10 Easy Ways to Generate Passive Income with Data Science

Introduction

Building a business with data science isn’t just great to practice skills. It’s also one of the many ways people break into the industry and land a job.

You can generate passive income with data science, from simple strategies like blog writing, to more-intensive approaches like launching a consultancy. Not only is building a data science a great addition to your resume that will prove you can think about providing business value WITH data science, but it also shows you don’t need an employer to make money.

However, there’s one caveat: These techniques require a lot of work to start generating passive income. In fact, most sources of passive earning are not “get rich quick” schemes, and if they are, it’s likely a scam. Yet, if you’re motivated and have the time and resources to invest, you can explore these ways to generate passive income with data science.

Read more about Data Science Projects.

1. Writing Data Science Content on Medium

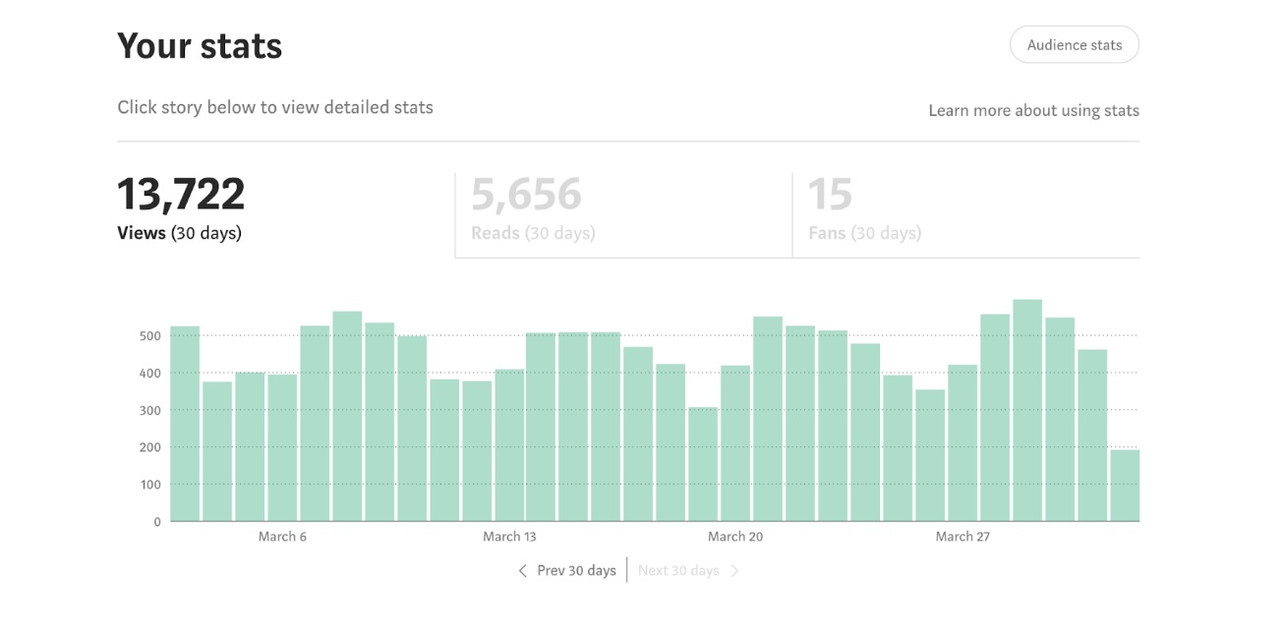

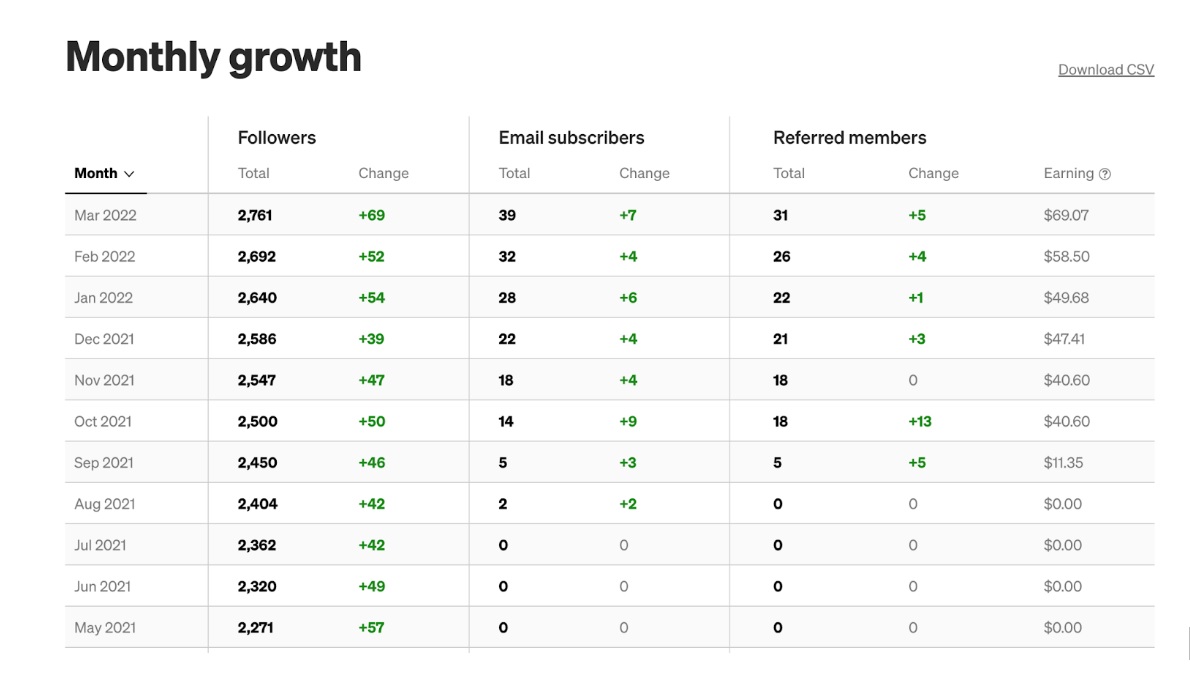

Medium is one of the best platforms for new data science writers, and although it’s not likely you’ll get rich as a Medium writer, it is one of the easiest ways to generate a passive income stream. When I first launched Interview Query, I was posting a lot about data science interviews on Towards Data Science. After a year of writing, we moved most of our publishing to our blog. Even so, the content I wrote still earns income (around $14 for every 1,000 views).

On Medium, you can also make money for referring users to become paid members. If readers reach their monthly free article limit while reading one of your blogs, you’ll earn if they convert to full paid members.

Blogging is a great way to make money AND get better at data science. Whenever you write about data science, you start to train your brain on how to communicate technical concepts better, which in turn helps you get better results.

2. Data Science Consulting

Surprise, surprise – one of the ways to make money off data science work is to literally just do some small data science jobs. It sounds obvious, but you’d be surprised by how many people completely write it off. There are two main ways you can get started:

- Try jobs on Upwork or a similar platform

- Reach out to local businesses in your city

One of the easiest ways to get paid is to build a scraper ingestion pipeline. This can be tremendously valuable for clients that don’t traditionally use tech but still need data for competitive analysis.

Other common entry-level jobs in data science consulting can consist of stuff like data cleaning and data modeling. If you’re taking these jobs from Upwork, just know that you’re competing against global labor, which can be much cheaper. Overall, it’s always best to position yourself as an amazing person to work with and a great communicator.

3. Real Estate Property Investments

Real estate investing is another pretty passive strategy to generate some side income. But how does it relate to data science?

Well, let’s quickly go over how normal real estate investing works. Normally what happens is that you buy a cheap rental property that you can rent out, and the monthly rent covers the cost of the mortgage while also allowing you to speculate on the upside.

For example, if we find a rental property for $200,000, we can estimate that a mortgage plus property taxes will cost us around $1,000 per month at current interest rates. If we can rent this house out for $1,500, we’d be profiting around $200/month if we factor $300/month for expenses, and get a capitalization rate of 12% every year ($24,000/$200,000). Additionally, if the price of the home goes up to $250,000 after five years and we sell it, we’ve just made a $50,000 profit (minus any closing costs).

So, how does data science factor into this? Well, by using data science and engineering, we can actually give ourselves an advantage in finding an investment property by analyzing housing data.

By analyzing the capitalization rate across thousands of neighborhoods in the United States, we can narrow down which units have the potential for being highly profitable real estate rental investments.

The best way to do this is by scraping “property sold” data from sites like Zillow and Redfin, as well as rental data from other sites, like Zumper and Craigslist. We can then merge the datasets together to get a holistic picture of which locations have the best home price to rental ratios across different segments of square footage, number of bedrooms and bathrooms, and more.

Additionally, there’s actually Airbnb-specific data you can use as well if you want to instead consider running more short-term rental properties. Inside Airbnb is a site that already scrapes Airbnb data in major metropolitan cities, and you can look at specific metrics, such as average nightly stay price and vacant days per month, to get an estimated rental income. These factors can help you determine whether specific spots may not be suitable for long-term rentals, but could be favorable for vacation rentals instead.

We should add that most real estate flips are not easy projects. You still need a significant amount of capital, manual oversight, and must perform due diligence. However, the data science work will allow you to narrow down the best opportunities and scale out your analysis.

4-6. Trading Alternative Assets

Four years ago, when Bitcoin was blowing up, Sam Bankman decided to start a crypto hedge fund because he noticed that bitcoin was being priced at $10,000 on one exchange and $9,000 on another. So naturally, he found an arbitrage where he could buy Bitcoin at $9,000, sell it for $10,000, and pocket $1,000. Repeated thousands of times at scale, Sam became a crypto billionaire by his 29th birthday.

Now I’m not telling you that there’s a way to be a bitcoin billionaire, but in the last few years, there has definitely been an explosion in making money off of alternative assets.

Alternative assets are defined as financial assets that don’t fit into the conventional equity/income/cash categories. So, more specifically, stuff like Pokemon cards, NFTs, crypto, sneakers, and even concert tickets. All of these items hold cash value where the prices fluctuate in inefficient markets.

When alternative assets are in inefficient markets, this means that many assets will be either easily undervalued or overvalued.

For example, if I try to sell one piece of Microsoft stock on Robinhood or Fidelity, I don’t even have to look at the current price, because my brokerage is usually going to sell it for the current market value at all times. I literally can’t sell the stock for $5,000 if it’s trading at $300. The brokerage wouldn’t let me.

On the other hand, if I suddenly need to sell my Charizard card on eBay quickly, I can put whatever price I want on it and someone will buy it if they think it’s undervalued in the market. This is what is defined as an inefficient market, and, generally, the most inefficient markets have strategies that you can use data science and trading strategies to exploit.

4. Pokemon Cards

One example: My friend told me recently that he’s already made $2,000 in the past few months just by scouring different marketplaces like Facebook and Craigslist for sellers that were undervaluing their Charizard and Pikachu cards. He would then resell them to collectors.

But he was doing this all by hand. Imagine if you built scrapers for different marketplaces and built models for understanding the true values of different Pokemon cards. You could figure out ways to arbitrage these assets across different marketplaces.

For example, suppose you determined the price of a Charizard was $1,000. Say the average price of a Charizard was $900 on your local Facebook Marketplace but $1500 on eBay: You could make a buy on Marketplace, and then sell it on eBay for a $600 profit.

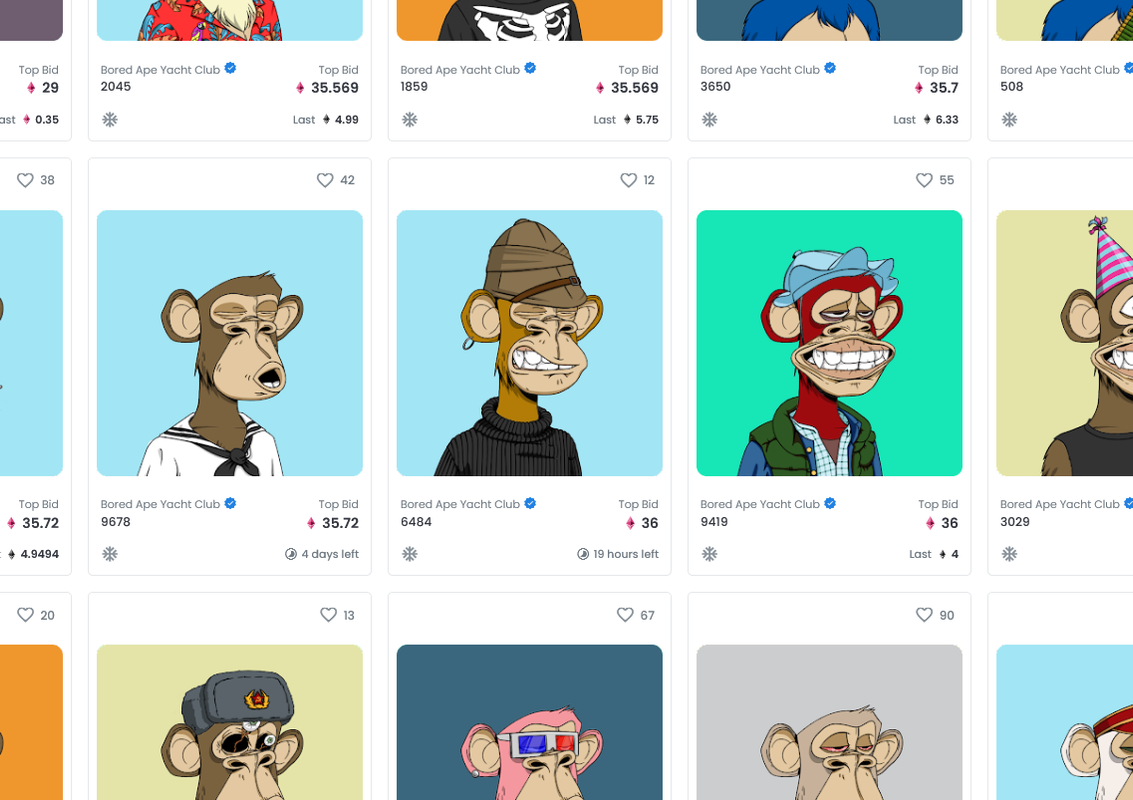

5. NFTs

There are literally people on OpenSea that are doing this for NFTs. If you can build a bot that can value an NFT better than most people, then you can buy and resell them at a profit using your valuation trading strategy.

Obviously, there are many caveats to this. Most alternative assets are in inefficient markets because of price volatility, but also because it’s harder to build models to validate physical items. Imagine finding an undervalued Charizard, and your bot automatically purchases it, only to only realize that the card has a tear, effectively devaluing the card. That sucks! However, that’s just the cost of improving your operations strategy, which means finding ways to lower the cost of buying and reselling.

A great formula for determining which new kind of market to enter is to look at three factors: The inefficiency of the market The operational intensity of buying and selling. The valuation model difficulty

For example, the reason why people enjoy trading NFTs is because the market is kind of inefficient, the operational intensity of buying and selling is pretty easy on OpenSea, and the valuation is pretty accessible as all the buying and selling data is on the blockchain.

Whereas if you compare Pokemon or trading cards, the market is also very inefficient and the valuation models are decent online, but the operational intensity is really hard in terms of buying and selling (evaluating card quality, meeting up with someone to get the physical card, etc.).

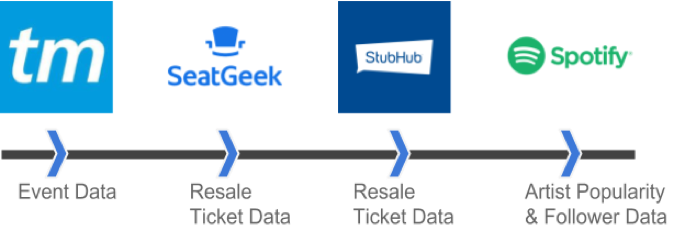

6. Concert Tickets

Many times concert tickets will go for above the actual value because artists are more popular in certain cities, but, because of venue and pricing constraints, prices can’t be raised too high. The first place to look would be to scrape sites like Stubhub and Seatgeek to see how the prices of concert tickets change over time.

7-9. Data-as-a-Service Business

Saving the best for last: The best way to generate passive income with data science is to build a data-as-a-service business. There’s a ton of data out there on the web. One way to make money off of it is to provide it to end users for a fee or subscription.

Data-as-a-Service businesses usually do one of three things for end consumers:

- Provide data easily to end users through an API

- Take an existing dataset and enrich it with more data to resell

- Aggregate datasets into summary analytics to display for sale on a dashboard.

For example, when I was in college, I started analyzing rental data on Craigslist for fun. One day, when my article went viral on HackerNews about analyzing Seattle’s rental market, I got an email from a real estate company that wanted me to productionize my scraper to feed them raw listing data.

There are tons of companies out there that really aren’t interested in building and maintaining scrapers. And so, if you can productionize this data into something that they need, then you can charge businesses for a service, which is always awesome because B2B has a pretty low revenue churn, especially if their business is dependent on your data feed.

One example is People Data Labs. People Data Labs has an API that allows you to query people’s emails, background information, etc. They essentially sell this data to other businesses that need identity verification, recruiting, or other services.

Some ideas for DaaS businesses:

7. Financial Data

Capitol Trades is a service that tracks the data of which U.S. senators and representatives sell which stocks, enabling hedge funds to make predictions off of their stock picks.

8. Real Estate Data

Scraped data online on Craigslist can be used to track real estate and commodity prices online, which could be used to sell to people running asset arbitrages.

9. Concert Ticket Data

Spotify API data mixed with concert ticket resale prices.

10. Data Science Platform Affiliates

Another great way to generate income through data science is by becoming an affiliate for data science platforms or online courses. This method allows you to earn commissions by promoting products you likely already use or believe in. It’s a relatively simple way to monetize your expertise, and here’s how you can get started:

- Choose a Data Science Platform or Course You Trust

- Sign Up for Their Affiliate Program

One of the key advantages of affiliate marketing is that you don’t need to create a product yourself. Instead, you leverage existing platforms or courses that have proven value. By sharing your experiences and insights about these resources, you can earn a commission whenever someone purchases through your unique affiliate link.

You could promote your affiliate links through various channels, such as blog posts, YouTube videos, or social media. The trick here is to be genuine in your endorsements—people can tell if you’re just trying to make a quick buck, and that’s a surefire way to lose trust and followers.

Overall, becoming an affiliate for a data science platform or course is a low-effort, potentially high-reward way to generate income. Just make sure you choose products that align with your brand and audience.

Use Your Data Science Skills to Build Passive Income

Generating side income isn’t an easy task, no matter what industry you’re in. But data science does offer huge potential for a side hustle. If you want to build your data science skills, consider upgrading to an Interview Query pro membership for access to:

If you want to learn more about what we discuss here on Interview Query, check out our blog, where we provide tons of topics such as: