Jane Street Strategy & Product Interview Guide (2025)

Introduction

Jane Street is a global trading firm known for blending quantitative research with cutting-edge technology to navigate complex financial markets. While long recognized for its strength in trading and engineering, the firm has been expanding its strategy and product teams to meet the growing need for structured decision-making and scalable internal tools.

According to recent industry research from Sanderson PLC and Infotrust, financial services firms are increasingly investing in advanced analytics, AI integration, and decision-support systems, which is fueling demand for strategy analysts and product managers who can translate complex data into actionable insights. In this environment, Jane Street’s strategy and product professionals work closely with traders, engineers, and researchers to refine processes, shape new initiatives, and ensure that ideas turn into measurable impact.

In this blog, we’ll walk through the responsibilities of these roles, the firm’s collaborative culture, and the interview process, while sharing tips to help you prepare and succeed. Keep reading to see how to position yourself for these opportunities.

Role Overview & Culture

Strategy and product positions sit at the crossroads of trading, engineering, and research, giving candidates the chance to shape systems and tools that directly influence market outcomes.

Day-to-Day Responsibilities

- Shape the direction of trading systems and internal tools through research, data modeling, and roadmap planning.

- Collaborate with traders to refine signals and analyze pricing inefficiencies.

- Conduct rigorous market research to identify opportunities and inform product direction.

- Brainstorm new product features or strategies in response to evolving market conditions.

Culture

- Intensely data-driven environment where quantitative reasoning guides decisions.

- Flat structure with minimal hierarchy; ideas matter more than titles.

- Fast-paced iteration cycles with constant testing and refinement.

Team Setting

- Small, integrated teams with traders, engineers, quants, and strategists working side by side.

- Tight feedback loops that encourage rapid learning and adjustment.

- High visibility of individual contributions across projects.

Expectations

- Strong quantitative thinking and analytical rigor.

- Ability to work across disciplines and adapt to evolving conditions.

- Ownership of decisions and outcomes, not just tasks.

Unique Perks

- Direct impact on real-time trading performance and firm strategy.

- Exposure to both technical and business-side problem solving.

- Opportunities to work on cutting-edge internal tools that blend finance, tech, and strategy.

Why This Role at Jane Street?

What sets this role apart is the scope and speed of impact you can make. From day one, you’re trusted to explore new markets or products with real financial implications, supported by robust systems and mentorship. Compensation reflects the firm’s emphasis on shared success and includes a generous base salary, profit-sharing, and a flat bonus structure. Perhaps most compelling is the unparalleled exposure to both technical and strategic functions—you’re not just advising on a product, you’re helping build it with the team that trades it.

If you’re energized by intellectual challenges, real-time feedback, and market complexity, this position offers a unique intersection of those elements. Let’s take a closer look at how the Jane Street strategy and product interview questions reveal what it takes to thrive in this role.

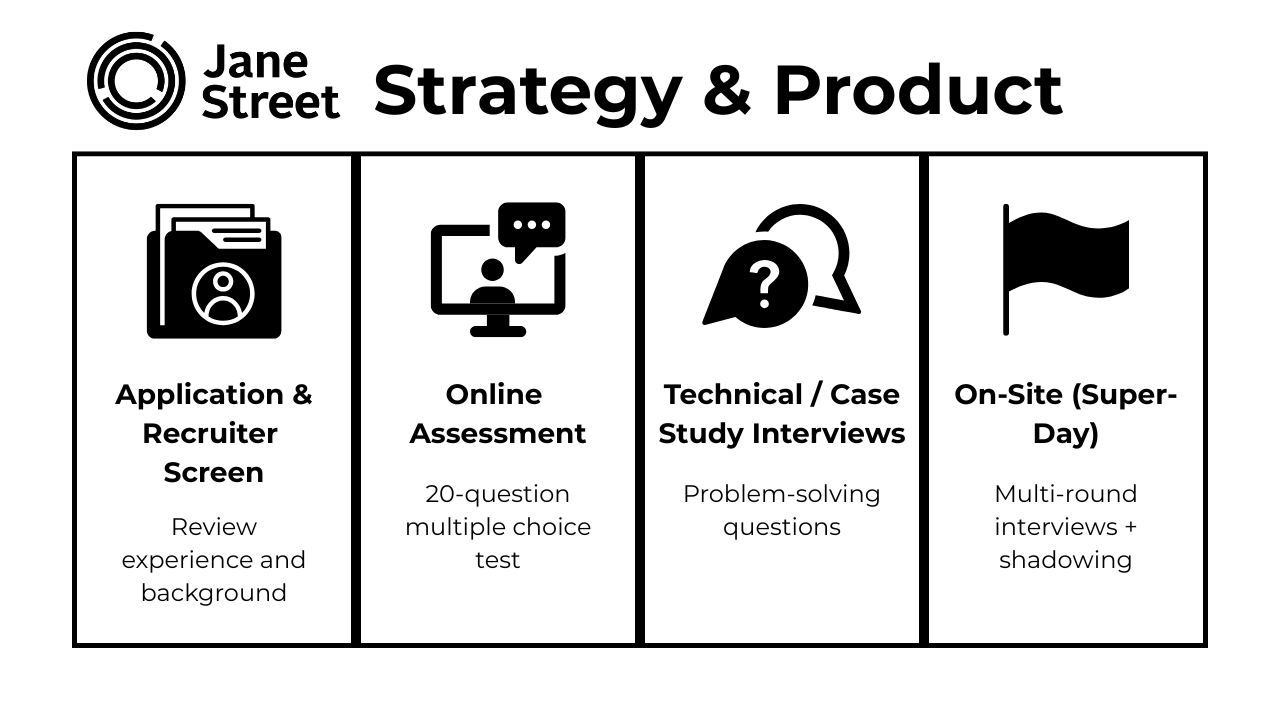

What Is the Interview Process Like for a Strategy & Product Role at Jane Street?

Overview of the Interview Process

Jane Street’s hiring process for the strategy & product role is as structured as it is selective. Candidates are evaluated not just on raw intellect, but also on how clearly they think under pressure, how they communicate in ambiguity, and how rigorously they reason with limited data. The process moves quickly, with tight feedback loops and increasingly complex assessments at each stage.

If you’re applying, expect to encounter fast-paced conversations, high mental math standards, and real-world trading cases. Every stage is designed to mimic the types of decisions you’d be making on the job—collaborative, time-sensitive, and data-heavy.

Application & Recruiter Screen

This first step evaluates fit at a high level. Recruiters look for a strong analytical background—often math, computer science, physics, or economics, as well as signs of curiosity about markets and decision-making frameworks. Prior trading experience isn’t required, but applicants should be comfortable thinking in terms of probabilities and trade-offs. Communication is also key: how clearly you explain your thought process is often weighed as heavily as the outcome itself.

Tips:

- Highlight coursework or projects that showcase analytical rigor (probability, data modeling, optimization).

- Be prepared to explain why Jane Street and what excites you about decision-making in uncertain environments.

- Practice concise answers to résumé questions—clarity and structure matter as much as content.

Strategy & Product Online Assessment

The Jane Street strategy and product online assessment is often cited by candidates as one of the most challenging but rewarding parts of the process. It’s a 20-question multiple-choice test, typically timed to last under an hour. The questions cover mental math, probability, expected value, combinatorics, and game theory. You’ll need to make fast but accurate calculations—no calculators allowed—and often under shifting constraints or rules. Many candidates report practicing on GRE quant sections, estimation games, and mental math drills to prepare.

Tips:

- Sharpen mental math speed: Practice quick calculations (percentages, ratios, approximations) without paper or calculator.

- Practice expected value problems: Work through simple EV calculations with dice, cards, or coin toss scenarios.

- Simulate timed practice: Use GRE quant or mental math drills under strict time limits to build endurance.

Technical/Case Study Interviews

If you pass the assessment, the next stage is live technical interviews. These sessions go beyond pure math: you’ll tackle market design problems, evaluate hypothetical product decisions, and walk through data-limited cases like pricing anomalies or latency trade-offs. These scenarios aren’t abstract, they closely resemble the types of decisions that shape Jane Street’s core product: internal trading strategies and systems.

For example, a latency trade-off problem might mirror a real choice about optimizing execution speed, while a pricing anomaly case could reflect how Jane Street assesses risk and opportunity in fragmented markets. Interviewers often ask you to explain assumptions and revise solutions on the fly. Expect to be challenged, redirected, and pushed to clarify your reasoning. These interviews mirror the kind of collaborative, high-stakes decision-making that defines Jane Street’s product development process.

Tips:

- Train with mental math drills (speed addition, multiplication, approximations).

- Practice probability puzzles (Monty Hall, urn problems, dice rolls).

- Work under strict time limits to simulate the real assessment—speed matters.

- Focus on estimation and elimination strategies when exact calculation is too slow.

On‑Site (Super‑Day)

Candidates who make it through the earlier rounds are invited to an on-site “super-day,” which includes 4–6 interviews, trader shadowing, and a casual lunch with the team. Each conversation digs deeper into specific competencies—some are case deep-dives, others test culture fit, communication, or learning mindset.

- Breaking down ambiguity and trade-offs

For the product strategy role in particular, the emphasis is on how well you can break down ambiguous problems, weigh trade-offs in a real-time, high-stakes environment, and translate strategic thinking into concrete proposals for trading systems or new market approaches. You’ll be expected to think like a generalist,—understanding the trader’s objectives, the engineer’s constraints, and the broader market structure,—all while prioritizing which ideas are worth pursuing and which introduce unnecessary risk or complexity.

- Validating ideas and exercising judgment

Some interviews will press you on how you’d validate a new trading idea, structure a pricing model, or design a feedback loop to monitor product performance post-deployment. This role demands not only quantitative fluency and product sense, but also strong judgment about when to move fast, when to experiment, and when to hold back. Candidates consistently mention how thoughtful and rigorous the interviewers are, with a focus on clarity, curiosity, and intellectual humility.

Tips:

- Practice case-style thinking: clearly state assumptions, propose a model, test it, and refine.

- When faced with a trade-off, quantify the cost/benefit rather than giving vague answers.

- Don’t panic if redirected—show adaptability and collaborative reasoning.

- Review examples of latency vs accuracy, or risk vs reward in decision-making systems.

What Questions Are Asked in a Jane Street Strategy & Product Interview?

Jane Street strategy and product interview questions are designed to assess far more than just mental math or logic—they reveal how you reason through uncertainty, communicate trade-offs, and collaborate across technical and trading teams.

Expect a mix of quantitative puzzles, product design prompts, and behavioral deep-dives. Each question simulates a real-world scenario you might face on the job, from launching a new market-making strategy to refining internal tools for trader workflows. What matters most is not just the answer you give, but how you structure your thinking, update your beliefs, and explain your reasoning under pressure.

Quantitative & Market‑Logic Questions

These questions test your ability to make decisions in probabilistic environments and evaluate market opportunities. You might be asked something like:

“Estimate the expected value of a new derivatives product traded over-the-counter.”

The goal isn’t a perfect number—it’s to see how you break the problem into components, ask clarifying questions, and define assumptions. For instance, you might start by identifying the payoff structure, modeling potential market conditions, and assigning probabilities to outcomes. It helps to think aloud, flag uncertainties, and revise assumptions as new information emerges. Questions often require mental math, expected value calculations, and insight into concepts like liquidity, volatility, and pricing risk.

Tip: Practice with Fermi problems, game theory setups, and basic derivatives logic. Interviewers care as much about your framework as your final number.

Estimate the expected value of a new derivatives product

Start by clarifying what kind of derivative is being evaluated:option, future, or swap,and ask for assumptions such as volatility or time to maturity. Then walk through expected value calculations using risk-neutral pricing or basic probability. If data is sparse, propose a Monte Carlo simulation or decision tree for clarity. This tests your grasp of both financial intuition and probabilistic modeling.

How to Stand Out: Balance rigor with practicality—explain your back-of-the-envelope assumptions, then show how you’d refine the model with simulations or more robust methods in production.

Model the outcome of a pricing decision when a competitor changes their offering

Begin by identifying key variables: price elasticity, customer churn rate, and market segmentation. Use game theory concepts like Nash equilibrium to think through competitor-customer reactions. Discuss scenarios where aggressive pricing could backfire or lead to a price war. This question reveals your ability to balance strategic and quantitative thinking under uncertainty.

How to Stand Out: Go beyond static models—illustrate how you’d simulate multi-period reactions and feedback loops, such as customer switching costs or delayed competitor responses.

How would you assess the liquidity impact of adding a new ETF to the market?

Outline the factors influencing liquidity: bid-ask spreads, trading volume, and underlying asset correlation. Consider how arbitrage between ETF and NAV plays a role, and suggest metrics like Amihud’s illiquidity ratio. Incorporate how investor demand, index tracking, and market maker behavior can amplify or dampen liquidity effects. This tests your understanding of market microstructure and product design.

How to Stand Out: Connect micro-level metrics like spreads and volume with macro-level drivers such as regulation or institutional adoption to demonstrate holistic market insight.

Estimate the number of active crypto traders in the U.S.

Use top-down reasoning, starting with the total U.S. population and filtering by internet access, age, and likely interest in trading. Use proxies like Coinbase account numbers, Reddit forum traffic, or Google Trends to justify assumptions. Be explicit about assumptions and walk through the math clearly. This question highlights your comfort with ambiguous estimation and external data sourcing.

How to Stand Out: Present a range (conservative vs optimistic) instead of one number, and explain which assumptions drive the variance—showing you’re comfortable with uncertainty and sensitivity analysis.

Design a simple pricing algorithm for an auction‑based product launch

Clarify the auction format: English, Dutch, Vickrey, etc., and specify the number of bidders. Propose a dynamic pricing rule that adjusts based on bid frequency, competitor moves, or reserve price triggers. Consider implementation constraints such as latency, data lag, or strategic bidder behavior. This tests your fluency in economic modeling and market incentives.

How to Stand Out: Go beyond the rules—discuss how you’d simulate bidder behavior and stress-test the algorithm before launch to anticipate edge cases.

How would you analyze the performance of a new trading strategy during volatile market conditions?

Discuss defining benchmarks: Sharpe ratio, drawdown, P&L attribution. Walk through segmenting the analysis by volatility regimes or using stress tests. Consider how to factor in slippage, liquidity constraints, and execution latency. The question tests both your statistical robustness and real‑world market realism.

How to Stand Out: Show that you’d measure both risk-adjusted performance and operational resilience. Use examples like flash-crash simulations or liquidity drought scenarios to prove foresight beyond standard metrics.

Product & User Impact Questions

These questions explore your product sense and ability to optimize decision-making tools for internal users, who are usually traders or researchers. For example:

“Design a dashboard for traders to monitor intraday risk across multiple desks.”

You’ll be evaluated on how you prioritize features, manage complexity, and define success metrics. A strong response starts with identifying the user’s goals—What risks are they watching? How often do they need to act?—and then proposes clear, actionable displays (e.g., live P&L variance, order book shifts, or tail-event flags). Expect follow-ups like “How would this scale to global markets?” or “How would you validate if this dashboard is improving performance?”

Tip: Read up on real-time decision tools, and be ready to explain trade-offs between flexibility, latency, and usability.

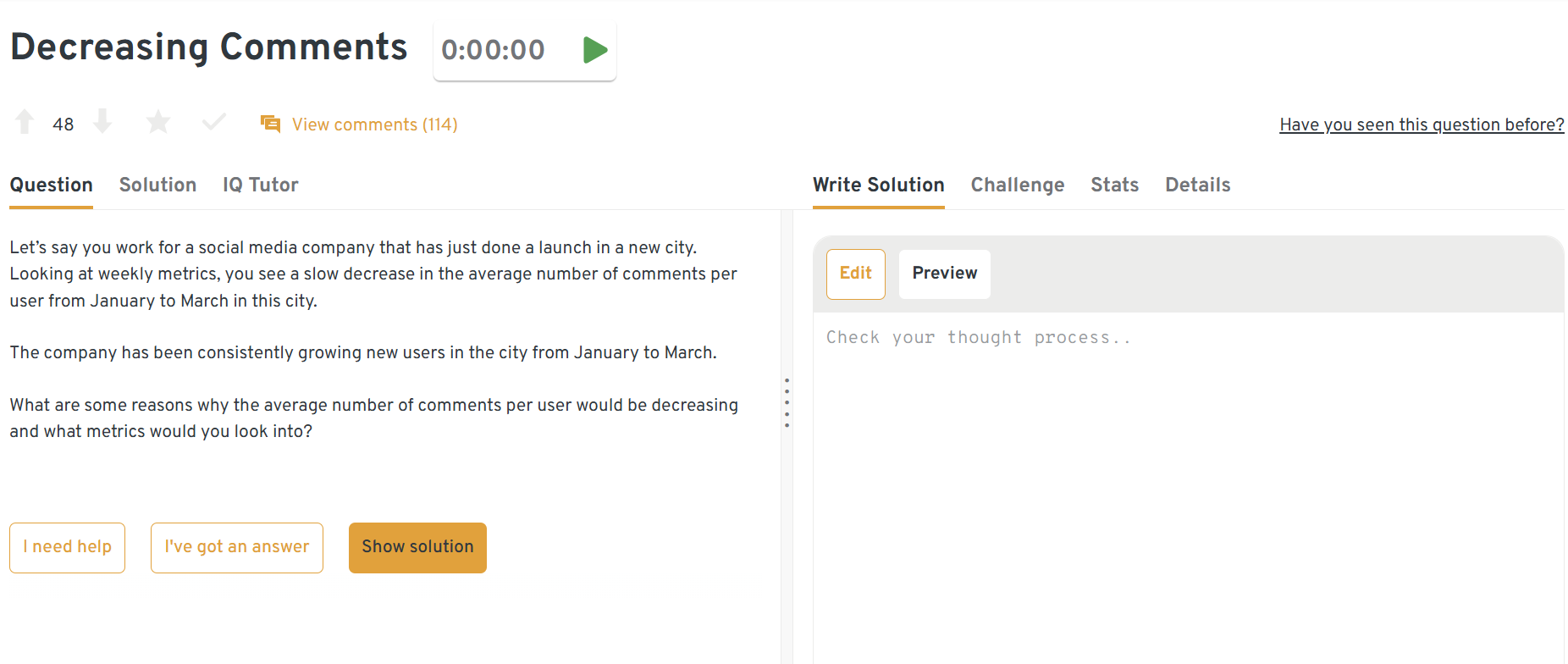

Identify reasons and metrics for decreasing average comments on posts

Here’s your question dashboard for practice. Start writing your answer in the editor on the right, and if you get stuck, just click “I need help” for step-by-step hints. If you have questions about the problem itself, your approach, or even your code, head over to the IQ Tutor tab and enter your questions and get real-time guidance to keep moving forward.

Start by examining engagement metrics such as active users, session frequency, and post reach. Segment by user cohorts or content type to identify whether the drop is broad or localized. Correlate declines with product changes, seasonality, or external factors. This question reflects how to connect user behavior to business impact.

Tips:

- Always start with metrics: DAU, posts created, comment rate per post.

- Segment by user cohort, geography, device, and content type.

- Investigate product changes, external seasonality, or competitor shifts.

- Tie findings back to business impact: are users less engaged overall, or just commenting less?

Identify potential biases in Jetco’s boarding times data

Consider how sampling bias or data collection methods might affect boarding time measurements. Analyze whether external factors like gate location, passenger demographics, or reporting delays are skewing results. Propose adjustments such as stratified sampling or normalization. This tests your ability to critique and validate operational metrics.

Tips:

- Think about sampling bias: are certain gates, times, or routes overrepresented?

- Consider operational factors: staff differences, aircraft type, or passenger demographics.

- Suggest fixes like stratified sampling or normalization to adjust comparisons.

- Show awareness that data collection design can create hidden bias.

Determine metrics to assess Mentions app health via celebrity activity

Track engagement indicators such as posts, comments, and follower interactions tied to celebrity accounts. Compare these metrics against baseline user activity to quantify celebrity influence. Establish leading indicators like retention of fans or network growth. This question emphasizes linking niche behaviors to overall product vitality.

Tips:

- Track direct activity: number of posts, comments, likes by celebrity accounts.

- Measure indirect influence: fan retention, follower growth, secondary engagement.

- Compare to baseline activity to see how much celebrities drive platform health.

- Stress leading vs. lagging indicators: early fan retention may predict long-term network growth.

Describe how to measure the success of Instagram TV

Define clear success metrics such as watch time, completion rate, and repeat viewership. Compare IGTV’s engagement to other video formats on the platform. Incorporate monetization metrics like ad revenue or creator payouts. This highlights balancing user engagement with revenue outcomes.

Tips:

- Define engagement metrics: watch time, completion rate, repeat sessions.

- Benchmark against other formats (Stories, Reels) for context.

- Add monetization metrics: ad revenue, creator earnings.

- Balance user vs. business outcomes: growth is only valuable if sustainable.

Evaluate flaws in the assumption that more insurance leads equal better performance

Assess lead quality by downstream conversion and customer lifetime value, not just volume. Highlight risks of incentivizing quantity over quality. Suggest alternative KPIs like cost per acquisition or churn-adjusted ROI. This question demonstrates critical thinking in product metrics design.

Tips:

- Call out lead quality: volume ≠ revenue. Focus on conversion rates and retention.

- Highlight risks of bad incentives: chasing cheap leads may inflate churn.

- Propose alternative KPIs: CPA, ROI, customer lifetime value.

- Demonstrate critical thinking in metric design—don’t just optimize quantity.

Write a query to compute and rank search results by average rating

Use SQL joins between search logs and ratings tables to compute aggregated scores. Apply ranking functions like

RANK()orDENSE_RANK()to order results. Filter out sparsely rated items to avoid skewed rankings. This evaluates the connection between analytics and user experience optimization.Tips:

- Practice joins between search logs and ratings.

- Use aggregate functions (

AVG) and ranking (RANK(),DENSE_RANK()). - Filter out low-volume items to avoid noisy averages.

- Explain how this ties to UX optimization—users trust rankings only if fair.

Determine whether optional location-sharing improves messaging engagement

Compare engagement metrics (messages sent, session duration) between cohorts who enabled vs. disabled location sharing. Control for confounding variables like user activity level or device type. Use statistical tests to verify if differences are significant. This reflects how analytics tie into assessing feature adoption and impact.

Tips:

- Use cohort analysis: compare sharers vs. non-sharers on message count, session length.

- Control for confounders: active users may also be more likely to enable sharing.

- Apply statistical tests (t-tests, regression) to validate significance.

- Frame results as feature ROI: adoption → engagement → retention.

Behavioral & Culture‑Fit Questions

Jane Street puts a high premium on collaboration, humility, and intellectual honesty. Behavioral questions are designed to test whether you’ll thrive in their flat, feedback-rich environment. Common prompts include: “Tell me about a time you took ownership of a decision with unclear data,”or “Describe a time you had to adjust your communication style across teams.”

They want to hear how you’ve navigated ambiguity, handled conflict, or admitted when you were wrong, and how that shaped the outcome. Responses that show self-awareness, curiosity, and openness to revision tend to resonate most. You’ll likely be asked to reflect on team dynamics, learning from failed projects, or how you structured a decision-making process.

Tell me about a time you disagreed with a teammate on a product or strategy decision. How did you handle it?

Frame it around a disagreement on prioritization, market assumptions, or trade-off analysis. Show how you listened to the other perspective, clarified assumptions, and aligned on the broader goal—whether through data analysis, small experiments, or scenario modeling. This tests your ability to collaborate across functions, especially in high-stakes, fast-moving environments like Jane Street.

Example:

“In a project to redesign an internal analytics dashboard, I wanted to prioritize latency reduction, while a teammate pushed for richer visualizations. Instead of debating opinions, I proposed running a quick pilot: one group tested a faster but simpler version, while another tested a feature-rich version. The pilot showed that traders valued speed far more. By focusing on shared goals and data, we resolved the disagreement quickly. I learned that aligning on measurable outcomes often makes trade-offs clearer.”

Describe a situation where you had to make a decision with incomplete data

Explain the tradeoff: what information was missing, and what the time pressure was. Walk through your reasoning, what assumptions you made, and how you planned for risks. Conclude with how the outcome played out and what you learned. This showcases how you operate under uncertainty—a constant in market-driven roles.

Example:

“During a market analysis project, we lacked full customer segmentation data but had a hard deadline. I built scenarios using proxies like regional volume and trading frequency, then flagged assumptions clearly to stakeholders. We designed contingency plans depending on which scenario proved closer to reality. The final decision aligned with our mid-case model and worked well, but more importantly, the team appreciated that I quantified uncertainty instead of freezing. It reinforced that speed with transparency can beat waiting for perfect data.”

What’s a mistake you made while working on a strategic or product-related project, and what did you learn from it?

Choose an example where your decision or communication misfired—perhaps overlooking a key stakeholder, misjudging trade-offs, or mis-prioritizing features. Focus on how you reflected, adjusted your framework for decision-making, and built safeguards to avoid repeating it. This demonstrates humility, adaptability, and the ability to learn from feedback loops, all of which Jane Street values.

Example:

“On one project, I pushed forward a roadmap without looping in engineering early enough. Midway, we realized technical debt made some features far harder to implement than I’d assumed, which delayed the rollout. I owned the oversight, re-scoped the roadmap with engineering, and introduced a new process where I always check technical feasibility upfront. The mistake taught me to integrate multiple perspectives earlier, which has since helped me avoid costly rework.”

How do you handle projects that involve long hours or ambiguous goals?

Highlight your approach to pacing, prioritization, and self-motivation. Share how you seek clarity through questions and break large, ambiguous problems into testable hypotheses. Mention how you manage team morale or coordination when things get hard. This reveals both grit and team awareness.

Example:

“In a strategy sprint with unclear deliverables, I broke the ambiguity down into testable hypotheses: what market we were targeting, what assumptions mattered most, and what metrics would define success. This gave the team concrete steps and deadlines, even though the end goal wasn’t fully defined. To manage morale, I suggested short daily check-ins and rotating late-night coverage instead of everyone staying late together. It kept energy levels sustainable while maintaining progress. I learned that structure and pacing are key to thriving under uncertainty.”

Describe how you’ve contributed to building a positive team culture

Offer specific actions like onboarding help, sharing knowledge, initiating retros, or improving workflows. Emphasize how your actions helped others feel heard, included, or more efficient. Back it with any feedback you received or outcomes you observed. This evaluates fit in Jane Street’s tight-knit, collaborative culture.

Example:

“On my last team, new analysts struggled with our data tools, which slowed onboarding. I created a short guide and offered weekly office hours to walk through common pitfalls. It reduced ramp-up time by weeks, and one new hire later told me it made them feel supported from day one. I also noticed retros were becoming perfunctory, so I suggested trying a ‘start-stop-continue’ format. Feedback improved, and the team adopted it permanently. These small actions reinforced that culture isn’t abstract—it’s built daily through habits.”

How to Prepare for a Strategy & Product Role at Jane Street

Preparation for Jane Street’s strategy and product interviews requires more than just studying formulas—it’s about training your judgment, refining how you explain ideas, and building confidence in ambiguity. Candidates who succeed often describe months of focused prep across mental math, market logic, and structured communication. Whether you come from a STEM, consulting, or trading background, your ability to reason quickly and collaborate clearly is what sets you apart. Here’s how to build the right habits and mindset before your interviews.

Refresh Probability & Game Theory

Master the core concepts

Brush up on foundational concepts like expected value, Bayes’ theorem, Nash equilibria, and dominant strategies. These aren’t abstract theory—they’re central to how Jane Street thinks about trading, product design, and strategic positioning. Practise under time pressure using mental-math drills: modular arithmetic, estimation, probability trees, and logic puzzles.

Turn theory into interview advantage

In the interview setting, these skills often appear in market-design or product trade-off questions—such as evaluating a new auction format, deciding how to price a novel instrument, or anticipating competitor reactions. Your ability to quickly quantify uncertainty, test scenarios, and articulate trade-offs makes your reasoning credible and structured.

Apply frameworks on the Jjob

In the role itself, these tools become even more critical. Strategy and product professionals at Jane Street work in fast-moving, high-stakes environments where incomplete data is the norm. Probability and game theory frameworks help you weigh competing priorities, update assumptions as market conditions change, and build strategies that balance risk and reward. Whether validating a new trading idea or designing an internal tool, showing you can reason rigorously under uncertainty will make you effective from day one.

Tips:

- In case-style practice, always state your assumptions explicitly. Transparency of thought matters as much as correctness.

- Utilize our statistics learning path to review some basics concepts then move to more challenging topics.

- For a deeper dive into product sense and structured reasoning, check this video for understanding product sense interview format and questions.

Dissect Real Trading Products

To succeed in Jane Street’s strategy and product interviews, you need more than abstract market interest—you need to speak the language of trading. Start by studying the structure and purpose of common instruments like options, futures, ETFs, and swaps. Understand how these products are priced, what risks they expose traders to, and how market makers manage those risks. Then dig into deeper mechanics:

- Bid-ask spread dynamics

- Order book structure and execution priority

- Latency arbitrage

- Dark-pool and off-exchange trading

- Inventory risk management

- Market microstructure theory

- Volatility surfaces and implied volatility

- How auction-based markets differ from continuous ones

These topics form the foundation for many interview scenarios—such as estimating a product’s value under constrained liquidity, or designing tooling for traders managing risk in fragmented markets. This prep is all about building the muscle to tackle unfamiliar problems quickly and confidently. At Jane Street, that means reasoning about how financial products work at a systems level, modeling them under uncertainty, and proposing product decisions that strike the right balance between trader needs, execution risk, and firm-wide priorities.

Tips:

- When you study options or futures, practice explaining how they’re priced and where risk comes from. For example, walk through how implied volatility shifts option premiums.

- For ETFs, be ready to discuss arbitrage between the ETF price and its NAV, and what that means for liquidity.

- With order books, try sketching out how execution priority works and how small changes in latency could change outcomes.

- For auction formats, compare how Dutch vs continuous markets affect both trader incentives and system design.

Mock the Online Assessment

Jane Street strategy and product online assessment is fast-paced and conceptually demanding—20 multiple-choice questions in under 60 minutes, covering probability, combinatorics, mental math, and logic puzzles. This stage is less about memorization and more about how you reason. Much like case interviews in consulting, success comes from quickly structuring unfamiliar problems, identifying key levers, and eliminating poor assumptions under time pressure.

Practice in real test-like conditions: set a strict 60-minute timer, use pencil and paper or spreadsheet only, and review your mistake patterns after each session. Focus especially on types of questions that trip you up—are they multi-stage probability trees? Logical inference? Conditional expectations?

Building this meta-awareness mimics the consulting-style drill of learning how you think, not just what you know.

Tips: Narrate your process aloud or to a peer—this builds the clarity and pacing you’ll need in later interview rounds.

Tell Impact‑Driven Stories

For behavioral and product rounds, prepare 3–5 concise, high-leverage STAR-format stories that highlight strategic thinking, ownership, and cross-functional collaboration. But don’t just focus on outcomes—focus on how you framed the problem, communicated trade-offs, and navigated ambiguity.

Think like a consultant: structure your answers clearly (“Here’s what we were trying to solve → Here’s what made it challenging → Here’s what I did → Here’s how it played out”), and guide your interviewer through your thinking with intention. Practice aloud to refine pacing and polish, and aim for a tone that’s both confident and reflective.

Jane Street interviewers appreciate humility paired with rigor—so be ready to flag what you didn’t know, how you updated, and what you’d do differently next time. This style of transparent, structured storytelling is key to showing you can thinkand communicate like a strategist under pressure.

Tips: Record yourself answering one or two questions, then play it back to check pacing, clarity, and whether you emphasize decision-making trade-offs. Small tweaks here can have a big payoff in interviews.

Seek Feedback

Run mock interviews with peers, mentors, or ideally, former Jane Streeters. Ask them to challenge your assumptions, redirect your thinking, or play “trader” while you explain your product logic. Real-time feedback is key to tightening your structure and surfacing blind spots.

FAQs

What does Jane Street look for in applicants?

Jane Street looks for people who are analytical, curious, and collaborative. For product and strategy roles, that means being able to reason quantitatively, explain your thinking clearly, and thrive in a feedback-driven, low-ego culture. You don’t need a finance background, but you do need to show comfort with probability, trade-off analysis, and decision-making under uncertainty.

How to crack the product interview?

The key is structured thinking. Break down ambiguous problems into objectives, constraints, and trade-offs, then walk through your reasoning step by step. Practice mental math and probability puzzles, but also prepare impact-driven stories that show ownership and collaboration. Mock interviews with peers can help you practice communicating under time pressure.

What is the favorite product question in an interview?

Jane Street interviewers often ask about designing or pricing a product under uncertainty—for example, how you’d set auction rules for a new market, or how you’d evaluate a trading tool with incomplete data. These questions reveal how you reason about incentives, risks, and outcomes, not just your final answer. You can check the top questions for product interview to start your preparation.

What is the final round interview for strategy and product at Jane Street?

The “Super-Day” usually includes 4–6 interviews plus informal conversations with team members. You’ll see a mix of case-style deep dives, probability puzzles, and culture fit discussions. For product strategy specifically, expect to be asked to validate a new product idea, analyze pricing trade-offs, or design a feedback loop for monitoring performance. Interviewers will probe your assumptions, so be ready to adapt on the fly.

Is Jane Street interview hard? What is the acceptance rate?

Yes—it’s considered one of the most rigorous interview processes in finance and tech. Candidates report that the probability puzzles and case studies are more demanding than typical consulting or big-tech interviews. While Jane Street doesn’t publish acceptance rates, industry estimates suggest it’s below 2%, making it more competitive than most hedge funds or FAANG companies.

How to become a product strategist?

Most product strategists at firms like Jane Street come from backgrounds in math, economics, computer science, or engineering. To build toward the role, focus on:

Strengthening your probability and game theory foundations.

Gaining experience in product design or analytics, where you can practice trade-off reasoning.

Learning how trading products (options, ETFs, futures) actually work.

Practicing clear, structured communication.

Build your product sense by working through our product metrics learning path. It’s designed to help you practice framing problems, choosing the right metrics, and reasoning about trade-offs

Pathways vary—some candidates come straight from university, others transition from consulting, data science, or software engineering.

What Is the Average Salary for a Strategy & Product Role at Jane Street?

Strategy & Product roles at Jane Street offer highly competitive compensation, often exceeding industry benchmarks. In New York, base salaries typically range from $150K to $200K, with annual profit-sharing bonuses that can substantially increase total compensation—many first-year hires report total comp between $300K and $500K, depending on performance and market conditions.

In London, salaries are slightly lower due to regional benchmarks and tax structure, but still highly attractive, with base pay around £100K to £130K, plus similarly structured profit-sharing. Compensation is flat and non-hierarchical—titles are de-emphasized, and the focus is on shared outcomes over individual quotas.

- Entry-Level / New Grad (L1)

- Base Salary: $150K–$180K USD (NYC) (Levels.fyi)

- Total Compensation: $300K–$400K USD (with profit-sharing bonus)

- Mid-Level (L2 – 2–4 YOE)

- Base Salary: $180K–$200K USD

- Total Compensation: $350K–$500K USD (Levels.fyi)

- Senior / Experienced (L3+)

- Base Salary: $200K+ USD

- Total Compensation: $500K–$700K+ USD (bonus-heavy) (Levels.fyi)

Are There Job Postings for Strategy & Product Roles on Interview Query?

Yes! You can browse open Jane Street strategy & product roles and other related opportunities on the Interview Query job board. To stay up to date on new listings and curated prep content, be sure to subscribe to the IQ newsletter. You’ll get updates on application windows, mock assessments, and new company guides straight to your inbox.

Conclusion

Cracking the Jane Street Strategy & Product interview requires more than just strong math—it demands structured thinking, thoughtful product intuition, and clear, adaptive communication. By understanding the flow of the interview process, from online assessments to case deep-dives, you’re already halfway there. The rest is deliberate preparation: refining how you reason under pressure, explain trade-offs, and work through ambiguity with confidence.

If you’re looking to level up your prep, check out our related guides for Data Engineer and Machine Learning Engineer roles at Jane Street. You can also attend a 1-on-1 mock interview to simulate the real thing with experienced mentors and get targeted feedback.