate TAM (how often Messenger friends already transact elsewhere), competitive moat (network effects vs. Venmo), revenue levers (interchange, float, data), and risk/compliance overhead. Walking through an MVP experiment—country rollout, success metrics like activation, retention, P2P velocity—demonstrates product-sense grounded in data.

Lyft is A/B-testing $1, $3, and $5 cancellation fees—how would you pick the optimal amount?

Candidates should randomise riders (or regions), then compare cancellation rate, completed-ride revenue, complaint volume, and lifetime value. Discussing heterogeneous treatment effects (new vs. power users) and elasticity curves shows maturity. Interviewers probe whether you can balance rider satisfaction against driver utilisation and net margin.

-

You need a controlled rollout, incremental-profit calculation (revenue – variable cost – cannibalisation), and a view on habit-formation (post-promo retention). Mentioning guardrails like surge-multiplier spikes or driver earnings keeps the answer realistic. Showing how you’d stop-loss the promo if unit economics go negative signals operational prudence.

-

Expectation is that you decompose incremental subscriber acquisition, retention lift, and engagement hours converted to expected revenue, subtract licence cost, and run scenario Monte-Carlo (seasonal churn, competitive releases). Citing proxy metrics (search share, completion rate) and a control-cell approach (countries without the show) proves you can isolate causal value.

-

The interviewer wants to hear you plot cancellation probability vs. dispatch time, simulate driver dead-heading cost, and find the break-even minute where driver idle-cost equals rider goodwill. Segmenting by city density and supply levels shows nuance. Proposing an adaptive, surge-aware threshold highlights a systems-thinking mindset.

SQL / Data-Manipulation Questions

Next, you’ll demonstrate proficiency in writing efficient queries and building dashboards that surface key performance indicators. Expect to optimize joins, use window functions for time-series analyses, and transform raw tables into executive-ready reports. For a business analyst CVS role, interviewers look for both correctness and consideration of query performance on large datasets.

-

Interviewers look for window-function fluency: partition by

user_id, order bysession_timestamp, filter toconversion = TRUE, and grab the earliestchannel. A good answer also mentions tie-breaking columns, joining back to a user spine, and validating that first-touch and multi-touch definitions don’t collide. This tests whether you can translate marketing concepts into production-grade SQL that drives real budget decisions. -

The core skill is writing a self-join (or windowed range join) that compares each row to others from the same user:

start_a < end_b AND start_b < end_a. Candidates earn bonus points if they discuss indexes on (user_id,start_date), NULL-end-date handling, and scalable anti-patterns (Cartesian explosions). Overlap logic pops up in billing, compliance, and entitlement auditing. -

Strong solutions build a self-join per basket (or explode arrays with

UNNEST) to create unordered pairs, apply alphabetical ordering to keepp2 > p1, aggregate counts, then TOP 5. Discussion of approximate methods (HyperLogLog, sampling) for billion-row scale shows you think about compute cost. Retail and trading firms alike expect engineers who can mine co-occurrence data efficiently. -

This query forces you to combine cohort selection (signup month), a rolling 30-day window, and bilateral cash flows (

sender_idplusrecipient_id). Interviewers want to see date arithmetic, conditional sums (payment_state = 'success'), and care with double-counting. It tells them you can craft complex retention or anti-fraud metrics without pulling wrong numbers. -

The task tests percentile thinking in pure SQL: compute comment totals per user, group by that total, then use

SUM(count) OVER (ORDER BY comments)to generate the running CDF. Explaining why you’d store results in an analytics table for dashboards shows awareness of downstream consumers. Which customers placed more than three transactions in both 2019 and 2020?

The problem checks your comfort with year-level grouping and intersection logic: aggregate by

(user_id, year), filterCOUNT > 3, thenHAVING COUNT(DISTINCT year)=2. It’s a quick litmus test of your ability to produce cohort intersection sets for marketing or credit-risk analysis.-

Classic ranking exercise:

DENSE_RANK()or a correlated sub-query (MAX(salary) WHERE salary < (SELECT MAX…)). Teams ask it to ensure you can handle edge cases (duplicate max, NULLs) and choose the most readable window approach. -

You need partitioned

MIN(purchase_date)per user, compare subsequent purchases, and exclude same-day multi-item baskets. Mentioning index usage and an incremental ETL strategy (write daily delta to an upsell fact table) signals production mindset. -

Interviewers want to see UNION ALL of normalized recipe rows followed by

GROUP BY ingredient_name. Good answers note why you’d standardize units and maintain a dimension table of ingredient metadata. It demonstrates your ability to merge heterogeneous sources before analysis. -

The SQL/analytics angle is limited, but the question probes probabilistic reasoning: two independent start times between 19:00-24:00, one-hour durations ⇒ collision probability ≈ (1 – (4⁄5)²) = 36 %; multiply by 365 and $1 000. Explaining both a Monte-Carlo script and the closed-form geometry shows breadth.

Behavioral & Stakeholder Management Questions

Finally, you’ll discuss past experiences that reveal how you build trust with cross-functional teams, navigate conflicts, and deliver results under tight deadlines. Describe situations where you used data storytelling to influence decisions, upheld patient privacy standards, or led collaborative workshops—showing the ownership mindset every cvs business analyst must embody.

-

CVS Health business-analysis teams frequently shepherd multi-month analytics initiatives that span pharmacy, retail, and insurance data. Interviewers want evidence that you can surface blockers—HIPAA red-tape, incompatible EHR formats, shifting business priorities—and still deliver an insight that affects patient care or cost savings. Your answer should highlight structured risk-mitigation (early data audits, phased roll-outs) and stakeholder updates that kept leadership confident in the project trajectory.

-

Business analysts at CVS Health brief store managers, clinicians, and executives who may not read SQL. The panel is looking for your playbook—e.g., narrative dashboards in Tableau, plain-language metric definitions, and “what-this-means” callouts tied to quality-of-care KPIs. Discuss how simplifying data improved adoption of, say, a medication-adherence scorecard or reduced call-center AHT.

-

This probes self-awareness and coachability—critical in a highly regulated environment where accuracy matters. Choose strengths relevant to CVS Health (e.g., building cost-savings models, compliance diligence) and a weakness you’ve actively improved (perhaps over-indexing on detail, solved by instituting peer reviews). Show you can accept feedback and iterate quickly, mirroring the company’s continuous-improvement culture.

-

CVS Health analysts must align actuaries, pharmacists, and marketing teams around a single narrative. Reviewers want to see how you diagnose knowledge gaps, adapt the medium (storyboards, executive one-pagers), and confirm understanding via Q&A or pilot tests. Emphasize empathy and iterative messaging that ultimately drove action—such as changing formulary placement or store-shelf layout.

Why do you want to join CVS Health, and how does this role advance your long-term career plans?

Here they’re filtering for genuine mission alignment—lowering healthcare costs, expanding access—and proof you’ve read recent CVS Health strategy (e.g., HealthHUB expansion, Aetna integration). Tie your data-driven background to measurable health-outcome goals, not just generic “big data” interest. Mention specific domains you hope to influence, like chronic-care management or retail supply-chain optimization.

Walk us through your system for juggling overlapping requests from merchandising, pharmacy ops, and clinical analytics. How do you keep deadlines straight without sacrificing quality?

The role entails a fast queue of ad-hoc asks plus quarterly roadmap work. Interviewers expect a framework—impact × effort scoring, RACI charts, or sprint boards—and examples where you renegotiated scope to protect analytic integrity (e.g., ensuring the correct ICD-10 filters before releasing a hospitalization dashboard).

Tell us about a recommendation you made that was not adopted. How did you respond, and what did you learn?

CVS Health values humility and resilience because even strong analyses can be overruled by regulatory or operational realities. This question gauges your ability to accept setbacks, revisit assumptions, and maintain productive relationships for the next project.

Give an example of how you ensured data privacy while still enabling rich insight generation.

HIPAA compliance is non-negotiable. Explain how you applied de-identification, data-masking, or minimum-necessary principles while still delivering segmentation powerful enough to guide, for instance, a flu-shot outreach campaign. Showing you “think privacy first” reassures hiring managers you’ll safeguard member trust.

How to Prepare for a Business Analyst Role at CVS

Preparing thoroughly for a CVS business analyst interview means blending domain research, technical practice, and behavioral readiness well before your scheduled dates.

Study the Role & Culture

Immerse yourself in CVS’s mission to put patients first—review recent initiatives in pharmacy services and retail analytics. Reflect on how your past projects align with their values of customer centricity and rapid iteration, and be ready to discuss specific examples of data-driven impact.

Practice Common Question Types

Allocate your prep time roughly 40 % to case studies, 30 % to SQL/Excel drills, and 30 % to behavioral storytelling. Craft concise frameworks for market-sizing and churn analyses, write and optimize queries on sample datasets, and rehearse STAR responses to common leadership-style prompts

Think Out Loud & Ask Clarifying Questions

During mock sessions, practice vocalizing your thought process and checking assumptions before diving in. Interviewers appreciate structured reasoning and will reward you for proactively seeking clarity on ambiguous requirements.

Mock Interviews & Feedback

Partner with peers or leverage Interview Query’s mock-interview platform to simulate full loops—case, technical, and behavioral. Solicit actionable feedback on your analytical approach, presentation style, and cultural fit to fine-tune your delivery under realistic conditions.

FAQs

What Is the Average Salary for a CVS Business Analyst?

Average Base Salary

Average Total Compensation

CVS Business Analyst compensation typically includes a base salary, annual bonus, and restricted stock units, with significant regional variation between markets like New York and Tampa.

How Many Rounds Are in the CVS BA Interview?

The typical CVS business analyst interview loop consists of four main stages: an initial recruiter screen, a case-study or SQL/Excel assessment, a stakeholder presentation round, and a behavioral discussion with hiring managers.

Which Tools Should I Know?

Proficiency in SQL, Tableau, and Excel is essential for this role; familiarity with Python or R for ad-hoc analyses can be a differentiator but is optional.

Is Healthcare Experience Required?

Domain knowledge in pharmacy or insurance can give you context, but it’s not mandatory; strong data storytelling and analytical skills are far more critical for success as a business analyst cvs.

Can I Re-Apply If Rejected?

Candidates may re-apply after a six-month cooling-off period. In the meantime, you can strengthen your profile by completing advanced SQL certifications, building a public portfolio of analytic projects, or gaining experience with healthcare data.

Conclusion

With targeted preparation, you’ll be well on your way to acing the cvs business analyst interview and making meaningful contributions to patient care and business strategy at CVS. For a deeper dive into the broader CVS ecosystem, explore our CVS Health interview guide and the specialized CVS Health Data Analyst guide.

To build the core skills you need—whether SQL, data visualization, or stakeholder storytelling—check out our comprehensive Learning Paths, and when you’re ready to simulate the real thing, schedule a Mock Interview. Take inspiration from successes like Chris Keating’s story as you embark on your own journey toward a rewarding career as a CVS Business Analyst.