UBS Data Scientist Interview Guide (2025) – Process, Questions & Preparation

Introduction

UBS stands as the world’s largest and only truly global wealth manager, with a presence in over 50 countries and managing more than $5.7 trillion in assets. With its deep roots in Swiss banking, UBS has consistently ranked among the top financial institutions worldwide, known for its stability, global reach, and client-centric innovation. Behind the scenes, a growing team of 1,200+ data scientists fuels UBS’s digital edge—building predictive models, deploying UBS RiskLab models, and modernizing legacy operations.

You’ve come to the right place if you’re preparing for a data scientist interview at UBS. We’ll guide you through the interview process, discuss the questions asked in the UBS data scientist interview, and share a few tips.

Why this role at UBS?

A data scientist role at UBS offers the chance to work at the intersection of finance and advanced analytics—solving real-world problems that impact global markets and client portfolios. With UBS investing heavily in AI, risk modeling, and data transformation, this role places you on the frontlines of digital innovation in one of the world’s most trusted financial institutions. Whether you’re optimizing pricing, detecting fraud, or improving client experiences, your work will directly shape decisions that move billions. It’s a role built for data scientists who want both technical depth and meaningful business impact.

What Is the Interview Process Like for a Data Scientist Role at UBS?

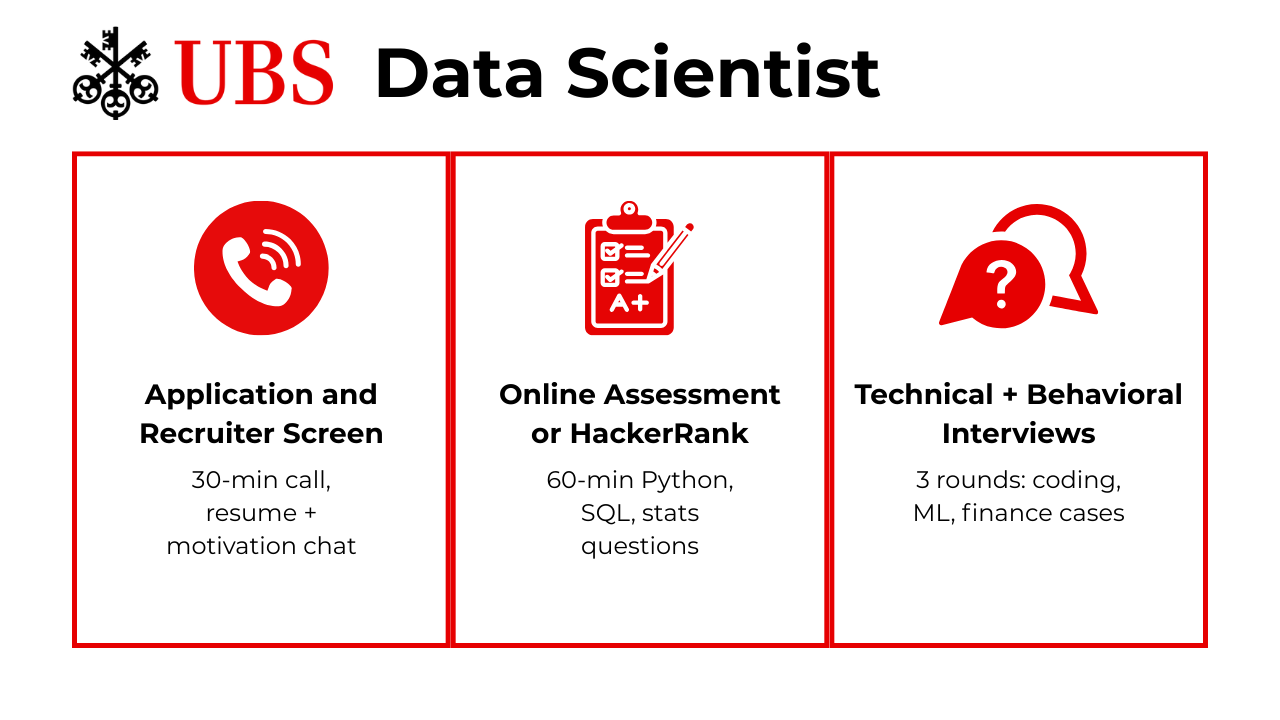

The UBS data scientist interview process is structured but varied, designed to assess your technical fluency, problem-solving skills, and alignment with the firm’s values. Candidates typically move through an application and recruiter screen, a timed online assessment, and one or more technical and behavioral interviews. While the timeline can be inconsistent, the overall process emphasizes practical, finance-focused data challenges and clear communication.

Application and Recruiter Screen

Most candidates apply via the UBS careers portal or LinkedIn, and may be asked to complete a brief Cultural Assessment or skills test focused more on fit than technical depth.

If you pass, you’ll move on to a 30-minute recruiter call covering your background, interest in UBS, and general fit. It’s light on technical questions. One candidate mentioned waiting several weeks between steps, so expect some lag in communication.

Online Assessment or HackerRank

Most candidates receive the UBS data scientist assessment within a week of applying, typically hosted on HackerRank. It’s a 60-minute mix of multiple choice and hands-on coding questions covering Python, SQL, stats, and basic ML. The problems lean toward real-world business logic or schema design, especially in finance-related contexts. “The hardest part was to code the React application on a small screen… Some array manipulation, which was comically easy.”

UBS prioritizes practical problem-solving over LeetCode-style puzzles, but the platform can be glitchy—some report issues with PySpark submissions and slow support. Don’t expect quick updates after you finish. As one candidate shared: “We were told you might get the HR round call… but it did not happen like that.” Prep well, be patient, and stay calm if tech issues pop up.

Technical + Behavioral Onsite/Virtual Interviews

After the assessment and recruiter call, you’ll move into the main interview loop—typically 1 to 3 rounds scheduled in a single afternoon. Each session lasts about 45–60 minutes and covers a mix of technical depth, business context, and communication skills. “The entire process took about three weeks, with four onsite interviews focused on different aspects—technical skills, communication, business sense, and culture fit.”

Expect live coding in Python and SQL, with occasional use of Spark or pandas. You’ll often be asked to share your screen and walk through your logic, though some rounds may resemble whiteboarding. “The interviewer provided me with some easy-to-medium Python code snippets and asked me to write code and explain my approach.” Scenario-based ML questions are also common—think KPI optimization or building solutions for finance use cases.

Behavioral rounds dig into collaboration, ownership, and clarity in complex problem-solving. UBS values structured thinking and impact-driven answers. Be ready to share examples from past projects and explain both your approach and your reasoning. “UBS teams care about both the ‘how’ and the ‘why.’”

What Questions Are Asked in a UBS Data Scientist Interview?

Here are some of the recurring questions that are frequently asked in UBS data scientist interviews:

Coding / Technical Questions

These questions are designed to assess your ability to write clean, efficient code while solving real-world problems involving time-series data, financial analytics, and algorithmic thinking:

To solve this, iterate through the list of timestamps and group them into sublists where each sublist contains timestamps that fall within the same 7-day period starting from the first timestamp. This involves calculating the difference in days between the current timestamp and the starting timestamp to determine the appropriate group.

To solve this, iterate through the list of stock prices to find the minimum price and calculate the potential profit for each day. Track the maximum profit and the corresponding buy and sell dates to determine the best days for the transaction.

3. Creating a new companies table with a list of scraped company names

To create a new production_companies table, start by cleaning the data to remove duplicates and correct misspellings. Use a combination of automated scripts and manual checks to ensure data accuracy. Implement constraints in the database to prevent duplicate entries and maintain data integrity.

4. Given a huge 100 GB log file, how would you count the total number of lines in the file in Python?

To count the total number of lines in a large file efficiently, you can read the file line by line using a loop and increment a counter for each line. This approach minimizes memory usage by not loading the entire file into memory at once.

To solve this, iterate through each word in the input string, convert it to lowercase, and check if it is not in the list of stop words. If it is not, include it in the result string. This will result in a string with all stop words removed and all characters in lowercase.

SQL Questions

These SQL questions are designed to evaluate your ability to work with relational data, perform aggregations, and implement ranking or pairwise comparisons:

To solve this, you need to join the employees and departments tables, filter departments with at least ten employees, and calculate the percentage of employees earning over 100K. Then, rank these departments based on the calculated percentage and select the top three.

To solve this, you need to calculate the absolute difference between each pair of scores and find the pair with the smallest difference. If there are multiple pairs with the same minimum difference, select the pair with student names that are higher alphabetically.

8. Write a query to get the total three-day rolling average for deposits by day

To calculate the three-day rolling average for deposits, filter the transactions to include only deposits (positive values) and group them by day. Use a window function to compute the rolling average over a three-day window, ensuring the date format in the output is ‘%Y-%m-%d’.

To solve this, you need to compare each user’s subscription date range with others to check for overlaps. This can be done by joining the table with itself and checking if the start date of one subscription is before the end date of another and vice versa, ensuring the user IDs are different.

System / Product Design Questions

These system and product design questions assess your ability to architect scalable, data-driven solutions and think strategically about business impact, crucial competencies for data scientists at UBS working on real-time analytics, pricing models, and AI-enabled decision systems:

10. Design a data pipeline for hourly user analytics

To build a data pipeline for hourly user analytics, you would need to extract data from the data lake, transform it to calculate hourly, daily, and weekly active users, and then load it into a system that supports real-time dashboard updates. This involves scheduling regular data extraction and transformation processes, possibly using tools like Apache Airflow, and ensuring the data is efficiently stored and accessible for dashboard queries.

11. How would you build a dynamic pricing system? What considerations would have to be made?

To build a dynamic pricing system, you would need to consider factors such as demand fluctuations, availability of listings, competitor pricing, and historical data. The system should incorporate machine learning models to predict demand and adjust prices in real-time, ensuring optimal pricing strategies that maximize revenue while maintaining competitiveness.

12. Given a dataset of 600,000 credit card transactions, build a fraud detection model

To build a fraud detection model, start by exploring and preprocessing the dataset to handle missing values and outliers. Use feature engineering to create meaningful input features, and then select an appropriate machine learning model, such as logistic regression or decision trees, to classify transactions as fraudulent or not. Evaluate the model’s performance using metrics like precision, recall, and F1-score, and iterate on the model to improve its accuracy.

13. How would you design a real-time dashboard to monitor key performance indicators (KPIs) for UBS’s client onboarding process?

To design a real-time dashboard for UBS’s client onboarding process, identify key KPIs such as onboarding time, client satisfaction, and compliance rates. Use a data processing engine to aggregate and process data from various sources, and display the KPIs on a dashboard with visualizations for easy monitoring. Ensure the system is scalable and reliable to handle data from multiple onboarding processes simultaneously.

Behavioral or “Culture Fit” Questions

UBS teams often navigate uncertain or evolving business needs. This question reveals adaptability and communication skills:

14. How would you answer when an Interviewer asks why you applied to their company?

UBS’s position as the world’s largest wealth manager offers exposure to complex financial datasets and high-stakes decision-making. Highlight how your data science skills can drive insights in areas like risk modeling, client personalization, or regulatory compliance. Emphasize adaptability in cross-functional teams (e.g., quant analysts, product managers) and UBS’s focus on translating technical work into actionable business outcomes.

15. Describe a situation where you had to make progress on a project with unclear requirements.

UBS focuses on your problem-solving abilities. Use the STAR method to outline the Situation, Task, Action, and Result. Emphasize how you clarified goals through stakeholder communication and iterative feedback. Highlight adaptability and how you ensured project success despite uncertainty.

16. How would you convey insights and the methods you use to a non-technical audience?

To effectively communicate insights to a non-technical audience, simplify technical jargon and use relatable analogies. Employ clear visuals like charts and graphs to illustrate data points, and connect findings to business impacts to make them relevant. Tailor your messaging to the audience’s level of understanding, ensuring clarity and engagement.

To effectively tailor data presentations for different audiences, it’s crucial to assess the technical proficiency of each group. For technical stakeholders, you can delve into detailed methodologies and data specifics, while for non-technical stakeholders, focus on high-level insights and practical implications. Adjusting your communication style and presentation content based on the audience’s needs ensures clarity and engagement, ultimately leading to more successful project outcomes.

18. Describe a time you had to convince a skeptical stakeholder to trust a model or data-driven recommendation.

Convincing a skeptical stakeholder requires demonstrating the model’s reliability and relevance to their concerns. Present clear evidence of the model’s past performance, use case studies, and offer transparency in the model’s methodology. Engaging the stakeholder in the validation process and addressing their specific doubts can build trust and acceptance.

How to Prepare for a Data Scientist Role at UBS

If you’re struggling with medium-to-hard SQL or coding questions, you’re likely just out of practice. Here’s how to prep effectively for the UBS data scientist interview:

Start by understanding UBS’s use of data science in risk, compliance, trading, and customer intelligence. Then, brush up on SQL and Python—prioritize window functions, joins, and data wrangling.

Follow a consistent routine: review concepts daily, code regularly, and dive deeper into ML on weekends. Simulate real interviews using Mock Interview or AI Interview tools to build confidence under pressure.

For behavioral rounds, use the STAR method and prep stories that show problem-solving, collaboration, and ownership. Track your prep with a checklist and stay flexible—adjust your plan as you improve.

FAQs

What Is the Average Salary for a Data Scientist Role at UBS?

Average Base Salary

Average Total Compensation

Where Can I Read More Discussion Posts on UBS Data Scientist Roles Here in IQ?

Check our data science blogs for more tips, resources, and shared interview experiences from past candidates.

Are There Job Postings for UBS Data Scientist Roles on Interview Query?

Yes! Visit the Interview Query Job Board to explore open roles and sign up for alerts tailored to data science roles at UBS and other top firms.

Does UBS Require a Drug Test?

Yes, candidates may be required to pass a drug test as part of the final onboarding process. This is typically mentioned after the final offer and before contract signing.

What Is the UBS HireVue Interview Like?

UBS may use HackerRank for initial behavioral screening. Expect to answer pre-recorded questions on motivation, team collaboration, and career goals.

Conclusion

Interviewing for a UBS data scientist role can feel intense, but understanding the process and common questions can give you a major advantage. With the right prep—technical practice, system design frameworks, and clear behavioral stories—you’ll stand out.

For extra support, check out our Data Science Learning Path, review real UBS-style interview questions, and get inspired by Chris Keating’s success story. These resources offer the structure and confidence you need to ace your interviews.

And if you want personalized help, explore our Coaching options tailored to your goals. Good luck!