Capital One Interview Questions & Case Prep (2025 Guide)

Introduction

Capital One is one of the largest banks in the U.S., but what makes it different is how much it feels like a tech company. It was the first U.S. bank to completely exit its own data centers and go “all-in” on the cloud back in 2020, setting a bold tone for its tech-forward culture. The focus is always on combining finance and technology to solve real problems in smarter, faster ways.

That mix of scale and innovation makes Capital One a popular destination for people in data science, data analytics, software engineering, product management, business analysis, and machine learning. The interview process reflects this balance: it emphasizes problem-solving, structured communication, and cultural fit.

In this guide, we will walk through what the Capital One interview process looks like and share role-specific tips to help you prepare with confidence.

Why Work at Capital One?

Capital One stands out as one of the most innovative and influential financial institutions in the U.S., blending technology with banking at scale. As a Fortune 100 company, it offers stability, competitive benefits, and a commitment to personal and professional growth. Employees frequently highlight the company’s supportive culture, strong internal mobility, and clear investment in associate development from tech bootcamps to leadership training.

Working at Capital One also means contributing to real-world impact. Whether it’s designing AI-powered credit decision tools or building inclusive financial products, employees play a part in shaping how millions of people manage their money. If you’re looking for a role with purpose, growth potential, and the opportunity to work on complex challenges in a collaborative environment, Capital One is an excellent place to build your career.

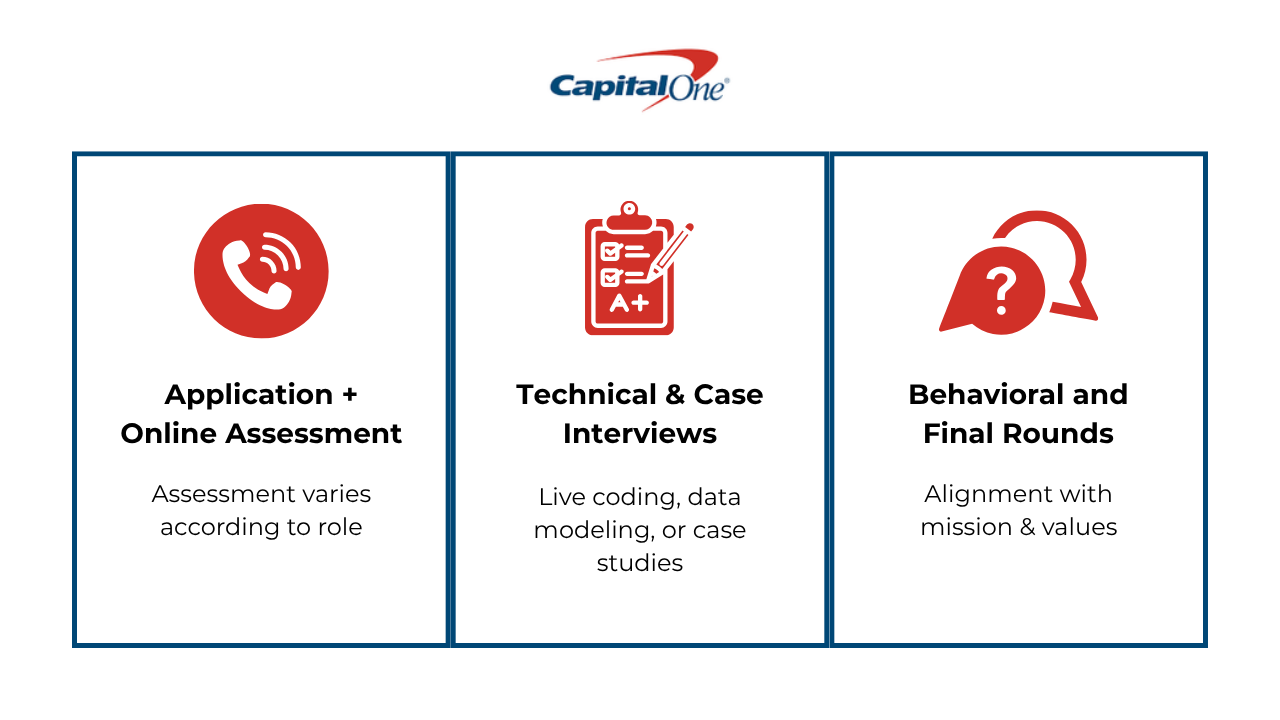

What's Capital One's Interview Process Like?

The Capital One interview process is structured to evaluate both technical expertise and problem-solving skills, as well as cultural fit and communication. While it may vary slightly depending on the role, most candidates go through several key stages. A typical Capital One interview process includes an initial application, an online assessment, one or more technical or case interviews, and final behavioral interviews with team members or hiring managers. Understanding the structure and expectations of each stage is crucial to your preparation.

Application + Online Assessment

After you apply, most technical candidates are invited to an online assessment. For SWE (and some ML/DE/DS roles) this is often a CodeSignal-style coding test under time pressure. For analytics/data and PM tracks, the screen may instead be a short SQL/Python exercise, a stats/ML quiz, or a product/strategy mini-case. Treat this phase as both a filter and a preview of how you’ll be expected to think.

What to expect by role

Software Engineer: Timed algorithms/data-structures (arrays, strings, hash maps, sorting, two-pointers, BFS/DFS, basic DP).

Tips: Aim for correctness first, then optimize; narrate complexity; build small helpers; test trivial/edge/stress cases.

Data Scientist: Short Python + SQL, core stats/ML (hypothesis testing, bias/variance, metrics), light case on experiment or model impact.

Tips: Start with a crisp hypothesis; define metrics (e.g., lift, MDE, AUC); state assumptions and pitfalls (leakage, selection bias).

Data Engineer: Coding (Python/Java) plus SQL focusing on joins, window functions, and data modeling/ETL logic.

Tips: Clarify data grain; reason about partitions, deduping, late data; choose operations for scalability; validate with row-count checks.

Data Analyst: SQL-heavy timed tasks; sometimes a quick analytics case reading a chart/table.

Tips: Master

SUM(CASE WHEN…), window functions, cohorts/funnels; define metrics precisely and call out NULL/dup behavior.ML Engineer: Coding + practical ML systems (feature engineering, inference latency, monitoring, A/B safety).

Tips: Balance accuracy vs throughput; discuss feature stores, drift/monitoring, offline/online metric gaps; vectorize where possible.

Product Manager: No coding; product sense + analytics mini-case (goal setting, success metrics, trade-offs).

Tips: Frame with problem → users → constraints; propose a lean experiment; pick one north-star metric and guardrails; quantify impact.

Technical and Case Interviews

After the assessment, successful candidates are invited to one or more technical or functional interviews. These may include live coding sessions for software engineering candidates, or data modeling and SQL/Python exercises for analytics roles.

In addition to technical rounds, many candidates across data, product, strategy, and even some engineering roles will face a Capital One case interview. These are designed to simulate real-world business scenarios and evaluate how you break down problems, analyze data, and communicate recommendations. You might be asked to assess the financial impact of a product change, identify trends in a dataset, or recommend a business strategy based on a customer use case. A successful case interview blends structured thinking with clear communication, even under ambiguity.

Tips (Technical – Coding/System)

- Clarify first: Inputs, outputs, constraints, failure/edge behavior, mutation vs new object, ordering guarantees.

- Narrate trade-offs: “Option A uses O(n) space but O(n) time; Option B is O(1) space but O(n log n). I’ll pick A due to constraints.”

- Readable code > clever hacks: Intentional names, small functions, linear flow. Handle errors/empty inputs explicitly.

- Verify complexity + memory: State Big-O and why it holds.

- Mini-design prompts: Be ready to sketch data models/APIs or a simple system diagram (service, data store, cache, queue) and call out bottlenecks.

Tips (Analytics – SQL/Python/Data Modeling)

- SQL checklist: JOIN type & cardinality, filters pre/post-JOIN, NULL behavior, GROUP BY completeness, window vs aggregate, HAVING vs WHERE.

- Patterns to master: conditional aggregation (

SUM(CASE…)), window functions (ROW_NUMBER, LAG, rolling metrics), deduping, cohorting, funnels. - Pandas habits:

groupby,merge,assign, vectorization over loops,pd.to_datetime, handling missingness. - Data modeling: Identify grain first; propose tables/entities, keys, slowly changing dims vs facts; call out source freshness & data quality.

- Communicate results: State metric definitions, sanity checks, and key caveats (“data censored after July 31,” “sample excludes new users”).

Tips (Business/PM/Strategy Case)

- Structure fast: MECE issue tree → hypothesis → plan of attack (metrics, segmentation, experiments).

- Anchor in metrics: Tie to business outcomes (revenue, retention, risk, cost-to-serve, adoption, NPS).

- Do the math out loud: Round numbers, show steps, state assumptions, then sensitivity-check (“If churn is 2× higher, ROI flips”).

- Use 80 / 20 data: Ask for exhibits; if none, propose a scrappy test or proxy metric.

- Close with a POV: Recommendation + risks + next steps + success metric (“We’d know it worked if DAU +5% with stable refund rate”).

Behavioral and Final Rounds

The final stage of the Capital One interview process includes behavioral interviews, which are just as important as the technical or case rounds. Many candidates make the mistake of underestimating this part, but Capital One places a strong emphasis on how well you align with their mission and values. In particular, they want to see that you uphold Excellence in your work, consistently Do the Right Thing when making decisions, demonstrate Respect for Individuals through inclusive collaboration, and embody a spirit of Succeeding Together as part of their team-oriented culture.

You’ll face questions about how you’ve handled past challenges, worked in teams, adapted to feedback, and solved ambiguous problems. Expect interviewers to dig deep into your experiences using follow-up questions, so surface-level answers won’t cut it. Practicing your responses using the STAR method (Situation, Task, Action, Result) is essential, but don’t memorize them as Capital One values authenticity and reflection. Demonstrating strong communication skills, self-awareness, and a growth mindset can be the deciding factor even for highly technical roles.

Tips

- Story bank (6–8): Prepare STAR stories for conflict, failure, leadership without authority, ambiguity, tight deadlines, data-driven win, doing the right thing under pressure.

- Map to values: After each story, explicitly link the behavior (Excellence, Do the Right Thing, Respect for Individuals, Succeed Together).

- Depth > breadth: Expect “tell me more”—have specifics: numbers, stakeholders, exact timeline, what you did vs the team.

- Action verbs + impact: “I designed X, reduced Y by Z%,” not “we kinda improved things.” Include a Result + Learn (STAR-L).

- Reflective close: “In hindsight, I’d change ___; since then I’ve ___,” showing growth and coachability.

- Questions to ask them: “How do teams operationalize ‘Do the Right Thing’ in trade-offs?” “What does great look like at 30/60/90 days?” “How are analytics decisions audited for bias and fairness?”

Most Asked Capital One Interview Questions

If you’re wondering what types of Capital One interview questions to expect, you’re not alone. While questions vary depending on the role, Capital One tends to focus on structured problem-solving, communication, and role-specific skills. From technical assessments to behavioral scenarios, the questions are designed to assess how you think, not just what you know.

Role-Specific Interview Guides

Business Analyst → Capital One Business Analyst Interview Guide

Data Scientist → Capital One Data Scientist Interview Guide

Data Analyst → Capital One Data Analyst Interview Guide

Data Engineer → Capital One Data Engineer Interview Guide

Machine Learning Engineer → Capital One Machine Learning Engineer Interview Guide

Product Manager → Capital One Product Manager Interview Guide

Software Engineer → Capital One Software Engineer Interview Guide

Here are some of the most frequently asked Capital One interview questions:

Behavioral & Case-Based Questions

Capital One interview process places heavy emphasis on behavioral and case-based evaluations, regardless of the role. These rounds test not just what you know, but how you approach real-world challenges, communicate under pressure, and align with the company’s values and thinking style.

In behavioral interviews, you can expect questions that explore past experiences and how you navigate teamwork, ambiguity, feedback, and problem-solving. Common Capital One interview questions include:

- Tell me about a time you had to solve a problem with limited data.

- Describe a situation where you had to influence a decision without direct authority.

- Give an example of a time you received critical feedback—what did you do with it?

- How do you manage competing priorities or tight deadlines?

Capital One case interview is another core component—even for data and engineering roles. These case scenarios are designed to test structured thinking, business sense, and clear communication. Interviewers may ask you to walk through a strategy or break down a problem step by step. Common examples include:

- A new credit card product is underperforming—how would you investigate the issue?

- What metrics would you use to evaluate the success of a mobile app feature?

- How would you use data to recommend changes to customer acquisition strategy?

Though these aren’t coding-heavy like the Capital One coding assessment, they require strong analytical reasoning and clear articulation of your thought process. Practice breaking down problems logically and speaking through your approach out loud, just as you would in a real-time business setting.

Technical Assessments and Coding Questions

For technical roles, Capital One assesses candidates through both live interviews and timed platforms like CodeSignal. The Capital One coding assessment is designed to test your algorithmic thinking, coding efficiency, and problem-solving under time pressure. Common Capital One codesignal questions focus on core data structures and algorithms.

Here are some topics to cover:

- Array manipulation and sorting (e.g., merge intervals, find duplicates)

# Merge Intervals

intervals = [[1,3],[2,6],[8,10],[15,18]]

intervals.sort(key=lambda x: x[0])

res = []

for s,e in intervals:

if not res or s > res[-1][1]:

res.append([s,e])

else:

res[-1][1] = max(res[-1][1], e)

# Output: [[1,6],[8,10],[15,18]]

- Hash maps and dictionaries (e.g., frequency counting, lookups)

# Frequency count of characters

s = "capitalone"

freq = {}

for c in s:

freq[c] = freq.get(c, 0) + 1

# freq → {'c':1,'a':2,'p':1,'i':1,'t':1,'l':1,'o':1,'n':1,'e':1}

- Graph traversal using BFS or DFS (e.g., pathfinding, connected components)

- String parsing and manipulation (e.g., longest substring, pattern matching)

- Sliding window & two pointers (e.g., minimum window substring, max consecutive 1s with ≤k flips)

# Longest substring without repeating chars

s = "abcabcbb"

seen, start, max_len = {}, 0, 0

for i, c in enumerate(s):

if c in seen and seen[c] >= start:

start = seen[c] + 1

seen[c] = i

max_len = max(max_len, i - start + 1)

# max_len → 3 ("abc")

- Prefix/suffix & cumulative sums (e.g., subarray sum equals k, product of array except self)

- Binary search & search space (e.g., search in rotated array, Koko eating bananas)

- Dynamic programming — grids (e.g., unique paths with obstacles, minimum path sum)

# Min path sum in grid

grid = [[1,3,1],[1,5,1],[4,2,1]]

m,n = len(grid), len(grid[0])

for i in range(1,m): grid[i][0]+=grid[i-1][0]

for j in range(1,n): grid[0][j]+=grid[0][j-1]

for i in range(1,m):

for j in range(1,n):

grid[i][j]+=min(grid[i-1][j],grid[i][j-1])

# grid[-1][-1] → 7

These topics form the backbone of many Capital One technical questions, whether in an online test or a live coding interview. Practicing these patterns in timed environments can significantly improve your speed and confidence. Focus not just on solving problems, but on writing clean, readable code and explaining your logic out loud, as communication is a big part of the technical evaluation.

Tips When Preparing for a Capital One Interview

When preparing for a Capital One interview, it’s essential to understand the values and expectations behind the questions you’ll face. The company looks for candidates who not only have strong technical or analytical skills but also demonstrate structured thinking, curiosity, and a collaborative mindset.

Here are a few tips to guide your prep:

Study Role-Specific Fundamentals

Whether you’re interviewing for a data, business, or engineering role, make sure you’ve reviewed the core concepts expected for your function. For data analysts and scientists, focus on SQL (joins, window functions, subqueries), Python or R for data manipulation, and statistical thinking. If you’re in engineering, brush up on algorithms, data structures, and system design. Product and business candidates should revisit key topics like product KPIs, go-to-market strategy, and business case analysis. Reviewing Capital One’s public-facing tech blog or project case studies can give insight into the kinds of problems they solve and help you tailor your preparation.

Here are some study tips for each role:

Data Analyst

- What to focus on: SQL joins, window functions,

SUM(CASE…), cohorts/funnels. A bit of Excel/Python helps. - Try this: Rebuild a mini dashboard from one raw table. Write 5 queries using

LAGand explain how NULLs change your totals. - Bring this: A one-page metric glossary (clear definitions + caveats) and a cleaned dataset with your QA checks.

Data Scientist

- What to focus on: Practical statistics/ML—experiments, bias/variance, over/underfit, and evaluation (AUC, PR, lift).

- Try this: Design an A/B test end-to-end (state MDE/power). Train a baseline model, then regularize and compare metrics.

- Bring this: A short model card (assumptions, risks, fairness) and how you’d monitor drift post-launch.

Data Engineer

- What to focus on: SQL at scale, solid data models (star/snowflake), and repeatable ETL/ELT with partitions & orchestration.

- Try this: Turn messy logs into clean dimension/fact tables; write an idempotent upsert; sketch a daily pipeline with backfills.

- Bring this: A simple lineage diagram and a data quality checklist (row counts, uniqueness, freshness, nulls).

ML Engineer

- What to focus on: Shipping ML—feature stores, offline/online parity, latency vs throughput, monitoring & alerts.

- Try this: Serve a lightweight model; add batching/caching; define drift & latency SLOs with alert rules.

- Bring this: An inference diagram (client → features → model → logs) and a rollout plan (shadow → canary → full).

Software Engineer

- What to focus on: Core DSA patterns (two-pointers, heaps, graphs, DP), clean code, and the basics of system design.

- Try this: Run 3 timed sets (easy → medium → hard). For each, state constraints, test edge cases, and say the complexity out loud.

- Bring this: A mini design doc for a rate-limited API (requirements, endpoints, data model, scaling & failures).

Product Manager

- What to focus on: Product sense, crisp KPIs, experimentation, prioritization, and stakeholder trade-offs.

- Try this: Pick a Capital One–style product; define a north-star metric + guardrails; outline V1 and a lean experiment.

- Bring this: A one-pager PRD—problem, users, success metrics, risks, and launch plan.

Business/Strategy Analyst

- What to focus on: Market sizing, unit economics, SQL/Excel, and telling a tight story with data (plus risk/compliance awareness).

- Try this: Build a quick revenue model with sensitivities; turn a messy sheet into a 3-slide exec update.

- Bring this: An assumption log (sources + ranges) and a before/after chart that shows how the insight changed a decision.

Practice Structured Communication

Many Capital One interview questions are open-ended and designed to evaluate your ability to break down problems logically. Use the STAR method (Situation, Task, Action, Result) for behavioral questions to ensure your answers are clear and complete. For case-based interviews, practice using frameworks like issue trees or MECE (Mutually Exclusive, Collectively Exhaustive) structures to keep your approach organized. For example, if asked how you’d improve a product, break it down into user metrics, revenue drivers, operational feasibility, and potential risks. Clarity and structure are often more important than getting the “right” answer.

Let’s take a look at how to apply the MECE framework to a case interview:

Case Prompt: “How would you increase adoption of Capital One’s mobile app among existing credit card customers?”

Step 1: Restate the Problem Clearly

Goal = Increase adoption (downloads & active usage)

Scope = Existing credit card customers

Step 2: Apply a MECE Breakdown

Think in buckets that are mutually exclusive and collectively exhaustive:

- Awareness & Marketing

- Do customers know the app exists?

- Are marketing channels reaching them effectively?

- Onboarding & Access

- Is the signup process smooth (passwords, 2FA, linking card)?

- Are there drop-off points (e.g., identity verification)?

- Core Value Proposition

- What features drive adoption? (bill pay, credit score monitoring, rewards tracking)

- Is the app providing something unique vs. web portal?

- User Experience & Engagement

- Is the app intuitive, fast, and reliable?

- Are there nudges (notifications, reminders) to form usage habits?

- Trust, Security & Compliance

- Do customers feel safe entering sensitive information?

- Any concerns about fraud prevention or privacy?

Step 3: Prioritize & Hypothesize

- Hypothesis: The biggest drop-off is during onboarding/KYC because it’s too complex.

- Test: Simplify document upload + progress bar → A/B experiment.

Step 4: Communicate Structured Answer

“I’d break the problem into awareness, onboarding, value, engagement, and trust. My initial hypothesis is onboarding complexity limits adoption, so I’d start with streamlining KYC and testing if activation improves. Meanwhile, I’d monitor engagement metrics to ensure adoption translates into real usage.”

This way you’re showing logical structure (MECE), prioritization, and data-driven thinking, which are exactly what Capital One interviewers look for.

Simulate the Format

Capital One’s process includes timed assessments and live interviews, so simulate both. For technical candidates, practice on platforms like CodeSignal and LeetCode under time constraints to get comfortable with pressure. Focus not just on solving the problem, but doing so with clean, well-structured code. For those preparing for a Capital One case interview, try mock cases with peers or practice out loud. Use whiteboarding tools or even a notebook to diagram your thinking.

Let’s walk through a few examples of how you can tackle whiteboarding in SWE and case interviews:

SWE Whiteboard drill (30–35 min)

Prompt: “Given an array of intervals

[[s,e], ...], merge overlaps and return a condensed list.”Whiteboard flow

Problem restate (2 min)

- Input: list of

[start,end](ints), may be unsorted - Output: merged non-overlapping intervals, sorted by start

- Edge cases: empty, single interval, fully nested, touching vs overlapping (e.g.,

[1,3]&[3,4]—merge or not? decide and state)

- Input: list of

Examples (3 min)

[[1,3],[2,6],[8,10],[15,18]] → [[1,6],[8,10],[15,18]] [[1,4],[4,5]] → (If touching counts as overlap) [[1,5]] []Approach sketch (3 min)

- Sort by start → linear sweep

- Keep

current = [s,e]and append/merge as you go - Time: O(n log n) for sort; Space: O(1)/O(n) depending on output

Pseudocode (7–8 min)

sort(intervals by start) res = [] for intv in intervals: if res empty OR intv.start > res[-1].end: res.append(intv) else: res[-1].end = max(res[-1].end, intv.end) return resTest out loud (3–4 min)

- Use the examples; also try a stressy one like nested:

[[1,10],[2,3],[3,9]] → [[1,10]].

- Use the examples; also try a stressy one like nested:

Complexity & trade-offs (1–2 min)

- O(n log n) / O(n). If intervals are already sorted: O(n).

- Alternative: line sweep with event points (overkill here).

PM / Case Whiteboard drill (20–25 min)

Prompt: “Increase active users of the Capital One mobile app by 10% in six months.”

Whiteboard flow

Goal & metric (2–3 min)

- North star: WAU/MAU; guardrails: CSAT, error rate, fraud, support tickets

Issue tree (5–6 min)

Adoption → Awareness | Onboarding | Value props Engagement→ Habit loops | Notifications | Feature depth Retention → Reliability | Speed | SupportHypotheses & tests (7–8 min)

- Hypothesis: Onboarding drop at KYC → simplify ID flow (doc scan), add progress bar

- Experiment: A/B on new onboarding; success: +X% activation, no ↑ in support/fraud

Plan & risks (3–4 min)

- Phased rollout, data instrumentation, bias checks; risks: compliance, false positives

Reflect on Past Experiences

Capital One values candidates who show a strong sense of ownership, adaptability, and self-awareness. Prepare 2–3 stories that highlight these traits, ideally from different parts of your experience (e.g., a challenging team project, a time you taught yourself a new skill, or how you handled unexpected failure).

Be prepared to go deep: interviewers often ask follow-up questions to probe your decision-making and learning process. Aim to show both impact and reflection—what you did and how you grew from it. After reflecting on your experience, master you storytelling with Interview Query mock interview and practice behavioral questions with fellow candidates.

Do Your Research

Capital One is known for its customer-centric, tech-forward culture. Before your interview, learn about the company’s mission (“changing banking for good”), its focus on innovation, and recent initiatives in AI, digital banking, or credit products. To dig deeper, explore their official technology platforms:

- Capital One Tech Blog – in-depth articles on engineering practices, architecture, and emerging tools.

- Capital One Tech on Medium – storytelling-style posts from engineers and leaders about culture, projects, and lessons learned.

- Capital One Software Blog – insights into cloud migration, data platforms, and large-scale modernization.

You can also supplement with recent news articles, leadership interviews, or industry coverage. When answering questions, reference these insights to demonstrate your alignment. For example, if asked why you want to work at Capital One, connect your skills or values to their work in responsible AI or customer experience innovation. Showing this level of interest and familiarity with their official tech thought leadership will help you stand out from other candidates.

Salaries at Capital One

Average Base Salary

Average Total Compensation

While compensation can vary by location, level, and experience, roles like software engineer and data analyst at Capital One have reported strong compensation packages. Capital One is known for offering a mix of solid base salaries, performance bonuses, and additional benefits like 401(k) matching, wellness stipends, and generous PTO.

- Software Engineer: ~$138K–$461K (median ~$153K). (Levels.fyi)

- Machine Learning Engineer: ~$149K–$355K (median ~$180K). (Levels.fyi)

- Data Scientist: median ~$171K – $210K. (Levels.fyi)

- Data Engineer: ~$126K–$213K ( median ~$174K). (Levels.fyi)

- Data Analyst: ~$94K–$123K. (Glassdoor)

- Product Manager: ~$111K–$523K (median ~$146K). (Levels.fyi)

Notes: Totals typically include base + bonus + stock where applicable and vary by level & location (e.g., McLean/NYC/Dallas/Richmond).

To see more detailed breakdowns by role, check out our salary sections in these guides:

- Capital One Business Analyst Interview Guide

- Capital One Data Scientist Interview Guide

- Capital One Data Analyst Interview Guide

- Capital One Data Engineer Interview Guide

- Capital One Machine Learning Engineer Interview Guide

- Capital One Product Manager Interview Guide

- Capital One Software Engineer Interview Guide

These guides include salary insights, interview expectations, and real candidate experiences to help you prepare.

Conclusion

Ready to ace your Capital One interview? Start by reviewing your role-specific interview guide and go over our interview learning path to refresh the key concepts for your position. Then, practice live coding with AI interviewer and sharpen your skills in real-time mock interviews with peers.

FAQs

What is the Capital One coding assessment like?

The Capital One coding assessment is typically a timed online test delivered through CodeSignal. It includes 3–4 algorithm and data structure problems that evaluate coding speed, logic, and accuracy. Practicing common Capital One codesignal questions, such as string manipulation, arrays, and graph traversal, can help you prepare.

How hard is the Capital One case interview?

The Capital One case interview is moderately challenging and emphasizes structured problem-solving, business judgment, and clear communication. Compared to tech companies like Google or Meta, which often focus more heavily on product sense or system design, Capital One’s case interviews are closer to those seen in consulting—requiring you to break down a real-world business scenario, interpret data, and make strategic recommendations.

For example, you might be asked to evaluate why a credit card feature is underperforming or propose a data-driven approach to improve customer retention. Unlike pure technical interviews, success here depends less on exact answers and more on how logically and clearly you think through the problem. Practicing with business-focused case frameworks can give you a competitive edge.

What is the Capital One interview process?

For tech roles (like data science, data analytics, software engineering, or machine learning), you can expect to start with an online coding or technical assessment—often on platforms like CodeSignal. If you move forward, you’ll have technical interviews that dive into problem-solving, algorithms, and system design, along with a chance to talk through your approach on a whiteboard.

For non-tech or business roles (like product management, business analysis, or operations), the early stage usually includes a case interview or business scenario assessment. These are designed to see how you structure problems and make data-driven recommendations. You’ll also go through behavioral interviews where you’ll use frameworks like STAR to show past experiences and cultural fit.

Across both tracks, Capital One emphasizes clear communication, logical thinking, and alignment with its customer-focused mission.

Where can I find Capital One interview questions?

You can find more real Capital One interview questions in our role-specific guides like Data Analyst Interview Guide or Software Engineer Interview Guide. These resources include behavioral, technical, and case-style examples.

What are Capital One code signal questions like?

Capital One code signal questions are part of a timed coding assessment, typically featuring 3–4 algorithm problems to be completed in about 70–90 minutes. The difficulty is similar to medium-level LeetCode questions, with topics like arrays, hash maps, string manipulation, and graph traversal.

Compared to companies like Uber or Instacart, the format is similar, though Capital One’s focus is more on clean, logical problem-solving than tricky edge cases. It’s generally less intense than coding interviews at Google or Meta but still requires speed and accuracy under pressure.