AI Boom, Tech Jobs Bust: Indeed Reports 36% Drop in Tech Jobs Since 2020

Tech Job Postings in Free-Fall

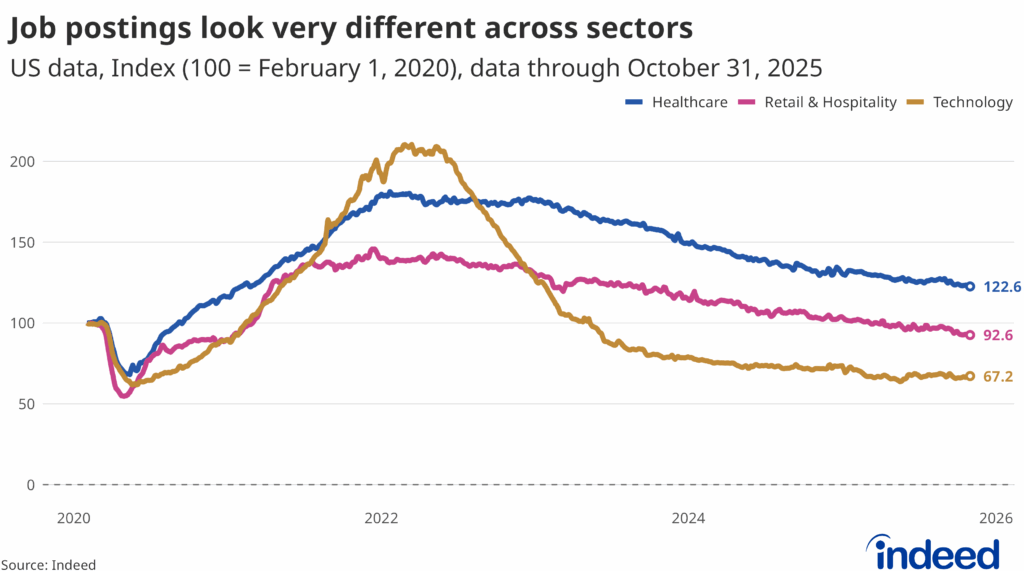

The AI boom may be reshaping the economy, but for tech workers, the picture is far from rosy. According to Indeed’s 2026 US Jobs & Hiring Trends Report, tech job postings have plunged over 30% below pre-pandemic levels as of late October 2025.

This is the steepest decline of any major sector. While total job postings across the economy have edged just 1.7% above their February 2020 baseline, tech has moved sharply in the opposite direction, its demand weakening more evidently than other sectors like healthcare.

Even within the sector, the decline is far from uniform. The hardest-hit roles are the ones that historically fed the tech talent pipeline, namely entry-level and early-career jobs that include terms like “developer,” “engineer,” or “analyst.”

Such news stands in stark contrast with earlier signs of optimism. A previous article about an October 2025 CompTIA analysis indicated a potential rebound in tech hiring, with both job postings and intent to hire seeing an all-time high for the year.

However, Indeed’s report suggests that the bounce may have been more of a blip than a turning point. It fits into what economists have been describing as a “low-hire, low-fire” labor market. With companies holding onto the workers and refusing to expand their teams, hiring remains sluggish and churn has flatlined, creating a frozen job market for both employers and workers.

What’s Driving the Collapse

Indeed’s senior economist Cory Stahle points to a one-two punch behind the slowdown. First, many tech companies over-hired during the post-pandemic boom, building teams faster than revenue could justify. The mass layoffs in the sector have also been attributed to this correction.

Second, and more recently, AI adoption has begun reshaping not only how firms think about headcount but also which skills they want to prioritize. As CIO Dive recently reported, companies are rapidly experimenting with AI tools that automate parts of software engineering, analytics, support, and operations.

Since this shift is not creating new jobs that can offset laid-off positions, it has resulted in a growing mismatch between what employers want and what job seekers are offering.

The clearest example is in data and analytics roles.

Despite surging interest from job seekers, Indeed’s Job Postings Index shows data & analytics demand hovering around 60.4. This is far below its pre-pandemic baseline, and is the lowest across all sectors tracked in the job report.

Roles like business analyst, data analyst, data scientist, and BI developer are drawing large talent pools that outpace the number of job postings, creating a fiercely competitive market.

The Hidden Cost: Growth Risks for Firms & Talent Pipelines

While tech workers feel the immediate pain of fewer openings, the effect goes beyond their individual careers. Companies ultimately face the bigger long-term risk, as we’ve covered in our previous article on the implications of declining entry-level jobs.

With fewer early-career roles being created, the future leadership pipeline is shrinking. The report describes today’s hiring landscape as “selective,” with employers posting fewer jobs but scrutinizing candidates more heavily. Job-search durations have also lengthened noticeably, influencing younger workers to seek alternatives to full-time roles, like freelancing and part-time jobs.

If companies do not maintain a steady influx of junior and mid-level talent, they may find themselves short of experienced workers who can adapt, lead, and innovate when the next growth cycle arrives. By sacrificing entry-level jobs in the name of AI efficiency and cost reductions, the looming talent crisis could hamper tech innovation just when firms need it most.

What to Do — And What to Watch for in 2026

For job seekers, navigating this market requires adaptation. Traditional tech roles may be shrinking, but adjacent paths like AI operations, data governance, cybersecurity, or tech-enabled roles in non-tech industries continue to see healthier demand. In light of regional variations, there may also be an incentive in relocating to smaller metro areas and emerging tech regions that show strong labor-market momentum.

Meanwhile, for employers, the challenge primarily lies in talent management. Companies can’t simply cut their way to long-term competitiveness. Rebuilding healthy talent pipelines will require renewed investment in training, upskilling, and thoughtful role design.

Overall, Indeed’s 2026 scenarios suggest relative stability ahead. U.S. job openings may settle between 6.8 million and 7.4 million, and unemployment may tick up only modestly.

But for tech in particular, the outlook is more cautious. Without meaningful hiring momentum, stagnation may be the highest risk, urging companies to rethink their talent strategy and redefine what “entry-level” means in the age of AI.