Revolut Interview Questions & Process Guide for 2025

Introduction

Revolut is a global fintech powerhouse redefining the way people manage money. Known for its all-in-one financial super-app, the company offers everything from international payments to crypto trading—all at lightning speed. Its meteoric rise has attracted talent worldwide, making it one of the most competitive companies to join. If you’re preparing for an interview here, understanding the Revolut interview process is just as important as studying common Revolut interview questions. This guide gives you both: a full breakdown of what to expect in each stage of the hiring funnel, plus a curated list of questions by function and level. Whether you’re applying as a software engineer, data analyst, or product manager, we’ll also direct you to role-specific prep pages so you can dive deeper with confidence.

Why Work at Revolut?

One reason why work at Revolut is: few companies offer this level of career acceleration. The remote-first policy gives you flexibility without sacrificing impact. The hyper-growth environment sharpens your problem-solving skills fast. And with equity plus rapid promotion cycles, your upside grows with the company.

What’s Revolut’s Interview Process Like?

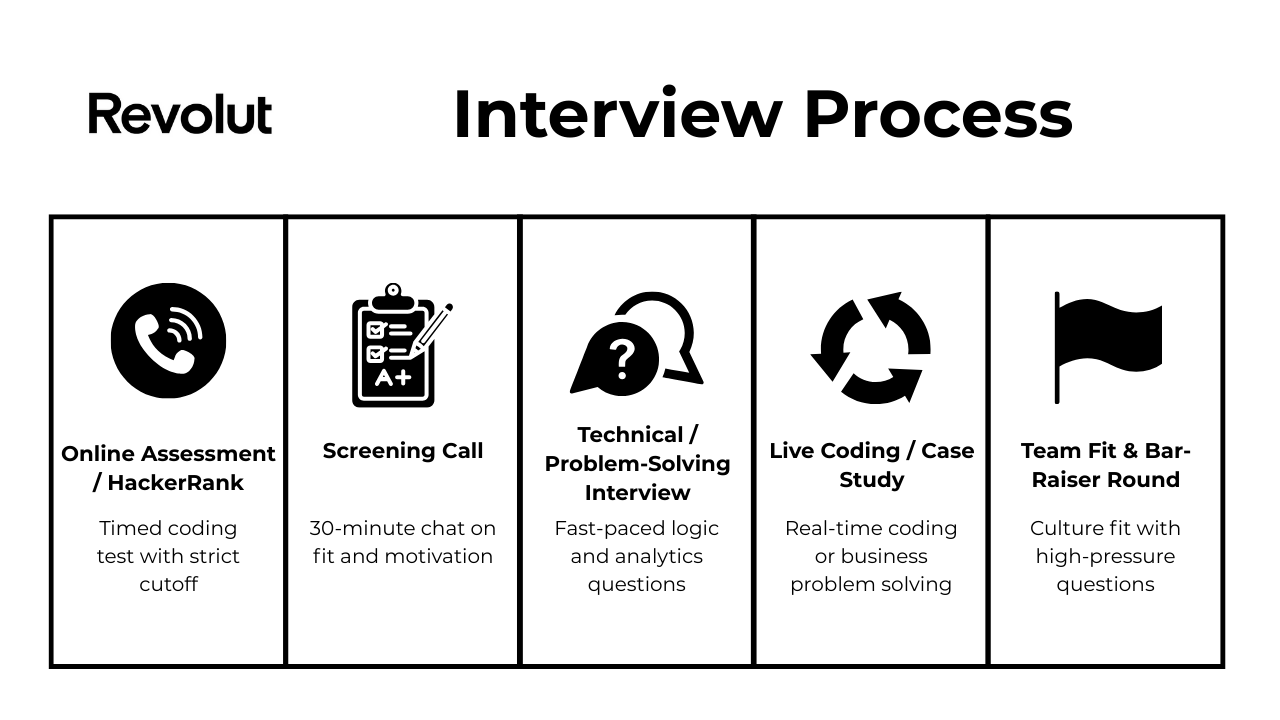

Here’s a quick-look timeline of the typical Revolut hiring journey:

- Online Assessment / HackerRank

- Screening Call

- Technical / Problem-Solving Interview

- Live Coding / Case Study

- Team Fit & Bar-Raiser Round

Online Assessment / HackerRank

The Revolut HackerRank test is the first hurdle for most technical roles. Candidates receive a timed Revolut online assessment, typically administered via HackerRank, focusing on data structures, algorithms, and sometimes SQL or math puzzles. The Revolut HackerRank usually includes 2–4 questions and is designed to filter out applicants below a strict performance threshold. There’s often a hard cutoff score to move forward. Some roles may also include logic-based brainteasers or role-specific coding challenges.

Screening Call

The Revolut screening interview is a 20–30 minute chat, typically conducted by a recruiter. Expect high-level Revolut screening call questions covering your background, role motivation, and basic eligibility. Common Revolut screening interview questions include “Why Revolut?” or “Tell me about a time you worked under pressure.” A screen call interview with Revolut also gauges communication clarity and initial culture fit.

Technical / Problem-Solving Interview

The Revolut technical interview dives deeper into your functional capabilities. Depending on your role, you might face algorithm problems, case-based business questions, or SQL analytics challenges. The Revolut problem solving interview is designed to test logical reasoning, resilience under pressure, and clarity of thinking. Typical Revolut problem-solving interview questions include end-to-end product analytics cases or architecture trade-offs. A problem-solving interview, Revolut style, leans heavily on speed and pragmatism.

Live Coding / Case Study

The Revolut live challenge interview often includes hands-on problem-solving in real time. Some roles use a Revolut case study interview format instead—especially product or data-focused positions. You might debug, build a feature, or reason through a growth strategy. Whiteboard-style formats are rare; Revolut prefers real-time collaboration in IDEs. Evaluation is based on clarity, correctness, and how you think out loud.

Team Fit & Bar-Raiser Round

The Revolut team fit interview focuses on ownership, pace, and product obsession. Common Revolut team fit interview questions revolve around decision-making, conflict resolution, and adaptability. Expect sharp follow-ups and high expectations. The Revolut culture fit interview is part values check, part stress test. In this Revolut bar raiser interview, the final interviewer assesses whether you’d raise the team’s overall bar.

Most Common Revolut Interview Questions

Role-Specific Interview Guides

For in-depth question banks tailored to the role, check out our comprehensive guides:

- Revolut Software Engineer Guide

- Revolut Product Manager Guide

- Revolut Data Analyst Guide

- Revolut Data Scientist Guide

- Revolut Data Analyst Interview Questions

- Revolut Growth Marketing Analyst Interview Questions

Problem-Solving & Case Study Questions

The Revolut problem-solving interview and Revolut case study interview are designed to test how you think under pressure, break down complex scenarios, and drive toward action.

1. Evaluate the effectiveness of a 50% rider discount

Begin by clarifying the goal: acquisition, retention, or frequency. Segment users to see who redeemed the discount and how their behavior changed post-promotion. Consider cost vs. lift in lifetime value. Revolut uses similar promotions in its growth experiments, so this case tests business intuition.

2. Calculate the average lifetime value for a SaaS company

Frame LTV by multiplying ARPU, retention, and gross margin over time. Use cohort analysis to observe decay patterns and test retention assumptions. This is a classic framework interview for roles in growth, biz ops, or product analytics.

3. Analyze the performance of a new LinkedIn feature

Start by identifying core metrics like usage frequency, conversion, and downstream impact. Segment results by user type to uncover heterogeneous effects. This type of case reflects how Revolut would test a new in-app flow.

4. Identify reasons and metrics for decreasing average comment volume

Build a funnel: % of users who saw content, engaged, and commented. Break down by device, feature changes, or campaign cycles. This problem aligns with how Revolut might debug engagement drops in a new product vertical.

5. How would you prioritize launching Revolut’s Metal Card in a new market?

Structure your approach using TAM, CAC, LTV, and regulatory risk. Identify leading indicators from existing markets and run a phased test rollout. This case reflects the kind of first-principles thinking expected in Revolut’s strategy team.

6. Revolut’s new ID verification step increased drop-off—what’s your diagnosis plan?

Propose a step-by-step funnel analysis. Isolate user attributes, device types, and times to completion. Suggest experiments to A/B test alternate flows and recovery nudges.

7. What metrics would you track after launching a budgeting tool inside the Revolut app?

Think activation (first use), retention (7-day, 30-day), and success (money moved, budgets set). Pair behavioral data with satisfaction scores to spot blind spots. Prioritizing actionable metrics is key in the Revolut case study interview.

Skills & Technical Depth Questions

The Revolut skills interview—sometimes referred to as the skills interview Revolut or part of the Revolut criteria assessment—is a core component of the Revolut technical interview loop. These questions measure hands-on ability across coding, SQL, data cleaning, and product sense, depending on the role.

8. Select the top 3 departments with at least ten employees by average salary

Use GROUP BY, HAVING, and window functions like DENSE_RANK() to calculate top average salaries per department. Pay attention to filtering departments based on headcount. This is the type of SQL problem Revolut uses to assess aggregation and ranking logic.

9. Calculate the first touch attribution channel in a user conversion funnel

Build out logic using ROW_NUMBER() or MIN(timestamp) partitioned by user ID. Tie the first event to eventual conversions across sessions. This mirrors real-world SQL used in Revolut’s growth and performance marketing teams.

10. Group a list of sequential timestamps into weekly lists starting from the first timestamp

Tackle this with date arithmetic and custom windowing in Python. Handle edge cases like gaps in data and week boundary alignment. Time series grouping is common in analytics at Revolut—especially for user behavior modeling.

11. Find all bigrams from a given sentence

Loop through the sentence tokens and return adjacent word pairs. This tests basic Python fluency, and variants show up in NLP and chatbot-related analytics questions at Revolut.

12. Write a SQL query to identify Revolut users with suspiciously fast onboarding times.

Use conditional filtering and timestamp differences between steps. Pair it with a percentile benchmark or z-score to define “fast.” Revolut’s fraud and compliance teams often screen candidates for anomaly detection logic.

13. Build a Python script that normalizes nested JSON data into flat CSVs.

Use pandas.json_normalize() or recursive parsing if needed. Handle nulls, missing keys, and array fields carefully. This is a typical data cleaning task from Revolut’s backend or analytics pipelines.

14. What KPIs would you prioritize when analyzing Revolut’s savings vault feature?

Look at deposit frequency, average balance, re-engagement after withdrawals, and churn rates. Bonus if you segment by income group or user tenure. This combines product sense with SQL-ready metrics—a perfect fit for the Revolut criteria assessment.

Screening Call & Behavioral Questions

Your Revolut interview experience begins with a recruiter screen focused on Revolut screening call questions, but behavioral themes continue across every round of the Revolut interview. These questions assess how well you align with Revolut’s core values, from ownership and speed to data-driven thinking.

15. Tell me about a time you took initiative without being asked.

Walk through the context, action, and measurable result. Revolut prizes ownership—highlight how you anticipated a need, acted quickly, and delivered impact.

16. Describe a time you had to make a decision with incomplete data.

Frame your approach using assumptions, proxies, and risk mitigation. Revolut often operates in ambiguous, high-speed environments—this question tests decision-making under uncertainty.

17. Tell me about a situation where you disagreed with your manager or team. How did you resolve it?

Demonstrate strong opinions, loosely held. Revolut values collaborative tension when paired with data and pragmatism. Focus on how you moved the conversation forward constructively.

18. Describe a project where you failed to meet expectations. What did you learn?

Revolut’s culture expects radical ownership and fast iteration. A strong answer shows accountability, the ability to rebound quickly, and lessons applied in the next round.

19. How do you manage multiple high-priority deadlines under pressure?

Break this down into triaging techniques, stakeholder alignment, and communication cadence. Revolut expects execution at speed—structure here matters more than story alone.

20. Tell me about a time you built something faster than expected. What enabled the speed?

Focus on tools, shortcuts, or team alignment that accelerated delivery. Revolut rewards pace, so highlight how you maintained quality while moving quickly.

21. Why do you want to work at Revolut, and how do you align with our values?

Go beyond generic fintech admiration. Tie your answer to Revolut’s mission, speed, and product obsession. The best answers reflect how you already work like a Revoluter.

Tips When Preparing for a Revolut Interview

When you’re deciding how to prepare for a Revolut interview, structure and speed matter. Here are five sharp strategies tailored to Revolut’s hyper-growth hiring style:

Simulate the Revolut assessment test under pressure

Practice timed HackerRank sessions using past algorithm and SQL questions to mirror the difficulty, pace, and cutoff logic of the actual Revolut assessment test.

Rehearse with Pacing and Precision

Revolut moves fast, and so should your answers. Practice answering common Revolut interview stage questions and behavioral prompts in under two minutes—clear setup, decisive action, and sharp results.

Embrace the Ownership Culture

Revolut hires for bias-to-action. Prepare STAR stories that show how you identified a problem, took initiative, and delivered impact without waiting for permission. Prepare 5–6 stories that show you solving problems across product, data, and operations.

Know the Product Cold

Spend time using Revolut’s app and reading their blog. Be ready to discuss a feature you’d improve and how. Understanding Revolut’s product roadmap and user base helps you stand out in every round.

Practice concise storytelling

Keep STAR responses under two minutes and emphasize quantifiable outcomes, especially when prepping for bar-raiser and team-fit interviews. Use mock interviews to prepare and get constructive feedback.

Salaries at Revolut

Average Base Salary

Average Total Compensation

Conclusion

Revolut’s interview process is fast-paced, rigorous, and designed to test both skill and ownership mindset. From the initial Revolut assessment test to final team-fit rounds, preparation means more than memorizing answers—it means thinking like a Revoluter. Focus on speed, structure, and impact in every response.

Ready for prep? Bookmark this guide so you can revisit.

Want to dive deeper? Check out the Revolut Data Scientist guide and Product Manager guide for tailored interview questions built for your exact path!

FAQs

What does the Revolut recruitment process look like end-to-end?

The Revolut recruitment process typically begins with an application review, followed by an online assessment, screening call, and one or more technical or case interviews. It wraps up with a bar-raiser or final culture-fit round. Each stage is fast-paced, and candidates are expected to demonstrate both domain skill and ownership mentality from start to finish.

Will there be a background check?

Yes, the Revolut background check is part of the final onboarding process. This usually includes verification of your employment history, education, and legal right to work.

How many interview stages should I expect at Revolut?

You can typically expect 4–5 Revolut interview stages, depending on the role. This includes:

- Online assessment

- Screening call

- Technical/problem-solving interview(s)

- Live challenge or case study

- Team-fit or bar-raiser round

Some roles may combine or skip steps based on urgency or experience level.

Is there an assessment test after the screening call?

Not usually. The Revolut assessment test—often a timed HackerRank or logic challenge—usually comes before the screening call. However, some roles may include additional take-home tasks or business cases later in the process.

How competitive is the bar-raiser round?

The Revolut bar raiser interview is highly selective and often the deciding factor. It’s not just about competence. It’s about whether you raise the overall bar for the team. Interviewers assess long-term value, cultural alignment, and whether you demonstrate Revolut’s values at a consistently high level.