U.S. Tech Jobs Could See Growth in Q1 2026, Toptal Data Suggests

2025 Was A Brutal Year for Tech Hiring

For most tech workers, 2025 was marked by an undeniable slowdown. Amid multiple layoffs and hiring freezes, interview processes stretched out and job postings thinned across roles. And as previously covered in a year-end tech jobs report, even as AI investment surged, overall tech job listings declined sharply, creating a disconnect between innovation headlines and hiring reality.

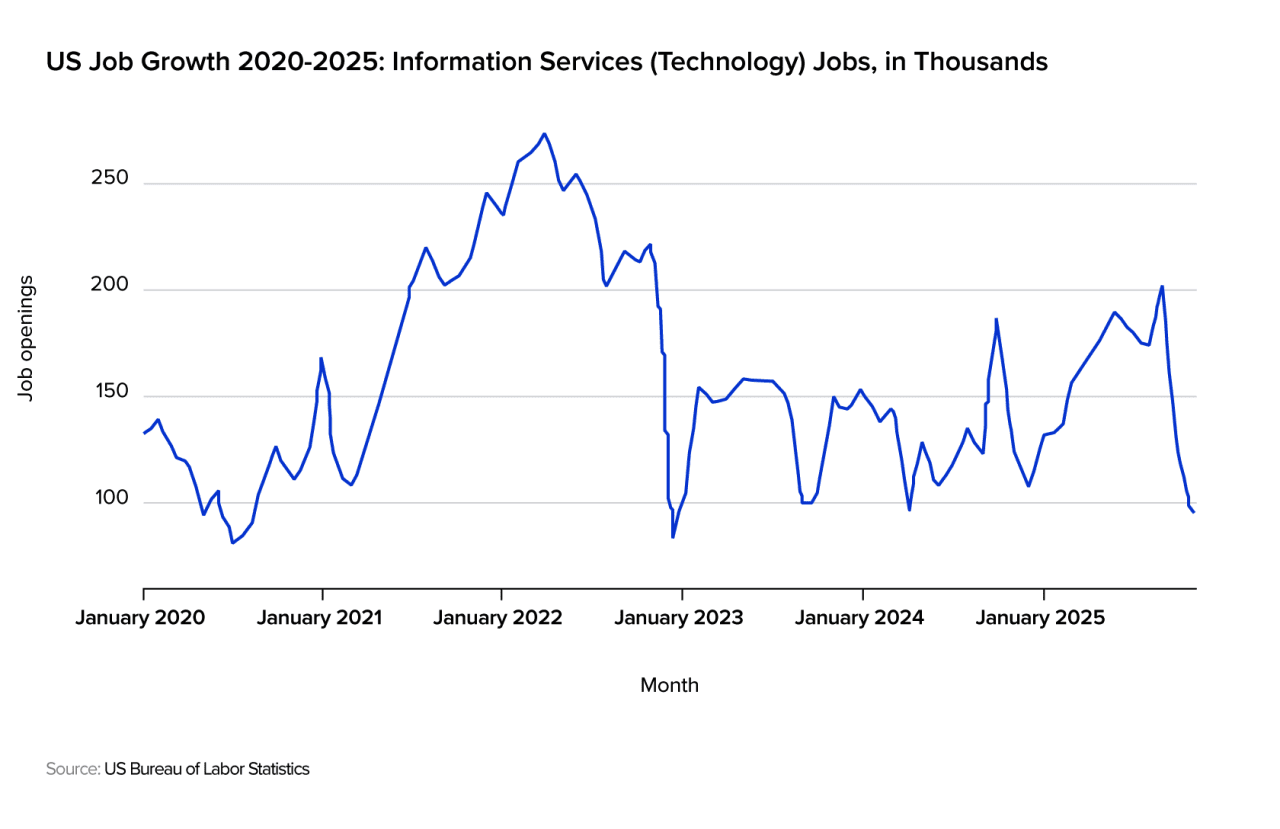

Several forces were responsible for this trend, from corrections to the post-pandemic overhiring and companies’ cost control strategies powered by AI to broader economic factors like higher interest rates. U.S. Bureau of Labor Statistics data reflected that pressure, showing slower growth across tech and professional services through 2024 and into 2025.

But despite how it’s felt, tech hiring hasn’t collapsed evenly across the board. And new data suggests something may be shifting.

What The Q1 2026 Forecast Says

A recent forecast that draws on Toptal marketplace data suggests that U.S. white-collar and tech hiring may strengthen in Q1 2026. That wording matters. “Strengthen” doesn’t mean a return to 2021-style hiring sprees, and points instead to stabilization: more job postings, fewer outright freezes, and selective hiring restarting after a long pause.

According to the report, while tech job growth has declined by about 21% over the last few years as per BLS data, there may be a significant turnaround as jobs are expected to increase slightly this quarter.

Furthermore, companies that move beyond AI experimentation also appear more willing to open roles, particularly contract, remote, and project-based positions, after an extended period of caution.

Still, this forecast is not a guarantee and only provides directional data. Any rebound is expected to be modest. But after multiple years of contraction, even stabilization would mark a meaningful change in momentum.

Why Remote and Flexible Roles May Lead the Recovery

One of the clearest signals in the data is where hiring is holding up best: remote and flexible tech roles. Even as return-to-office mandates dominate headlines, remote job postings have proven more resilient than fully on-site roles.

While it may seem like a contradiction, it’s a workforce strategy. Companies can access wider talent pools, control costs, and hire precisely without expanding office footprints. Remote hiring also allows firms to test demand and productivity before committing to full-time headcount growth.

From the worker side, flexibility remains a top priority. Even when candidates accept hybrid or on-site roles, remote options often carry disproportionate negotiating power. The result is a quiet split, where loud RTO policies are paired with quieter, more careful remote hiring behind the scenes.

If tech hiring recovers anywhere first, it’s likely in roles that are both specialized, location-flexible, and where output matters more than presence.

Which Tech Roles Are Most Likely to Benefit

Not all tech roles will rebound equally. The strongest signals continue to cluster around positions with direct business impact and hard-to-replace skill sets.

Senior and specialized software engineers remain in demand, especially those working on revenue-critical systems. Data scientists and analysts stand out as well. As previously noted in another job report by Indeed, data roles have held up better than many other tech titles even during the downturn. Their value is easier to justify when insights directly influence pricing, growth, or efficiency.

AI and machine learning engineers are another clear beneficiary, driven by sustained investment pressure. Companies may slow hiring broadly, but few are backing away from AI roadmaps. Cloud and infrastructure roles also remain essential, particularly as firms optimize and modernize systems rather than expand them.

What these roles share is specialization. A previous analysis of in-demand tech jobs notes that generalist profiles are being squeezed, while focused, applied skill sets travel better across teams and companies. BLS occupational outlooks mirror this, showing above-average long-term growth for many of these roles, even after the recent contraction.

One important caveat, however, is that entry-level hiring may lag. Even if demand improves, companies are likely to prioritize experienced hires who can contribute quickly.

What This Means for Tech Workers in 2026

For tech workers watching the market closely, these signals are optimistic, but don’t necessarily mean that the job market has is completely “back.” If a recovery comes, it will be uneven and selective. Flexibility, specialization, and demonstrable impact matter more than sheer volume of openings.

At this point, positioning oneself carefully continues to matter. Remote-friendly companies are likely to move first, but hiring bars will remain high. Metrics, selectivity, and proof of value won’t disappear just because postings tick upward.

In other words, a modest rebound doesn’t erase the structural changes tech has gone through. But it may signal the end of pure contraction, and the beginning of a more targeted, skills-driven hiring phase.